10 Best High Margin Businesses with 20%+ Free Cash Flow Margins - Value Sense 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Strategic Power of High-Margin Business Models

Free cash flow margin represents the ultimate measure of business efficiency and competitive advantage, revealing companies that convert revenue into actual cash available for strategic deployment. Businesses maintaining FCF margins above 20% demonstrate exceptional operational excellence, pricing power, and sustainable competitive moats that create long-term shareholder value.

This metric reveals the percentage of revenue converted to available cash after covering all operating expenses and necessary capital expenditures, providing insight into operational efficiency and capital allocation effectiveness.

High-Margin Selection Criteria:

- Free cash flow margin exceeding 20% demonstrating exceptional cash conversion

- Strong profitability ratings indicating sustainable competitive advantages

- Quality business fundamentals supporting margin sustainability

- Operational leverage and scalability supporting continued margin expansion

Top 11 High-Margin Businesses - Ranked by FCF Margin

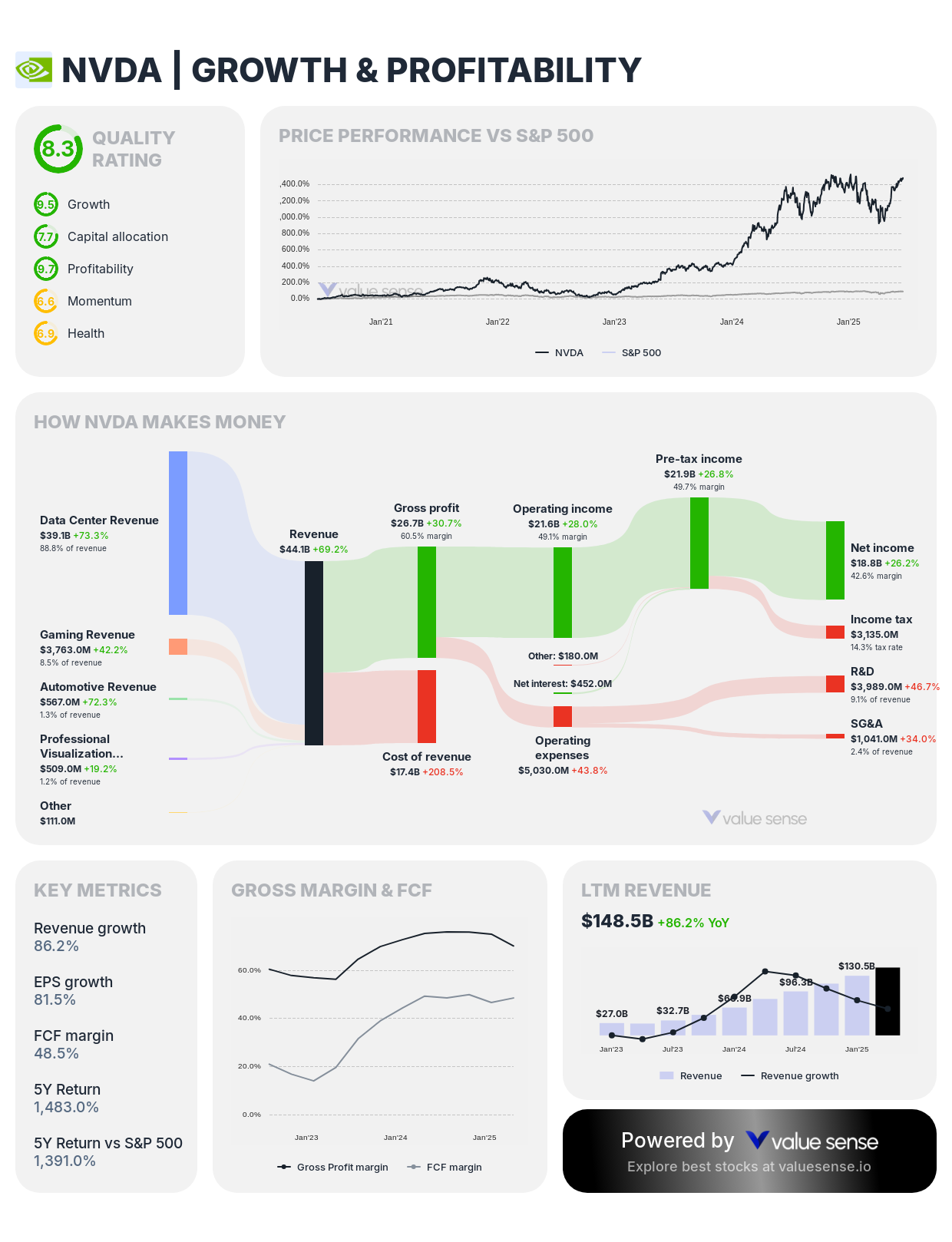

1. NVIDIA Corporation (NVDA) - 48.5% FCF Margin ⭐

Profitability Analysis:

- FCF Margin (LTM): 48.5%

- Profitability Rating: 9.7 (Exceptional)

- Gross Profit Margin: 70.1%

- EBIT Margin: 58.0%

- EBITDA Margin: 61.2%

- Net Income Margin: 51.7%

- Earnings Quality (FCF to Net Income): 93.9%

Investment Thesis: NVIDIA achieves extraordinary 48.5% free cash flow margin with outstanding profitability rating of 9.7, demonstrating the AI computing leader's exceptional ability to convert revenue into available cash. The company's dominant position in artificial intelligence accelerators and data center infrastructure creates unprecedented pricing power and operational leverage that translates directly into exceptional cash generation.

Business Model Advantages:

- Dominant position in AI computing with technological leadership and limited competition

- CUDA software ecosystem creating switching costs and recurring revenue opportunities

- Asset-light business model with exceptional operational leverage and scalability

- Premium pricing power through essential role in AI infrastructure and data center computing

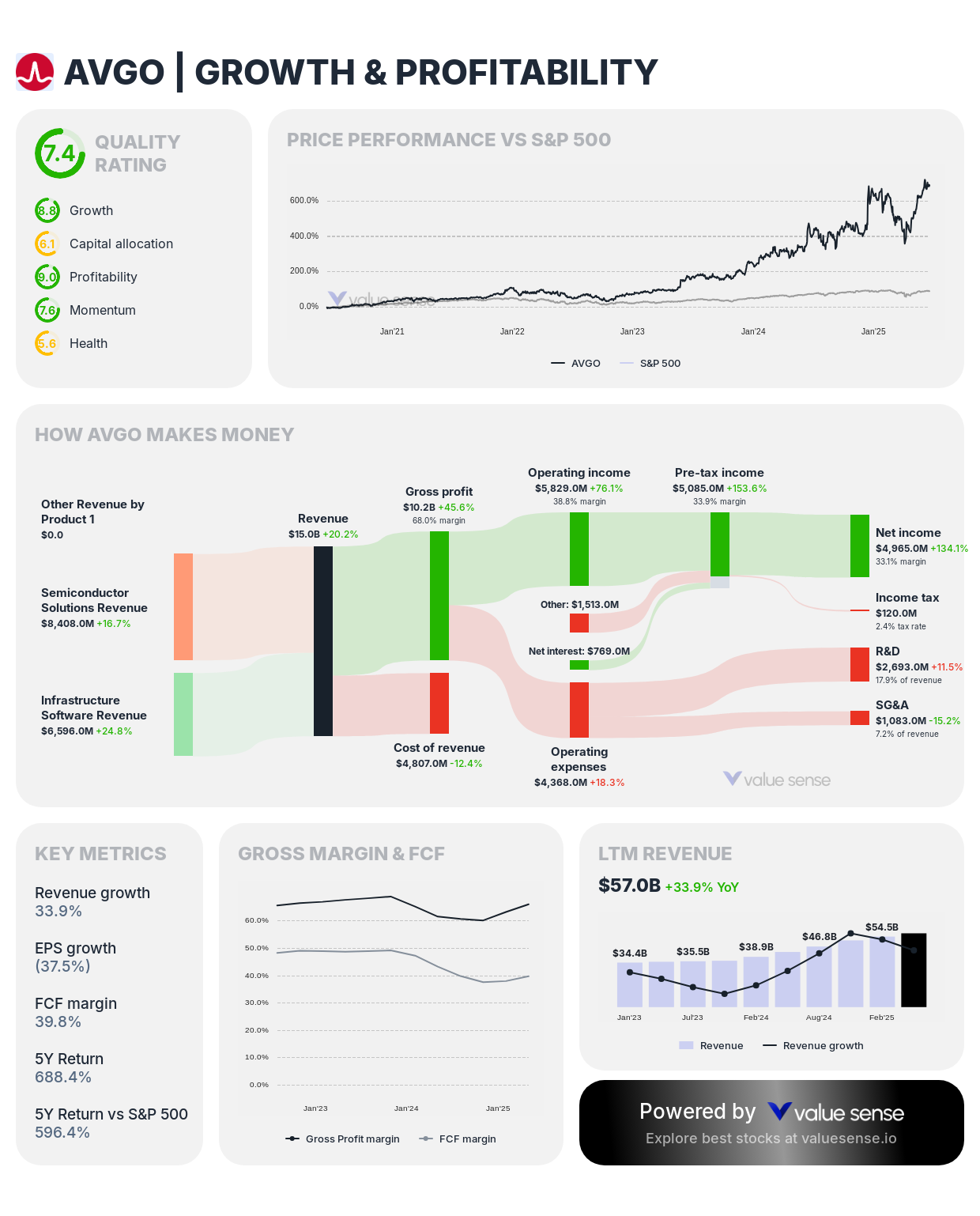

2. Broadcom Inc. (AVGO) - 39.8% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 39.8%

- Profitability Rating: 9.0 (Exceptional)

- Gross Profit Margin: 66.1%

- EBIT Margin: 35.9%

- EBITDA Margin: 45.1%

- Net Income Margin: 22.6%

- Earnings Quality (FCF to Net Income): 169.9%

Investment Thesis: Broadcom demonstrates exceptional 39.8% free cash flow margin with profitability rating of 9.0, reflecting the semiconductor company's focus on mission-critical applications and strategic acquisitions. The company's diversified portfolio spanning semiconductors and infrastructure software creates substantial pricing power and cash generation capabilities.

Business Model Advantages:

- Mission-critical semiconductor components with high switching costs and pricing power

- Strategic acquisitions expanding addressable markets and enhancing competitive positioning

- Diversified portfolio reducing cyclical risk while maintaining premium margins

- Infrastructure software business providing high-margin recurring revenue streams

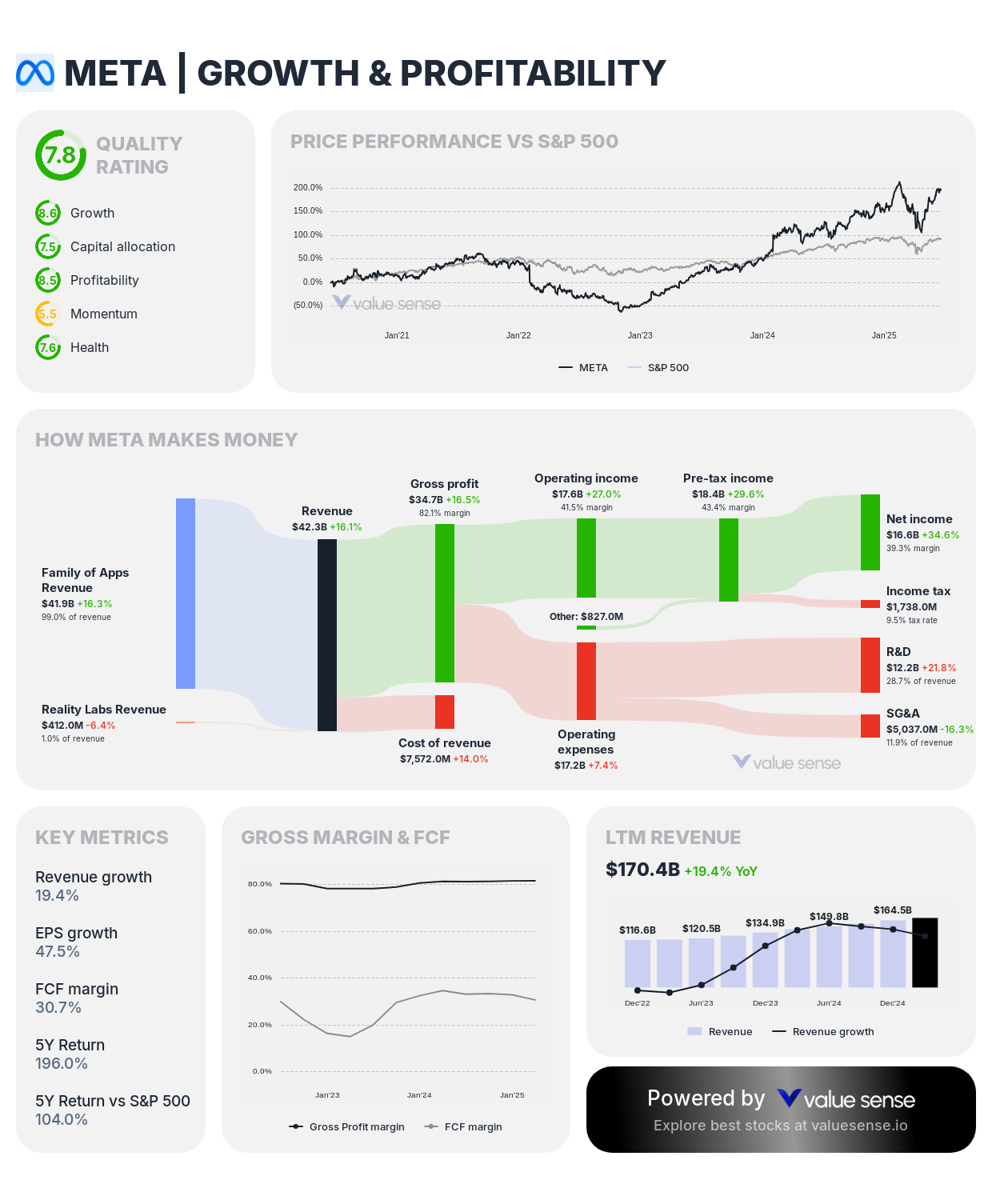

3. Meta Platforms, Inc. (META) - 30.7% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 30.7%

- Profitability Rating: 6.9 (Strong)

- Gross Profit Margin: 81.7%

- EBIT Margin: 42.9%

- EBITDA Margin: 47.8%

- Net Income Margin: 39.1%

- Earnings Quality (FCF to Net Income): 79.5%

Investment Thesis: Meta achieves substantial 30.7% free cash flow margin with strong profitability rating of 6.9, demonstrating the social media leader's exceptional ability to monetize its massive user base across Facebook, Instagram, and WhatsApp platforms. The company's asset-light business model and data advantages create exceptional operational leverage and cash generation.

Business Model Advantages:

- Dominant social media platforms with massive user engagement and network effects

- Asset-light business model with exceptional operational leverage and scalability

- Data advantages creating competitive moats in digital advertising and user targeting

- Multiple revenue streams across Facebook, Instagram, WhatsApp, and emerging platforms

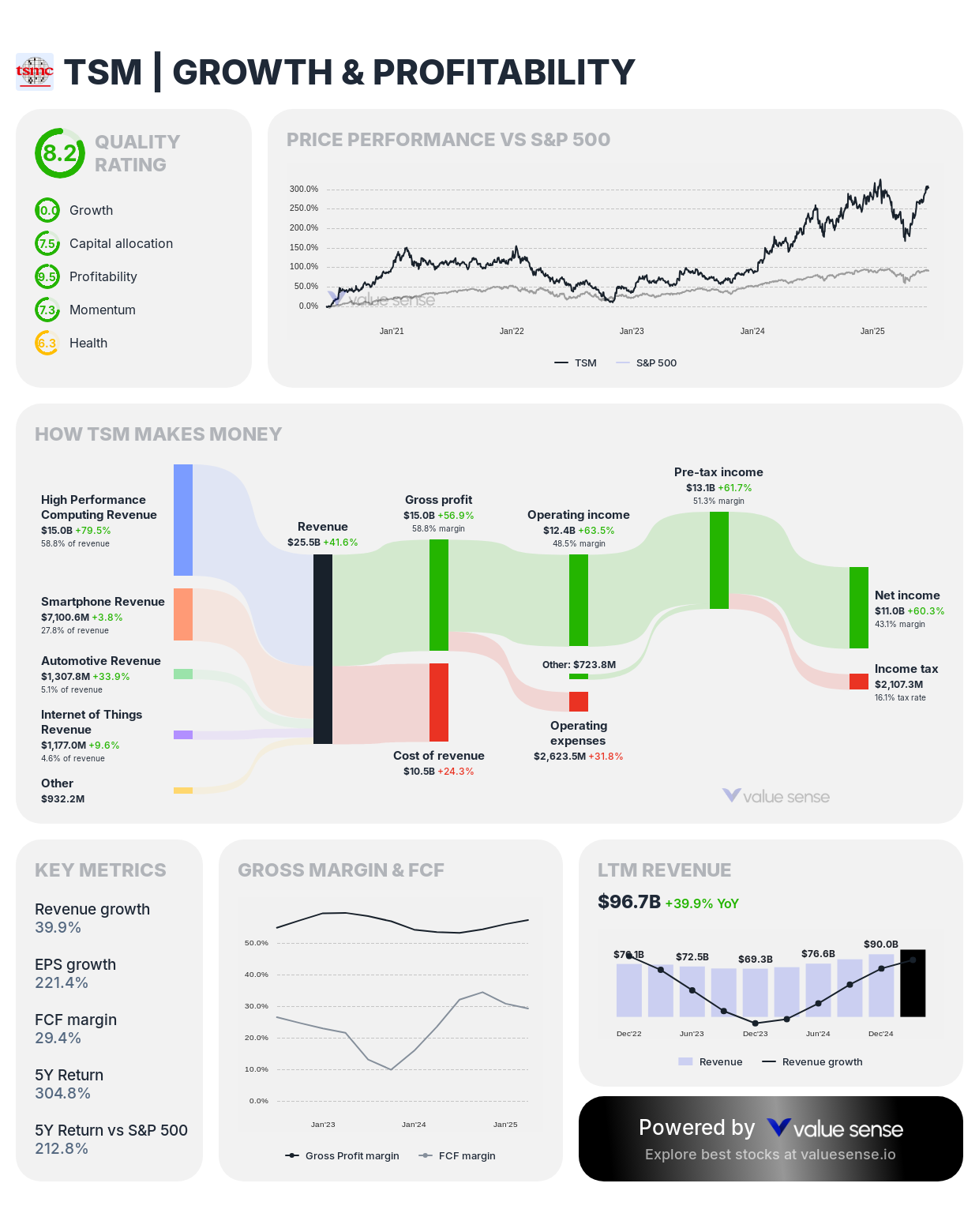

4. Taiwan Semiconductor Manufacturing Company (TSM) - 29.4% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 29.4%

- Profitability Rating: 8.5 (Exceptional)

- Gross Profit Margin: 57.4%

- EBIT Margin: 47.1%

- EBITDA Margin: 69.9%

- Net Income Margin: 41.7%

- Earnings Quality (FCF to Net Income): 70.4%

Investment Thesis: TSMC demonstrates exceptional 29.4% free cash flow margin with outstanding profitability rating of 8.5, reflecting the semiconductor foundry's irreplaceable position in advanced chip manufacturing. The company's technological leadership and essential supplier relationships create substantial pricing power and operational efficiency.

Business Model Advantages:

- Global semiconductor foundry leadership with advanced process technology and limited competition

- Essential supplier relationships with technology leaders providing demand visibility and pricing power

- Massive scale advantages and operational efficiency through continuous technology advancement

- Strategic positioning in AI and high-performance computing driving premium pricing opportunities

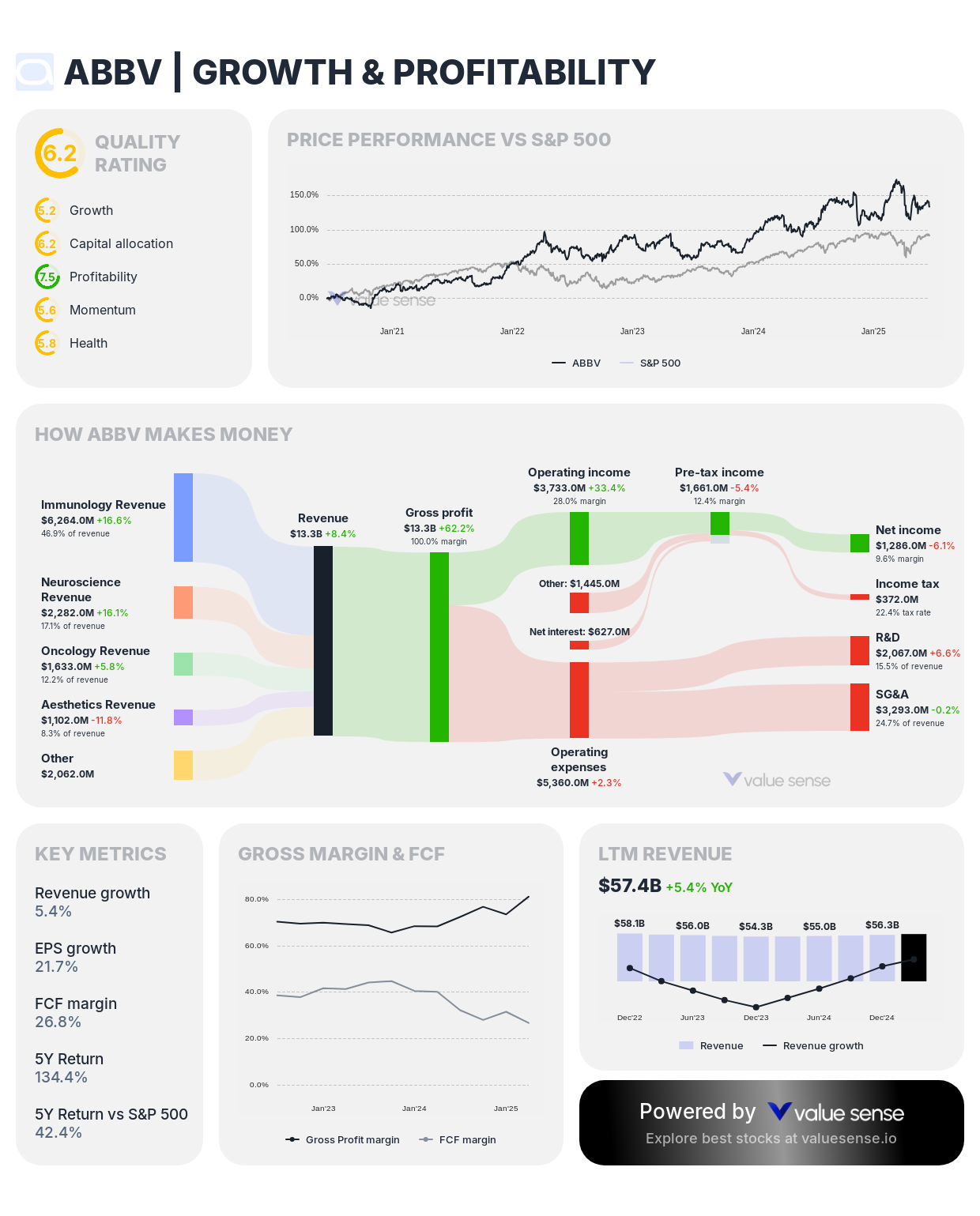

5. AbbVie Inc. (ABBV) - 26.8% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 26.8%

- Profitability Rating: 7.5 (Strong)

- Gross Profit Margin: 81.2%

- EBIT Margin: 17.6%

- EBITDA Margin: 28.5%

- Net Income Margin: 7.3%

- Earnings Quality (FCF to Net Income): 367.2%

Investment Thesis: AbbVie achieves strong 26.8% free cash flow margin with profitability rating of 7.5, demonstrating the pharmaceutical company's exceptional cash generation despite significant R&D investments. The company's diversified portfolio and breakthrough treatments create substantial pricing power and operational efficiency.

Business Model Advantages:

- Diversified pharmaceutical portfolio with patent protection and pricing power

- Breakthrough treatments in immunology, oncology, and neuroscience addressing large markets

- Strategic acquisitions enhancing therapeutic capabilities and market reach

- International expansion opportunities providing additional growth and margin enhancement

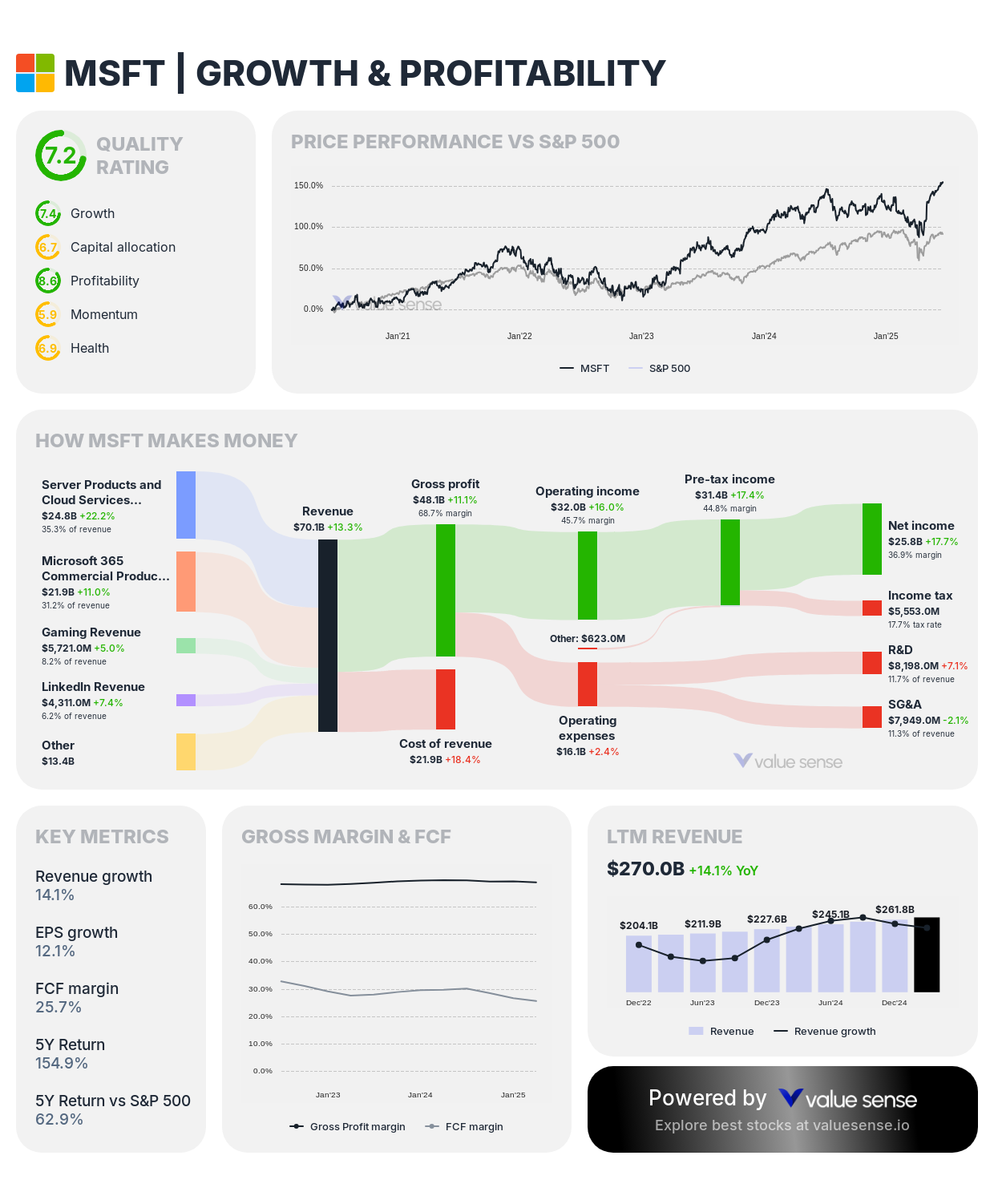

6. Microsoft Corporation (MSFT) - 25.7% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 25.7%

- Profitability Rating: 9.5 (Exceptional)

- Gross Profit Margin: 69.1%

- EBIT Margin: 45.2%

- EBITDA Margin: 55.6%

- Net Income Margin: 35.8%

- Earnings Quality (FCF to Net Income): 71.8%

Investment Thesis: Microsoft demonstrates excellent 25.7% free cash flow margin with exceptional profitability rating of 9.5, reflecting the software giant's successful transformation to cloud computing and subscription services. The company's predictable revenue streams and operational leverage create sustainable competitive advantages and exceptional cash generation.

Business Model Advantages:

- Enterprise software dominance with high switching costs and recurring revenue

- Azure cloud platform expansion providing scalable, high-margin growth opportunities

- Subscription-based business model creating predictable revenue streams and operational leverage

- Integrated software ecosystem enhancing customer retention and pricing power

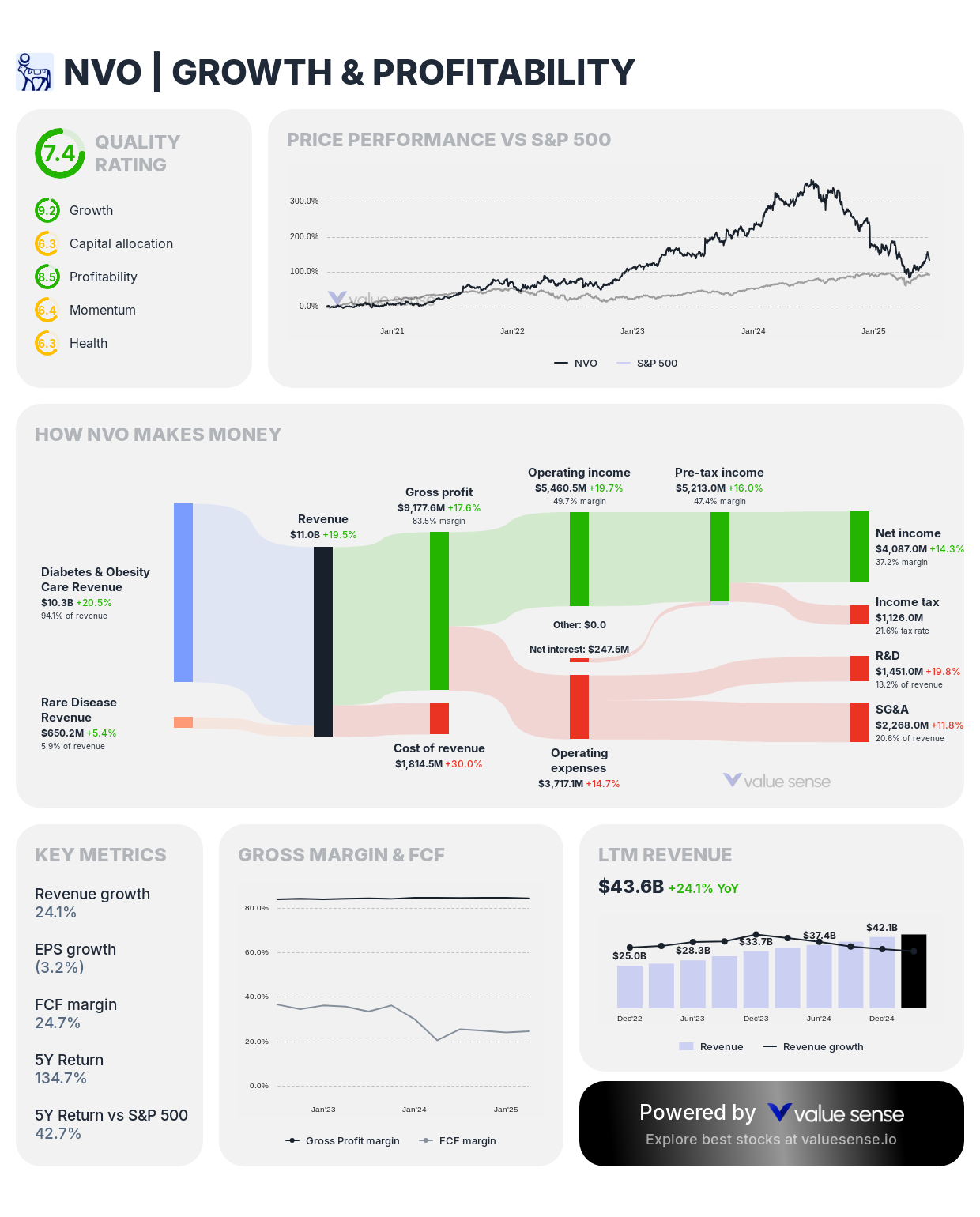

7. Novo Nordisk A/S (NVO) - 24.7% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 24.7%

- Profitability Rating: 6.5 (Strong)

- Gross Profit Margin: 84.3%

- EBIT Margin: 44.5%

- EBITDA Margin: 52.5%

- Net Income Margin: 34.5%

- Earnings Quality (FCF to Net Income): 71.4%

Investment Thesis: Novo Nordisk achieves solid 24.7% free cash flow margin with strong profitability rating of 6.5, demonstrating the pharmaceutical company's exceptional ability to convert diabetes and obesity treatment revenue into available cash. The company's specialized focus and market leadership create substantial pricing power and operational efficiency.

Business Model Advantages:

- Global leadership in diabetes care with expanding patient populations and treatment options

- Revolutionary obesity treatments addressing massive addressable markets with premium pricing

- Specialized therapeutic focus creating competitive advantages and operational efficiency

- Continuous innovation in drug delivery systems and treatment effectiveness

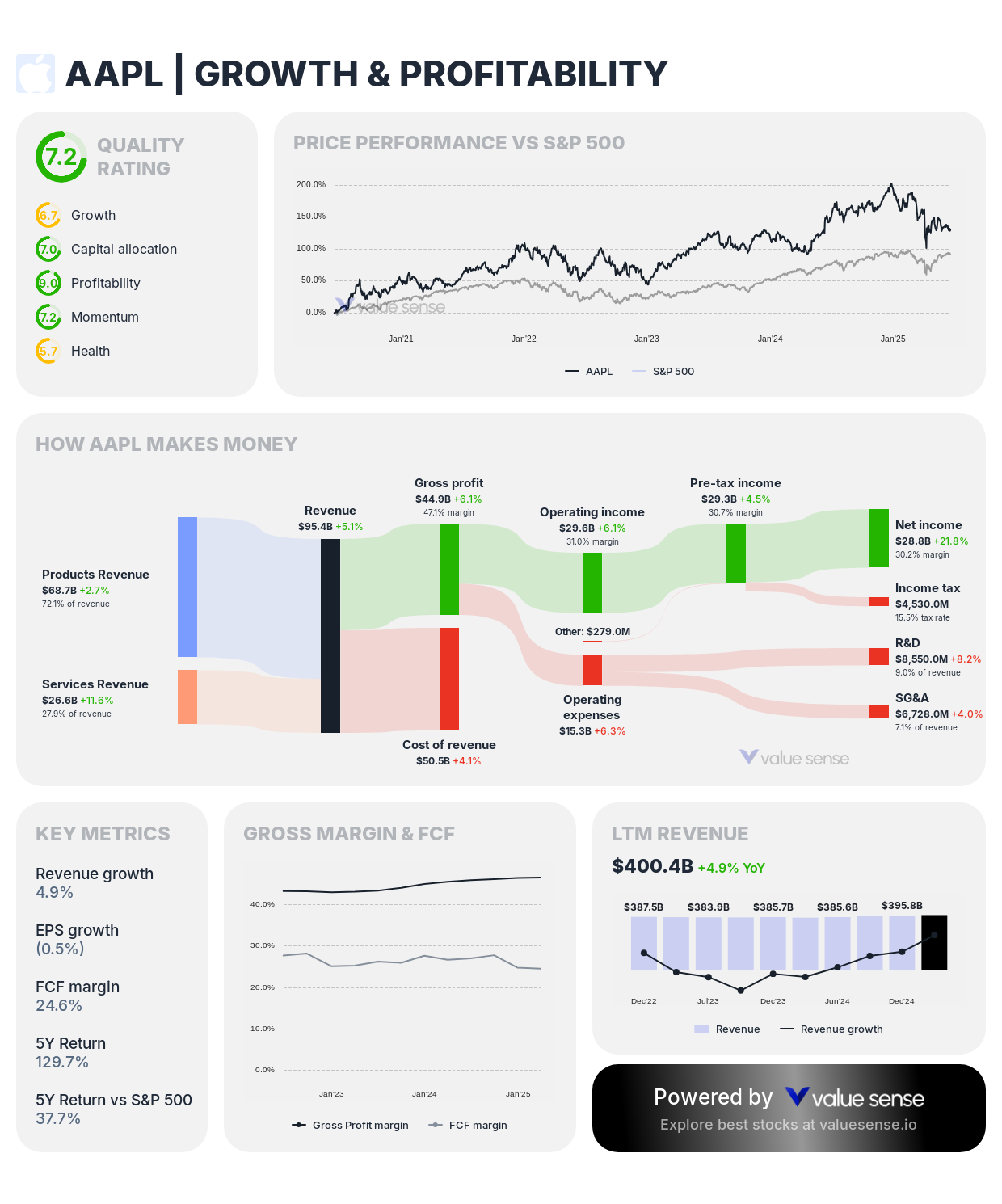

8. Apple Inc. (AAPL) - 24.6% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 24.6%

- Profitability Rating: 9.4 (Exceptional)

- Gross Profit Margin: 46.6%

- EBIT Margin: 31.8%

- EBITDA Margin: 34.8%

- Net Income Margin: 25.3%

- Earnings Quality (FCF to Net Income): 101.2%

Investment Thesis: Apple demonstrates excellent 24.6% free cash flow margin with exceptional profitability rating of 9.4, reflecting the technology giant's integrated ecosystem and premium positioning. The company's operational efficiency and capital allocation discipline create exceptional cash generation despite massive scale.

Business Model Advantages:

- Integrated ecosystem creating customer loyalty and premium pricing opportunities

- Services revenue expansion providing high-margin, recurring revenue streams

- Operational excellence and supply chain management creating cost advantages

- Premium brand positioning enabling pricing power and margin sustainability

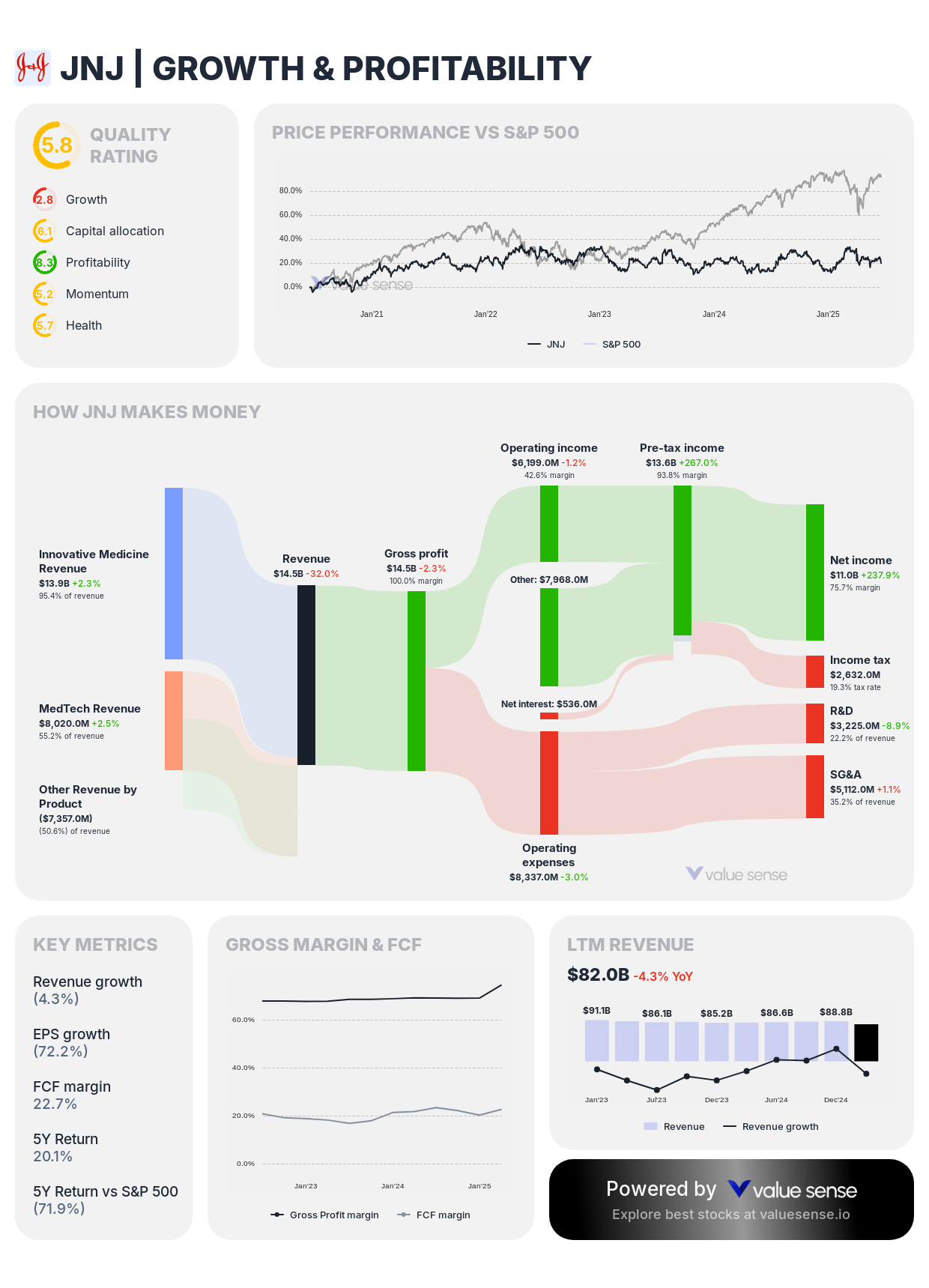

9. Johnson & Johnson (JNJ) - 22.7% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 22.7%

- Profitability Rating: 6.3 (Strong)

- Gross Profit Margin: 74.4%

- EBIT Margin: 26.8%

- EBITDA Margin: 30.9%

- Net Income Margin: 26.6%

- Earnings Quality (FCF to Net Income): 85.2%

Investment Thesis: Johnson & Johnson achieves solid 22.7% free cash flow margin with strong profitability rating of 6.3, demonstrating the healthcare giant's ability to generate substantial cash across diversified operations. The company's pharmaceutical pipeline and medical device innovations create multiple revenue streams supporting consistent cash generation.

Business Model Advantages:

- Diversified healthcare portfolio providing stability across economic cycles and market conditions

- Pharmaceutical pipeline focused on high-growth therapeutic areas with premium pricing

- Medical device innovation creating competitive advantages and market leadership positions

- Strong balance sheet and cash generation supporting strategic investments and shareholder returns

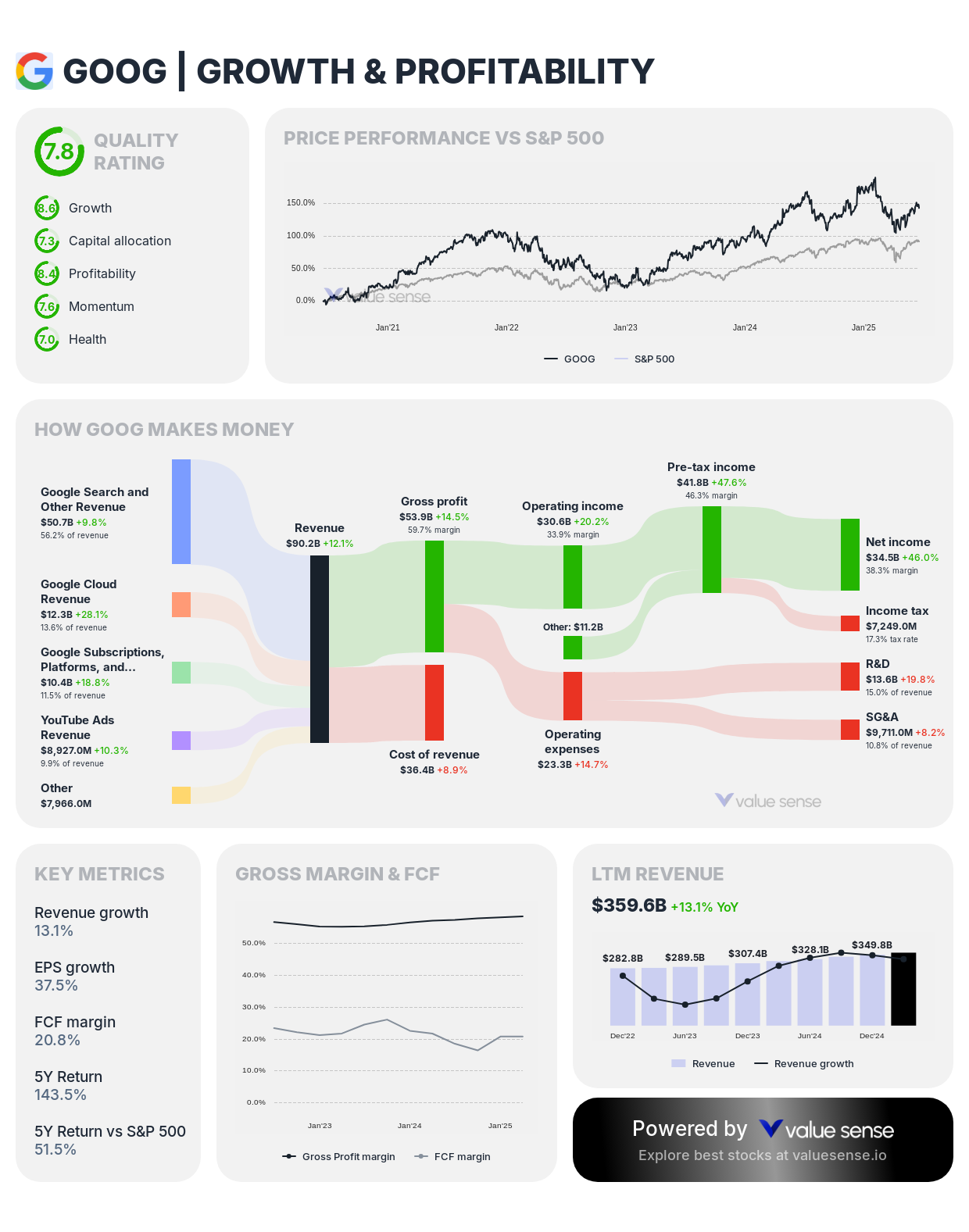

10. Alphabet Inc. (GOOGL) - 20.8% FCF Margin

Profitability Analysis:

- FCF Margin (LTM): 20.8%

- Profitability Rating: 8.4 (Exceptional)

- Gross Profit Margin: 58.6%

- EBIT Margin: 32.7%

- EBITDA Margin: 35.8%

- Net Income Margin: 30.9%

- Earnings Quality (FCF to Net Income): 67.5%

Investment Thesis: Alphabet demonstrates solid 20.8% free cash flow margin with exceptional profitability rating of 8.4, reflecting the technology giant's dominant search advertising platform and expanding cloud services. The company's asset-light business model and data advantages create substantial operational leverage and cash generation.

Business Model Advantages:

- Search advertising monopoly with exceptional pricing power and market dominance

- YouTube platform providing growing advertising revenue and user engagement

- Google Cloud expansion offering scalable, high-margin growth opportunities

- Artificial intelligence capabilities creating competitive advantages across multiple business segments

High-Margin Business Investment Strategy

Prioritize Exceptional FCF Margins: Focus on companies with FCF margins exceeding 30%, including NVIDIA (48.5%), Broadcom (39.8%), and Meta (30.7%). These businesses demonstrate exceptional operational efficiency and competitive advantages that translate revenue into substantial available cash for strategic deployment.

Confirm with Profitability Ratings: Companies with profitability ratings above 9.0, including NVIDIA (9.7), Microsoft (9.5), and Apple (9.4), demonstrate exceptional business model quality and sustainable competitive advantages. These ratings provide additional confirmation of margin sustainability and competitive positioning.

Assess Earnings Quality: High FCF-to-Net Income ratios like AbbVie (367.2%) and Broadcom (169.9%) indicate companies generating more cash than reported earnings, demonstrating exceptional cash conversion and accounting quality. This metric helps identify businesses with sustainable cash generation capabilities.

Diversification Across Business Models: Spread investments across technology platforms (NVIDIA, Meta), enterprise software (Microsoft, Alphabet), healthcare (AbbVie, Novo Nordisk), and consumer technology (Apple) to capture different competitive advantages while reducing concentration risk.

Understanding Our Profitability Rating Methodology

Our proprietary profitability rating system evaluates companies across multiple dimensions:

Gross Profit Margin Analysis: Measures pricing power and production efficiency, with companies like Novo Nordisk (84.3%) and Meta (81.7%) demonstrating exceptional gross profitability.

Operating Efficiency Assessment: EBIT and EBITDA margins reveal operational effectiveness, with NVIDIA (58.0% EBIT) and TSMC (69.9% EBITDA) showing superior operational performance.

Cash Conversion Quality: The FCF-to-Net Income ratio indicates earnings quality, with ratios above 100% like Apple (101.2%) demonstrating superior cash conversion capabilities.

Sustainability Factors: Long-term competitive positioning, market leadership, and business model scalability contribute to overall profitability rating assessment.

Key Takeaways for High-Margin Investors

✅ Exceptional Leaders: NVIDIA (48.5%) and Broadcom (39.8%) offer extraordinary FCF margins with strong competitive positioning

✅ Profitability Excellence: Companies with 9.0+ profitability ratings demonstrate exceptional business model quality

✅ Earnings Quality: High FCF-to-Net Income ratios indicate superior cash conversion and accounting quality

✅ Diversified Models: High-margin opportunities span technology, healthcare, software, and consumer platforms

✅ Sustainable Advantages: Companies with technological leadership and network effects demonstrate margin sustainability

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best Graham Number Stocks

📖 11 Best Earnings Growth Stocks

📖 9 Best DCF Undervalued Stocks

FAQ About High-Margin Businesses

What makes free cash flow margin more important than other profitability metrics?

Free cash flow margin measures actual cash generated after covering operational expenses and necessary capital expenditures, providing the most accurate picture of business cash generation capability. Unlike accounting metrics that can be influenced by non-cash charges or timing differences, FCF margin reveals the actual cash available for strategic deployment, debt reduction, or shareholder returns. Companies like NVIDIA (48.5% FCF margin) and Broadcom (39.8%) demonstrate exceptional ability to convert revenue into available cash, indicating superior business models and operational efficiency.

Why do some companies show high FCF margins but different profitability ratings?

Profitability ratings incorporate multiple factors beyond FCF margin, including consistency across business cycles, competitive positioning, and sustainability of margins over time. Meta shows 30.7% FCF margin with 6.9 profitability rating because the rating considers factors like competitive threats, regulatory risks, and business model evolution. Companies like Microsoft achieve higher profitability ratings (9.5) despite lower FCF margins (25.7%) due to exceptional business model stability and competitive advantages.

How sustainable are exceptional FCF margins like NVIDIA's 48.5%?

Exceptional FCF margins typically require strong competitive moats, technological leadership, or unique market positioning to sustain over time. NVIDIA's 48.5% margin reflects its dominant position in AI computing with limited competition and exceptional pricing power. However, investors should assess whether such margins reflect temporary market conditions or sustainable competitive advantages. Companies with technological leadership and platform advantages typically demonstrate more sustainable high margins than those benefiting from cyclical factors.

What sectors typically provide the most consistent high-margin opportunities?

Technology and healthcare sectors frequently demonstrate the most consistent high-margin opportunities due to asset-light business models, intellectual property protection, and network effects. Software companies like Microsoft benefit from recurring revenue and operational leverage, while pharmaceutical companies like AbbVie benefit from patent protection and pricing power. However, individual company competitive advantages and execution capability matter more than sector membership for sustained high-margin performance.

How should investors balance high FCF margins with growth potential?

Successful high-margin investing typically balances current cash generation with sustainable growth opportunities. Companies like NVIDIA and TSMC combine exceptional FCF margins with substantial growth potential through AI adoption and semiconductor demand. Mature companies like Apple and Microsoft offer steady high margins with modest growth, while emerging leaders like Meta provide high margins with platform expansion opportunities. The optimal balance depends on investment objectives, risk tolerance, and portfolio diversification needs.

Important Note on Margin Sustainability: High free cash flow margins can fluctuate based on business cycles, competitive dynamics, and strategic investments. Companies may temporarily sacrifice margins for growth investments or market share expansion. Investors should analyze underlying business fundamentals, competitive positioning, and management strategy when evaluating margin sustainability over extended periods.

Disclaimer: This analysis is for informational purposes only and should not be considered personalized investment advice. Free cash flow margins are based on the most recent available financial data and may vary with quarterly reporting. Always conduct thorough research and consult with qualified financial advisors before making investment decisions.