10 Best High Quality Large Cap Stock Picks for 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Market Overview & Selection Criteria

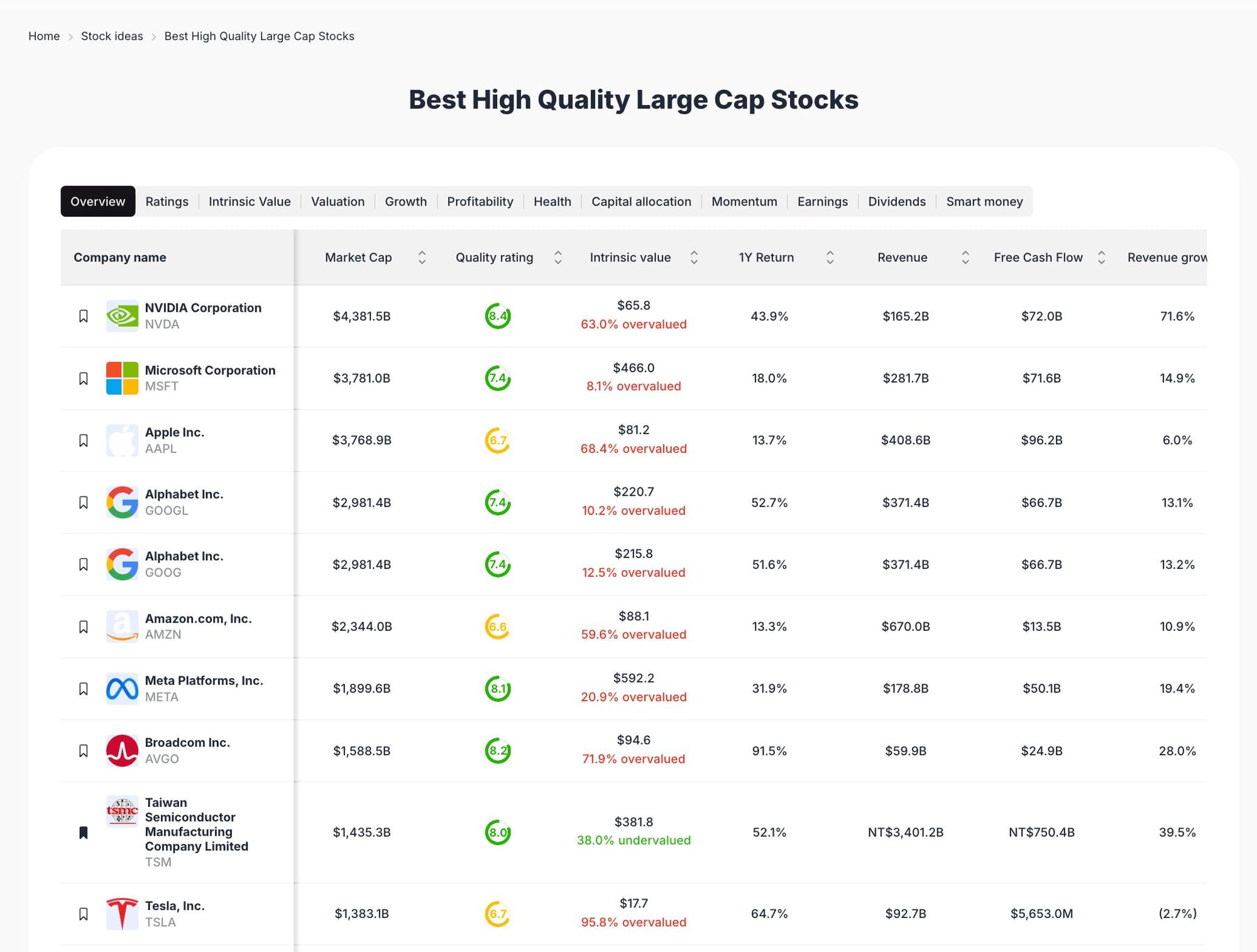

The 2025 market landscape is dominated by large cap technology and consumer companies, many of which have demonstrated resilience, robust free cash flow, and consistent revenue growth. For this watchlist, we selected stocks based on their market cap, ValueSense quality rating, intrinsic value assessment, and recent financial performance. Each stock is evaluated for growth potential, profitability, and sector leadership, with a focus on both overvalued and undervalued opportunities for educational analysis.

Featured Stock Analysis

Stock #1: NVIDIA Corporation (NVDA)

| Metric | Value |

|---|---|

| Market Cap | $4,381.5B |

| Quality Rating | 8.4 |

| Intrinsic Value | $665.8 (63.0% overvalued) |

| 1Y Return | 43.9% |

| Revenue | $165.2B |

| Free Cash Flow | $72.0B |

| Revenue Growth | 71.6% |

Investment Thesis:

NVIDIA stands at the forefront of the AI and semiconductor revolution, boasting the highest market cap among large caps. Its 71.6% revenue growth and $72B in free cash flow highlight exceptional operational leverage. Despite being 63% overvalued relative to ValueSense’s intrinsic value estimate, NVIDIA’s quality rating of 8.4 reflects strong fundamentals and sector dominance.

NVIDIA’s 43.9% one-year return underscores investor confidence in its AI leadership and data center expansion. The company’s ability to monetize new AI workloads and maintain high margins supports its premium valuation, though current pricing suggests limited margin of safety.

Key Catalysts:

- AI chip demand and data center expansion

- New product launches in GPU and AI hardware

- Strategic partnerships in automotive and cloud

Risk Factors:

- High valuation risk (63% over intrinsic value)

- Cyclical semiconductor demand

- Geopolitical supply chain exposure

Stock #2: Microsoft Corporation (MSFT)

| Metric | Value |

|---|---|

| Market Cap | $3,781.0B |

| Quality Rating | 7.4 |

| Intrinsic Value | $466.0 (8.1% overvalued) |

| 1Y Return | 18.0% |

| Revenue | $281.7B |

| Free Cash Flow | $71.6B |

| Revenue Growth | 14.9% |

Investment Thesis:

Microsoft remains a global technology powerhouse, with a diversified portfolio spanning cloud, productivity, and AI. Its 7.4 quality rating and $71.6B in free cash flow reflect operational excellence. The stock is currently 8.1% overvalued, suggesting it trades close to fair value.

Microsoft’s 18% annual return is driven by Azure’s cloud growth and integration of AI across its product suite. The company’s scale and recurring revenue streams from Office and cloud services provide stability and growth visibility.

Key Catalysts:

- Expansion of Azure and cloud services

- AI integration in enterprise software

- Growth in subscription-based revenues

Risk Factors:

- Slower growth in legacy segments

- Competitive pressures in cloud and AI

- Regulatory scrutiny in global markets

Stock #3: Apple Inc. (AAPL)

| Metric | Value |

|---|---|

| Market Cap | $3,768.9B |

| Quality Rating | 6.7 |

| Intrinsic Value | $381.2 (68.4% overvalued) |

| 1Y Return | 13.7% |

| Revenue | $408.6B |

| Free Cash Flow | $96.2B |

| Revenue Growth | 6.0% |

Investment Thesis:

Apple’s brand strength and ecosystem drive its $3.77T market cap and $96.2B in free cash flow. However, with a 68.4% overvaluation relative to intrinsic value and modest 6% revenue growth, Apple’s upside appears limited at current levels.

The company’s 13.7% one-year return reflects continued demand for premium devices and services, but growth is slowing. Apple’s quality rating of 6.7 suggests solid fundamentals, but investors should be mindful of valuation risk.

Key Catalysts:

- New product cycles (iPhone, wearables)

- Expansion of services and subscriptions

- Share buybacks and capital returns

Risk Factors:

- Slowing hardware growth

- High dependency on iPhone sales

- Regulatory and supply chain risks

Stock #4: Alphabet Inc. (GOOGL)

| Metric | Value |

|---|---|

| Market Cap | $2,981.4B |

| Quality Rating | 7.4 |

| Intrinsic Value | $220.7 (10.2% overvalued) |

| 1Y Return | 52.7% |

| Revenue | $371.4B |

| Free Cash Flow | $66.7B |

| Revenue Growth | 13.1% |

Investment Thesis:

Alphabet’s 52.7% one-year return and 7.4 quality rating highlight its leadership in digital advertising and cloud. Trading at 10.2% above intrinsic value, Alphabet offers a blend of growth and profitability, supported by $66.7B in free cash flow.

The company’s investments in AI, cloud, and YouTube continue to drive revenue growth, while its diversified business model provides resilience.

Key Catalysts:

- AI and cloud expansion

- Growth in YouTube and digital ads

- New monetization initiatives

Risk Factors:

- Regulatory scrutiny in US/EU

- Ad market cyclicality

- Rising competition in cloud

Stock #5: Alphabet Inc. (GOOG)

| Metric | Value |

|---|---|

| Market Cap | $2,981.4B |

| Quality Rating | 7.4 |

| Intrinsic Value | $215.8 (12.5% overvalued) |

| 1Y Return | 51.6% |

| Revenue | $371.4B |

| Free Cash Flow | $66.7B |

| Revenue Growth | 13.2% |

Investment Thesis:

GOOG shares mirror GOOGL’s fundamentals, with a 51.6% return and similar financials. The 12.5% overvaluation is modest, and the quality rating remains strong at 7.4. Alphabet’s dual share structure provides flexibility for investors.

Key Catalysts:

- AI-driven product launches

- Cloud and ad revenue growth

- Strategic investments in new tech

Risk Factors:

- Regulatory and antitrust risks

- Market saturation in core segments

- Currency and macro headwinds

Stock #6: Amazon.com, Inc. (AMZN)

| Metric | Value |

|---|---|

| Market Cap | $2,344.0B |

| Quality Rating | 6.6 |

| Intrinsic Value | $88.1 (59.6% overvalued) |

| 1Y Return | 13.3% |

| Revenue | $670.0B |

| Free Cash Flow | $13.5B |

| Revenue Growth | 10.9% |

Investment Thesis:

Amazon’s scale in e-commerce and cloud is unmatched, with $670B in revenue and a 6.6 quality rating. However, the stock is 59.6% overvalued, and free cash flow is relatively modest at $13.5B.

Amazon’s 13.3% return reflects steady growth, but margin pressures and valuation risk warrant caution. AWS remains a key driver, but retail profitability is a concern.

Key Catalysts:

- AWS cloud expansion

- Logistics and automation investments

- International market growth

Risk Factors:

- Low free cash flow relative to revenue

- Competitive retail landscape

- Regulatory and antitrust scrutiny

Stock #7: Meta Platforms, Inc. (META)

| Metric | Value |

|---|---|

| Market Cap | $1,899.6B |

| Quality Rating | 8.1 |

| Intrinsic Value | $592.2 (20.9% overvalued) |

| 1Y Return | 31.9% |

| Revenue | $178.8B |

| Free Cash Flow | $50.1B |

| Revenue Growth | 19.4% |

Investment Thesis:

Meta’s 8.1 quality rating and 19.4% revenue growth highlight its leadership in social media and digital advertising. With a 31.9% return and $50.1B in free cash flow, Meta is well-positioned for continued innovation in AI and the metaverse.

The stock is 20.9% overvalued, but strong fundamentals and growth prospects support its premium.

Key Catalysts:

- AI-driven engagement and monetization

- Expansion in VR/AR and metaverse

- Growth in ad revenues

Risk Factors:

- Regulatory and privacy concerns

- Competition from emerging platforms

- Content moderation challenges

Stock #8: Broadcom Inc. (AVGO)

| Metric | Value |

|---|---|

| Market Cap | $1,588.5B |

| Quality Rating | 8.2 |

| Intrinsic Value | $494.6 (71.9% overvalued) |

| 1Y Return | 91.5% |

| Revenue | $59.9B |

| Free Cash Flow | $24.9B |

| Revenue Growth | 28.0% |

Investment Thesis:

Broadcom’s 91.5% one-year return and 8.2 quality rating reflect its strong position in semiconductors and infrastructure software. The company’s 28% revenue growth and $24.9B in free cash flow are impressive, but the stock is 71.9% overvalued.

Broadcom’s diversified product mix and M&A strategy drive growth, but valuation risk is significant.

Key Catalysts:

- Expansion in AI and networking chips

- Software segment growth

- Strategic acquisitions

Risk Factors:

- High valuation premium

- Integration risks from acquisitions

- Cyclical demand in semiconductors

Stock #9: Taiwan Semiconductor Manufacturing Company Limited (TSM)

| Metric | Value |

|---|---|

| Market Cap | $1,435.3B |

| Quality Rating | 8.0 |

| Intrinsic Value | $381.8 (38.0% undervalued) |

| 1Y Return | 52.1% |

| Revenue | NT$3,401.2B |

| Free Cash Flow | NT$750.4B |

| Revenue Growth | 39.5% |

Investment Thesis:

TSMC is the only stock in this collection trading at a significant discount (38% undervalued) to its intrinsic value, with a strong 8.0 quality rating. Its 52.1% return and 39.5% revenue growth highlight its global leadership in advanced chip manufacturing.

TSMC’s robust free cash flow and strategic importance in the semiconductor supply chain make it a standout value opportunity.

Key Catalysts:

- Leadership in advanced node manufacturing

- Rising demand for AI and high-performance chips

- Global supply chain expansion

Risk Factors:

- Geopolitical tensions (Taiwan/China)

- Customer concentration risk

- Capital-intensive operations

Stock #10: Tesla, Inc. (TSLA)

| Metric | Value |

|---|---|

| Market Cap | $1,383.1B |

| Quality Rating | 6.7 |

| Intrinsic Value | $117.7 (95.8% overvalued) |

| 1Y Return | 64.7% |

| Revenue | $92.7B |

| Free Cash Flow | $5,653.0M |

| Revenue Growth | -2.7% |

Investment Thesis:

Tesla’s 64.7% return and $1.38T market cap reflect its disruptive role in EVs and energy. However, the stock is 95.8% overvalued, and revenue growth has turned negative (-2.7%), raising questions about sustainability.

Tesla’s 6.7 quality rating suggests solid fundamentals, but investors should monitor execution risks and competitive pressures.

Key Catalysts:

- New vehicle launches and production ramp

- Expansion in energy storage and solar

- Advancements in autonomous driving

Risk Factors:

- Negative revenue growth

- High valuation risk

- Competitive EV landscape

Portfolio Diversification Insights

This collection spans technology, semiconductors, consumer electronics, e-commerce, and social media, providing broad exposure to global growth drivers. While tech dominates, the inclusion of TSMC and Broadcom adds hardware and manufacturing diversity. The portfolio is heavily weighted toward US large caps, with TSMC offering international exposure and a rare undervalued opportunity.

Market Timing & Entry Strategies

Given the prevalence of overvaluation, dollar-cost averaging and staged entry may help manage risk. Monitoring intrinsic value gaps and sector rotation trends can inform entry points. TSMC stands out as a potential value entry, while others may warrant patience for valuation resets.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Best High Quality Industrials Stocks to Buy Now

📖 5 Best Telecom Infrastructure Stock Picks for 2025

📖 12 Best Robotics Stock Picks for 2025: In-Depth Analysis & Watchlist

📖 10 Best Stock Picks for 2025: E-commerce Watchlist & Analysis

📖 5 Best Stock Picks for October 2025: Top Undervalued Stocks

FAQ for Quality Large Cap Stocks

Q1: How were these stocks selected?

Stocks were chosen based on ValueSense’s quality ratings, intrinsic value assessments, and key financial metrics, focusing on large cap leaders with strong fundamentals.

Q2: What's the best stock from this list?

TSMC currently offers the largest discount to intrinsic value, while NVIDIA and Broadcom lead in growth and returns. Each stock’s suitability depends on individual investment goals.

Q3: Should I buy all these stocks or diversify?

Diversification across sectors and valuation profiles can help manage risk. This list provides exposure to multiple growth drivers and geographies.

Q4: What are the biggest risks with these picks?

Key risks include overvaluation, regulatory scrutiny, sector cyclicality, and geopolitical tensions, especially for semiconductor and tech stocks.

Q5: When is the best time to invest in these stocks?

Market timing is challenging; consider staged entry or dollar-cost averaging, and monitor valuation relative to intrinsic value for each stock.

Summary & Investment Outlook

This 2025 large cap watchlist highlights both growth leaders and value opportunities, with TSMC standing out for its undervaluation and sector strength. While many stocks trade above intrinsic value, their quality ratings and market leadership justify ongoing analysis. For more in-depth research and tools, visit ValueSense.