High ROIC Stocks with Exceptional Quality and Momentum

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Investors seeking high-quality growth stocks often face the challenge of filtering through thousands of companies to find those with the best momentum, strong fundamentals, and high returns on invested capital (ROIC). Using a structured screening approach, we’ve identified some of the top-performing stocks that meet strict criteria for momentum, quality, and efficiency.

Screening Criteria for Top-Tier Growth Stocks

The Screening criteria for High-Momentum Stocks With Exceptional Quality and ROIC > 20%:

- Momentum Score: Above 8

- Quality Score: Above 7

- Return on Invested Capital (ROIC): Above 20%

These parameters ensure that only the strongest contenders, with solid fundamentals and significant investor interest, make the cut. Here are some of the standout companies that passed this rigorous screening process.

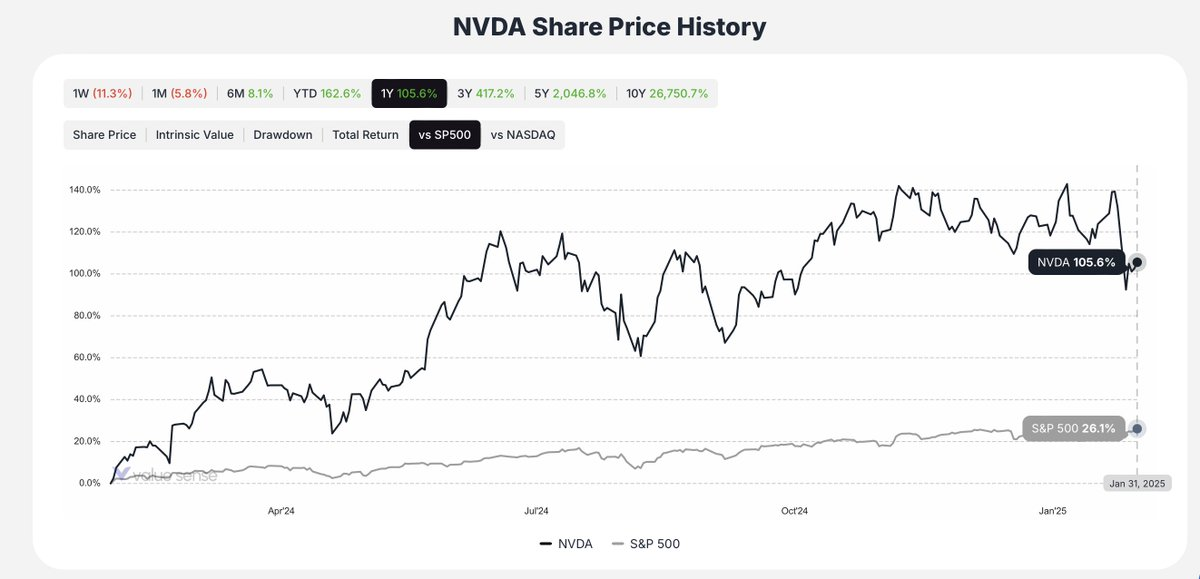

NVIDIA Corporation ($NVDA)

- Momentum: 9.7

- Quality: 9.1

- ROIC: 56.3%

NVIDIA continues to dominate the semiconductor industry, benefiting from the AI revolution and strong demand for GPUs. The company’s high ROIC reflects its ability to allocate capital efficiently while maintaining significant pricing power in the market.

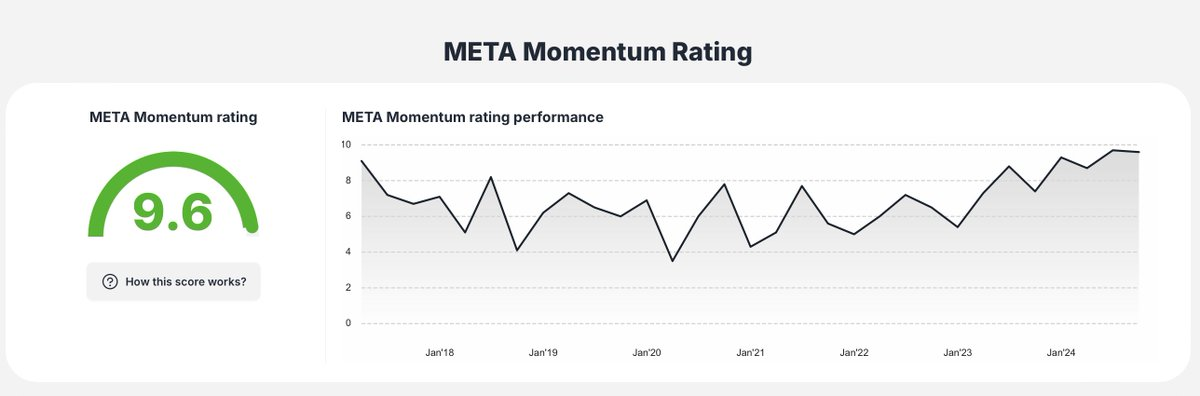

Meta Platforms, Inc. ($META)

- Momentum: 9.4

- Quality: 8.5

- ROIC: 29.7%

Meta, the parent company of Facebook, Instagram, and WhatsApp, has seen impressive growth in digital advertising and AI-driven content recommendations. Its strong quality and ROIC scores suggest a well-managed business with sustainable profit margins.

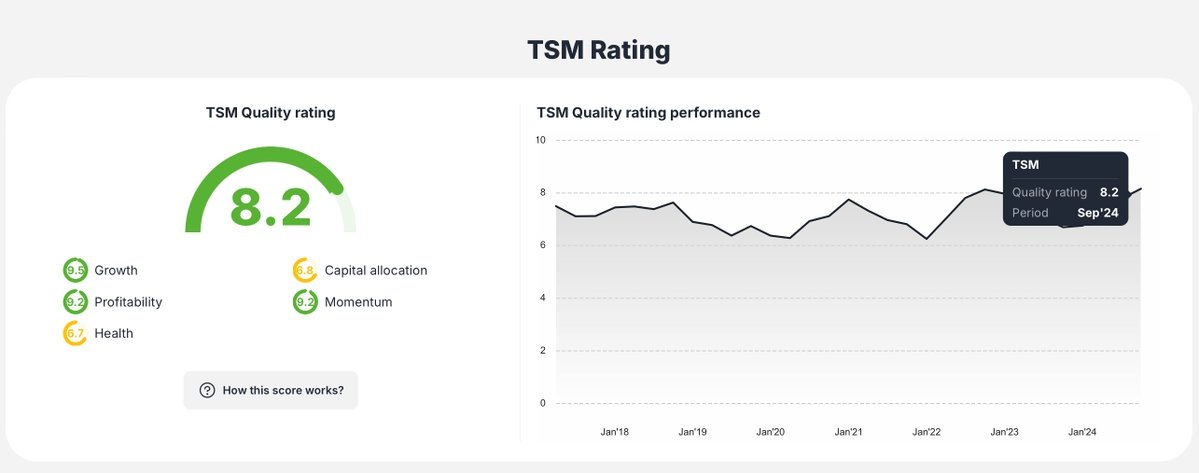

Taiwan Semiconductor Manufacturing ($TSM)

- Momentum: 9.2

- Quality: 8.3

- ROIC: 31.4%

As the world's leading contract semiconductor manufacturer, TSMC plays a crucial role in global chip production. The company's high ROIC and quality scores highlight its efficiency and strong competitive moat.

Palantir Technologies ($PLTR)

- Momentum: 9.6

- Quality: 8.1

- ROIC: 38.4%

Palantir specializes in big data analytics and AI-driven insights, serving both government and commercial clients. Its strong momentum and quality scores indicate sustained investor interest and a growing market footprint.

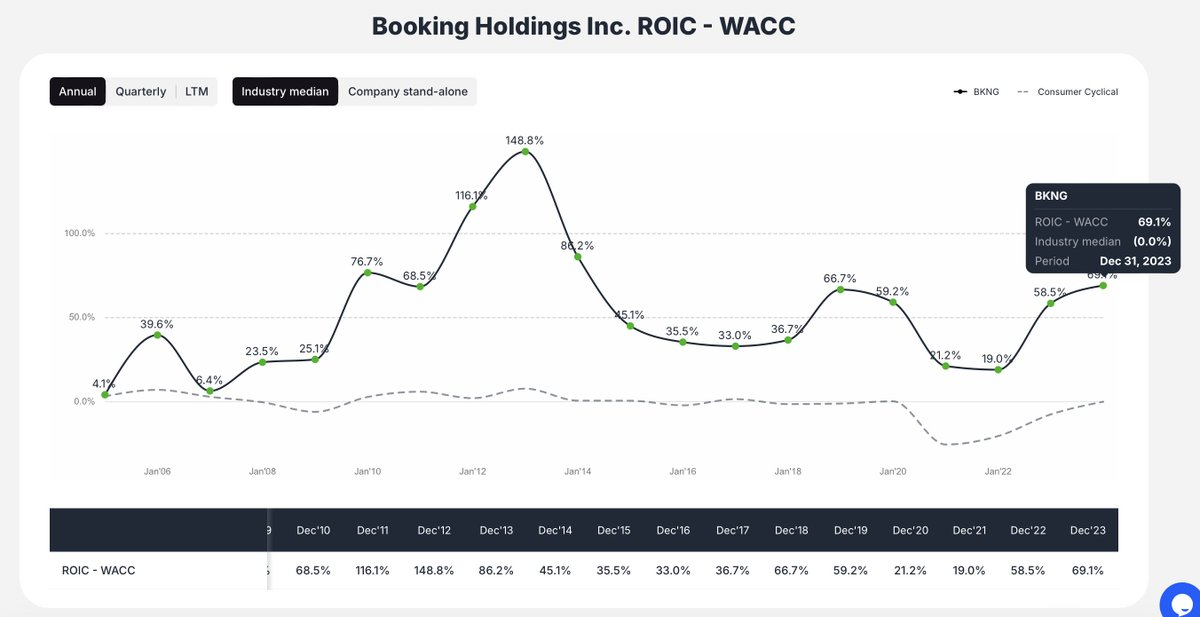

Booking Holdings ($BKNG)

- Momentum: 6.9

- Quality: 7.6

- ROIC: 96.4%

Booking Holdings, the parent company of Booking.com, Kayak, and Priceline, continues to thrive in the online travel industry. Its strong momentum and high ROIC indicate efficient capital allocation and consistent revenue growth from global travel demand.

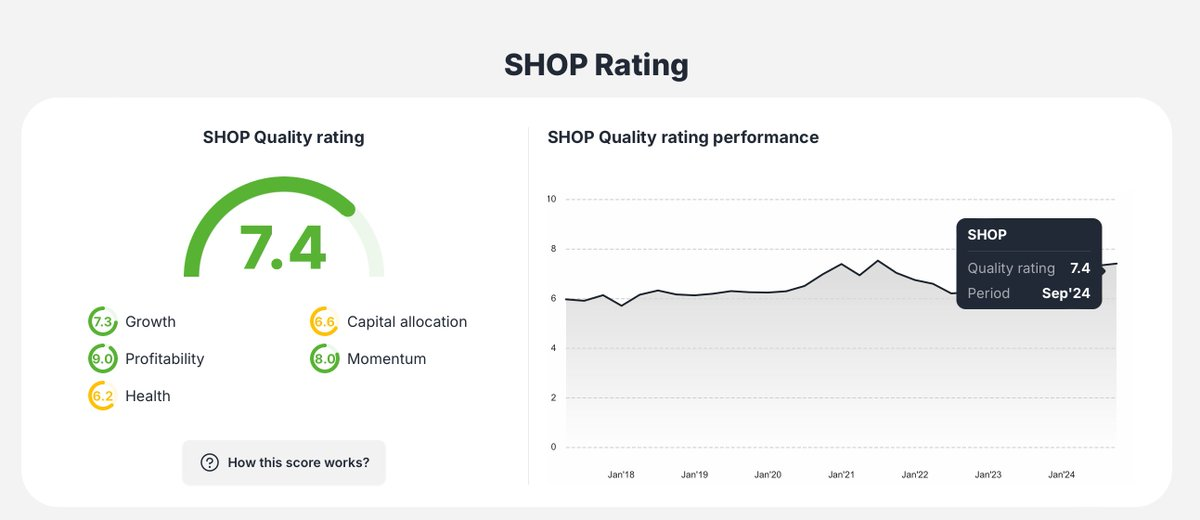

Shopify ($SHOP)

- Momentum: 9.6

- Quality: 7.4

- ROIC: 61.8%

Shopify remains a key player in the e-commerce space, enabling businesses of all sizes to sell online. Its impressive ROIC indicates excellent capital efficiency, while high momentum suggests continued investor confidence.

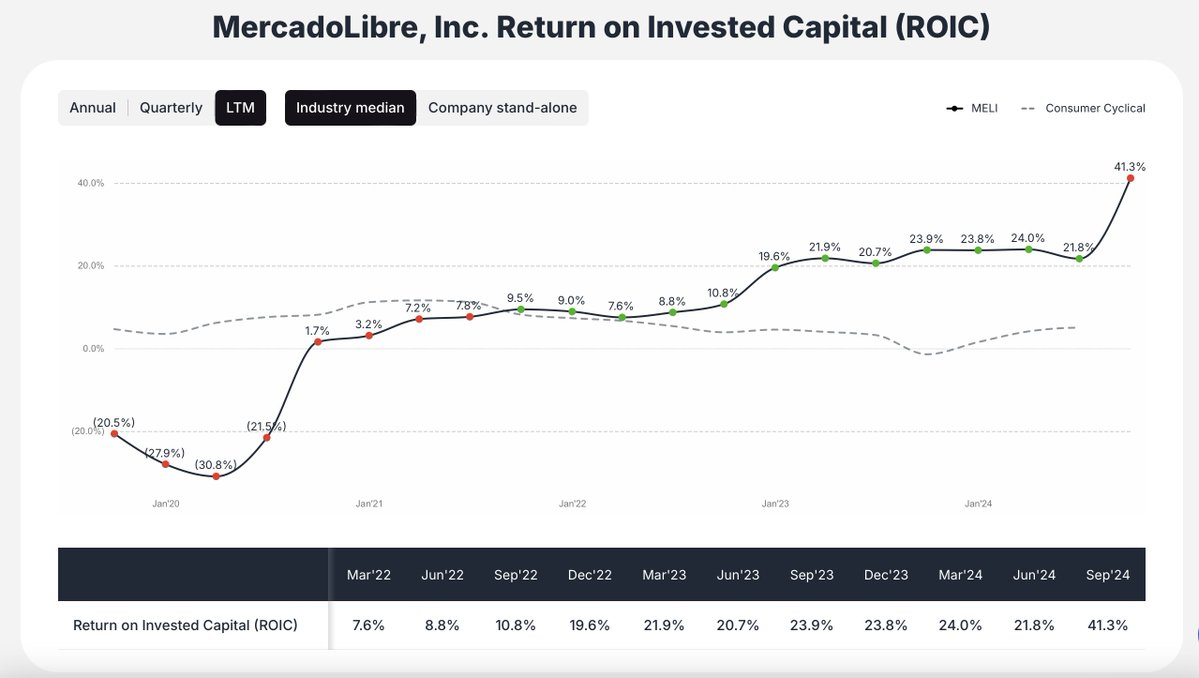

MercadoLibre ($MELI)

- Momentum: 9.5

- Quality: 7.5

- ROIC: 41.3%

MercadoLibre is often referred to as the Amazon of Latin America. With strong e-commerce and fintech operations, its high momentum and ROIC indicate robust growth and capital efficiency.

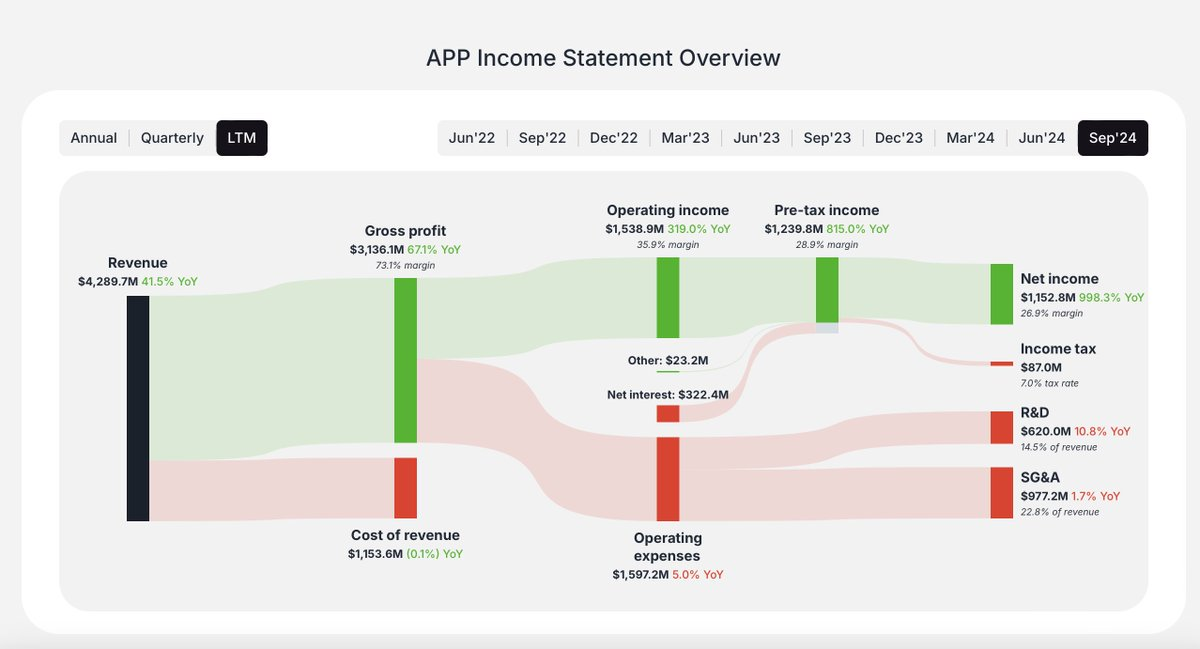

AppLovin ($APP)

- Momentum: 9.2

- Quality: 7.8

- ROIC: 38.2%

AppLovin specializes in mobile app monetization, benefiting from increasing digital ad spending. Its strong quality and momentum scores indicate sustained growth potential.

You can check out the companies from the thread on the Value Sense platform. It's absolutely free.

For investors seeking opportunities, our analytics team provides comprehensive lists of undervalued companies where the intrinsic value suggests potential undervaluation, combining fundamental analysis with quality metrics:

Ready to start?

Join 3,500+ value investors worldwide

FAQ

1. What criteria were used to select these high-quality growth stocks?

The stocks in this list were selected based on three key metrics:

- Momentum Score (Above 8) – Measures investor interest and recent price performance.

- Quality Score (Above 7) – Assesses financial health and business strength.

- Return on Invested Capital (ROIC) (Above 20%) – Indicates how efficiently a company uses its capital to generate profits.

2. Why is ROIC an important metric for evaluating stocks?

ROIC (Return on Invested Capital) is crucial because it measures a company's ability to generate returns on the capital invested in its business. A high ROIC (above 20%) suggests strong profitability, efficient capital allocation, and a sustainable competitive advantage.

3. Which company has the highest ROIC on this list?

Booking Holdings ($BKNG) has the highest ROIC at 96.4%, indicating exceptional capital efficiency and profitability in the online travel industry.

4. Why is NVIDIA ($NVDA) considered a top-performing growth stock?

NVIDIA has a Momentum Score of 9.7, a Quality Score of 9.1, and an ROIC of 56.3%. The company dominates the semiconductor industry, benefiting from AI advancements and strong GPU demand, making it a strong growth stock.

5. How does momentum score impact stock selection?

A high Momentum Score (above 8) indicates strong recent price performance and growing investor interest. Stocks with high momentum tend to continue their upward trends, making them attractive for growth investors.