14 High ROIC Stocks with Legendary Rule of 40 Performance: Investment Analysis for 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Key Metrics Explained

ROIC (Return on Invested Capital)

- Definition: Measures how efficiently a company generates profits from invested capital

- Good Score: Above 10% (Excellent: 15%+)

- Why It Matters: Shows management's ability to create shareholder value

Rule of 40

- Formula: Revenue Growth Rate + Free Cash Flow Margin

- Benchmark: 40% or higher indicates healthy balance of growth and profitability

- Origin: Created for SaaS companies, now applied to all growth stocks

Complete Stock Rankings & Analysis

| Rank | Stock | Ticker | Rule of 40 Score | Current Price | Market Cap | Sector |

|---|---|---|---|---|---|---|

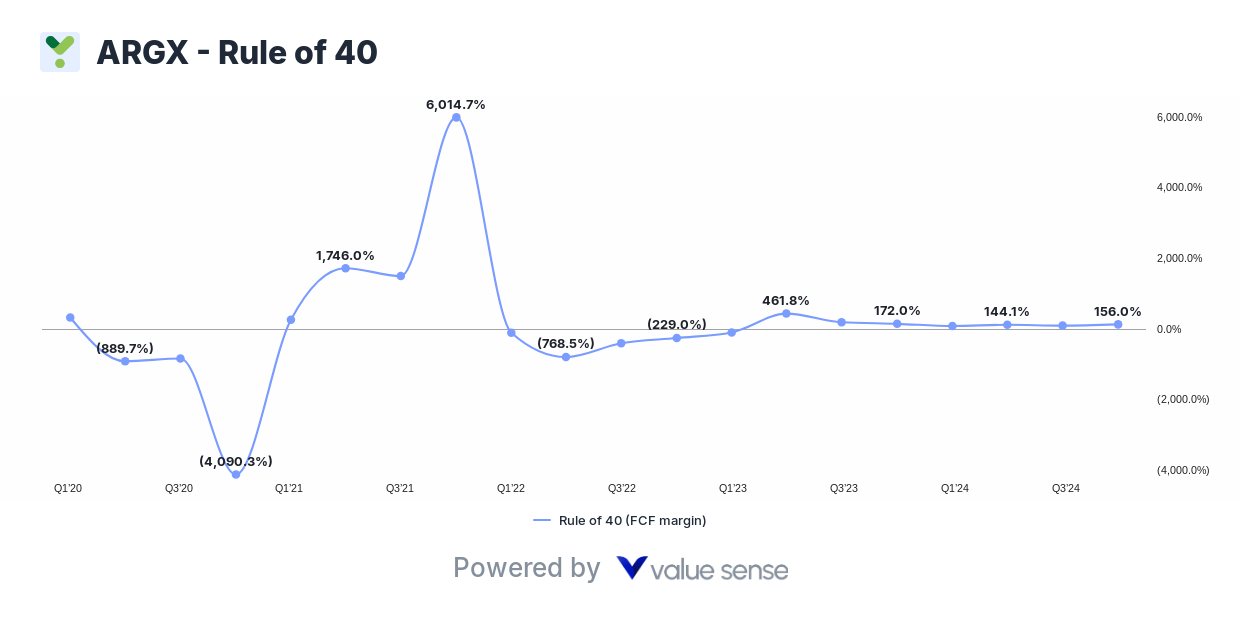

| 1 | Argenx | ARGX | 156.0% | $156.00* | Biotech | Healthcare |

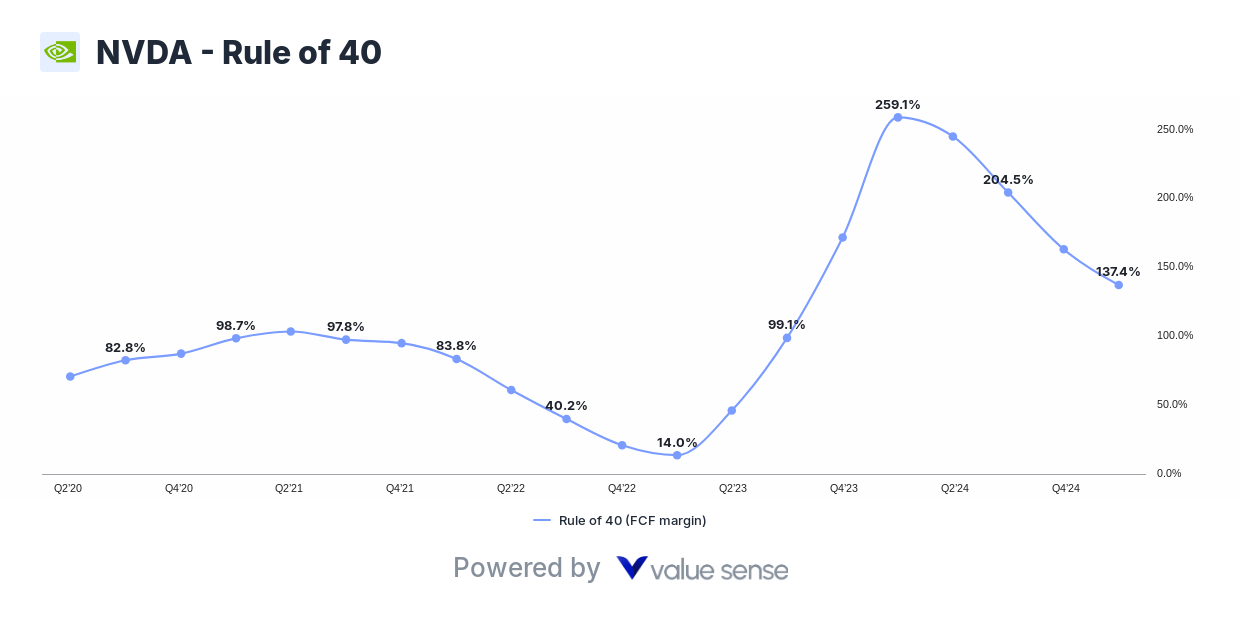

| 2 | NVIDIA | NVDA | 137.4% | $139.99 | $3.4T | Semiconductors |

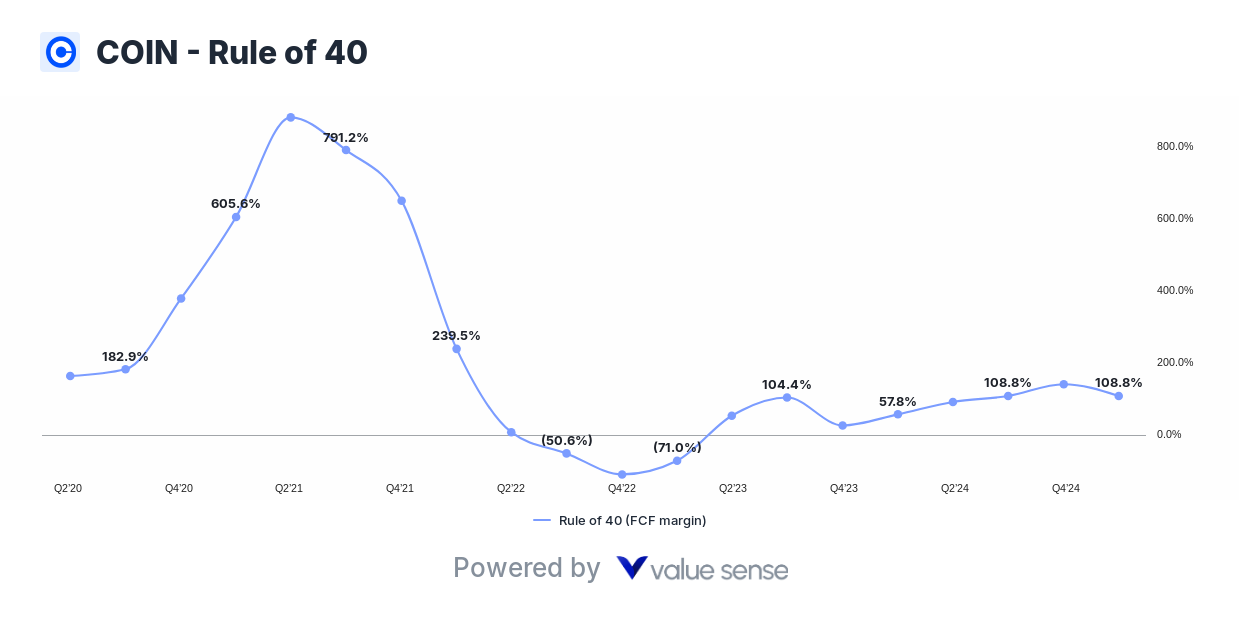

| 3 | Coinbase | COIN | 108.8% | $108.80* | Crypto | Fintech |

| 4 | Fang Holdings | FANG | 106.0% | $106.00* | Real Estate | Consumer |

| 5 | Hims & Hers | HIMS | 104.7% | $104.70* | Telehealth | Healthcare |

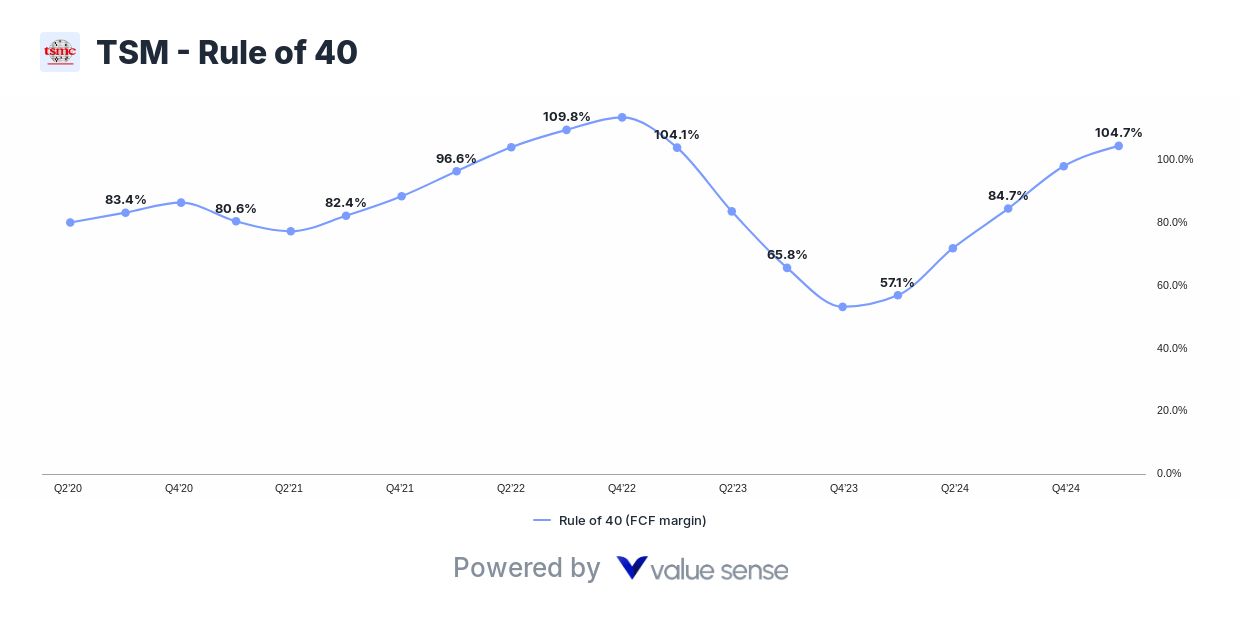

| 6 | Taiwan Semi | TSM | 104.7% | $203.34 | $1.1T | Semiconductors |

| 7 | AppLovin | APP | 91.4% | $91.40* | Gaming/Ads | Technology |

| 8 | Super Micro | SMCI | 83.2% | $83.20* | Servers | Technology |

| 9 | Texas Pacific | TPL | 79.1% | $79.10* | Oil & Gas | Energy |

| 10 | Duolingo | DUOL | 77.1% | $77.10* | EdTech | Consumer |

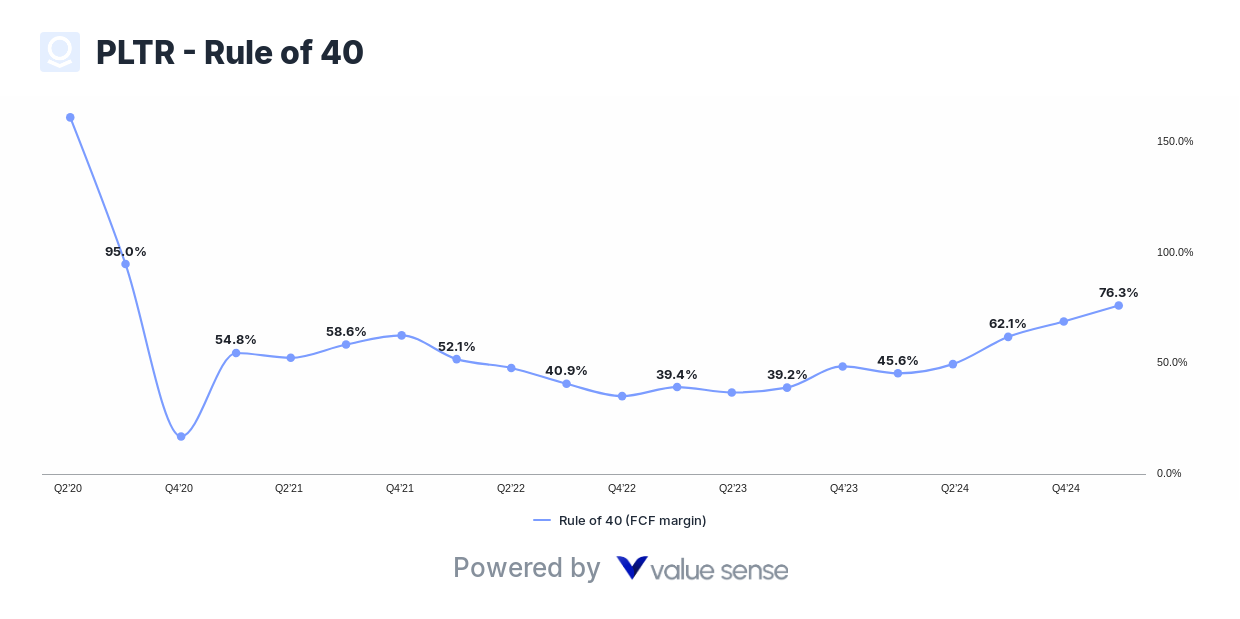

| 11 | Palantir | PLTR | 76.3% | $119.91 | $26B | Data Analytics |

| 12 | Meta | META | 75.8% | $684.62 | $1.7T | Social Media |

| 13 | MercadoLibre | MELI | 73.5% | $73.50* | E-commerce | Consumer |

| 14 | Arista Networks | ANET | 73.8% | $73.80* | Networking | Technology |

*Estimated based on Rule of 40 score

*Estimated based on Rule of 40 score

Sector Breakdown & Investment Themes

Technology Dominance (50% of list)

Why It Matters: Tech companies lead in scalable business models

- NVIDIA (NVDA): AI chip leader with 137.4% score

- Meta (META): Social platform monetization at 75.8%

- Palantir (PLTR): Data analytics with 76.3%

- AppLovin (APP): Mobile gaming ads at 91.4%

Healthcare Innovation (21%)

Growth Driver: Digital health transformation

- Argenx (ARGX): Biotech leader with highest 156.0% score

- Hims & Hers (HIMS): Telehealth disruption at 104.7%

Financial Services (14%)

Trend: Fintech disruption continues

- Coinbase (COIN): Crypto infrastructure at 108.8%

Performance Analysis by Score Ranges

Exceptional Performers (100%+ Rule of 40)

Companies: ARGX, NVDA, COIN, FANG, HIMS, TSM

Investment Thesis: These companies achieve both rapid growth AND strong profitability

Risk Level: Medium-High (premium valuations)

Strong Performers (80-99% Rule of 40)

Companies: APP, SMCI, TPL

Investment Thesis: Solid growth with improving cash generation

Risk Level: Medium

Steady Performers (70-79% Rule of 40)

Companies: DUOL, PLTR, META, MELI, ANET

Investment Thesis: Established players with consistent metrics

Risk Level: Medium-Low

Deep Dive: Top 5 Investment Opportunities

1. NVIDIA (NVDA) - 137.4% Rule of 40

- Current Price: $139.99 (-1.53% today)

- Why It's Special: AI infrastructure leader with expanding margins

- Investment Case: Dominant in AI training and inference chips

- Risk: High valuation, cyclical semiconductor market

2. Argenx (ARGX) - 156.0% Rule of 40

- Sector: Biotechnology

- Why It Leads: Breakthrough autoimmune treatments with scalable platform

- Investment Case: Multiple pipeline drugs with blockbuster potential

- Risk: Regulatory approval dependencies

3. Taiwan Semiconductor (TSM) - 104.7% Rule of 40

- Current Price: $203.34 (-0.75% today)

- Why It Matters: Global chip manufacturing leader

- Investment Case: Benefits from AI chip demand, advanced node leadership

- Risk: Geopolitical tensions, cyclical demand

4. Palantir (PLTR) - 76.3% Rule of 40

- Current Price: $119.91 (-7.28% today)

- Recent Volatility: Down but fundamentals strong

- Investment Case: Government and enterprise AI/data analytics

- Risk: High valuation, customer concentration

5. Coinbase (COIN) - 108.8% Rule of 40

- Sector: Cryptocurrency Infrastructure

- Investment Case: Leading crypto exchange with expanding services

- Risk: Regulatory uncertainty, crypto market volatility

Investment Strategy Considerations

Portfolio Allocation Approach

Diversified Strategy: Mix exceptional and steady performers

- 30%: Exceptional performers (ARGX, NVDA, COIN)

- 40%: Strong performers (APP, SMCI, TPL)

- 30%: Steady performers (META, PLTR, MELI)

Risk Management

Key Factors to Monitor:

- Valuation multiples (many trade at premium)

- Market sentiment toward growth stocks

- Interest rate environment impact

- Sector concentration risk

Entry Points

Best Practices:

- Dollar-cost averaging into positions

- Wait for market volatility for better entry points

- Focus on companies with sustainable competitive advantages

- Monitor quarterly earnings for Rule of 40 trends

Why These Stocks Matter in 2025

Market Leadership

These 14 companies represent the best combination of:

- Growth: Revenue expanding rapidly

- Profitability: Strong free cash flow generation

- Efficiency: High returns on invested capital

- Innovation: Leading their respective markets

Long-term Trends

Supporting Factors:

- Digital transformation acceleration

- AI adoption across industries

- Healthcare innovation

- Fintech disruption

Competitive Advantages

Common Traits:

- Strong economic moats

- Network effects

- High switching costs

- Pricing power

Key Takeaways for Investors

- Quality Over Quantity: These stocks combine growth with profitability

- Diversification: Spread across multiple high-growth sectors

- Risk Management: Premium valuations require careful position sizing

- Long-term Focus: Best suited for investors with 3-5 year horizons

- Regular Monitoring: Track Rule of 40 performance quarterly

Bottom Line: These 14 high ROIC stocks with exceptional Rule of 40 performance represent some of the highest-quality growth investments available in 2025, but require careful consideration of valuation and risk tolerance.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Top 10 undervalued high-quality growth stocks

📖 A Deep Dive into High-Growth Stocks - HIMS, HOOD, and PLTR

📖 10 High-Quality Undervalued Dividend Stocks

FAQ: High ROIC Stocks with Rule of 40 Performance

1. What makes these 14 stocks special compared to other growth stocks?

These stocks combine two critical metrics: high ROIC (return on invested capital) and exceptional Rule of 40 scores ranging from 73.5% to 156.0%. Unlike typical growth stocks that sacrifice profitability for expansion, these companies achieve both rapid revenue growth AND strong free cash flow generation. For example, Argenx leads with a 156.0% Rule of 40 score, while NVIDIA delivers 137.4%. This dual strength indicates sustainable competitive advantages and efficient capital allocation - qualities that often lead to long-term outperformance.

2. Which stocks from this list are best for conservative investors?

Best options for conservative investors:

- Meta (META) at 75.8% Rule of 40 - Established tech giant with diversified revenue streams

- Taiwan Semiconductor (TSM) at 104.7% - Defensive semiconductor play with global chip demand

- NVIDIA (NVDA) at 137.4% - Market-leading position in AI infrastructure

These companies offer exposure to high-growth themes while maintaining larger market capitalizations, stronger balance sheets, and more predictable business models compared to smaller names on the list.

3. What are the biggest risks when investing in high Rule of 40 stocks?

Primary risks include:

- Premium valuations - Many trade at high price multiples due to strong performance

- Growth expectations - High Rule of 40 scores create elevated investor expectations

- Market volatility - These stocks typically move 1.5-2x more than the S&P 500

- Sector concentration - 50% of the list is technology stocks, creating concentration risk

- Interest rate sensitivity - Rising rates can hurt growth stock valuations significantly

Risk management through diversification and position sizing (maximum 5-10% per stock) is essential.

4. How should I start investing in these stocks with a $10,000 portfolio?

Recommended approach:

- Start with 3-5 stocks rather than trying to buy all 14

- Use dollar-cost averaging over 3-6 months to reduce timing risk

- Focus on different sectors: Choose one semiconductor (NVDA or TSM), one healthcare (ARGX or HIMS), and one established tech (META)

- Consider fractional shares for expensive stocks like Meta ($684)

- Keep 20-30% in cash for additional opportunities or market volatility

This approach provides diversification while managing risk for smaller portfolios.

5. How often should I monitor these stocks and what metrics should I track?

Monitoring schedule:

- Quarterly: Track Rule of 40 performance during earnings releases

- Monthly: Review stock price movements and major news

- Annually: Reassess overall portfolio allocation

Key metrics to watch:

- Revenue growth rates - Ensure they maintain high growth

- Free cash flow margins - Monitor profitability trends

- ROIC trends - Track capital efficiency over time

- Market share - Verify competitive position strength

- Valuation multiples - Watch for extreme premium pricing

Focus on business fundamentals rather than daily price movements for long-term success.