The Efficiency Wars: A Deep Dive into Three High-Growth Stocks - HIMS, HOOD, and PLTR

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Today, we'll analyze three compelling companies that showcase different approaches to achieving efficiency: Hims & Hers Health (HIMS), Robinhood Markets (HOOD), and Palantir Technologies (PLTR).

The Efficiency Metrics That Matter

When evaluating growth stocks, three key efficiency metrics stand out:

- Revenue per Employee: A measure of how much revenue each employee generates

- Revenue Growth: The year-over-year percentage increase in revenue

- Free Cash Flow (FCF) Margin: The percentage of revenue converted to free cash flow

- Price-to-FCF Ratio: Valuation relative to free cash flow generation

Let's examine how our three contenders stack up:

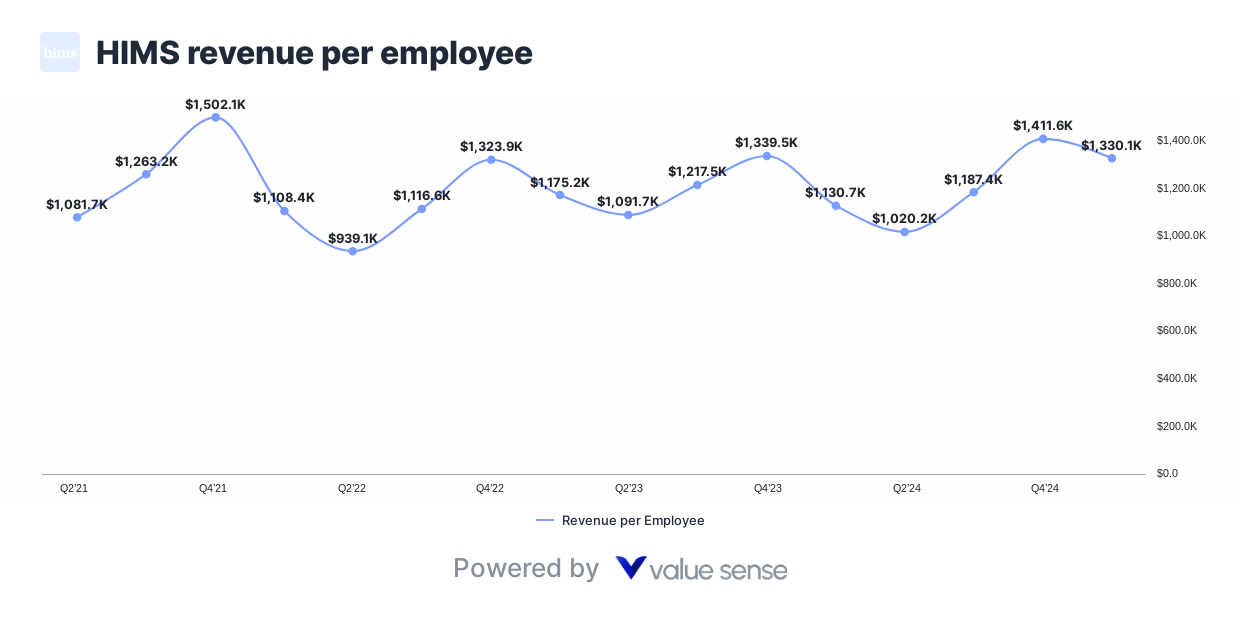

HIMS: The Revenue Growth Champion

Hims & Hers Health emerges as the clear winner in terms of raw revenue growth, posting an impressive 86.0% year-over-year increase.

Key Metrics:

- Revenue per Employee: $1,330.1K

- Revenue Growth: 86.0%

- FCF Margin: 13.5%

- P/FCF: 52.3x

The telehealth platform has demonstrated remarkable execution in scaling its direct-to-consumer healthcare model. With revenue reaching $586 million in Q1 2025 compared to $278.2 million in the prior year, HIMS showcases the power of digital healthcare transformation Forbes.

What makes HIMS efficient?

- Digital-first approach: Eliminates traditional healthcare inefficiencies

- Subscription model: Predictable recurring revenue streams

- Direct-to-consumer: Cuts out intermediaries and reduces costs

- Telehealth scalability: Serve more patients without proportional infrastructure increases

However, the relatively modest FCF margin of 13.5% suggests the company is still in heavy investment mode, prioritizing growth over near-term profitability optimization.

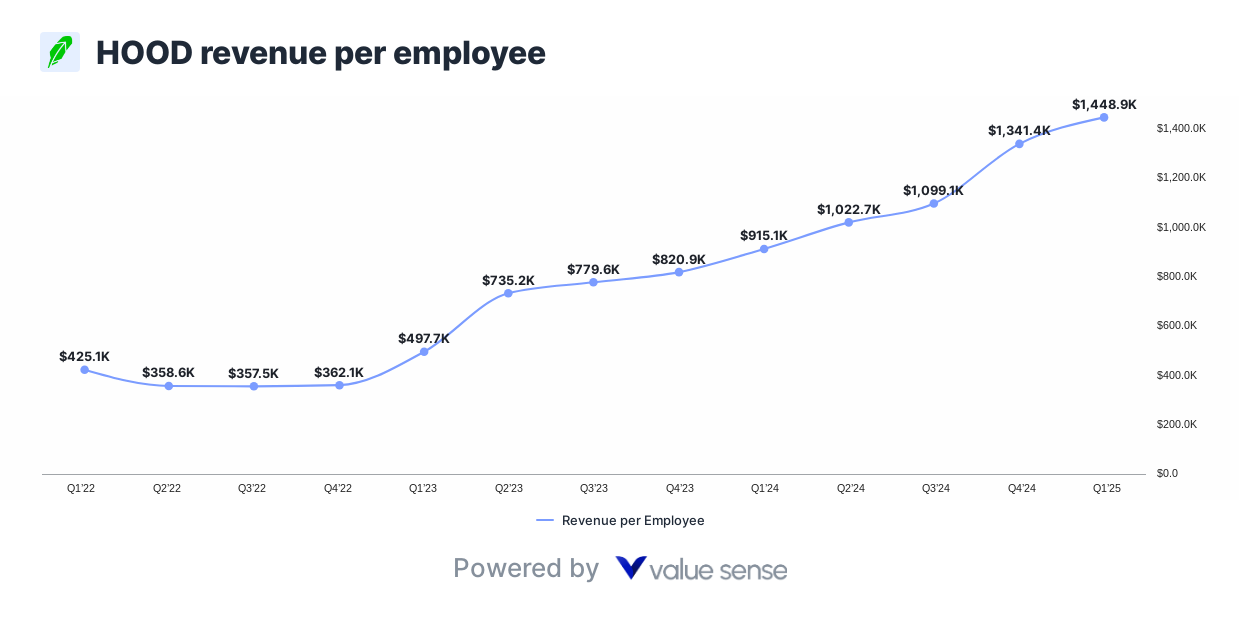

HOOD: The Cash Flow Efficiency Master

Robinhood Markets strikes an impressive balance between growth and profitability, leading the pack with a 33.0% FCF margin.

Key Metrics:

- Revenue per Employee: $1,448.9K

- Revenue Growth: 58.3%

- FCF Margin: 33.0%

- P/FCF: 54.4x

Robinhood's efficiency stems from its commission-free trading platform that has revolutionized retail investing. The company reported record Q4 2024 revenues of $1.01 billion, up 115% year-over-year, while maintaining strong operational leverage Robinhood Investor Relations.

HOOD's efficiency advantages:

- Platform scalability: Technology infrastructure serves millions with minimal incremental costs

- Network effects: More users attract more users and trading activity

- Diversified revenue streams: Trading, Gold subscriptions, crypto, and cash management

- Operational leverage: Fixed costs spread across growing user base

The company's ability to generate over $1.4M in revenue per employee while maintaining robust cash flow conversion demonstrates the power of well-executed fintech platforms.

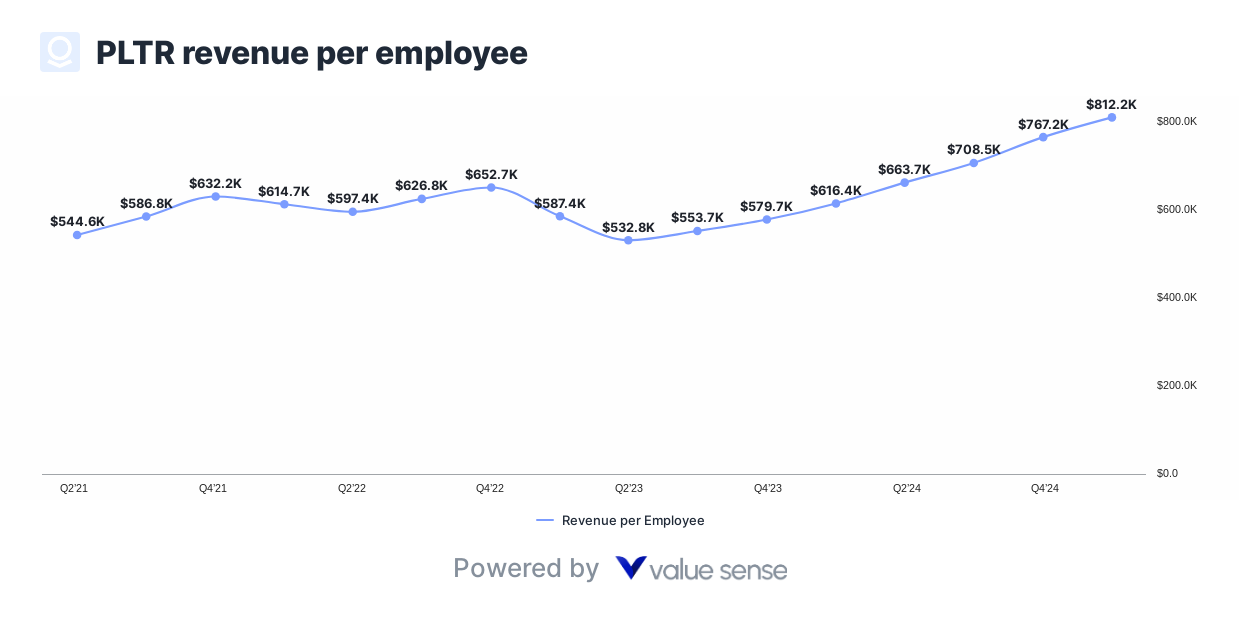

PLTR: The Premium Efficiency Play

Palantir Technologies represents a fascinating case study in premium positioning and operational efficiency.

Key Metrics:

- Revenue per Employee: $812.2K

- Revenue Growth: 33.5%

- FCF Margin: 42.3%

- P/FCF: 234.8x

While Palantir shows the lowest revenue per employee and growth rate among the three, it commands the highest FCF margin at 42.3% and trades at a significant premium with a P/FCF of 234.8x.

Palantir's unique efficiency model:

- High-value, low-volume: Focus on large enterprise and government contracts

- Sticky customer relationships: Long-term contracts with high switching costs

- Proprietary technology: Differentiated AI/data analytics platform

- Operational leverage: Software scales efficiently once deployed

The company's Q1 2025 results showed U.S. revenue growth of 55% year-over-year, with particularly strong performance in commercial markets Palantir Investor Relations.

Industry Context and Benchmarks

To understand these metrics in context, it's important to compare against industry standards:

- Tech company median revenue per employee: ~$400K OnDeck

- SaaS companies median revenue per employee: $125K SaaS Capital

- High-growth tech FCF margins: Typically 10-25%

All three companies significantly outperform these benchmarks, demonstrating their operational excellence.

Investment Implications and Risk Considerations

The Growth vs. Efficiency Trade-off

Each company represents a different point on the growth-efficiency spectrum:

HIMS prioritizes maximum growth, accepting lower current profitability for market share gains in the massive healthcare market.

HOOD balances growth with profitability, showing sustainable unit economics while still capturing market opportunity.

PLTR focuses on premium positioning and margin expansion, with growth driven by value rather than volume.

Valuation Considerations

The P/FCF ratios reveal market expectations:

- HIMS (52.3x): Expects continued rapid growth acceleration

- HOOD (54.4x): Similar growth expectations with better current profitability

- PLTR (234.8x): Premium valuation betting on continued margin expansion and market dominance

Risk Factors to Monitor

HIMS Risks:

- Regulatory changes in telehealth

- Increased competition from traditional healthcare providers

- Customer acquisition cost inflation

HOOD Risks:

- Market volatility affecting trading volumes

- Regulatory scrutiny of retail trading platforms

- Competition from traditional brokerages going commission-free

PLTR Risks:

- Dependence on government contracts

- Long sales cycles limiting growth acceleration

- Competitive pressure in enterprise analytics

The Verdict: Which Efficiency Model Wins?

There's no single "winner" among these three efficiency champions - each excels in different aspects:

Choose HIMS if you believe in:

- The digital healthcare transformation

- Sacrificing near-term margins for market dominance

- High-growth, high-opportunity markets

Choose HOOD if you prefer:

- Balanced growth with strong cash generation

- Proven scalable business models

- Exposure to the democratization of finance

Choose PLTR if you want:

- Premium margins and pricing power

- Exposure to AI and big data trends

- Long-term competitive moats

Looking Ahead: The Future of Efficient Growth

The efficiency metrics these companies display today will likely evolve as they mature:

- HIMS should see FCF margins improve as growth moderates and scale benefits emerge

- HOOD may face margin pressure as it invests in new products and markets

- PLTR could see revenue per employee improve as it scales commercial operations

The key for investors is understanding not just current efficiency, but the trajectory and sustainability of these metrics over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Top 10 undervalued high-quality growth stocks

📖 Analyzing Warren Buffett's Portfolio

📖 10 High-Quality Undervalued Dividend Stocks