How ACON (Aclarion) Makes Money in 2025: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

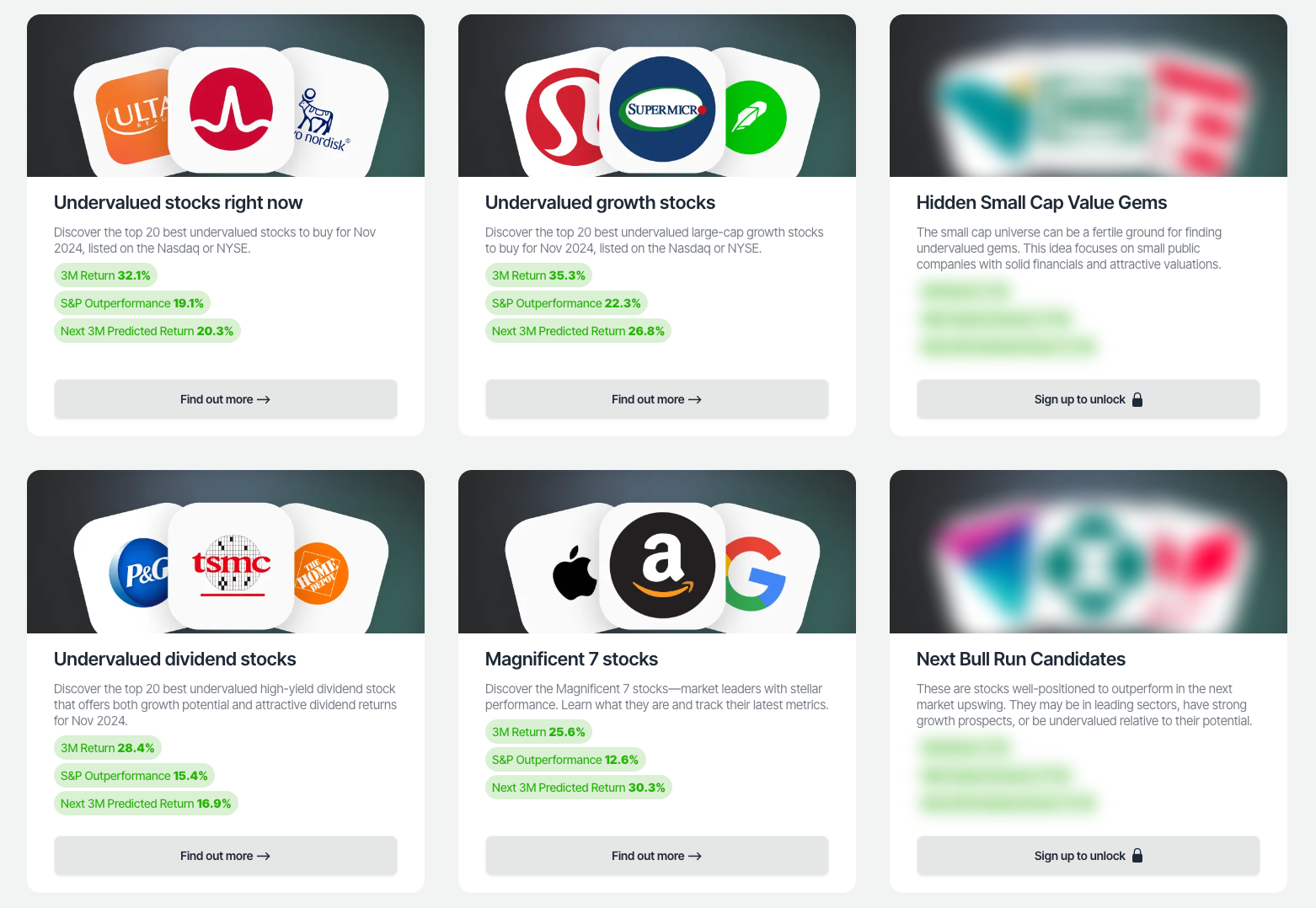

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a company like ACON makes money is essential for investors and anyone interested in the business of [industry]. In this post, we break down ACON’s quarterly income statement (Q2 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

Quick ACON Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2025/11/ACON_income_1762005193.png)

ACON operates in [industry], generating revenue primarily through [brief description of business model and main products/services]. The company’s revenue model is focused on [description of main revenue streams]. In Q2 2025, ACON reported total revenue of $19.3K, reflecting a remarkable 76.1% year-over-year (YoY) growth, signaling strong momentum in its core operations.

Revenue Breakdown

- Total Revenue (Q2 2025): $19.3K (+76.1% YoY)

- Revenue: $19.3K (100% of total)

- Growth is powered by [key growth drivers, e.g., expanding customer base, new product launches, or market penetration].

ACON’s revenue is currently reported as a single segment, with no detailed breakdown by product or service line in the provided data. This suggests the company may be in an early growth phase or operates a focused business model.

Gross Profit and Margins

- Gross Profit: $5,140.0 (26.6% gross margin)

- Cost of Revenue: $14.2K (+39.1% YoY)

- ACON maintains moderate gross margins, which are typical for companies balancing growth investments with cost management. The majority of costs are tied to delivering its core products or services.

Operating Income and Expenses

- Operating Expenses: $1,741.6 (+55.1% YoY)

- R&D: $270.4 (+33.8% YoY, 1,399.8% of revenue) — ACON is investing heavily in research and development relative to its revenue base, likely to fuel future innovation and product development.

- SG&A: $1,471.2 (+59.7% YoY, 7,615.4% of revenue) — Sales, general, and administrative expenses are also elevated as a percentage of revenue, reflecting significant spending on growth initiatives, marketing, and overhead.

- Operating Income: Not reported in the provided data.

- ACON continues to prioritize innovation and growth, as evidenced by its substantial R&D and SG&A investments, even as these expenses weigh heavily on current profitability.

Net Income

- Net Income: $1,600.8 (+29.3% YoY, 8,285.9% net margin)

- ACON converts a significant portion of its sales into profit, but the net margin figure appears anomalously high due to a possible data entry or reporting error (net income exceeds total revenue). Investors should verify this with the company’s official filings.

- The company’s ability to deliver net income growth despite rising costs highlights operational discipline, but the margin metrics require further validation.

What Drives ACON’s Money Machine?

- Revenue Growth: ACON’s top-line growth of 76.1% YoY is the standout feature of its financial performance, indicating strong demand or successful market expansion.

- Investment in Innovation: Heavy R&D spending, though a large portion of revenue, signals a focus on future product development and long-term competitiveness.

- Operational Leverage: Despite high operating expenses, ACON manages to grow net income, suggesting some degree of scalability as revenue expands.

- Future Growth Areas: The company’s growth trajectory and investment profile suggest it is positioning itself for future expansion, though current profitability metrics should be interpreted with caution due to data inconsistencies.

Visualizing ACON’s Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.

- Most revenue flows into cost of revenue and operating expenses, with R&D and SG&A taking significant portions relative to the company’s size.

- Despite high investment levels, ACON reports net income growth, though the margin figures require verification.

- The Sankey diagram makes it easy to see the proportion of revenue consumed by various cost categories and what remains as profit, providing a clear picture of ACON’s financial health and operational priorities[1][3].

Key Takeaways

- ACON’s money comes overwhelmingly from its core revenue stream, with no significant diversification by segment in the reported period.

- High reported net margins (subject to verification) illustrate the potential power of ACON’s business model, but investors should scrutinize the underlying data for accuracy.

- Heavy investment in R&D and SG&A reflects a growth-oriented strategy, balanced by the ability to deliver net income growth.

- Ongoing growth is driven by rapid revenue expansion, likely supported by new customer acquisition, product launches, or market share gains.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About ACON’s Income Statement

1. What is the main source of ACON’s revenue in 2025?

ACON generates 100% of its revenue from its core operations, with no segment breakdown provided in the latest quarterly data. This suggests a focused business model centered on a primary product or service offering.

2. How profitable is ACON in Q2 2025?

ACON reported net income of $1,600.8 in Q2 2025, with a net margin of approximately 8,285.9%. However, this figure appears inconsistent with the company’s total revenue and likely reflects a data error. Investors should consult official filings for accurate profitability metrics.

3. What are the largest expense categories for ACON?

The biggest expenses on ACON’s income statement are cost of revenue $14.2K and operating expenses, particularly Sales, General & Administrative (SG&A) costs $1,471.2 and Research & Development (R&D) $270.4. Both SG&A and R&D represent a very high percentage of revenue, indicating aggressive investment in growth and innovation.

4. Why does ACON’s net margin appear unusually high?

The reported net margin is anomalously high, likely due to a data entry or reporting error (net income exceeds total revenue). This discrepancy should be clarified with the company’s official financial statements.

5. How does ACON’s revenue growth compare to previous years?

ACON’s revenue grew by 76.1% year-over-year in Q2 2025, a strong performance that suggests successful execution of its growth strategy. This growth rate significantly outpaces the increase in cost of revenue (+39.1% YoY) and operating expenses (+55.1% YoY), indicating improving operational leverage.

Note: All financial data and percentages are based on the provided JSON and should be cross-checked with ACON’s official filings for accuracy. The Sankey chart visualization offers a clear, intuitive way to understand ACON’s financial flows, highlighting both strengths and areas for investor scrutiny[1][3]. For the most reliable analysis, always refer to the company’s latest SEC filings and earnings releases.