How FORD (Ford Motor Company) Makes Money in 2025: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how an automotive manufacturer like FORD makes money is essential for investors and anyone interested in the business of vehicle production and sales. In this post, we break down FORD's quarterly income statement (Q2 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

* *

Quick FORD Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2025/10/FORD_income_1761920469.png)

FORD operates as a global automotive manufacturer, designing, developing, and selling vehicles across multiple segments including passenger cars, trucks, and commercial vehicles. Revenue comes primarily from vehicle sales, financing services, and aftermarket parts. The company serves customers across North America, Europe, and international markets, with a significant focus on truck and SUV production, which represents a substantial portion of its revenue base.

Revenue Breakdown

- Total Revenue (Q2 2025): $2,494.8B (-68.4% YoY)

- FORD's revenue experienced a significant year-over-year decline of 68.4%, reflecting challenging market conditions and reduced vehicle sales volumes during the period.

- The automotive sector faced headwinds including supply chain pressures, changing consumer demand, and competitive market dynamics.

Gross Profit and Margins

- Gross Profit: $621.0B (24.9% gross margin)

- Cost of Revenue: $3,115.7B (-50.4% YoY)

- FORD maintains a gross margin of approximately 24.9%, which reflects the cost structure inherent in automotive manufacturing. While the gross margin percentage remained relatively stable, the absolute gross profit declined due to lower overall revenue.

- Most costs come from manufacturing and production expenses, including raw materials, labor, factory overhead, and supply chain costs associated with vehicle production.

Operating Income and Expenses

- Operating Expenses: $1,938.8B (-2.4% YoY)

- SG&A (Sales, General & Administrative): $1,938.8B (-2.4% YoY, 77.7% of revenue)

- FORD continues to manage operating expenses while navigating the challenging revenue environment. The company's SG&A expenses represent 77.7% of revenue, indicating that a substantial portion of each sales dollar goes toward selling, distribution, administrative functions, and general corporate overhead.

- The company has demonstrated cost discipline with a modest 2.4% year-over-year reduction in operating expenses, though the high ratio to revenue reflects the impact of lower sales volumes on operational leverage.

Net Income

- Net Income: $850.0B (+112.7% YoY, 34.1% net margin)

- FORD reported net income of $850.0B in Q2 2025, representing a remarkable 112.7% year-over-year increase. The 34.1% net margin is exceptionally strong, indicating that FORD converts a significant portion of sales into profit.

- This substantial profitability is driven by other income items that contributed $850.0B to the bottom line, which may include gains from investments, asset sales, financing activities, or other non-operational sources that significantly boosted net income despite the challenging revenue environment.

What Drives FORD's Money Machine?

- Vehicle Sales: The primary revenue driver, though experiencing significant headwinds in Q2 2025 with a 68.4% year-over-year decline

- Cost Management: FORD's ability to reduce operating expenses by 2.4% year-over-year demonstrates operational discipline despite lower revenue

- Other Income Sources: Non-operational income of $850.0B represents the dominant profit driver in Q2 2025, suggesting gains from strategic transactions, investments, or financing operations

- Manufacturing Efficiency: The 24.9% gross margin reflects the company's production efficiency and pricing power in the automotive market

Visualizing FORD's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.[3][5]

- Revenue flows into gross profit after accounting for manufacturing costs, with the 24.9% gross margin representing the value retained after direct production expenses.

- Operating expenses, particularly SG&A costs at 77.7% of revenue, represent a significant allocation of resources toward sales, distribution, and administrative functions.

- Despite the challenging revenue environment, FORD's net margin of 34.1% demonstrates the substantial impact of other income sources on overall profitability, which more than offset the operational challenges reflected in lower vehicle sales.

Key Takeaways

- FORD's revenue declined 68.4% year-over-year in Q2 2025, reflecting significant headwinds in the automotive market

- The company maintains a healthy 24.9% gross margin, demonstrating underlying manufacturing efficiency

- Operating expenses represent 77.7% of revenue, indicating the cost structure of maintaining sales and administrative operations

- Net profitability of 34.1% is substantially driven by other income sources totaling $850.0B, which significantly exceeded operational results

- FORD's ability to reduce operating expenses by 2.4% demonstrates cost discipline during a challenging period

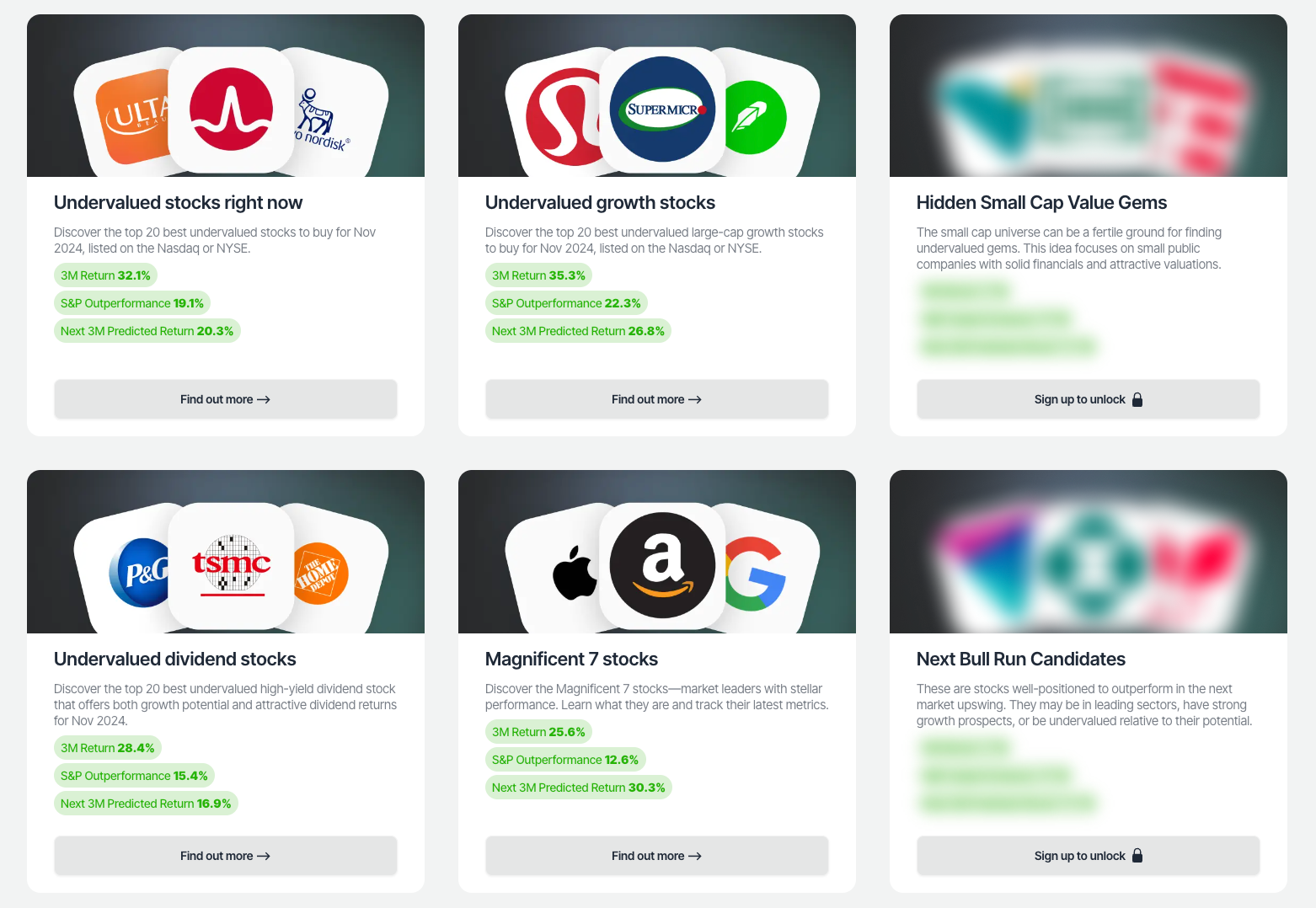

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About FORD's Income Statement

1. What is the main source of FORD's revenue in 2025?

FORD generates its revenue primarily from vehicle sales across its automotive business segments, including passenger vehicles, trucks, and commercial vehicles sold globally. In Q2 2025, the company reported total revenue of $2,494.8B, though this represented a significant 68.4% year-over-year decline due to challenging market conditions and reduced sales volumes.

2. How profitable is FORD in Q2 2025?

FORD reported net income of $850.0B in Q2 2025, with a net margin of approximately 34.1%, reflecting strong profitability. However, it's important to note that this exceptional profitability was primarily driven by other income sources totaling $850.0B rather than operational results from vehicle sales, which were significantly impacted by the 68.4% revenue decline.

3. What are the largest expense categories for FORD?

The largest expense category on FORD's income statement is Sales, General & Administrative (SG&A) expenses, which totaled $1,938.8B in Q2 2025, representing 77.7% of revenue. These expenses cover selling and distribution costs, administrative overhead, and general corporate functions necessary to operate the business. Additionally, cost of revenue of $3,115.7B represents the direct manufacturing and production costs associated with vehicle production.

4. Why did FORD's revenue decline so significantly in Q2 2025?

FORD's 68.4% year-over-year revenue decline in Q2 2025 reflects challenging conditions in the automotive industry, including reduced consumer demand, supply chain pressures, and competitive market dynamics. The automotive sector faced headwinds during this period that impacted vehicle sales volumes across manufacturers.

5. How does FORD's gross margin compare to typical automotive manufacturers?

FORD's gross margin of 24.9% in Q2 2025 reflects the cost structure inherent in automotive manufacturing, where significant resources are required for raw materials, labor, and factory operations. This margin level is typical for established automotive manufacturers and demonstrates the company's manufacturing efficiency and ability to manage production costs effectively.