How JD (JD.com) Makes Money in 2026: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

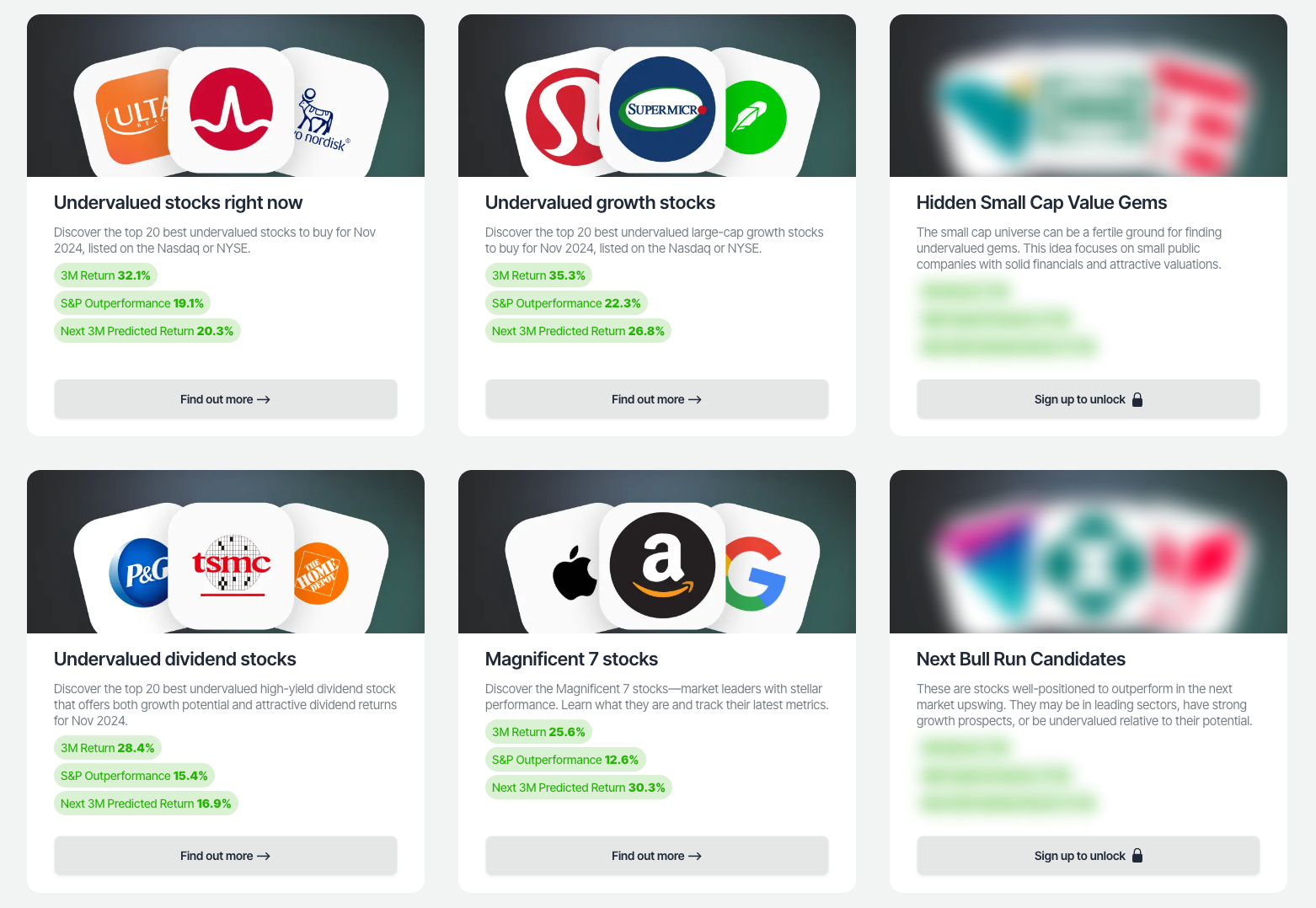

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a leading Chinese e-commerce and retail technology company like JD makes money is essential for investors and anyone interested in the business of digital commerce and logistics. In this post, we break down JD's quarterly income statement (Q2 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

Quick JD Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2025/11/JD_income_1762771362.png)

JD operates one of China’s largest e-commerce platforms, providing direct sales of electronics, home appliances, and general merchandise, as well as third-party marketplace services. Revenue comes primarily from online direct sales, complemented by logistics services and technology-driven retail solutions. JD’s business segments include JD Retail (core direct sales), JD Logistics (supply chain and delivery), and New Businesses (technology and innovation initiatives).

Revenue Breakdown

- Total Revenue (Q2 2025): $80.8B (+22.4% YoY)

- Revenue (Direct Sales & Services): $80.8B (100% of total)

- [Segment breakdown not disclosed in this filing; historically, JD Retail is the dominant contributor, with logistics and new businesses as smaller but growing segments.]

- Growth is powered by strong e-commerce demand, expansion of logistics services, and increased penetration in lower-tier cities.

Gross Profit and Margins

- Gross Profit: $12.8B (15.9% gross margin)

- Cost of Revenue: $67.9B (+22.0% YoY)

- JD maintains moderate margins due to its scale in direct sales, efficiency in logistics, and technology-driven cost controls.

- Most costs come from procurement of goods for resale, logistics and fulfillment expenses, and technology infrastructure.

Operating Income and Expenses

- Operating Income: [Not disclosed in this filing]

- Operating Expenses: $13.0B (+62.3% YoY)

- R&D: $1.2B (+25.7% YoY, 1.5% of revenue) — Focused on automation, AI, supply chain technology, and platform innovation.

- SG&A: $6.86B (+116.3% YoY, 8.5% of revenue) — Includes marketing, personnel, and administrative costs to support rapid business expansion.

- JD continues to invest in technology and logistics while scaling operations to capture market share and drive future growth.

Net Income

- Pre-Tax Income: [Not disclosed in this filing]

- Income Tax: [Not disclosed in this filing]

- Net Income: $1.40B (-51.1% YoY, 1.7% net margin)

- JD converts a moderate portion of sales into profit due to its high-volume, low-margin retail model and ongoing investments in growth and innovation.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

What Drives JD's Money Machine?

- Direct E-commerce Sales: Over 90% of revenue is historically generated from direct sales of electronics, appliances, and general merchandise.

- Active Customer Accounts: JD’s platform serves hundreds of millions of active users, driving high transaction volumes and repeat business.

- Logistics & Technology Investment: Strategic investments in automated warehouses, last-mile delivery, and AI-driven supply chain solutions enhance efficiency and customer experience.

- Future Growth Areas: JD Logistics and New Businesses (including healthcare and fintech) are expanding rapidly, though not yet major profit contributors.

Visualizing JD's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.

- Most revenue flows into gross profit, with operating expenses (especially SG&A) taking the largest chunk.

- Even after significant investments in technology and logistics, only 1.7% of revenue drops to the bottom line.

Key Takeaways

- JD’s money comes overwhelmingly from direct e-commerce sales of goods to consumers.

- High gross and net margins illustrate the power of JD’s scale and logistics-driven business model, though margins remain moderate due to fierce competition and investment needs.

- Heavy investment in R&D and logistics infrastructure, balanced by efficiency in procurement and fulfillment.

- Ongoing growth is driven by e-commerce expansion, logistics services, and technology innovation.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About JD's Income Statement

1. What is the main source of JD's revenue in 2025?

JD generates over 90% of its revenue from direct e-commerce sales of electronics, appliances, and general merchandise. Logistics and technology services contribute a smaller but growing share.

2. How profitable is JD in Q2 2025?

JD reported net income of $1.40B in Q2 2025, with a net margin of approximately 1.7%, reflecting moderate profitability driven by scale and operational efficiency, but weighed down by heavy investment in growth.

3. What are the largest expense categories for JD?

The biggest expenses on JD’s income statement are cost of revenue (primarily procurement and logistics), followed by operating expenses—especially Sales, General & Administrative (SG&A) at $6.86B in Q2 2025, and R&D at $1.2B, as JD prioritizes technology and logistics innovation.

4. Why does JD Logistics operate at a loss?

JD Logistics, despite generating significant revenue, posted an operating loss in Q2 2025. This is because JD aggressively invests in expanding its logistics network and technology, believing these will drive long-term growth—even if the division is unprofitable today.

5. How does JD's effective tax rate compare to previous years?

JD’s effective tax rate in Q2 2025 was not disclosed in this filing. Historically, JD’s tax rate has been moderate, influenced by tax incentives for technology investment and international structuring.