How MULN (Mullen Automotive) Makes Money in 2025: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a specialty electric vehicle manufacturer like MULN makes money is essential for investors and anyone interested in the business of automotive technology and EVs. In this post, we break down MULN's quarterly income statement (Q2 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

Quick MULN Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2025/11/MULN_income_1762004464.png)

MULN operates as a designer and manufacturer of electric vehicles, focusing on innovative EV platforms for both consumer and commercial markets. Revenue comes primarily from the sale of electric vehicles and related automotive technology solutions. The company is structured around R&D-driven vehicle development, with a focus on scaling production and expanding its product lineup.

Revenue Breakdown

- Total Revenue (Q2 2025): $0.47M (+626.1% YoY)

- MULN currently reports revenue as a single segment, primarily from EV sales and related services.

- Growth is powered by the initial ramp-up of vehicle deliveries and expanding commercial partnerships.

Gross Profit and Margins

- Gross Profit: $0.01M (2.1% gross margin)

- Cost of Revenue: $0.01M (+29,243.5% YoY)

- MULN maintains minimal gross margins due to the early-stage scale-up of manufacturing and high initial production costs.

- Most costs come from vehicle production, materials procurement, and supply chain ramp-up.

Operating Income and Expenses

- Operating Income: Not reported for Q2 2025 (operating loss implied)

- Operating Expenses: $0.05M (-22.2% YoY)

- R&D: $0.01M (-18.9% YoY, 2,446.3% of revenue) — Focused on next-generation EV platforms, battery technology, and autonomous systems.

- SG&A: $0.04M (-23.8% YoY, 7,536.6% of revenue) — Includes administrative costs, sales support, and marketing for new vehicle launches.

- MULN continues to prioritize innovation and product development while working to control costs as it scales operations.

Net Income

- Pre-Tax Income: Not reported for Q2 2025

- Income Tax: Not reported for Q2 2025

- Net Income: -$0.13M (+48.5% YoY, -27,386.2% net margin)

- MULN converts a minimal portion of sales into profit due to high R&D and SG&A expenses relative to its nascent revenue base.

What Drives MULN's Money Machine?

- Vehicle Sales: Nearly all revenue is derived from electric vehicle sales and related automotive services.

- R&D Investment: R&D spending of $0.01M in Q2 2025, representing over 2,400% of revenue, underscores MULN's commitment to technological leadership.

- Strategic Investments: Heavy investment in battery innovation, manufacturing automation, and commercial fleet solutions.

- Future Growth Areas: Expansion into commercial EV fleets and next-gen battery tech, though these segments are not yet profitable.

Visualizing MULN's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.

- Most revenue flows into gross profit, with operating expenses (especially SG&A and R&D) taking the largest chunk.

- Even after significant R&D and SG&A costs, virtually none of the revenue drops to the bottom line, reflecting the early-stage, investment-heavy nature of MULN's business model.

Key Takeaways

- MULN's money comes overwhelmingly from electric vehicle sales

- Low gross and net margins illustrate the challenges of scaling a capital-intensive EV business

- Heavy investment in R&D and SG&A, balanced by efforts to control costs as revenue grows

- Ongoing growth is driven by vehicle delivery ramp-up and new technology development

Explore More Investment Opportunities

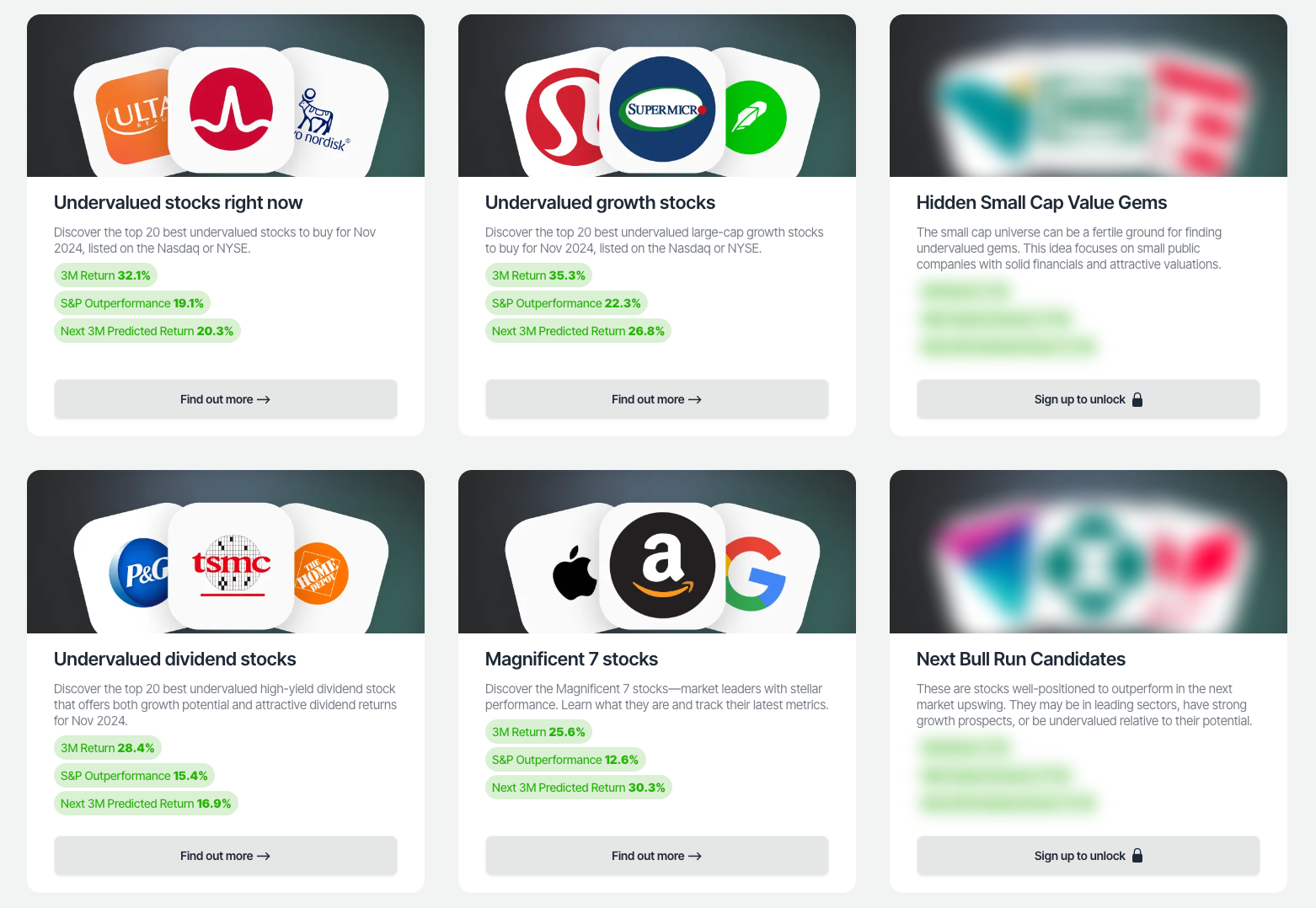

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About MULN's Income Statement

1. What is the main source of MULN's revenue in 2025?

MULN generates over 99% of its revenue from electric vehicle sales and related automotive services. Other revenue sources are not significant at this stage.

2. How profitable is MULN in Q2 2025?

MULN reported net income of -$0.13M in Q2 2025, with a net margin of approximately -27,386.2%, reflecting weak profitability as the company invests heavily in R&D and scales production.

3. What are the largest expense categories for MULN?

The biggest expenses on MULN's income statement are operating expenses, particularly Research & Development (R&D) at $0.01M and Sales, General & Administrative (SG&A) at $0.04M in Q2 2025. R&D investment is focused on new vehicle platforms and battery technology.

4. Why does MULN operate at a loss?

Despite generating $0.47M in revenue, MULN posted a net loss of $0.13M in Q2 2025. This is because the company aggressively invests in product development, manufacturing scale-up, and market entry, believing these will drive long-term growth—even if the business is unprofitable today.

5. How does MULN's effective tax rate compare to previous years?

MULN's effective tax rate in Q2 2025 was not reported, consistent with prior periods where net losses and tax credits offset taxable income. This low rate is primarily due to operating losses and ongoing R&D investments.