How PEP (PepsiCo) Makes Money in 2025: A Deep-Dive With Income Statement

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

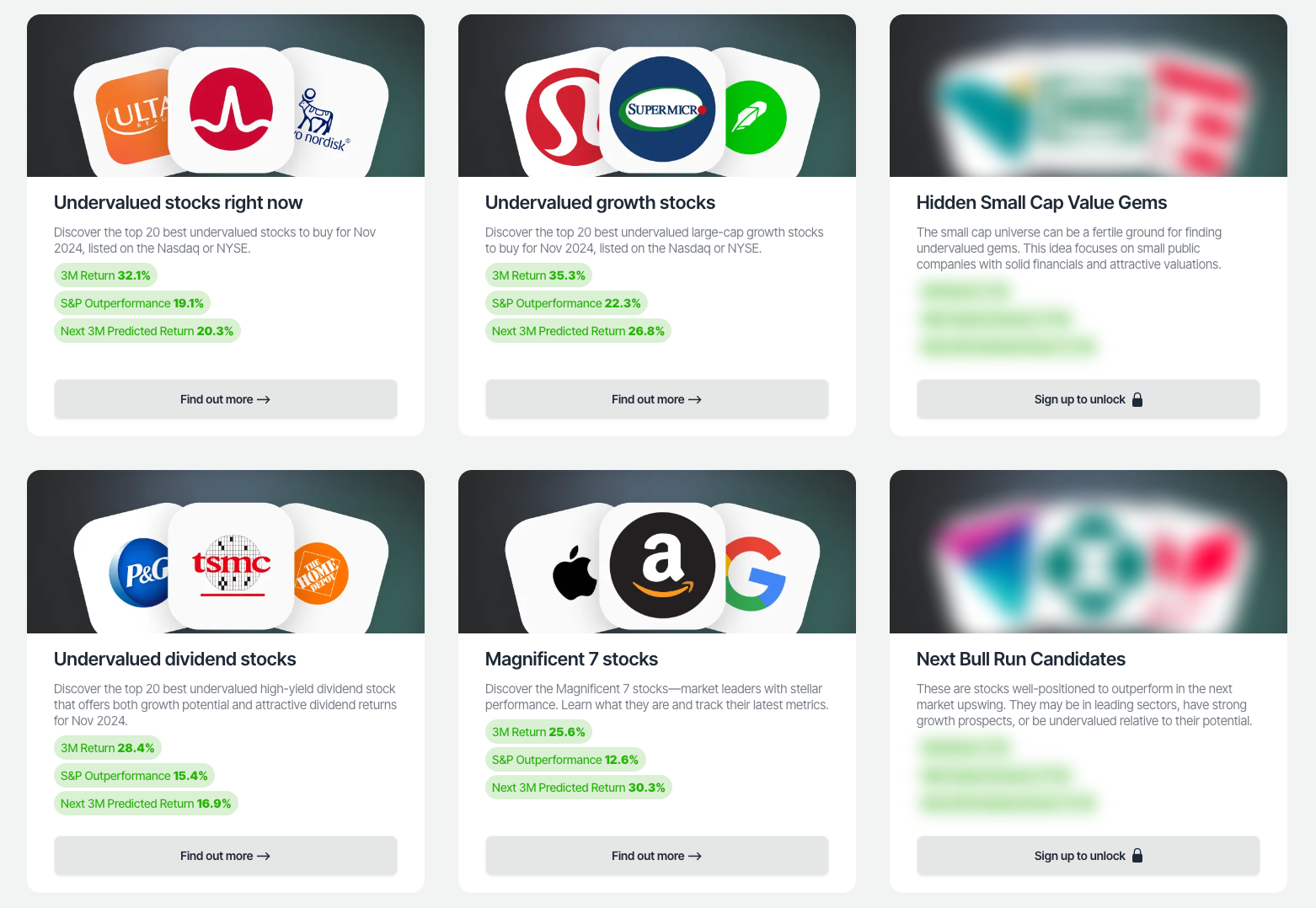

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a global beverage and snacking company like PepsiCo (PEP) makes money is essential for investors and anyone interested in the business of consumer staples. In this post, we break down PepsiCo's quarterly income statement (Q3 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.[2][3]

Quick PepsiCo Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2025/11/PEP_income_1762004318.png)

PepsiCo operates as one of the world's largest food and beverage companies, with a diversified portfolio spanning iconic brands like Pepsi, Gatorade, Tropicana, Lay's, Quaker, and Doritos. Revenue comes from two primary segments: beverages (including soft drinks, juices, and sports drinks) and snacking foods (salty snacks, crackers, and grain-based products). The company generates revenue across multiple geographic regions, including North America, Europe, and Asia Pacific, making it a truly global enterprise with exposure to both developed and emerging markets.

Revenue Breakdown

- Total Revenue (Q3 2025): $23.9B (+2.7% YoY)

- The company's revenue growth remains modest at 2.7% year-over-year, reflecting a mature market position in developed economies while navigating inflationary pressures and shifting consumer preferences.

- Growth is powered by pricing actions, volume recovery in key markets, and continued expansion in emerging markets where demand for convenient snacking and beverages remains strong.

Gross Profit and Margins

- Gross Profit: $12.7B (53.0% gross margin)

- Cost of Revenue: $11.2B (+8.2% YoY)

- PepsiCo maintains robust margins of 53%, reflecting the strength of its diversified brand portfolio and operational scale. However, the cost of revenue grew at 8.2% year-over-year, outpacing revenue growth of 2.7%, indicating pressure from commodity costs, supply chain expenses, and manufacturing inflation.

- Most costs come from raw materials (agricultural commodities like corn and sugar), packaging, and manufacturing labor. The company's ability to pass through price increases to consumers has helped offset some of these inflationary pressures, though margin compression remains a concern.

Operating Income and Expenses

- Operating Income: $3,569.0M (-7.8% YoY, 14.9% margin)

- Operating Expenses: $9,122.0M (+0.8% YoY)

- SG&A (Sales, General & Administrative): $9,122.0M (+0.8% YoY, 38.1% of revenue) — PepsiCo invests heavily in marketing, distribution, and administrative functions to maintain its market leadership. The relatively flat year-over-year growth in SG&A demonstrates disciplined cost management despite inflationary headwinds.

- PepsiCo continues to balance growth investments with operational efficiency, maintaining relatively stable SG&A spending as a percentage of revenue while navigating a challenging macroeconomic environment.

Net Income

- Pre-Tax Income: $3,464.0M (-6.2% YoY, 14.5% margin)

- Income Tax: $846.0M (24.4% effective tax rate)

- Net Income: $2,603.0M (-11.2% YoY, 10.9% net margin)

- PepsiCo converts approximately 10.9% of sales into profit, a solid figure for a mature consumer staples company. However, the 11.2% year-over-year decline in net income reflects the margin pressure from rising input costs that have outpaced the company's pricing actions and operational efficiencies.

What Drives PepsiCo's Money Machine?

- Beverage and Snacking Portfolio: The company's diversified brand portfolio across beverages (Pepsi, Gatorade, Tropicana) and snacks (Lay's, Doritos, Quaker) generates revenue across multiple categories and price points, reducing dependence on any single product.

- Pricing Power: PepsiCo's strong brand equity allows the company to implement price increases, which have been critical in offsetting commodity and labor cost inflation in recent periods.

- Global Distribution Network: The company's extensive distribution infrastructure across North America, Europe, and Asia Pacific enables efficient market penetration and product availability.

- Operational Scale: With $23.9B in quarterly revenue, PepsiCo benefits from significant economies of scale in manufacturing, procurement, and logistics, supporting its 53% gross margin.

Visualizing PepsiCo's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.[2][3]

Most revenue flows into gross profit at a 53% rate, with the remaining 47% consumed by cost of revenue. From there, operating expenses (particularly SG&A at 38.1% of revenue) take a significant chunk, leaving operating income of 14.9% of revenue. After accounting for interest expenses $264M and other income items $159M, as well as taxes at an effective rate of 24.4%, approximately 10.9% of revenue drops to the bottom line as net income.

The chart illustrates that while PepsiCo maintains healthy margins throughout the income statement, the company faces margin compression due to cost of revenue growing faster than top-line revenue. This is a key dynamic for investors to monitor, as the company's ability to continue raising prices while maintaining volume will be critical to future profitability.

Key Takeaways

- PepsiCo's money comes from its diversified portfolio of beverages and snacking products sold globally, with strong brand recognition enabling pricing power.

- Gross margins of 53% illustrate the power of PepsiCo's scale and brand equity, though margin pressure from input cost inflation remains a headwind.

- Operating expenses represent 38.1% of revenue, primarily driven by SG&A spending on marketing, distribution, and administration.

- Net margins of 10.9% demonstrate solid profitability, though the 11.2% year-over-year decline signals that cost pressures are outpacing pricing actions in the current environment.

- Ongoing growth is driven by pricing actions, volume recovery, and expansion in emerging markets, though mature market saturation limits top-line growth to low single digits.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About PepsiCo's Income Statement

1. What is the main source of PepsiCo's revenue in 2025?

PepsiCo generates revenue from its diversified portfolio of beverages (including Pepsi, Gatorade, and Tropicana) and snacking products (including Lay's, Doritos, and Quaker). The company operates across multiple geographic segments including North America, Europe, and Asia Pacific, with North America representing the largest revenue contributor. In Q3 2025, total revenue reached $23.9B, with growth of 2.7% year-over-year driven by pricing actions and volume recovery in key markets.

2. How profitable is PepsiCo in Q3 2025?

PepsiCo reported net income of $2,603.0M in Q3 2025, with a net margin of approximately 10.9%, reflecting solid profitability for a mature consumer staples company. However, net income declined 11.2% year-over-year, indicating that cost pressures from inflation are outpacing the company's pricing actions. Operating income of $3,569.0M (14.9% margin) shows that the company maintains healthy operational profitability before accounting for interest and taxes.

3. What are the largest expense categories for PepsiCo?

The biggest expenses on PepsiCo's income statement are cost of revenue $11.2B and SG&A expenses $9,122.0M. Cost of revenue grew 8.2% year-over-year, driven by commodity inflation, packaging costs, and manufacturing labor expenses. SG&A spending, which represents 38.1% of revenue, covers marketing, distribution, and administrative functions necessary to maintain the company's market leadership and brand presence globally.

4. Why is PepsiCo's operating income declining despite revenue growth?

Operating income declined 7.8% year-over-year while revenue grew only 2.7%, primarily because cost of revenue increased 8.2% year-over-year. This margin compression reflects inflationary pressures on commodities, packaging, and labor that are growing faster than PepsiCo's ability to raise prices without impacting volume. While the company has implemented pricing actions, these have not fully offset the underlying cost inflation, resulting in declining profitability despite modest revenue growth.

5. What is PepsiCo's effective tax rate in Q3 2025?

PepsiCo's effective tax rate in Q3 2025 was 24.4%, resulting in income tax expense of $846.0M on pre-tax income of $3,464.0M. This moderate tax rate reflects the company's global tax structure and various tax benefits available to large multinational corporations, though the specific drivers of this rate may include jurisdictional mix, deductions, and tax planning strategies.

This analysis is based on PepsiCo's Q3 2025 financial statements and is intended for educational purposes to help investors understand how the company generates revenue and manages expenses. For investment decisions, consult with a financial advisor.