How to calculate Discounted Cash Flow (DCF) valuation

Welcome to Value Sense Blog

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

The Discounted Cash Flow (DCF) analysis represents a fundamental approach to business valuation, calculating the net present value (NPV) of projected earnings and cash flows, adjusted for capital requirements to sustain growth. This valuation method is based on the principle that a company's intrinsic value stems from its ability to generate EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) and cash flows for its capital providers. Unlike relative valuation techniques that rely on market value comparisons, DCF focuses on a company's fundamental outlook, independent of external market factors.

A DCF valuation requires detailed financial modeling to estimate future performance, incorporating assumptions about growth rates, operational efficiency, and discount rates that account for the time value of money. By analyzing projected cash flows and assets, a DCF analysis determines the enterprise value of the business, encompassing both equity and debt components.

Because this methodology emphasizes future earning potential rather than current market sentiment, the DCF approach can provide a more objective assessment of a business's fundamental value, though its accuracy depends heavily on the quality of assumptions made about the company's growth trajectory and financial performance.

Key Components of a DCF model

- Free Cash Flow (FCF): FCF represents the EBITDA converted to cash flow after accounting for depreciation, amortization, working capital changes, and capital expenditures on assets. This unlevered free cash flow is available to all capital providers, excluding the impact of financing decisions on the company's valuation.

- Terminal Value (TV): TV calculates the ongoing market value of the business beyond the explicit forecast period, capturing future earnings through either a perpetual growth approach or exit multiples based on comparable business valuation metrics.

- Discount Rate: The discount rate, typically the weighted average cost of capital (WACC), converts projected cash flows to present value. This rate helps estimate risk-adjusted returns required by investors, incorporating both equity and debt costs.

These fundamental components combine to determine the enterprise value in a comprehensive DCF model.

Steps in the DCF Analysis

- Project Unlevered Free Cash Flows (UFCFs): Estimate future earnings and cash flows, starting with EBITDA, adjusting for depreciation, amortization, working capital, and capital expenditures on assets over the forecast period.

- Choose a Discount Rate: Determine the appropriate weighted average cost of capital (WACC) to reflect both the time value of money and the risk profile in the business valuation.

- Calculate the Terminal Value (TV): Project the company's long-term market value using either a perpetual growth approach or industry-standard exit multiples.

- Calculate Enterprise Value (EV): Convert projected UFCFs and TV to present valuation by applying the discount rate, and determining the total business worth.

- Calculate Equity Value: Derive shareholder value by subtracting net debt from the enterprise value, reflecting the true ownership worth.

- Review the Results: Validate that the DCF outputs align with industry benchmarks, comparable company metrics, and overall market conditions to ensure a credible valuation assessment.

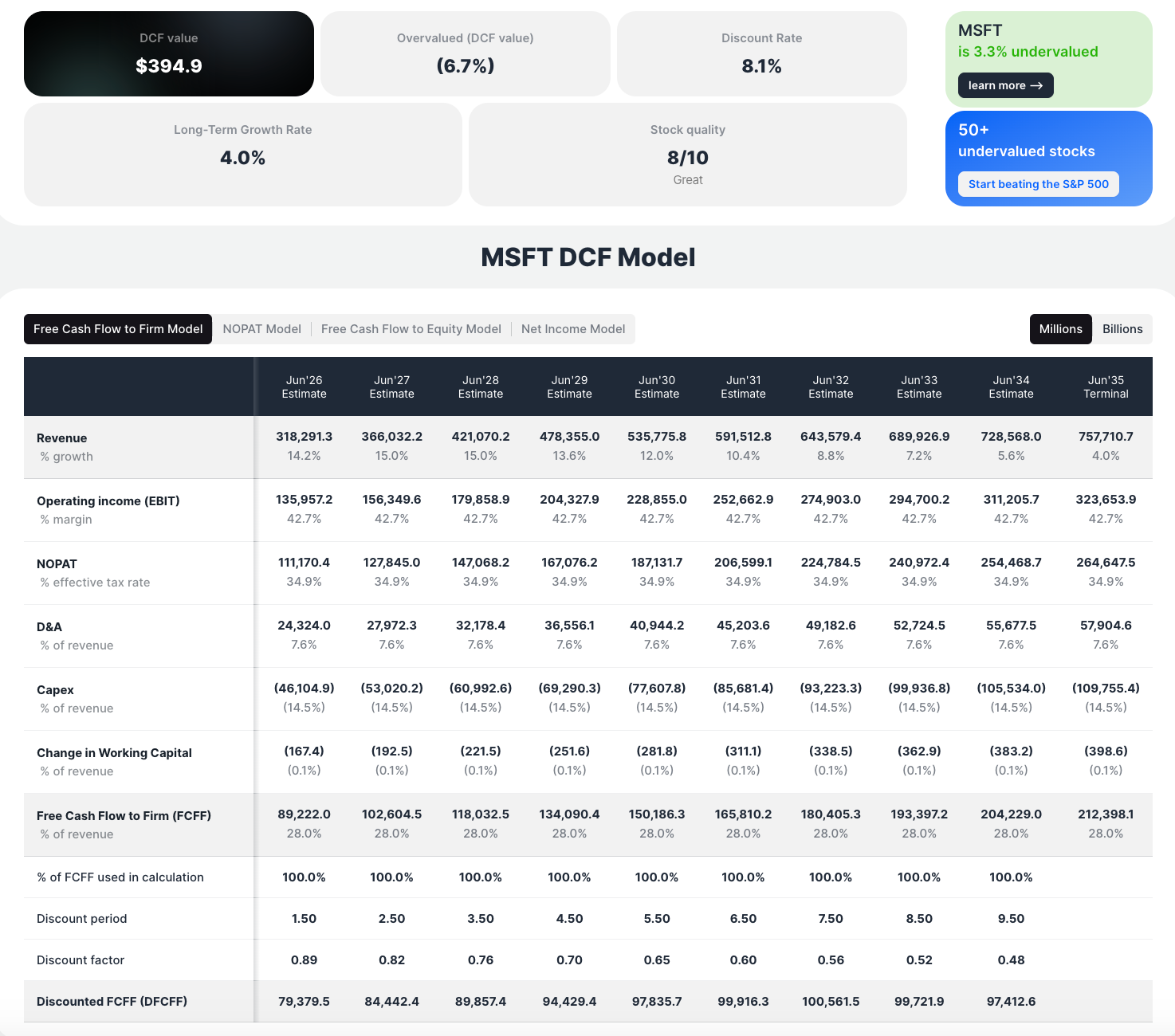

How to calculate DCF online? Any DCF calculators for stocks?

Use the Value Sense Free DCF analysis tool for discounted cash flow stock valuation. Select any stock and instantly calculate a DCF model for free.

also, we have 10+ FREE intrinsic value tools:

- DCF calculator

- reverse DCF calculator

- margin of safety calculator

- intrinsic value calculator

- relative value calculator

- discount rate calculator

- and many more...

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide

FAQs

1. What is the main purpose of Discounted Cash Flow (DCF) analysis?

The primary purpose of DCF analysis is to estimate a company’s intrinsic value by calculating the net present value (NPV) of its projected earnings and cash flows. This valuation approach focuses on the company’s fundamental ability to generate cash flows for its investors, offering an objective assessment of its true worth.

2. Why is the Weighted Average Cost of Capital (WACC) used as the discount rate in DCF?

WACC is used as it reflects the company’s overall cost of capital, considering both equity and debt components. It ensures that the projected cash flows are adjusted for the time value of money and risk, providing a fair valuation for investors and stakeholders.

3. What is Terminal Value (TV), and how is it calculated in a DCF model?

Terminal Value represents the estimated value of a business beyond the forecast period. It is calculated using either the perpetual growth method, which assumes constant growth beyond the forecast, or exit multiples derived from comparable industry metrics.

4. How does Free Cash Flow (FCF) factor into DCF analysis?

Free Cash Flow is central to DCF as it represents the cash available to all capital providers after accounting for operating expenses, working capital changes, and capital expenditures. FCF serves as the foundation for projecting future earnings in the valuation model.

5. Where can I perform a DCF analysis online for free?

You can use the Value Sense Free DCF Analysis Tool to calculate a discounted cash flow model for stocks instantly. This tool allows users to evaluate any stock's intrinsic value quickly and conveniently. Visit valuesense.io for access.