Howard Marks - Oaktree Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

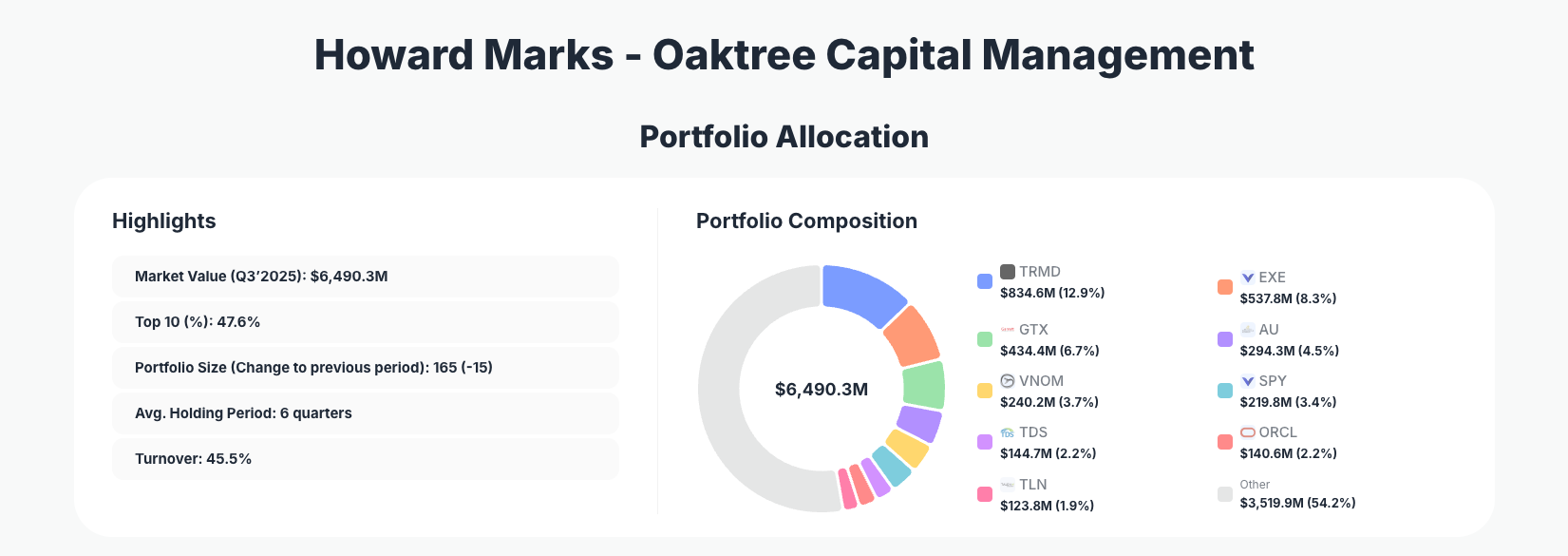

Howard Marks, co-founder of Oaktree Capital Management, exemplifies his renowned approach to distressed investing and market cycles in the latest 13F filing. His $6.5B Q3 2025 portfolio showcases active management with significant trims in select names alongside bold new buys in energy and tech, reflecting a nimble strategy amid volatile markets.

Portfolio Snapshot: Balanced Concentration with High Turnover

Portfolio Highlights (Q3 2025): - Market Value: $6,490.3M - Top 10 Holdings: 47.6% - Portfolio Size: 165 -15 - Average Holding Period: 6 quarters - Turnover: 45.5%

Oaktree's portfolio maintains a disciplined concentration, with the top 10 holdings commanding nearly half of the $6.5 billion total, underscoring Howard Marks' philosophy of focusing on high-conviction ideas while diversifying across 165 positions. The reduction in portfolio size by 15 holdings signals pruning of underperformers, aligning with Marks' cycle-aware approach that emphasizes capital preservation in uncertain environments. High turnover at 45.5% reveals proactive repositioning, a hallmark of Oaktree's opportunistic style that capitalizes on mispriced assets.

This structure balances risk through broad exposure yet amplifies returns via concentrated bets, particularly in shipping, energy, and industrials. The average holding period of 6 quarters indicates patience with core positions but readiness to act when valuations shift, as seen in recent moves. Tracking these dynamics on Oaktree's superinvestor page provides investors with real-time insights into how Marks navigates credit cycles and equity opportunities.

Top Positions Breakdown: Energy Bets, Trims, and Fresh Initiations

Oaktree's portfolio reveals dynamic shifts, starting with notable changes in key holdings. Expand Energy Corporation (EXE) holds at 8.3% despite a minor "Reduce 0.00%," maintaining significant exposure to energy infrastructure. Garrett Motion Inc. (GTX) follows at 6.7% after a "Reduce 13.55%," trimming a turbocharger play amid industrial sector pressures. AngloGold Ashanti Limited (AU) sits at 4.5% following a "Reduce 15.41%," dialing back gold mining amid commodity volatility.

Newer moves highlight opportunism: Viper Energy Partners LP (VNOM) enters at 3.7% with a "Buy," betting on oil royalties. STATE STREET CORP (_) drops sharply to 3.4% via "Reduce 67.65%," signaling de-risking in financials. Fresh "Buy"s include Telephone and Data Systems, Inc. (TDS) at 2.2% and Oracle Corporation (ORCL) at 2.2%, diversifying into telecom and cloud tech.

Aggressive scaling appears in Talen Energy Corporation (TLN) with "Add 347.87%" to 1.9%, plus outside top 10: Core Scientific, Inc. (CORZ) "Buy" at 1.8% for bitcoin mining exposure, and Barnes Group Inc. (B) "Add 4.57%" at 1.7% in industrials. Anchoring steadily is TORM plc (TRMD) at 12.9% with "No change," a core shipping position reflecting conviction in tanker rates.

What the Portfolio Reveals About Oaktree's Strategy

Oaktree's Q3 moves underscore a risk-managed value approach, blending cyclical sectors like energy and commodities with selective tech dips: - Sector Focus on Cyclicals: Heavy energy (EXE, VNOM) and commodities (AU, TRMD) bets signal anticipation of supply constraints and inflation hedges. - Opportunistic Trims: Reductions in GTX, AU, and STATE STREET CORP suggest profit-taking or risk reduction as valuations stretched. - Diversified Bets: New positions in ORCL, TDS, CORZ, and TLN show willingness to chase growth in tech, energy transition, and crypto infrastructure. - Turnover Discipline: 45.5% turnover with portfolio shrinkage indicates active capital recycling into higher-conviction names.

This reveals Marks' hallmark cycle positioning—trimming froth while hunting distressed opportunities—prioritizing asymmetric risk/reward over broad market beta.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| TORM plc (TRMD) | $834.6M | 12.9% | No change |

| Expand Energy Corporation (EXE) | $537.8M | 8.3% | Reduce 0.00% |

| Garrett Motion Inc. (GTX) | $434.4M | 6.7% | Reduce 13.55% |

| AngloGold Ashanti Limited (AU) | $294.3M | 4.5% | Reduce 15.41% |

| Viper Energy Partners LP (VNOM) | $240.2M | 3.7% | Buy |

| STATE STREET CORP (_) | $219.8M | 3.4% | Reduce 67.65% |

| Telephone and Data Systems, Inc. (TDS) | $144.7M | 2.2% | Buy |

| Oracle Corporation (ORCL) | $140.6M | 2.2% | Buy |

| Talen Energy Corporation (TLN) | $123.8M | 1.9% | Add 347.87% |

The table highlights Oaktree's measured concentration, with TRMD's steady 12.9% anchor providing shipping stability while top holdings aggregate 47.6%. Notable trims like STATE STREET CORP's 67.65% cut and AU's 15.41% reduction free up capital for buys like VNOM and ORCL, demonstrating tactical reallocation. This 10-stock slice represents diverse cyclicals and growth, with no single name dominating excessively—true to Marks' balanced yet conviction-driven style.

Such positioning mitigates downside while positioning for upside in energy and tech recoveries, with turnover enabling responsiveness to market dislocations.

Investment Lessons from Howard Marks' Oaktree Approach

- Master Market Cycles: Trim positions like GTX and AU when cycles peak, preserving capital for better opportunities like VNOM buys.

- Embrace Opportunistic Concentration: 47.6% in top 10 shows conviction in understood sectors (shipping, energy) without over-reliance.

- High Turnover with Discipline: 45.5% churn reflects constant valuation vigilance, exiting STATE STREET CORP aggressively.

- Diversify Across Cycles: Blend commodities (TRMD), energy (EXE), and tech (ORCL) to navigate volatility.

- Second-Level Thinking: New bets like CORZ and TLN target under-the-radar plays in bitcoin mining and power generation.

Looking Ahead: What Comes Next?

Oaktree's trimmed portfolio (down 15 positions) and high turnover suggest ample dry powder for distressed opportunities in a potentially volatile 2026, especially if rates stabilize or recessions loom. Energy exposure via EXE, VNOM, and TLN positions well for commodity rebounds, while ORCL and CORZ offer tech/crypto hedges. Watch for further builds in undervalued cyclicals or credit-sensitive names, aligning with Marks' contrarian bent. Current setup favors asymmetric bets in a high-uncertainty environment.

FAQ about Howard Marks Oaktree Capital Portfolio

Q: What drove Oaktree's most significant changes in Q3 2025?

A: Major trims included STATE STREET CORP (Reduce 67.65%) and AngloGold Ashanti (Reduce 15.41%), likely profit-taking, while aggressive adds like Talen Energy (Add 347.87%) and new buys in VNOM, TDS, ORCL, and CORZ signal fresh conviction in energy and tech.

Q: Why does Oaktree maintain 47.6% concentration in its top 10 holdings?

A: This reflects Howard Marks' strategy of high-conviction bets on cyclical recoveries (TRMD at 12.9%, EXE at 8.3%) balanced by a 165-position portfolio, emphasizing asymmetric opportunities while managing risk through diversification.

Q: What sectors dominate Oaktree's recent portfolio moves?

A: Energy and commodities lead with positions like EXE, VNOM, AU, alongside industrials (GTX, B) and tech/crypto (ORCL, CORZ, TLN), indicating a cycle-bottom fishing approach.

Q: How can I track Oaktree Capital's portfolio like a pro?

A: Follow quarterly 13F filings on the SEC site, but use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/oaktree-capital for real-time analysis, visualizations, and change alerts—note the 45-day reporting lag means positions evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!