Influence: The Psychology of Persuasion by Robert B. Cialdini Ph.D.

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Influence: The Psychology of Persuasion” by Robert B. Cialdini, Ph.D., stands as a foundational text in the world of behavioral psychology, marketing, and business strategy. Cialdini, a distinguished professor emeritus of psychology and marketing at Arizona State University, is globally recognized for his pioneering research into the mechanisms of compliance and persuasion. His background as both an academic and a practitioner—having consulted for Fortune 500 companies, government agencies, and non-profits—gives the book a rare blend of rigorous scientific insight and practical business application. First published in 1984, “Influence” has been revised and updated over the years, but its core principles remain as relevant as ever, making it a perennial bestseller and a must-read for anyone interested in understanding human behavior, especially in the context of business and investing.

The book was written during a period when the fields of psychology and marketing were converging, and companies were beginning to realize the power of behavioral science in shaping consumer decisions. Cialdini’s research was groundbreaking in its method: he went undercover in sales organizations, fundraising offices, and telemarketing firms to see firsthand how compliance professionals operate. This “participant observer” approach enabled him to distill the most effective persuasion tactics into six universal principles. These principles—reciprocation, commitment and consistency, social proof, liking, authority, and scarcity—form the backbone of the book and have since become standard reference points in both academic and professional circles.

The main theme of “Influence” is deceptively simple: by understanding the psychological triggers that guide human behavior, one can both defend against manipulation and ethically influence others. For investors, business leaders, and anyone navigating high-stakes negotiations, these insights are invaluable. The book’s purpose is to arm readers with knowledge that can be used to recognize when they are being influenced—consciously or unconsciously—and to harness these same principles to achieve their own goals, whether in sales, marketing, leadership, or investment decision-making.

“Influence” is considered a classic not just for its content, but for its accessibility and enduring relevance. It is regularly cited in business school curricula, marketing seminars, and investment workshops. The book’s real-world examples, ranging from door-to-door sales tactics to billion-dollar advertising campaigns, make it easy to relate to and apply. Its lessons are as applicable to the retail investor navigating Wall Street hype as they are to the CEO negotiating mergers or the fund manager crafting shareholder communications.

What sets “Influence” apart from other psychology or business books is its blend of empirical research, vivid storytelling, and actionable advice. Unlike dense academic tomes, Cialdini’s writing is clear, engaging, and filled with memorable anecdotes. For investors, the book’s unique value lies in its ability to reveal the hidden levers of decision-making—both in oneself and in the market at large. It teaches not only how to resist being swayed by hype and herd mentality but also how to ethically use persuasion to build stronger relationships, negotiate better deals, and make more rational investment choices. Anyone in finance, marketing, management, or entrepreneurship will find the book indispensable for understanding the psychological forces that drive markets and people.

Key Themes and Concepts

“Influence: The Psychology of Persuasion” is structured around a set of core psychological principles that explain why people say “yes”—and how these principles can be leveraged in both personal and professional contexts. Throughout the book, Cialdini weaves together scientific studies, real-world stories, and practical examples to demonstrate how these themes manifest in everyday life and business. The book’s enduring popularity is due in large part to the universality and timelessness of these themes, which are as relevant to investors and entrepreneurs as they are to consumers and managers.

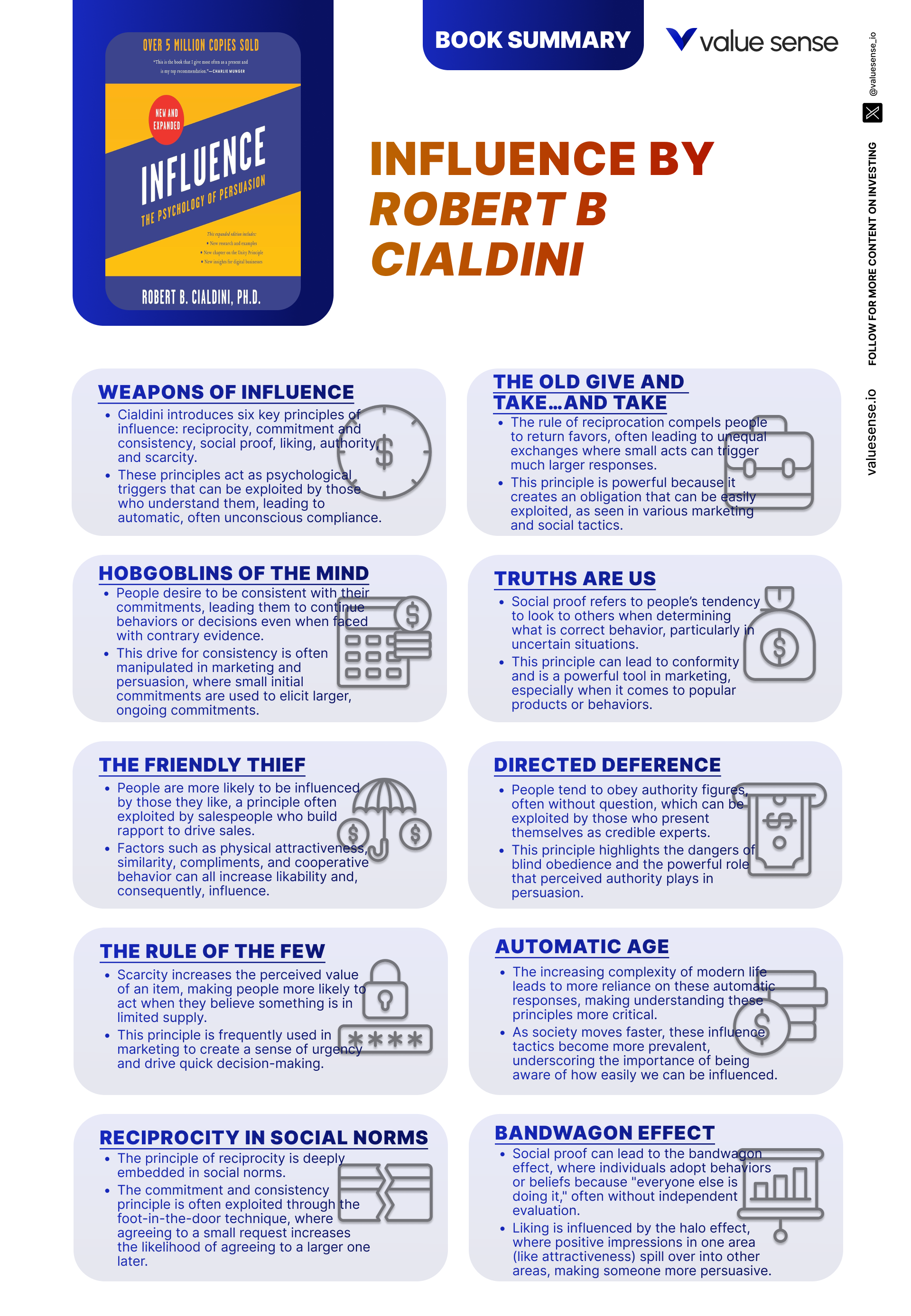

At its heart, “Influence” is about understanding the automatic, often subconscious, drivers of human behavior. Cialdini’s six principles—reciprocity, commitment and consistency, social proof, liking, authority, and scarcity—are not only psychological curiosities but also powerful tools that shape decisions in the marketplace and beyond. Each principle is explored in depth, with attention to both its scientific foundation and its practical application, making the book a bridge between theory and actionable insight.

- Automatic Influence: One of the book’s most crucial themes is the concept of automatic, or “click, whirr,” responses. Cialdini demonstrates that much of human compliance is driven by ingrained psychological triggers that bypass rational analysis. These automatic responses are rooted in evolutionary psychology and are essential for navigating a complex world efficiently. For example, the “expensive = good” heuristic often leads investors to equate high price with high value, even when fundamentals do not support this belief. Understanding these triggers enables investors to recognize when their own decisions—or those of the market—are being shaped by subconscious biases rather than objective analysis. Cialdini’s examples, such as the jewelry store owner who sold out of turquoise jewelry simply by doubling the price, illustrate how easily these triggers can be manipulated.

- Reciprocity: The rule of reciprocation is one of the most powerful motivators of compliance. Cialdini explains that humans are hardwired to return favors, gifts, and concessions, creating a social obligation that can be exploited in negotiations, sales, and even investment pitches. In finance, this principle is often seen in the form of “free” research reports, exclusive insights, or value-added services that create a sense of indebtedness. Cialdini’s research shows that even uninvited favors can generate powerful obligations, and he details how reciprocal concessions—such as the “door-in-the-face” technique—can be used to increase the likelihood of agreement. For investors, being aware of this dynamic helps in both resisting undue influence and in structuring offers that are more likely to be accepted.

- Commitment and Consistency: Cialdini’s exploration of commitment and consistency reveals how people strive to align their actions with their stated beliefs and previous behaviors. Once a commitment is made—especially if it is public—individuals feel psychological pressure to act consistently with that commitment. This principle underpins many classic sales and marketing techniques, such as the “foot-in-the-door” approach, but it also explains why investors often hold onto losing positions (to remain consistent with their initial thesis) or double down on prior decisions. Recognizing this tendency allows investors to avoid self-sabotaging behaviors and to make more rational, data-driven choices.

- Social Proof: Social proof is the idea that people look to the actions of others to determine correct behavior, particularly in uncertain or ambiguous situations. In the investment world, this manifests as herd behavior, momentum trading, and the tendency to follow “hot tips” or celebrity investors. Cialdini’s analysis of social proof includes both the positive aspects—such as learning from the wisdom of the crowd—and the dangers, such as bubbles and panics driven by groupthink. Understanding social proof enables investors to recognize when market sentiment is driving prices rather than fundamentals, and to either capitalize on or guard against such trends.

- Liking and Authority: These two principles are closely linked in the book, as both relate to the influence of personal relationships and perceived expertise. People are more likely to comply with requests from those they like or admire, and from those they perceive as authorities. In finance, this can be seen in the power of charismatic fund managers, celebrity endorsements, or the use of impressive titles and credentials. Cialdini provides numerous examples of how liking (based on similarity, compliments, or physical attractiveness) and authority (based on titles, uniforms, or expertise) can sway decisions, often against one’s rational interests. For investors, being aware of these influences is crucial in evaluating advice and avoiding undue persuasion.

- Scarcity: The principle of scarcity explains why limited availability increases perceived value and urgency. Cialdini shows how phrases like “limited time offer” or “only a few shares left” can trigger a fear of missing out (FOMO) that overrides rational analysis. In the stock market, this principle is often at play during IPOs, hot new issues, or during periods of market euphoria when everyone seems to be chasing the same opportunity. Recognizing the psychological impact of scarcity can help investors avoid impulsive decisions and focus on long-term value.

- Defensive Strategies Against Manipulation: While much of the book focuses on how to ethically use influence, Cialdini is equally concerned with helping readers defend themselves against manipulation. He provides specific warning signs and countermeasures for each principle, empowering readers to recognize when they are being influenced and to make more deliberate choices. For investors, these defensive strategies are invaluable in a world where hype, FOMO, and persuasive sales tactics are ever-present.

Book Structure: Major Sections

Part 1: Introduction to Influence

This opening section, which covers Chapter 1, sets the stage for the entire book by introducing the concept of influence and the psychological principles that underpin compliance. Cialdini explains that influence is not merely a matter of conscious choice; rather, it is often the result of deeply ingrained psychological triggers that operate below the level of awareness. The section outlines the idea of “weapons of influence”—automatic mechanisms that can be used to persuade people without their full understanding or consent.

Key concepts in this section include the identification of “trigger features” that prompt automatic compliance, the distinction between rational and automatic decision-making, and the pervasive role of these triggers in everyday life. Cialdini uses vivid examples, such as the mother turkey’s response to the “cheep-cheep” sound, to illustrate how both animals and humans can be manipulated by simple cues. He also introduces the notion that these principles are double-edged swords: they can be used for good or ill, depending on the intent of the influencer.

For investors, this section provides a foundational understanding of why seemingly irrational market behaviors—such as panic selling or euphoric buying—are so common. By recognizing the automatic nature of many decisions, investors can begin to develop strategies to counteract emotional and impulsive reactions, focusing instead on data-driven analysis and long-term thinking.

In today’s markets, where information overload and rapid-fire news cycles are the norm, the concepts introduced in this section are more relevant than ever. Investors must be vigilant against both internal and external triggers of automatic behavior, using self-awareness and disciplined processes to guard against costly mistakes. The rise of algorithmic trading and behavioral finance only underscores the importance of understanding these foundational principles.

Part 2: Principles of Influence

This major section encompasses Chapters 2 through 7 and forms the core of the book. Here, Cialdini explores the six key principles of influence—reciprocation, commitment and consistency, social proof, liking, authority, and scarcity—in depth. Each principle is examined through a combination of scientific research, real-world case studies, and practical applications, illustrating how these forces shape decisions in business, investing, and everyday life.

The section delves into the mechanics of each principle: how reciprocation creates social obligations, how commitment and consistency drive people to align their actions with their public statements, how social proof leads to herd behavior, how liking and authority foster compliance, and how scarcity generates urgency and desire. Cialdini provides memorable anecdotes—such as the Hare Krishna flower tactic (reciprocation), the “foot-in-the-door” sales technique (commitment), and the Milgram obedience experiments (authority)—to bring each principle to life. He also discusses the ethical considerations of using these tools and the potential for abuse.

Investors can apply the lessons from this section by developing greater self-awareness and skepticism when confronted with persuasive sales pitches, market hype, or consensus thinking. By understanding the psychological levers that are being pulled—whether by financial advisors, media pundits, or the market itself—investors can make more objective, rational decisions. The section also provides guidance on how to ethically use these principles to build trust, foster collaboration, and negotiate more effectively.

With the proliferation of digital media, social networks, and algorithmic trading, the principles outlined in this section are more relevant than ever. Modern investors must navigate an environment where influence tactics are deployed at scale and with increasing sophistication. By mastering these principles, investors can both protect themselves from manipulation and harness the power of persuasion to achieve their financial goals.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Weapons of Influence

This opening chapter is critically important because it establishes the conceptual framework for the entire book. Cialdini introduces the idea that much of human compliance is driven by automatic psychological mechanisms—what he terms “weapons of influence.” The chapter explores how these mechanisms operate beneath conscious awareness, shaping decisions in ways that can be both beneficial and dangerous. By laying out the foundation, Cialdini prepares readers to recognize and understand the six key principles that follow in subsequent chapters.

One of the most memorable examples in this chapter is the story of the mother turkey, which will care for any chick making the “cheep-cheep” sound, regardless of the chick’s actual identity. This illustrates the concept of “trigger features”—simple cues that elicit automatic responses. Cialdini also discusses the jewelry store owner who doubled the price of turquoise jewelry and sold out, demonstrating how people often use price as a shortcut for quality. These examples underscore the idea that humans, like animals, have built-in responses that can be exploited by savvy influencers. The chapter is rich with anecdotes and research findings that make the concept of automatic influence tangible and relatable.

Investors can apply the lessons from this chapter by becoming more aware of their own automatic responses—such as the tendency to follow market trends or to equate high price with high value. By recognizing when they are operating on autopilot, investors can pause and subject their decisions to rational analysis. Concrete steps include setting predetermined investment criteria, using checklists to evaluate opportunities, and seeking out contrarian perspectives to counteract herd mentality.

Historically, the lessons from this chapter have been borne out in countless market cycles, from the tulip mania of the 17th century to the tech bubble of the late 1990s. In each case, investors were swayed by powerful psychological triggers—scarcity, social proof, and authority—rather than objective analysis. In today’s fast-paced, information-rich environment, the need to recognize and counteract automatic influence is more pressing than ever. The chapter’s insights remain timeless, offering a roadmap for making more deliberate, data-driven investment decisions.

Chapter 2: Reciprocation: The Old Give and Take…and Take

This chapter is essential because it explores the rule of reciprocation, one of the most powerful and universal principles of human behavior. Cialdini demonstrates that the urge to return favors is deeply ingrained and can be leveraged to gain compliance in both social and commercial contexts. The chapter explains how reciprocation creates a sense of obligation, which can be exploited by those seeking to influence others, from salespeople to fundraisers to negotiators.

Cialdini provides compelling examples, such as the Hare Krishna practice of giving a flower or small gift before soliciting a donation. Even when the recipient did not want the gift, the act of giving created a powerful obligation to reciprocate. The chapter also introduces the concept of “reciprocal concessions,” exemplified by the “door-in-the-face” technique: making a large request that is likely to be refused, followed by a smaller request that seems more reasonable by comparison. Cialdini cites studies showing that this technique dramatically increases compliance rates. The chapter is filled with data, anecdotes, and quotes that illustrate the pervasive influence of reciprocity in everyday life.

For investors and business professionals, understanding the rule of reciprocation is crucial for both defense and offense. To guard against being manipulated, one can pause before responding to unsolicited favors and evaluate whether the sense of obligation is justified. On the offensive side, offering genuine value—such as free research, insights, or introductions—can build goodwill and increase the likelihood of future cooperation or agreement. The key is to use this principle ethically, with an awareness of its psychological power.

Historically, the principle of reciprocity has underpinned successful negotiations, partnerships, and client relationships across industries. In modern finance, it is often seen in the form of “value-added” services, client dinners, or exclusive invitations. The chapter’s lessons remain highly relevant, especially in an era where trust and relationships are paramount. By understanding and applying the rule of reciprocation, investors can build stronger networks, negotiate better deals, and avoid falling prey to manipulative tactics.

Chapter 3: Commitment and Consistency: Hobgoblins of the Mind

This chapter is critically important because it explains how the need for consistency drives human behavior, often leading people to act in ways that are at odds with their best interests. Cialdini explores how commitments—especially when made publicly—create psychological pressure to behave consistently with those commitments, even in the face of new information or changing circumstances. This principle is central to many classic sales and marketing techniques, as well as to common investor pitfalls.

One of the most striking examples in the chapter is the “foot-in-the-door” technique: getting someone to agree to a small request, which increases the likelihood that they will agree to a larger request later. Cialdini also discusses the power of written and public commitments, citing studies where people who wrote down their intentions were far more likely to follow through. The chapter is packed with research findings, such as the famous study in which homeowners who agreed to put a small sign in their window were later much more likely to agree to a large billboard on their lawn. Cialdini’s analysis is supported by data, quotes, and real-world stories that make the principle of consistency come alive.

Investors can apply the lessons from this chapter by being mindful of the commitments they make—both to themselves and to others. For example, making a public commitment to a particular investment thesis can create pressure to stick with it, even when evidence suggests a change is warranted. To counteract this bias, investors should regularly review their decisions, seek out disconfirming evidence, and be willing to change course when necessary. Using written investment plans and checklists can help ensure that decisions are based on data rather than on the desire to appear consistent.

Throughout history, the need for consistency has led investors to hold onto losing positions, double down on bad bets, and ignore warning signs. The lessons from this chapter are especially relevant in today’s environment, where social media and public platforms make it easy to make—and be held to—public commitments. By understanding the power of consistency, investors can avoid self-sabotaging behaviors and make more rational, adaptive decisions.

Chapter 4: Social Proof: Truths Are Us

This chapter is a cornerstone of the book because it explains how people look to the behavior of others to determine what is correct, especially in situations of uncertainty or ambiguity. Cialdini’s exploration of social proof sheds light on why herd behavior, bubbles, and panics are so common in markets and in everyday life. The chapter provides a scientific and practical framework for understanding both the benefits and dangers of relying on the actions of others as a guide.

Cialdini presents memorable examples, such as the phenomenon of bystander apathy—where individuals are less likely to help in an emergency when others are present, due to “pluralistic ignorance.” He also discusses how laugh tracks in sitcoms and testimonials in advertising harness the power of social proof to influence behavior. The chapter is filled with research data, including studies showing that people are more likely to engage in certain behaviors (such as donating or investing) when they see others doing the same. Cialdini’s analysis is supported by quotes, anecdotes, and case studies that illustrate the pervasive influence of social proof.

For investors, the lesson is clear: while it can be valuable to learn from the wisdom of the crowd, it is equally important to recognize when herd behavior is leading to irrational exuberance or panic. Investors can apply this insight by developing independent analysis, seeking out contrarian viewpoints, and using objective criteria to guide decisions. Being aware of the power of social proof can help investors avoid being swept up in bubbles or selling in a panic during downturns.

Historically, social proof has played a decisive role in market manias and crashes, from the South Sea Bubble to the housing crisis of 2008. In the age of social media, meme stocks, and viral trading trends, the principle of social proof is more relevant than ever. By understanding and managing the influence of social proof, investors can make more disciplined, data-driven decisions and avoid costly mistakes.

Chapter 5: Liking: The Friendly Thief

This chapter is essential because it explores how personal relationships, attractiveness, and similarity can dramatically increase compliance and influence. Cialdini demonstrates that people are far more likely to say “yes” to those they know and like, and he unpacks the psychological mechanisms that drive this effect. The chapter is particularly relevant for investors and business professionals, who often rely on trust and rapport to build relationships and close deals.

Cialdini provides a wealth of examples, such as the success of Tupperware parties, where social bonds and peer pressure drive sales. He also discusses how physical attractiveness, similarity, and compliments can increase liking and compliance, citing studies that show attractive people are perceived as more trustworthy and competent. The chapter is rich with data, anecdotes, and quotes that illustrate the subtle but powerful influence of liking in both personal and professional contexts.

Investors and business leaders can apply the lessons from this chapter by focusing on relationship-building, demonstrating genuine interest in others, and finding common ground. At the same time, it is important to be aware of the potential for manipulation and to evaluate opportunities based on objective criteria rather than personal feelings. Using structured decision-making processes can help ensure that liking does not override rational analysis.

Throughout history, the principle of liking has played a crucial role in business development, sales, and negotiations. In the modern era, where social media and personal branding are increasingly important, the ability to build rapport and trust is more valuable than ever. By understanding the power of liking, investors can both build stronger networks and guard against being unduly influenced by charisma or personal relationships.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 6: Authority: Directed Deference

This chapter is vital because it examines how perceived authority and expertise can lead to compliance and obedience, even in the absence of rational justification. Cialdini explores the psychological mechanisms that drive deference to authority, drawing on both classic experiments and real-world examples. The chapter is particularly relevant for investors, who are often bombarded with expert opinions, analyst reports, and authoritative-sounding advice.

Cialdini discusses the famous Milgram experiment, in which participants were willing to administer what they believed were painful electric shocks to others simply because an authority figure told them to. He also analyzes the impact of symbols of authority—such as titles, uniforms, and impressive credentials—on compliance. The chapter is filled with data, quotes, and anecdotes that demonstrate the pervasive influence of authority in shaping behavior and decisions.

For investors, the lesson is to approach expert opinions with a healthy dose of skepticism and to evaluate advice based on evidence rather than credentials alone. Concrete steps include verifying sources, seeking out diverse perspectives, and relying on objective analysis rather than authority-driven narratives. By understanding the power of authority, investors can avoid being swayed by hype or “expert” predictions that are not supported by data.

Historically, deference to authority has led to both great successes and catastrophic failures—from the triumphs of visionary leaders to the disasters of groupthink and blind obedience. In today’s environment, where financial influencers and celebrity investors command massive followings, the principle of authority is more relevant than ever. By mastering this principle, investors can make more independent, evidence-based decisions and avoid costly mistakes.

Chapter 7: Scarcity: The Rule of the Few

This chapter is crucial because it explores how the perception of scarcity increases desire and urgency, often leading to impulsive or irrational decisions. Cialdini demonstrates that limited availability—whether real or manufactured—can trigger powerful psychological reactions, such as the fear of missing out (FOMO). The chapter is especially relevant for investors, who are frequently confronted with “limited time offers,” IPOs, and other situations where scarcity is used as a sales tactic.

Cialdini provides compelling examples, such as the “limited edition” marketing strategy and the panic buying that occurs during shortages. He also discusses the concept of psychological reactance—the tendency to want something more when it is perceived as scarce or forbidden. The chapter is rich with data, anecdotes, and quotes that illustrate the impact of scarcity on decision-making and behavior.

Investors can apply the lessons from this chapter by pausing before making decisions driven by urgency or FOMO and by evaluating opportunities based on fundamentals rather than scarcity-driven hype. Concrete steps include setting predefined investment criteria, using checklists, and seeking out independent analysis. By recognizing the psychological impact of scarcity, investors can avoid impulsive decisions and focus on long-term value creation.

Throughout history, the principle of scarcity has played a decisive role in market bubbles, panics, and manias. In the modern era, where “hot” IPOs and viral trading trends are commonplace, the lessons from this chapter are more relevant than ever. By understanding and managing the influence of scarcity, investors can make more disciplined, rational decisions and avoid costly mistakes.

Practical Investment Strategies

- Strategy 1: Guard Against Automatic Responses: Recognize when you are making decisions on autopilot, especially during periods of market volatility. Implement a checklist for all major investment decisions, including questions about the underlying thesis, risk factors, and alternative viewpoints. Set rules for pausing before executing trades, such as a mandatory 24-hour cooling-off period for large or emotionally charged decisions. This approach helps ensure that choices are based on data and analysis, not on subconscious triggers or external pressure.

- Strategy 2: Use Reciprocity Ethically in Networking: Build stronger professional relationships by offering genuine value—such as sharing research, introductions, or insights—without expecting immediate returns. Track your interactions in a CRM or spreadsheet, noting where you have provided value. When seeking cooperation or information, frame your request in the context of past value provided. This approach leverages the power of reciprocity while maintaining ethical standards and fostering long-term trust.

- Strategy 3: Public Commitment to Investment Plans: Increase your own discipline by making your investment plan public—whether through a blog, investment club, or accountability partner. Clearly articulate your criteria for buying, holding, and selling, and review your plan regularly. Public commitments create psychological pressure to stick to your strategy, reducing the temptation to chase fads or deviate from your process. Use written records and periodic reviews to reinforce consistency and improve decision-making.

- Strategy 4: Independent Analysis to Counter Social Proof: When confronted with popular trends or consensus opinions, conduct your own research and seek out contrarian perspectives. Use tools such as Value Sense’s stock screener to identify undervalued opportunities that may be overlooked by the crowd. Document your reasoning and compare it against prevailing sentiment. This disciplined approach helps you avoid herd behavior and capitalize on mispriced assets.

- Strategy 5: Build Rapport but Maintain Objectivity: In negotiations or due diligence, focus on building genuine rapport with counterparts—through active listening, demonstrating empathy, and finding common ground. However, always evaluate opportunities based on objective criteria, such as financial statements, market analysis, and risk assessments. Use a two-step process: first, build the relationship; second, conduct a rigorous, data-driven evaluation. This strategy leverages the power of liking while safeguarding against emotional bias.

- Strategy 6: Vet Authority and Expertise: When considering expert opinions or analyst reports, verify credentials and seek out independent, third-party validation. Develop a habit of cross-referencing advice with your own research and with alternative sources. Use a “trust but verify” approach, especially when recommendations come from high-profile or charismatic figures. This strategy helps you avoid being swayed by authority-driven hype or unsubstantiated claims.

- Strategy 7: Resist Scarcity-Driven FOMO: Before acting on limited-time offers, IPOs, or “hot” investment tips, pause and evaluate the fundamentals. Set predefined criteria for evaluating opportunities and commit to a disciplined process, regardless of external urgency. Use checklists and accountability partners to reinforce this discipline. This approach helps you avoid impulsive decisions and focus on long-term value creation.

- Strategy 8: Defensive Strategies Against Manipulation: Develop a set of warning signs and countermeasures for each principle of influence. For example, if you sense a strong obligation to reciprocate, pause and evaluate whether the favor was solicited or genuine. If you feel pressure to act quickly due to scarcity, take a step back and analyze the underlying value. Regularly review your decision-making process for signs of bias or manipulation, and adjust your approach as needed.

Modern Applications and Relevance

Since its original publication, “Influence: The Psychology of Persuasion” has only grown in relevance, particularly as the pace and complexity of financial markets have increased. The rise of algorithmic trading, social media, and the democratization of investing through platforms like Robinhood and Value Sense have amplified the psychological triggers Cialdini describes. Today, investors are bombarded with persuasive messages, from viral tweets to influencer endorsements, making it more important than ever to understand the principles of influence.

One of the most significant changes since the book’s release is the sheer volume and speed of information. News cycles move at lightning pace, and market sentiment can shift in minutes. This environment intensifies the impact of social proof, scarcity, and authority, as investors are constantly exposed to the actions and opinions of others. The GameStop and AMC trading frenzy of 2021, driven by social media and herd behavior, is a textbook example of Cialdini’s principles in action. The fear of missing out (FOMO), the influence of charismatic leaders, and the rapid spread of information all contributed to extreme volatility and irrational decision-making.

Despite these changes, the core principles outlined in “Influence” remain timeless. Human psychology has not fundamentally changed, and the same triggers that drove compliance in the 1980s continue to shape behavior today. What has evolved is the scale and sophistication with which these principles are deployed. Marketers, financial advisors, and even algorithmic trading systems now use behavioral insights to influence decisions at unprecedented scale. For investors, the challenge is to remain vigilant, disciplined, and self-aware in the face of constant persuasion.

Modern investors can adapt Cialdini’s classic advice by leveraging technology to reinforce discipline and objectivity. Tools such as automated stock screeners, portfolio trackers, and decision checklists can help counteract emotional and automatic responses. At the same time, building strong professional networks, seeking diverse perspectives, and maintaining a commitment to ethical behavior remain as important as ever. The principles of influence are not just tools for persuasion—they are also safeguards against manipulation and self-deception.

Ultimately, “Influence” provides a roadmap for navigating the complexities of today’s market environment. By mastering the psychological principles that drive behavior, investors can make more rational decisions, build stronger relationships, and achieve better outcomes. The book’s enduring relevance is a testament to the universality of its lessons and the ongoing need for self-awareness and critical thinking in the world of investing.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Awareness and Education: The first step for investors is to develop an awareness of the six principles of influence and how they manifest in both personal and professional contexts. Read “Influence” in its entirety, take notes on key concepts, and reflect on past decisions where these principles may have played a role. Consider attending workshops or webinars on behavioral finance to deepen your understanding. Allocate one week to this foundational learning phase.

- Personal Bias Assessment: Conduct a self-assessment to identify which psychological triggers most frequently influence your decisions. Review past trades, negotiations, or business deals and note any patterns—such as acting on FOMO, following the crowd, or being swayed by authority. Set aside time each quarter to revisit this exercise and track your progress in overcoming these biases.

- Portfolio Construction with Psychological Safeguards: When building your portfolio, integrate psychological safeguards into your process. Use written investment plans, checklists, and predefined criteria for buying, holding, and selling. Allocate a portion of your portfolio to contrarian or independent ideas to counteract social proof and herd behavior. Consider diversifying across sectors and asset classes to reduce the impact of scarcity-driven trends. Rebalance your portfolio quarterly to maintain discipline.

- Ongoing Management and Review: Establish a regular review schedule—such as monthly or quarterly—to assess your portfolio and decision-making process. Use this time to evaluate whether any recent decisions were influenced by psychological triggers rather than objective analysis. Solicit feedback from trusted advisors or accountability partners to gain an external perspective. Document your reviews and adjust your strategy as needed.

- Continuous Improvement and Resource Utilization: Commit to continuous improvement by staying up-to-date on behavioral finance research, market trends, and best practices. Subscribe to reputable investment newsletters, participate in online forums, and attend industry conferences. Use tools such as Value Sense’s stock screener and intrinsic value models to reinforce objective analysis. Regularly review and update your investment plan to incorporate new insights and lessons learned.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Influence: The Psychology of Persuasion

1. What are the six principles of influence described by Cialdini?

Cialdini identifies six universal principles of influence: reciprocation, commitment and consistency, social proof, liking, authority, and scarcity. Each principle is rooted in psychological research and is illustrated with real-world examples throughout the book. Understanding these principles helps readers recognize when they are being influenced and how to use these tools ethically in business and investing.

2. How can investors apply the lessons from “Influence” to improve their decision-making?

Investors can use Cialdini’s insights to recognize and counteract psychological biases, such as herd mentality, FOMO, and deference to authority. By implementing checklists, conducting independent analysis, and setting predefined investment criteria, investors can make more rational, data-driven decisions. The book also offers guidance on building trust and rapport in professional relationships, which is valuable for networking and negotiations.

3. What are some common examples of influence tactics in financial markets?

Influence tactics are pervasive in financial markets, from “limited time offers” and IPO hype (scarcity) to celebrity endorsements and analyst recommendations (authority). Social proof is seen in momentum trading and viral stock trends, while reciprocity is used in the form of free research or value-added services. Recognizing these tactics allows investors to avoid being swayed by hype and focus on fundamentals.

4. Is “Influence” still relevant in today’s digital and fast-paced market environment?

Absolutely. The core psychological principles described by Cialdini are timeless, even as the tools and platforms for influence have evolved. In fact, the rise of social media, algorithmic trading, and digital marketing has amplified the impact of these principles. Understanding influence is more important than ever for investors seeking to navigate a complex, rapidly changing landscape.

5. Can the principles in “Influence” be used ethically in investing and business?

Yes, Cialdini emphasizes the ethical use of influence principles throughout the book. The goal is to build trust, foster collaboration, and achieve win-win outcomes, rather than to manipulate or deceive. By using these tools transparently and with integrity, investors and business leaders can build stronger relationships, negotiate better deals, and make more sustainable decisions.