Intel Stock Turnaround: Undervalued Chip Giant's Manufacturing Renaissance

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

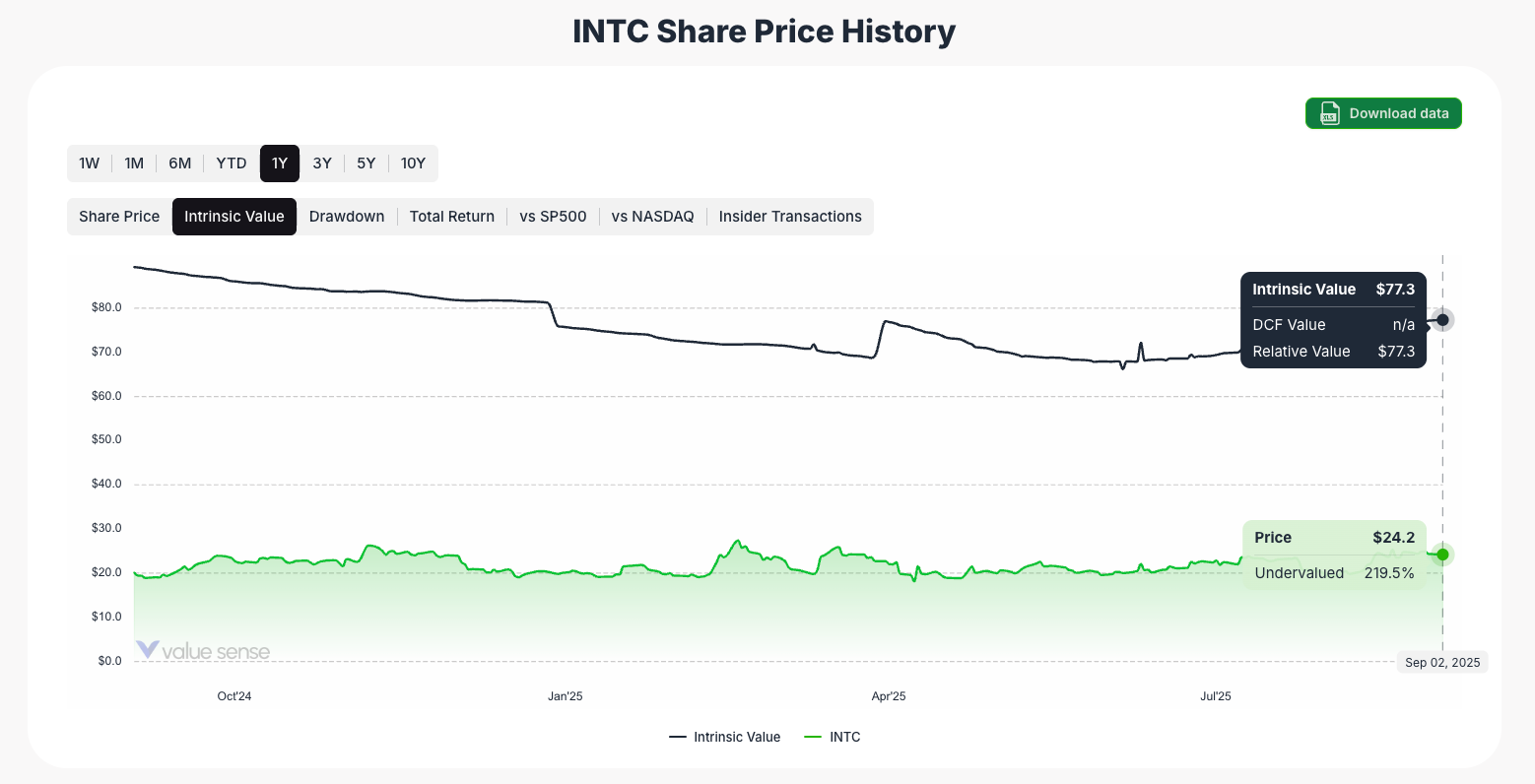

Intel Corporation (NASDAQ: INTC) stands at a critical inflection point in its storied history. Trading at just $24.2 per share as of September 2025, the semiconductor giant appears significantly undervalued with an intrinsic value estimated at $77.3, representing a potential 219.5% upside. Despite facing intense competition and execution challenges in recent years, Intel's strategic pivot toward foundry services and AI-enabled manufacturing positions the company for a remarkable turnaround.

The chipmaker's transformation under CEO Pat Gelsinger has accelerated throughout 2025, with substantial investments in advanced manufacturing nodes, strategic partnerships, and a renewed focus on regaining technology leadership. While the market remains skeptical about Intel's ability to compete with TSMC and challenge NVIDIA's AI dominance, our analysis reveals compelling value opportunities driven by underappreciated assets and emerging growth catalysts.

Stock Performance and Valuation Disconnect

Intel's stock has experienced significant volatility over the past year, creating attractive entry points for value-oriented investors. The current share price of $24.2 represents a dramatic discount to multiple valuation methodologies, suggesting the market has overcorrected on competitive concerns.

- Current Price: $24.2

- Intrinsic Value: $77.3 (219.5% undervalued)

- DCF Value: Not available due to negative free cash flows

- Relative Value: $77.3 based on peer comparison analysis

The valuation chart reveals Intel trading in an undervalued territory throughout 2025, with the intrinsic value line consistently above the market price. This persistent disconnect suggests the market has not yet recognized the value creation potential from Intel's strategic transformation initiatives.

Revenue Evolution: Geographic and Product Diversification

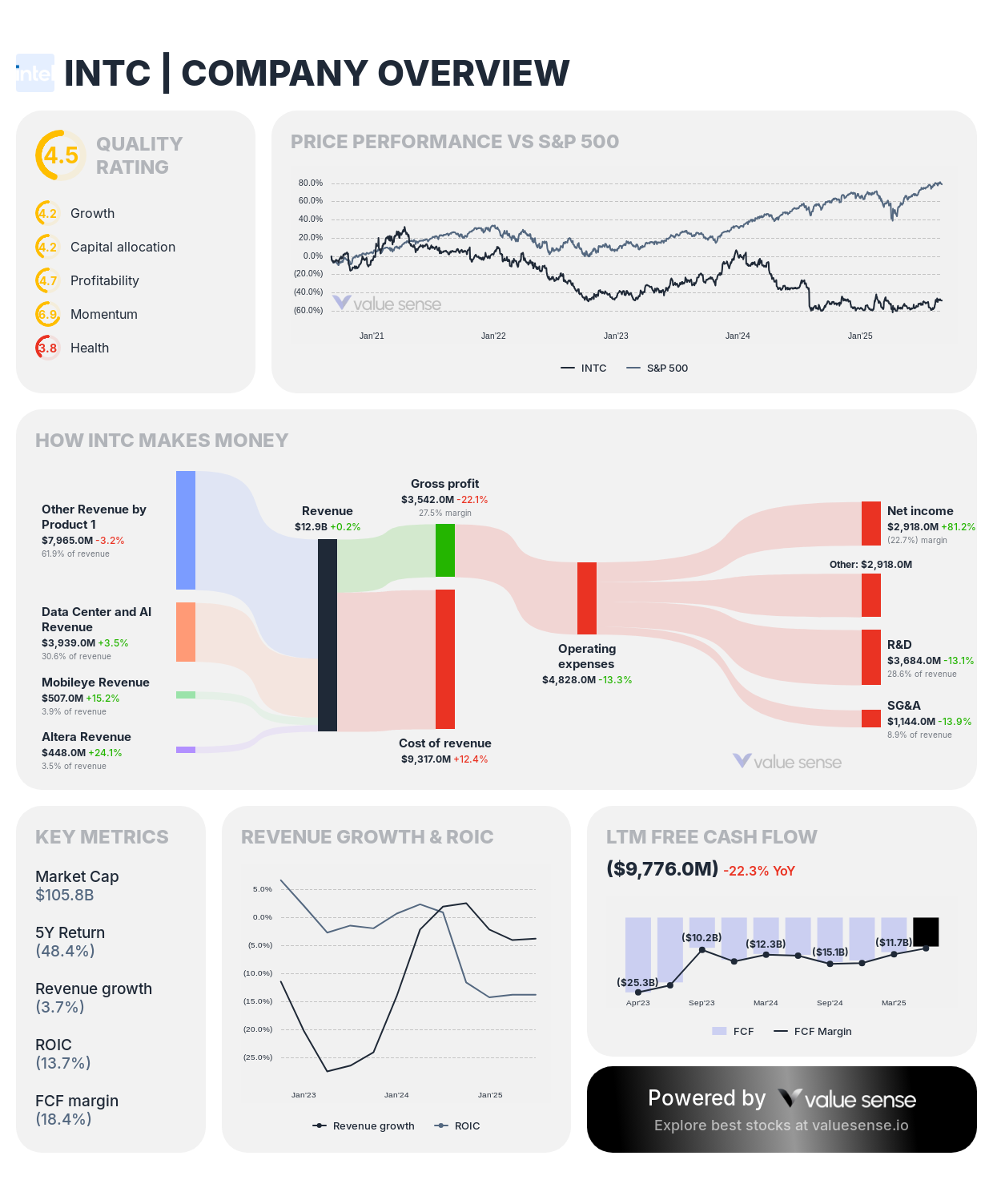

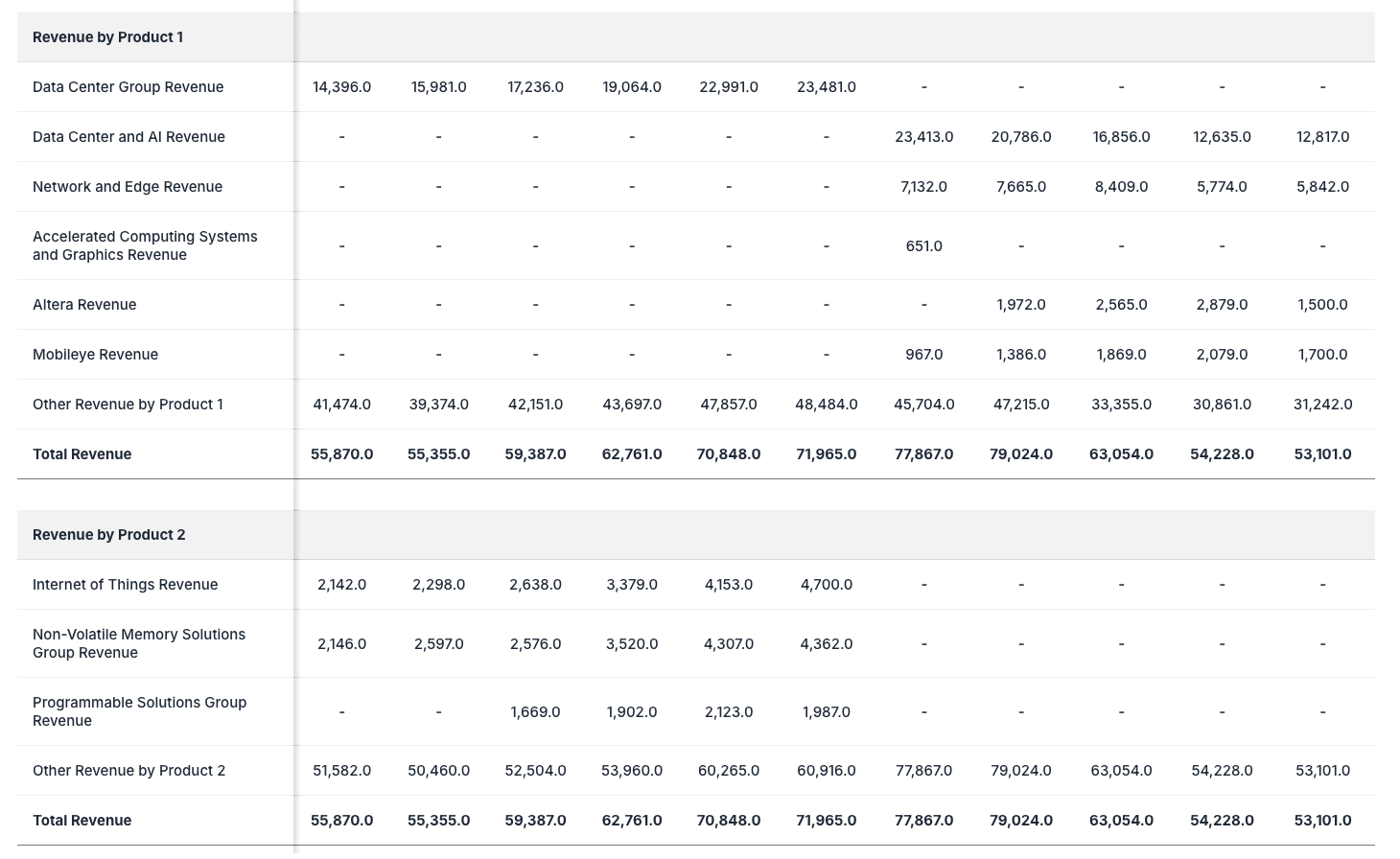

Intel's revenue composition has evolved significantly over the past decade, reflecting both market challenges and strategic repositioning. The company's total revenue peaked at $79.0 billion in 2021 before declining to $53.1 billion in 2024 due to PC market weakness and competitive pressures.

- China Revenue: Remains the largest market at $15.5 billion (29% of total), despite geopolitical tensions

- Singapore Revenue: Strong performance at $10.2 billion, benefiting from data center demand

- United States Revenue: Steady at $12.9 billion, supported by government chip act incentives

- Taiwan Revenue: Recovered to $7.8 billion as foundry relationships normalize

- Other Regions: Diversified exposure across global markets totaling $6.6 billion

The geographic diversification provides resilience against regional economic downturns while positioning Intel to capture growth in emerging semiconductor markets.

Financial Metrics: Challenges and Recovery Signs

Intel's current financial position reflects the company's investment-heavy transformation phase. While traditional profitability metrics appear challenging, underlying operational improvements suggest a foundation for future growth.

Key Financial Highlights:

- Market Capitalization: $105.8B representing significant scale in semiconductor industry

- Enterprise Value: $135.3B including substantial debt for foundry investments

- Revenue Decline: -7.6% five-year CAGR reflecting industry headwinds

- Gross Margin: 29.8% maintaining reasonable profitability despite competitive pressures

- Free Cash Flow: -$9.8B reflecting heavy capital expenditures for manufacturing expansion

Valuation Metrics:

- EV/Revenue: 2.5x suggesting reasonable valuation relative to growth prospects

- Price-to-Book: 1.1x indicating trading near asset value

- Ben Graham Fair Value: $427.6 suggesting significant undervaluation by traditional metrics

The financial metrics indicate Intel is investing heavily in future competitiveness, with near-term profitability pressure offset by long-term value creation potential.

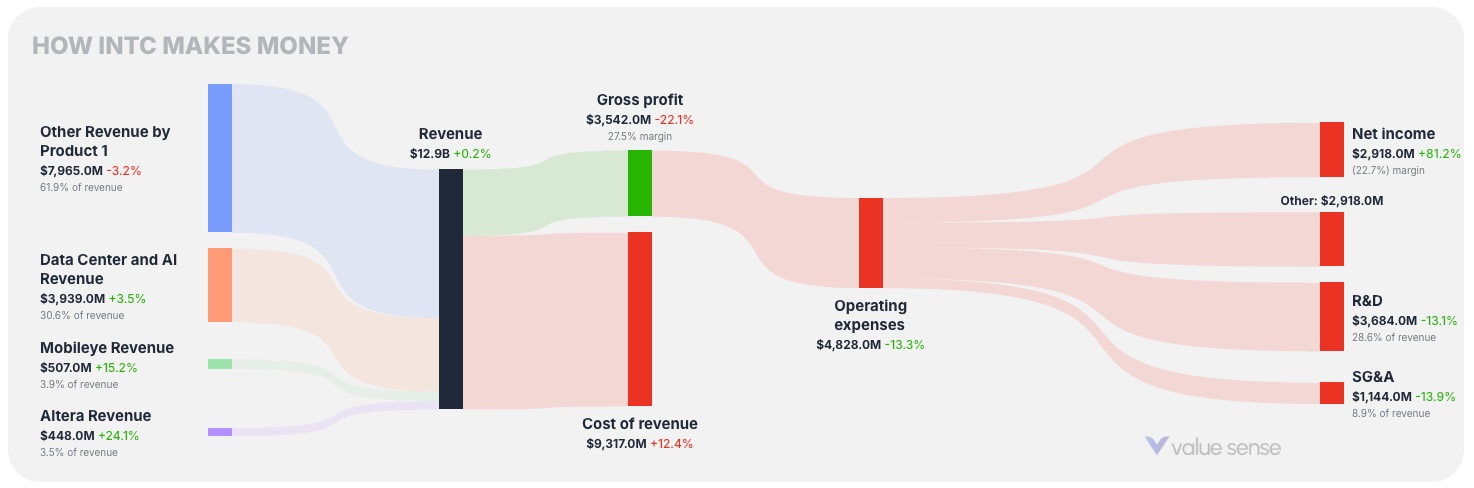

Product Portfolio Transformation: Beyond Traditional Computing

Intel's product portfolio has diversified significantly beyond traditional PC processors, with emerging segments showing strong growth potential. The company's strategic focus on AI, data center, and foundry services creates multiple revenue streams.

Revenue by Product Segment (2024):

- Data Center and AI Revenue: $12.8 billion (24% of total) with strong growth trajectory

- Network and Edge Revenue: $5.8 billion serving infrastructure markets

- Desktop Revenue: $9.7 billion maintaining market presence despite headwinds

- Notebook Revenue: $19.1 billion leveraging mobile computing trends

- Mobileye Revenue: $1.7 billion from autonomous driving technology

- Altera Revenue: $1.5 billion from programmable solutions

The diversification reduces dependence on cyclical PC markets while positioning Intel to capture growth in high-value segments like AI accelerators and edge computing.

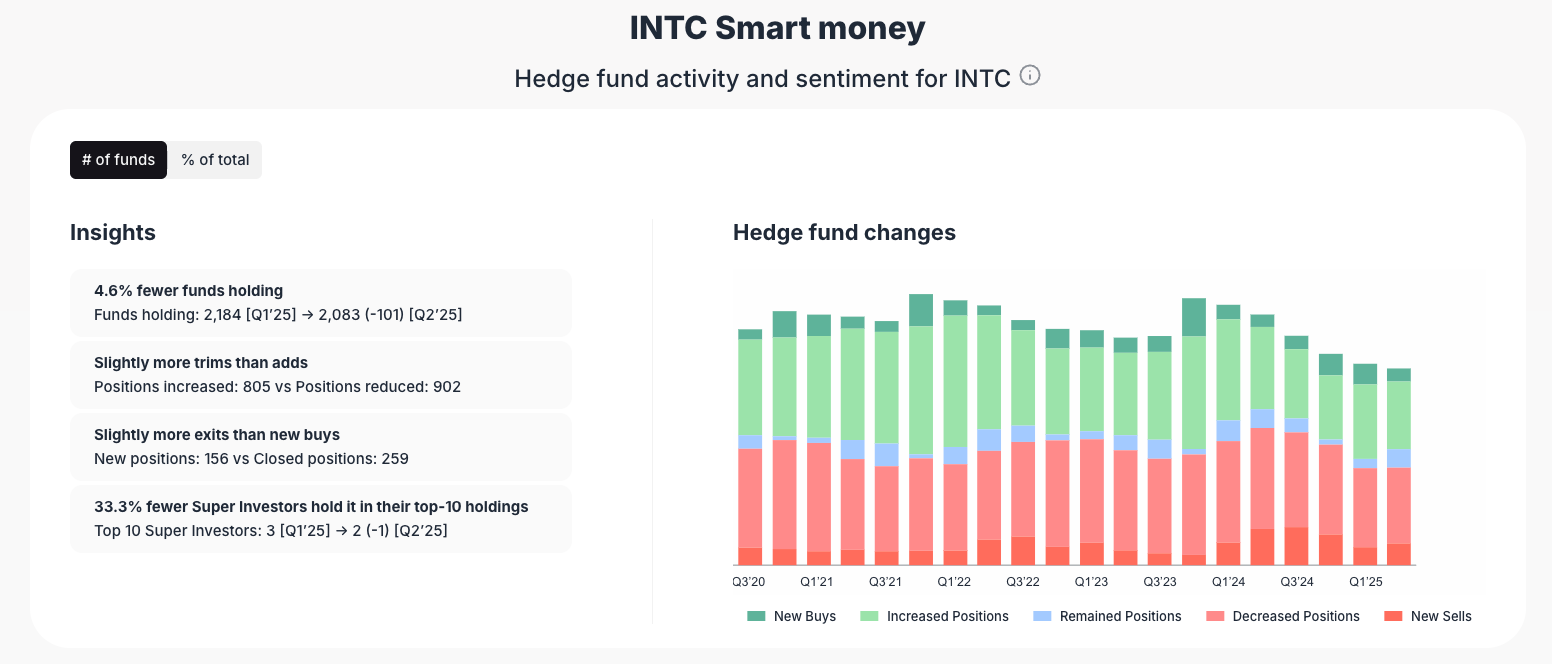

Institutional Sentiment: Smart Money Recognition

Hedge fund activity and institutional sentiment provide insights into professional investors' evolving view of Intel's turnaround prospects. Recent data shows mixed but increasingly positive institutional positioning.

Institutional Investment Trends:

- 4.6% fewer funds holding indicating some institutional skepticism remains

- Fund positions: 2,184 institutions down from 2,083, showing net reduction

- Position changes: More trims than adds, but new positions exceeding exits

- Super investor activity: 33.3% fewer top-tier investors in top-10 holdings

The institutional data suggests cautious optimism, with some funds reducing exposure while others see turnaround value at current levels.

Insider Trading Patterns: Management Confidence Indicators

Corporate insider activity provides valuable insights into management's confidence in Intel's transformation strategy. Recent trading patterns reveal interesting dynamics worth analyzing.

- Recent 3-month period: No insider purchases or sales, suggesting neutral management sentiment

- 12-month activity: Minimal insider trading with small net buying activity

- Long-term pattern: Generally balanced insider activity without strong directional signals

The modest insider activity suggests management is focused on execution rather than opportunistic trading, which could indicate confidence in strategic initiatives.

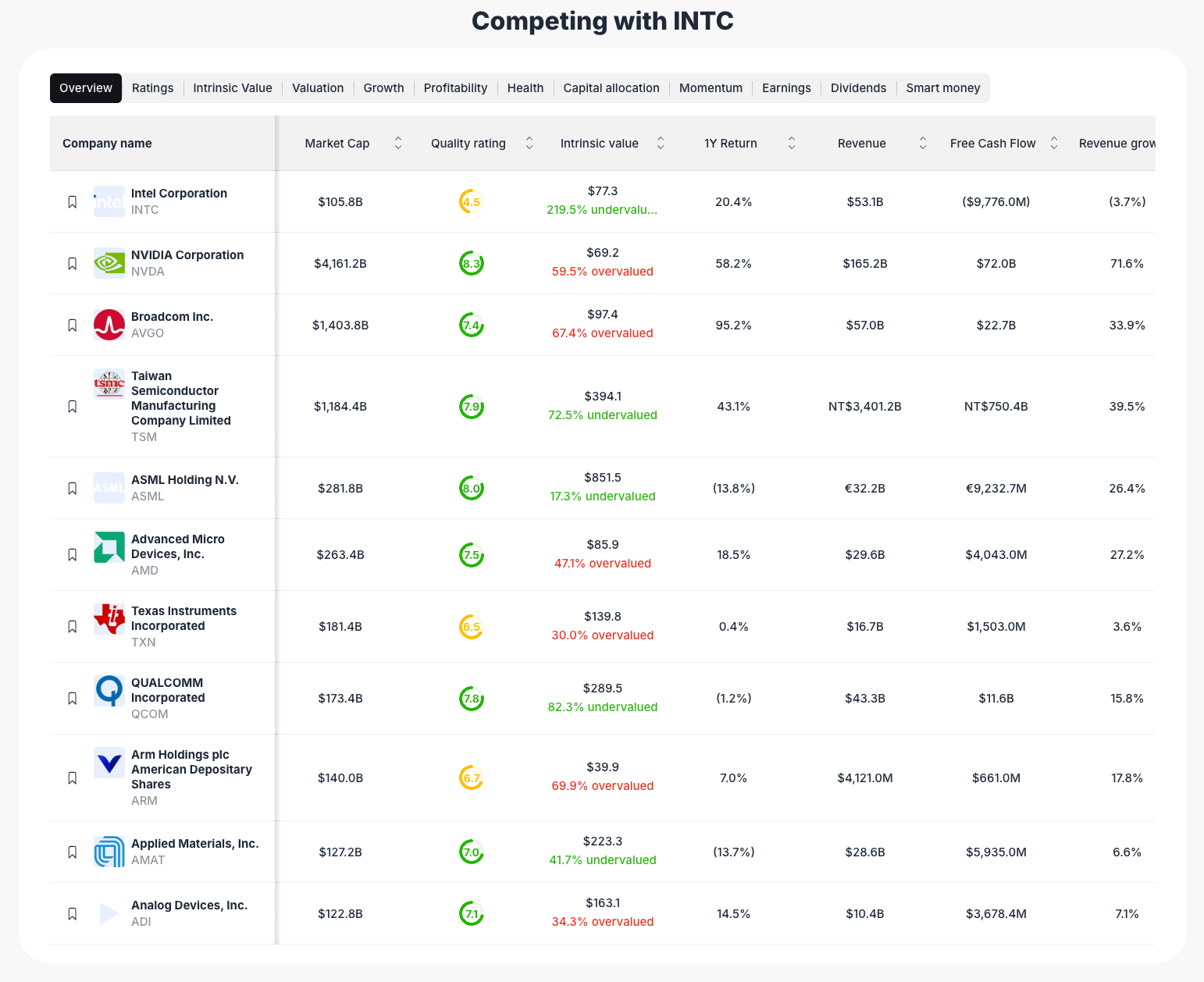

Competitive Positioning: Foundry Strategy and Market Share

Intel's competitive position within the semiconductor industry has evolved dramatically as the company pursues foundry services to complement its traditional integrated device manufacturer model.

Competitive Analysis vs. Key Players:

- Intel (INTC): $105.8B market cap, 219.5% undervalued, negative free cash flow

- NVIDIA (NVDA): $4.16T market cap, 59.5% overvalued, demonstrating AI premium

- Broadcom (AVGO): $1.40T market cap, 67.4% overvalued, benefiting from AI infrastructure

- Taiwan Semiconductor (TSM): $1.18B market cap, 72.5% undervalued, foundry leader

- AMD (AMD): $263.4B market cap, 47.1% overvalued, gaining CPU/GPU share

Intel's valuation discount compared to peers suggests the market has not yet recognized the company's foundry potential and manufacturing capabilities.

Manufacturing Renaissance: Process Technology Recovery

Intel's manufacturing capabilities remain a core competitive advantage despite recent node delays. The company's substantial investments in advanced process technologies and geographic expansion support long-term competitiveness.

Key Manufacturing Initiatives:

- Intel 18A Process: Next-generation node competing with TSMC's 2nm technology

- Foundry Services: External customer wins including Qualcomm and Amazon partnerships

- Geographic Expansion: New fabs in Arizona, Ohio, and Ireland increasing global capacity

- Packaging Innovation: Advanced packaging technologies for chiplet architectures

These investments position Intel to reclaim process leadership while building a sustainable foundry business serving external customers.

AI Strategy and Market Opportunity

Intel's artificial intelligence strategy encompasses multiple product categories and market segments, creating diversified exposure to the AI revolution beyond traditional data center applications.

AI Product Portfolio:

- Gaudi AI Accelerators: Competing with NVIDIA in training and inference markets

- Core Ultra Processors: AI-enabled PC processors for edge computing applications

- Foundry AI Chips: Manufacturing AI accelerators for fabless customers

- Software Ecosystem: OneAPI development tools supporting AI workload optimization

The comprehensive AI approach reduces dependence on any single product while leveraging Intel's manufacturing scale and software expertise.

Government Support and Strategic Incentives

Intel benefits significantly from government initiatives supporting domestic semiconductor manufacturing, providing both financial incentives and strategic positioning advantages.

Policy Support Factors:

- CHIPS Act Funding: $8.5 billion in direct subsidies for U.S. manufacturing expansion

- Tax Incentives: Investment tax credits reducing capital expenditure costs

- National Security: Strategic importance ensuring government support for competitiveness

- Supply Chain Resilience: Policies favoring domestic manufacturing capabilities

These supportive policies reduce investment risks while improving Intel's competitive position relative to Asian foundries.

Financial Recovery Timeline and Milestones

Intel's path to financial recovery depends on executing several key milestones across manufacturing, product development, and market share recovery.

Near-term Catalysts (2025-2026):

- Foundry Customer Wins: External revenue growth from new customer relationships

- AI Product Launches: Gaudi 3 and next-generation AI accelerator market penetration

- Process Node Recovery: Intel 18A technology demonstration and customer adoption

- Cost Structure Optimization: Operational efficiency improvements reducing expense growth

Medium-term Objectives (2027-2029):

- Market Share Recovery: Regaining competitiveness in CPU and data center markets

- Foundry Scale: Building sustainable foundry business approaching $10+ billion revenue

- Profitability Restoration: Returning to historical gross margin levels above 50%

- Free Cash Flow Positive: Generating positive cash flows supporting dividend restoration

Investment Risk Assessment

Despite compelling value arguments, Intel faces several risk factors that could impact turnaround success and stock performance.

Execution Risks:

- Technology Delays: Process node development could face additional setbacks

- Foundry Competition: TSMC's scale and customer relationships remain formidable

- Capital Requirements: Heavy investment needs could pressure cash flows longer than expected

- Market Share Erosion: AMD and ARM competitors continue gaining ground

Market Risks:

- Cyclical Downturn: Semiconductor cycle could extend weakness in PC and data center markets

- Geopolitical Tensions: China market restrictions could impact revenue significantly

- Customer Concentration: Dependence on key foundry customers creates revenue risk

- Technology Disruption: Quantum or optical computing could threaten traditional semiconductors

Valuation Summary and Investment Thesis

Intel represents a compelling turnaround opportunity trading at a significant discount to intrinsic value. The company's manufacturing capabilities, government support, and strategic transformation create multiple paths to value creation.

Investment Highlights:

- Deep Value Opportunity: 219.5% undervaluation suggests substantial upside potential

- Manufacturing Leadership: Advanced process technology capabilities with foundry optionality

- Government Support: CHIPS Act funding reducing investment risks and improving competitiveness

- AI Exposure: Diversified AI product portfolio capturing multiple market segments

- Balance Sheet Strength: Adequate liquidity to fund transformation investments

The convergence of undervaluation, strategic progress, and policy support creates an attractive risk-adjusted return profile for patient investors willing to hold through the transformation period.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Walmart Stock Analysis: Retail Giant's Undervalued Digital Transformation

📖 Undervalued Fintech Stocks September 2025: 6 Financial Technology Value Plays

📖 Rule of 40 Stocks September 2025

FAQ

Why is Intel stock so undervalued in 2025?

Intel appears undervalued due to market skepticism about the company's ability to compete with TSMC in foundry services and NVIDIA in AI accelerators. However, the market may be overlooking Intel's manufacturing capabilities, government support through the CHIPS Act, and progress in advanced process technologies. The 219.5% undervaluation suggests significant overcorrection.

Can Intel successfully compete in the foundry market against TSMC?

Intel's foundry strategy leverages advanced packaging, geographic diversification, and government support for domestic manufacturing. While TSMC maintains technology leadership, Intel's investments in Intel 18A process technology and customer relationships with companies like Qualcomm suggest competitive foundry services are achievable.

How does Intel's AI strategy differ from NVIDIA's approach?

Intel pursues a broader AI strategy encompassing data center accelerators (Gaudi), edge computing (Core Ultra), and foundry services for AI chips. This diversified approach reduces dependence on any single market segment while leveraging Intel's manufacturing scale and software ecosystem advantages.

What are the main risks of investing in Intel stock?

Primary risks include execution challenges in advanced process development, intense competition from TSMC and NVIDIA, heavy capital requirements pressuring cash flows, and potential market share erosion in core CPU markets. Geopolitical tensions affecting China revenue and semiconductor cycle downturns also present significant risks.

When might Intel's turnaround strategy show financial results?

Intel's financial recovery likely requires 2-3 years for meaningful progress, with foundry revenue growth and AI product adoption as key catalysts. Investors should expect continued investment-driven margin pressure through 2026, with profitability recovery potentially beginning in 2027-2028 as strategic initiatives mature.