Understanding Stock Valuation: A Step-by-Step Guide to Calculating Intrinsic Value

Welcome to Value Sense Blog

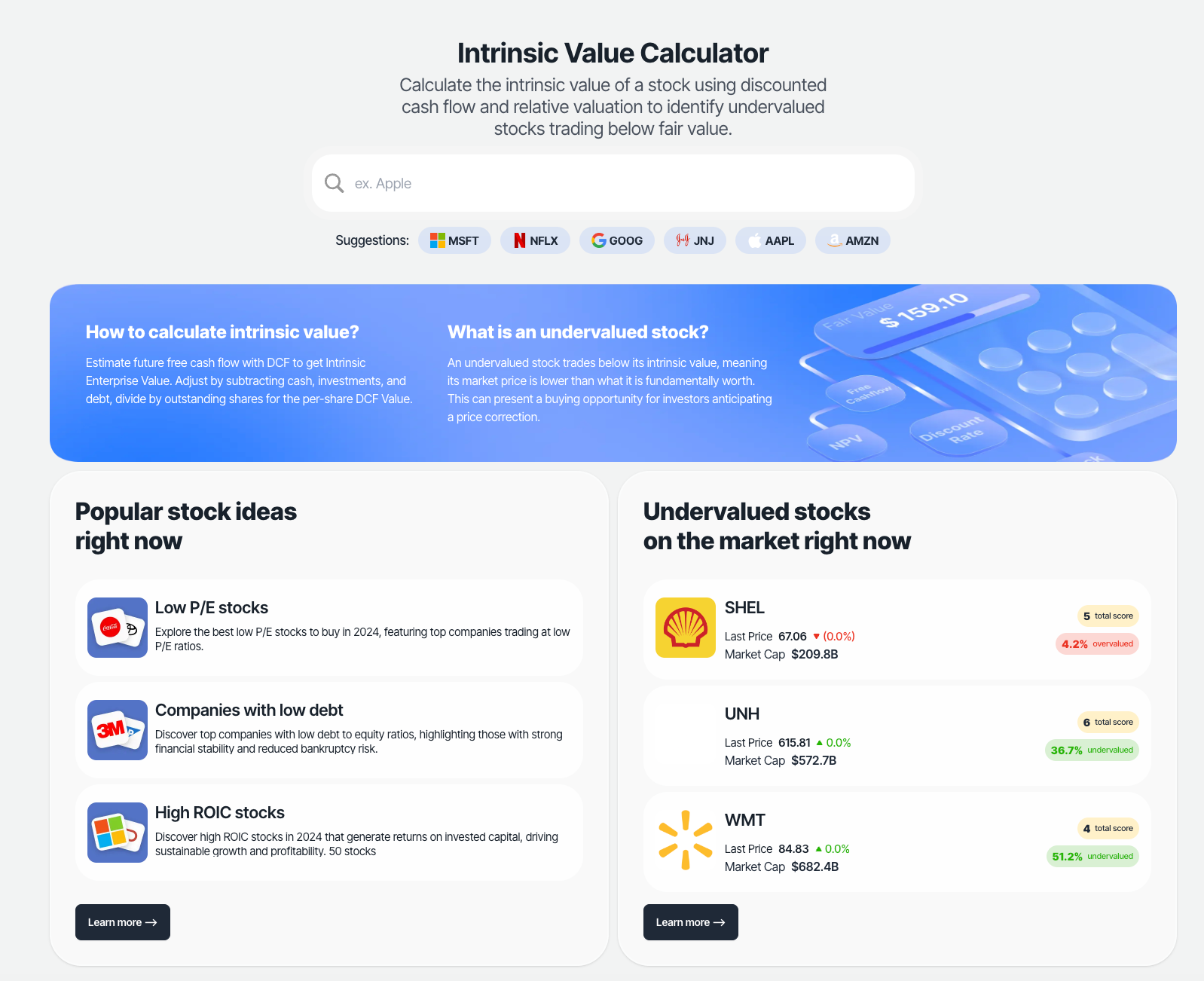

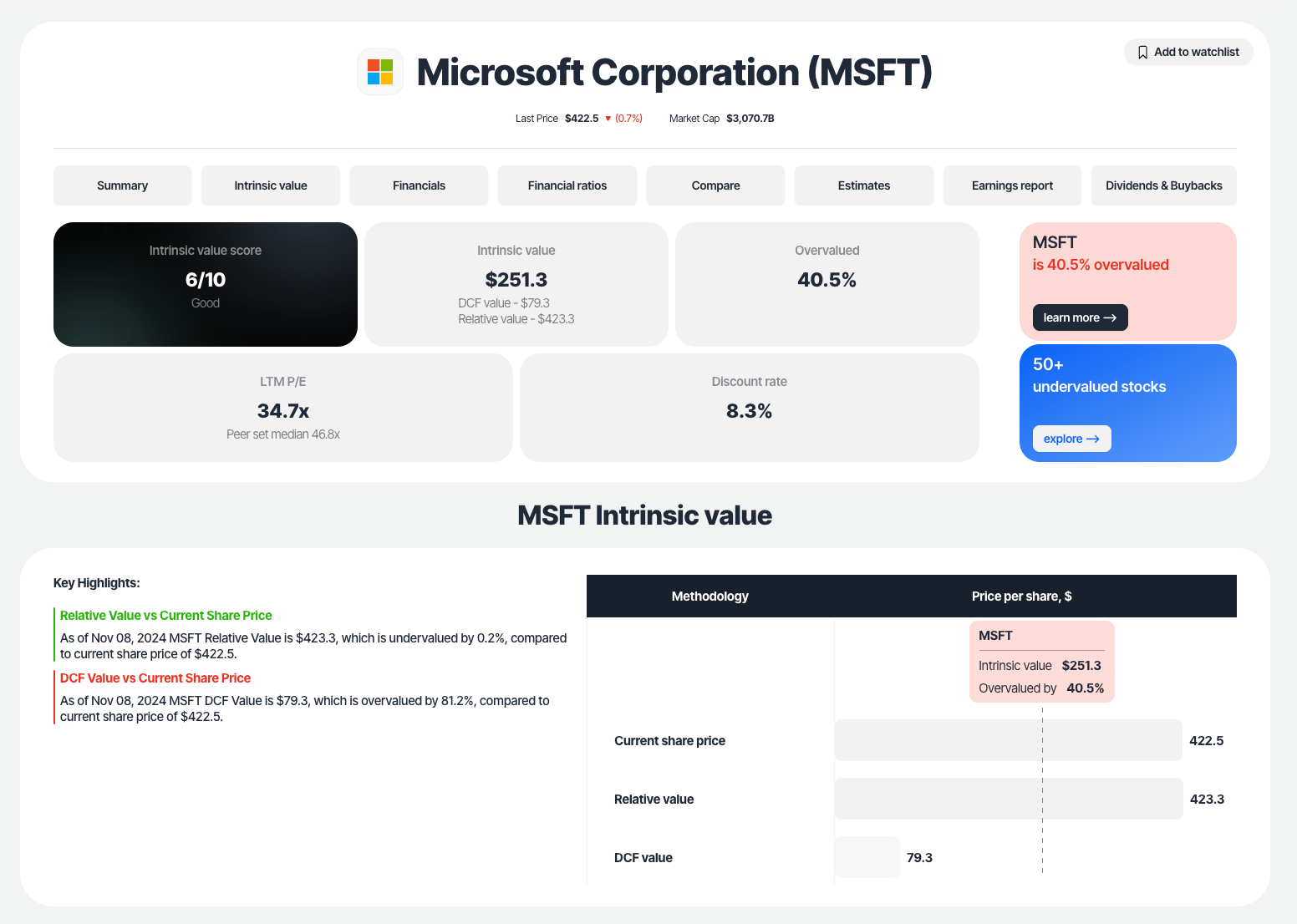

At Value Sense we help investors instantly find top-performing stocks and undervalued companies, saving time on research. You can explore our intrinsic value tools at valuesense.io and learn more about our latest stock ideas.

Why Valuation Matters

Stock valuation is a crucial aspect of investing, and it revolves around determining what a stock is worth. The fundamental goal is to avoid overpaying for shares of a business. However, the deeper purpose of valuation is to estimate the future cash flows a business will generate for its owners. This estimation allows investors to figure out what they would be willing to pay today for those future cash flows, ensuring a high rate of return over time.

When determining the value of a company, there are several key methods and metrics to consider. Business valuation typically involves analyzing cash flow, earnings, and assets. One of the most widely used approaches is discounted cash flow (DCF), which projects future cash flows and discounts them to present value.

The Concept of a Money Printing Machine

To visualize the valuation process, imagine a business as a money printing machine. This machine can print a certain amount of cash each year, and our task is to assess its value. For example, if Microsoft’s machine is selling for $1.85 trillion, the question arises: would you pay that price if it only printed $1 million a year? Clearly not. But if it could generate $100 billion annually, that would be a different matter. The essence of valuation lies in understanding how much cash a business can produce in the future.

Defining Intrinsic Value

Warren Buffett frequently quotes economist John Burr Williams, who stated that the intrinsic value of any stock, bond, or business is determined by the cash inflows and outflows discounted at an appropriate interest rate expected to occur during the asset's remaining life. This definition leads us to the concept of discounted cash flow (DCF) analysis, which is the foundation for calculating intrinsic value.

Step 1: Understanding Owner's Earnings

To begin the valuation process, we need to determine how much cash the business generates for its owners right now, known as the owner's earnings. This is calculated as operating cash flow minus maintenance capital expenditure. While operating cash flow is readily available in the cash flow statement, maintenance capital expenditure is often harder to ascertain, as companies report total capital expenditure without breaking it down.

If maintenance capital expenditure is not disclosed, you can use free cash flow, which is operating cash flow minus total capital expenditure. This approach is more conservative, albeit slightly less accurate.

Step 2: Historical Example - Valuing Apple in 2016

Let's apply this to a historical example of valuing Apple stock in 2016. Apple's operating cash flow that year was $65.824 billion, with total capital expenditure of $12.734 billion. This results in a free cash flow of $53.09 billion. This figure serves as our starting point.

Step 3: Estimating Future Cash Flows

Next, we need to project how quickly the business will grow over the next 10 years. Historical data shows Apple grew at roughly 20-30% annually before 2016. However, for our conservative estimate, we should not expect such high growth rates for a mature company like Apple. A realistic growth rate of 10% per year will be used for our calculations.

Step 4: Calculating Terminal Value

After estimating future cash flows, we also need to determine the terminal value, which is what we expect to sell the business for in 10 years. Historically, Apple has traded at a price-to-free cash flow multiple of about 10. If we project Apple's free cash flow to reach $137.7 billion in 10 years, we can estimate the terminal value by multiplying that figure by 10, resulting in a terminal value of $1.377 trillion.

Step 5: Discounting Future Cash Flows

Now, we must discount these future cash flows back to their present value. This is because money today is worth more than money in the future. To do this, we use the desired annual return rate, which we'll set at 15%. By dividing our estimated free cash flow by 1.15 for each of the 10 years, we can calculate the present value of future cash flows, including the terminal value.

Step 6: Summing Up the Values

After discounting, we sum all the present values of future cash flows to determine the intrinsic value of the business. In this case, we calculate Apple’s intrinsic value to be approximately $759.53 billion with a 10% growth rate and $1.062 trillion with a 15% growth rate. This range gives us insight into what we should be willing to pay for Apple stock.

Step 7: Adding Cash Reserves

When valuing a business, it’s essential to account for any cash reserves it holds. For Apple in 2016, the company had $20.484 billion in cash and $46.671 billion in short-term marketable securities. Adding these to our intrinsic value range gives us a new range between $826.7 billion and $1.129 trillion.

Step 8: Incorporating a Margin of Safety

Investing involves uncertainty, and it's crucial to factor in a margin of safety. This acts as a buffer against our assumptions potentially being wrong. For beginners, a 50% margin of safety is advisable, while more experienced investors might settle for 30%. Applying a 30% margin of safety to our intrinsic value range reduces it to between $580 billion and $790 billion.

Final Thoughts: Market Cap Comparison

At the end of 2016, Apple’s market cap was $609 billion, which fell within our calculated range, making it a potentially attractive investment opportunity. Notably, Warren Buffett was also buying Apple stock around this time, further validating our analysis. Understanding this valuation process equips you with the tools to identify undervalued stocks effectively.

Conclusion

Valuing stocks through discounted cash flow analysis is a powerful technique employed by many successful investors. By following this step-by-step guide, you can assess a company's intrinsic value and make informed investment decisions that align with your financial goals.

How to calculate Intrinsic Value?

Use Value Sense Free Intrinsic Value analysis tool for stock valuation. Select any stock and instantly calculate an intrinsic value for free.

also, we have 10+ FREE intrinsic value tools:

- reverse DCF calculator

- earnings growth model

- Peter Lynch charts

- discount rate calculator

- margin of safety calculator

- intrinsic value calculator

- and many more...

For those seeking market opportunities, our analytics team has compiled over 10 exclusive lists of undervalued and high-quality stocks:

Ready to start?

Join 3,500+ value investors worldwide