ValueSense Intrinsic Value Tools - Intrinsic Value Calculator

ValueSense's Intrinsic Value Calculator is a comprehensive valuation tool that combines multiple proven methodologies to help you determine whether a stock is fairly valued, undervalued, or overvalued. Using automated calculations and proprietary models, it provides professional-grade valuation analysis without requiring complex manual calculations.

Accessing the Intrinsic Value Calculator

Method 1: Via Tools Hub

- Hover over "More tools" in the main navigation bar

- Click "Intrinsic value tools" from the dropdown menu

- This takes you to the comprehensive valuation tools hub

- Click "Find out more" on the "Intrinsic Value" card

- Access the main calculator page with search functionality

Method 2: Direct Stock Analysis

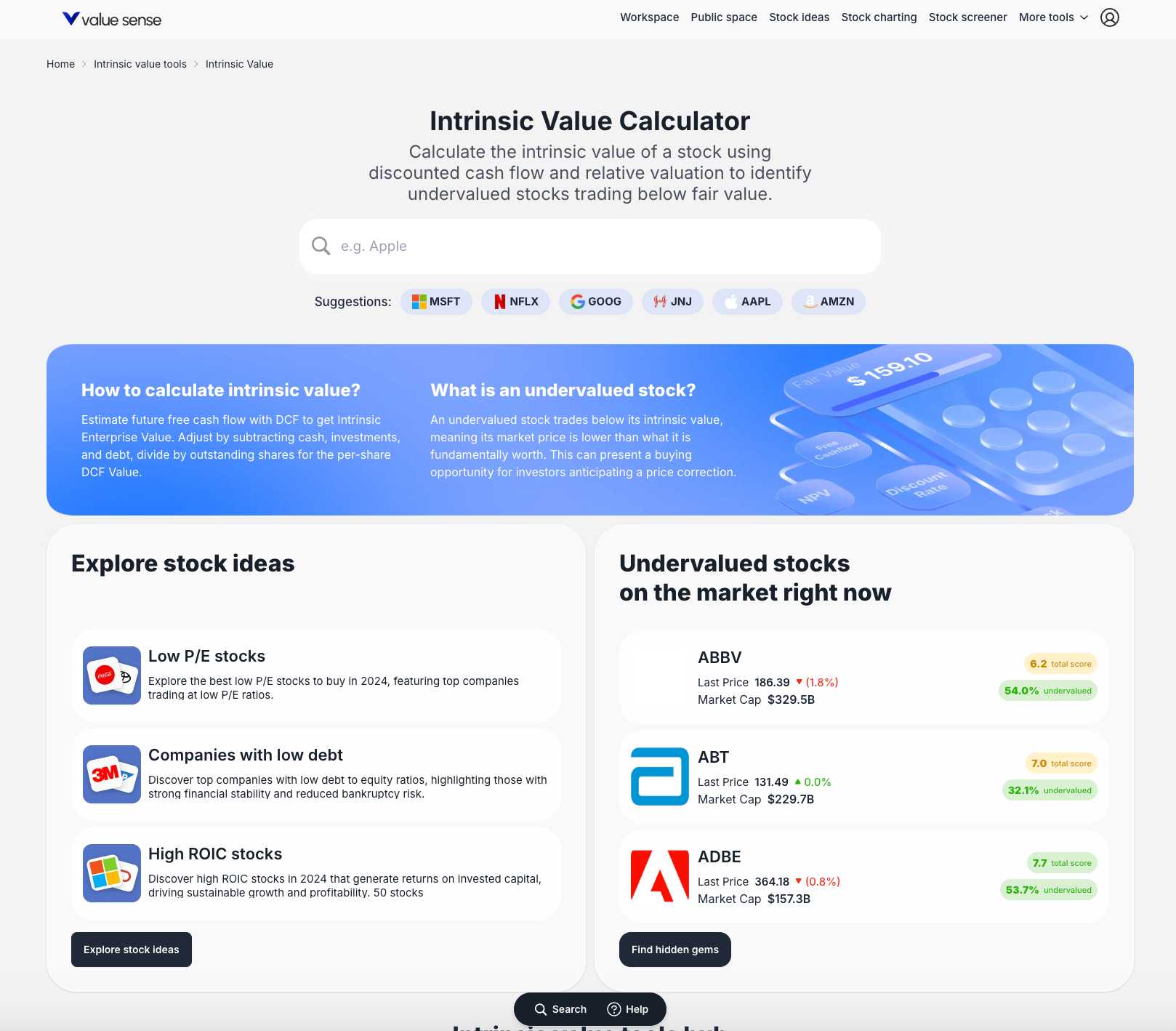

Free Intrinsic Value tools - Value of stocks

A free website for calculating the intrinsic value of stocks and the fair market value of a stock.

- From the calculator page, search for any company by name or ticker

- Click on suggested tickers below the search bar

- Or type directly into the search bar (e.g., "Apple" or "MSFT")

- This loads the detailed intrinsic value analysis instantly

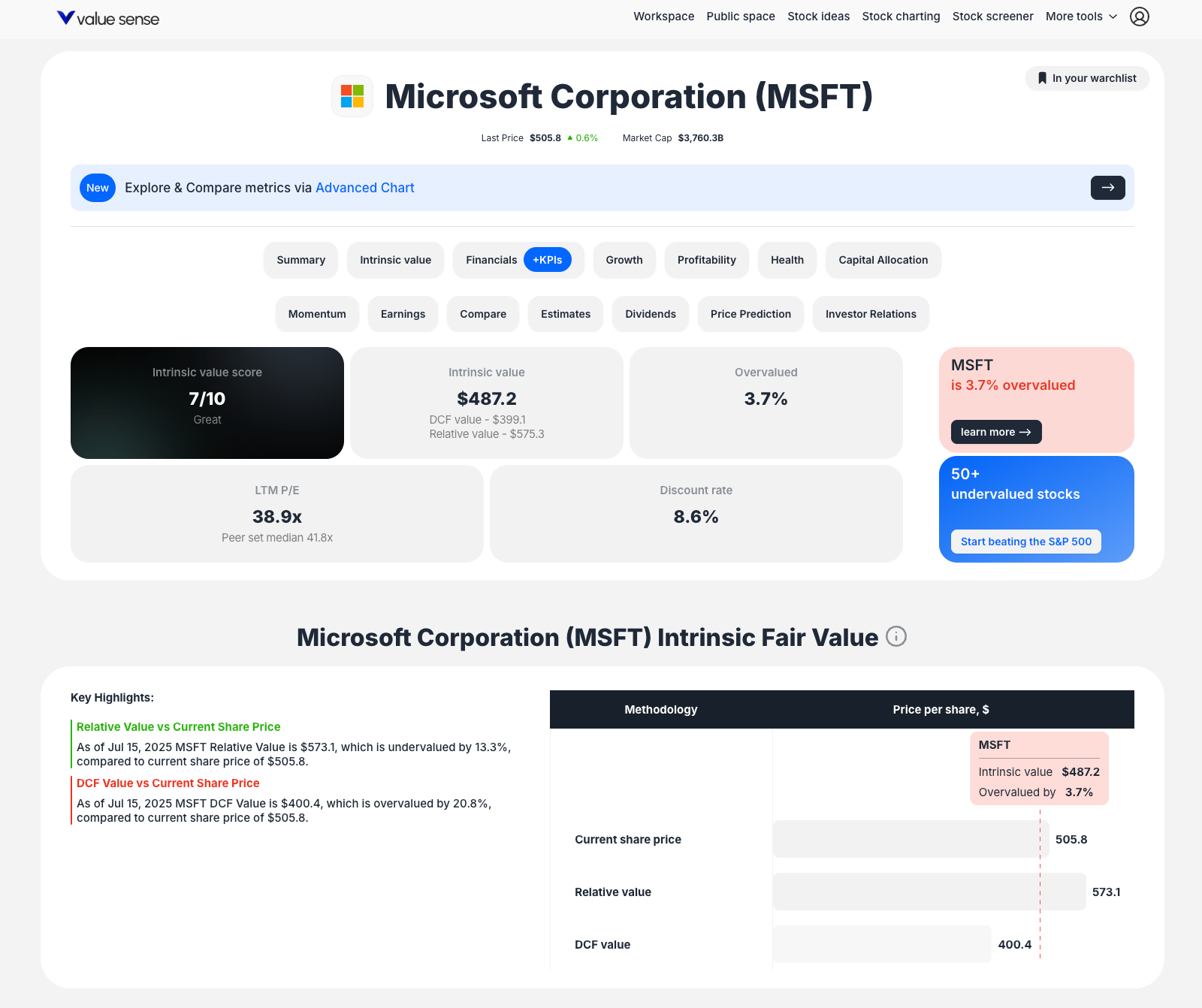

Understanding the Results

Top-Level Summary Cards

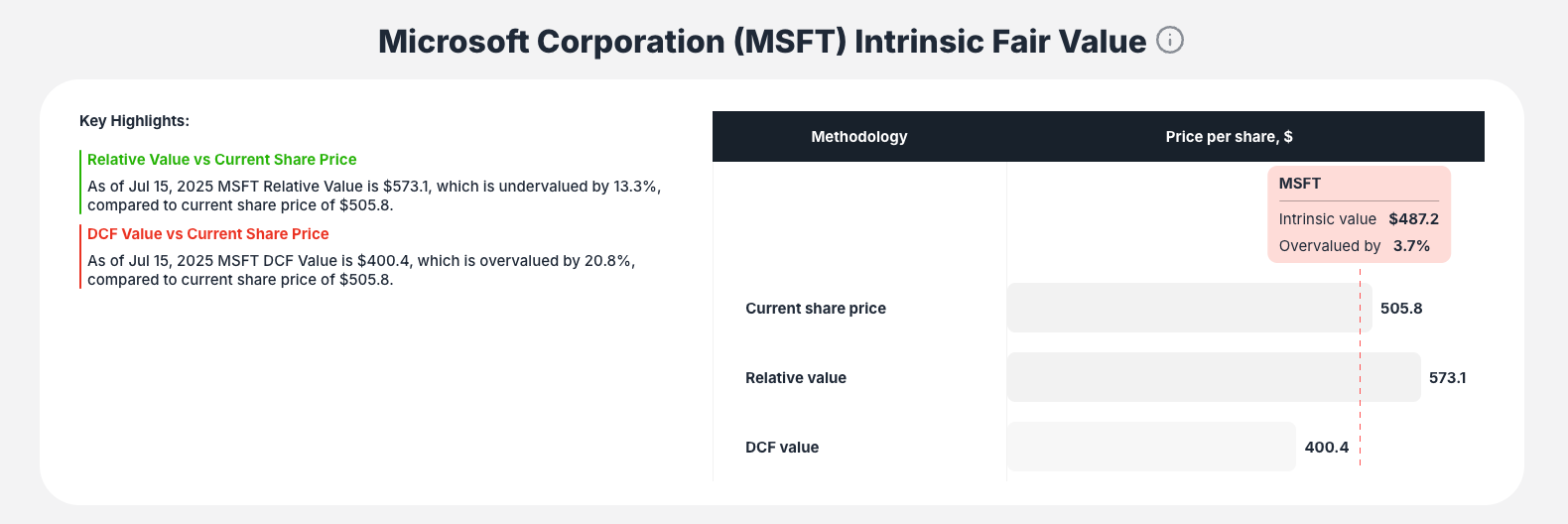

When you analyze a stock (e.g., Microsoft - MSFT), you get immediate insights:

- Intrinsic Value Score: Proprietary rating (e.g., "7/10 Great")

- Intrinsic Value: Final calculated fair value per share (e.g., $487.2)

- Component Breakdown:

- DCF Value: Discounted cash flow result (e.g., $399.1)

- Relative Value: Peer comparison value (e.g., $575.1)

- Valuation Status: Clear indicator (e.g., "3.7% overvalued")

- Key Metrics: LTM P/E ratio and discount rate used

Visual Analysis Tools

Fair Value Comparison Chart

- Bar chart comparing current share price to calculated intrinsic, relative, and DCF values

- Instant visual understanding of valuation relationships

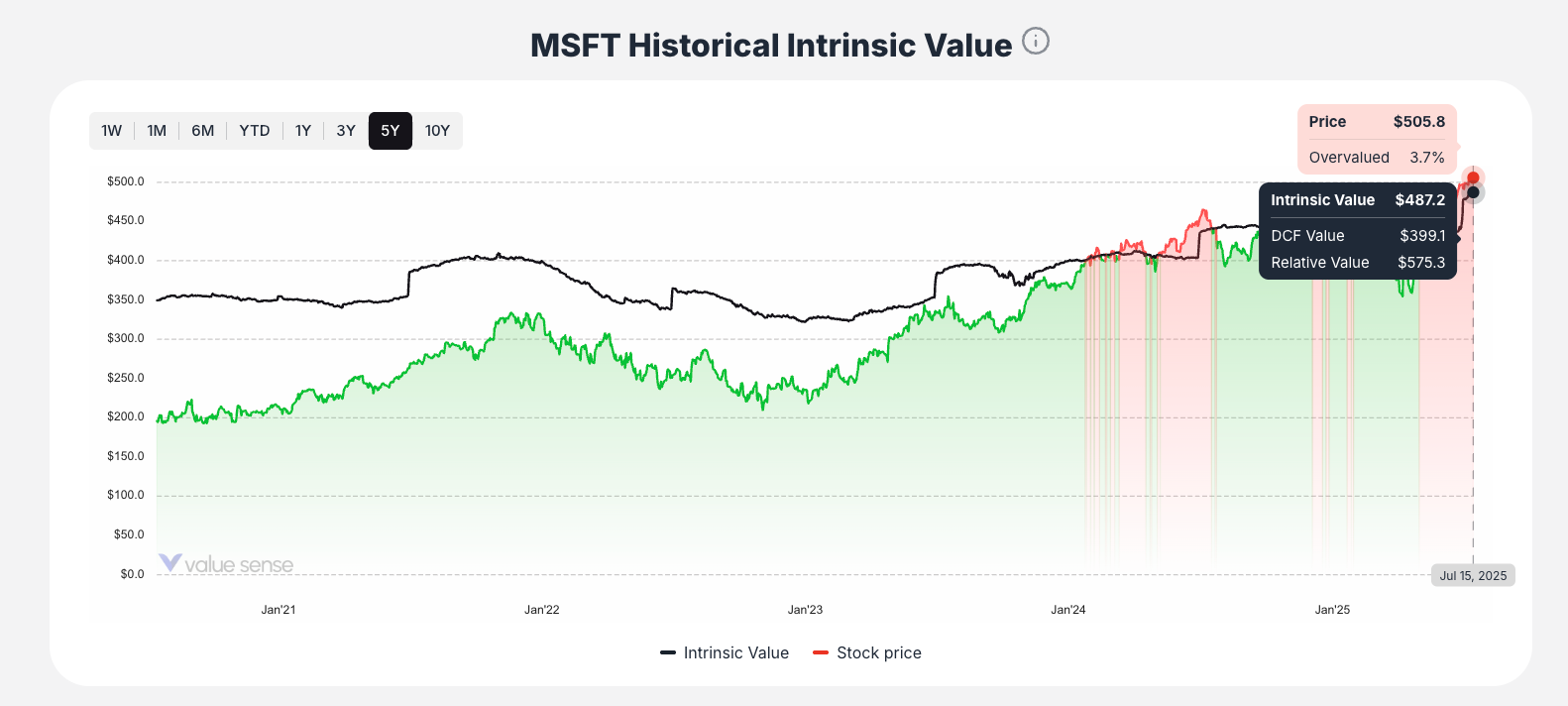

Historical Intrinsic Value Chart

- Line chart plotting stock price against calculated intrinsic value over time

- Choose timeframes from 1 week to 5 years

- Interactive hover feature reveals detailed data for any historical point

- Identify valuation trends and timing opportunities

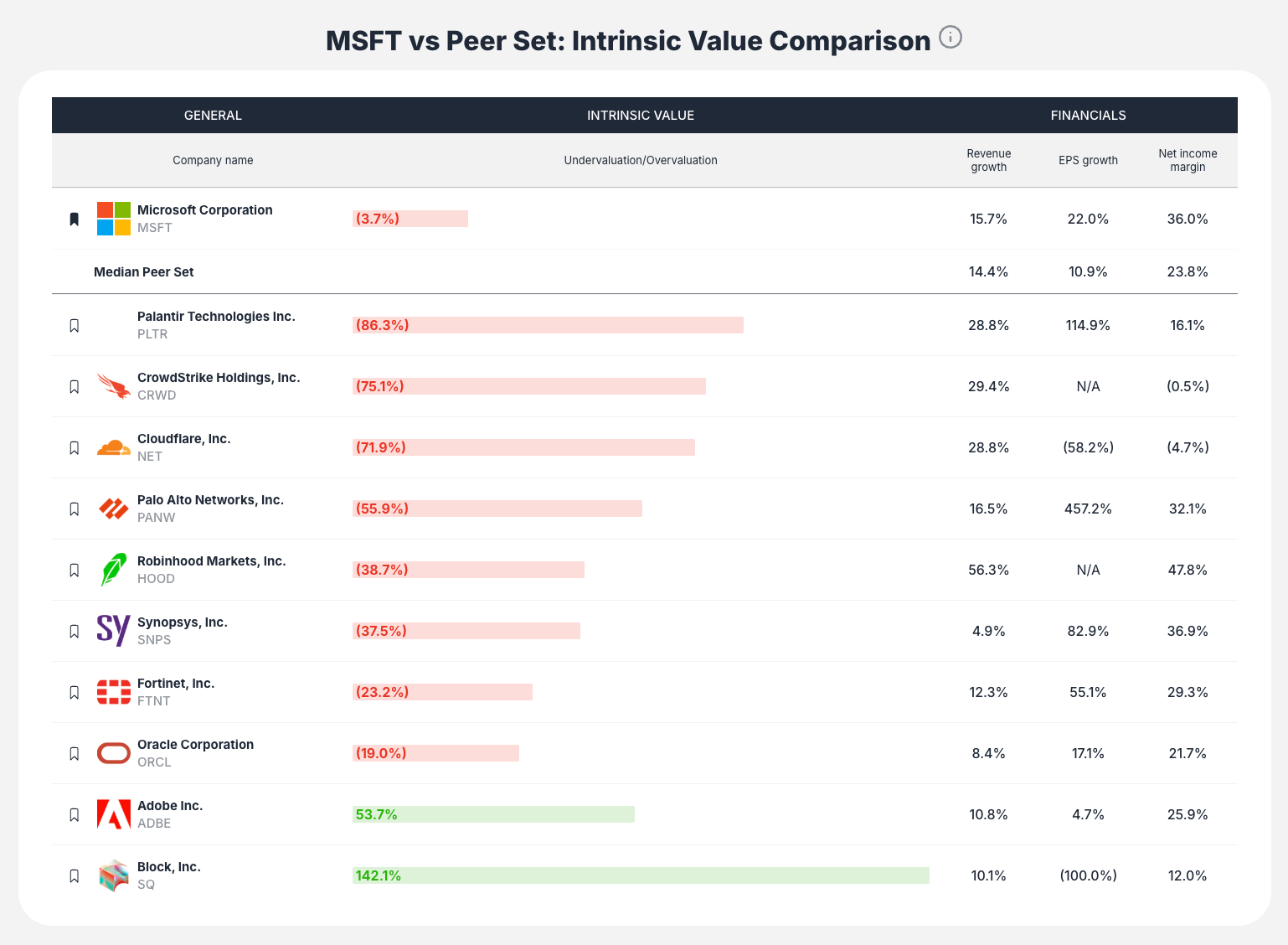

Peer Comparison Table

- Compare the analyzed company to industry peers

- Metrics include under/overvaluation percentages, revenue growth, EPS growth, and net income margins

- Understand if valuation is company-specific or industry-wide

Methodologies and Calculations

Blended Model Approach

The primary "Intrinsic Value" combines multiple proven methodologies:

Discounted Cash Flow (DCF)

- Estimates future free cash flows

- Discounts them at appropriate rates

- Adjusts for cash, investments, and debt

- Divides by outstanding shares for per-share value

Relative Valuation

- Determines market price relative to fundamental worth

- Based on assets, earnings, and cash flows

- Compares multiples to peers and historical averages

Automated Calculations

- No manual input required beyond selecting the stock

- Proprietary models use current financial data

- Professional-grade analysis without complex calculations

How to Interpret Results

Quick Investment Decision

- Overvaluation Percentage: If positive, stock may be expensive

- Undervaluation Percentage: If negative, stock may be a bargain

- Intrinsic Value Score: Higher scores indicate better valuation attractiveness

Advanced Analysis

- DCF vs. Relative Value Gap: Large differences indicate market sentiment vs. fundamental value disconnect

- Historical Trends: Use the chart to see if current valuation is temporary or persistent

- Peer Context: Compare to industry peers to understand relative attractiveness

Key Workflow for Using the Calculator

Step 1: Stock Selection

- Search for any company using ticker or name

- Or click on suggested popular stocks

Step 2: Summary Assessment

- Review the intrinsic value score and over/undervaluation percentage

- Get immediate investment direction

Step 3: Component Analysis

- Examine DCF and Relative value breakdown

- Understand what's driving the valuation

Step 4: Historical Context

- Use the interactive chart to see valuation trends

- Identify if current levels are typical or unusual

Step 5: Peer Comparison

- Compare to industry competitors

- Understand relative valuation attractiveness

Step 6: Additional Analysis

- Explore other valuation models for the same stock

- Use integrated links to find similar investment opportunities

Best Practices for Using the Calculator

Initial Screening

- Use the intrinsic value score as a quick quality filter

- Focus on significantly undervalued opportunities

- Consider the magnitude of under/overvaluation

Comprehensive Analysis

- Always review both DCF and Relative value components

- Check historical valuation trends for context

- Compare to peer group for industry perspective

Timing Decisions

- Use historical charts to identify valuation cycles

- Look for stocks approaching historical support levels

- Consider market conditions when interpreting results

Key Features to Remember

Automated Professional Analysis

- No complex calculations required

- Proprietary models handle all technical aspects

- Instant results for any publicly traded stock

Multiple Valuation Perspectives

- Blended approach combines best of different methodologies

- See both fundamental (DCF) and market-based (Relative) values

- Comprehensive view reduces single-model bias

Interactive Historical Analysis

- Hover over any point on historical charts for detailed data

- Understand valuation trends and cycles

- Identify optimal entry and exit points

Peer and Industry Context

- Never analyze stocks in isolation

- Compare to relevant peer groups

- Understand industry-wide valuation trends

The Intrinsic Value Calculator transforms complex financial modeling into an accessible, powerful tool that helps you make informed investment decisions based on rigorous valuation analysis.