Intrinsic Value Guide: Learn how to value stocks

“Price is what you pay, value is what you get.” — Warren Buffett

Understanding stock valuation is crucial for making informed investment decisions. It helps you determine whether a stock is priced fairly, overvalued, or undervalued. This guide will walk you through the fundamentals of stock valuation, introduce key metrics and methods, and provide practical insights to enhance your investment strategy.

1. Introduction to Stock Valuation

A company's valuation is like a price tag representing what someone would pay to buy it today. Successful investing hinges on buying stocks at a price lower than their intrinsic value, the estimated real worth based on future earnings potential. This guide aims to demystify the process of valuing stocks, helping you make smarter investment choices. It will also guide you from understanding theoretical concepts to applying practical insights, helping you become a true value investor.

2. Key Drivers of Valuation

Understanding the Fundamentals

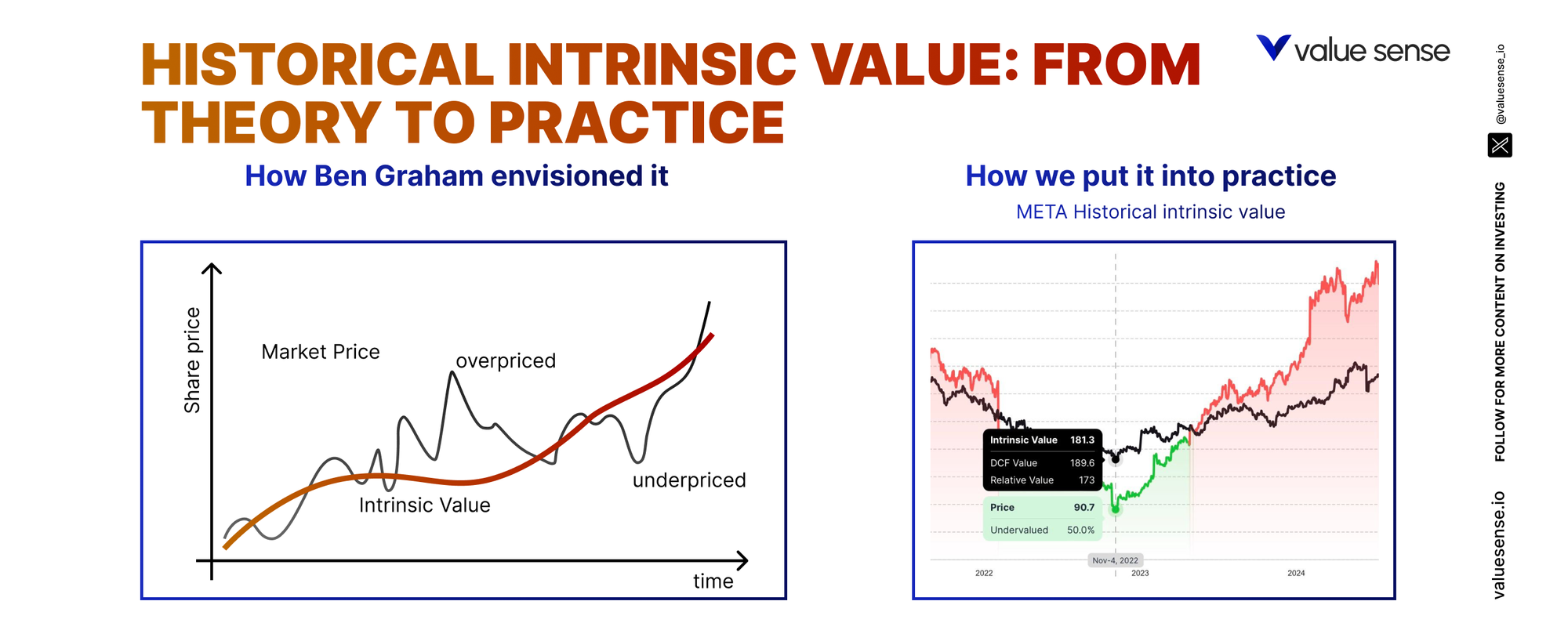

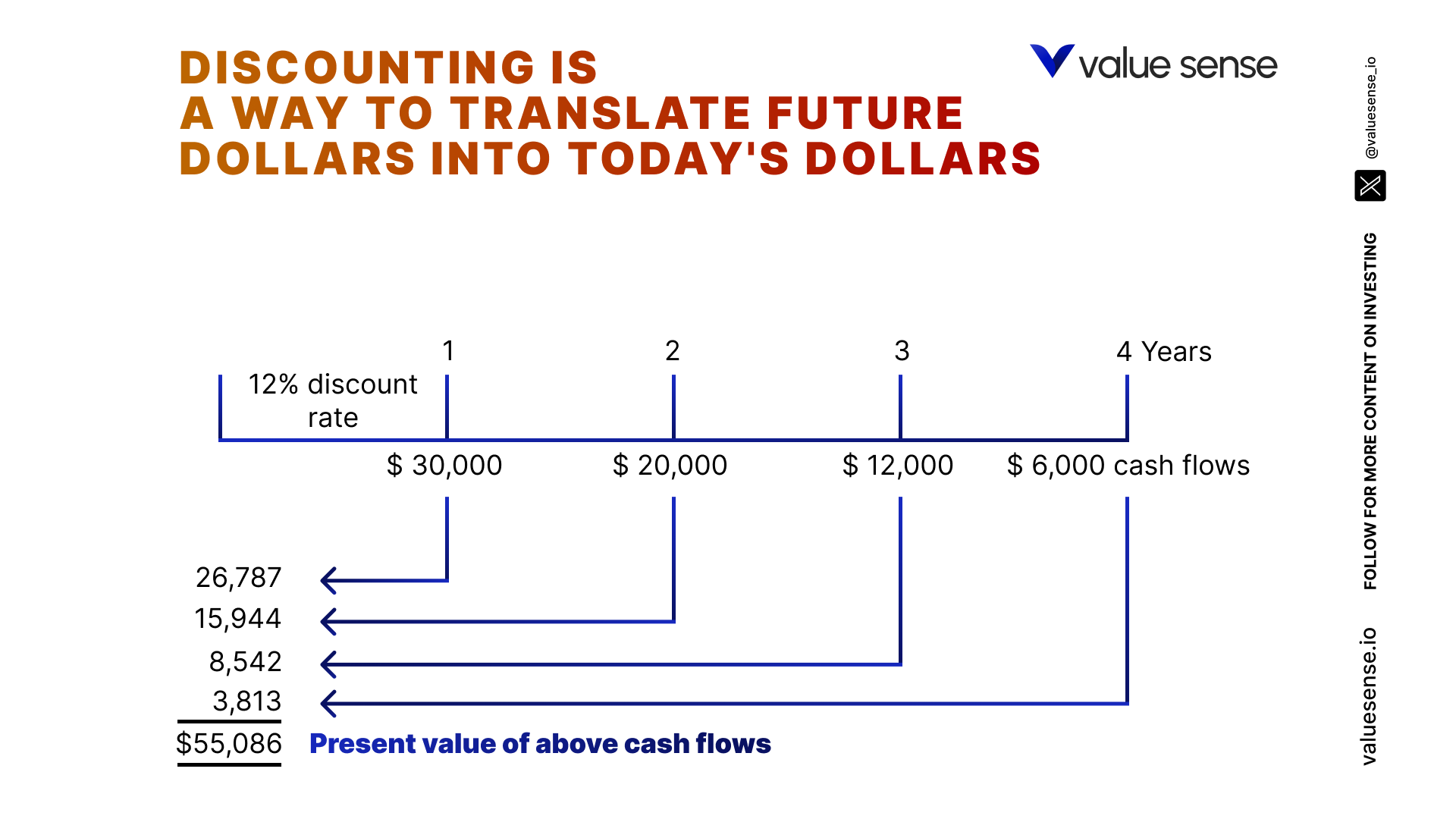

Think of a company as an apple tree. Its value isn't just based on the apples it bears today but also on the apples it will produce in the future. Similarly, a company's value derives from both its current earnings and its future profit potential. A way of translating future profits into today’s value is known as discounting. This is one of the most powerful concepts in investing and the cornerstone of valuation. The final result of valuation is called intrinsic value - the company’s true worth.

Short-Term vs. Long-Term Perspectives

In the short term, stock prices can be volatile and influenced by market sentiment. However, over the long term, a company's stock price tends to reflect its earnings power and intrinsic value. Understanding the distinction between short-term market noise and long-term value can help investors make more rational decisions.

Market Cap and Enterprise Value

- Market Capitalization (Market Cap): Stock Price × Outstanding Shares

- Enterprise Value (EV): Market Cap + Total Debt - Cash

Market cap provides a quick snapshot of a company's overall value, while enterprise value gives a more comprehensive picture by accounting for debt and cash. Knowing these metrics helps investors assess a company's size and financial health.

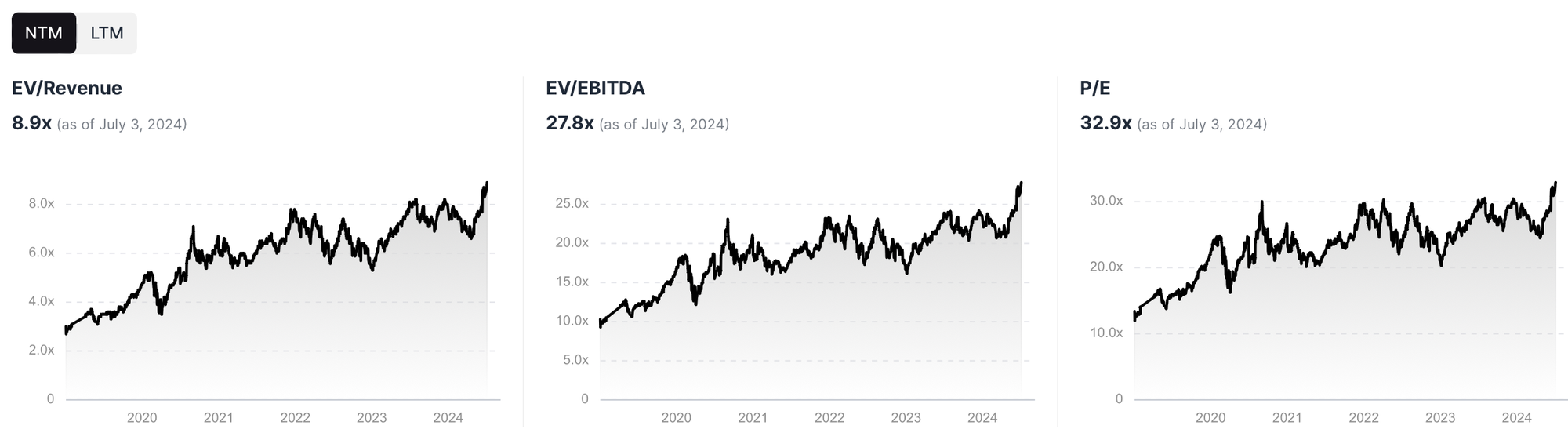

3. Valuation Tools and Metrics

Understanding and utilizing various valuation tools and metrics is key to evaluating a company's worth. Here's a breakdown of some essential tools:

Price-to-Earnings (P/E) Ratio

- Formula: Stock Price / Earnings Per Share (EPS)

- Significance: Indicates how long it would take to earn back your investment, assuming constant earnings. A lower P/E ratio might indicate that a stock is undervalued.

Price-to-Book (P/B) Ratio

- Formula: Stock Price / Book Value Per Share

- Significance: Compares market value to book value, useful for assessing asset-heavy companies. A P/B ratio below 1 can indicate a potentially undervalued stock.

Price-to-Earnings Growth (PEG) Ratio

- Formula: P/E Ratio / Growth Rate

- Significance: Adjusts the P/E ratio to account for growth rates, providing a more nuanced view. A PEG ratio below 1 might suggest that a stock is undervalued relative to its growth potential.

Discounted Cash Flow (DCF) Analysis

- Purpose: Estimates a company's value based on future cash flows, adjusted to present value using a discount rate. This method helps investors understand the value of future profits in today's terms.

- Reverse DCF: Determines the growth rate implied by the current stock price, helping assess if market expectations are reasonable.

Free Cash Flow Yield

- Formula: Free Cash Flow Per Share / Stock Price

- Significance: Preferred by many investors for its robustness compared to earnings. A higher yield can indicate a more attractive investment.

4. Business Lifecycle and Valuation

Understanding a company's lifecycle stage is critical when choosing appropriate valuation metrics. For example, using earnings-based metrics might not be suitable for startups, while mature companies might be better assessed using stable cash flow metrics.

Lifecycle Stages

- Startup: Unprofitable, high potential but high risk.

- Hyper-growth: Rapid growth, reinvestment in the business.

- Self-funding: Breaking even, refining the business model.

- Operating Leverage: Expanding margins, scalable.

- Maturity: Steady, predictable growth.

- Decline: Decreasing revenue and earnings, potential turnarounds.

5. The Catch with DCF Models

Challenges of DCF Models

- Predicting Future Cash Flows: Difficult due to uncertainties. Estimations can be significantly off if future events don't unfold as expected.

- Sensitivity to Discount Rates: Small changes can significantly impact valuation. Choosing the right discount rate is crucial and often subjective.

- Terminal Value Assumptions: Estimating future value beyond a certain point is highly speculative. The terminal value often accounts for a large portion of the DCF valuation, making it a critical yet challenging component.

Despite these challenges, DCF models are valuable for understanding what needs to happen for an investment to be worthwhile. They provide a detailed picture of a company's potential profitability.

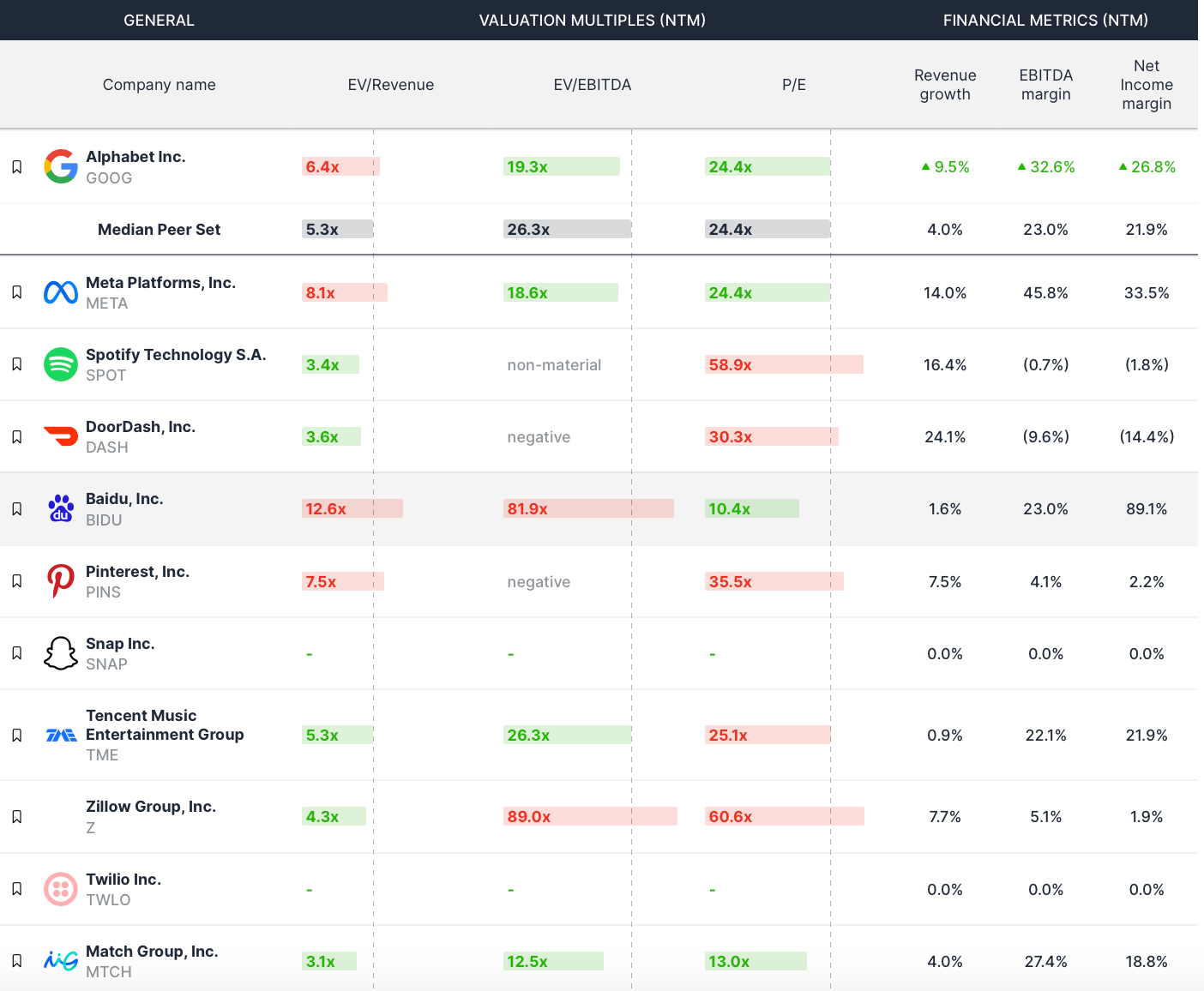

6. Comparative Analysis

Steps for Comparative Analysis

- Identify Comparable Companies: Look for companies in the same sector with similar business models.

- Examine Key Metrics: Compare customer metrics, growth rates, and margins. This helps in understanding relative performance.

- Investigate Past Performers: Review historical data of similar companies. Historical performance can provide insights into potential future outcomes.

- Benchmark Against the Market: Consider broader market and economic conditions. This helps in contextualizing a company's performance.

- Account for Sector Trends: Identify industry trends that may impact valuation. Staying updated with sector trends ensures that your analysis is relevant.

Comparative analysis helps investors gauge how a company stacks up against its peers, providing a relative valuation perspective.

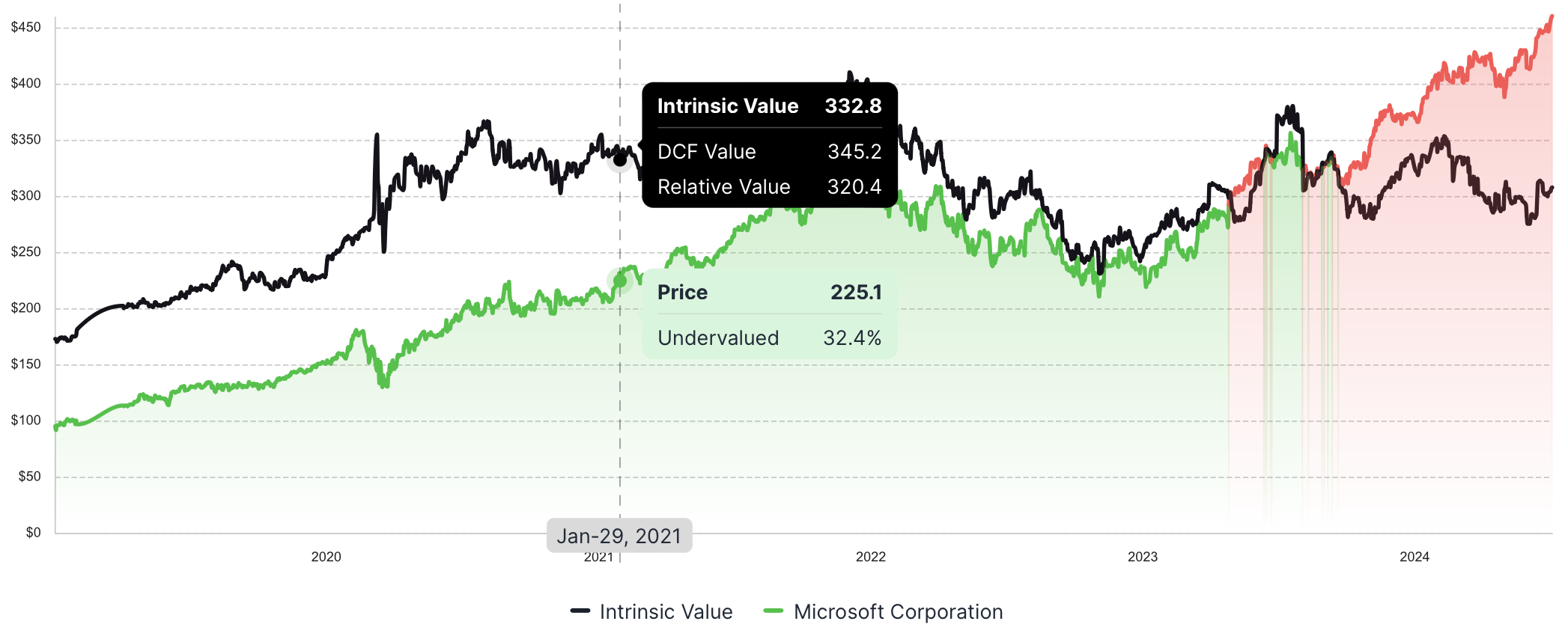

7. Ben Graham's dream: Historical Intrinsic Value

Understanding Historical Intrinsic Value

Historical intrinsic value involves assessing a company's past performance to estimate its true worth over time. This approach can provide insights into how well the company has utilized its assets and managed its operations, giving investors a clearer picture of its long-term potential.

Benefits of Historical Analysis

- Track Record: Evaluating a company's historical intrinsic value helps identify patterns and trends in its performance.

- Consistency: Companies with a consistent track record of growth and profitability are often better investment choices.

- Context: Historical data provides context for current valuations, helping investors make more informed decisions.

Methods to Assess Historical Intrinsic Value

- Historical P/E Ratios: Analyze past price-to-earnings ratios to see how the company's valuation has changed over time.

- Historical Earnings Growth: Review the company's earnings growth history to assess its growth trajectory.

- Historical Free Cash Flow: Examine the company's historical free cash flow to evaluate its ability to generate cash over time.

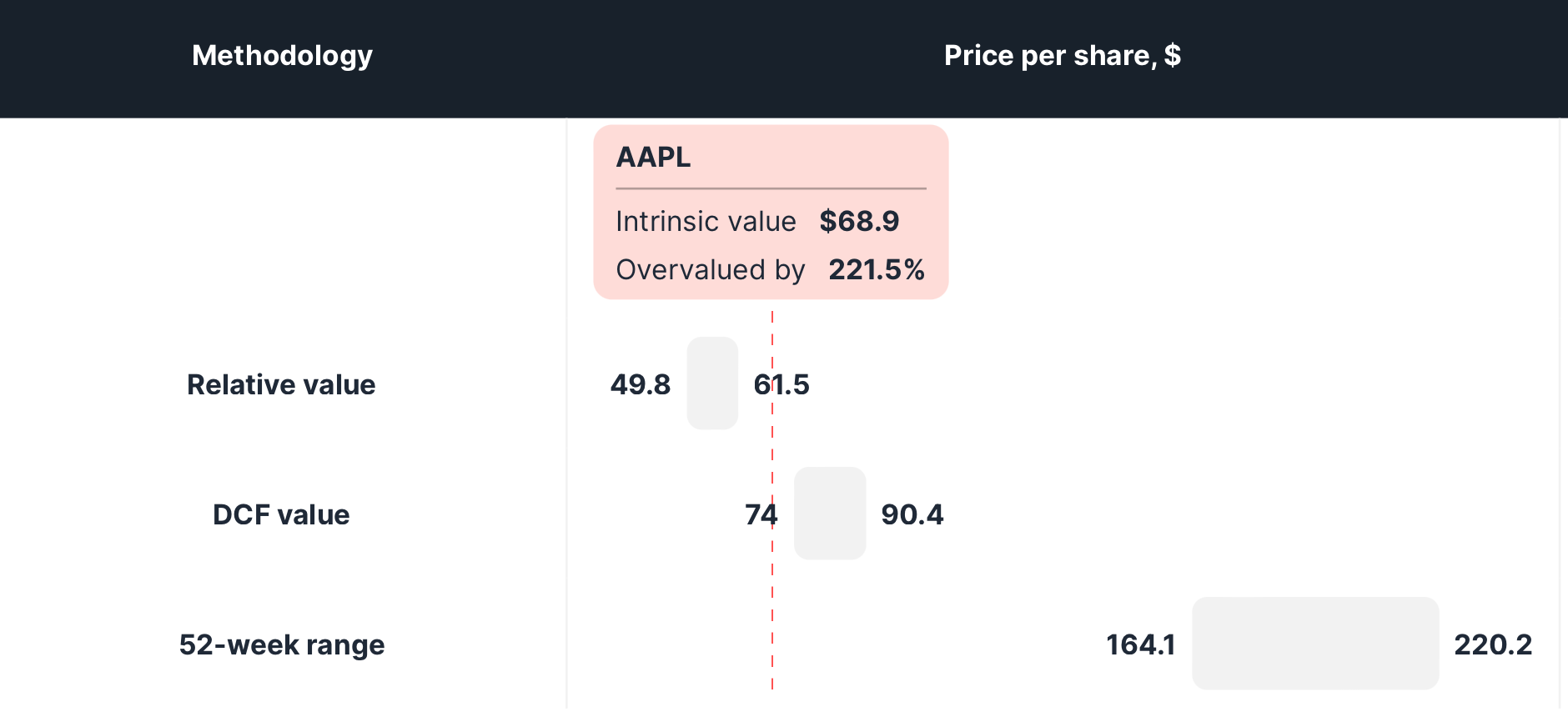

Consider a company like Microsoft. By analyzing its historical P/E ratios, earnings growth, and free cash flow over the past decade, you can gauge how its intrinsic value has evolved and whether its current valuation is justified.

8. Conclusion

Valuing stocks involves understanding various metrics, tools, and methods. It requires a blend of art and science, considering both quantitative data and qualitative factors. By mastering these concepts, you can make more informed investment decisions and identify opportunities for growth and profit.

This guide aims to provide you with the foundational knowledge needed to navigate the complexities of stock valuation, empowering you to make sound investment decisions and build long-term wealth.

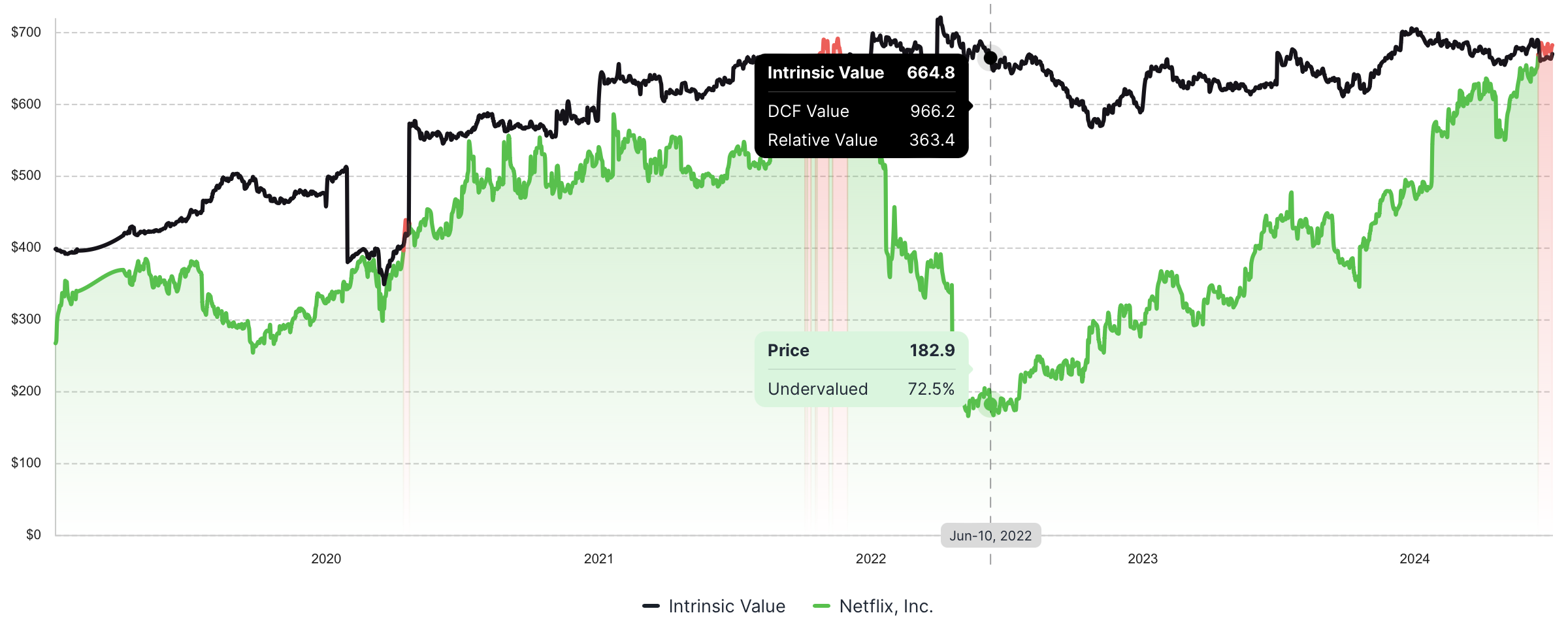

Happy investing! And don’t forget that you can check out the intrinsic value of any company to spot opportunities like Netflix and many others.

Looking for undervalued stocks?

Did you know that stocks from Value Sense's "undervalued index" beat the S&P500 by 14% last year?

Our curated watchlist reveals 10 undervalued stocks that market-beating analysts predict.