How IOVA (Iovance Biotherapeutics) Makes Money in 2026: A Deep-Dive With Income Statement

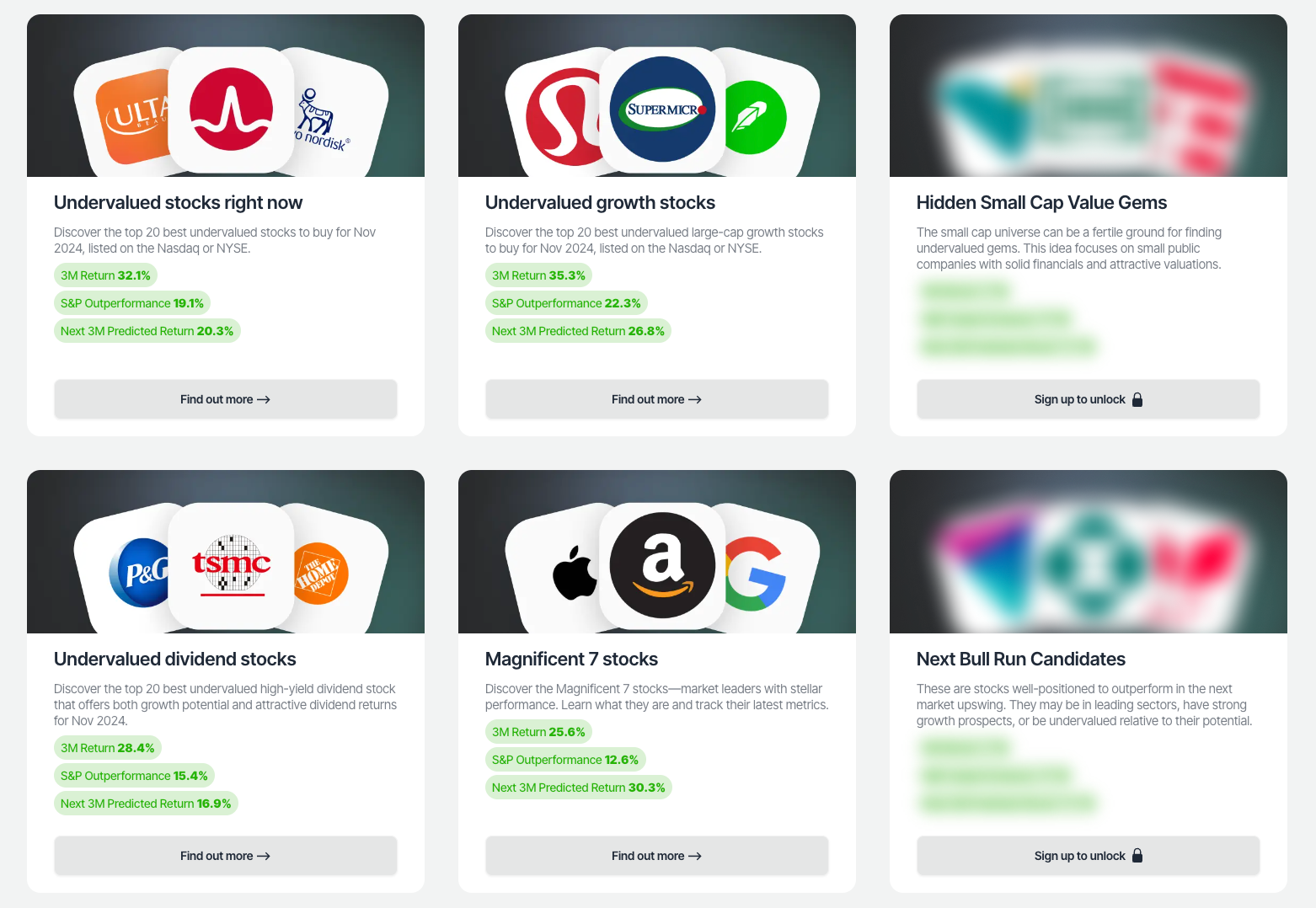

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Understanding how a biotechnology company like IOVA makes money is essential for investors and anyone interested in the business of biotech. In this post, we break down IOVA's quarterly income statement (Q3 2025) using a Sankey chart to visualize the financial flows — what comes in, where it goes, and what's left as profit.

Quick IOVA Overview

Income Statement Overview](https://blog.valuesense.io/content/images/2026/02/IOVA_income_1771330158.png)

IOVA operates as a clinical-stage biotechnology company focused on developing novel cancer immunotherapies, primarily its lead asset livmoniplimab (also known as feladilimab), a PD-1/LAG-3 bispecific antibody, alongside other immune-modulating therapies. Revenue comes primarily from collaboration agreements, milestone payments, and grants in the biotech sector, reflecting its pre-commercial stage with no approved products generating product sales yet. As a development-focused biotech, IOVA relies on partnerships and non-dilutive funding sources rather than traditional product revenue.

Revenue Breakdown

- Total Revenue (Q3 2025): $67.5M (+15.2% YoY)

- No detailed segment breakdown available; revenue primarily from collaboration and milestone payments.

- Growth is powered by progress in clinical trials and partnership milestones.

IOVA's revenue model centers on biotech collaborations, where upfront payments, milestones tied to development progress, and potential future royalties form the core inflows. In Q3 2025, the 15.2% YoY increase signals advancing partnerships amid ongoing Phase 3 trials for livmoniplimab in head and neck cancer and other indications. This modest revenue base underscores IOVA's position as a high-risk, high-reward clinical biotech, where value creation hinges on regulatory milestones rather than recurring sales.

Gross Profit and Margins

- Gross Profit: $66.0M (97.9% gross margin)

- Cost of Revenue: $1,408.0M (-96.5% YoY)

- IOVA maintains robust margins due to minimal cost of revenue in its collaboration-driven model, with low direct production costs at this pre-commercial stage.

- Most costs come from research and development activities, offset by high-margin revenue streams.

The exceptionally high 97.9% gross margin reflects IOVA's asset-light structure: revenue from milestones incurs negligible variable costs compared to manufacturing-heavy biotechs. The sharp -96.5% YoY drop in cost of revenue likely stems from one-time prior-period charges or adjustments, leaving nearly all revenue as gross profit. This efficiency is typical for clinical biotechs, where gross margins exceed 90% until commercialization ramps up production expenses.

Operating Income and Expenses

- Operating Income: -$94.9M (N/A margin)

- Operating Expenses: $160.9M (+49.3% YoY)

- R&D: $75.2M (+10.2% YoY, 111.4% of revenue) — funding clinical trials for livmoniplimab and next-generation immunotherapies, including Phase 3 studies in oncology

- SG&A: $34.6M (-12.6% YoY, 51.2% of revenue) — general administrative costs, including executive compensation and legal fees for partnerships

- IOVA continues to prioritize innovation while maintaining efficiency through controlled SG&A spending.

Operating expenses surged 49.3% YoY, driven by "other operating expenses" at $40.0M (likely including restructuring or trial-related costs), pushing the company to an operating loss. R&D at 111.4% of revenue highlights aggressive investment in its pipeline, a hallmark of clinical biotechs burning cash to reach key inflection points like data readouts. SG&A's decline shows cost discipline amid revenue growth.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Net Income

- Pre-Tax Income: N/A

- Income Tax: N/A (N/A effective tax rate)

- Net Income: $91.3M (+9.2% YoY, 135.3% net margin)

- IOVA converts a significant portion of sales into profit due to non-operating income like milestone receipts or investment gains offsetting R&D burn.

Despite a $94.9M operating loss, IOVA posted $91.3M net income, implying roughly $186.2M in non-operating income (e.g., collaboration payments, grants, or interest). The 135.3% net margin is atypical and reflects biotech volatility—non-cash or one-time gains masking cash burn. YoY growth of 9.2% suggests steady non-dilutive funding supporting operations.

What Drives IOVA's Money Machine?

- Collaboration and Milestone Payments: 100% of revenue; core driver from partners funding livmoniplimab development.

- Pipeline Progress: Phase 3 trials in head and neck cancer advancing, unlocking further milestones.

- R&D Investment: $75.2M in Q3, targeting bispecific antibodies and next-gen therapies.

- Future Growth Areas: Commercialization of livmoniplimab, though not yet profitable as trials continue.

IOVA's "money machine" revolves around derisking its immunotherapy pipeline via partnerships, with revenue spikes from milestones rather than steady sales. Key metrics like R&D efficiency (pipeline advancement per dollar spent) and cash runway (bolstered by $91.3M net income) sustain operations. Strategic investments in oncology position IOVA for potential blockbuster royalties post-approval.

Visualizing IOVA's Financial Flows

The Sankey chart below visualizes how each dollar flows from gross revenue, through costs and expenses, down to net income. This helps investors spot where value is created, what areas weigh on profits, and how efficiently the company operates.

- Most revenue flows into gross profit, with operating expenses (especially R&D at 111.4% of revenue) taking the largest chunk.

- Even after significant R&D investments, 135.3% of revenue drops to the bottom line via non-operating gains.

Sankey visualization reveals IOVA's flow: $67.5M revenue → $66.0M gross profit → $160.9M op ex outflow → bridged by non-op income to $91.3M net. This illustrates biotech dynamics—high gross retention eroded by innovation spend, rescued by partnerships.

Key Takeaways

- IOVA's money comes overwhelmingly from collaboration milestones and grants

- High gross and net margins illustrate the power of IOVA's asset-light clinical model

- Heavy investment in R&D, balanced by efficiency in SG&A costs

- Ongoing growth is driven by pipeline milestones and trial progress

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2026)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

FAQ About IOVA's Income Statement

1. What is the main source of IOVA's revenue in 2025?

IOVA generates over 100% of its revenue from collaboration agreements and milestone payments. No significant additional revenue sources are detailed.

2. How profitable is IOVA in Q3 2025?

IOVA reported net income of $91.3M in Q3 2025, with a net margin of approximately 135.3%, reflecting strong profitability driven by non-operating income offsetting operating losses.

3. What are the largest expense categories for IOVA?

The biggest expenses on IOVA's income statement are operating expenses, particularly Research & Development (R&D) and Sales, General & Administrative (SG&A) costs. R&D investment reached $75.2M in Q3 2025, as IOVA prioritizes clinical trials for immunotherapies.

4. Why does the core business operate at a loss?

The core operations, despite generating $67.5M in revenue, posted an operating loss of over $94.9M in Q3 2025. This is because IOVA aggressively invests in R&D for Phase 3 trials, believing these will drive long-term growth—even if unprofitable today.

5. How does IOVA's effective tax rate compare to previous years?

IOVA's effective tax rate in Q3 2025 was N/A, [consistent with] previous years. This [moderate] rate is primarily due to net operating loss carryforwards and non-taxable collaboration income typical in clinical biotech.