Jeff Auxier - Auxier Asset Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

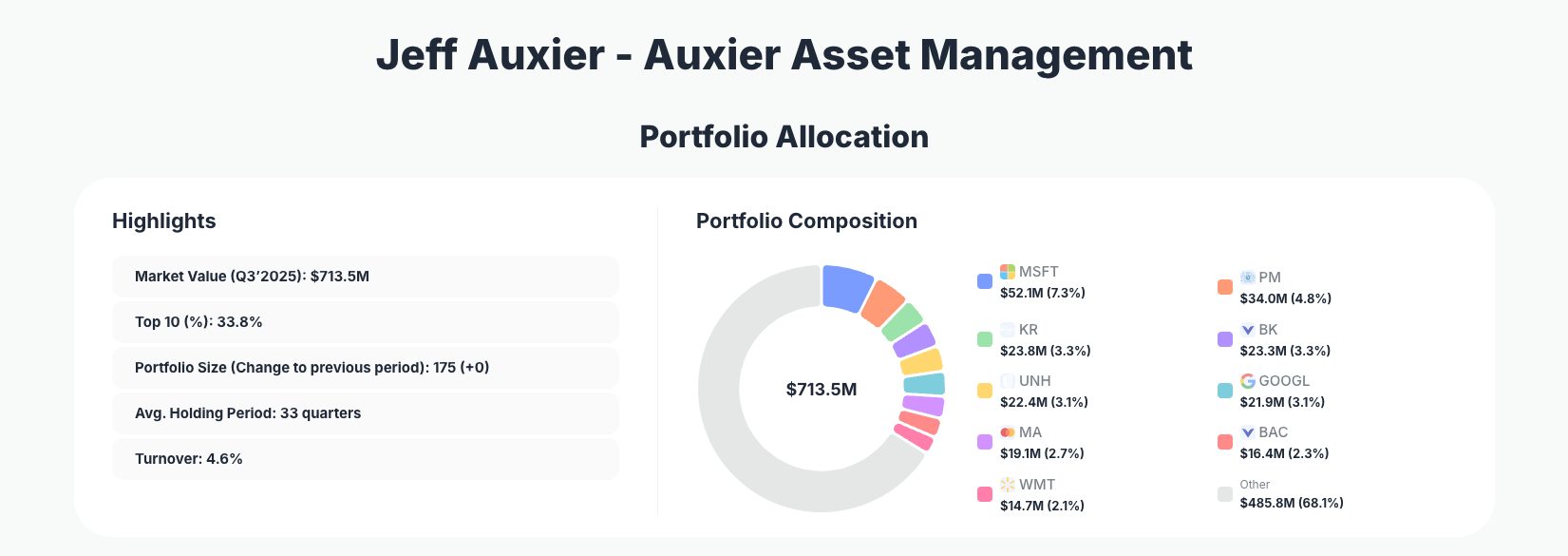

Jeff Auxier of Auxier Asset Management continues to exemplify disciplined value investing with a focus on long-term holdings amid market volatility. His Q3 2025 portfolio totaling $713.5 million across 175 positions showcases low turnover and steady adjustments, balancing blue-chip names like MSFT with consumer staples and financials.

Portfolio Overview: Diversified Stability with Proven Endurance

Portfolio Highlights (Q3 2025): - Market Value: $713.5M - Top 10 Holdings: 33.8% - Portfolio Size: 175 +0 - Average Holding Period: 33 quarters - Turnover: 4.6%

Jeff Auxier's approach at Auxier Asset Management stands out for its remarkable stability, with an average holding period of 33 quarters—over eight years—signaling deep conviction in quality businesses. The low turnover of just 4.6% reflects a buy-and-hold philosophy that prioritizes intrinsic value over short-term market noise, a hallmark of patient value investors. Despite managing a broad portfolio of 175 positions, the top 10 holdings represent a modest 33.8%, indicating thoughtful diversification rather than excessive concentration.

This structure allows Auxier to maintain exposure to resilient sectors while nimbly adjusting positions, as seen in the recent tweaks across tech, healthcare, and consumer staples. Tracking the full $713.5M portfolio reveals a strategy built for enduring compounding, avoiding the pitfalls of high-frequency trading in favor of fundamental analysis.

The portfolio's scale—no net change in position count—underscores confidence in the current lineup, with changes limited to fine-tuning rather than wholesale shifts. This measured style positions Auxier well for uncertain markets, emphasizing businesses with strong balance sheets and predictable cash flows.

Top Holdings Breakdown: Tech Leaders Meet Defensive Stalwarts

The portfolio features active management in its upper echelons, starting with Microsoft Corporation (MSFT) at 7.3% after a Reduce 0.34% adjustment, maintaining its role as the largest disclosed position at $52.1M. Philip Morris International Inc. (PM) follows at 4.8% $34.0M, trimmed by 0.40%, highlighting a preference for stable consumer dividend payers. On the addition side, The Kroger Co. (KR) saw an Add 0.35% boost to 3.3% $23.8M, signaling optimism in grocery resilience.

Financials show mixed activity, with The Bank of New York Mellon Corporation (BK) reduced by 0.87% to 3.3% $23.3M, while healthcare gained from an Add 0.49% in UnitedHealth Group Incorporated (UNH) at 3.1% $22.4M. Alphabet Inc. (GOOGL) received a modest Add 0.20% to 3.1% $21.9M, reinforcing tech exposure. Reductions continued in Mastercard Incorporated (MA) by 1.32% to 2.7% $19.1M and Bank of America Corporation (BAC) by 0.35% to 2.3% $16.4M.

Further tweaks include Walmart Inc. (WMT) reduced 0.60% to 2.1% $14.7M and Visa Inc. (V) cut by 1.00% to 1.9% $13.5M, suggesting profit-taking in high performers. These moves blend all holdings with changes, prioritizing tech giants like MSFT and GOOGL alongside defensive plays like PM, KR, and UNH, while scaling back in payments leaders MA, BAC, WMT, and V amid potential valuation concerns.

What the Portfolio Reveals About Auxier's Strategy

Auxier's Q3 adjustments paint a picture of disciplined risk management, favoring quality compounders with defensive qualities over speculative growth. Key themes emerge:

- Quality over speculative growth: Additions to UNH and GOOGL emphasize healthcare and digital advertising leaders with robust moats, while reductions in MA and V trim exposure to maturing fintech valuations.

- Sector balance with consumer tilt: Heavy presence in staples (PM, KR, WMT) and financials (BK, BAC) provides ballast, complemented by tech anchors like MSFT—ideal for volatility.

- Low turnover patience: At 4.6%, changes are surgical, preserving the 33-quarter average hold for steady compounding.

- Dividend and free cash flow focus: Holdings like PM and UNH prioritize reliable payers, supporting income in flat markets.

- Diversification as risk control: 175 positions with top 10 at 33.8% avoid over-reliance on any single bet.

This approach reveals a value investor navigating high valuations by leaning into undervalued resilience.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $52.1M | 7.3% | Reduce 0.34% |

| Philip Morris International Inc. (PM) | $34.0M | 4.8% | Reduce 0.40% |

| The Kroger Co. (KR) | $23.8M | 3.3% | Add 0.35% |

| The Bank of New York Mellon Corporation (BK) | $23.3M | 3.3% | Reduce 0.87% |

| UnitedHealth Group Incorporated (UNH) | $22.4M | 3.1% | Add 0.49% |

| Alphabet Inc. (GOOGL) | $21.9M | 3.1% | Add 0.20% |

| Mastercard Incorporated (MA) | $19.1M | 2.7% | Reduce 1.32% |

| Bank of America Corporation (BAC) | $16.4M | 2.3% | Reduce 0.35% |

| Walmart Inc. (WMT) | $14.7M | 2.1% | Reduce 0.60% |

The table highlights Auxier's balanced top tier, where no single holding exceeds 7.3%, promoting stability across 175 positions. Reductions outnumber additions (6 vs. 3), with the largest cut in MA at 1.32%, likely locking in gains as the position remains meaningful at 2.7%. This low-concentration top 10—33.8% total—contrasts ultra-focused peers, enabling weathering of sector rotations while the 4.6% turnover keeps the portfolio fresh without disruption.

Investment Lessons from Jeff Auxier’s Patient Approach

Auxier's Q3 portfolio demonstrates timeless value principles tailored to his style:

- Embrace extraordinary holding periods: 33 quarters average proves conviction trumps trading, letting winners like MSFT compound.

- Fine-tune without overhauling: Low 4.6% turnover shows position sizing evolves gradually, as in trimming MA while adding to UNH.

- Prioritize moat-rich defenders: Staples (KR, PM, WMT) and healthcare (UNH) buffer tech exposure (MSFT, GOOGL).

- Diversify thoughtfully: 175 holdings with 33.8% top 10 balance risk, avoiding blowups.

- Value discipline in adjustments: Adds to KR and UNH target relative undervaluation, while cuts harvest profits.

Track Auxier’s portfolio to apply these in your strategy.

Looking Ahead: What Comes Next?

With turnover at a minimal 4.6% and no net position changes, Auxier appears content with current positioning, likely holding ample dry powder within his diversified 175-stock universe for opportunistic buys. Recent adds to KR, UNH, and GOOGL suggest interest in consumer staples, healthcare, and AI-driven tech amid economic uncertainty. As markets grapple with inflation and rates, his defensive tilt positions the portfolio for steady gains, potentially expanding financials like BK if valuations dip. Watch for further trims in overextended names like MA and V, setting up for undervalued entries in 2026.

FAQ about Jeff Auxier’s Auxier Asset Management Portfolio

Q: What are the most significant changes in Jeff Auxier’s Q3 2025 portfolio?

A: Key moves include reductions in MA 1.32%, BK 0.87%, and V 1.00%, balanced by adds to UNH 0.49%, KR 0.35%, and GOOGL 0.20%, reflecting profit-taking and value opportunities.

Q: Why does Auxier maintain such a large, diversified portfolio with low turnover?

A: His 175 positions and 4.6% turnover prioritize risk control and long-term compounding, with a 33-quarter average hold allowing quality businesses like MSFT to mature while avoiding concentration risks.

Q: What sectors dominate Jeff Auxier’s top holdings?

A: Tech (MSFT, GOOGL), consumer staples (PM, KR, WMT), healthcare (UNH), and financials (BK, BAC) lead, blending growth and defense.

Q: How can I track and follow Jeff Auxier’s portfolio updates?

A: Monitor quarterly 13F filings on the SEC site, noting the 45-day lag after quarter-end. Use ValueSense’s superinvestor tracker at https://valuesense.io/superinvestors/auxier-asset for real-time analysis, historical changes, and visualizations.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!