Jensen Investment Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

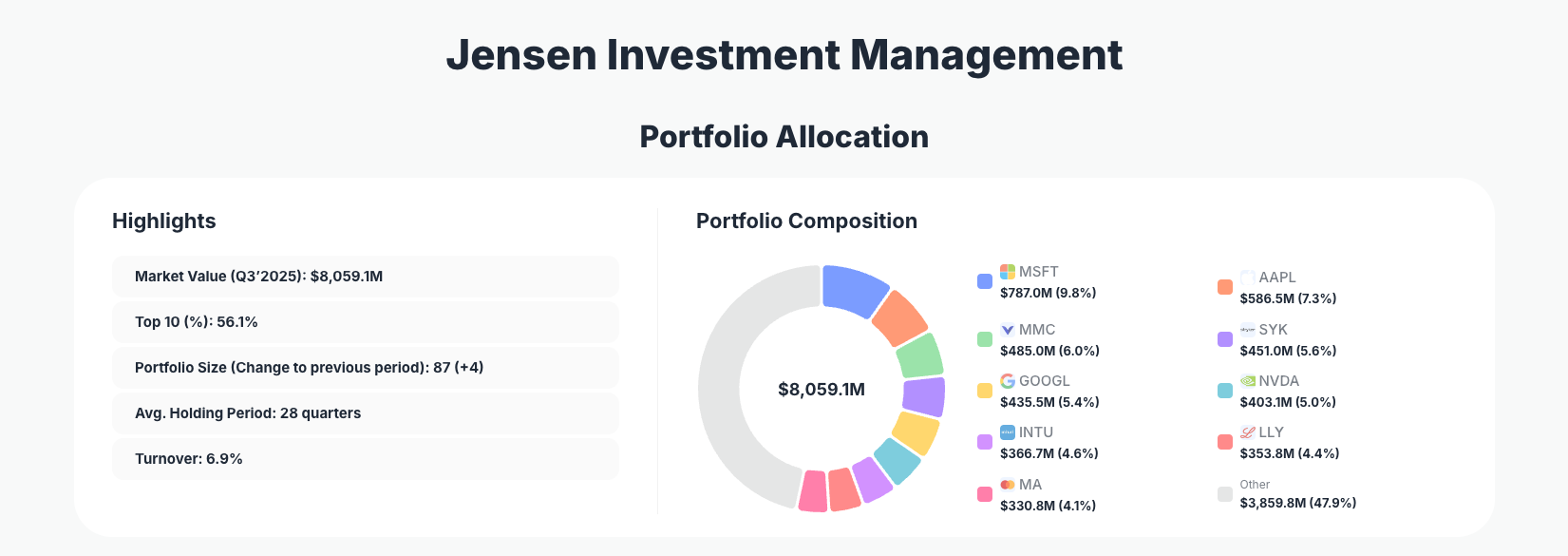

Jensen Investment Management continues its disciplined growth-oriented strategy with a mix of trims in legacy tech and bold additions in high-conviction names. Their $8.1B portfolio for Q3 2025 shows low turnover at 6.9% across 87 positions, signaling confidence in quality compounders while making tactical adjustments amid market volatility.

Portfolio Snapshot: Concentrated Quality in a Diversified Wrapper

Portfolio Highlights (Q3’2025): - Market Value: $8,059.1M - Top 10 Holdings: 56.1% - Portfolio Size: 87 +4 - Average Holding Period: 28 quarters - Turnover: 6.9%

Jensen Investment Management's portfolio maintains a hallmark balance of concentration in top ideas while spreading risk across 87 positions, a net increase of four new names this quarter. The top 10 holdings command 56.1% of the $8.1 billion portfolio, underscoring a high-conviction approach to quality growth stocks that have defined the firm's long-term outperformance. With an impressive average holding period of 28 quarters—over seven years—this reflects a buy-and-hold philosophy rooted in durable competitive advantages rather than short-term trading.

Low turnover of 6.9% indicates measured activity, with reductions in several mega-cap tech names offset by aggressive builds in emerging leaders like healthcare innovators. This Q3 2025 portfolio adjustment suggests Jensen is rotating within its core growth universe, trimming overvalued positions to fund bets on accelerating secular trends. The firm's strategy favors businesses with strong moats, recurring revenues, and scalable models, primarily in technology and healthcare, positioning it well for a market favoring quality amid economic uncertainty.

Top Holdings Breakdown: Strategic Trims and High-Conviction Adds

The portfolio's core remains anchored by technology stalwarts, but Q3 reveals active management with significant changes across key positions. Leading the pack is Microsoft Corporation (MSFT) at 9.8% $787.0M, though reduced by 3.19% as the firm takes profits on the cloud leader. Apple Inc. (AAPL) follows at 7.3% $586.5M with a modest Reduce 0.60% trim, maintaining exposure to consumer tech durability.

Further down, Marsh & McLennan Companies, Inc. (MMC) holds 6.0% $485.0M after a Reduce 0.70% adjustment, balancing insurance brokerage stability. Stryker Corporation (SYK) at 5.6% $451.0M saw a sharp Reduce 13.94%, signaling caution on medtech valuations. The most dramatic shift came in Alphabet Inc. (GOOGL), reduced 24.58% to 5.4% $435.5M, likely profit-taking after AI-driven gains.

On the addition side, NVIDIA Corporation (NVDA) jumped with an Add 23.59% to 5.0% $403.1M, doubling down on AI chip dominance. Intuit Inc. (INTU) was cut Reduce 14.55% to 4.6% $366.7M, while Eli Lilly and Company (LLY) exploded with an Add 124.45% to 4.4% $353.8M, betting big on GLP-1 drug momentum. Mastercard Incorporated (MA) sits at 4.1% $330.8M post Reduce 6.35%, and newcomer Abbott Laboratories (ABT) entered with Add 1.30% at 4.0% $322.7M, adding diagnostics diversification. These moves highlight Jensen's focus on refining exposure to high-quality growth names.

What the Portfolio Reveals About Jensen's Strategy

Jensen Investment Management's Q3 actions paint a picture of disciplined growth investing: trimming winners to reallocate toward even stronger secular tailwinds. Key themes emerge from the changes:

- Tech Refinement Over Abandonment: Heavy reductions in MSFT, AAPL, GOOGL, and others suggest profit-taking on mature giants, while adding to NVDA shows continued AI enthusiasm.

- Healthcare Acceleration: Massive builds in LLY (124% add) and ABT indicate a pivot toward innovative pharma and diagnostics amid aging demographics.

- Quality Moats First: Holdings like MMC and MA emphasize recurring revenue models with high barriers.

- Risk Management via Diversification: 87 positions dilute single-stock risk, but 56% top-10 concentration demands conviction.

- Long-Horizon Focus: 28-quarter average hold supports compounding over trading.

This approach prioritizes businesses with predictable growth, balancing sector exposure without chasing fads.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $787.0M | 9.8% | Reduce 3.19% |

| Apple Inc. (AAPL) | $586.5M | 7.3% | Reduce 0.60% |

| Marsh & McLennan Companies, Inc. (MMC) | $485.0M | 6.0% | Reduce 0.70% |

| Stryker Corporation (SYK) | $451.0M | 5.6% | Reduce 13.94% |

| Alphabet Inc. (GOOGL) | $435.5M | 5.4% | Reduce 24.58% |

| NVIDIA Corporation (NVDA) | $403.1M | 5.0% | Add 23.59% |

| Intuit Inc. (INTU) | $366.7M | 4.6% | Reduce 14.55% |

| Eli Lilly and Company (LLY) | $353.8M | 4.4% | Add 124.45% |

| Mastercard Incorporated (MA) | $330.8M | 4.1% | Reduce 6.35% |

The table underscores Jensen's concentrated yet balanced top tier, with the top five holdings alone comprising over 34% of the portfolio. Notable reductions in high-flyers like GOOGL -24.58% and SYK -13.94% freed capital for standout adds such as LLY's massive 124% increase, highlighting opportunistic rebalancing. This 56.1% top-10 weighting reflects confidence in a select group of quality growers, tempered by the broader 87-position diversification to manage volatility.

Investment Lessons from Jensen Investment Management

Jensen's Q3 portfolio exemplifies timeless principles of growth investing applied with precision:

- Trim Winners to Fund Better Ideas: Reducing MSFT and GOOGL while adding to LLY shows discipline in reallocating from good to great.

- Long Holding Periods Unlock Compounding: 28 quarters average proves patience with quality moats pays off.

- Bet Big on Secular Winners: 124% add to LLY and 23% to NVDA demonstrate sizing up for transformative trends like AI and biotech.

- Low Turnover Builds Conviction: 6.9% activity avoids noise, focusing on enduring advantages.

- Diversify Without Diluting Focus: 87 holdings mitigate risk while top-10 drives returns.

These lessons emphasize understanding businesses deeply before committing capital long-term.

Looking Ahead: What Comes Next?

Jensen's positioning sets up for continued growth theme dominance, with trims creating dry powder amid a portfolio expanded to 87 names. Expect further rotations into AI enablers like NVDA and healthcare disruptors such as LLY, especially if valuations cool in overowned tech. The +4 position increase hints at scouting undervalued opportunities in software and industrials.

In a high-interest-rate environment, low-turnover discipline favors resilient compounders. Watch for Q4 filings on Jensen's portfolio page for signs of broader market rotation, with current bets aligning well against recession risks.

FAQ about Jensen Investment Management Portfolio

Q: What drove the massive 124% increase in Eli Lilly (LLY)?

Jensen significantly boosted its stake in LLY to 4.4% $353.8M, likely capitalizing on the obesity drug boom and pipeline strength, signaling high conviction in healthcare innovation amid aging global demographics.

Q: Why the heavy reductions in tech like GOOGL and SYK?

Reductions such as 24.58% in GOOGL and 13.94% in SYK reflect profit-taking on elevated valuations, reallocating to fresher growth like NVDA and LLY.

Q: How concentrated is Jensen's strategy?

With 56.1% in the top 10 across 87 positions, Jensen balances bold bets on quality growth with diversification, maintaining a 28-quarter average hold for stability.

Q: What sectors dominate the portfolio?

Technology leads with names like MSFT and NVDA, complemented by healthcare (LLY, ABT) and financials (MA).

Q: How can I track Jensen Investment Management's portfolio?

Monitor quarterly 13F filings via the SEC, but use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/jensen-investment for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!