Jim Simons - Renaissance Technologies Llc Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

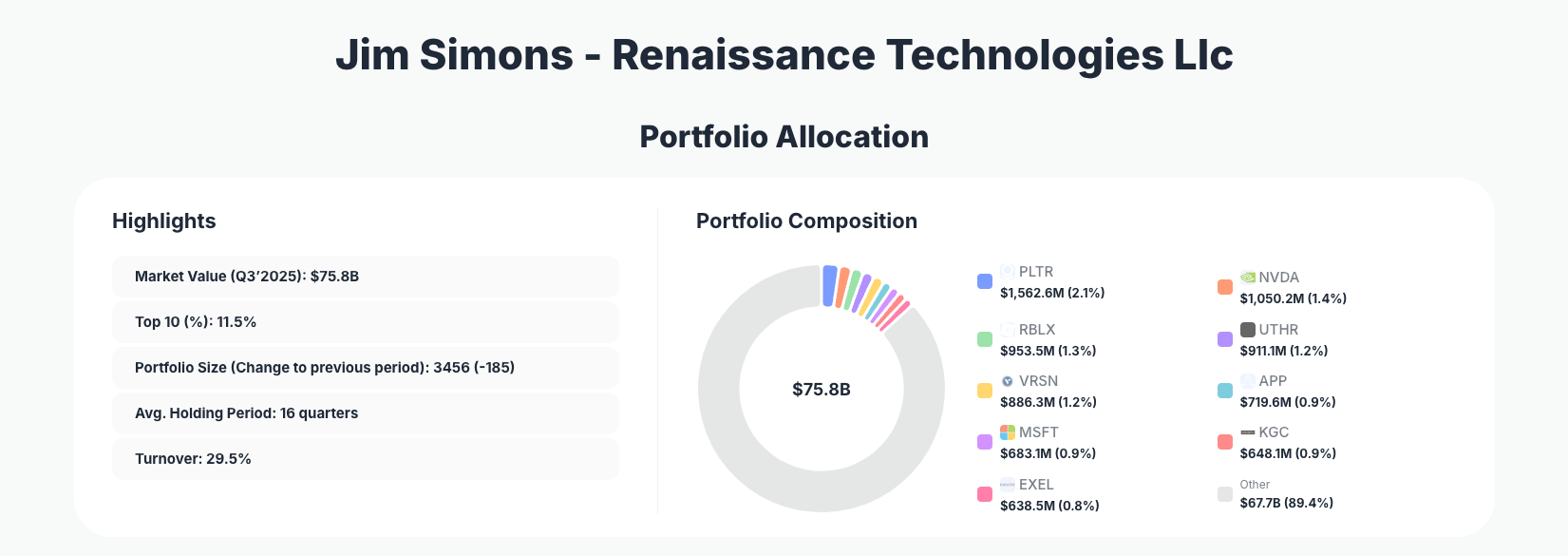

Jim Simons, the legendary mathematician behind Renaissance Technologies, showcases the firm's signature quantitative approach through its latest 13F filing. The firm's $75.8B portfolio reflects high-velocity trading with 3,456 positions and notable adjustments across tech giants and emerging names, underscoring Renaissance's data-driven edge in navigating volatile markets.

Portfolio Overview: The Quant Factory's Massive Scale

Portfolio Highlights (Q3’2025): - Market Value: $75.8B - Top 10 Holdings: 11.5% - Portfolio Size: 3456 -185 - Average Holding Period: 16 quarters - Turnover: 29.5%

Renaissance Technologies' Q3 2025 portfolio exemplifies the firm's unparalleled scale, managing $75.8 billion across 3,456 positions—a reduction of 185 from the prior quarter. This massive diversification contrasts sharply with concentrated value strategies, highlighting Renaissance's reliance on algorithmic models to exploit short-term inefficiencies across thousands of names. The top 10 holdings represent just 11.5% of the portfolio, a hallmark of quant funds that spread risk through breadth rather than depth.

The 29.5% turnover rate signals active rebalancing, consistent with Renaissance's quantitative framework that processes vast datasets for statistical arbitrage opportunities. An average holding period of 16 quarters (about 4 years) suggests a blend of medium-term momentum plays and longer-term structural bets, setting it apart from pure high-frequency trading desks. Investors tracking this portfolio gain insights into where algorithms detect alpha amid market rotations.

This structure underscores Renaissance's edge: low concentration in top positions allows flexibility to pivot on signals from AI-driven models pioneered by Simons, even as the portfolio shrinks slightly in position count.

Top Holdings: Tech Trims, Gaming Adds, and Biotech Momentum

Renaissance's top holdings reveal aggressive portfolio management, starting with a significant trim in Palantir Technologies Inc. (PLTR) at 2.1% after a 36.56% reduction to $1,562.6M. The firm also cut NVIDIA Corporation (NVDA) by 24.17% to 1.4% $1,050.2M, potentially locking in AI-driven gains amid valuation concerns. On the buy side, Roblox Corporation (RBLX) saw a 12.81% addition to 1.3% $953.5M, signaling conviction in metaverse and gaming growth.

Healthcare and tech staples show mixed signals, with United Therapeutics Corporation (UTHR) added 2.56% to 1.2% $911.1M, while VeriSign, Inc. (VRSN) dipped 2.97% to 1.2% $886.3M. Further reductions hit AppLovin Corporation (APP) by 27.48% to 0.9% $719.6M and Kinross Gold Corporation (KGC) by 22.09% to 0.9% $648.1M, reflecting commodity rotations.

Notable conviction appears in a massive 248.21% build in Microsoft Corporation (MSFT) to 0.9% $683.1M, alongside trims in Exelixis, Inc. (EXEL) by 2.28% to 0.8% $638.5M and Franco-Nevada Corporation (FNV) by 12.54% to 0.8% $635.2M. These moves across 11 key changers illustrate Renaissance's models favoring Big Tech rebounds and selective healthcare over prior AI and gold exposures.

What the Portfolio Reveals

Renaissance's Q3 adjustments paint a picture of algorithmic adaptability in a post-AI boom environment: - Tech Sector Dominance with Pruning: Heavy trims in high-flyers like PLTR and NVDA suggest models detecting overextension, while massive MSFT adds point to stable cloud/AI infrastructure bets. - Gaming and Biotech Opportunism: Additions in RBLX and UTHR highlight momentum in user-generated content and rare disease treatments, sectors ripe for data-driven edges. - Diversified Risk Management: With top 10 at just 11.5% across 3,456 names, the firm mitigates single-stock risk through statistical dispersion. - Commodity De-Risking: Reductions in KGC and FNV indicate fading gold signals amid rate uncertainty. - High Turnover Discipline: 29.5% churn reflects relentless signal optimization, prioritizing edge over loyalty.

This quant-centric strategy thrives on volume and velocity, using proprietary math to capture fleeting inefficiencies.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Palantir Technologies Inc. (PLTR) | $1,562.6M | 2.1% | Reduce 36.56% |

| NVIDIA Corporation (NVDA) | $1,050.2M | 1.4% | Reduce 24.17% |

| Roblox Corporation (RBLX) | $953.5M | 1.3% | Add 12.81% |

| United Therapeutics Corporation (UTHR) | $911.1M | 1.2% | Add 2.56% |

| VeriSign, Inc. (VRSN) | $886.3M | 1.2% | Reduce 2.97% |

| AppLovin Corporation (APP) | $719.6M | 0.9% | Reduce 27.48% |

| Microsoft Corporation (MSFT) | $683.1M | 0.9% | Add 248.21% |

| Kinross Gold Corporation (KGC) | $648.1M | 0.9% | Reduce 22.09% |

| Exelixis, Inc. (EXEL) | $638.5M | 0.8% | Reduce 2.28% |

Renaissance's top 10 table underscores extreme diversification, with no position exceeding 2.1% and the group totaling just 11.5% of $75.8B. Significant reductions in PLTR, NVDA, and APP—totaling over 28% cuts—suggest profit-taking on momentum names, while outsized MSFT adds 248% reveal model-favored quality in a volatile tape. This low-concentration approach, paired with 3456 positions, exemplifies quant risk control, avoiding blowups through sheer breadth.

The -185 position trim and 29.5% turnover further indicate portfolio hygiene, culling underperformers to maintain signal purity amid broader market shifts.

Investment Lessons from Jim Simons' Renaissance Approach

Renaissance's portfolio demonstrates timeless quant principles: - Scale Through Diversification: 3,456 positions at 11.5% top-10 concentration show breadth beats bets for consistent alpha. - Embrace High Turnover: 29.5% churn proves models evolve faster than fundamentals, capturing transient edges. - Data Over Narrative: Massive MSFT adds amid PLTR/NVDA trims highlight algorithmic conviction over hype. - Medium-Term Holding Discipline: 16-quarter average balances momentum with mean reversion. - Adapt or Perish: Position cuts like 36.56% in PLTR stress relentless signal monitoring.

Looking Ahead: What Comes Next?

Renaissance's positioning sets up for continued quant dominance in 2026, with trims in overheated AI names freeing capital for undervalued signals in gaming (RBLX) and biotech (UTHR). The portfolio contraction to 3,456 suggests efficiency gains, potentially deploying into volatility plays if rates stabilize. High turnover implies agility for election-year rotations or AI infrastructure rebounds via MSFT-like bets. Track via Renaissance's portfolio on ValueSense for signals on broader market inefficiencies.

FAQ about Jim Simons Renaissance Technologies Portfolio

Q: What drove Renaissance's biggest Q3 2025 changes?

A: Key moves included a 248.21% add to MSFT 0.9% and 36.56% reduction in PLTR 2.1%, reflecting quant models shifting from speculative AI to stable tech amid high valuations.

Q: Why is Renaissance's portfolio so diversified compared to other superinvestors?

A: With 3,456 positions and top 10 at 11.5%, Renaissance prioritizes statistical arbitrage over conviction bets, using algorithms across thousands of names for risk-adjusted returns—unlike concentrated value funds.

Q: What is Jim Simons' role at Renaissance today?

A: Simons, now retired from daily management, serves as non-executive chairman; the firm runs on his quantitative legacy with teams executing black-box models.

Q: Which sectors show Renaissance conviction in Q3?

A: Tech (PLTR, NVDA, MSFT), gaming (RBLX), biotech/healthcare (UTHR, EXEL), and commodities (KGC, FNV), with adds in gaming/biotech signaling growth pockets.

Q: How can I track Renaissance Technologies' portfolio?

A: Follow quarterly 13F filings on the SEC (45-day lag post-quarter-end) via ValueSense at https://valuesense.io/superinvestors/renaissance for real-time analysis, visualizations, and change alerts.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!