John Armitage - Egerton Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

John Armitage - Egerton Capital continues to showcase a refined blend of quality growth and disciplined risk management. His Q3’2025 portfolio highlights a $9.5B book tilted toward dominant franchises in technology, financials, and industrials, with notable size increases in names like Amazon.com, Inc. and Boston Scientific Corporation, offset by trims in select financial and brokerage holdings.

Portfolio Overview: Disciplined Concentration in Compounding Machines

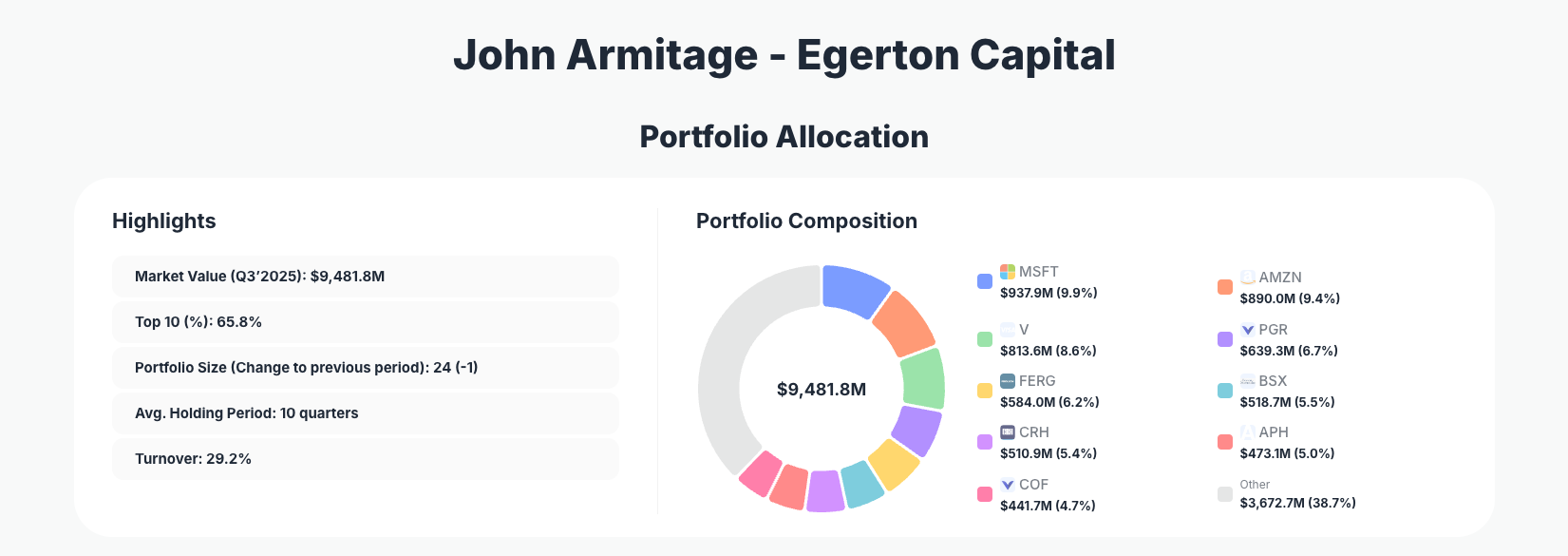

Portfolio Highlights (Q3’2025): - Market Value: $9,481.8M

- Top 10 Holdings: 65.8%

- Portfolio Size: 24 -1

- Average Holding Period: 10 quarters

- Turnover: 29.2%

The latest 13F shows Egerton Capital’s portfolio running as a moderately concentrated book, with roughly two-thirds of capital in the top 10 positions despite holding 24 names overall. This setup reflects Armitage’s preference for backing a focused group of global compounders while still maintaining enough diversification across sectors and themes.

A 10-quarter average holding period underlines a multi-year orientation: positions are generally held through cycles, while a 29.2% turnover indicates that Armitage is not static—he actively sizes and rebalances when risk/reward skews change. Within the context of Egerton Capital’s strategy, this looks like “active ownership” of long-duration growth stories rather than short-term trading.

The slight reduction in portfolio size to 24 -1 suggests ongoing pruning of lower-conviction ideas to recycle capital into more attractive opportunities. Combined with significant adds to several core names, the Q3’2025 changes point to Armitage doubling down on business models he sees as structural winners, while reducing exposure in areas where the upside is either more cyclical or more fully priced.

Top Holdings Analysis: Tech Platforms, Payment Rails, and Specialty Leaders

The core of Egerton Capital’s portfolio is built around a cluster of large-cap quality growth names, with a tilt to technology, financial infrastructure, and niche industrials.

At the top, Microsoft Corporation remains a cornerstone at 9.9% of the portfolio, even after a “Reduce 1.80%” action that modestly trims position size while keeping it as a major driver of performance. The adjustment looks like risk management rather than a change in long-term conviction.

A key story this quarter is the aggressive build in e‑commerce and cloud exposure through Amazon.com, Inc., now 9.4% of the portfolio following an “Add 21.45%” move. This sizable increase signals growing confidence in Amazon’s earnings power as logistics efficiency, AWS growth, and advertising continue to compound.

Payments and transaction infrastructure are another pillar. Visa Inc. stands at 8.6% after a notable “Add 24.76%”, reinforcing Egerton’s conviction in global card networks as long-term beneficiaries of digitizing commerce. On the insurance side, The Progressive Corporation accounts for 6.7% despite a small “Reduce 1.87%”, a tweak that likely reflects profit-taking after strong share performance rather than an exit signal.

Within industrials and building products, Ferguson plc represents 6.2% of capital following an “Add 16.43%”, highlighting confidence in North American repair/remodel and commercial construction demand. Similarly, CRH plc sits at 5.4%, though Egerton executed a “Reduce 6.78%” here, perhaps rebalancing after strength or moderating exposure to construction cyclicality.

Healthcare exposure is anchored by Boston Scientific Corporation, now 5.5% of the portfolio following a dramatic “Add 223.74%”. This outsized increase marks Boston Scientific as one of Q3’s biggest conviction upgrades, suggesting Armitage sees durable growth in minimally invasive therapies and medical device innovation.

On the technology components side, Amphenol Corporation has been scaled up to 5.0% with an “Add 20.67%”, reinforcing Egerton’s bet on connectivity hardware across automotive, industrial, and communications end markets. In consumer and financial services, Capital One Financial Corporation remains significant at 4.7%, though the “Reduce 10.96%” move shows some caution around consumer credit or valuation.

Rounding out the top set of changed positions, Interactive Brokers Group, Inc. represents 4.5% of the portfolio after a “Reduce 22.37%”, one of the larger trims this quarter. This suggests selective de‑risking in brokerage and trading-sensitive revenue streams, potentially recycling funds into higher-conviction secular growers like Amazon, Visa, and Boston Scientific.

What the Portfolio Reveals About Egerton’s Current Strategy

Several clear themes emerge from the Q3’2025 13F:

- Quality compounders over speculative growth

The largest allocations go to businesses with entrenched competitive advantages—platform software (MSFT), scaled e‑commerce and cloud (AMZN), global card networks (V), and leading specialty insurers (PGR). These are not early-stage bets; they are cash-generative franchises with long runways. - Balanced sector exposure with a growth tilt

Technology and communication infrastructure (via Microsoft, Amazon, Amphenol) are offset by financials and payments (Visa, Progressive, Capital One, Interactive Brokers) and real‑asset-linked industrials (Ferguson, CRH). Healthcare via Boston Scientific adds a defensive growth angle. - Geographic diversification via global listings

While many holdings are U.S.-listed, several—such as Ferguson and CRH—bring substantial non‑U.S. revenue exposure, giving the portfolio a global earnings footprint even if the 13F only captures U.S.-traded securities. - Dividend optionality, not yield hunting

Many of these companies pay dividends, but the portfolio does not appear yield‑focused. Instead, dividends are a secondary benefit layered on top of earnings growth and buybacks—particularly in names like Microsoft, Visa, and Amphenol. - Risk management through calibrated trims and adds

Reductions in Capital One, Progressive, CRH, and especially Interactive Brokers sit alongside major adds in Amazon, Visa, Ferguson, Amphenol, and especially Boston Scientific, suggesting a deliberate rotation toward higher‑conviction secular growth names.

Portfolio Concentration Analysis

Using the reported top 10 holdings:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Microsoft Corporation (MSFT) | $937.9M | 9.9% | Reduce 1.80% |

| Amazon.com, Inc. (AMZN) | $890.0M | 9.4% | Add 21.45% |

| Visa Inc. (V) | $813.6M | 8.6% | Add 24.76% |

| The Progressive Corporation (PGR) | $639.3M | 6.7% | Reduce 1.87% |

| Ferguson plc (FERG) | $584.0M | 6.2% | Add 16.43% |

| Boston Scientific Corporation (BSX) | $518.7M | 5.5% | Add 223.74% |

| CRH plc (CRH) | $510.9M | 5.4% | Reduce 6.78% |

| Amphenol Corporation (APH) | $473.1M | 5.0% | Add 20.67% |

| Capital One Financial Corporation (COF) | $441.7M | 4.7% | Reduce 10.96% |

(Top 10 holdings collectively account for 65.8% of the total portfolio.)

This table underscores meaningful concentration: the top three positions alone—Microsoft, Amazon, and Visa—command nearly 28%+ of the portfolio. The large “Add” actions in AMZN, V, FERG, BSX, and APH show that Armitage is comfortable steering substantial capital toward his highest‑conviction ideas when the valuation and outlook align.

At the same time, the presence of multiple 4–7% positions—such as PGR, FERG, CRH, COF, and IBKR—helps diversify stock‑specific risk while still allowing each name to matter. This is not an extremely concentrated “five‑stock” portfolio, but it is far more focused than a typical mutual fund.

Investment Lessons from John Armitage’s Egerton Capital Approach

Retail investors studying John Armitage’s portfolio can extract several practical principles:

- Concentrate when conviction is high

Egerton is willing to put nearly 10% of capital each into MSFT and AMZN. Large weights are reserved for businesses with durable moats, recurring revenue, and strong balance sheets. - Use adds and trims, not binary decisions

Actions such as “Reduce 1.80%” in Microsoft or “Reduce 1.87%” in Progressive show that portfolio management is often incremental. You don’t need to sell out entirely to manage risk. - Let winners run over multiple years

A 10‑quarter average holding period implies that Egerton is prepared to ride compounding stories for years, allowing fundamentals—not just short‑term price moves—to drive returns. - Rotate toward improving risk/reward

The massive “Add 223.74%” in Boston Scientific and strong adds in AMZN, V, and APH suggest a willingness to act decisively when the upside potential meaningfully outweighs perceived risk. - Balance structural growth with cyclical exposure

Combining secular winners (cloud, payments, med‑tech) with more cyclical or rate‑sensitive names (banks, insurers, building materials) can help smooth the impact of macro swings.

Looking Ahead: What Comes Next for Egerton Capital?

Based on the current positioning, several forward-looking observations stand out:

- Dry powder via trims

Reductions in COF, PGR, CRH, and especially IBKR may free capital for future opportunities—whether to further increase existing compounders or to initiate new positions once valuations become compelling. - Potential focus areas

Given the pattern of adds, investors might expect Egerton to continue favoring:- asset‑light, high‑margin platforms (software, cloud, payment networks)

- healthcare innovation (med‑tech, devices)

- infrastructure and building product plays tied to long‑term repair/remodel and public investment cycles.

- Resilience across macro scenarios

With exposure to defensive growth (healthcare, recurring software), secular digitalization (payments, e‑commerce, cloud), and real-asset leverage (building products), the portfolio appears designed to participate in upside while buffering against single-scenario dependence. - Monitoring via future 13Fs

Upcoming quarters will reveal whether the outsized add to Boston Scientific was a one‑time repositioning or the start of a broader build in healthcare. Similarly, ongoing moves in AMZN, V, and MSFT will signal how strongly Armitage wants to lean into mega‑cap tech.

If you want to dive deeper into each name, detailed valuations, and historical moves, you can explore the full breakdown on ValueSense’s Egerton tracker:

▶️ Analyze John Armitage – Egerton Capital’s latest moves on ValueSense

(Visit: https://valuesense.io/superinvestors/egerton-capital)

FAQ about John Armitage – Egerton Capital Portfolio

Q: What were the most significant changes in Egerton Capital’s Q3’2025 13F?

The most notable moves were aggressive adds to Boston Scientific (BSX) (Add 223.74%), Visa (V) (Add 24.76%), Amazon (AMZN) (Add 21.45%), Ferguson (FERG) (Add 16.43%), and Amphenol (APH) (Add 20.67%), alongside meaningful trims in Interactive Brokers (IBKR) (Reduce 22.37%), Capital One (COF), and CRH.

Q: How concentrated is John Armitage’s portfolio?

Egerton’s top 10 holdings make up 65.8% of a 24‑position portfolio, indicating a focused but not ultra‑concentrated approach. Names like MSFT, AMZN, and V carry near‑10% weights, while a second tier of 4–7% positions spreads risk across financials, industrials, and healthcare.

Q: Does Egerton Capital have a clear style—value, growth, or something else?

Based on the Q3’2025 holdings, Egerton leans toward quality growth: dominant franchises with strong competitive moats, high returns on capital, and secular tailwinds. Valuation still matters—as seen in incremental trims—but the portfolio is not classic deep value; it is more about paying reasonable prices for resilient compounders.

Q: Which sectors and themes does the portfolio emphasize right now?

The portfolio emphasizes: - technology and cloud/software (MSFT, AMZN, APH)

- payments and financial infrastructure (V, PGR, COF, IBKR)

- industrials and building materials (FERG, CRH)

- healthcare/med‑tech (BSX).

Q: How can I track John Armitage’s future portfolio changes?

You can follow his holdings through quarterly 13F filings, which U.S. institutional managers must file with the SEC. These reports are released with a 45‑day lag after each quarter-end, meaning the data is not real-time. ValueSense’s superinvestor tracker for Egerton Capital aggregates these filings, shows position history, and highlights adds, trims, and new holdings so you can monitor updates quickly and visually.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!