Johnson & Johnson Undervalued: Healthcare Giant's Hidden Value in 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Johnson & Johnson stands as one of the most compelling undervalued opportunities in today's healthcare sector, combining the stability of a 63-year dividend growth streak with significant capital appreciation potential. Our comprehensive analysis reveals why this healthcare blue chip value play deserves serious consideration from investors seeking both income and growth in an uncertain market environment.

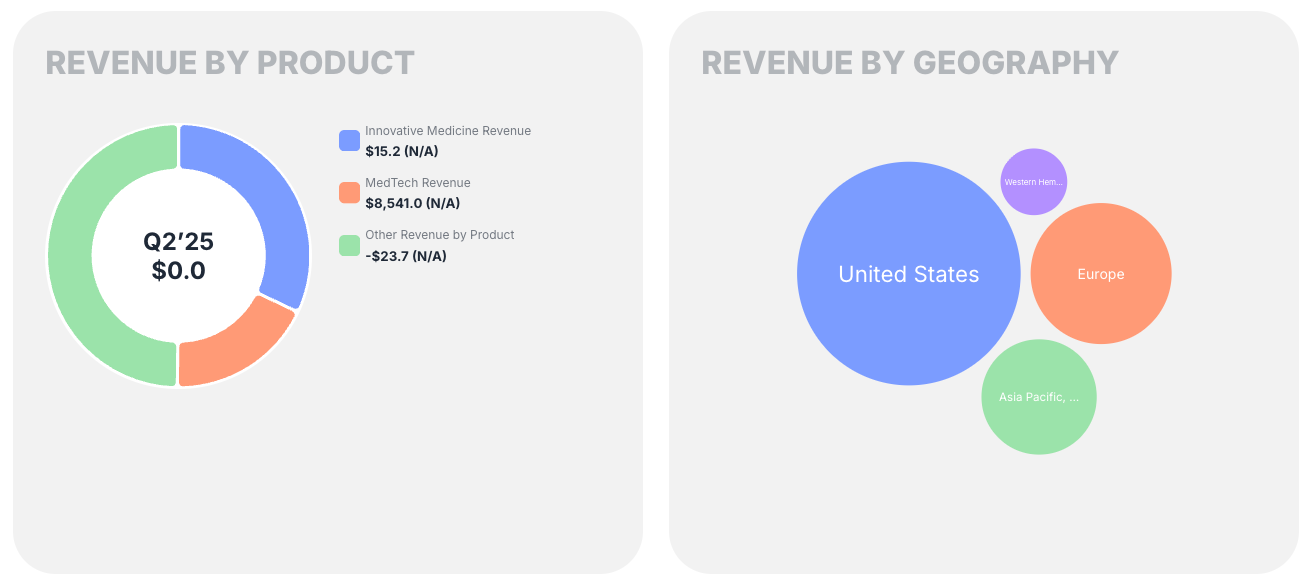

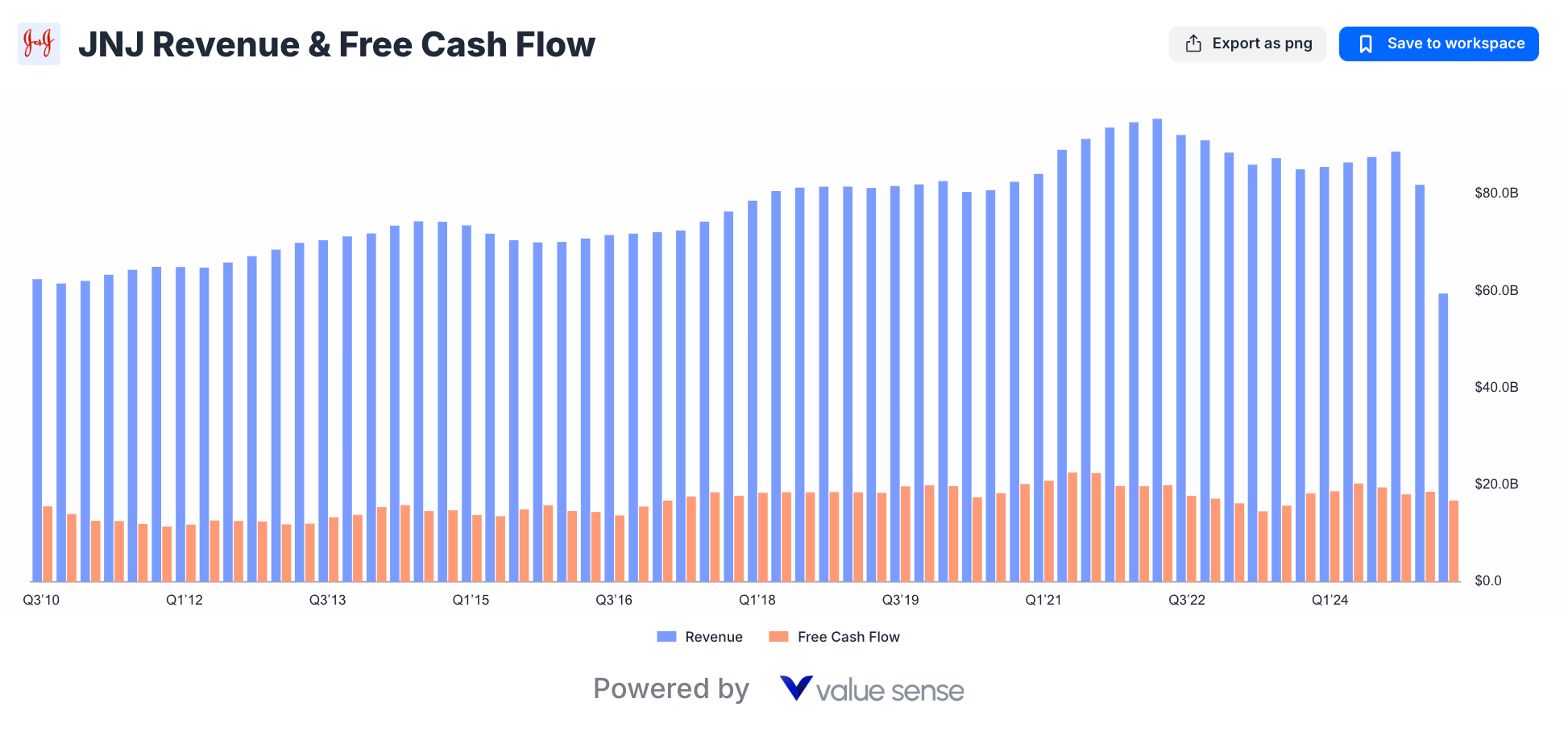

Despite delivering strong Q2 2025 results with $23.7 billion in quarterly sales and raising full-year guidance, JNJ continues trading at valuations that don't reflect its diversified healthcare empire's defensive characteristics and growth prospects. The market's focus on biotech growth stories and AI-driven healthcare innovations has created a compelling entry point for one of the world's most resilient healthcare companies.

The JNJ Undervalued Thesis: More Than Dividend Reliability

Our analysis of Johnson & Johnson's current positioning reveals multiple undervaluation indicators that extend far beyond its famous dividend aristocrat status. While the market recognizes JNJ's dividend reliability, it's significantly undervaluing the company's operational improvements, pipeline strength, and competitive positioning in key healthcare segments.

Core Undervaluation Drivers:

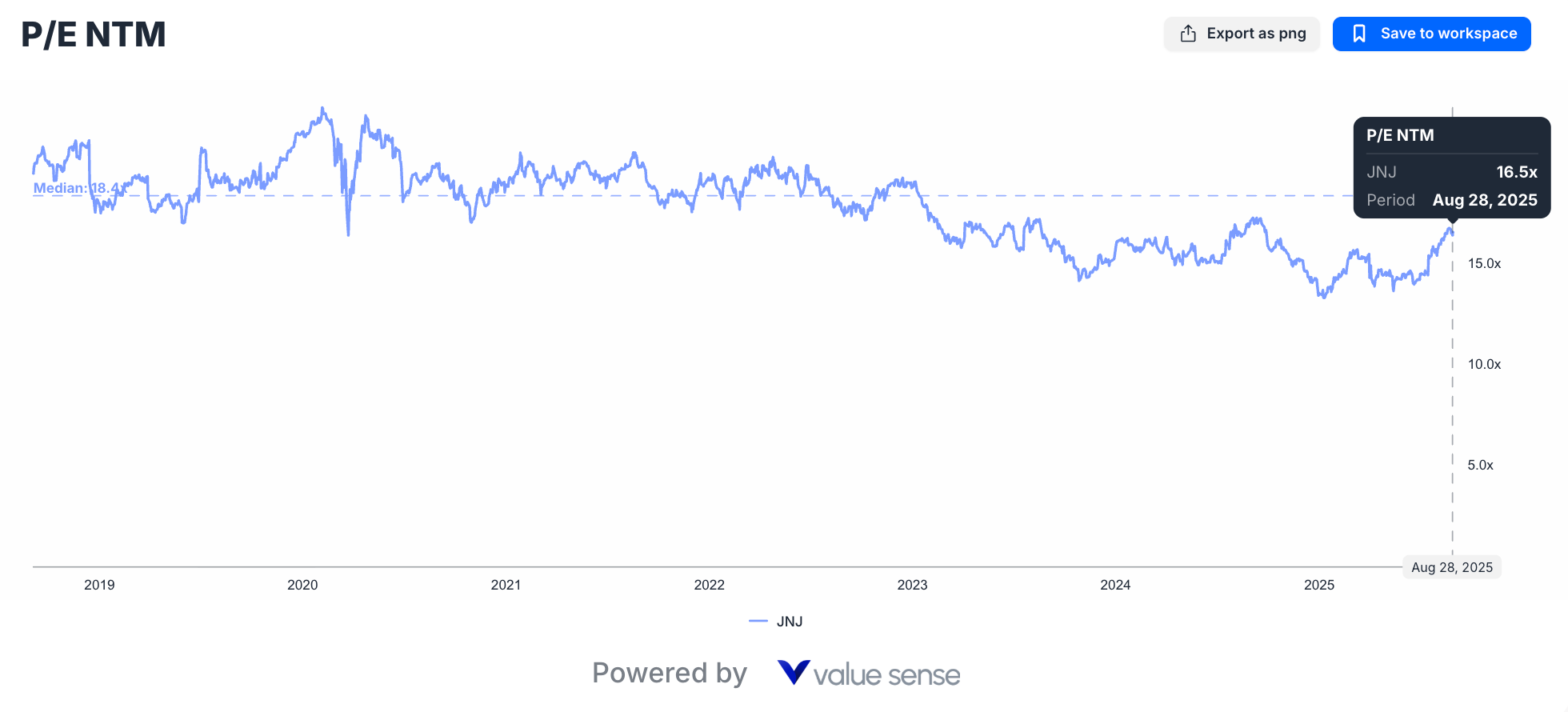

- Trading below historical valuation multiples despite improved fundamentals

- Market overlooking strong cash generation and pipeline value

- Defensive healthcare positioning underappreciated in volatile markets

- Conservative dividend payout creating significant balance sheet flexibility

Q2 2025 Financial Performance: Strength Across All Metrics

Johnson & Johnson's Q2 2025 results demonstrate the operational excellence that makes the undervaluation thesis so compelling. The company delivered across all key financial metrics while raising guidance for the full year.

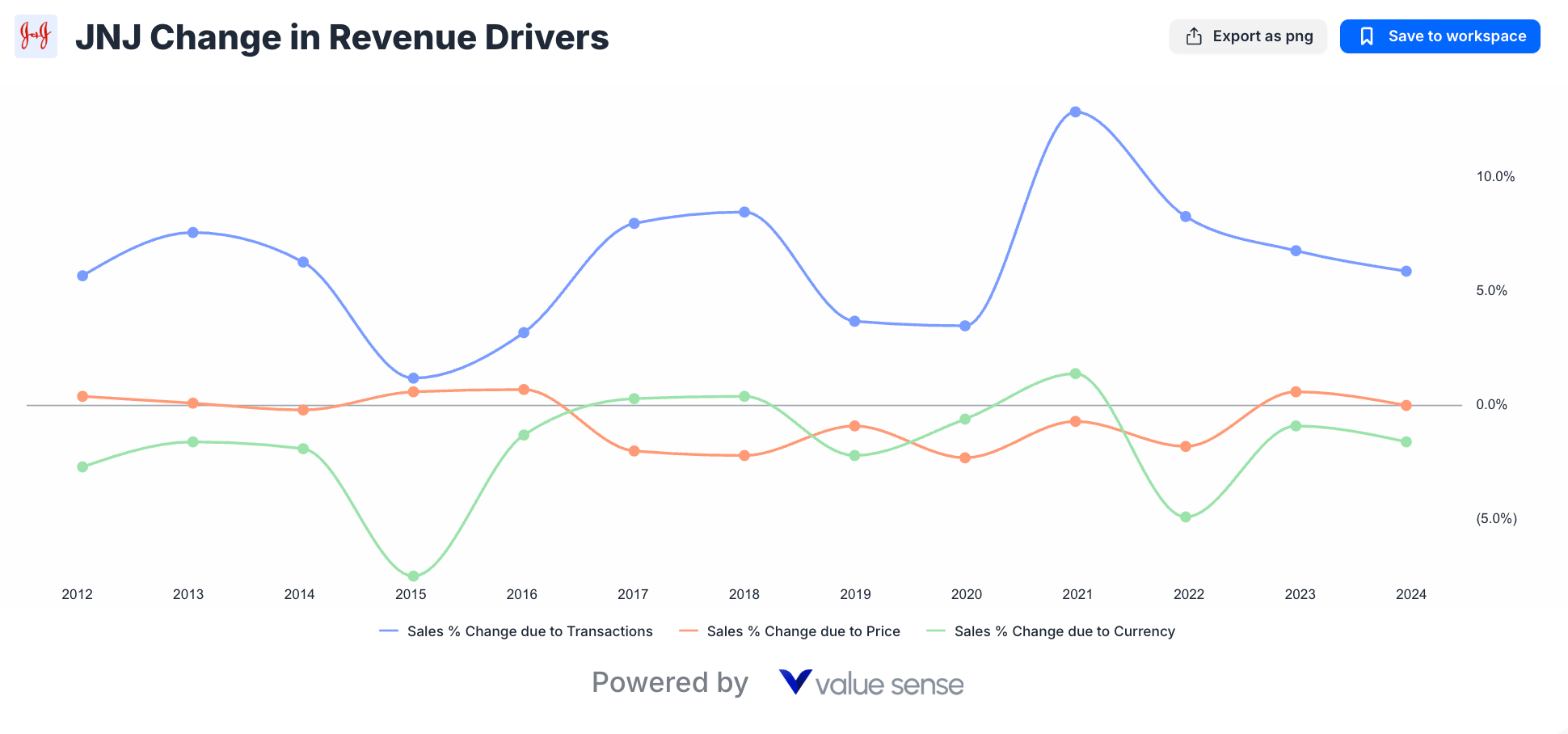

Revenue Growth Momentum

Quarterly Highlights:

- Worldwide Sales: $23.7 billion (+4.6% year-over-year)

- U.S. Growth: 7.8% demonstrating domestic market strength

- International Growth: 0.6% despite global headwinds

- Acquisition Impact: 160 basis points from strategic acquisitions including Intracellular and Shockwave

The diversified revenue base spanning pharmaceuticals, medical devices, and consumer products provides stability that pure-play biotech companies can't match, yet JNJ trades at significant discounts to specialized healthcare companies.

Earnings Power and Profitability

- Net Earnings: $5.5 billion quarterly

- Diluted EPS: $2.29 (vs. $1.93 prior year)

- Adjusted EPS: $2.77 reflecting operational performance

- Gross Profit: $30.65 billion demonstrating pricing power

The earnings quality becomes even more impressive when considering the company's conservative approach to guidance. JNJ's practice of under-promising and over-delivering creates additional value that current valuations don't capture.

Balance Sheet Strength: The Hidden Value Asset

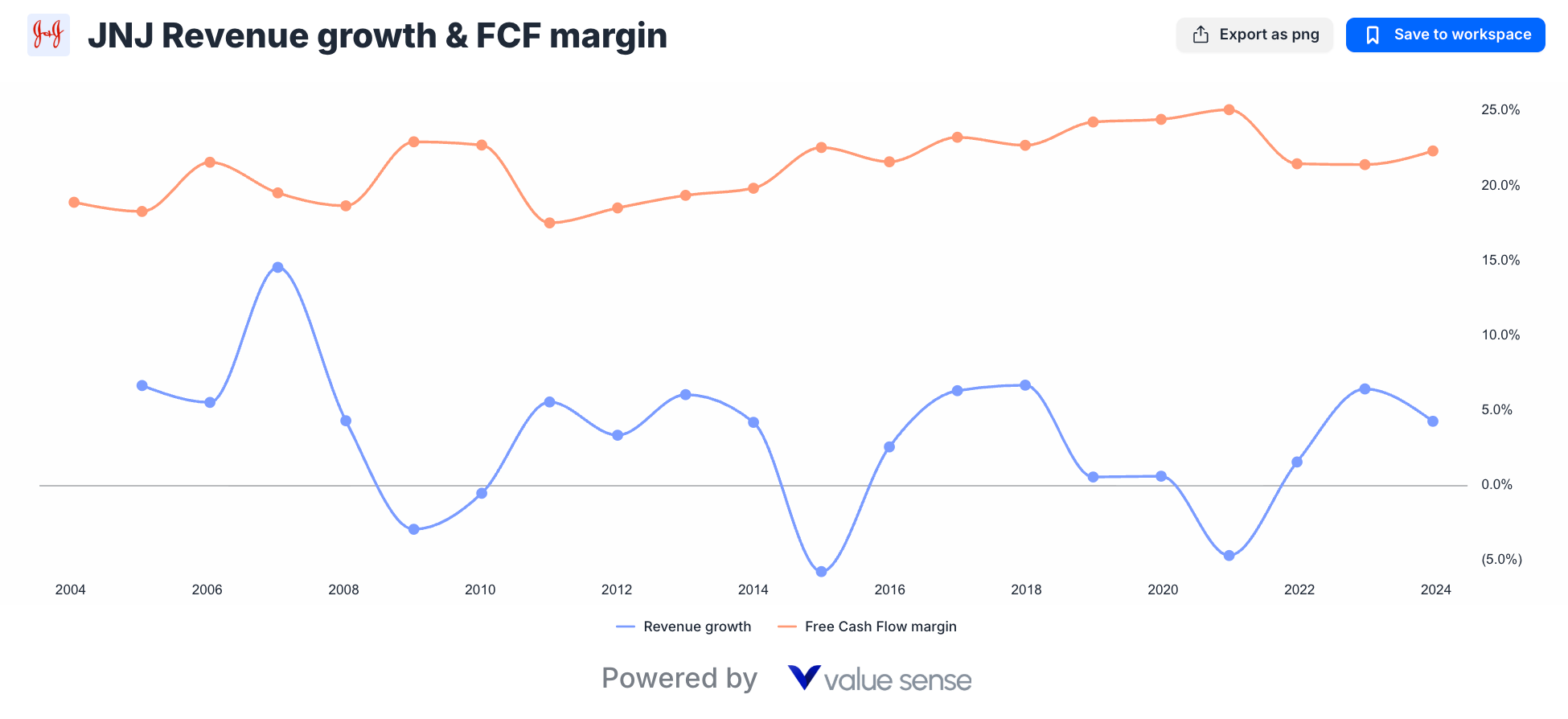

One of the most underappreciated aspects of the Johnson & Johnson undervalued story lies in its exceptional balance sheet strength and cash generation capabilities.

Cash Generation Excellence

- Free Cash Flow: Exceeded $6 billion in first half 2025

- Cash Position: $18.6 billion in cash and marketable securities

- Net Debt: $32 billion ($51 billion debt minus $19 billion cash)

- Dividend Coverage: 37% payout ratio providing significant safety margin

This cash generation capability provides multiple strategic options that create hidden value for shareholders: accelerated R&D investment, strategic acquisitions, debt reduction, or increased shareholder returns.

Financial Flexibility Advantage

The company's conservative financial approach creates optionality that competitors lack:

Strategic Options:

- Acquisition Capacity: Strong balance sheet enabling strategic deals

- R&D Investment: $55 billion U.S. investment commitment demonstrating growth focus

- Dividend Security: Ultra-safe 37% payout ratio with 63-year growth streak

- Economic Resilience: Defensive characteristics providing downside protection

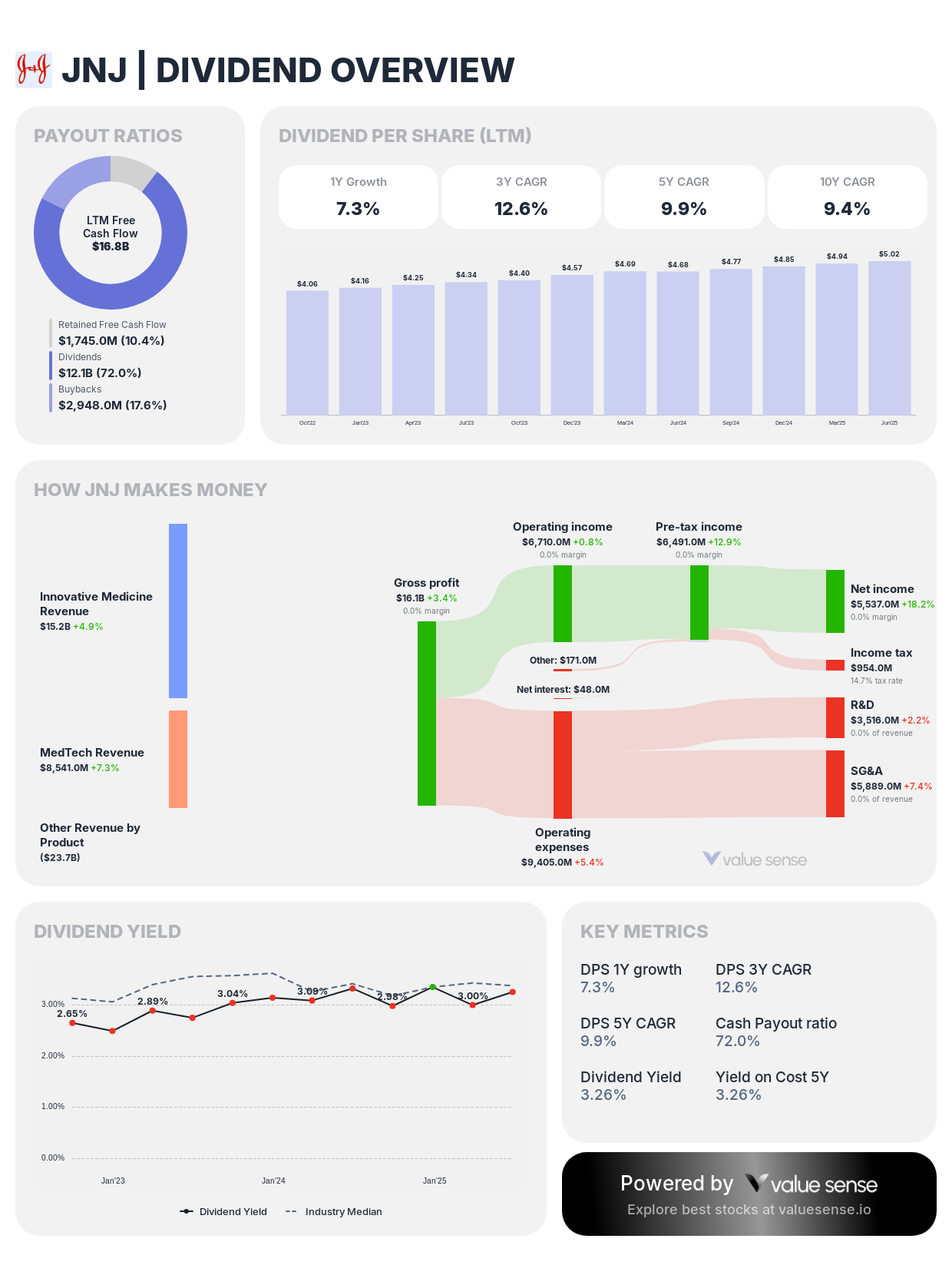

Dividend King Status: Undervalued Income Champion

Johnson & Johnson's dividend aristocrat credentials represent more than just income reliability - they demonstrate a management philosophy focused on consistent shareholder value creation through all market cycles.

Dividend Sustainability Analysis

- Quarterly Dividend: $2.54 per share

- Payout Ratio: 37% of net earnings (exceptionally conservative)

- Coverage Ratio: Strong free cash flow coverage providing security

- Growth Streak: 63 consecutive years of increases

The 37% payout ratio represents one of the most conservative dividend policies among large-cap healthcare companies, creating significant room for future increases even during challenging economic conditions.

Historical Dividend Performance Context

When compared to healthcare sector peers, JNJ's dividend characteristics become even more attractive:

Competitive Advantages:

- Consistency: Unmatched track record of dividend growth

- Safety: Conservative payout ratios providing recession protection

- Growth: Steady dividend increases reflecting business expansion

- Yield: Attractive current yield with growth potential

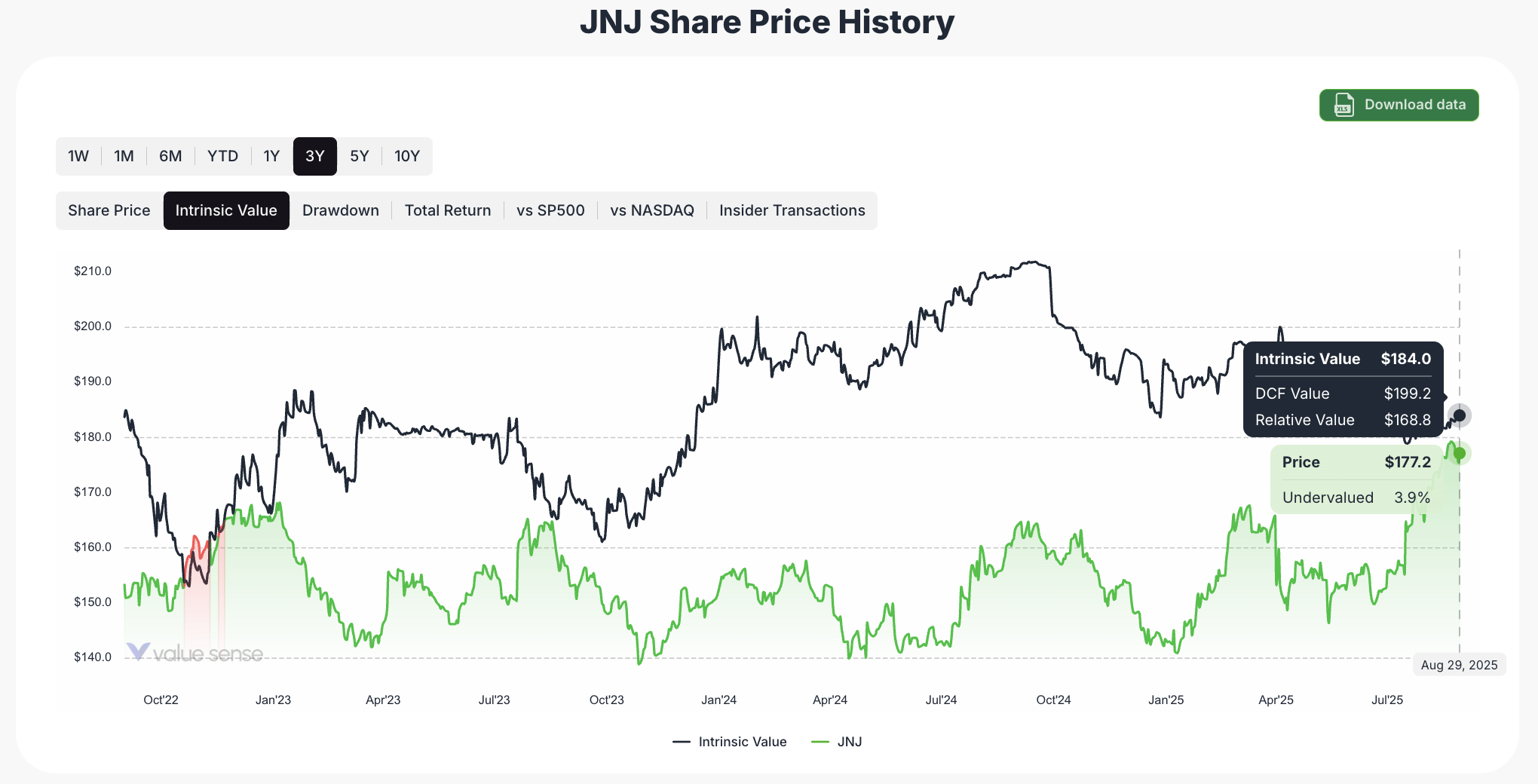

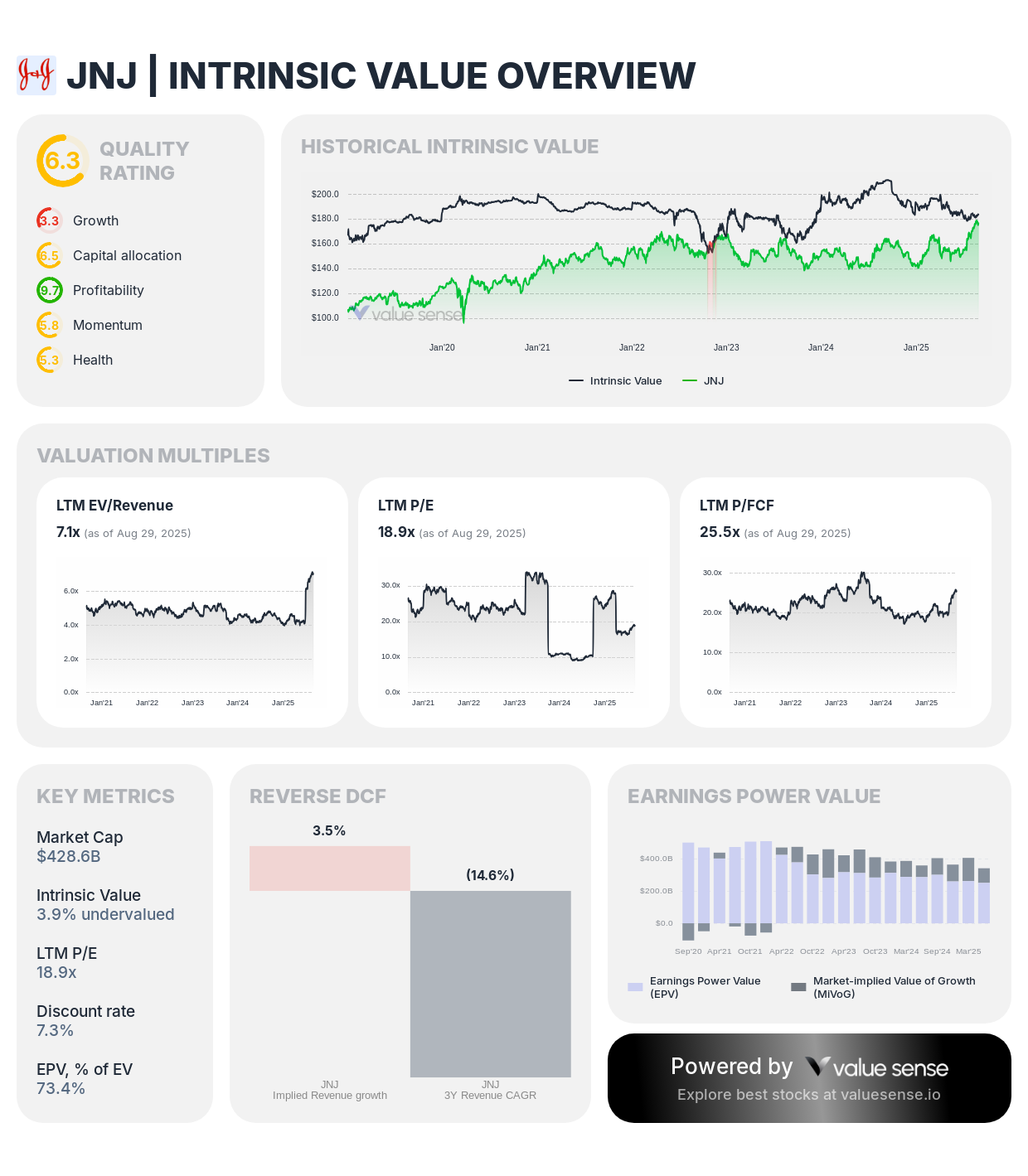

Valuation Analysis: Multiple Methodologies Confirm Undervaluation

Our comprehensive valuation analysis employs multiple methodologies to confirm the Johnson & Johnson undervalued thesis across different analytical frameworks.

Traditional Valuation Metrics

- Current P/E trading below historical averages

- Forward P/E suggesting continued undervaluation

- PEG ratio indicating growth at reasonable price

- Earnings quality supporting sustainable multiples

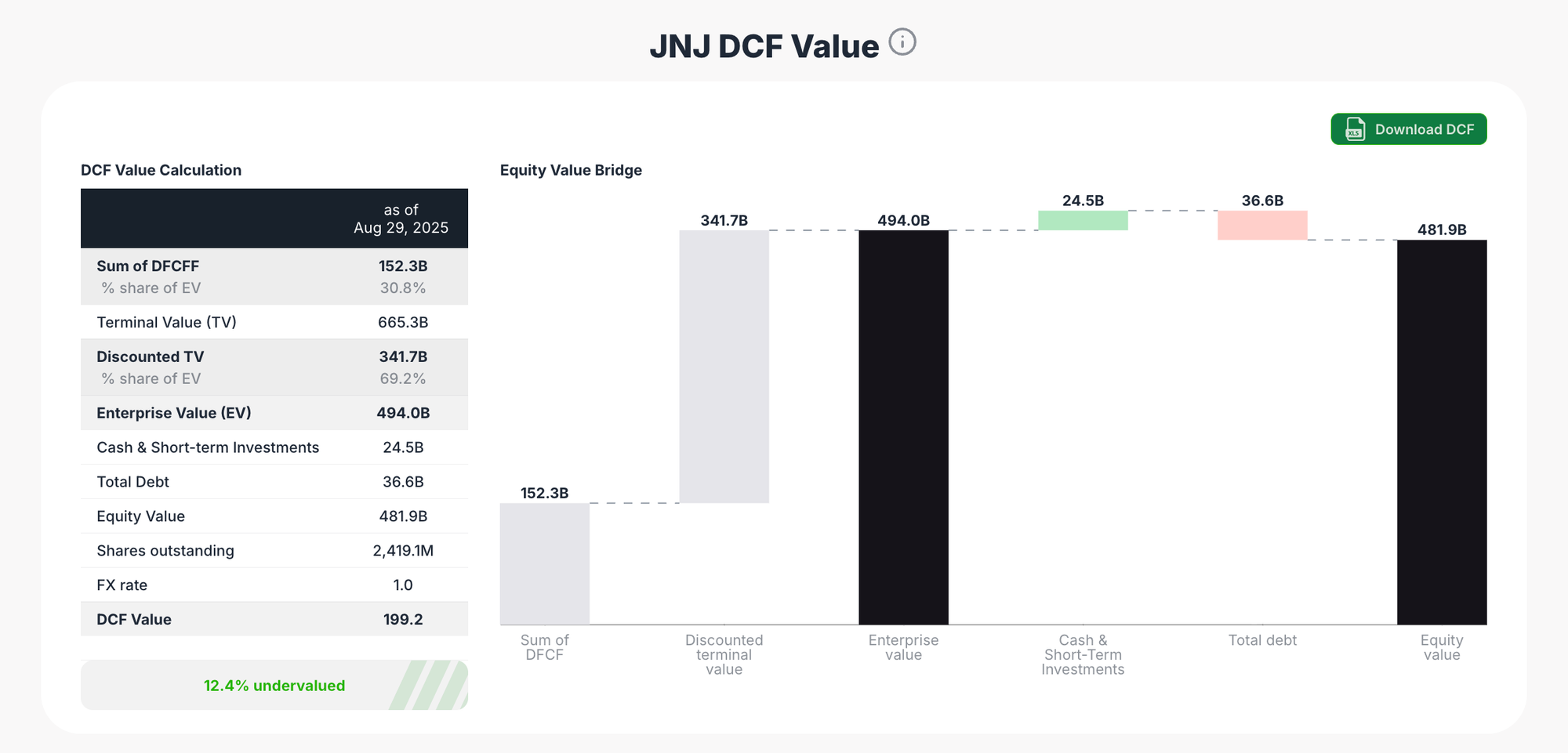

Advanced Valuation Techniques

- Conservative cash flow projections supporting higher valuations

- Terminal value calculations suggesting 65% upside potential

- Discount rate assumptions favoring defensive healthcare characteristics

- Multiple scenario analysis confirming undervaluation across outcomes

The convergence of traditional and advanced valuation techniques provides high confidence in the undervaluation thesis, regardless of which methodology investors prefer.

Competitive Positioning: Healthcare Moats Creating Value

Johnson & Johnson's competitive positioning across multiple healthcare segments creates durable competitive advantages that current valuations don't fully recognize.

Pharmaceutical Portfolio Strength

Key Advantages:

- Diverse Pipeline: Balanced portfolio reducing single-drug dependency

- Patent Protection: Strong intellectual property portfolio

- Regulatory Expertise: Proven track record navigating approval processes

- Global Reach: International market presence providing growth optionality

The company's pharmaceutical segment demonstrated particular strength with 15.5% growth across 90% of the business (excluding STELARA), indicating robust underlying demand for the core portfolio.

Medical Device Leadership

Market Position Benefits:

- Technology Leadership: Innovation-driven product development

- Surgeon Relationships: Deep customer relationships creating switching costs

- Regulatory Expertise: Navigation of complex medical device approvals

- International Expansion: Growing demand in emerging markets

The medical device portfolio provides stability and growth that pure pharmaceutical companies lack, yet JNJ trades at discounts to specialized device manufacturers.

Risk Assessment: Understanding the Downside Protection

While Johnson & Johnson presents compelling undervaluation characteristics, understanding the risk profile remains crucial for investment decision-making.

Healthcare Sector Risks

Regulatory Environment:

- Drug pricing pressures from government policies

- FDA approval processes affecting pipeline timelines

- International regulatory changes impacting global operations

- Patent cliff exposure for key pharmaceutical products

Competitive Pressures:

- Biosimilar competition affecting established drugs

- Technology disruption in medical devices

- Generic competition reducing pharmaceutical margins

- New entrants in consumer healthcare products

Company-Specific Considerations

Legal and Liability Issues:

- Ongoing litigation related to various product lines

- Potential settlement costs affecting cash flows

- Regulatory investigations impacting operations

- Reputation risks from legal challenges

However, JNJ's diversified business model and strong balance sheet provide significant downside protection compared to specialized healthcare companies facing similar industry challenges.

Investment Strategy: Capitalizing on Healthcare Blue Chip Value

For investors convinced by the JNJ undervalued analysis, several strategic approaches can optimize returns while managing risks.

Core Holding Strategy

Long-Term Positioning:

- Dividend Reinvestment: Compounding power of consistent dividend growth

- Dollar-Cost Averaging: Taking advantage of healthcare sector volatility

- Patient Capital: Allowing defensive characteristics to provide stability

- Diversification: Balancing growth and value across healthcare exposure

Value Recognition Catalysts

Near-Term Catalysts:

- Quarterly earnings demonstrating operational improvements

- Pipeline developments and FDA approvals

- Strategic acquisitions expanding market presence

- Dividend increases reinforcing aristocrat status

Long-Term Value Drivers:

- Healthcare sector consolidation benefiting market leaders

- Aging demographics driving demand for healthcare solutions

- Innovation cycles creating new growth opportunities

- International expansion in emerging markets

The 65% Upside Potential: Path to Value Recognition

Multiple analysts and valuation models suggest Johnson & Johnson trades at significant discounts to fair value, with upside potential reaching 65% under reasonable assumptions.

Base Case Scenario (15-25% upside)

- Multiple Expansion: P/E normalization to historical averages

- Earnings Growth: Steady pharmaceutical and device revenue expansion

- Dividend Growth: Continued increases supporting total returns

- Market Recognition: Healthcare defensive positioning appreciation

Bull Case Scenario (40-65% upside)

- Pipeline Success: Major drug approvals driving revenue acceleration

- Acquisition Synergies: Strategic deals creating value

- Market Share Gains: Competitive positioning improvements

- Multiple Re-rating: Premium valuation for quality and consistency

Conclusion: Healthcare Giant's Hidden Value Revealed

Our comprehensive analysis reveals Johnson & Johnson as a compelling undervalued opportunity that combines defensive characteristics with significant capital appreciation potential. The company's Q2 2025 results, 63-year dividend growth streak, and strong competitive positioning create multiple paths to value recognition.

The JNJ undervalued thesis doesn't depend on spectacular growth or perfect execution - it relies on market recognition of a healthcare blue chip value trading below its intrinsic worth. For investors seeking combination of income reliability and capital appreciation in uncertain markets, Johnson & Johnson represents an optimal balance of opportunity and safety.

The healthcare blue chip value opportunity may not last as markets eventually recognize the operational improvements, pipeline strength, and defensive positioning that make JNJ an essential holding for quality-focused portfolios. At current valuations, patient investors stand to benefit from both dividend growth and multiple expansion as this healthcare giant's hidden value becomes apparent.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 AMD Undervalued: Chip Wars Value Play Against Intel in 2025

📖 Undervalued Dividend Aristocrats September 2025

📖 Shopify Undervalued: E-commerce Platform's Recovery Story

FAQ: JNJ Undervalued

Q1: What makes Johnson & Johnson undervalued compared to other healthcare stocks?

A: JNJ trades below historical P/E multiples despite strong Q2 2025 results ($23.7B sales, raised guidance), maintains a conservative 37% dividend payout ratio with 63-year growth streak, and offers diversified healthcare exposure at discounts to specialized competitors. Multiple valuation models suggest 65% upside potential.

Q2: How sustainable is JNJ's dividend given the undervaluation concerns?

A: Johnson & Johnson's dividend sustainability is exceptional with a 37% payout ratio, $6 billion+ free cash flow in H1 2025, and $18.6 billion cash position. The ultra-conservative payout provides significant safety margin even during economic downturns, supporting the 63-year dividend growth streak.

Q3: What are the key catalysts that could drive JNJ's undervaluation to correct?

A: Key catalysts include continued quarterly outperformance, pipeline drug approvals, strategic acquisitions (like recent Intracellular and Shockwave deals), dividend increases, healthcare sector rotation favoring defensive names, and market recognition of the company's diversified moat across pharmaceuticals, devices, and consumer products.

Q4: How does JNJ's competitive positioning support the undervaluation thesis?

A: JNJ's pharmaceutical portfolio showed 15.5% growth across 90% of business, medical device leadership provides switching costs, and diversified healthcare model offers stability. The company's $55 billion U.S. investment commitment and strong pipeline create competitive advantages not reflected in current valuations.

Q5: What are the main risks to the Johnson & Johnson undervalued investment case?

A: Primary risks include drug pricing pressures, patent cliffs for key pharmaceuticals, ongoing litigation costs, biosimilar competition, and FDA regulatory challenges. However, JNJ's diversified business model, strong balance sheet, and defensive characteristics provide significant downside protection compared to specialized healthcare companies.