Josh Tarasoff - Greenlea Lane Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Josh Tarasoff - Greenlea Lane Capital continues to showcase an ultra-concentrated, long-term compounding style. His Q3’2025 portfolio holds just eight positions, with modest trims in giants like Amazon.com, Inc. and Brookfield Corporation, a reduction in Tesla, Inc., and a dramatic 132.17% increase in Burford Capital Limited—moves that fine‑tune risk while doubling down on high-conviction ideas.

CTA:

Explore every position and historical change in Josh Tarasoff’s portfolio on ValueSense:

Portfolio Overview: An Eight-Stock Conviction Machine

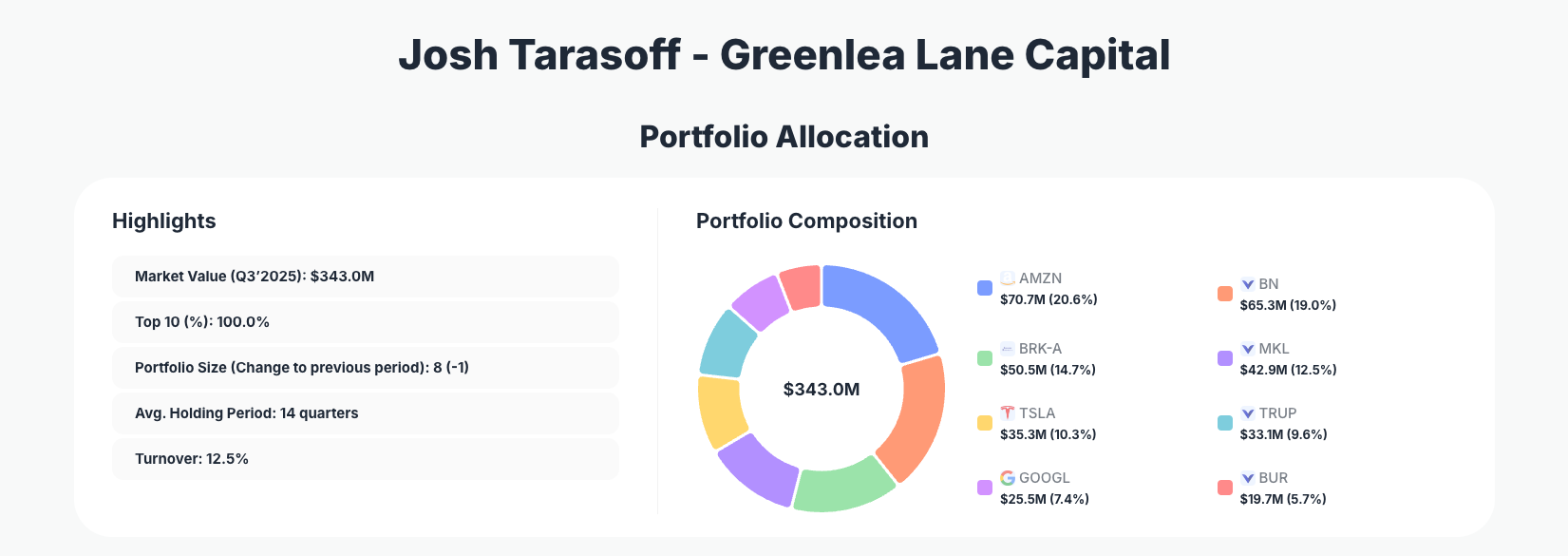

Portfolio Highlights (Q3’2025): - Market Value: $343.0M

- Top 10 Holdings: 100.0%

- Portfolio Size: 8 -1

- Average Holding Period: 14 quarters

- Turnover: 12.5%

The latest Greenlea Lane Capital portfolio remains a study in concentration: the entire $343.0M is allocated across just eight stocks, with the top 10 holdings representing 100.0% of reported equity exposure. This structure underscores Tarasoff’s preference for deep conviction over broad diversification, relying on a handful of businesses to drive long-term compounding.

With an average holding period of 14 quarters, the Q3’2025 portfolio reflects a buy-and-hold discipline—moderate 12.5% turnover indicates incremental repositioning rather than wholesale shifts. The reduction in portfolio size by one position (8, down from 9) suggests a continued sharpening of focus toward the best ideas instead of maintaining marginal holdings.

The mix of dominant tech platforms, diversified asset managers, insurance-style compounders, and niche specialists shows a coherent philosophy: own scalable, capital-efficient franchises and let time and compounding do the heavy lifting. Within that framework, small trims to mega-caps and a large add to Burford Capital Limited signal a willingness to rebalance risk and upside while staying firmly invested.

Top Holdings Snapshot: Platforms, Compounders, and a Bold Legal-Finance Bet

The Q3’2025 Greenlea Lane portfolio is anchored by a tight group of high-conviction positions, with several notable adjustments this quarter.

The largest disclosed position is Amazon.com, Inc. at 20.6% of the portfolio, valued at $70.7M. Tarasoff made a modest “Reduce 0.85%” move here, a small trim that fine-tunes exposure while keeping Amazon as a core pillar. Close behind, Brookfield Corporation sits at 19.0% $65.3M, also slightly adjusted with a “Reduce 1.57%” action—again, a refinement rather than a change in thesis.

Insurance and conglomerate compounders remain central. Berkshire Hathaway Inc. (BRK-A) accounts for 14.7% $50.5M with “No change,” and Markel Corporation holds 12.5% $42.9M, also with “No change.” These stable allocations highlight enduring confidence in diversified, underwriting-driven capital allocators.

On the growthier side, Tesla, Inc. remains a meaningful 10.3% position $35.3M despite a “Reduce 2.13%” transaction, indicating risk management around a highly volatile name while still maintaining substantial exposure. TRUPANION INC, at 9.6% $33.1M with “No change,” reflects a long-term bet on pet insurance and recurring premium economics, even though its ticker is not standard in this dataset.

Big Tech remains represented via Alphabet Inc., which comprises 7.4% of the portfolio $25.5M with “No change.” This reinforces a core theme: own dominant digital platforms and let network effects and cash generation compound value over years.

The most eye-catching move is in Burford Capital Limited, now a 5.7% position at $19.7M after an “Add 132.17%” increase. This aggressive scaling suggests rising conviction in Burford’s litigation finance model and its asymmetric payoff structure relative to the rest of the portfolio. Though smaller in weight, the magnitude of the add makes Burford the clearest incremental bet this quarter.

Overall, across these 8 disclosed names, the portfolio blends: - Tech platforms: Amazon.com, Inc., Alphabet Inc.

- Diversified asset/holding companies: Brookfield Corporation, Berkshire Hathaway Inc. (BRK-A)

- Insurance and specialty financials: Markel Corporation, TRUPANION INC, Burford Capital Limited

- Disruptive growth: Tesla, Inc.

What the Portfolio Reveals About Current Strategy

Several strategic themes emerge from the Q3’2025 positioning:

- Extreme concentration in best ideas

With 100.0% of capital in the top 10 (and only 8 stocks total), Tarasoff is clearly comfortable concentrating in businesses he understands deeply rather than diversifying away potential alpha. - Quality and scalability over pure value

The presence of Amazon.com, Inc., Alphabet Inc., and Tesla, Inc. alongside Berkshire Hathaway Inc. (BRK-A), Markel Corporation, and Brookfield Corporation indicates a focus on durable moats, reinvestment runways, and strong capital allocation—rather than deep-value turnarounds. - Financial and insurance DNA

Brookfield, Berkshire, Markel, TRUPANION INC, and Burford Capital Limited collectively tilt the portfolio heavily toward financial and insurance-adjacent models: fee-based asset management, float-driven insurance, and legal-finance claims. This cluster highlights a belief in sophisticated risk-underwriting businesses that can compound capital over cycles. - Incremental de-risking in mega-cap tech, selective aggression in niche finance

Small reductions in Amazon.com, Inc., Brookfield Corporation, and Tesla, Inc. paired with a dramatic add to Burford Capital Limited suggest a measured rebalancing: shaving large, widely held winners while scaling a more idiosyncratic opportunity. - Low activity consistent with long-term orientation

With 14-quarter average holding periods and 12.5% turnover, the Greenlea Lane Capital portfolio continues to reflect patience. The goal is clearly to let intrinsic value compound rather than chase short-term market moves.

Portfolio Concentration Analysis

Using the reported top holdings:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Amazon.com, Inc. (AMZN) | $70.7M | 20.6% | Reduce 0.85% |

| Brookfield Corporation (BN) | $65.3M | 19.0% | Reduce 1.57% |

| Berkshire Hathaway Inc. (BRK-A) | $50.5M | 14.7% | No change |

| Markel Corporation (MKL) | $42.9M | 12.5% | No change |

| Tesla, Inc. (TSLA) | $35.3M | 10.3% | Reduce 2.13% |

| TRUPANION INC | $33.1M | 9.6% | No change |

| Alphabet Inc. (GOOGL) | $25.5M | 7.4% | No change |

| Burford Capital Limited (BUR) | $19.7M | 5.7% | Add 132.17% |

Even within an already concentrated eight-stock lineup, the top two positions—Amazon.com, Inc. and Brookfield Corporation—alone absorb nearly 40% of capital, while the top four comprise over two-thirds of the portfolio. This skew underscores how central these platforms and capital allocators are to Tarasoff’s long-term thesis.

At the same time, smaller names like TRUPANION INC and Burford Capital Limited play a complementary role: they are sized meaningfully enough to matter (5–10% weights) but not large enough to dominate risk. The massive “Add 132.17%” in Burford at a 5.7% weight is especially revealing—it is big enough to contribute significantly if the thesis proves right, but constrained if volatility spikes or fundamentals disappoint.

Investment Lessons from Josh Tarasoff’s Greenlea Lane Approach

Individual investors can draw several practical lessons from how the Greenlea Lane Capital portfolio is constructed and managed:

- Concentrate when conviction is earned, not assumed

Running just eight positions demands deep research and comfort with business quality. Concentration is a reward for understanding, not a starting point. - Let winners run, adjust at the margin

Small “Reduce 0.85%” or “Reduce 1.57%” actions in Amazon.com, Inc. and Brookfield Corporation show that trimming is often incremental, not binary—all-in or all-out decisions are rare. - Hold for years, not quarters

A 14-quarter average holding period reinforces that the real edge comes from owning excellent businesses through cycles rather than reacting to short-term noise. - Blend stability with selective asymmetry

Pairing stable compounders like Berkshire Hathaway Inc. (BRK-A), Markel Corporation, and Alphabet Inc. with higher-variance names like Tesla, Inc., TRUPANION INC, and Burford Capital Limited helps balance durability with upside optionality. - Use position sizing as a risk-control tool

Even after adding 132.17% to Burford, Tarasoff keeps it at 5.7% of the portfolio—big enough to move the needle, but not large enough to dominate overall outcomes.

Looking Ahead: What Comes Next for Greenlea Lane

While 13F filings don’t disclose cash levels or intraday moves, the current Q3’2025 positioning provides useful clues about the road ahead:

- With only eight positions and 12.5% turnover, further changes are likely to be incremental adjustments—adds to existing names or occasional exits if the thesis breaks.

- The heavy weighting in global platforms and financial/insurance models suggests Tarasoff may continue to favor asset-light, scalable, cash-generative businesses if new ideas enter the portfolio.

- The large add in Burford Capital Limited indicates increased comfort with non-traditional financial niches; similar specialized opportunities could appear over time.

- Given the long holding periods, the current mix of Amazon.com, Inc., Brookfield Corporation, Berkshire Hathaway Inc. (BRK-A), Markel Corporation, Tesla, Inc., TRUPANION INC, Alphabet Inc., and Burford Capital Limited likely represents core holdings for multiple years, barring major fundamental shifts.

Investors tracking Greenlea Lane should view this 13F as a snapshot of a long-term roadmap rather than a trading log; subsequent quarters will reveal whether Burford continues to grow in importance and whether any new high-conviction ideas join this concentrated roster.

FAQ about Josh Tarasoff – Greenlea Lane Capital Portfolio

Q: What were the most significant changes in Josh Tarasoff’s Q3’2025 portfolio?

The standout move was an “Add 132.17%” to Burford Capital Limited, taking it to 5.7% of the portfolio. Smaller trims included “Reduce 0.85%” in Amazon.com, Inc., “Reduce 1.57%” in Brookfield Corporation, and “Reduce 2.13%” in Tesla, Inc.

Q: How concentrated is the Greenlea Lane Capital portfolio?

Extremely concentrated: the entire $343.0M portfolio is invested in just eight positions, and the top 10 holdings represent 100.0% of reported equity exposure. The top four stocks alone—Amazon.com, Inc., Brookfield Corporation, Berkshire Hathaway Inc. (BRK-A), and Markel Corporation—make up the bulk of assets.

Q: Does the portfolio reflect a specific sector or style bias?

Yes. There is a clear bias toward: - Capital allocators and financial/insurance businesses: Brookfield Corporation, Berkshire Hathaway Inc. (BRK-A), Markel Corporation, TRUPANION INC, and Burford Capital Limited

- Dominant tech platforms and digital ecosystems: Amazon.com, Inc., Alphabet Inc., and Tesla, Inc.

This mix leans toward quality, scalability, and long runways for compounding.

Q: Does the 13F filing show real-time positions for Greenlea Lane?

No. Like all U.S. 13F filings, Greenlea Lane’s disclosures are subject to a reporting lag—managers typically have up to 45 days after quarter-end to file. That means the Q3’2025 filing reflects positions as of quarter-end, and some exposures may have changed since then.

Q: How can I track and follow Josh Tarasoff’s portfolio over time?

You can monitor quarterly changes via the SEC’s 13F filings, but the easiest way is to use ValueSense’s superinvestor tools. The Greenlea Lane page at Greenlea Lane Capital’s portfolio shows current holdings, historical weights, and changes such as “Add 132.17%” or “Reduce 2.13%,” helping you visualize how Tarasoff’s conviction evolves over time.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!