Lee Ainslie - Maverick Capital Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Lee Ainslie - Maverick Capital continues to lean into high-conviction tech and infrastructure names while actively reshaping the broader book. His Q3’2025 portfolio shows $7.5 billion spread across more than 200 positions, with aggressive turnover and sizeable moves in leaders like Amazon.com, Inc., Microsoft Corporation, NVIDIA Corporation, and a massive ramp in Union Pacific Corporation.

The Big Picture: Dynamic, High-Turnover Maverick Playbook

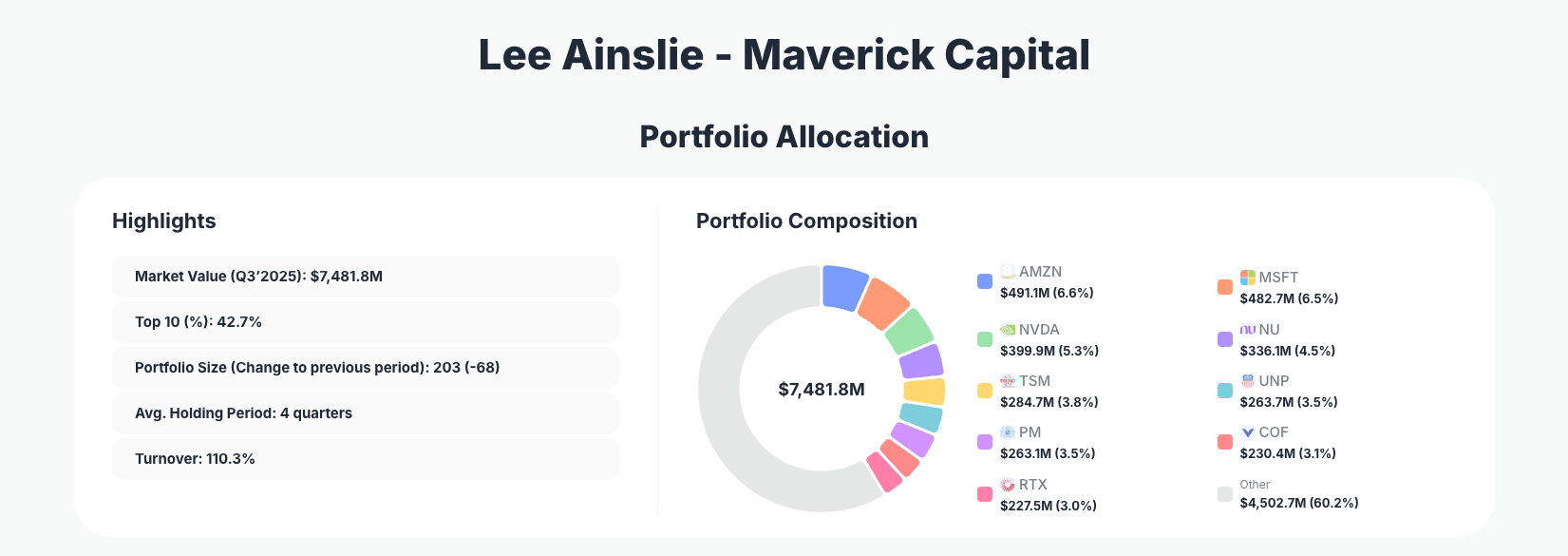

Portfolio Highlights (Q3’2025): - Market Value: $7,481.8M

- Top 10 Holdings: 42.7%

- Portfolio Size: 203 -68

- Average Holding Period: 4 quarters

- Turnover: 110.3%

The latest Maverick Capital portfolio combines a sizable $7.5B equity book with a relatively concentrated top layer: just 10 names account for 42.7% of assets, while the fund still runs 203 positions in total. The drop of 68 holdings quarter-over-quarter underscores a decisive cleanup, with smaller or lower-conviction names trimmed or exited to sharpen focus.

A 110.3% turnover rate and a 4‑quarter average holding period underline Maverick’s active trading style. This is not a buy‑and‑hold forever portfolio; it is a research‑driven, catalyst‑oriented approach that scales positions up or down quickly as risk‑reward shifts. Within that framework, the top of the Q3’2025 portfolio is clearly tilted toward dominant tech platforms, high‑quality financials, and critical infrastructure.

Despite the breadth of names, the real drivers of performance are the top dozen positions, which include mega‑caps like AMZN, MSFT, and NVDA, alongside more targeted bets in fintech, semiconductors, railroads, and defense/aerospace. The result is a barbelled profile: diversified enough to manage idiosyncratic risk, but concentrated enough at the top to matter.

Top Holdings Analysis: Tech Platforms, Semis & Essential Infrastructure

The core of the Maverick Capital portfolio is anchored in a small set of high‑impact positions where Ainslie made meaningful changes this quarter.

The largest disclosed mover is Amazon.com, Inc. (AMZN), now at 6.6% of the portfolio with $491.1M invested and an “Add 8.55%” action. This signals ongoing conviction in Amazon’s cloud and e‑commerce flywheel, with Maverick leaning further into one of the market’s core compounders.

Right behind, Microsoft Corporation (MSFT) sits at 6.5% of assets and $482.7M, with a substantial “Add 23.69%” increase. This step‑up suggests a strong view on Microsoft’s AI and cloud monetization runway, making it one of the most important drivers of the fund’s large‑cap tech exposure.

NVIDIA Corporation (NVDA) remains a top position at 5.3% $399.9M, but Maverick executed a notable “Reduce 27.61%”. The position size shows continued belief in NVIDIA’s GPU dominance, while the reduction likely reflects risk management and profit‑taking after a powerful run.

In fintech, Nu Holdings Ltd. (NU) stands at 4.5% of the book $336.1M with a modest “Reduce 3.44%” move. The small trim points to fine‑tuning rather than a change in thesis on the Latin American digital banking leader.

Semiconductors remain a key theme via Taiwan Semiconductor Manufacturing Company Limited (TSM), representing 3.8% of the portfolio at $284.7M. However, Maverick “Reduce 42.08%” here, a large cut that meaningfully de‑risks geopolitical and cyclical exposure while still keeping TSMC as a core chip manufacturing play.

One of the most eye‑catching moves is in transportation infrastructure: Union Pacific Corporation (UNP) is now 3.5% of assets $263.7M with an astonishing “Add 49,416.64%”. That magnitude indicates the position was effectively negligible last quarter and is now a serious stake, highlighting a strong, fresh conviction in railroads as durable, cash‑generative infrastructure.

Tobacco and staples exposure shows up via Philip Morris International Inc. (PM) at 3.5% $263.1M and an “Add 9.49%”, suggesting an appetite for high‑yield, cash‑rich defensives alongside growth. Financials exposure includes Capital One Financial Corporation (COF) at 3.1% $230.4M with a modest “Reduce 2.78%”, a small risk trim in consumer credit.

Defense and aerospace is represented by RTX Corporation (RTX), a 3.0% position worth $227.5M, tagged simply as “Buy”—indicating a new or meaningfully scaled‑up stake in a diversified defense contractor benefiting from higher global security spending.

Rounding out the key changes list, healthcare innovation is present through Natera, Inc. (NTRA) at 2.9% $214.5M with a “Reduce 10.54%”. Maverick is still keeping Natera as a sizable bet in diagnostics and genomics, but dialing back exposure after strong performance or shifting risk views.

Together, these 10–11 highlighted names demonstrate how the Maverick Capital portfolio blends mega‑cap tech, semiconductors, financials, railroads, tobacco, defense, and healthcare into a cohesive, actively managed growth‑plus‑quality strategy.

What the Portfolio Reveals About Maverick’s Current Strategy

Several themes stand out from Q3’2025 positioning and trades:

- High‑conviction in scalable tech platforms

- Balancing AI enthusiasm with risk control

- Infrastructure and real‑asset tilt

- A near‑zero to 3.5% ramp in UNP underscores a belief in railroads as essential infrastructure, offering pricing power, inflation pass‑through, and stable cash flows.

- Quality cash‑flow compounders and defensives

- Selective exposure to healthcare innovation

- Maintaining but trimming NTRA keeps Maverick levered to long‑term growth in diagnostics while managing near‑term execution and regulatory risk.

- Active risk management framework

- A 110.3% turnover and numerous Add/Reduce tags show that Ainslie continuously re‑sizes positions as fundamentals, valuations, and macro conditions evolve—this is a dynamic risk‑reward optimization approach, not static allocation.

Overall, the quarter’s moves show Maverick doubling down where visibility and competitive moats are strongest, while trimming exposures where valuations or risk concentrations may have stretched.

Portfolio Concentration Analysis

Using the disclosed top holdings:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Amazon.com, Inc. (AMZN) | $491.1M | 6.6% | Add 8.55% |

| Microsoft Corporation (MSFT) | $482.7M | 6.5% | Add 23.69% |

| NVIDIA Corporation (NVDA) | $399.9M | 5.3% | Reduce 27.61% |

| Nu Holdings Ltd. (NU) | $336.1M | 4.5% | Reduce 3.44% |

| Taiwan Semiconductor Manufacturing Company Limited (TSM) | $284.7M | 3.8% | Reduce 42.08% |

| Union Pacific Corporation (UNP) | $263.7M | 3.5% | Add 49,416.64% |

| Philip Morris International Inc. (PM) | $263.1M | 3.5% | Add 9.49% |

| Capital One Financial Corporation (COF) | $230.4M | 3.1% | Reduce 2.78% |

| RTX Corporation (RTX) | $227.5M | 3.0% | Buy |

These top positions alone sum to a significant slice of the $7,481.8M portfolio, consistent with the reported 42.7% weight in the top 10 overall. The 6.5–6.6% allocations to AMZN and MSFT illustrate Maverick’s willingness to let best ideas carry real portfolio impact, while keeping position sizes below double‑digit extremes common in more concentrated funds.

The presence of both cyclical and defensive elements—tech, semis, rail, tobacco, financials, defense—helps diversify factor exposures. Yet the simultaneous Add to AMZN/MSFT and Reduce in NVDA/TSM shows that even within a theme (AI, cloud, semis), Maverick is fine‑tuning which risk buckets it wants to overweight.

Investment Lessons from Lee Ainslie’s Maverick Strategy

Several takeaways for individual investors emerge from the Q3’2025 Maverick Capital portfolio:

- Concentrate in your true edge

- Maverick’s largest weights sit in businesses with durable moats and secular tailwinds (AMZN, MSFT, NVDA), reflecting deep research and comfort with their long‑term economics.

- Treat position sizing as a risk lever

- Blend growth with resilient cash flows

- Be willing to make big moves when conviction is high

- The 49,416.64% increase in UNP illustrates that when thesis clarity is strong, moving a name from negligible to core can materially shape future returns.

- Active doesn’t mean random

- A 110.3% turnover is high, but the pattern of Adds/Reduces suggests a structured process around valuation, risk, and thesis updates—not short‑term trading for its own sake.

Looking Ahead: What Comes Next for Maverick Capital?

Based on the current Maverick portfolio, several forward‑looking points stand out:

- AI and cloud remain central

- Scope to re‑add to semis on volatility

- Infrastructure and defense as structural themes

- Room for continued portfolio pruning

- With 203 holdings even after cutting 68 positions, Maverick still has ample scope to concentrate further or exit smaller names to free capital for top ideas.

Investors following Ainslie should watch future 13F filings for whether the fund continues to upsize rails and defense, rotates back into semis, or introduces new high‑conviction growth names to the top 10.

FAQ about Lee Ainslie – Maverick Capital Portfolio

Q: What were the most significant changes in Maverick’s Q3’2025 portfolio?

The biggest shifts include adding 23.69% to MSFT, adding 8.55% to AMZN, a massive 49,416.64% increase in UNP, and sharp reductions of 27.61% in NVDA and 42.08% in TSM.

Q: How concentrated is the Maverick Capital portfolio?

While Maverick holds 203 positions, the top 10 account for 42.7% of the $7,481.8M portfolio. This reflects a blend of broad diversification with a meaningful concentration in a handful of high‑conviction names at the top.

Q: Does Maverick follow a long‑term, low‑turnover strategy?

Not strictly. The average holding period is 4 quarters and turnover is 110.3%, indicating an active approach. Positions are held long enough for theses to play out, but resized or rotated as fundamentals, prices, and risks change.

Q: Which sectors or themes does Maverick emphasize right now?

Key themes include: - Mega‑cap tech and cloud (AMZN, MSFT)

- Semiconductors and AI infrastructure (NVDA, TSM)

- Financials and fintech (NU, COF)

- Transportation infrastructure (UNP)

- Defensive cash‑flow businesses and defense (PM, RTX)

- Healthcare innovation (NTRA)

Q: How can I track or follow Lee Ainslie’s Maverick Capital holdings?

You can monitor Maverick’s positions through quarterly 13F filings, which U.S. institutional managers must submit within 45 days of each quarter‑end. There is always a 45‑day reporting lag, so holdings may have changed since the filing date. For up‑to‑date visualizations, historical trends, and position‑level analysis, use the ValueSense superinvestor tracker at Maverick Capital’s portfolio page.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!