Leopold Aschenbrenner's AI Revolution Portfolio: A Deep Dive Into Situational Awareness LP's $1.5B Holdings

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Leopold Aschenbrenner, the 23-year-old former OpenAI researcher who predicted AGI by 2027, has taken Wall Street by storm with his hedge fund Situational Awareness LP. After leaving OpenAI and publishing his influential essay series "Situational Awareness: The Decade Ahead," Aschenbrenner founded what has become one of the most talked-about AI-focused hedge funds in the market.

The fund, which now manages over $1.5 billion in assets, gained an impressive 47% in the first half of 2024, significantly outperforming both the S&P 500 and traditional tech hedge funds. But what makes this portfolio so compelling? Let's dive deep into the holdings and strategy behind this AI revolution fund.

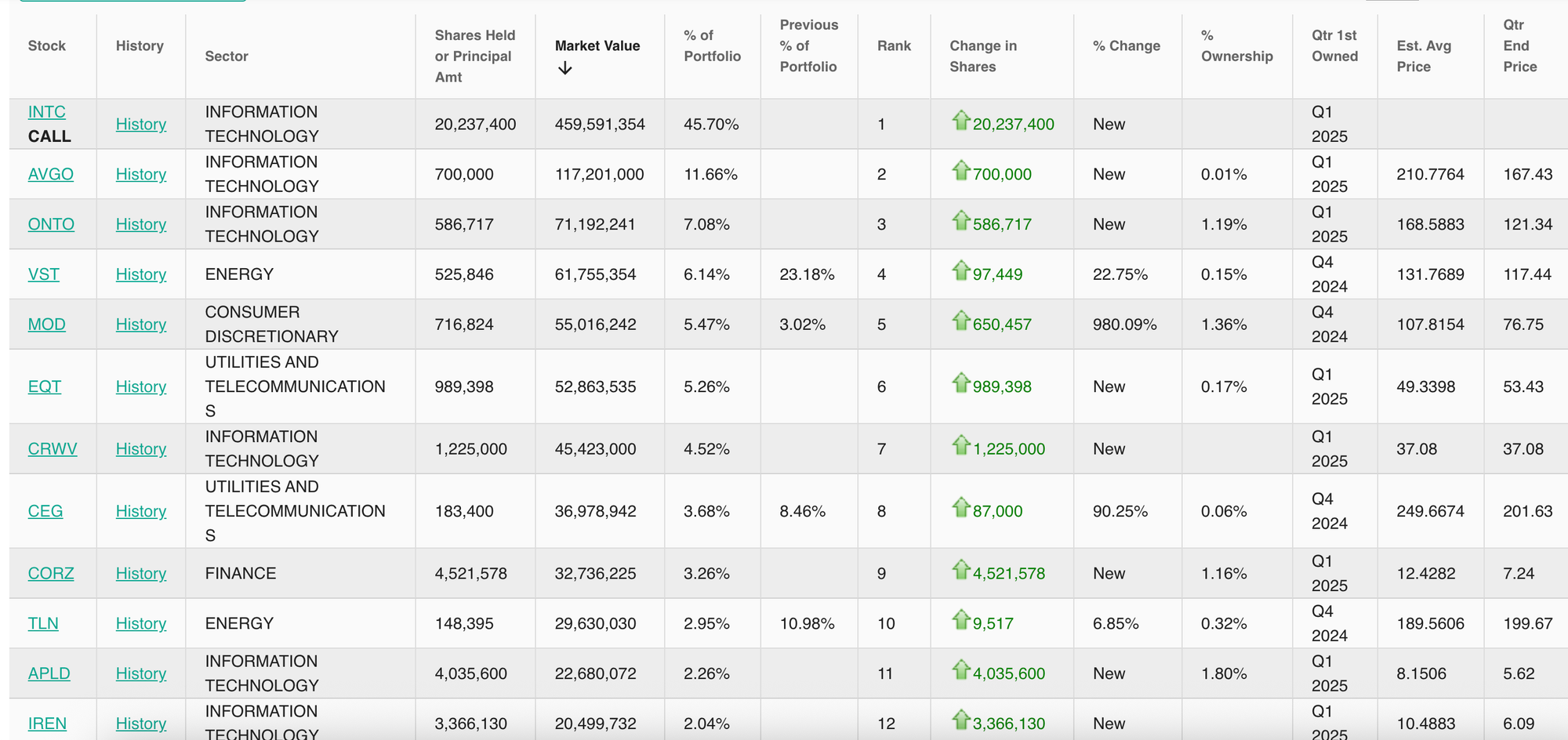

Portfolio Overview: Tech-Heavy, AI-Focused Strategy

Based on the latest 13F filings, Situational Awareness LP maintains a highly concentrated portfolio with 95.71% of assets concentrated in their top 10 holdings. This concentration reflects Aschenbrenner's conviction-based approach to investing in companies positioned to benefit from the AI revolution.

Top Holdings Breakdown

1. Intel Corporation (INTC) - 45.70% of Portfolio

- Position Size: 20,237,400 shares (including call options)

- Market Value: $459.6M

- Analysis: Despite Intel's recent struggles, Aschenbrenner sees significant value in the chipmaker's AI infrastructure potential

2. Broadcom Inc. (AVGO) - 11.66% of Portfolio

- Position Size: 700,000 shares

- Market Value: $117.2M

- Analysis: A clear bet on AI semiconductor infrastructure and data center acceleration

- Onto Innovation Inc. (ONTO) - 7.08% of Portfolio

- Position Size: 586,717 shares

- Market Value: $71.2M

- Analysis: Semiconductor process control equipment essential for advanced chip manufacturing

Fundamental Analysis: Quality Meets Value

Using ValueSense's proprietary analysis framework, we've evaluated the fundamental strength of Aschenbrenner's key holdings:

Financial Health Assessment

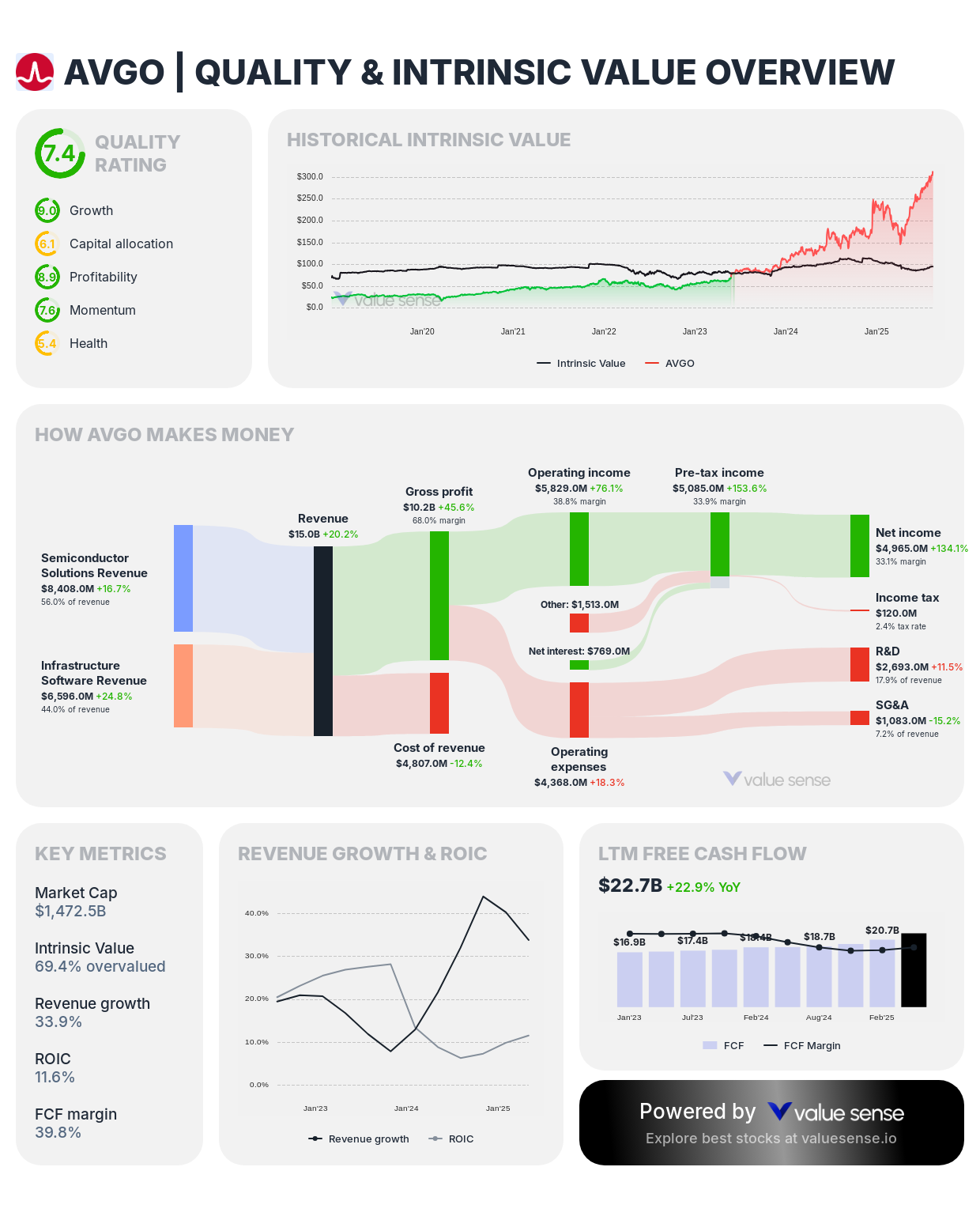

Broadcom (AVGO) - The Portfolio's Quality Champion

- Quality Rating: A+ (Green)

- Revenue: $57.0B with 33.9% growth

- Free Cash Flow: $22.7B (39.8% margin)

- Valuation: Currently trading at $95.7 intrinsic value vs. market price

- Key Strength: Exceptional cash generation and dominant market position in AI chips

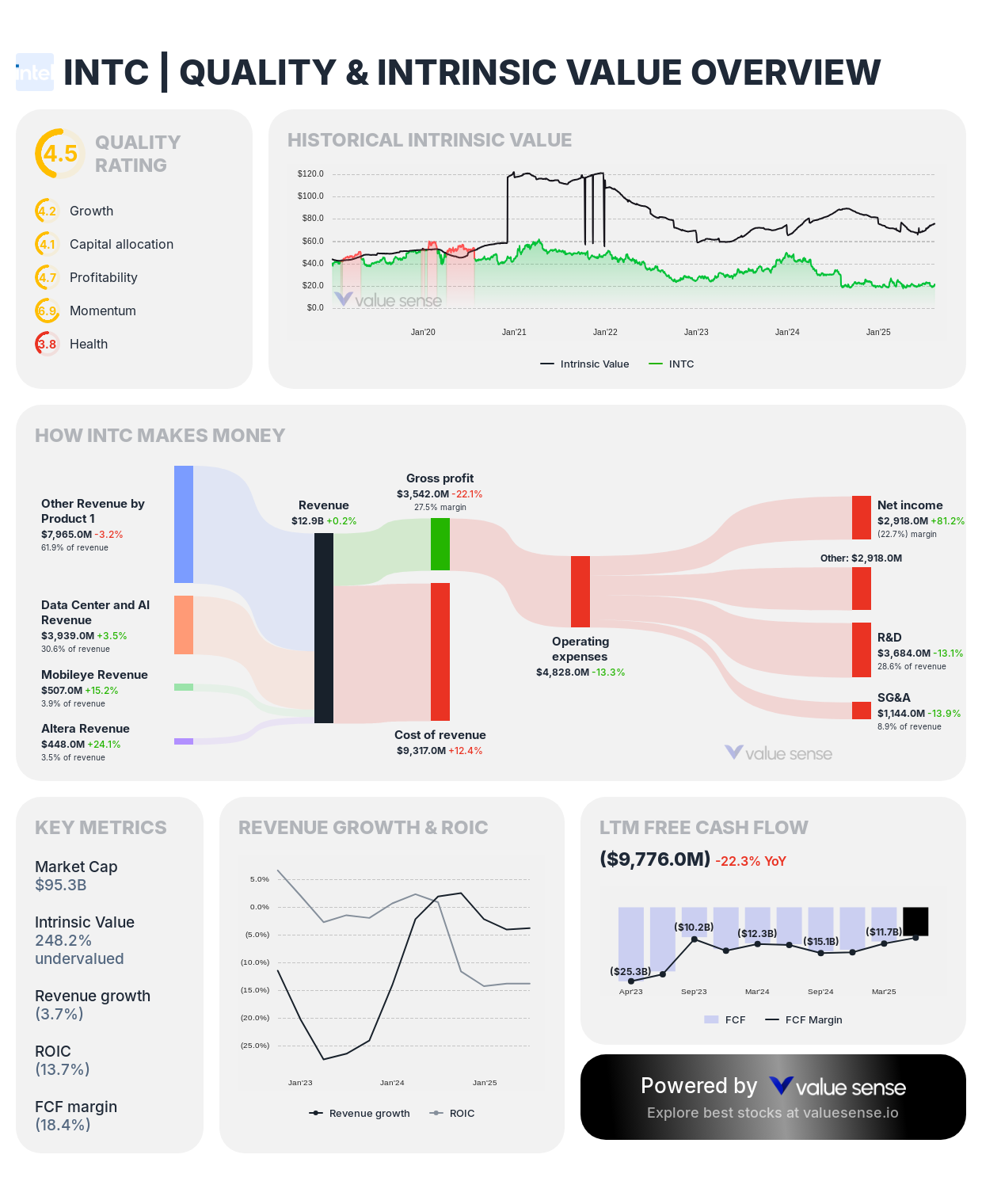

Intel (INTC) - The Contrarian Value Play

- Quality Rating: C+ (Yellow)

- Revenue: $53.1B with declining growth (-3.7%)

- Free Cash Flow: Negative $9.8B (concerning)

- Valuation: Significantly undervalued at $75.9 intrinsic value

- Investment Thesis: Turnaround potential in AI/data center markets despite current struggles

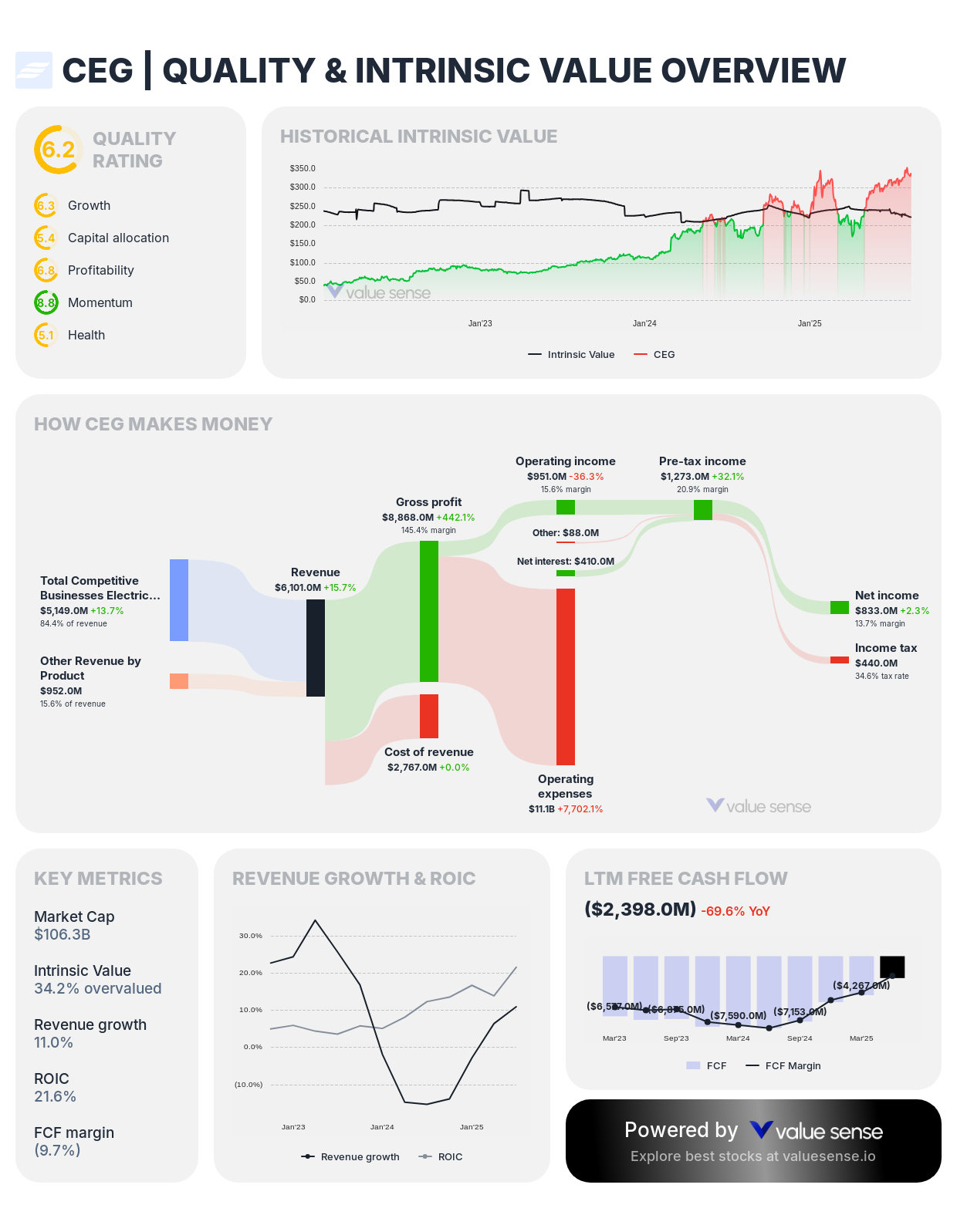

Constellation Energy (CEG) - The Clean Energy AI Play

- Quality Rating: C+ (Yellow)

- Revenue: $24.8B with 11.0% growth

- Free Cash Flow: Negative $2.4B

- Key Insight: Nuclear power positioning for AI data center energy demands

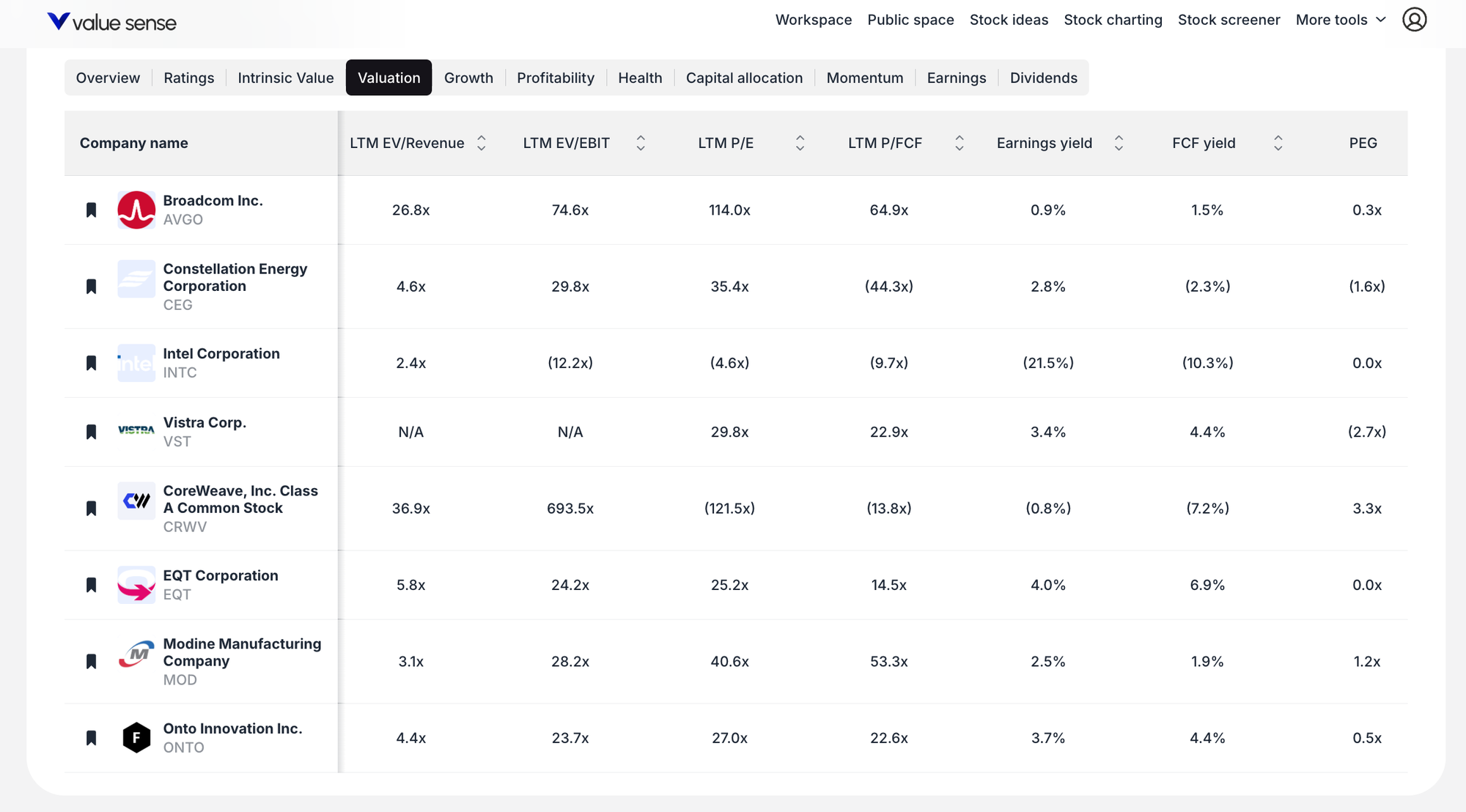

Valuation Metrics: Finding Alpha in AI Infrastructure

The portfolio shows interesting valuation characteristics across different methodologies:

Multiple Valuation Approaches

- DCF Analysis: Most holdings show potential undervaluation using discounted cash flow models

- Ben Graham Approach: Several positions meet traditional value investing criteria

- Peter Lynch Fair Value: Growth at reasonable price (GARP) characteristics evident

- Market-Implied Growth: High expectations built into current valuations

Key Valuation Insights

- AVGO: Premium valuation justified by superior fundamentals (26.8x EV/Revenue)

- INTC: Deep value opportunity with 2.4x EV/Revenue despite challenges

- ONTO: Reasonable valuation for semiconductor equipment exposure (4.4x EV/Revenue)

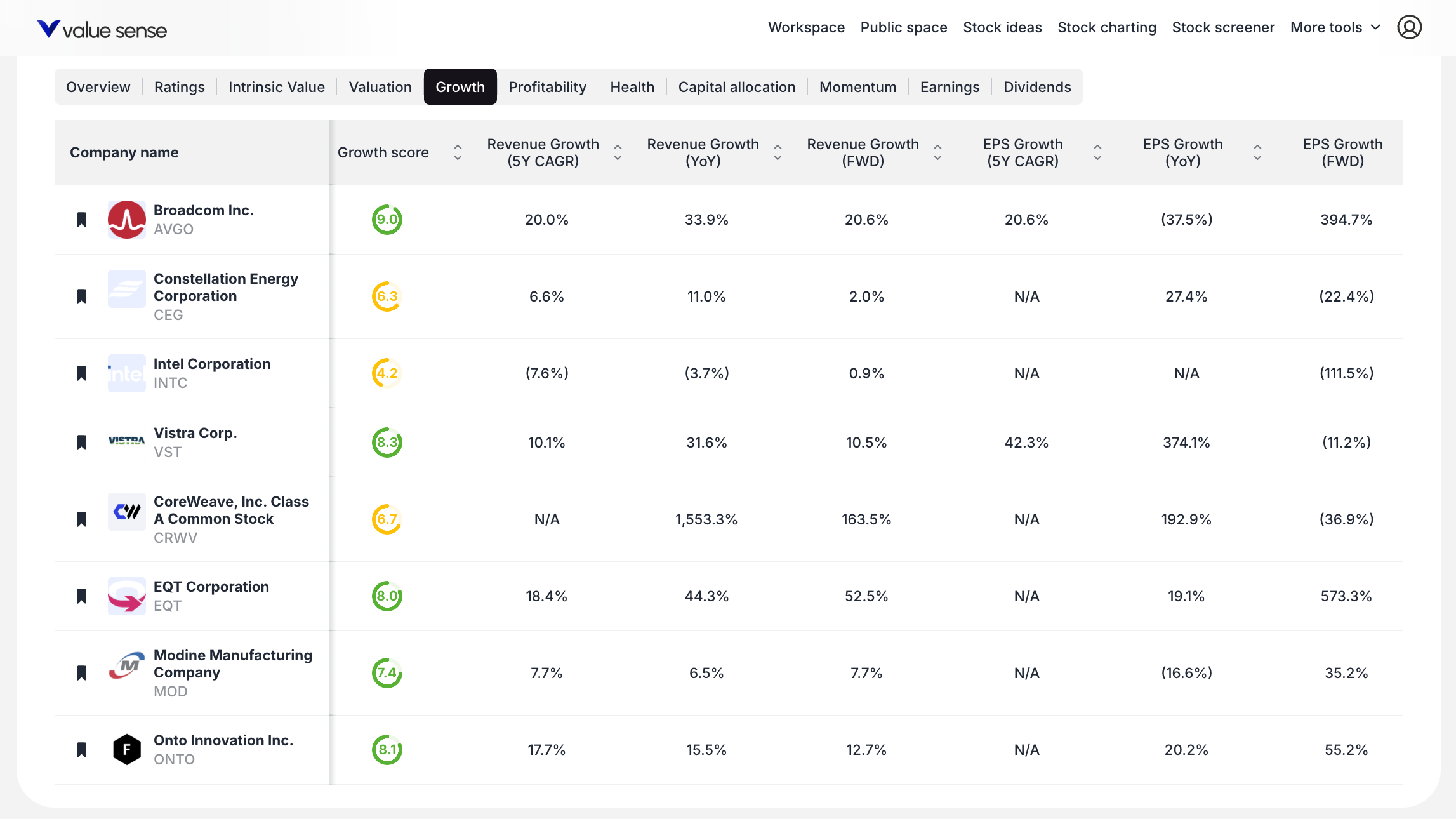

Growth Analysis: Betting on AI Infrastructure Expansion

The portfolio's growth characteristics align with Aschenbrenner's thesis on AI development:

Revenue Growth Patterns

- Broadcom: Exceptional 33.9% YoY revenue growth driven by AI chip demand

- Constellation Energy: Steady 11.0% growth as data centers require more power

- Vistra Corp: Outstanding 31.6% growth in energy infrastructure

Future Growth Projections

- EPS Growth: Mixed results with some positions showing cyclical challenges

- FCF Growth: Strong free cash flow generation in key holdings like Broadcom

- Market Positioning: All major holdings positioned for AI infrastructure buildout

Risk Assessment: Concentration and Sector Exposure

While the portfolio's performance has been impressive, several risk factors deserve attention:

Portfolio Risks

- Sector Concentration: Heavy technology and semiconductor exposure

- Cyclical Exposure: Many holdings sensitive to tech cycle fluctuations

- Intel Exposure: Nearly 46% allocation to a struggling chipmaker

Mitigation Factors

- Diversified AI Exposure: Holdings span chips, equipment, and infrastructure

- Quality Companies: Focus on market leaders with strong competitive positions

- Long-term Thesis: Positions aligned with multi-year AI development cycle

Investment Strategy: Conviction-Based AI Themes

Aschenbrenner's investment approach reflects several key themes:

Core Investment Themes

- Semiconductor Infrastructure: Intel, Broadcom, Onto Innovation

- AI Data Center Power: Constellation Energy, Vistra Corp

- Communication Infrastructure: EQT Corporation, CoreWeave exposure

- Manufacturing Equipment: Focus on companies enabling AI chip production

Strategic Positioning

The portfolio positioning suggests Aschenbrenner believes:

- Current AI infrastructure is inadequate for AGI development

- Significant capital investment required in chips, power, and data centers

- Market hasn't fully priced in the infrastructure investment needed

- Intel represents a compelling turnaround opportunity

Performance Attribution: What's Driving Returns

The fund's 47% first-half performance can be attributed to several factors:

Performance Drivers

- AI Infrastructure Thesis: Correctly identified infrastructure bottlenecks

- Timing: Positioned ahead of major AI infrastructure investments

- Concentration: High-conviction bets amplified successful picks

- Contrarian Positioning: Value found in out-of-favor names like Intel

Conclusion: A Portfolio Built for the AI Future

Leopold Aschenbrenner's Situational Awareness LP represents more than just another tech-focused hedge fund. It's a carefully constructed bet on the infrastructure requirements for achieving AGI by 2027, as outlined in his influential essay series.

The portfolio's concentration in AI infrastructure companies—from semiconductor manufacturers to power generators—reflects deep conviction in the massive capital requirements for advanced AI development. While the heavy concentration in Intel represents significant risk, the overall positioning appears well-aligned with the multi-trillion-dollar AI infrastructure buildout ahead.

Key Takeaways for Investors

- Infrastructure Focus: The portfolio prioritizes AI infrastructure over consumer AI applications

- Value Opportunities: Finding undervalued assets in the AI supply chain

- Long-term Vision: Positioning for 2027 AGI timeline requires infrastructure today

- High Conviction: Concentrated bets on carefully selected themes

As Aschenbrenner continues to execute his vision for the "decade ahead," Situational Awareness LP stands as one of the most interesting case studies in thematic investing. The fund's performance will serve as a real-time test of whether the infrastructure requirements for AGI development are as significant—and profitable—as predicted.

This analysis is based on publicly available 13F filings and ValueSense fundamental analysis. Portfolio allocations and performance data reflect the most recent available information. Past performance does not guarantee future results.

About ValueSense: ValueSense provides institutional-grade fundamental analysis and portfolio insights for professional investors. Our platform combines traditional value investing principles with modern quantitative analysis to identify investment opportunities across global markets.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 11 Best High Free Cash Flow Stocks

📖 10 Best Undervalued Dividend Stocks

📖 11 Best Multibagger Stocks with Heavy Moats