Li Lu - Himalaya Capital Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

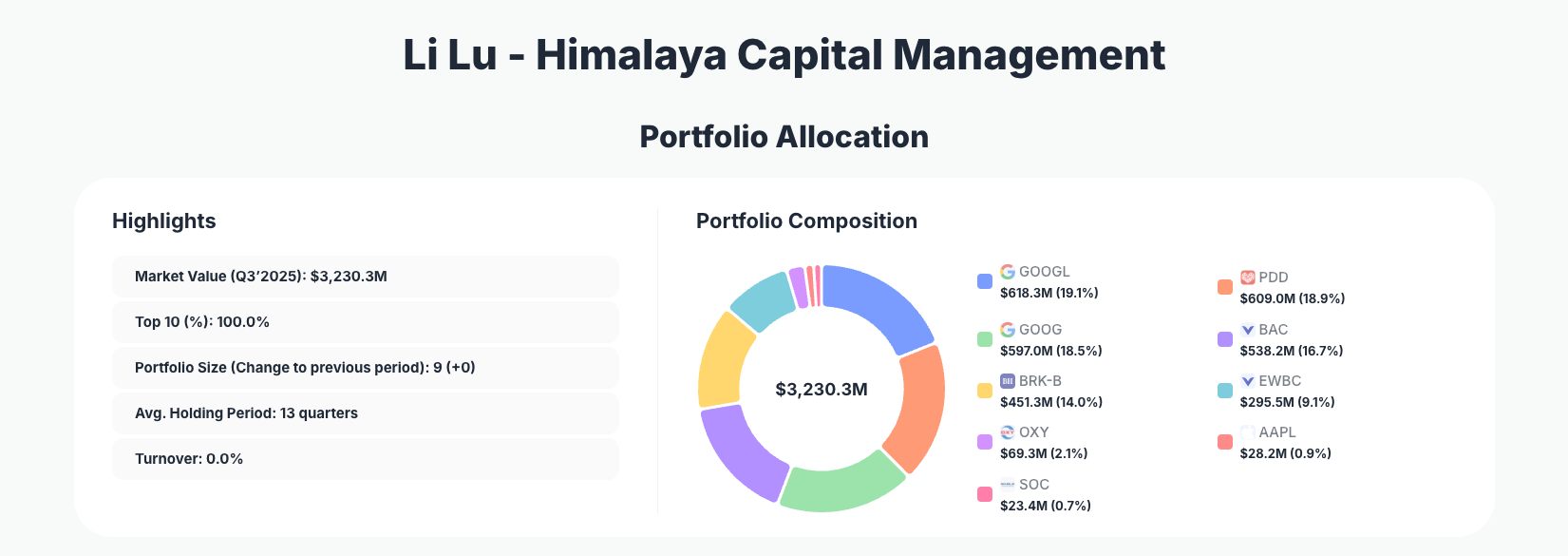

Li Lu - Himalaya Capital Management once again underscores his reputation for concentrated, long-term value investing. His Q3’2025 portfolio shows $3.23 billion deployed across just nine positions, with zero turnover and a 100% allocation in the top 10 holdings—an extreme expression of conviction that stands in stark contrast to typical institutional diversification.

Explore Li Lu – Himalaya Capital live portfolio on ValueSense

Portfolio Overview: Concentrated Patience in Action

Portfolio Highlights (Q3’2025): - Market Value: $3,230.3M

- Top 10 Holdings: 100.0%

- Portfolio Size: 9 +0

- Average Holding Period: 13 quarters

- Turnover: 0.0%

The latest 13F shows that Himalaya Capital’s portfolio remains fully concentrated: nine positions, all of which sit inside the top-10 bucket and together account for 100% of reported equity exposure. There were no new buys, no sales, and no position-size adjustments in Q3’2025, reinforcing Li Lu’s discipline in letting carefully selected businesses compound over many years.

With an average holding period of 13 quarters, this portfolio is more akin to a collection of long-term business partnerships than a trading book. The 0.0% turnover is especially notable in a volatile macro environment, signaling that Himalaya Capital’s investment theses are anchored in structural fundamentals rather than short-term market sentiment.

Such concentration amplifies both upside and downside: when only nine names make up the entire portfolio, security selection and entry prices matter enormously. At the same time, it reflects deep conviction that each holding possesses durable competitive advantages, capable management, and long runways for reinvestment.

Top Holdings: Big Tech, Chinese Platforms, and Financial Powerhouses

While there were no changes this quarter (the action field is “No change” across all reported top-10 holdings), the composition itself reveals a clear strategic pattern. The core of the portfolio is split between dominant global technology platforms, leading financial institutions, and select energy and niche plays.

The largest position is Alphabet’s class A shares, with Alphabet Inc. (GOOGL) representing 19.1% of the portfolio at $618.3M. These voting shares are paired with a nearly equal allocation to the non-voting class C shares: Alphabet Inc. (GOOG) accounts for 18.5% at $597.0M. Together, Alphabet exposure sits just below 40% of assets, highlighting Himalaya’s conviction in the company’s entrenched position in search, advertising, and cloud services.

The second major pillar is Chinese e-commerce and platform exposure via PDD Holdings Inc. (PDD), which makes up 18.9% of the portfolio with $609.0M invested. This position sits almost shoulder-to-shoulder with Alphabet in weight, suggesting Li Lu views PDD as a core long-term compounder within China’s evolving consumer internet landscape.

Financials are the next major cluster. Bank of America Corporation (BAC) commands 16.7% of assets at $538.2M, providing exposure to a systemically important U.S. bank with scale, deposit funding strength, and significant leverage to interest-rate cycles. Complementing this is a substantial stake in Berkshire Hathaway Inc. (BRK-B) at 14.0% and $451.3M—effectively a “meta-holding” that encapsulates a diversified collection of operating companies and investments, many of which align philosophically with Li Lu’s own approach.

Within regional banking, East West Bancorp, Inc. (EWBC) holds a meaningful 9.1% allocation at $295.5M. Its niche in cross-border banking and strong balance sheet characteristics make it a differentiated financial holding in the portfolio.

Energy exposure is more modest but still deliberate. Occidental Petroleum Corporation (OXY) represents 2.1% of the portfolio at $69.3M, providing a measured stake in upstream energy and commodity price optionality without dominating overall risk.

Finally, two smaller but notable positions round out the book. Apple Inc. (AAPL) accounts for 0.9% at $28.2M—tiny relative to most superinvestors’ Apple stakes but still a nod to the company’s ecosystem strength. Sable Offshore Corp. (SOC) stands at 0.7% and $23.4M, likely reflecting a more targeted, opportunistic idea in energy/offshore assets rather than a core pillar of the portfolio.

Because holdings_with_changes is empty this quarter, all of the above positions are unchanged, emphasizing that the story of Q3’2025 is stability, not activity.

What the Portfolio Reveals About Li Lu’s Current Strategy

Several strategic themes stand out from the Q3’2025 positioning:

- Extreme concentration in a handful of compounders

With approximately 40% in Alphabet (GOOGL + GOOG) and nearly 19% in PDD, the portfolio is built around a few high-conviction bets rather than broad sector diversification. - Blend of U.S. and Chinese champions

The combination of Alphabet, PDD, Bank of America, Berkshire, and East West Bancorp shows a willingness to allocate capital across geographies where Li Lu sees durable competitive advantages and attractive risk–reward profiles. - Financials as core ballast

The sizable allocations to BAC, BRK-B, and EWBC suggest a belief that strong financial institutions, purchased at reasonable valuations, can compound value across cycles while providing some diversification against pure tech growth risk. - Measured exposure to energy cyclicality

Positions in OXY and SOC introduce commodity and cash-flow cyclicality, likely as a hedge against inflation and to capture upside when energy markets tighten. - Emphasis on time in the market over timing the market

A 13-quarter average holding period and 0.0% turnover reflect a commitment to long-term compounding rather than reacting to short-term volatility or headlines.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Alphabet Inc. (GOOGL) | $618.3M | 19.1% | No change |

| PDD Holdings Inc. (PDD) | $609.0M | 18.9% | No change |

| Alphabet Inc. (GOOG) | $597.0M | 18.5% | No change |

| Bank of America Corporation (BAC) | $538.2M | 16.7% | No change |

| Berkshire Hathaway Inc. (BRK-B) | $451.3M | 14.0% | No change |

| East West Bancorp, Inc. (EWBC) | $295.5M | 9.1% | No change |

| Occidental Petroleum Corporation (OXY) | $69.3M | 2.1% | No change |

| Apple Inc. (AAPL) | $28.2M | 0.9% | No change |

| Sable Offshore Corp. (SOC) | $23.4M | 0.7% | No change |

The table makes clear how top-heavy Himalaya Capital’s equity book is. The top five positions—GOOGL, PDD, GOOG, BAC, and BRK-B—collectively represent 87.2% of the portfolio by value. The remaining four holdings share just under 13%, with the smallest positions under 1% each.

Such concentration means that performance will be driven primarily by the fortunes of Alphabet, PDD, Bank of America, Berkshire, and East West Bancorp. For investors studying the Himalaya portfolio, this is both a roadmap of where Li Lu sees the most attractive long-term risk–reward and a reminder that his approach is not designed to mimic an index.

Investment Lessons from Li Lu and Himalaya Capital

There are several practical takeaways for investors analyzing the Li Lu – Himalaya Capital approach:

- Concentrate when you truly understand the businesses

Allocating nearly 40% to Alphabet and close to 19% to PDD shows that size follows conviction, not arbitrary diversification rules. - Holding periods matter more than quarterly noise

A 13-quarter average holding period and 0.0% turnover demonstrate a willingness to sit through volatility as long as the business thesis remains intact. - Quality and competitive advantage justify patience

The focus on dominant platforms (Alphabet, PDD), scale financials (BAC, BRK-B, EWBC), and strategic energy bets underscores the importance of moats, management, and reinvestment opportunities. - Position sizing is a strategic tool, not an afterthought

The stark contrast between large core positions and tiny allocations to AAPL and SOC illustrates how Himalaya differentiates between foundational holdings and opportunistic or smaller ideas. - Inactivity can be a sign of strength, not neglect

Zero changes in a quarter does not mean a lack of work; it often indicates that the best opportunity remains in doing nothing when existing holdings remain attractively valued.

Looking Ahead: What Comes Next?

Because Q3’2025 saw no reported changes, the forward-looking story centers on how these existing positions might fare:

- Alphabet (GOOGL/GOOG)

Future returns will hinge on continued dominance in digital advertising, growth in Google Cloud, and disciplined capital allocation. Regulatory risks and AI competition remain key watchpoints, but Li Lu’s large allocation signals confidence in Alphabet’s ability to adapt. - PDD Holdings (PDD)

As Chinese consumer and platform dynamics evolve, PDD’s growth, profitability trajectory, and regulatory environment will be critical. The large allocation suggests Li Lu believes the market underestimates its long-term earnings power. - Financials cluster (BAC, BRK-B, EWBC)

Interest-rate regimes, credit cycles, and capital-return policies (buybacks, dividends) will materially influence these positions. A resilient U.S. economy with controlled credit losses would be supportive for this bucket of the portfolio. - Energy exposure (OXY, SOC)

These holdings are leveraged to commodity prices, capital discipline, and any structural supply–demand imbalances. They may function as partial hedges if inflation or geopolitical tensions pressure broader markets.

Given the unchanged positioning and long average holding period, it would not be surprising if future 13F filings continue to show only occasional, high-conviction adjustments rather than frequent trading.

FAQ about Li Lu – Himalaya Capital Portfolio

Q: Were there any changes in Li Lu’s Q3’2025 portfolio?

A: No. The Q3’2025 13F for Himalaya Capital’s portfolio reports 0.0% turnover and “No change” for all top-10 holdings, indicating no buys, sells, or position-size adjustments this quarter.

Q: How concentrated is Li Lu’s portfolio?

A: Extremely concentrated. There are only 9 positions, all within the top 10 bucket, representing 100.0% of the reported equity portfolio. The top five holdings alone account for over 85% of total assets.

Q: What is Li Lu’s effective holding period and strategy?

A: The average holding period is 13 quarters, signaling a long-term, business-owner mindset. Rather than trading frequently, Li Lu appears to focus on buying a small set of high-conviction companies and holding them through multiple market cycles.

Q: Which sectors or themes dominate the portfolio?

A: The portfolio is anchored by global technology and internet platforms (GOOGL, GOOG, PDD), major financial institutions (BAC, BRK-B, EWBC), and selective energy names (OXY, SOC).

Q: How can I track Li Lu’s future portfolio changes?

A: Li Lu’s U.S. equity holdings are disclosed via quarterly 13F filings, which are typically reported with a 45-day lag after quarter-end. You can follow all updates, historical holdings, and visualizations on ValueSense’s dedicated superinvestor page for Himalaya Capital at https://valuesense.io/superinvestors/himalaya.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!