Louis Moore Bacon - Moore Capital Management, Lp Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

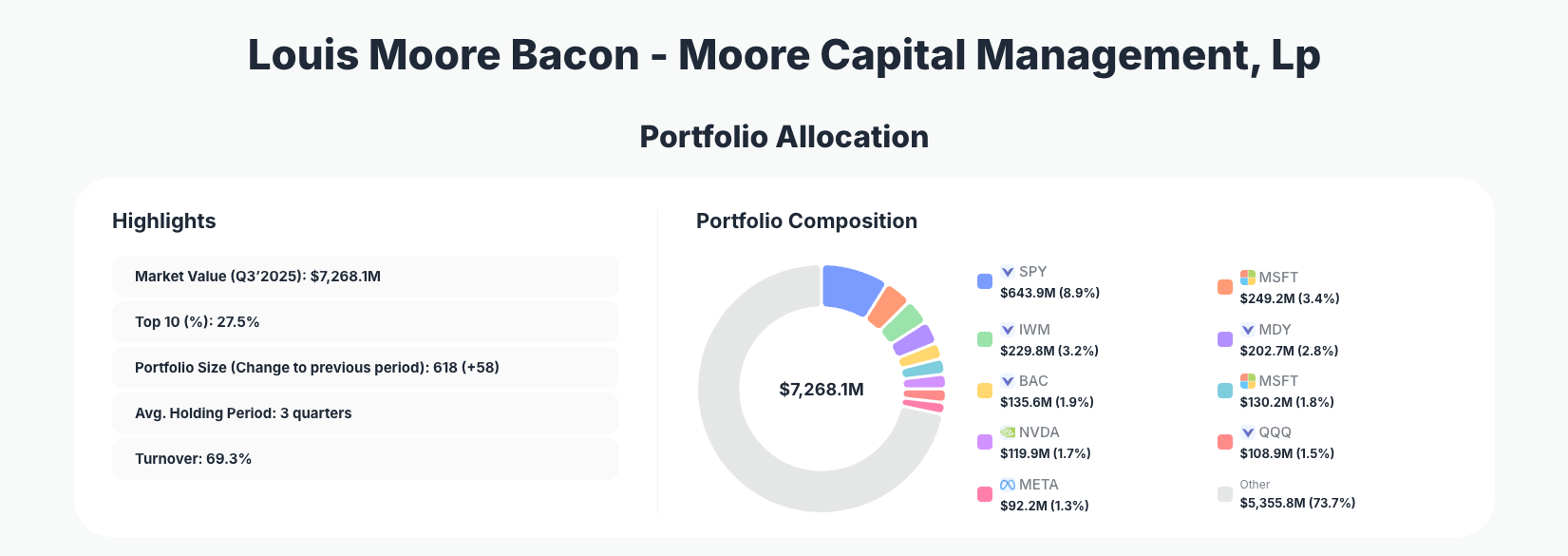

Louis Moore Bacon, the legendary macro trader behind Moore Capital Management, showcases his signature high-turnover, opportunistic style in the latest 13F filing. His $7.3B Q3 2025 portfolio reflects aggressive repositioning amid market volatility, with massive ETF builds, selective tech additions like MSFT, and trims in high-flyers such as NVDA, all within an expansive 618-position universe.

Portfolio Snapshot: High Turnover in a Diversified Powerhouse

Portfolio Highlights (Q3 2025): - Market Value: $7,268.1M - Top 10 Holdings: 27.5% - Portfolio Size: 618 +58 - Average Holding Period: 3 quarters - Turnover: 69.3%

This Moore Capital portfolio stands out for its sheer scale and dynamism, managing over $7.2 billion across 618 positions—a net addition of 58 new names quarter-over-quarter. The top 10 holdings represent just 27.5% of the portfolio, signaling a highly diversified approach that contrasts with concentrated superinvestor peers. With an average holding period of only 3 quarters and a blistering 69.3% turnover, Louis Bacon's strategy emphasizes tactical flexibility over long-term conviction, likely reflecting his macro trading roots where positioning adapts swiftly to global economic shifts.

The portfolio's expansion to 618 holdings underscores a broad opportunity set, blending broad-market ETFs with individual names in tech and financials. This structure allows for precise risk allocation while maintaining liquidity through ETF exposure. High turnover at 69.3% indicates active management, with significant capital rotation into market proxies amid uncertain conditions, as seen in the Q3 updates.

Top Positions Breakdown: ETF Surge Meets Tech Rebalancing

The portfolio's changes paint a picture of strategic pivots, starting with the standout SPDR S&P 500 ETF TR at 8.9% after an explosive Add 808.97%, positioning $643.9M for broad market upside. Microsoft appears twice in flux: a new Add 16.50% tranche at 3.4% $249.2M alongside a Reduce 47.77% in another MSFT slice at 1.8% $130.2M, netting nuanced exposure to the tech giant. ISHARES TR follows with Add 528.61% to 3.2% $229.8M, complemented by yet another ISHARES TR Add 123.73% at 1.2% $89.4M, amplifying passive indexing bets.

Trims balance the aggression: SPDR S&P MIDCAP 400 ETF TR at 2.8% $202.7M after Reduce 46.35%, while Bank of America (BAC) edges up with Add 2.17% to 1.9% $135.6M. NVIDIA (NVDA) sees Reduce 30.40% to 1.7% $119.9M, INVESCO QQQ TR surges with Add 262.80% to 1.5% $108.9M, and Meta Platforms (META) grows via Add 24.56% to 1.3% $92.2M. These moves highlight a tilt toward liquid ETFs for core exposure, selective financial adds, and profit-taking in mega-cap tech.

What the Portfolio Reveals About Bacon's Macro Playbook

Louis Bacon's Q3 moves reveal a tactical macro mindset, blending broad-market hedges with opportunistic equity bets: - ETF Dominance for Liquidity: Massive adds in S&P 500, midcap, iShares, and QQQ ETFs (over 15% combined) suggest hedging against volatility while maintaining upside capture. - Tech Sector Rotation: Dual MSFT positions, NVDA trim, and META add indicate profit-taking in AI leaders while doubling down on software stability. - Financials as Value Anchor: BAC addition points to banking resilience amid rate uncertainty. - High Diversification for Risk Control: 618 positions mitigate single-name risk in a high-turnover 69.3% framework. - Short Holding Periods: 3-quarter average reflects event-driven trades over buy-and-hold.

This setup prioritizes adaptability, using ETFs for beta exposure and stocks for alpha in a fragmented market.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| SPDR S&P 500 ETF TR | $643.9M | 8.9% | Add 808.97% |

| Microsoft Corporation | $249.2M | 3.4% | Add 16.50% |

| ISHARES TR | $229.8M | 3.2% | Add 528.61% |

| SPDR S&P MIDCAP 400 ETF TR | $202.7M | 2.8% | Reduce 46.35% |

| Bank of America Corporation | $135.6M | 1.9% | Add 2.17% |

| Microsoft Corporation | $130.2M | 1.8% | Reduce 47.77% |

| NVIDIA Corporation | $119.9M | 1.7% | Reduce 30.40% |

| INVESCO QQQ TR | $108.9M | 1.5% | Add 262.80% |

| Meta Platforms, Inc. | $92.2M | 1.3% | Add 24.56% |

The table underscores Moore Capital's low concentration, with the top position—SPDR S&P 500 ETF TR—at just 8.9% despite an 808.97% surge, and top 10 totaling only 27.5%. This diffused structure suits Bacon's macro style, avoiding over-reliance on any single bet amid 69.3% turnover. ETF-heavy top ranks provide efficient market access, while trims in NVDA and one MSFT slice demonstrate disciplined profit-taking, balancing growth with midcap and financial diversification.

Investment Lessons from Louis Bacon's Macro Mastery

- Embrace High Turnover for Adaptability: 69.3% turnover and 3-quarter holds teach that rigid positions lose to evolving markets—stay nimble.

- Leverage ETFs for Core Exposure: Explosive adds in S&P 500 and QQQ show how proxies deliver beta without stock-picking risk.

- Rotate Within Winners: Dual MSFT moves (add one, trim another) highlight fine-tuning over wholesale exits.

- Diversify Aggressively: 618 positions across ETFs and stocks manage risk in uncertain macro environments.

- Time Trims Ruthlessly: 30-47% reductions in NVDA and MSFT prove locking gains preserves capital.

Looking Ahead: What Comes Next?

With 618 positions and high turnover, Moore Capital appears primed for further rotation, potentially deploying into volatility-spiking areas like energy or emerging markets if macro signals shift. The ETF buildup suggests cash readiness for opportunistic strikes, while tech trims free capital for undervalued cyclicals. In a 2026 landscape of potential rate cuts and AI digestion, current positioning—broad beta via S&P/QQQ plus BAC stability—sets up for resilient returns, monitoring for new 13F reveals on Moore Capital's page.

FAQ about Louis Bacon's Moore Capital Portfolio

Q: What drove the massive ETF additions like SPDR S&P 500's 808.97% increase?

A: These moves signal a defensive pivot to broad-market exposure amid volatility, allowing low-cost beta capture while freeing resources for tactical stock bets—classic Bacon macro hedging.

Q: Why the high 69.3% turnover and 618 positions— is concentration not key?

A: Bacon's style favors diversification and frequent trades over conviction bets, using scale to spread risk across global opportunities rather than ultra-concentrated wagers.

Q: What explains the mixed Microsoft signals (add 16.50%, reduce 47.77%)?

A: Likely portfolio rebalancing: building fresh exposure while trimming legacy positions, optimizing tax efficiency or conviction levels in a key tech holding.

Q: How does NVDA's 30.40% reduction fit Bacon's tech view?

A: Profit-taking after AI run-up, redirecting to META adds and ETFs—shows selective growth rotation without abandoning tech.

Q: How can I track Louis Bacon's Moore Capital portfolio?

A: Follow quarterly 13F filings on the SEC (45-day lag post-quarter-end) via ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/moore-capital for real-time analysis, visualizations, and change alerts.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!