Fortress Balance Sheets: The Best Low-Debt Companies (October 2025)

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

As borrowing costs remain elevated and economic uncertainty lingers, investors turn toward companies with ultra-strong balance sheets and minimal debt. In October 2025, the top global innovators in tech, manufacturing, and AI distinguish themselves with low total debt to equity, high cash ratios, and the financial flexibility to withstand macro shocks and pursue aggressive growth. Below, we profile these leaders with key metrics and qualitative insights.

Why It Matters

Low debt-to-equity ratios signal financial resilience. These companies are less exposed to interest rate risks, have higher flexibility during downturns, and can deploy their operating cash to seize growth opportunities—rather than pay down liabilities. Investors prize such stocks for stable capital returns and downside protection.

Low Debt Standouts: Quality, Metrics, and Competitive Edge

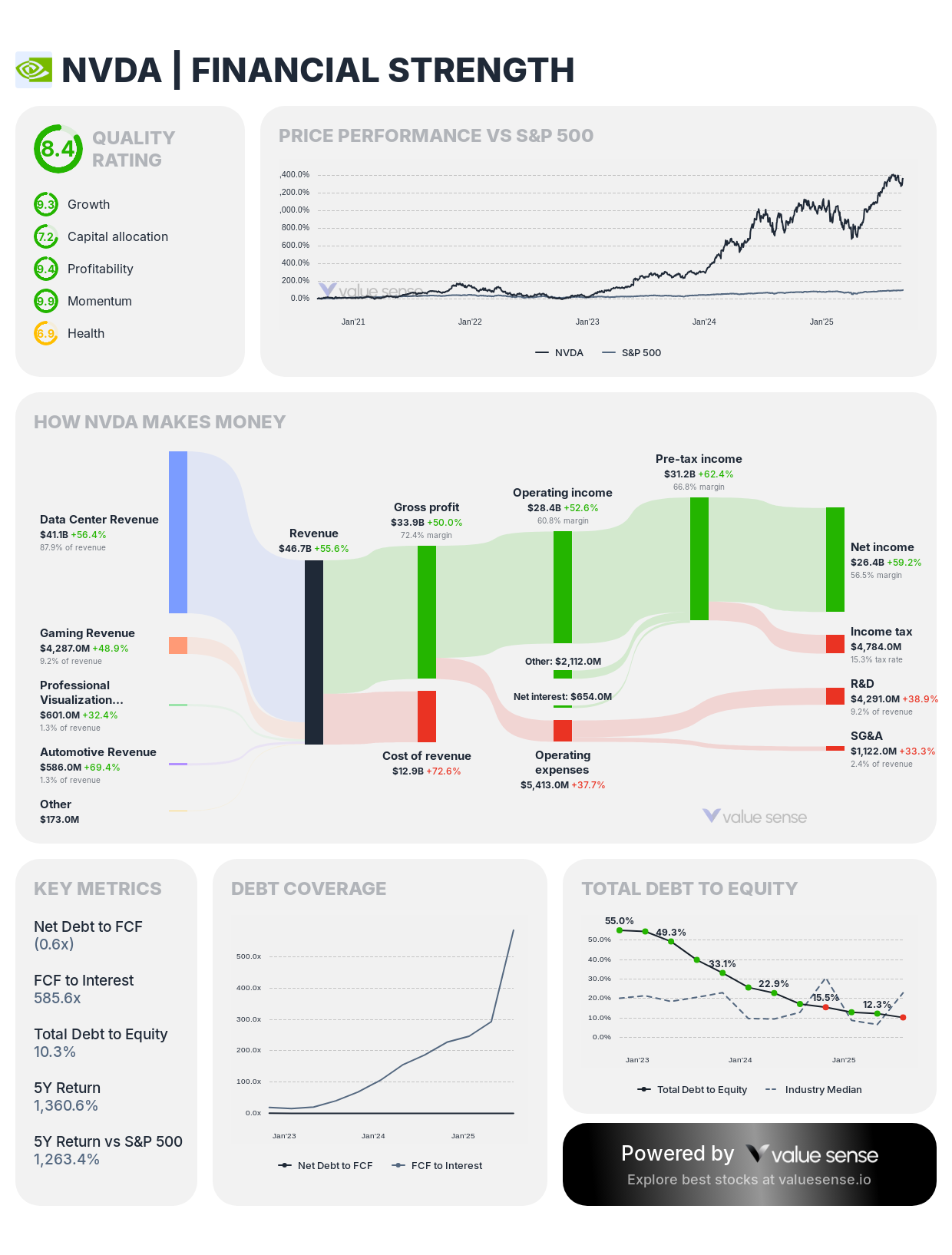

NVIDIA Corporation (NVDA)

- Total Debt/Equity: 10.6%

- Liquidity: Current ratio 4.2x, quick ratio 3.5x

- Net Debt to FCF: (0.6x)

- FCF to Interest: 291.6x

- Key Value: NVIDIA’s cutting-edge AI dominance is powered by superb cash flow and negligible leverage—making it the blueprint for tech resilience.

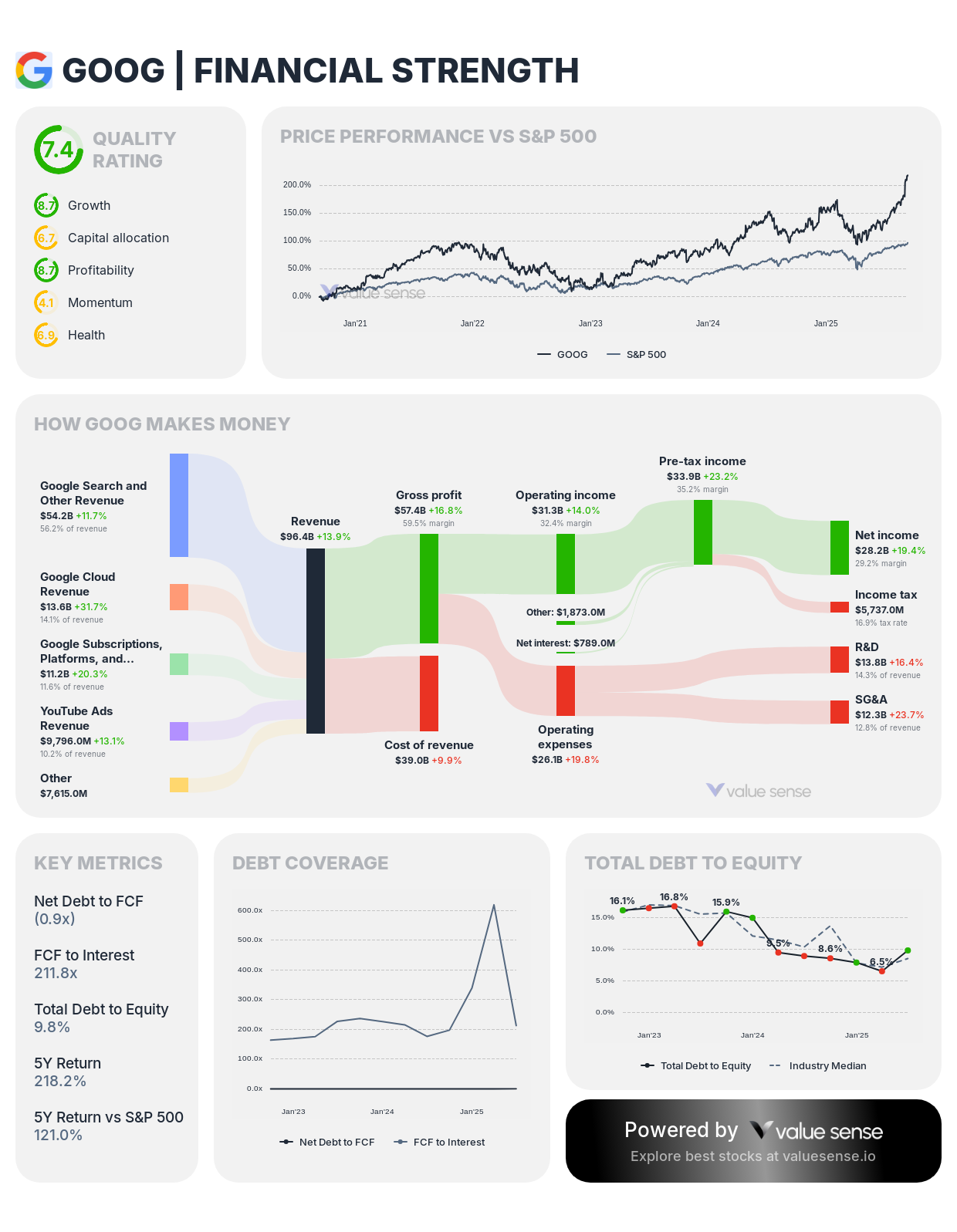

Alphabet Inc. (GOOG, GOOGL)

- Total Debt/Equity: 9.8–11.5%

- Liquidity: Current ratio 1.9x, quick ratio 1.7x

- Net Debt to FCF: (0.9x)/(0.8x)

- FCF to Interest: 211.8x (GOOG)/166x (GOOGL)

- Key Value: Google’s fortress cash position lets it invest continuously in R&D, maintain market dominance, and pursue strategic buybacks with little credit risk.

Taiwan Semiconductor Manufacturing Co. (TSMC)

- Total Debt/Equity: 0.0%

- Liquidity: Quick ratio 2.1x, net debt to FCF (3.5x)

- FCF to Interest: 284.7x

- Key Value: The vital chip supplier for the world’s technology operates entirely debt-free, safely funding massive CAPEX with operating profits.

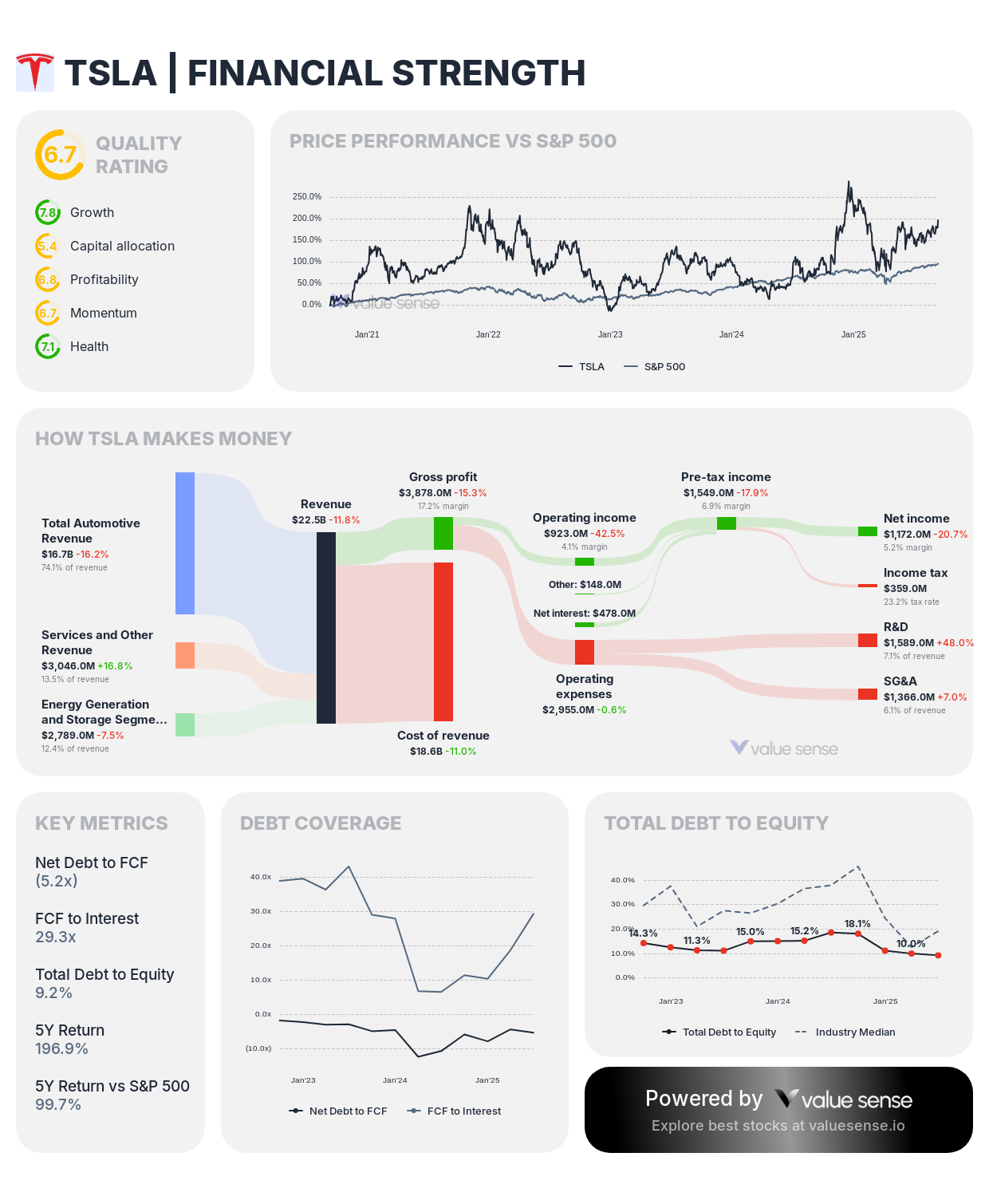

Tesla, Inc. (TSLA)

- Total Debt/Equity: 9.2%

- Liquidity: Current ratio 2.0x, quick ratio 1.4x

- Net Debt to FCF: (5.2x)

- FCF to Interest: 29.3x

- Key Value: Tesla continues to scale globally with strong cash metrics and remarkably low leverage, staying flexible in a competitive industry.

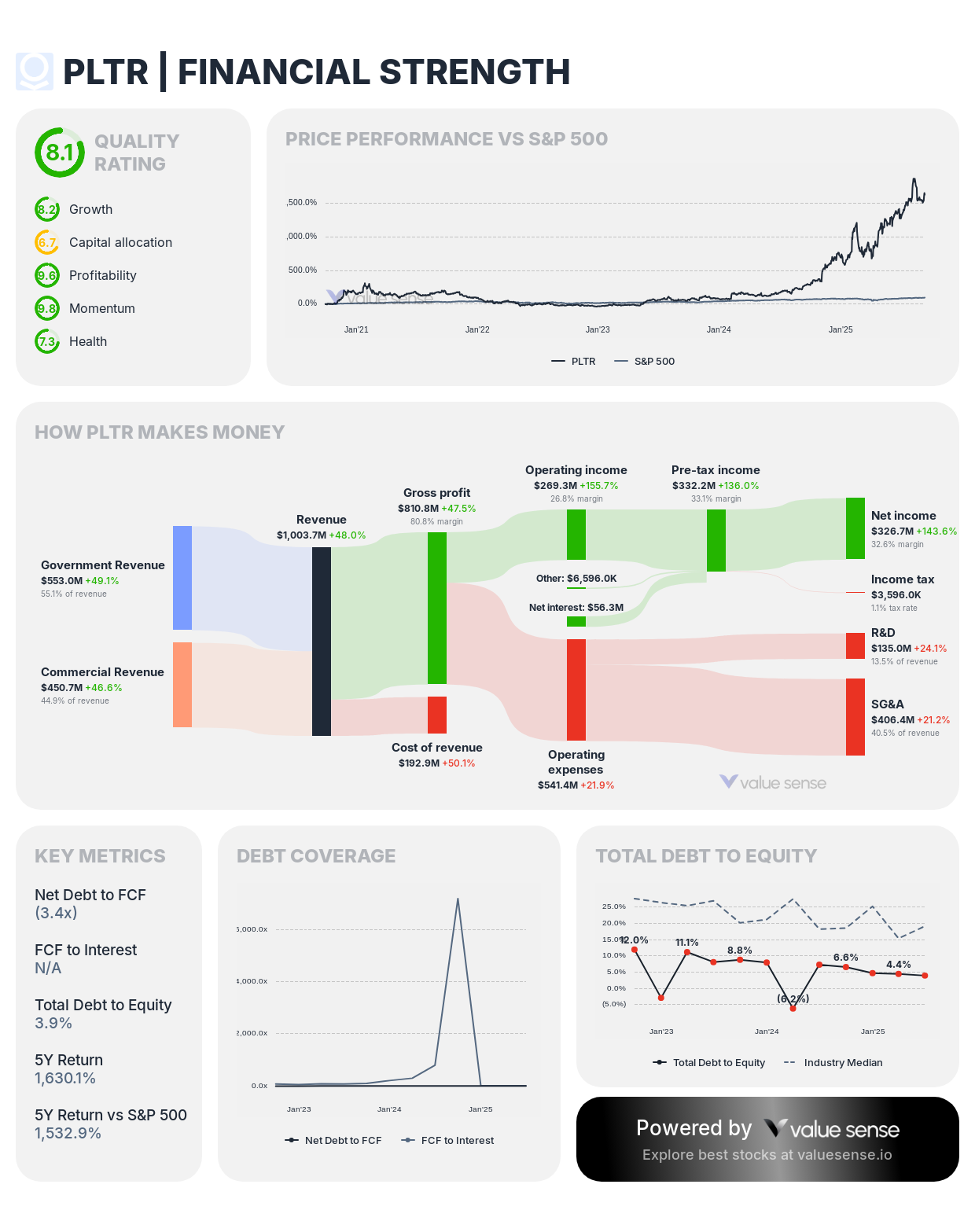

Palantir Technologies (PLTR)

- Total Debt/Equity: 3.9%

- Liquidity: Current ratio 6.3x, quick ratio 6.2x, net debt to FCF (3.4x)

- Key Value: Big-data software pureplay Palantir operates with almost no financial leverage, giving it the runway to invest aggressively in AI.

Additional Financially Strong Name

- Microsoft (MSFT): Debt to equity 17.6%, net debt/FCF (0.5x), high liquidity, steady capital returns.

- Costco Wholesale (COST): 30.2% debt to equity but liquidity ratios standout, quick ratio 0.5x and net debt/FCF (0.9x).

- Berkshire Hathaway (BRK-B): 19.0% debt to equity, unmatched liquidity from insurance, manufacturing and energy.

- Johnson & Johnson (JNJ): Defensive dividend payer, low debt to equity, healthy quick and current ratios.

October 2025 Metrics Table

| Company Name | Debt/Equity | Current Ratio | Quick Ratio | Net Debt/FCF | FCF/Interest |

|---|---|---|---|---|---|

| NVIDIA (NVDA) | 10.6% | 4.2x | 3.5x | (0.6x) | 291.6x |

| Alphabet (GOOG) | 9.8% | 1.9x | 1.7x | (0.9x) | 211.8x |

| Alphabet (GOOGL) | 11.5% | 1.9x | 1.7x | (0.8x) | 166.0x |

| TSMC | 0.0% | 0.0x | 2.1x | (3.5x) | 284.7x |

| Tesla (TSLA) | 9.2% | 2.0x | 1.4x | (5.2x) | 29.3x |

| Palantir (PLTR) | 3.9% | 6.3x | 6.2x | (3.4x) | N/A |

What It Means for Investors

These companies not only lead in innovation and profitability - they also set the standard for risk management. Their ability to finance R&D, return capital, and withstand downturns is reinforced by fortress balance sheets. For October 2025, quality investors should continue to prioritize such leaders for both stability and upside.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Visa Stock Analysis: Undervalued Digital Payments Growth Story

📖 Procter & Gamble Undervalued: Consumer Staples Dividend Champion

📖 High ROIC Stocks in September 2025: The Best Quality Compounders

📖 Adobe Stock Analysis: Undervalued Creative Software Monopoly

📖 Pfizer Undervalued Post-COVID

FAQ about Low debt stocks for October 2025

Q: Why should I prioritize companies with low debt now?

A: Because elevated rates and financial volatility put extra pressure on highly leveraged companies; low-debt firms offer more stability and control.

Q: Is zero debt an automatic positive?

A: Zero debt can indicate strategic conservatism—like TSMC—but moderate debt can be healthy if managed prudently for growth or capital returns.

Q: Which financial ratios are best for judging balance sheet safety?

A: Debt/equity, current and quick ratios, net debt to free cash flow, and FCF/interest coverage provide a comprehensive safety analysis.

Q: Are any industries especially strong in low debt profiles?

A: Mega-cap tech (semiconductors, software, platforms) and critical infrastructure have led this cycle with superior liquidity.