10 Quality Low-Debt Stocks for Long-Term Wealth Building - Value Sense Analysis

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Financial resilience separates thriving businesses from struggling ones during economic uncertainty. Companies with minimal debt enjoy greater operational flexibility, reduced interest expenses, and enhanced ability to weather market volatility. These advantages become particularly valuable during rising interest rate environments when debt servicing costs increase.

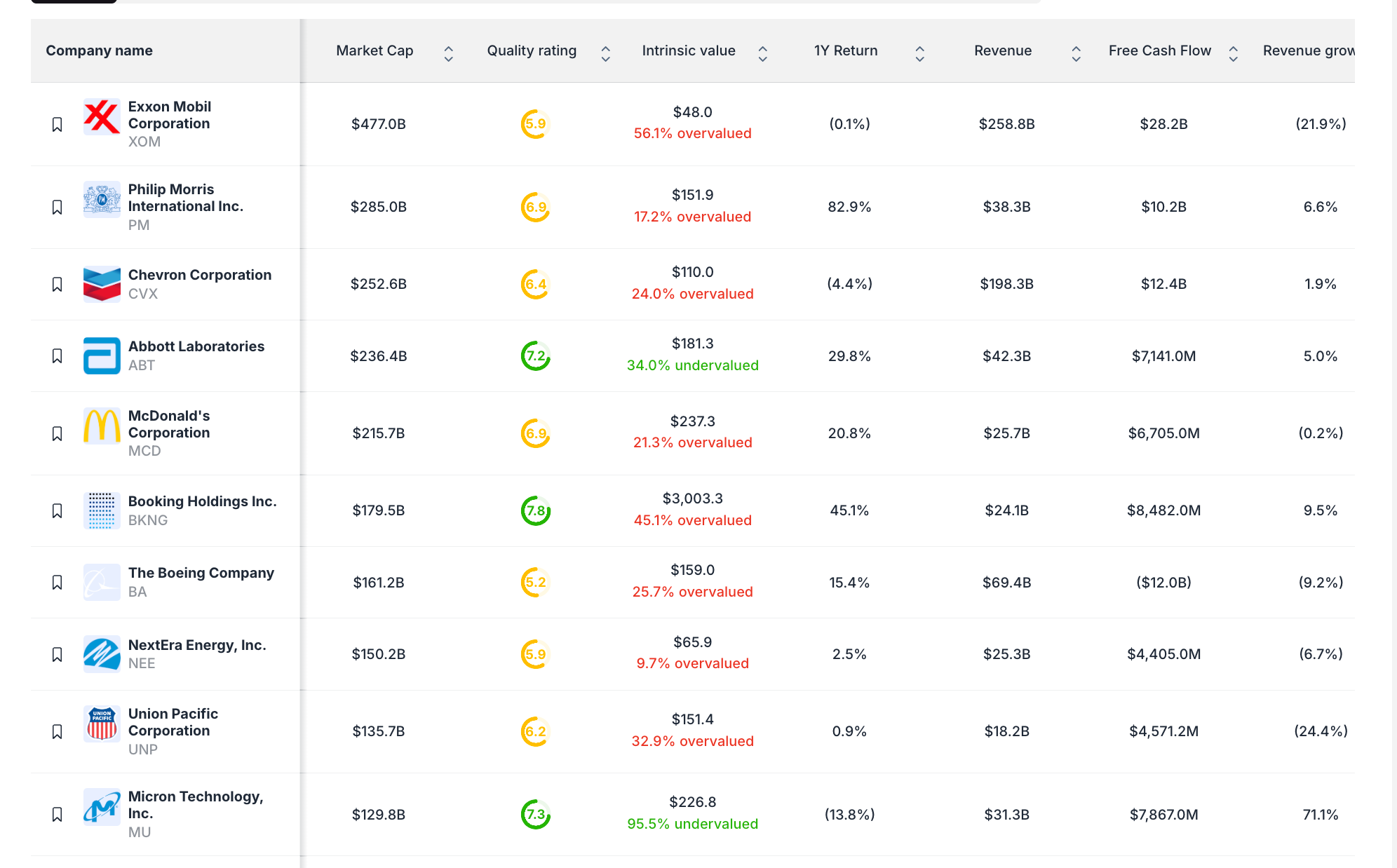

At Value Sense, we've identified 10 quality companies with debt-to-equity ratios below 30%, positioning them for sustainable growth with limited financial risk. Our proprietary valuation model further separates truly undervalued opportunities from those trading at premiums to their intrinsic worth.

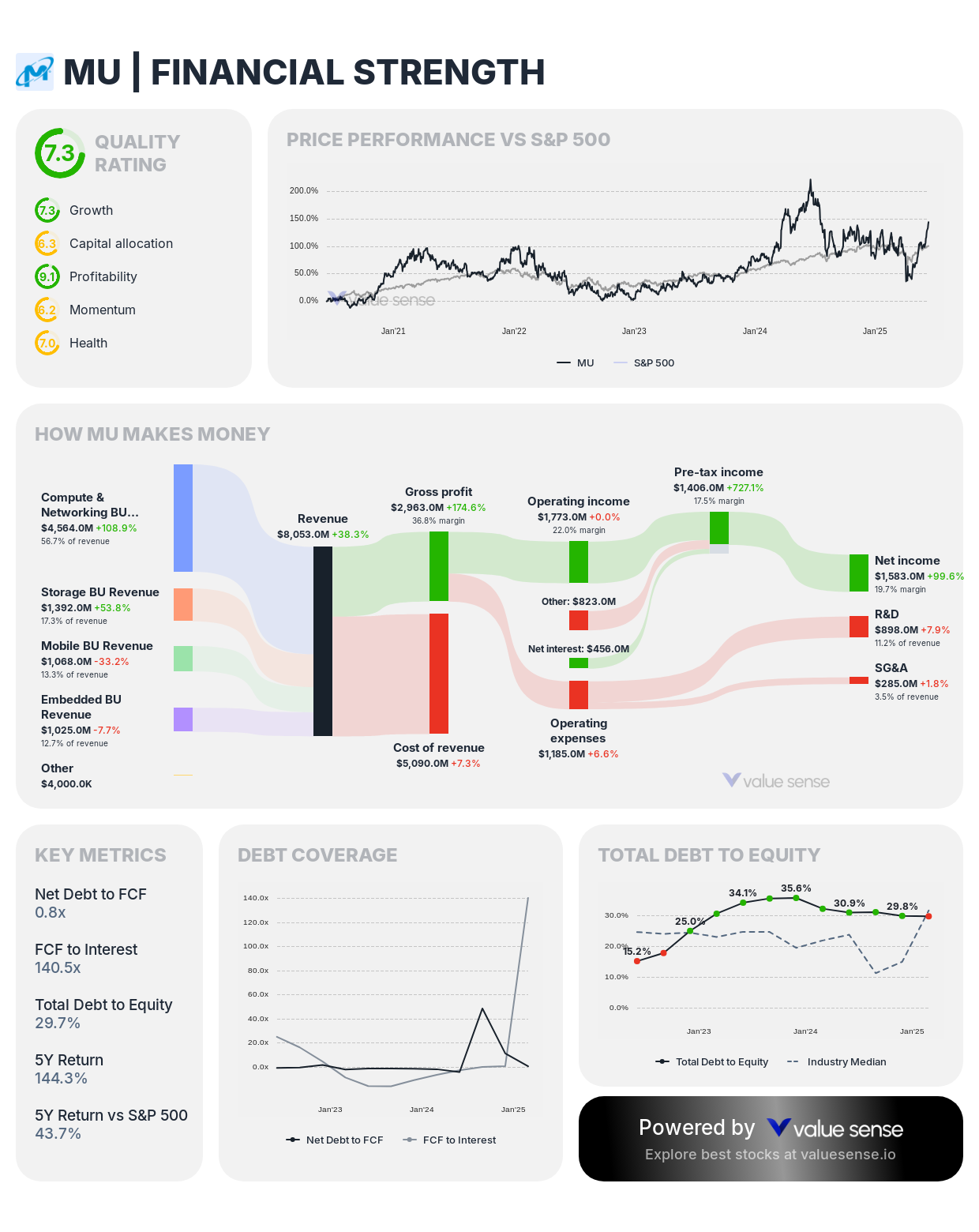

1. Micron Technology, Inc. (MU) - 95.5% Undervalued

Sector: Semiconductors | Market Cap: $129.8B | 1Y Return: (13.8%)

Financial Strength Metrics:

- Quality Rating: 7/10

- Revenue: $31.3B

- Free Cash Flow: $7,867.0M

- Revenue Growth: 71.1%

Investment Thesis: Micron Technology stands out as the most significantly undervalued company in our analysis, trading at an impressive 95.5% below intrinsic value. As a leading provider of memory and storage solutions, Micron is positioned to benefit from AI, data center, and edge computing growth trends. The company's strong balance sheet and substantial free cash flow generation provide a solid foundation for continued investment in advanced technologies while maintaining financial flexibility.

Growth Drivers:

- AI and data center memory demand acceleration

- Transition to advanced nodes improving margins

- Automotive and industrial applications expanding

- Supply discipline improving industry pricing dynamics

Why It's Undervalued: Despite temporary cyclical headwinds reflected in the negative one-year return, Micron's long-term fundamentals remain exceptional. The market appears to be underestimating the company's improved competitive position, technology leadership, and potential for substantial margin expansion as memory demand rebounds, particularly in AI applications.

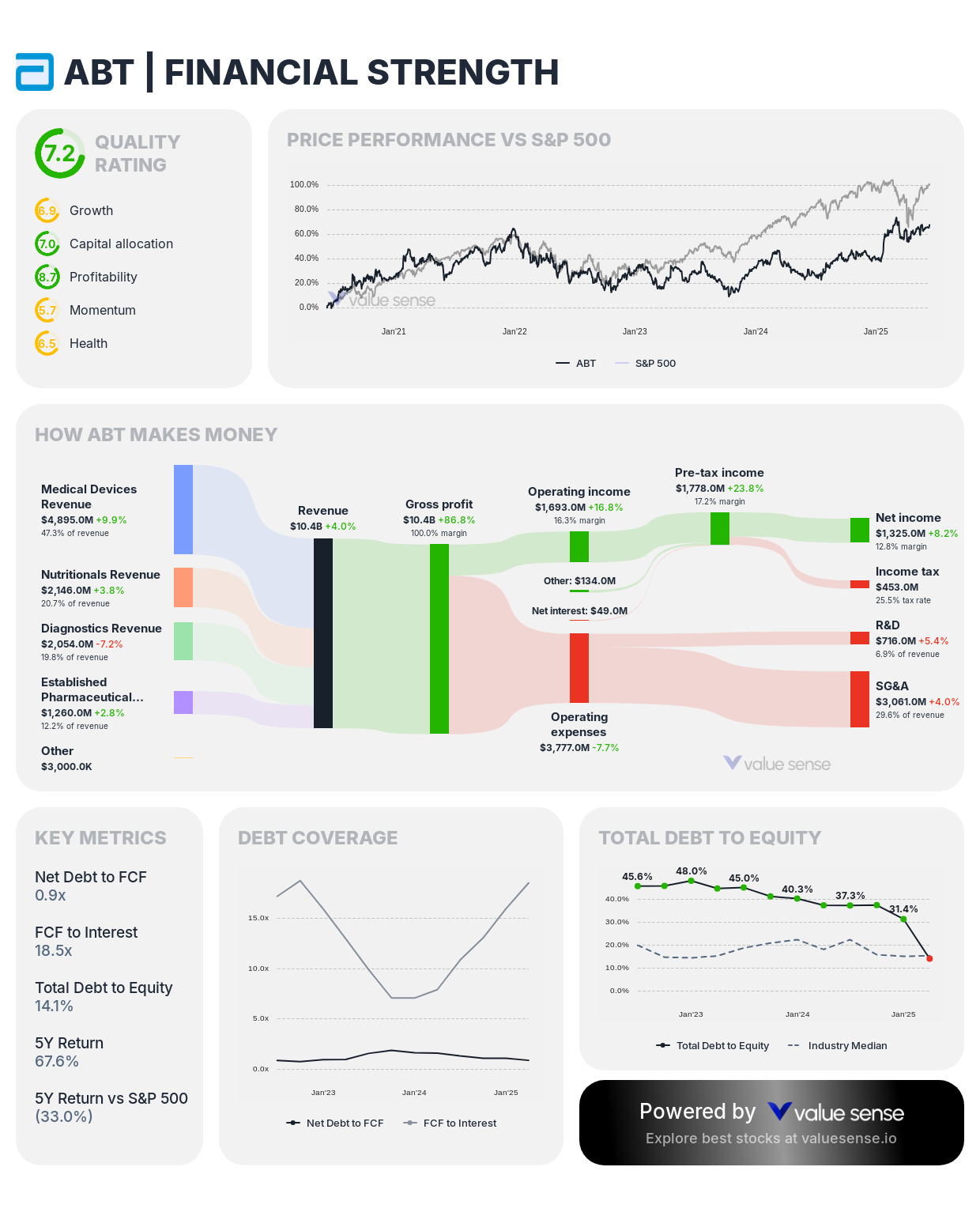

2. Abbott Laboratories (ABT) - 34.0% Undervalued

Sector: Healthcare | Market Cap: $236.4B | 1Y Return: 29.8%

Financial Strength Metrics:

- Quality Rating: 7/10

- Revenue: $42.3B

- Free Cash Flow: $7,141.0M

- Revenue Growth: 5.0%

Investment Thesis: Abbott Laboratories presents a compelling investment case as a diversified healthcare leader trading 34% below intrinsic value. With leading positions in diagnostics, medical devices, nutrition, and established pharmaceuticals, Abbott offers both defensive characteristics and growth potential. The company's consistent innovation pipeline and global expansion initiatives support sustainable long-term growth with minimal financial risk.

Growth Drivers:

- Continuous glucose monitoring leadership with FreeStyle Libre

- Structural heart and electrophysiology device expansion

- Emerging market penetration across product lines

- Diagnostic platform innovations driving recurring revenue

Why It's Undervalued: Abbott's quality rating of 7/10 reflects its operational excellence and strong market positions. The 29.8% one-year return suggests the market is beginning to recognize Abbott's value, but our analysis indicates substantial upside remains as healthcare spending continues to grow globally and Abbott's innovation pipeline delivers results.

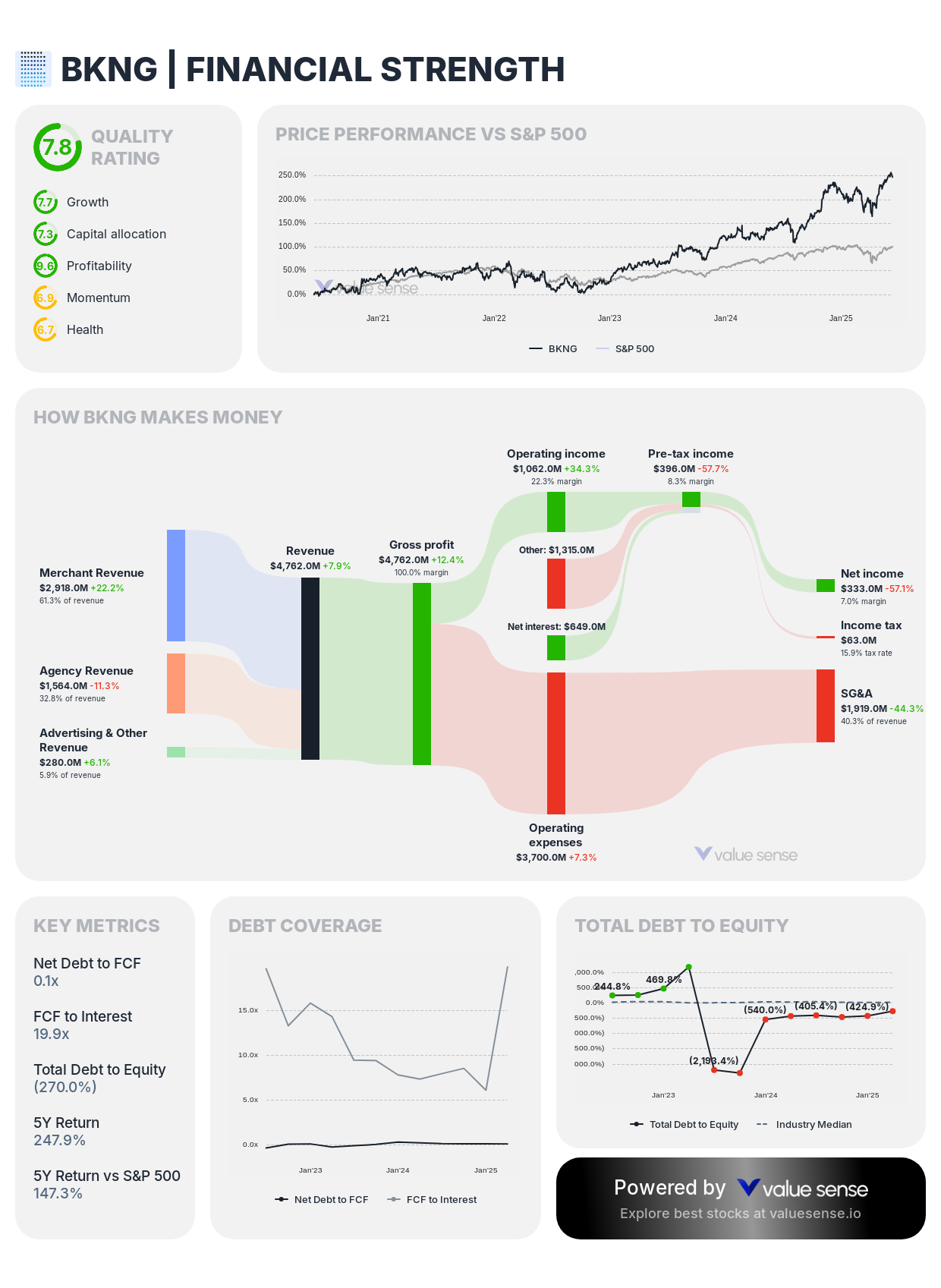

3. Booking Holdings Inc. (BKNG) - 45.1% Overvalued

Sector: Online Travel | Market Cap: $179.5B | 1Y Return: 45.1%

Financial Strength Metrics:

- Quality Rating: 7/10

- Revenue: $24.1B

- Free Cash Flow: $8,482.0M

- Revenue Growth: 9.5%

Investment Thesis: While Booking Holdings scores highly on our quality metrics with a 7/10 rating, our valuation model indicates it's currently trading 45.1% above intrinsic value. As the world's leading online travel agency, Booking benefits from network effects, a capital-light business model, and exceptional free cash flow generation. However, its premium valuation suggests investors should consider waiting for more attractive entry points.

Strengths:

- Industry-leading operating margins and capital efficiency

- Substantial free cash flow supporting share repurchases

- Strong network effects and global brand recognition

- Expanding into complementary travel services

Valuation Consideration: Despite its quality business model and strong performance (45.1% one-year return), the current premium to intrinsic value suggests limited upside potential in the near term. Investors might consider watching for pullbacks to establish positions in this high-quality business.

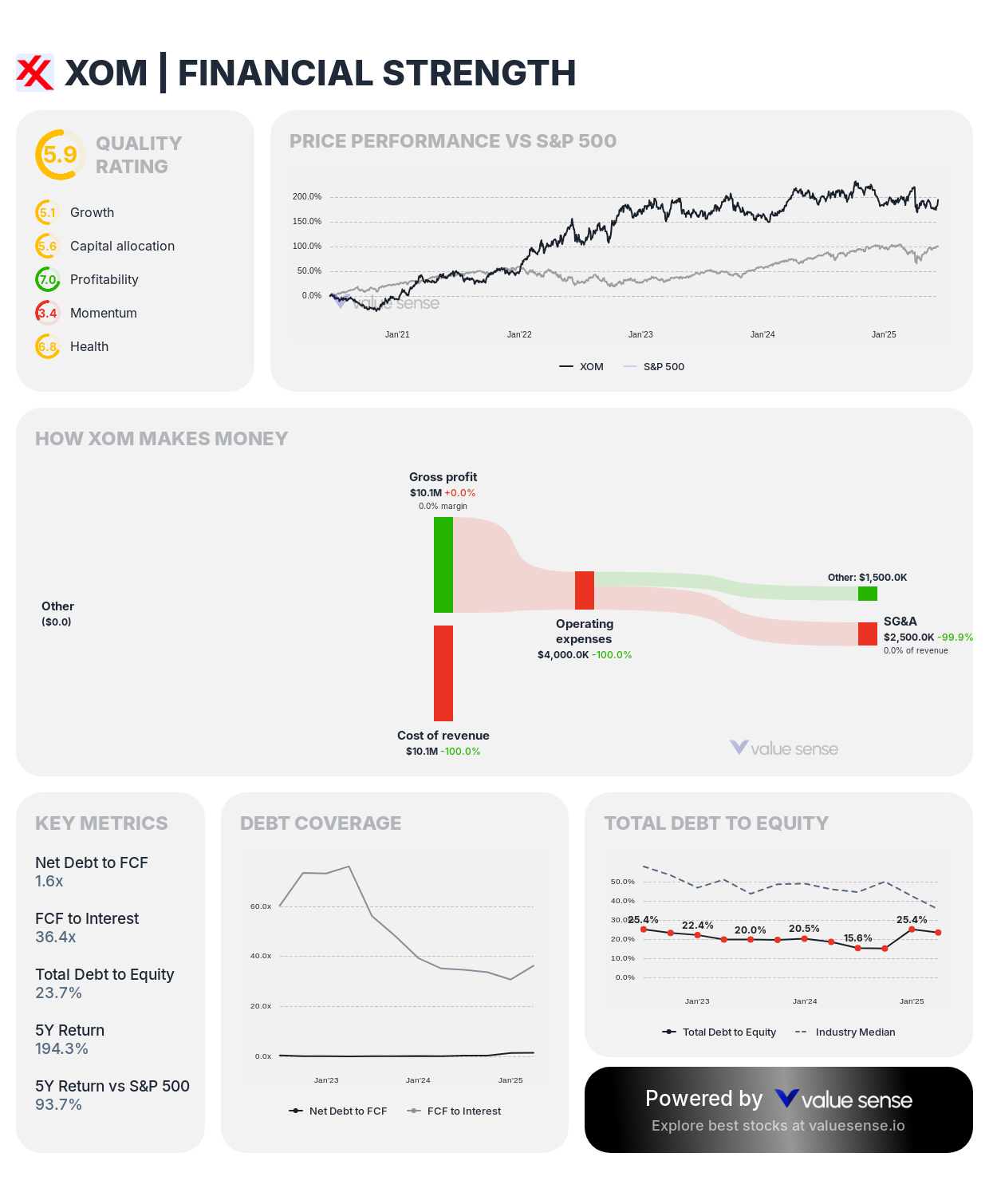

4. Exxon Mobil Corporation (XOM) - 56.1% Overvalued

Sector: Energy | Market Cap: $477.0B | 1Y Return: (0.1%)

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $258.8B

- Free Cash Flow: $28.2B

- Revenue Growth: (21.9%)

Investment Thesis: Exxon Mobil maintains a stronger balance sheet than many energy peers, earning a quality rating of 6/10. However, our analysis indicates the stock is trading 56.1% above intrinsic value. As one of the world's largest integrated energy companies, Exxon offers scale advantages, vertical integration, and substantial free cash flow generation, but current valuations appear to overestimate long-term growth potential.

Strengths:

- Integrated business model providing operational stability

- Significant free cash flow supporting dividends

- Strategic investments in low-cost production assets

- Disciplined capital allocation approach

Valuation Consideration: Despite flat performance over the past year (0.1% return), Exxon's premium valuation suggests investors are paying too much for its current assets and growth prospects. The negative revenue growth trend (-21.9%) further supports a cautious approach to this overvalued energy giant.

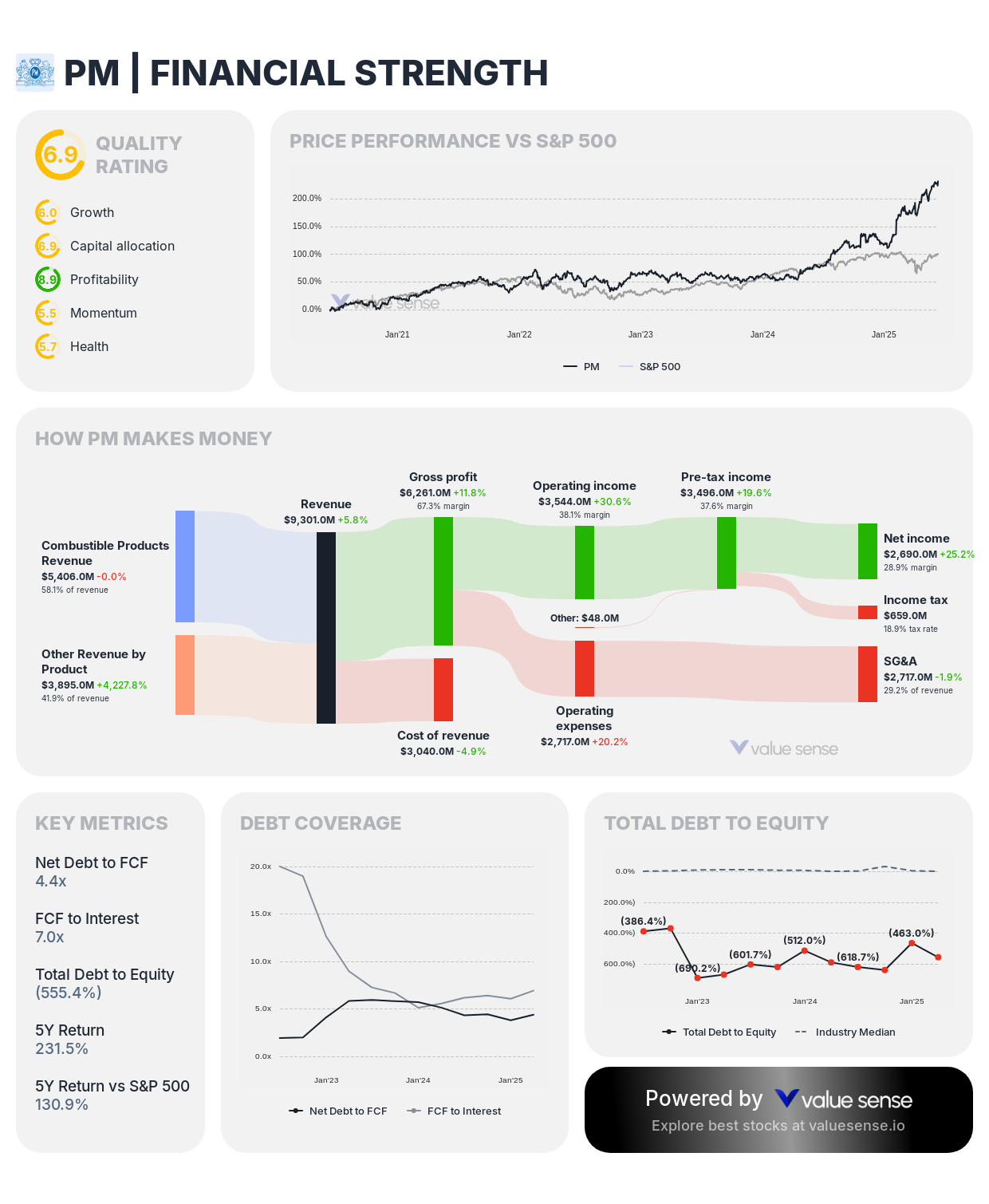

5. Philip Morris International Inc. (PM) - 17.2% Overvalued

Sector: Consumer Staples | Market Cap: $285.0B | 1Y Return: 82.9%

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $38.3B

- Free Cash Flow: $10.2B

- Revenue Growth: 6.6%

Investment Thesis: Philip Morris earns a quality rating of 6/10 based on its strong brand portfolio, pricing power, and substantial free cash flow generation. However, our valuation model indicates it's trading 17.2% above intrinsic value. The company's transition toward reduced-risk products provides a growth avenue, but regulatory risks and premium valuation warrant caution.

Strengths:

- Leading position in reduced-risk tobacco products

- Strong free cash flow supporting generous dividends

- Pricing power offsetting volume declines

- Geographic diversification reducing regulatory risk

Valuation Consideration: The stock's impressive 82.9% one-year return has pushed valuation beyond our intrinsic value estimate. While Philip Morris maintains strong fundamentals, the current premium suggests limited upside potential in the near term.

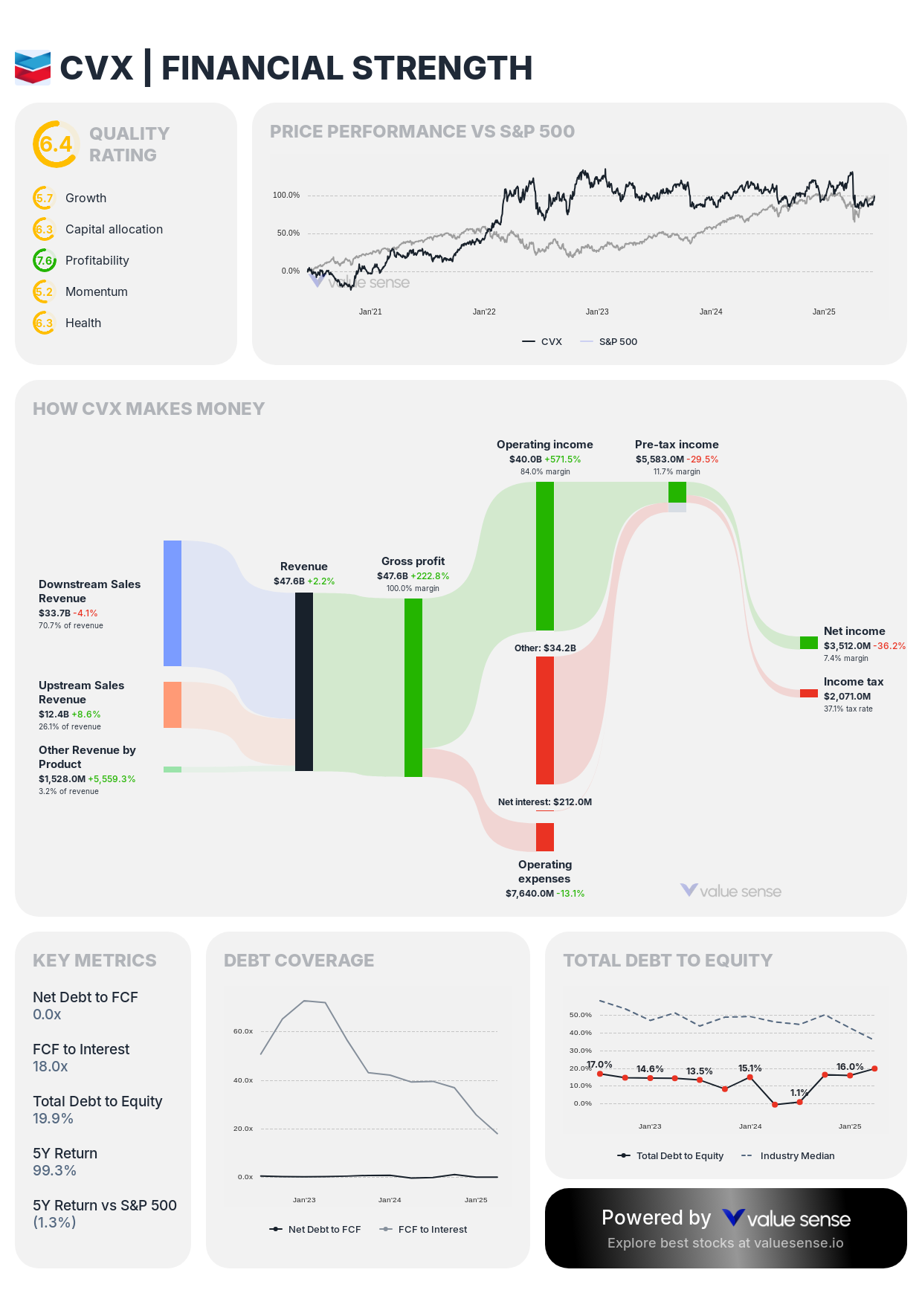

6. Chevron Corporation (CVX) - 24.0% Overvalued

Sector: Energy | Market Cap: $252.6B | 1Y Return: (4.4%)

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $198.3B

- Free Cash Flow: $12.4B

- Revenue Growth: 1.9%

Investment Thesis: Chevron earns a quality rating of 6/10 based on its strong balance sheet, operational efficiency, and integrated business model. However, our analysis indicates it's trading 24.0% above intrinsic value. While Chevron's financial discipline and low-cost production assets provide competitive advantages, the current valuation appears to overestimate future cash flows.

Strengths:

- Industry-leading balance sheet strength

- Portfolio of low-cost production assets

- Disciplined capital allocation approach

- Substantial free cash flow generation

Valuation Consideration: Despite underperforming the market with a negative 4.4% one-year return, Chevron still trades at a premium to our calculated intrinsic value. The modest revenue growth of 1.9% further suggests limited upside potential at current prices.

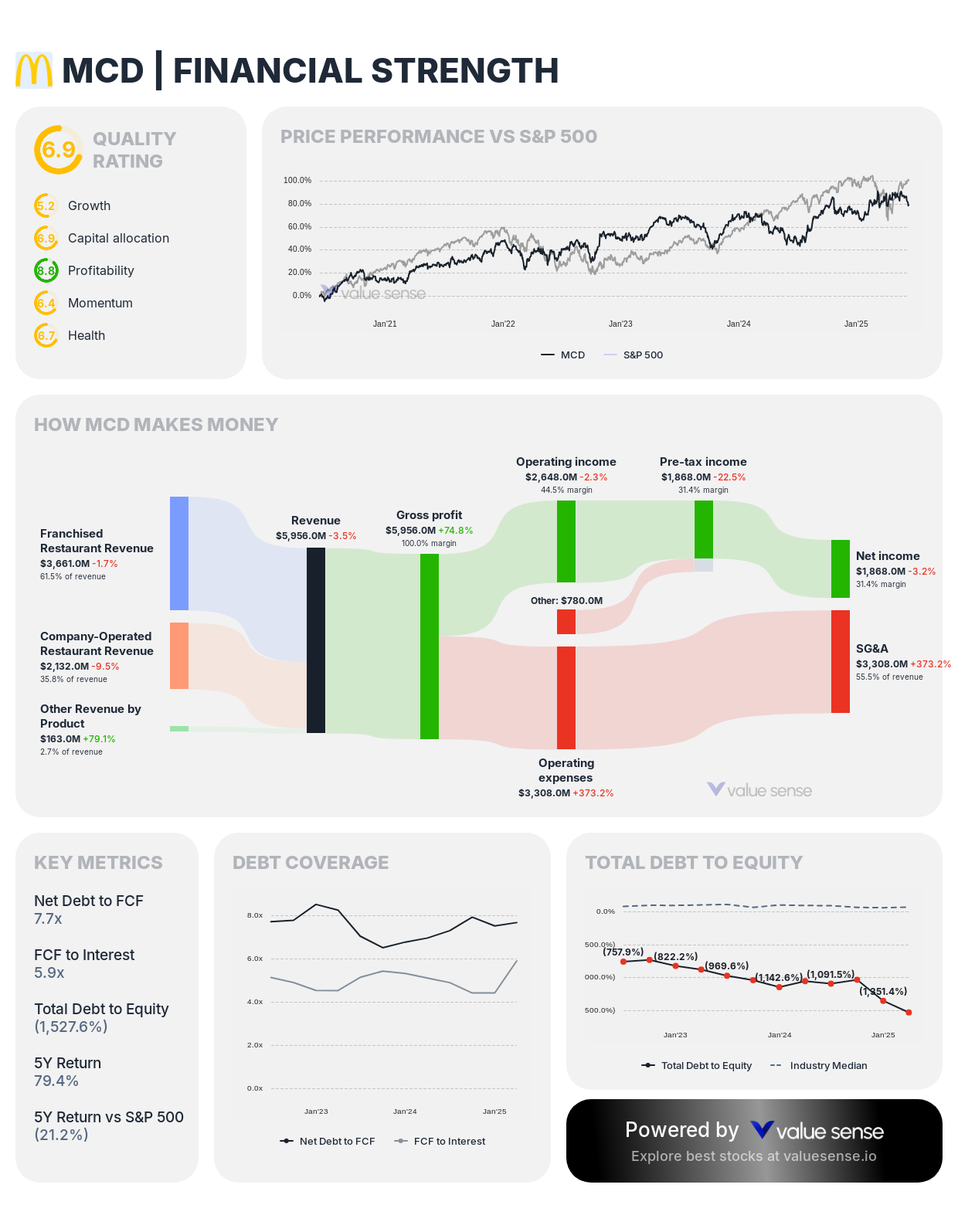

7. McDonald's Corporation (MCD) - 21.3% Overvalued

Sector: Restaurants | Market Cap: $215.7B | 1Y Return: 20.8%

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $25.7B

- Free Cash Flow: $6,705.0M

- Revenue Growth: (0.2%)

Investment Thesis: McDonald's earns a quality rating of 6/10 based on its powerful brand, franchise-based business model, and consistent free cash flow generation. However, our valuation model indicates it's trading 21.3% above intrinsic value. While McDonald's offers defensive characteristics and reliable dividends, the premium valuation and flat revenue growth suggest limited upside potential.

Strengths:

- Asset-light franchise model generating stable cash flows

- Global brand recognition and scale advantages

- Digital initiatives enhancing customer experience

- Consistent dividend growth history

Valuation Consideration: The 20.8% one-year return has pushed McDonald's valuation beyond our intrinsic value estimate. With revenue growth slightly negative at -0.2%, investors appear to be paying a premium for the company's defensive characteristics rather than growth potential.

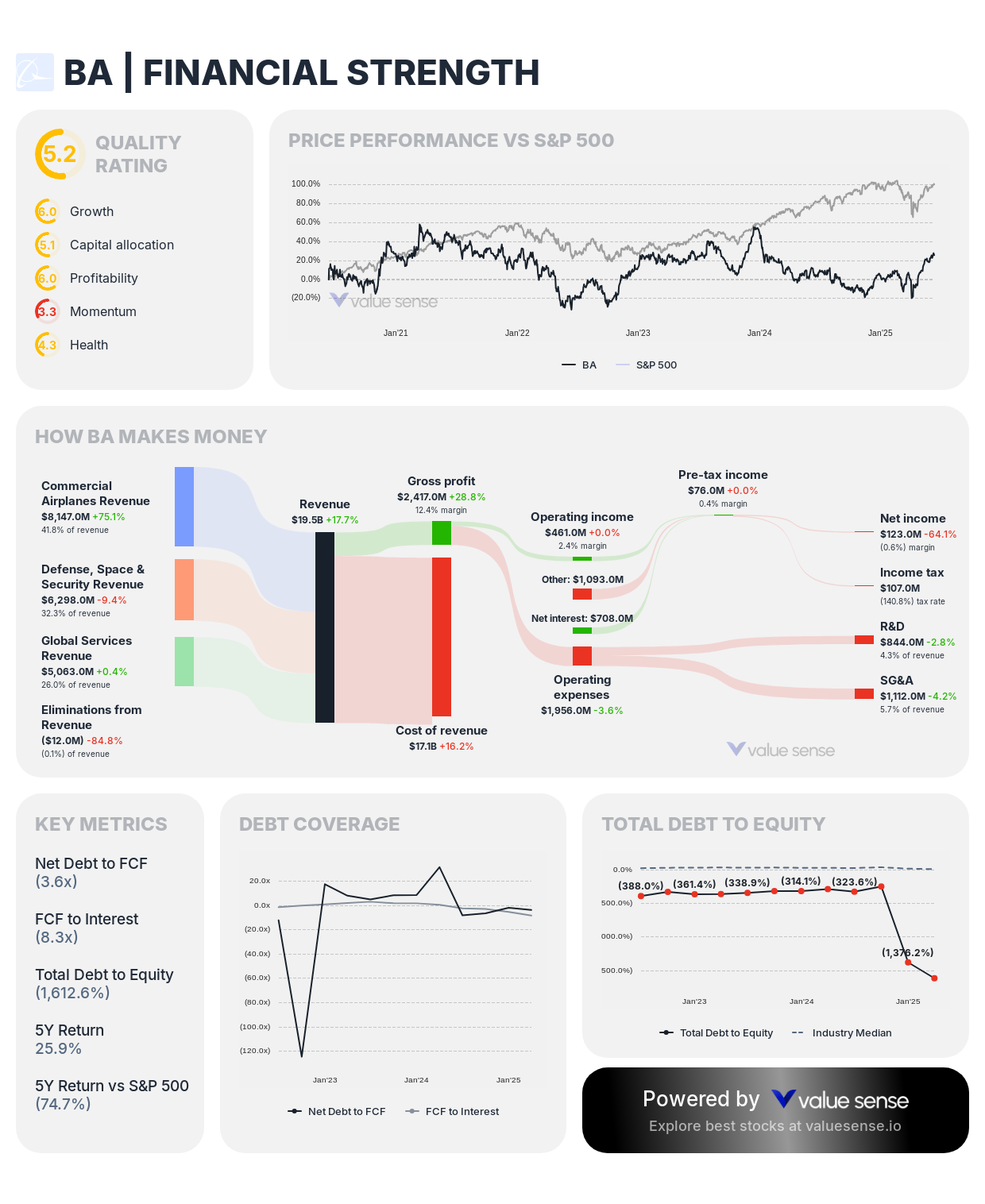

8. The Boeing Company (BA) - 25.7% Overvalued

Sector: Aerospace & Defense | Market Cap: $161.2B | 1Y Return: 15.4%

Financial Strength Metrics:

- Quality Rating: 5/10

- Revenue: $69.4B

- Free Cash Flow: ($12.0B)

- Revenue Growth: (9.2%)

Investment Thesis: Boeing receives a moderate quality rating of 5/10, reflecting its strong market position but ongoing operational challenges. Our analysis indicates the stock is trading 25.7% above intrinsic value. While Boeing benefits from a duopoly position in commercial aircraft and substantial defense contracts, negative free cash flow and declining revenue raise concerns about its current valuation.

Strengths:

- Commercial aircraft market duopoly with high barriers to entry

- Substantial defense and space business providing diversification

- Large order backlog supporting future revenue visibility

- Potential for free cash flow improvement as production normalizes

Valuation Consideration: Despite operational challenges, Boeing has delivered a 15.4% one-year return, pushing its valuation above our intrinsic value estimate. The negative free cash flow of $12.0B and declining revenue (-9.2%) suggest investors may be overly optimistic about the company's recovery timeline.

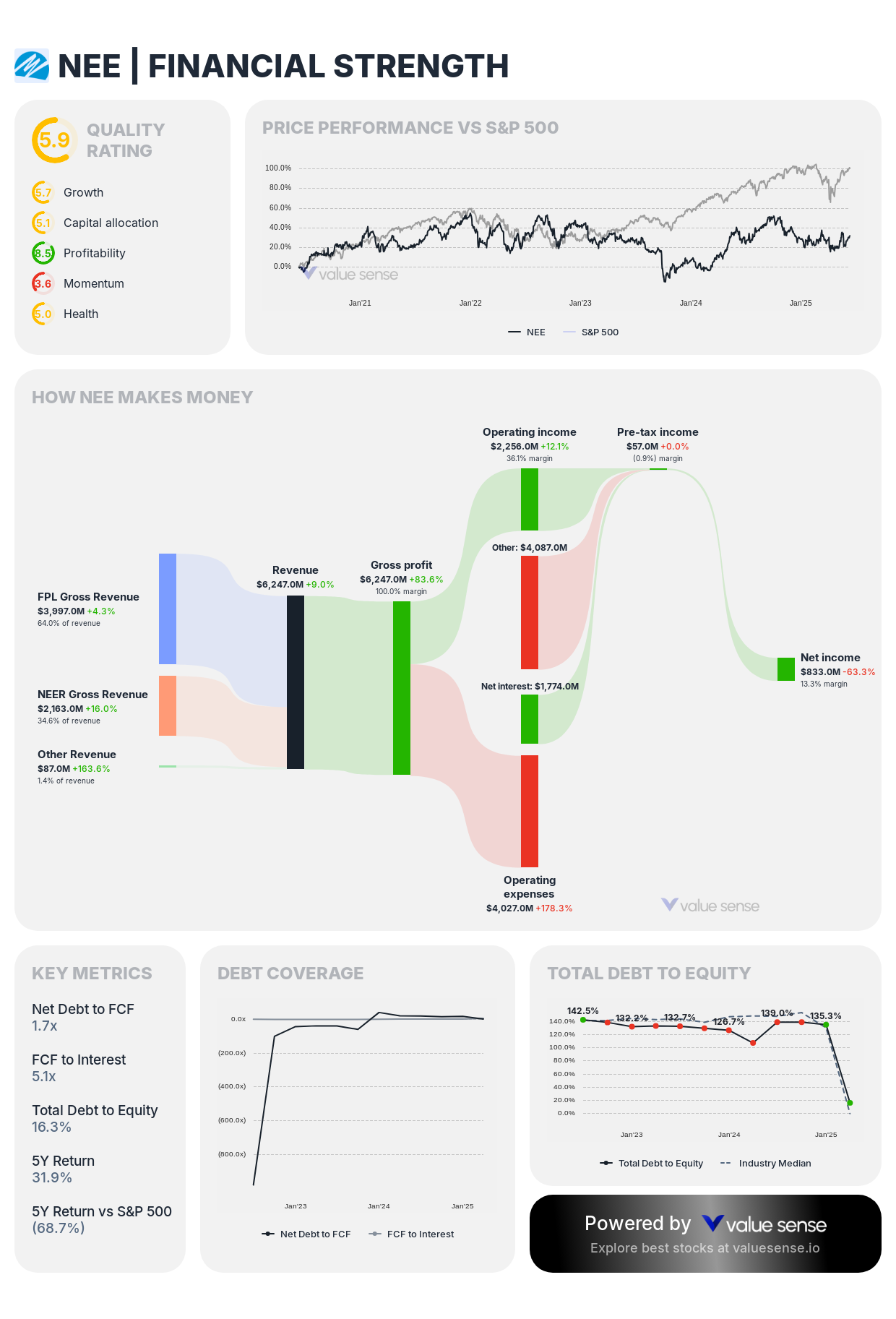

9. NextEra Energy, Inc. (NEE) - 9.7% Overvalued

Sector: Utilities | Market Cap: $150.2B | 1Y Return: 2.5%

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $25.3B

- Free Cash Flow: $4,405.0M

- Revenue Growth: (6.7%)

Investment Thesis: NextEra Energy earns a quality rating of 6/10 based on its leadership in renewable energy development and regulated utility operations. Our valuation model indicates a modest 9.7% premium to intrinsic value, making it the least overvalued stock among our overvalued selections. The company's renewable energy growth potential and regulated returns provide a solid foundation, though current valuation appears slightly stretched.

Strengths:

- Leading position in renewable energy development

- Stable cash flows from regulated utility operations

- Visible growth pipeline through energy transition

- Strong operational execution history

Valuation Consideration: With a modest 2.5% one-year return, NextEra trades slightly above our intrinsic value estimate. The declining revenue (-6.7%) suggests investors should monitor performance closely before establishing positions, despite the company's quality fundamentals.

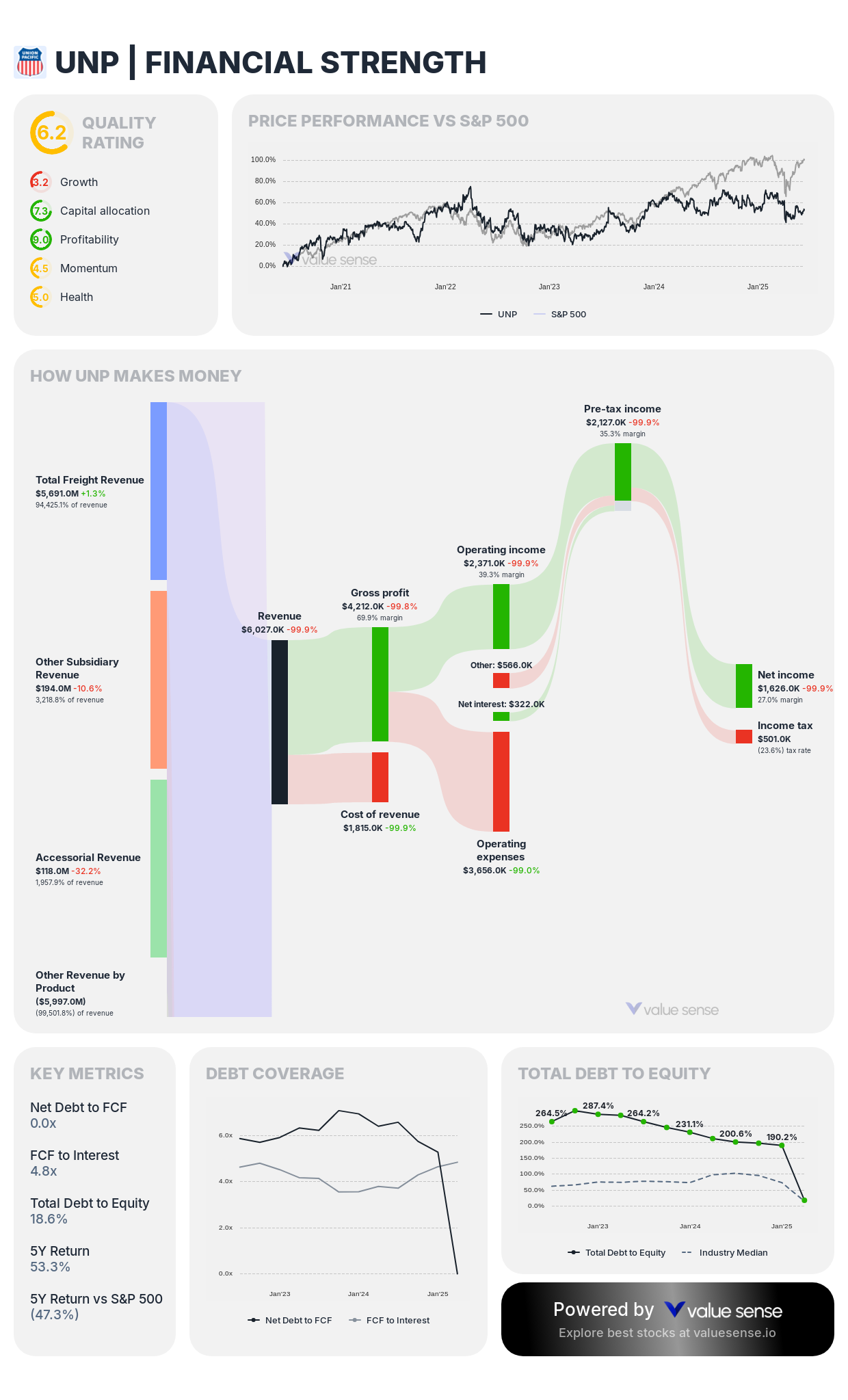

10. Union Pacific Corporation (UNP) - 32.9% Overvalued

Sector: Railroads | Market Cap: $135.7B | 1Y Return: 0.9%

Financial Strength Metrics:

- Quality Rating: 6/10

- Revenue: $18.2B

- Free Cash Flow: $4,571.2M

- Revenue Growth: (24.4%)

Investment Thesis: Union Pacific earns a quality rating of 6/10 based on its essential transportation infrastructure, pricing power, and operational efficiency. However, our analysis indicates it's trading 32.9% above intrinsic value. While the railroad benefits from wide economic moats and substantial free cash flow generation, the premium valuation and significant revenue decline suggest limited upside potential.

Strengths:

- Irreplaceable rail network with high barriers to entry

- Operational efficiency improvements enhancing margins

- Strong free cash flow supporting shareholder returns

- Pricing power in transportation services

Valuation Consideration: Despite flat performance over the past year (0.9% return), Union Pacific trades at a substantial premium to our intrinsic value estimate. The concerning revenue decline of 24.4% further supports a cautious approach at current valuations.

Investment Strategy for Low-Debt Quality Companies

When evaluating companies with strong balance sheets and low debt levels, investors should consider both valuation and quality metrics to identify the most promising opportunities:

Focus on Undervalued Quality: Among our analyzed companies, Micron Technology (MU) and Abbott Laboratories (ABT) stand out as high-quality businesses (7/10 ratings) trading significantly below intrinsic value. These represent the most compelling investment opportunities based on our comprehensive analysis.

Exercise Caution with Overvalued Names: Despite strong quality ratings, companies like Booking Holdings (BKNG) and NextEra Energy (NEE) currently trade at premiums to intrinsic value. Investors should consider waiting for more attractive entry points despite their financial strength and competitive positions.

Balance Sheet Strength as a Foundation: Low debt levels provide companies with strategic flexibility, reduced financial risk, and enhanced ability to weather economic downturns. This financial resilience becomes particularly valuable during periods of economic uncertainty or rising interest rates.

Consider Industry Context: Different industries have different optimal capital structures. For capital-intensive businesses like utilities or railroads, even relatively low debt levels may represent appropriate financial leverage, while technology companies often benefit from debt-free balance sheets.

Why Financial Strength Matters More Than Ever

Companies with strong balance sheets and minimal debt enjoy several strategic advantages in the current economic environment:

- Interest Rate Resilience: Low-debt companies face minimal exposure to rising borrowing costs, protecting profit margins during monetary tightening cycles.

- Strategic Flexibility: Financial strength enables companies to pursue opportunistic acquisitions, increase R&D investments, or return capital to shareholders without compromising balance sheet integrity.

- Recession Resistance: During economic downturns, companies with minimal debt obligations can focus on operations rather than debt servicing, often gaining market share from financially constrained competitors.

- Capital Allocation Options: Strong free cash flow combined with low debt provides management teams with expanded options for value creation through dividends, share repurchases, or growth investments.

Conclusion: Balancing Quality, Value, and Financial Strength

Our Value Sense analysis reveals a nuanced picture of quality low-debt companies in today's market. While financial strength provides important advantages, investors must remain disciplined about valuation to maximize long-term returns.

The most compelling opportunities in our analysis are Micron Technology (MU) and Abbott Laboratories (ABT), combining quality business models, strong balance sheets, and attractive valuations. These companies offer the potential for substantial returns while maintaining the financial resilience to navigate economic uncertainty.

For investors seeking to build a portfolio of financially strong companies, we recommend focusing on the intersection of quality fundamentals, reasonable debt levels, and attractive valuations relative to intrinsic worth. This balanced approach provides the foundation for sustainable long-term investment returns with reduced financial risk.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Top 10 undervalued high-quality growth stocks

📖 A Deep Dive into High-Growth Stocks - HIMS, HOOD, and PLTR

📖 10 High-Quality Undervalued Dividend Stocks

Frequently Asked Questions About Low-Debt Stocks

What makes a stock considered "low-debt"?

A low-debt stock typically has a debt-to-equity ratio below 30%, meaning its total debt is less than 30% of its shareholders' equity. This indicates the company finances its operations primarily through equity rather than borrowed money. Companies with positive net cash positions (more cash than debt) represent the strongest balance sheets. Low-debt companies generally have greater financial flexibility, reduced interest expenses, and enhanced ability to weather economic downturns compared to highly leveraged competitors.

Why are low-debt stocks attractive during rising interest rate environments?

Low-debt stocks become particularly attractive during rising interest rate environments because they face minimal exposure to increasing borrowing costs. While heavily indebted companies must allocate more cash flow to service higher interest payments, low-debt companies maintain stable financial positions. This interest rate resilience protects profit margins and cash flows, allowing management to focus on strategic growth initiatives rather than debt refinancing concerns. Additionally, when credit markets tighten, low-debt companies often gain competitive advantages over financially constrained rivals.

How does Value Sense determine if a low-debt stock is undervalued or overvalued?

Value Sense employs a proprietary valuation model that calculates intrinsic value based on multiple factors beyond just debt levels. Our comprehensive approach incorporates discounted cash flow analysis, normalized earnings power, competitive positioning, growth prospects, and return on invested capital. We then compare our calculated intrinsic value to current market prices to determine the degree of undervaluation or overvaluation. Quality ratings (scored on a 1-10 scale) provide additional context by evaluating business model strength, competitive advantages, and operational excellence alongside financial metrics.

Which sectors typically have the strongest balance sheets with low debt levels?

Technology, healthcare, and consumer staples sectors frequently feature companies with strong balance sheets and low debt levels. Technology companies often maintain substantial cash reserves and minimal debt due to their asset-light business models and strong cash flow generation. Healthcare companies, particularly those with established product portfolios and consistent revenue streams, often maintain conservative financial policies. Consumer staples businesses with strong brands and pricing power can generate reliable cash flows that reduce the need for debt financing. However, individual company financial policies vary significantly within sectors.

Should investors avoid all overvalued stocks regardless of their debt levels?

Investors should not automatically avoid all overvalued stocks, as valuation represents just one factor in the investment decision process. For high-quality companies with sustainable competitive advantages, temporary overvaluation may not prevent long-term outperformance. However, maintaining valuation discipline remains important, particularly when overvaluation is significant. Our analysis suggests a balanced approach: prioritize undervalued quality stocks with strong balance sheets for new investments, while potentially maintaining positions in moderately overvalued companies with exceptional business models and financial strength if your investment horizon is sufficiently long-term.