11 Low-Debt Stocks With High FCF Conversion and Revenue Growth

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

Many investors believe that high growth and great capital allocation are impossible to find in a single company. That’s why they miss out on the best opportunities in the market.

But the reality is different.

Some companies deliver exceptional revenue growth while maintaining low debt and strong free cash flow (FCF) conversion.

If you're looking for stocks with low debt, publicly traded companies with no debt, or companies with zero debt that also have high growth potential, this list is for you.

Here are 11 high-growth stocks with ROIC > 20% and FCF Yield > 3% to prove that you can have both.

Top Low-Debt, High-FCF Conversion Stocks for 2025

Technology Giants with High Growth and Strong FCF

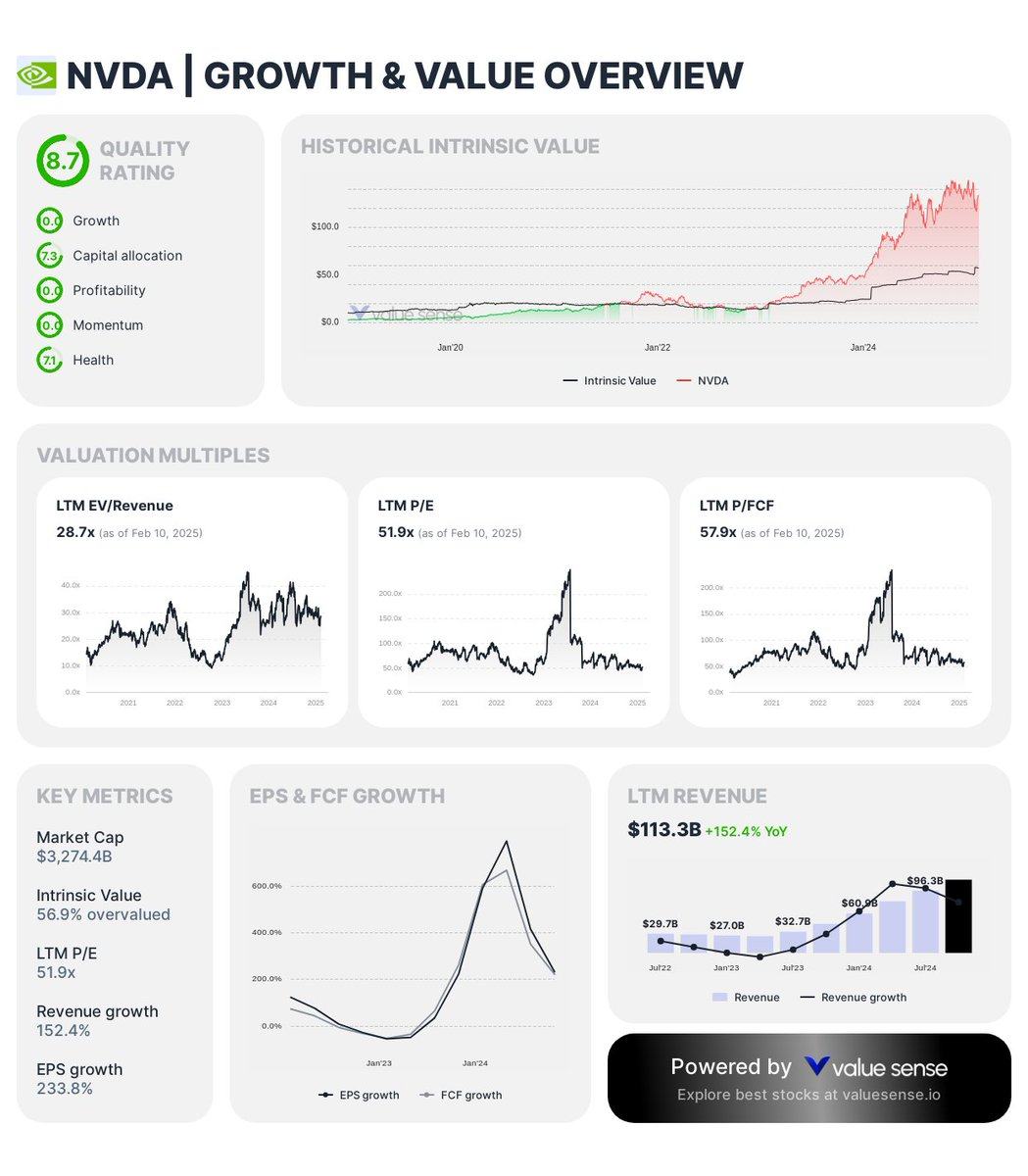

1. NVIDIA Corporation ($NVDA)

- Net Debt to FCF: (0.5x) (Essentially a debt-free company)

- FCF / Net Income: 89.7%

- Revenue Growth: 152.4%

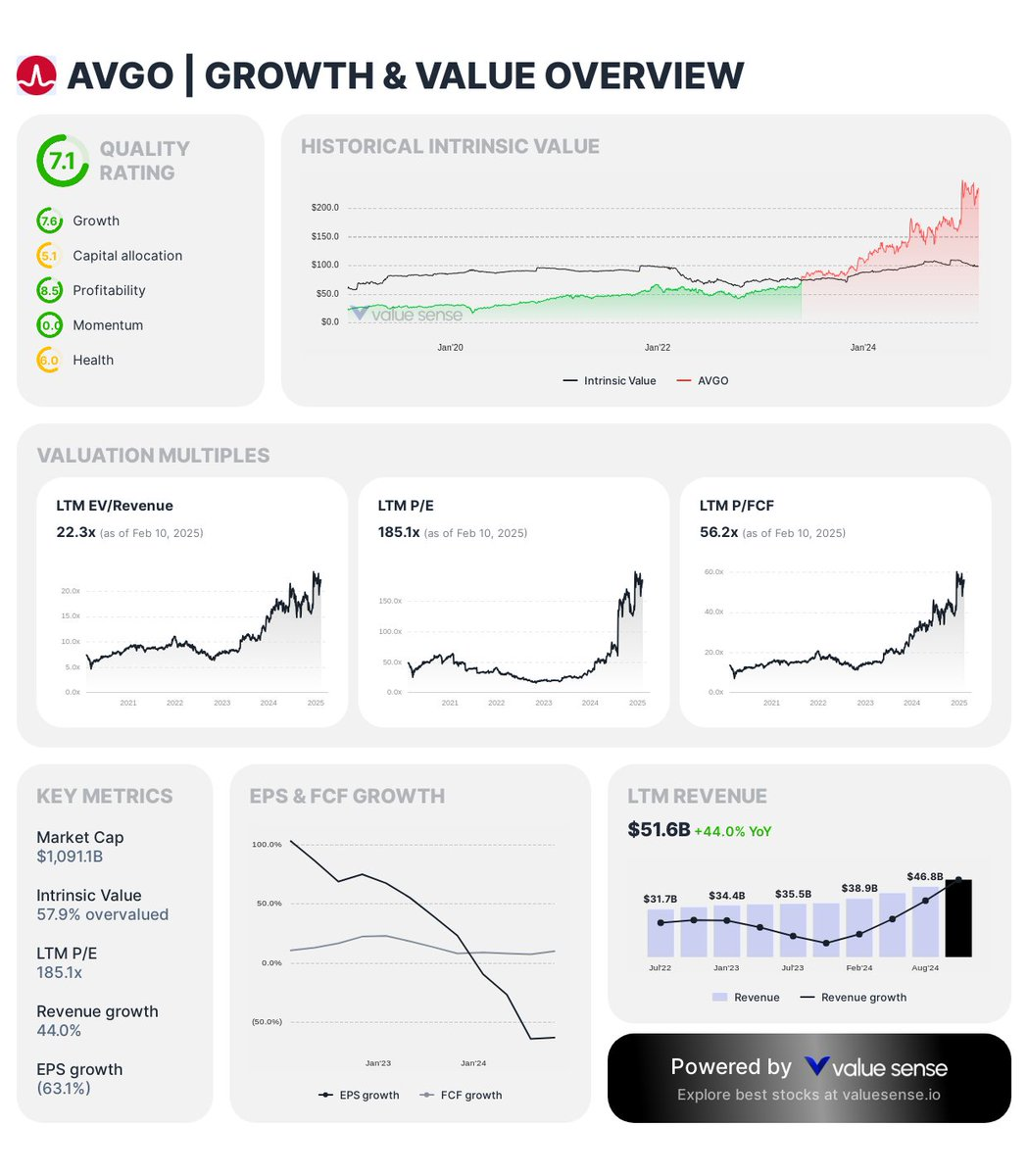

2. Broadcom Inc. ($AVGO)

- Net Debt to FCF: 3.0x

- FCF / Net Income: 989.0%

- Revenue Growth: 44.0%

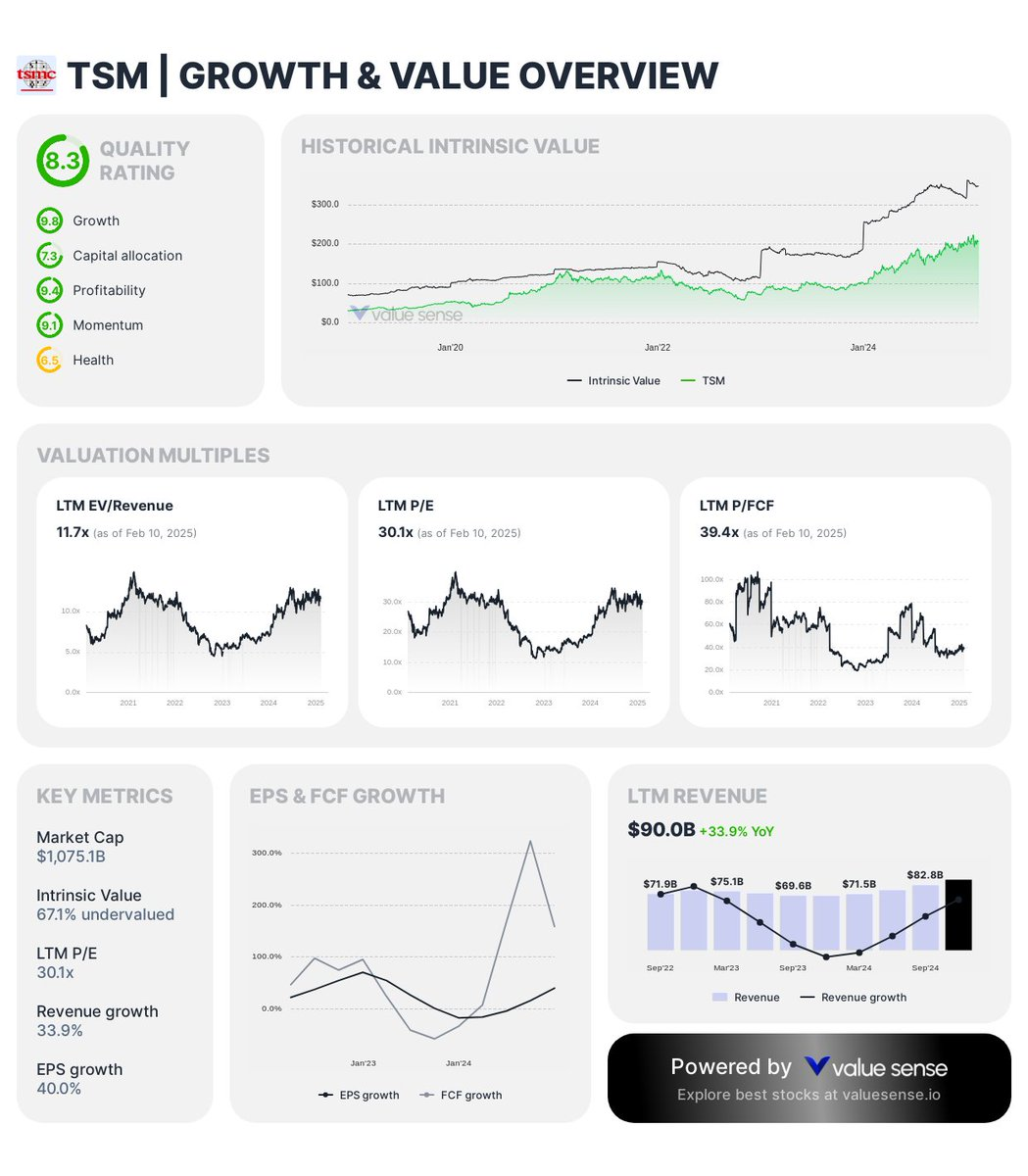

3. Taiwan Semiconductor Manufacturing ($TSM)

- Net Debt to FCF: (1.3x) (One of the top companies with no debt concerns)

- FCF / Net Income: 88.3%

- Revenue Growth: 22.7%

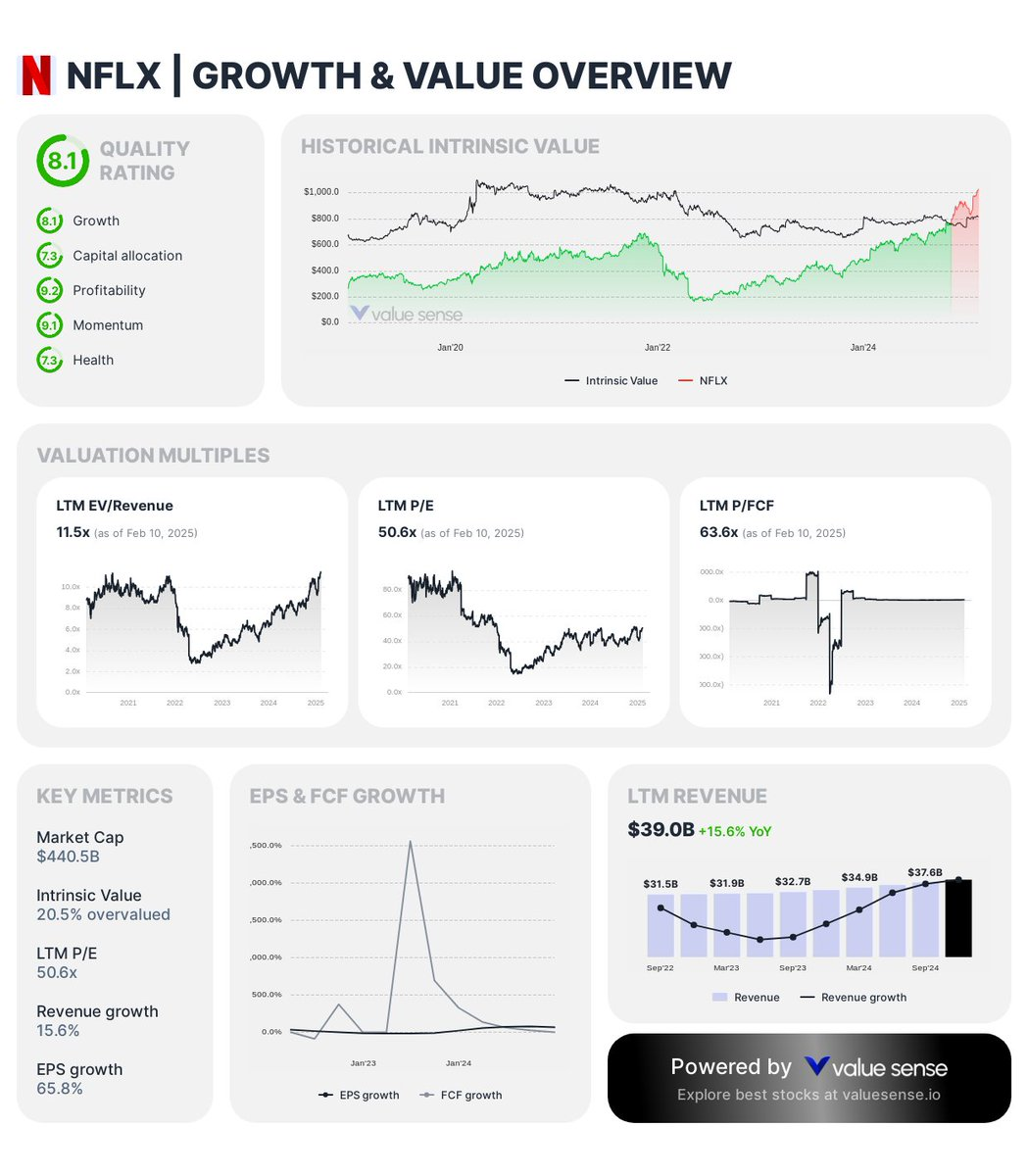

4. Netflix, Inc. ($NFLX)

- Net Debt to FCF: 0.9x (Among the most resilient publicly traded companies with no debt issues)

- FCF / Net Income: 91.6%

- Revenue Growth: 14.7%

Software & AI Leaders with Strong Fundamentals

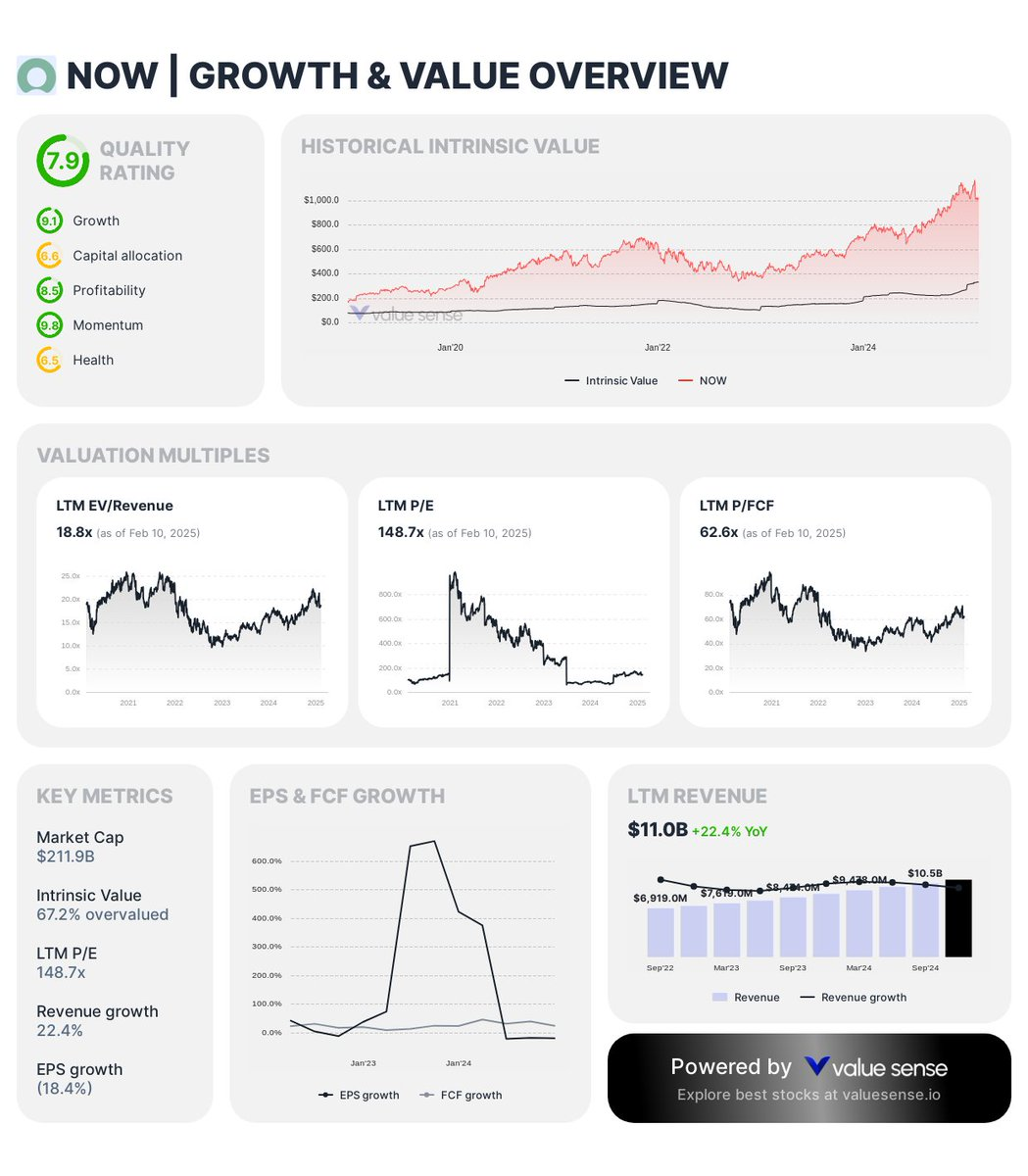

5. ServiceNow, Inc. ($NOW)

- Net Debt to FCF: (0.9x)

- FCF / Net Income: 250.5%

- Revenue Growth: 23.5%

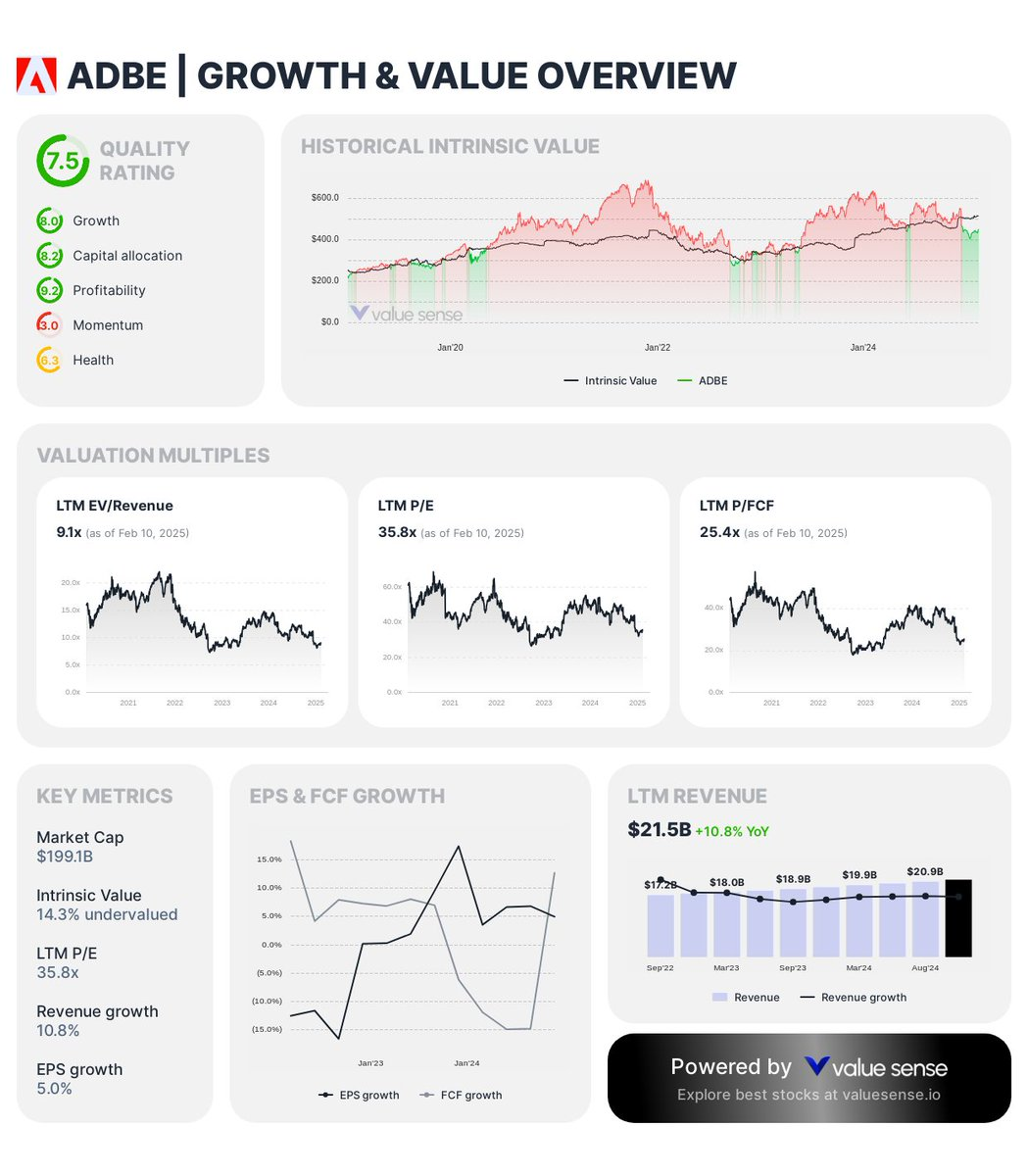

6. Adobe Inc. ($ADBE)

- Net Debt to FCF: (0.4x) (Considered a stock with no debt concerns)

- FCF / Net Income: 140.7%

- Revenue Growth: 10.8%

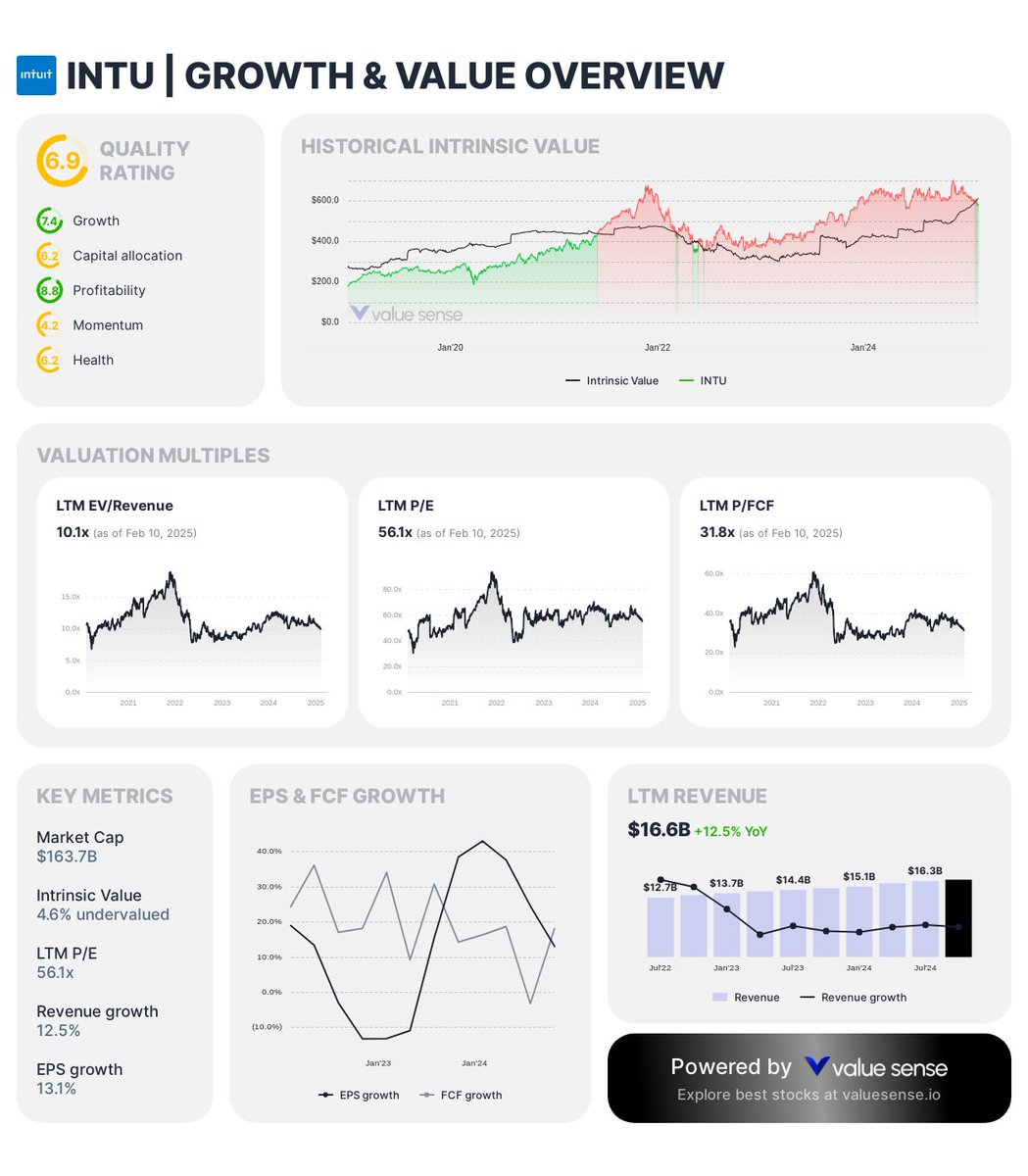

7. Intuit Inc. ($INTU)

- Net Debt to FCF: 0.7x (Ranks high among debt-free companies in the USA)

- FCF / Net Income: 176.2%

- Revenue Growth: 12.5%

Consumer & AI-Driven Stocks With Consistent Performance

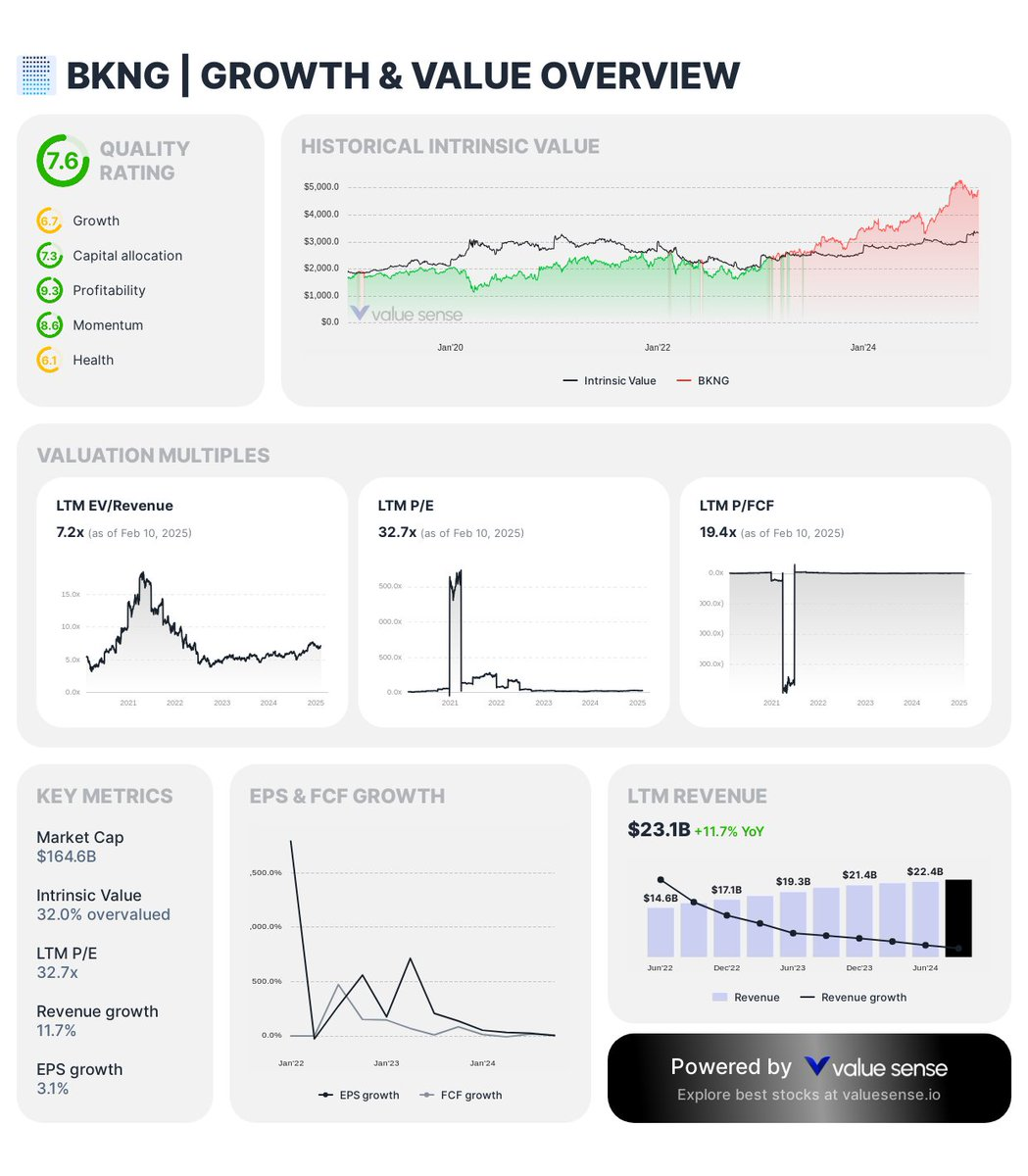

8. Booking Holdings Inc. ($BKNG)

- Net Debt to FCF: 0.1x (Effectively a debt-free stock in the USA)

- FCF / Net Income: 168.8%

- Revenue Growth: 11.7%

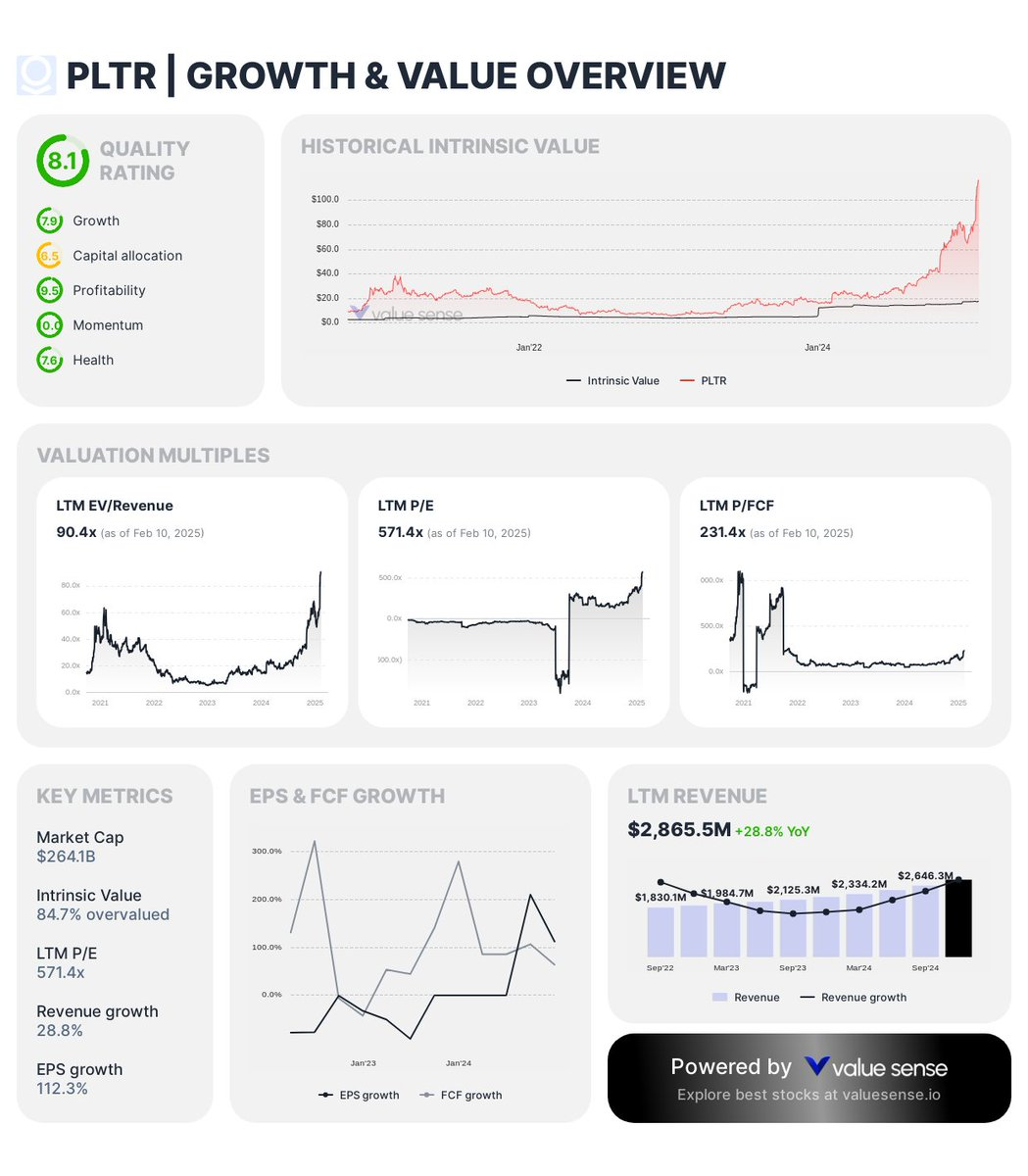

9. Palantir Technologies Inc. ($PLTR)

- Net Debt to FCF: (4.3x)

- FCF / Net Income: 203.2%

- Revenue Growth: 24.5%

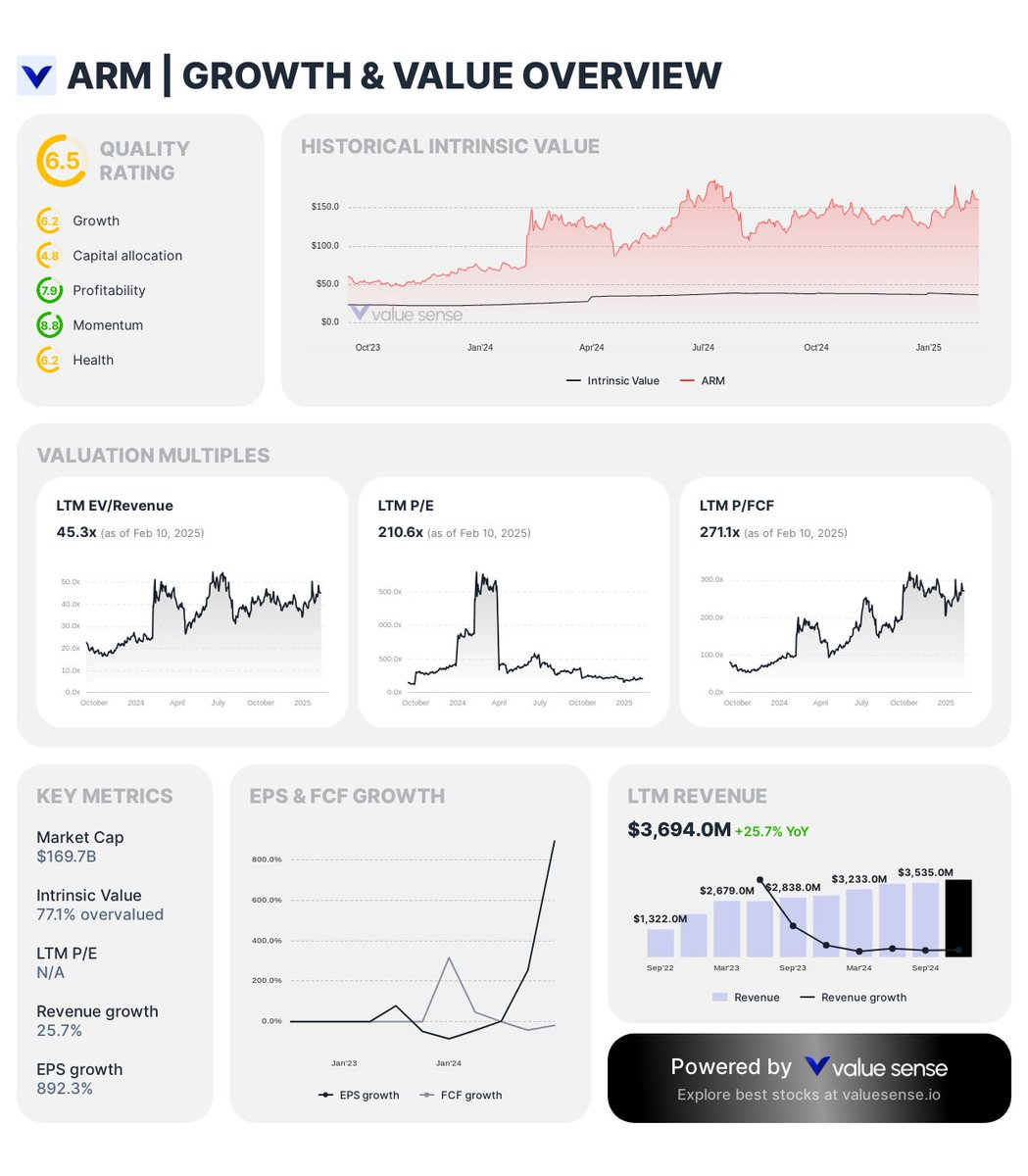

10. Arm Holdings plc ($ARM)

- Net Debt to FCF: (4.0x)

- FCF / Net Income: 81.9%

- Revenue Growth: 24.6%

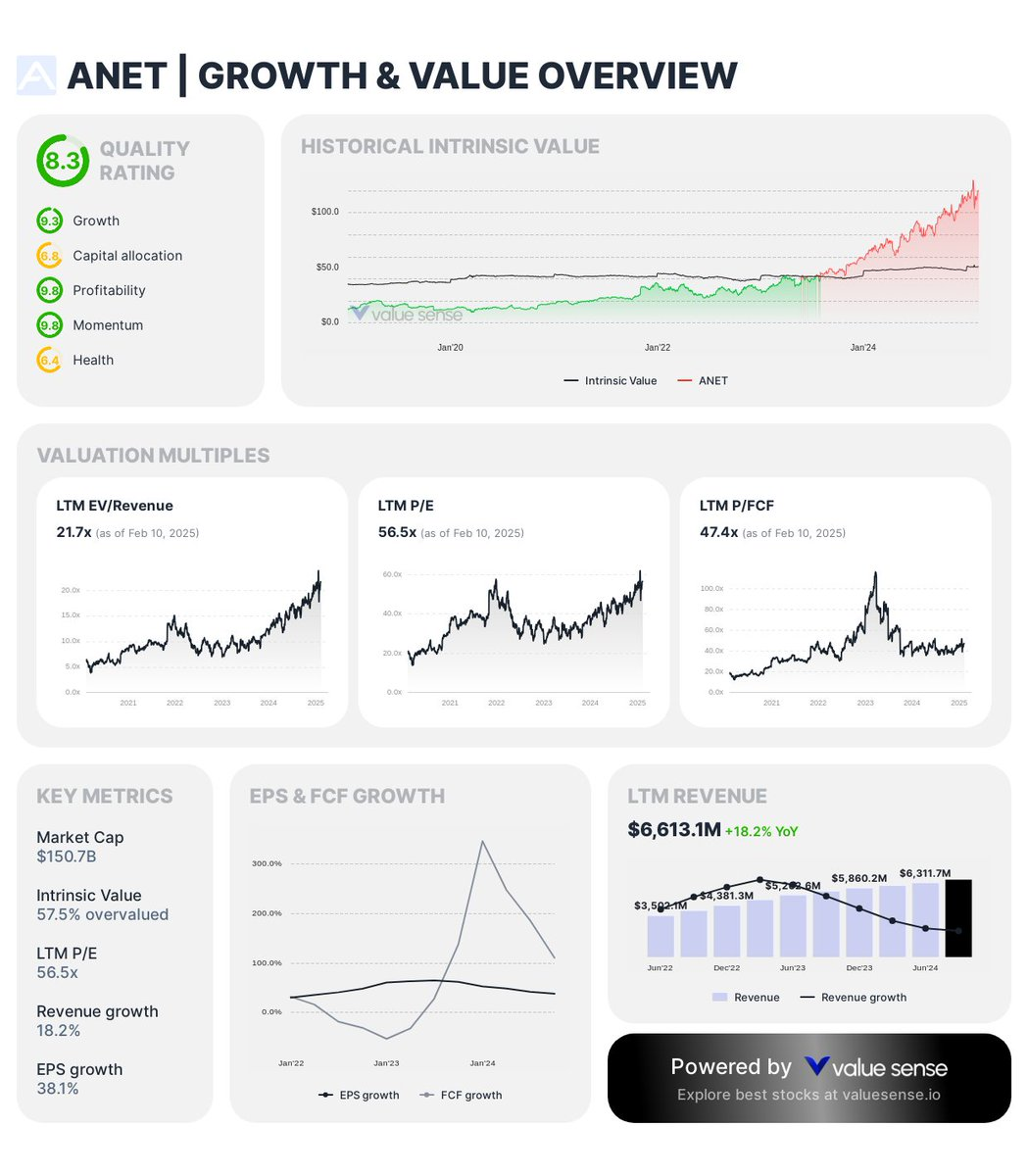

11. Arista Networks, Inc. ($ANET)

- Net Debt to FCF: (2.3x) (A stock with zero debt worries and high cash flow conversion)

- FCF / Net Income: 119.3%

- Revenue Growth: 18.2%

Screening Criteria: What Makes These Stocks Stand Out?

To qualify for this list, each company had to meet the following key financial strength metrics:

✅ Net Debt to FCF < 3x (Ensures low leverage and financial stability)

✅ FCF / Net Income > 80% (Indicates strong cash conversion efficiency)

✅ Revenue Growth > 10% (Shows strong business expansion potential)

These companies have superior capital allocation, enabling them to grow profitably while maintaining financial discipline.

This makes them some of the best stocks with low debt and high growth potential for 2025.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Stocks With Great Health Ratings and 15%+ Returns Over 5 Years

📖 High ROIC Stocks with Exceptional Quality and Momentum

📖 High-Quality Stocks With High Free Cash Flow

FAQ – Common Questions About High-FCF & Low-Debt Stocks

💡 Why is Free Cash Flow (FCF) important?

- FCF measures how much cash a company generates after covering expenses and investments, making it a key indicator of profitability and sustainability.

💡 What does a high FCF/Net Income ratio mean?

- It indicates strong earnings quality, showing that net income translates efficiently into cash, rather than being tied up in receivables or inventory.

💡 Why focus on Net Debt to FCF?

- It helps investors assess a company's ability to repay debt quickly using its cash flow, reducing financial risk.

💡 Are these companies truly debt-free?

- While some have low leverage, others qualify as debt-free companies in the USA, meaning they have little to no financial obligations impacting growth.

💡 How can I find more high-quality stocks?

- Platforms like Value Sense analyze undervalued stocks using fundamental and quality-based metrics.