The Magnificent 7 Stocks: Fundamental Quality Rankings & Insights

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The Magnificent 7 stocks have become the undisputed titans of modern financial markets, collectively representing trillions in market capitalization and driving innovation across multiple industries. These seven technology giants—NVIDIA, Meta, Alphabet, Microsoft, Apple, Tesla, and Amazon—command unprecedented influence over market movements and continue to reshape the global economy through their technological leadership and market dominance.

At ValueSense, we believe that understanding the fundamental quality of these market leaders requires looking beyond market sentiment and momentum to examine the underlying operational excellence, financial strength, and sustainable competitive advantages that truly drive long-term value creation. Our proprietary algorithm evaluates companies across comprehensive metrics including profitability, balance sheet strength, cash generation capabilities, return on invested capital, and competitive positioning to provide investors with data-driven insights into which companies offer the strongest fundamental foundations.

Understanding Our Quality Assessment Framework

Our comprehensive quality assessment methodology evaluates companies across multiple dimensions to provide a holistic view of operational excellence and financial strength. The algorithm considers profitability metrics, cash flow generation, balance sheet quality, capital efficiency, competitive moat strength, and growth sustainability. This multi-faceted approach ensures that our quality ratings reflect genuine business strength rather than temporary market conditions or speculative valuations.

The results of our analysis reveal important insights about the relative fundamental strength of these market leaders, with some surprising findings that challenge conventional wisdom about their comparative quality and investment attractiveness.

ValueSense's Fundamental Quality Rankings

Based on our comprehensive analysis of operational metrics, financial strength, and competitive positioning, here's how the Magnificent 7 stocks rank by fundamental quality:

- NVDA | NVIDIA Corporation

- META | Meta Platforms, Inc.

- GOOGL | Alphabet Inc.

- MSFT | Microsoft Corporation

- AAPL | Apple Inc.

- TSLA | Tesla, Inc.

- AMZN | Amazon.com, Inc.

This ranking reflects our algorithm's assessment of each company's fundamental business quality, operational efficiency, and sustainable competitive advantages, providing investors with insights into which companies demonstrate the strongest underlying business fundamentals.

Detailed Analysis of Each Magnificent 7 Stock

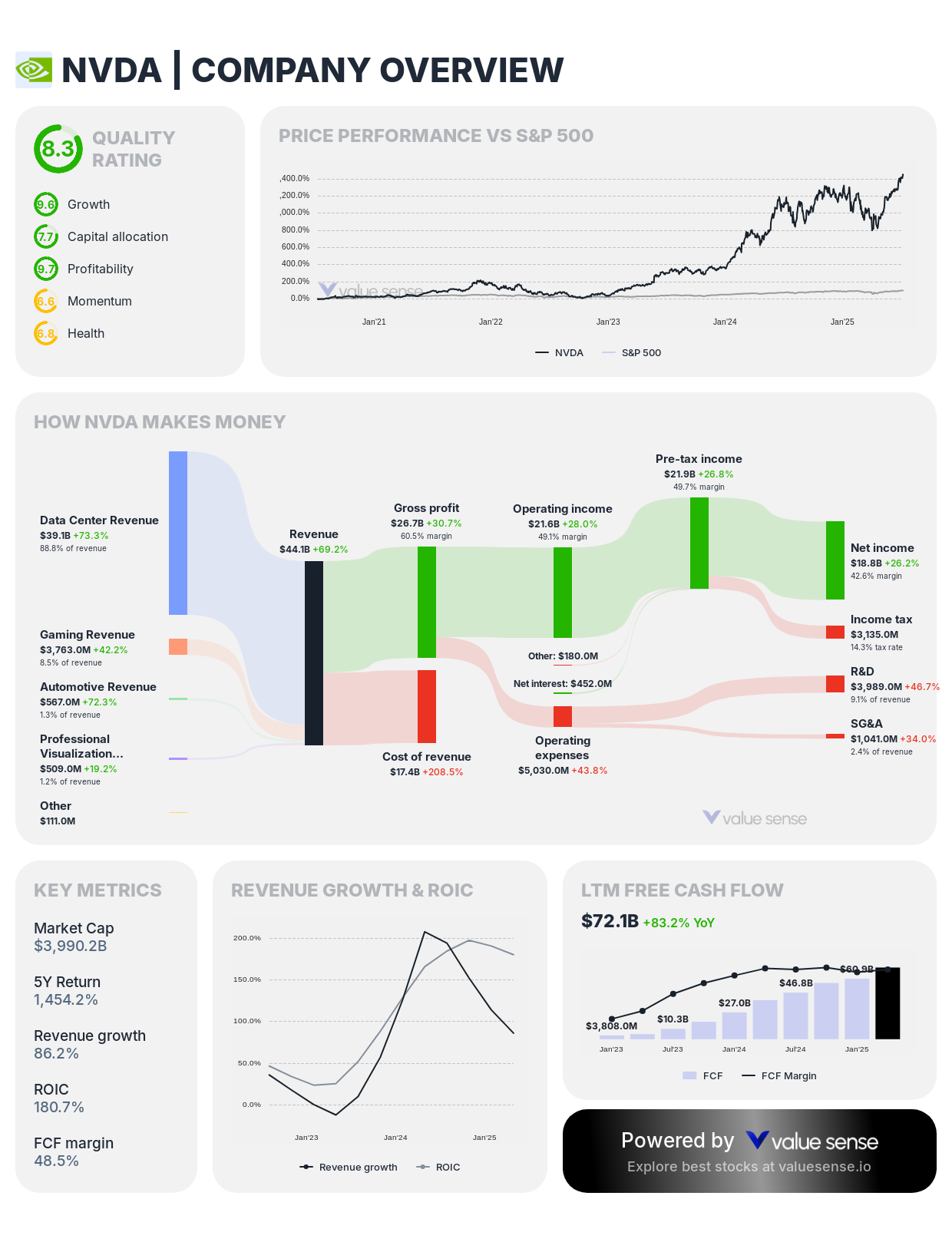

1. NVIDIA Corporation (NVDA) - The Undisputed Quality Leader

NVIDIA emerges as the clear winner in our fundamental quality analysis, demonstrating exceptional operational metrics that reflect its dominant position in artificial intelligence infrastructure and high-performance computing markets.

Key Financial Metrics:

- Market Cap: $$3,867.3B - Largest market capitalization reflecting investor confidence

- Quality Rating: 8.3 (Exceptional) - Highest quality rating among all Magnificent 7 stocks

- Intrinsic Value: 69.4% overvalued - Premium valuation reflects extraordinary growth expectations

- 1-Year Return: 23.5% - Strong performance despite market volatility

- Revenue: $$148.5B - Explosive revenue growth driven by AI infrastructure demand

- Free Cash Flow: $$72.1B - Exceptional cash generation capabilities

- Revenue Growth: 86.2% - Unprecedented growth trajectory in technology sector

NVIDIA's exceptional quality rating stems from its unique combination of technological leadership, pricing power, and scalable business model. The company's dominant position in AI accelerators, data center infrastructure, and high-performance computing creates an unparalleled competitive moat that translates into extraordinary financial metrics. The company's ability to maintain premium pricing while scaling production demonstrates exceptional operational excellence and market positioning strength that justifies its top quality ranking.

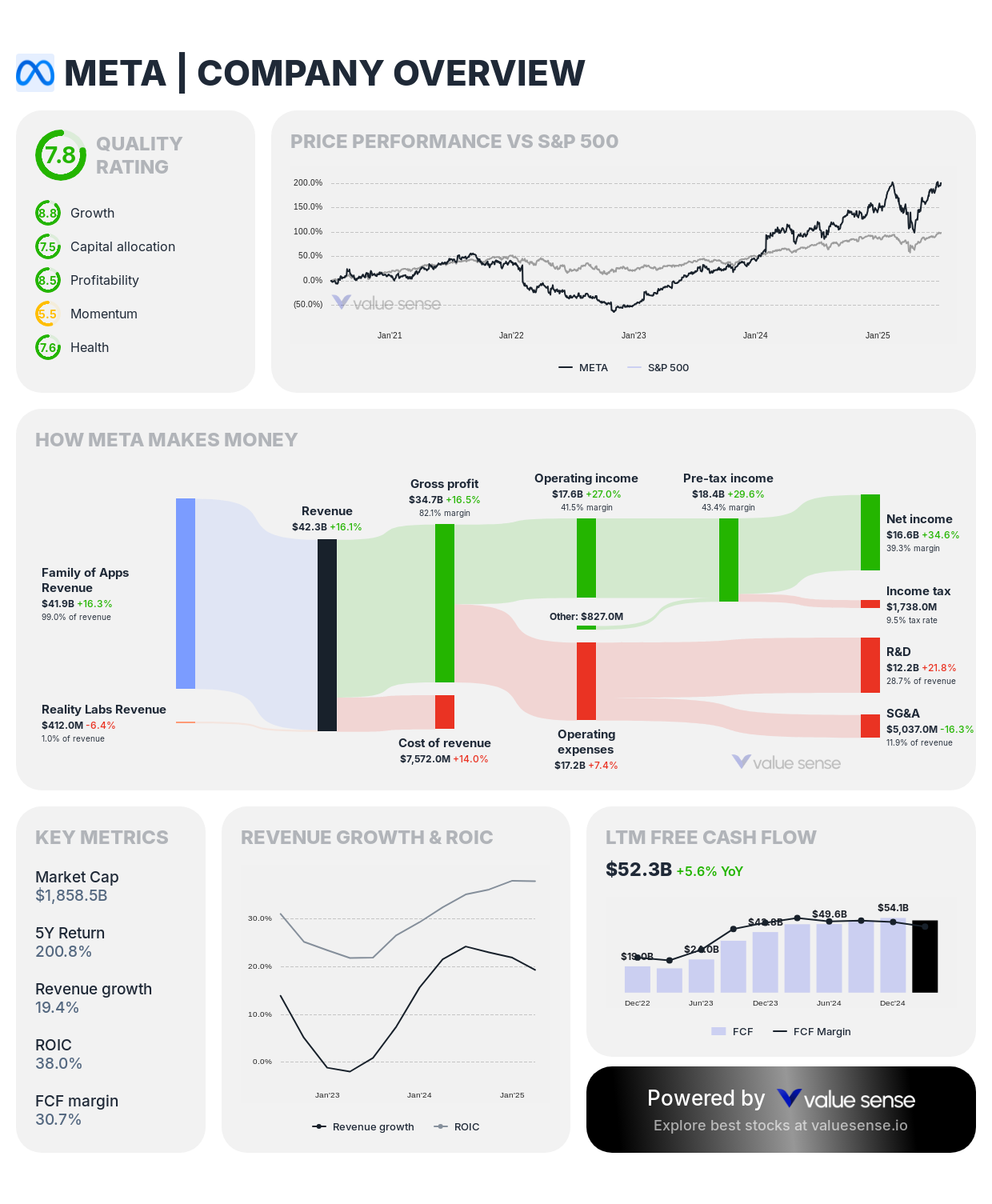

2. Meta Platforms Inc. (META) - Social Media Efficiency Champion

Meta Platforms secures the second position through its remarkable operational efficiency and successful strategic pivot while maintaining dominance across multiple social media platforms.

Key Financial Metrics:

- Market Cap: $$1,828.1B - Substantial market capitalization reflecting platform strength

- Quality Rating: 7.9 (Strong) - Second-highest quality rating demonstrates operational excellence

- Intrinsic Value: 35.4% overvalued - More reasonable valuation premium compared to peers

- 1-Year Return: 36.0% - Strong performance driven by efficiency improvements

- Revenue: $$170.4B - Diversified revenue streams across multiple platforms

- Free Cash Flow: $$52.3B - Robust cash generation supporting innovation investments

- Revenue Growth: 19.4% - Solid growth despite mature social media markets

Meta's high quality rating reflects its successful transformation from a growth-at-all-costs mentality to operational efficiency while maintaining its dominant market position. The company's ability to optimize costs while investing heavily in future technologies like virtual and augmented reality demonstrates management's capability to balance current profitability with long-term growth opportunities. The platform's network effects and user engagement metrics create sustainable competitive advantages that support consistent cash generation and operational excellence.

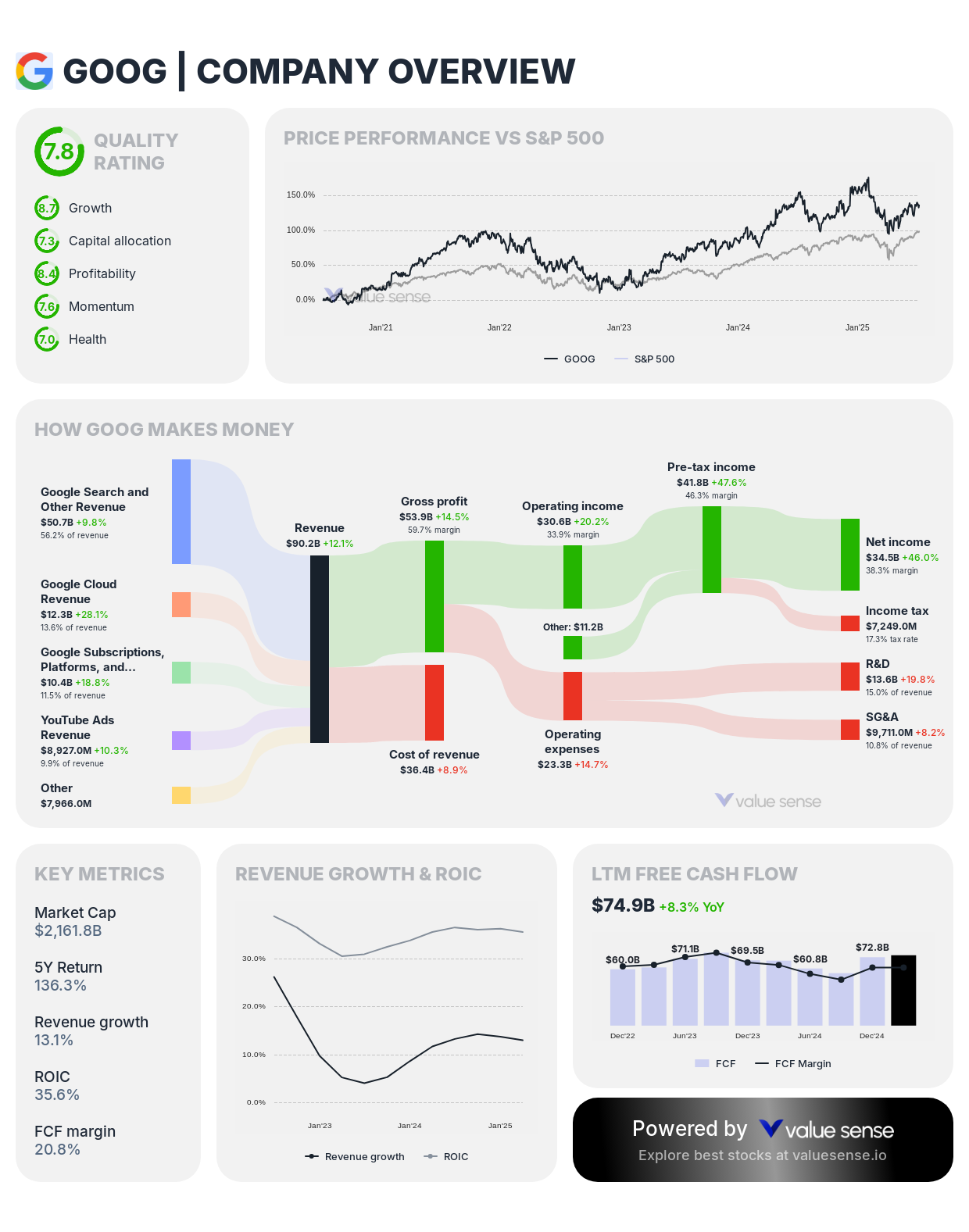

3. Alphabet Inc. (GOOG) - Search and Cloud Infrastructure Powerhouse

Alphabet maintains its position as a quality leader through its diversified technology portfolio, dominant search engine franchise, and rapidly expanding cloud computing business.

Key Financial Metrics:

- Market Cap: $$2,159.3B - Substantial market value reflecting business diversity

- Quality Rating: 7.9 (Strong) - Tied for second-highest quality rating

- Intrinsic Value: 4.9% overvalued - Most reasonable valuation among Magnificent 7

- 1-Year Return: (6.4%) - Recent weakness potentially creates opportunity

- Revenue: $$359.6B - Largest revenue base among technology peers

- Free Cash Flow: $$74.9B - Exceptional cash generation capabilities

- Revenue Growth: 13.1% - Steady growth across multiple business segments

Alphabet's strong quality rating stems from its diversified revenue streams spanning search advertising, cloud computing, YouTube, and emerging technologies. The company's dominant position in search creates a virtually unassailable competitive moat, while its expanding cloud business and artificial intelligence capabilities provide multiple growth avenues. The combination of stable, high-margin search revenue with growing cloud and other segments creates a balanced portfolio that supports consistent cash generation and reinvestment in innovation.

4. Microsoft Corporation (MSFT) - Enterprise Software and Cloud Leader

Microsoft demonstrates consistent quality through its successful cloud transformation and dominant position in enterprise software markets, creating a stable foundation for long-term growth.

Key Financial Metrics:

- Market Cap: $$3,702.8B - Second-largest market capitalization among Magnificent 7

- Quality Rating: 7.2 (Strong) - Solid quality metrics across business segments

- Intrinsic Value: 3.4% overvalued - Fair valuation relative to fundamental strength

- 1-Year Return: 7.4% - Steady performance in volatile market environment

- Revenue: $$270.0B - Diversified revenue across cloud and software segments

- Free Cash Flow: $$69.4B - Strong cash generation supporting growth investments

- Revenue Growth: 14.1% - Consistent double-digit growth trajectory

Microsoft's quality rating reflects its successful transformation from a traditional software company to a cloud-first organization while maintaining its dominant position in enterprise productivity software. The company's Azure cloud platform, Office 365 suite, and growing artificial intelligence capabilities create multiple revenue streams with strong recurring characteristics. The combination of enterprise software stability with cloud growth provides a balanced foundation that supports consistent financial performance and strategic flexibility.

5. Apple Inc. (AAPL) - Consumer Electronics and Services Ecosystem

Apple maintains its position through exceptional brand loyalty, premium product positioning, and an expanding services ecosystem, though faces challenges from market saturation in key product categories.

Key Financial Metrics:

- Market Cap: $$3,175.6B - Third-largest market capitalization among Magnificent 7

- Quality Rating: 7.2 (Strong) - Tied with Microsoft for quality rating

- Intrinsic Value: 65.0% overvalued - Significant premium valuation reflects brand strength

- 1-Year Return: (7.5%) - Recent weakness amid growth concerns

- Revenue: $$400.4B - Largest revenue base among consumer technology companies

- Free Cash Flow: $$98.5B - Exceptional cash generation capabilities

- Revenue Growth: 4.9% - Slower growth reflecting smartphone market maturation

Apple's quality rating reflects its exceptional brand strength, customer loyalty, and ecosystem integration that create sustainable competitive advantages. The company's ability to maintain premium pricing and generate exceptional cash flows demonstrates the strength of its market position. However, the slower growth trajectory and dependence on iPhone sales in mature markets present challenges that prevent a higher quality ranking despite the company's financial strength.

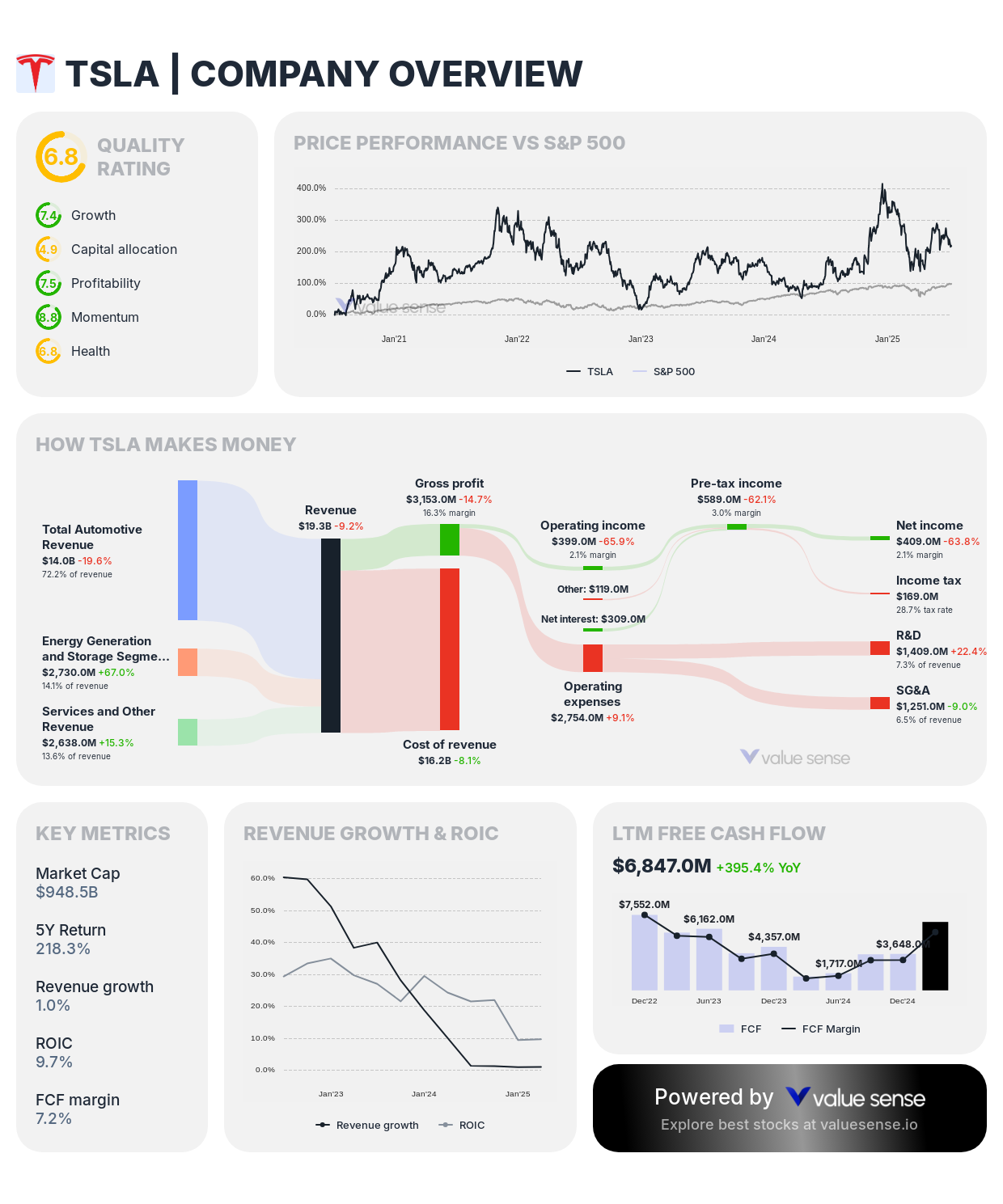

6. Tesla Inc. (TSLA) - Electric Vehicle and Energy Innovation Pioneer

Tesla demonstrates innovation leadership in electric vehicles and energy storage solutions, though faces increasing competition and execution challenges that impact its overall quality assessment.

Key Financial Metrics:

- Market Cap: $$944.9B - Substantial valuation for automotive company

- Quality Rating: 6.3 (Moderate) - Lower quality rating reflects operational challenges

- Intrinsic Value: 93.7% overvalued - Highest premium valuation among Magnificent 7

- 1-Year Return: 16.2% - Volatile performance characteristic of growth stock

- Revenue: $$95.7B - Growing revenue base from vehicle and energy sales

- Free Cash Flow: $$6,847.0M - Improving but inconsistent cash generation

- Revenue Growth: 1.0% - Slowing growth amid increased competition

Tesla's moderate quality rating reflects the challenges of operating in the capital-intensive automotive industry while maintaining innovation leadership. The company's pioneering position in electric vehicles and energy storage provides significant growth opportunities, but increased competition, execution challenges, and the cyclical nature of automotive markets create operational complexity that impacts overall quality metrics. The company's ability to maintain technological leadership while scaling production efficiently will be crucial for improving its fundamental quality profile.

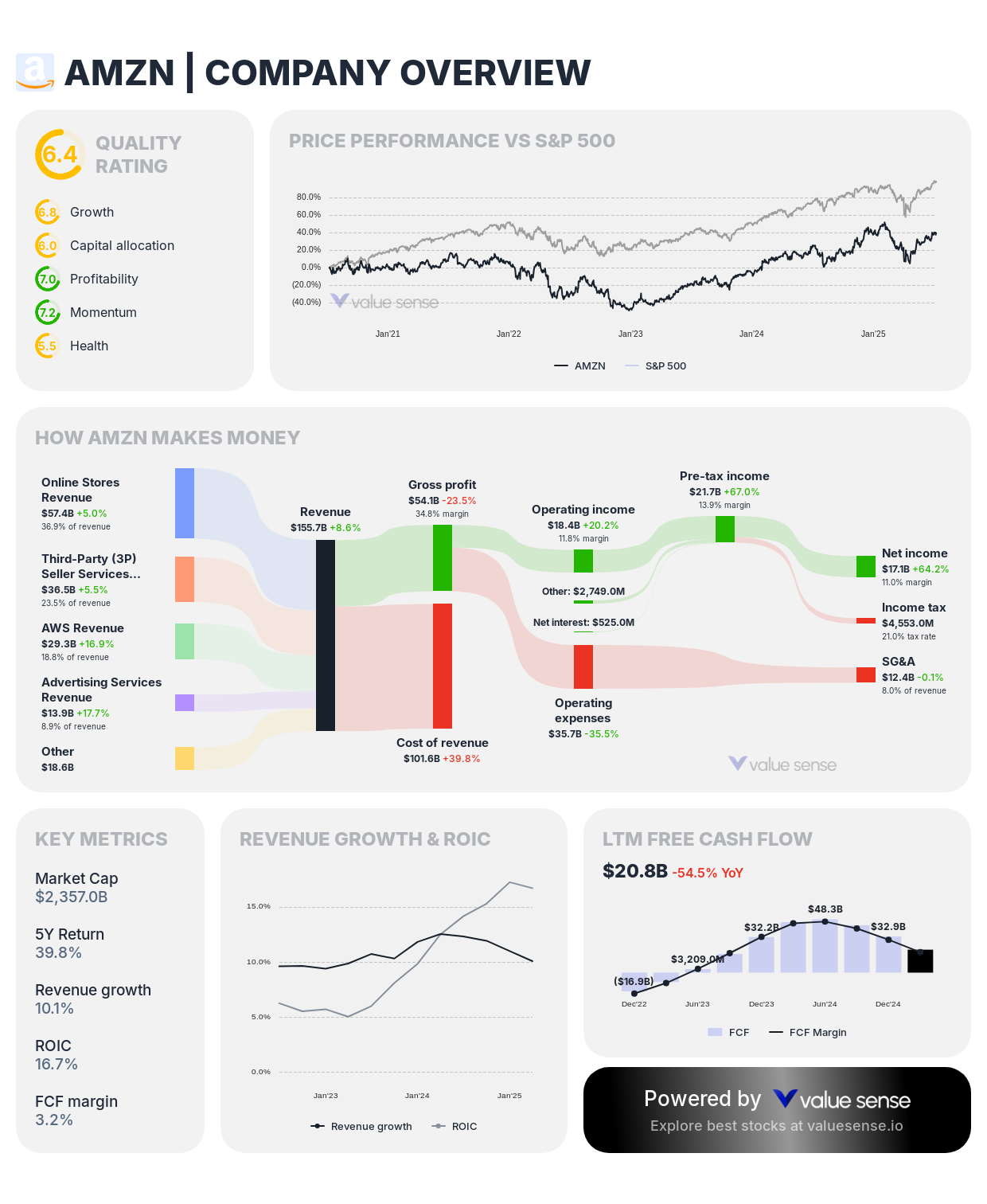

7. Amazon.com Inc. (AMZN) - E-commerce and Cloud Computing Conglomerate

Amazon ranks last in our quality analysis despite its massive scale and market influence, reflecting challenges in optimizing profitability and capital efficiency across its diverse business portfolio.

Key Financial Metrics:

- Market Cap: $$2,374.9B - Large market capitalization despite quality concerns

- Quality Rating: 6.3 (Moderate) - Lowest quality rating among Magnificent 7

- Intrinsic Value: 66.2% overvalued - Significant premium valuation

- 1-Year Return: 12.1% - Modest performance relative to growth expectations

- Revenue: $$650.3B - Largest revenue base among all technology companies

- Free Cash Flow: $$20.8B - Improving but still low relative to revenue scale

- Revenue Growth: 10.1% - Steady but unspectacular growth

Amazon's lower quality rating reflects the inherent challenges of managing a diverse portfolio spanning low-margin e-commerce, capital-intensive logistics, and high-margin cloud computing. While the company's scale and market positions create significant competitive advantages, the complexity of optimizing profitability across such diverse business models impacts overall operational efficiency metrics. The company's continued investments in growth initiatives and market expansion create near-term pressure on profitability metrics that influence its quality assessment.

Key Insights from Our Quality Analysis

Technology Infrastructure Companies Excel

Our analysis reveals that companies focused on technology infrastructure and platform businesses—NVIDIA, Meta, and Alphabet—demonstrate superior fundamental quality compared to those with more complex operational models. These companies typically exhibit higher profit margins, better capital efficiency, and more predictable cash generation patterns that translate into stronger quality ratings.

Software Scalability Advantage

The ranking highlights important differences between software-focused companies and those with significant hardware or physical operations. Software and platform businesses generally demonstrate superior scalability characteristics, higher margins, and more efficient capital deployment that contribute to higher quality ratings in our assessment framework.

Scale Complexity Trade-offs

Amazon's last-place ranking despite its massive revenue base demonstrates that scale alone doesn't guarantee operational excellence. The company's diverse business model, while providing growth opportunities and market leadership, also creates operational complexity that impacts overall efficiency and profitability metrics used in our quality assessment.

Valuation Premium Variations

The analysis reveals significant differences in valuation premiums across the Magnificent 7, with companies like Alphabet and Microsoft trading closer to fair value while others like Tesla and NVIDIA command substantial premiums that may limit future return potential and increase investment risk.

Investment Implications and Strategic Considerations

Quality-Focused Portfolio Construction

Investors seeking exposure to the Magnificent 7 should consider weighting positions based on fundamental quality metrics rather than market capitalization alone. Companies with higher quality ratings like NVIDIA, Meta, and Alphabet may offer better risk-adjusted returns over extended time horizons, while those with lower quality ratings may require more careful timing and risk management.

Valuation Sensitivity Analysis

The significant valuation premiums across most Magnificent 7 stocks suggest that investors should be prepared for potential volatility as markets adjust to changing growth expectations, competitive dynamics, and macroeconomic conditions. Understanding the relationship between quality and valuation provides important context for managing portfolio risk and return expectations.

Diversification Benefits and Risks

While the Magnificent 7 provides exposure to different technology sectors and business models, their collective dominance in market indices creates concentration risk that investors should carefully consider. The diverse business models across these companies provide some natural diversification benefits, but their shared exposure to technology trends and market sentiment creates correlated risks that require active management.

Conclusion

Our comprehensive fundamental quality analysis of the Magnificent 7 stocks reveals important insights that challenge conventional market wisdom and provide valuable guidance for informed investment decisions. NVIDIA's dominance in our quality rankings reflects its exceptional operational metrics and unassailable market position in critical growth markets, while Amazon's last-place finish highlights the challenges of managing complex, diverse business models efficiently.

The significant valuation premiums across most of these market leaders suggest that investors should carefully balance quality considerations with valuation discipline when constructing portfolios. While these companies will likely continue to drive market performance and technological innovation, understanding their relative fundamental strengths provides a more informed foundation for investment decisions and risk management.

For investors seeking to build portfolios around these market leaders, our analysis suggests focusing on companies that combine strong fundamental quality with reasonable valuations, while maintaining awareness of the concentration risks inherent in the Magnificent 7's market dominance.

For comprehensive analysis, real-time updates, and detailed financial metrics on these and other market leaders, visit ValueSense.io to access our complete database of quality assessments and valuation models.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Best Undervalued S&P 500 Stocks

📖 11 Best Undervalued Multibagger Stocks

📖 8 Best Undervalued Low Debt Stocks