Mairs & Power Growth Fund Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

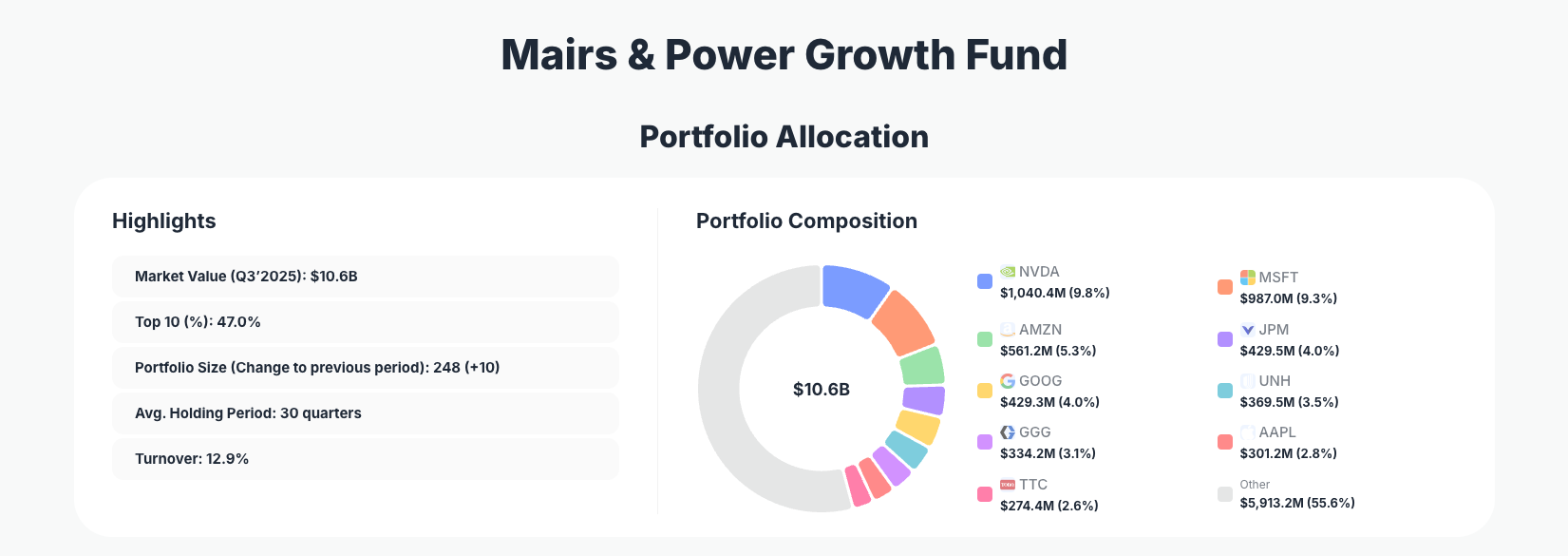

Mairs & Power Growth Fund maintains its disciplined growth investing approach with a diversified yet conviction-weighted $10.6B portfolio revealed in the Q3 2025 13F filing. The fund trimmed several mega-cap tech leaders like NVDA and MSFT while adding to stalwarts such as AMZN and AAPL, signaling a strategy of rebalancing toward resilient quality amid market highs.

Portfolio Snapshot: Balanced Growth with Proven Longevity

Portfolio Highlights (Q3’2025): - Market Value: $10.6B - Top 10 Holdings: 47.0% - Portfolio Size: 248 +10 - Average Holding Period: 30 quarters - Turnover: 12.9%

The Mairs & Power Growth Fund's Q3 2025 portfolio exemplifies a balanced growth strategy, with nearly half the value concentrated in just 10 names despite holding 248 positions overall. This structure allows for meaningful exposure to high-conviction ideas while maintaining diversification across sectors, a hallmark of the fund's patient approach evidenced by an impressive average holding period of 30 quarters—over seven years.

Low turnover at 12.9% underscores the fund's buy-and-hold philosophy, avoiding the pitfalls of frequent trading in volatile markets. Recent additions of 10 new positions suggest opportunistic expansion without disrupting core holdings. Investors tracking this via the Mairs & Power portfolio page on ValueSense can see how this discipline has compounded returns over decades.

The portfolio's evolution reflects adaptability: trimming overvalued tech while bolstering healthcare and consumer names, positioning for sustained growth in a high-interest-rate environment.

Core Positions: Tech Trims and Strategic Adds

Leading the pack is NVIDIA Corporation (NVDA) at 9.8% of the portfolio after a Reduce 4.07% move, with $1,040.4M invested. Close behind, Microsoft Corporation (MSFT) holds 9.3% following a Reduce 4.95% adjustment ($987.0M value). The fund added 2.53% to Amazon.com, Inc. (AMZN) at 5.3% $561.2M, showing confidence in e-commerce resilience.

Significant reductions include JPMorgan Chase & Co. (JPM) by 9.29% to 4.0% $429.5M and Alphabet Inc. (GOOG) by 2.18% also at 4.0% $429.3M. On the buy side, UnitedHealth Group Incorporated (UNH) gained 1.21% to 3.5% $369.5M, while Graco Inc. (GGG) saw a minor Reduce 1.08% to 3.1% $334.2M.

Apple Inc. (AAPL) received a 3.52% boost to 2.8% $301.2M, and The Toro Company (TTC) was trimmed 1.35% to 2.6% $274.4M. Extending to other changes, Eli Lilly and Company (LLY) dropped 1.96% to 2.6% $273.3M, highlighting a pattern of profit-taking in high-flyers and incremental buys in steady growers.

This mix reveals a portfolio favoring mega-cap tech (over 28% combined in top names) blended with industrials like GGG and TTC, plus healthcare via UNH and LLY, demonstrating broad-based growth exposure.

What the Portfolio Reveals About Mairs & Power's Strategy

The Q3 moves paint a picture of disciplined risk management in a tech-dominated market. Trims in NVDA, MSFT, and GOOG suggest taking profits after strong runs, while adds to AMZN, AAPL, and UNH indicate preference for companies with durable competitive edges and recurring revenues.

- Sector Focus: Heavy tech weighting (top positions) balanced by financials (JPM), healthcare (UNH, LLY), and industrials (GGG, TTC), reducing reliance on any single area.

- Quality Over Speculation: Emphasis on profitable leaders with strong moats, aligning with growth-at-a-reasonable-price principles.

- Risk Management: Low turnover and long holding periods mitigate volatility; recent changes show active rebalancing without overhauling the core.

- Geographic Concentration: Primarily U.S.-centric, leveraging domestic economic strength.

This approach prioritizes compounding through quality businesses rather than chasing momentum.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| NVIDIA Corporation (NVDA) | $1,040.4M | 9.8% | Reduce 4.07% |

| Microsoft Corporation (MSFT) | $987.0M | 9.3% | Reduce 4.95% |

| Amazon.com, Inc. (AMZN) | $561.2M | 5.3% | Add 2.53% |

| JPMorgan Chase & Co. (JPM) | $429.5M | 4.0% | Reduce 9.29% |

| Alphabet Inc. (GOOG) | $429.3M | 4.0% | Reduce 2.18% |

| UnitedHealth Group Incorporated (UNH) | $369.5M | 3.5% | Add 1.21% |

| Graco Inc. (GGG) | $334.2M | 3.1% | Reduce 1.08% |

| Apple Inc. (AAPL) | $301.2M | 2.8% | Add 3.52% |

| The Toro Company (TTC) | $274.4M | 2.6% | Reduce 1.35% |

The top 10 command 47.0% of the $10.6B portfolio, with NVDA and MSFT alone representing over 19%—a testament to conviction in AI and cloud leaders despite trims. This concentration enables outsized impact from winners while the broader 248 holdings provide stability.

Notably, reductions in JPM 9.29% and MSFT 4.95% freed capital for adds like AAPL 3.52% and AMZN 2.53%, suggesting a rotation toward consumer and e-commerce durability. The table underscores measured adjustments rather than wholesale shifts, preserving the fund's growth-oriented core.

Investment Lessons from Mairs & Power Growth Fund

The portfolio demonstrates timeless principles tailored to long-term growth investing:

- Patience Pays: Long Holding Periods: 30-quarter average tenure shows commitment to compounding, avoiding short-term noise.

- Trim Winners, Add Quality: Profit-taking in NVDA and MSFT while boosting AAPL and UNH balances growth with valuation discipline.

- Diversify Thoughtfully: 248 positions with 47% in top 10 strike a balance between conviction and risk control.

- Focus on Moats: Holdings like GGG and TTC highlight preference for niche industrials with enduring advantages.

- Low Turnover Discipline: 12.9% rate minimizes taxes and transaction costs, maximizing net returns.

These lessons emphasize understanding businesses deeply before sizing positions large.

Looking Ahead: What Comes Next?

With 248 positions and recent +10 additions, Mairs & Power appears poised for selective deployment amid moderating inflation and potential rate cuts. Trims in overextended tech may create dry powder for undervalued industrials or healthcare plays like UNH expansions.

Market conditions favor this setup: AI tailwinds support NVDA/MSFT cores, while AMZN/AAPL position for consumer recovery. Watch for further rotations into small/mid-caps given the fund's growth mandate and historical success spotting them early.

FAQ about Mairs & Power Growth Fund Portfolio

Q: What drove the significant reductions in NVDA, MSFT, and JPM?

A: The fund reduced NVDA by 4.07%, MSFT by 4.95%, and JPM by 9.29%, likely locking in gains after strong rallies and rebalancing toward relatively undervalued names like AMZN and AAPL amid high valuations in tech and financials.

Q: Why does the portfolio maintain 47% concentration in just 10 holdings despite 248 positions?

A: This structure allows high-conviction bets on proven growers like NVDA and MSFT while diversification across many smaller stakes manages risk, aligning with the fund's balanced growth strategy and low 12.9% turnover.

Q: What sectors dominate Mairs & Power's Q3 2025 portfolio?

A: Technology leads with NVDA, MSFT, AMZN, GOOG, and AAPL; healthcare via UNH and LLY; financials with JPM; and industrials like GGG and TTC provide balance for resilient growth exposure.

Q: How can I track Mairs & Power Growth Fund's portfolio changes?

A: Follow quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/mairs-power for real-time analysis, historical data, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!