Margin of Safety by Seth A. Klarman

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“Margin of Safety: Risk-Averse Value Investing Strategies for the Thoughtful Investor” by Seth A. Klarman is one of the most coveted and influential texts in the world of value investing. First published in 1991, this book has become legendary among investment professionals and serious individual investors alike, not least because of its rarity—physical copies routinely sell for thousands of dollars on secondary markets. Klarman, the founder and CEO of Baupost Group, one of the most successful hedge funds globally, is renowned for his disciplined, risk-averse approach and his unwavering commitment to value investing principles. His track record at Baupost, with consistent long-term returns and a reputation for capital preservation, gives the book an authority that few other investment texts can match.

“Margin of Safety” was written at a time when Wall Street was still reeling from the excesses of the 1980s and the crash of 1987. The book is deeply rooted in the lessons learned from market bubbles, manias, and the dangers of speculation. Klarman’s writing is both a critique of the prevailing investment culture—characterized by short-termism, speculation, and institutional conflicts—and a guide to a more thoughtful, patient, and risk-averse approach. The main purpose of the book is to teach investors how to avoid the most common pitfalls, understand the true nature of risk, and focus on the preservation of capital through the discipline of value investing.

This book is considered a classic and a must-read for anyone serious about investing, particularly those interested in value strategies. It stands out because it is not a step-by-step manual or a collection of formulas; rather, it is a philosophical treatise on the mindset and discipline required for successful investing. Klarman’s insights into investor psychology, market inefficiencies, and the structural flaws of Wall Street have only grown more relevant in the decades since publication. The book is particularly valuable for investors who want to develop a durable investment philosophy, build resilience against market noise, and learn how to identify genuine value in a world obsessed with momentum and speculation.

What makes “Margin of Safety” unique is its blend of practical wisdom and deep skepticism about the prevailing norms of the investment industry. Klarman does not promise quick riches; instead, he emphasizes the importance of patience, humility, and rigorous analysis. Unlike many investment books that focus on maximizing returns, Klarman’s emphasis is on minimizing losses and avoiding permanent capital impairment. This contrarian approach is especially relevant for investors who have witnessed repeated cycles of boom and bust and are seeking a more sustainable, rational path forward.

“Margin of Safety” is essential reading for both professional and individual investors who are willing to think independently and resist the herd mentality. Its lessons are particularly critical in today’s environment of information overload, algorithmic trading, and relentless market volatility. For those who aspire to outperform over the long run—not through luck or speculation, but through careful, disciplined decision-making—Klarman’s book offers both a roadmap and a challenge: to invest thoughtfully, with a true margin of safety.

Key Themes and Concepts

Throughout “Margin of Safety,” Seth Klarman weaves together several interlocking themes that define the essence of value investing and set his philosophy apart from the mainstream. These themes run consistently through the book’s four major sections, shaping not only the technical aspects of investing but also the psychological and behavioral mindset required for sustainable success. Klarman’s writing is both a critique of the investment industry’s failings and a prescription for how thoughtful investors can sidestep common traps and focus on long-term wealth preservation.

The book’s key concepts are not just theoretical—they are grounded in decades of market experience, with practical examples and actionable advice. Klarman’s insistence on risk aversion, his skepticism of Wall Street, and his focus on intrinsic value resonate throughout the chapters. The following themes represent the core pillars of Klarman’s investment philosophy and provide a framework for applying his lessons in any market environment.

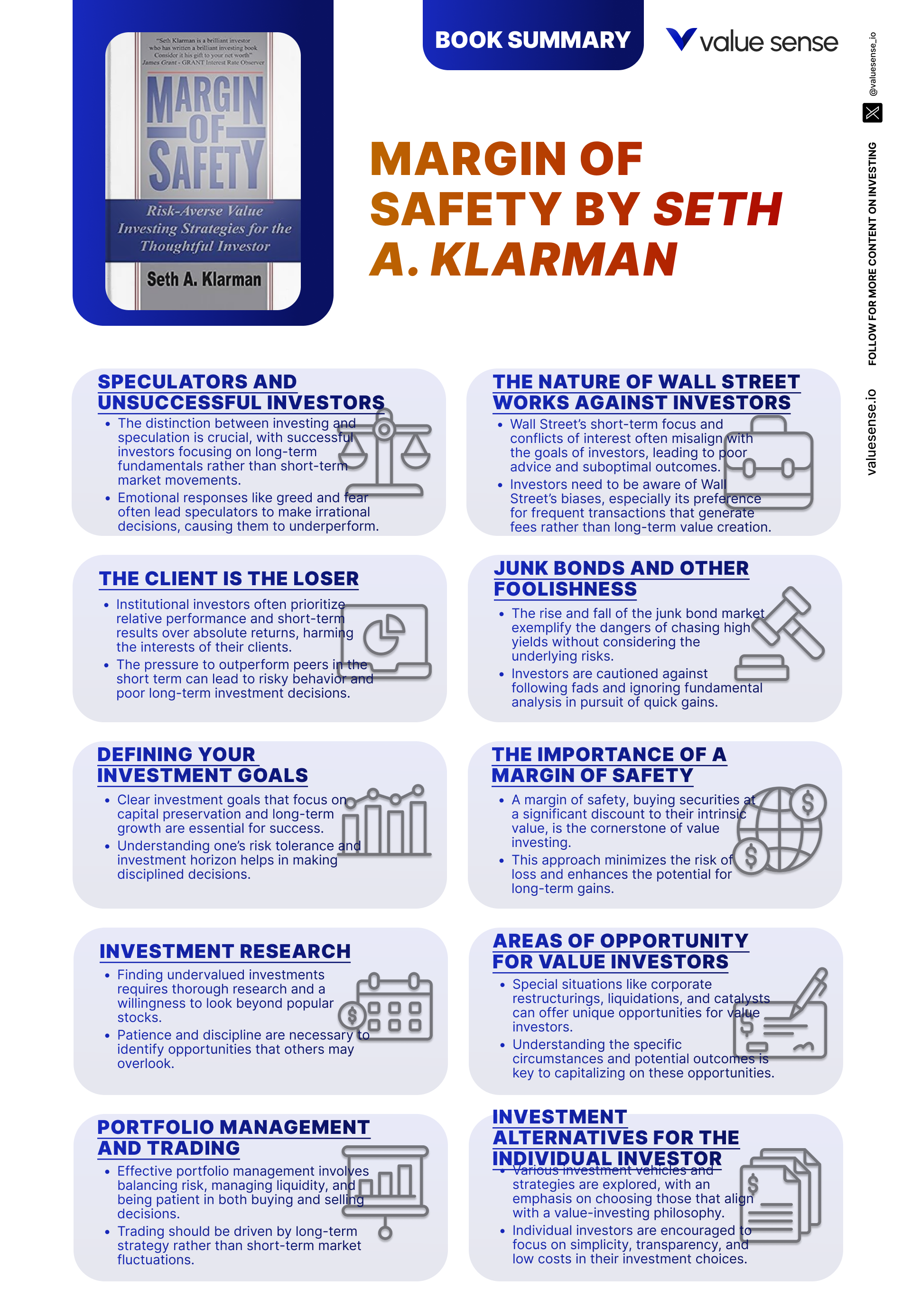

- Margin of Safety: The concept of margin of safety is the cornerstone of Klarman’s value investing philosophy. It refers to the practice of buying securities at a significant discount to their intrinsic value, thereby providing a buffer against errors in judgment, unforeseen events, or market volatility. Klarman illustrates how this principle protects investors from permanent capital loss and allows them to withstand adverse scenarios. For example, he discusses investing in companies trading below their liquidation value or with assets that far exceed their market price. The practical application for investors is clear: always demand a margin of safety in every investment, whether it’s a stock, bond, or special situation, and avoid investments where the downside risk is not adequately protected.

- Value vs. Speculation: Klarman draws a sharp distinction between value investing and speculation. He argues that most market participants are speculators, focused on price movements and short-term gains rather than the underlying business value. The book repeatedly warns against the dangers of the “greater fool” theory and the temptation to chase hot trends. Klarman uses historical examples of bubbles and crashes to demonstrate the perils of speculation. Investors are urged to focus on fundamental analysis, intrinsic value, and a long-term horizon, rather than trying to outguess the market or profit from short-term volatility.

- Wall Street Conflicts: One of the book’s most enduring themes is the inherent conflict of interest that pervades Wall Street. Klarman exposes how brokers, analysts, and investment banks often prioritize their own profits—through commissions, fees, and product sales—over the interests of their clients. He provides detailed examples of how bullish bias, short-term incentives, and the pressure to “sell” ideas can lead to poor investment outcomes. The practical takeaway is that investors must be skeptical of Wall Street advice, do their own homework, and be aware of the incentives that drive recommendations and research.

- Long-Term Focus: Klarman repeatedly emphasizes the importance of maintaining a long-term perspective, both in terms of investment horizon and performance measurement. He critiques the obsession with quarterly earnings, short-term benchmarks, and relative performance. Instead, he advocates for absolute performance and the compounding benefits of patient, disciplined investing. Real-world examples include the success of investors like Warren Buffett, who have consistently outperformed by ignoring short-term noise and focusing on business fundamentals. Investors are encouraged to resist the urge to trade frequently and to judge their results over years, not months.

- Risk Aversion: Preserving capital is at the heart of Klarman’s approach. He argues that risk is not volatility, but the probability of permanent capital loss. The book is filled with discussions on how to avoid large losses by being conservative in assumptions, diversifying portfolios, and avoiding leverage. Klarman’s own success at Baupost is attributed to his relentless focus on risk management. Investors should prioritize downside protection over chasing high returns, use conservative valuation metrics, and be willing to hold cash when no attractive opportunities are available.

- Research and Analysis: Klarman underscores that successful value investing requires rigorous research and due diligence. He outlines a systematic approach to analyzing financial statements, understanding business models, and identifying mispriced securities. The book provides practical techniques for evaluating assets, liabilities, and cash flows, and stresses the importance of reading primary sources rather than relying on Wall Street summaries. Investors are advised to cultivate analytical independence, question assumptions, and dig deeply into company filings and industry trends before committing capital.

- Institutional Challenges: Klarman dedicates significant attention to the structural challenges faced by institutional investors, such as the pressure to deliver short-term results, bureaucratic decision-making, and misalignment of incentives. He explains how these factors often lead to herd behavior, excessive trading, and suboptimal performance. The book encourages individual investors to exploit these inefficiencies by being more patient, flexible, and independent in their approach. Klarman’s critique of the institutional “performance derby” is a call to arms for thoughtful investors to resist crowd psychology and focus on their own goals.

Book Structure: Major Sections

Part 1: Where Most Investors Stumble

This opening section, spanning chapters 1 through 4, lays the groundwork by exposing the most frequent mistakes made by investors. Klarman starts by dissecting the critical difference between investing and speculation, then moves on to the often-misunderstood incentives and conflicts embedded in Wall Street’s structure. He also takes aim at the short-term orientation of institutional investors and the damaging effects it has on client outcomes.

Key concepts include the tendency of investors to chase performance, the dangers of relying on Wall Street “experts,” and the pitfalls of focusing on relative rather than absolute returns. Klarman provides vivid examples, such as the repeated cycles of market bubbles and busts, to illustrate how emotional decision-making and herd behavior lead to poor results. He highlights the “greater fool” theory, where investors buy overpriced assets in the hope that someone else will pay even more, and explains how this mindset is a recipe for disaster.

For investors, the practical application is clear: avoid speculation, be wary of advice from conflicted parties, and focus on fundamental analysis. Klarman urges readers to develop their own investment philosophy, grounded in skepticism and independent thinking. He recommends learning to recognize and sidestep the psychological traps that lure many into short-term, speculative behavior.

In today’s market, where information is abundant but wisdom is scarce, these lessons are more relevant than ever. The proliferation of financial media, social trading platforms, and algorithmic strategies has only amplified the risks of herd behavior and short-termism. Klarman’s critique of institutional incentives and Wall Street conflicts remains a powerful warning for anyone navigating the modern investment landscape.

Part 2: The Philosophy of Value Investing

Chapters 5 through 8 form the philosophical heart of the book, where Klarman articulates the core principles of value investing. This section introduces the margin of safety concept, risk aversion, and the importance of absolute performance. Klarman argues that successful investing is more about avoiding losses than chasing gains, and that a clear, disciplined philosophy is essential for long-term success.

Central to this part is the idea of buying securities at a significant discount to intrinsic value, thereby creating a margin of safety. Klarman provides detailed methods for valuing companies and stresses the importance of conservative assumptions and a bottom-up approach. He critiques the obsession with market timing and macroeconomic forecasting, advocating instead for a focus on individual businesses and their underlying economics.

Investors are encouraged to adopt a risk-averse mindset, prioritize capital preservation, and measure performance in absolute terms. Klarman’s emphasis on patience, discipline, and humility provides a counterbalance to the greed and overconfidence that often drive market manias. He recommends developing a systematic process for evaluating opportunities and being willing to hold cash when no attractive investments are available.

These philosophical principles remain timeless, even as markets evolve. In an era of rapid technological change and increased volatility, Klarman’s insistence on margin of safety and fundamental analysis offers a durable framework for navigating uncertainty. The section’s focus on intrinsic value and risk management is especially pertinent for investors seeking to avoid the pitfalls of speculation and market fads.

Part 3: The Value-Investment Process

This section, encompassing chapters 9 through 12, translates Klarman’s philosophy into actionable steps. Here, he details the research and analytical processes that underpin successful value investing, from sourcing ideas to conducting deep-dive analysis and identifying unique opportunities in specialized market niches.

Klarman explains how to systematically analyze financial statements, assess management quality, and value assets conservatively. He highlights the importance of thorough due diligence, including reading company filings, understanding industry dynamics, and maintaining skepticism about management projections. The section also explores specialized areas such as distressed securities, liquidations, and spin-offs, where value investors can find mispriced opportunities overlooked by the broader market.

For practitioners, this section provides a toolkit for uncovering undervalued securities and building a robust investment process. Klarman emphasizes the need for patience, analytical rigor, and a willingness to act independently of market consensus. He encourages investors to focus on what they can know and control, rather than trying to predict market movements or macroeconomic trends.

In the modern context, where data is ubiquitous and competition is fierce, Klarman’s process-oriented approach is a blueprint for gaining an edge. The emphasis on deep research, primary sources, and contrarian thinking is as relevant today as it was when the book was written. Investors who follow this disciplined process are better positioned to identify genuine value and avoid costly mistakes.

Part 4: Portfolio Management and Professional Selection

The final section, covering chapters 13 and 14, addresses the practical realities of managing a portfolio and selecting an investment professional. Klarman discusses strategies for portfolio construction, risk management, and trading, as well as the criteria for choosing a trustworthy investment manager.

Key concepts include diversification, position sizing, and the importance of discipline in trading decisions. Klarman offers advice on balancing risk and return, maintaining flexibility, and avoiding overconcentration in any single investment. He also provides a checklist for evaluating investment professionals, emphasizing alignment of interests, track record, and transparency.

For investors, the actionable takeaway is to approach portfolio management with the same rigor and skepticism applied to security analysis. Klarman recommends regular portfolio reviews, adherence to predetermined rules, and a focus on long-term objectives. When selecting a manager, he urges investors to look beyond marketing materials and focus on substance, integrity, and alignment of incentives.

In today’s world of robo-advisors, passive funds, and proliferating investment products, Klarman’s guidance on portfolio management and professional selection is invaluable. His insistence on discipline, transparency, and alignment of interests provides a strong foundation for building resilient portfolios and making informed decisions about delegating capital.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Deep Dive: Essential Chapters

Chapter 1: Speculators and Unsuccessful Investors

This opening chapter is foundational, as it establishes the critical distinction between investing and speculation—a theme that reverberates throughout the entire book. Klarman argues that most market participants are, in fact, speculators rather than true investors. He explains that speculation is characterized by a focus on price movements and the hope of selling to a “greater fool” at a higher price, whereas investing is grounded in the careful analysis of intrinsic value and a commitment to long-term wealth preservation. This chapter is essential because it challenges readers to examine their own motivations and behaviors, setting the stage for the value investing principles that follow.

Klarman provides vivid examples of speculative manias, referencing the Dutch Tulip Bubble, the South Sea Bubble, and the 1980s junk bond craze. He quotes Benjamin Graham’s classic definition of investment as “an operation which, upon thorough analysis, promises safety of principal and an adequate return.” Klarman warns that speculators are often driven by emotion, herd behavior, and the lure of easy gains, leading to repeated cycles of boom and bust. He points to the 1987 stock market crash as a recent example of how speculative excess can quickly unravel, causing massive losses for those who ignore fundamental value.

For investors seeking to apply these lessons, the first step is to clarify their own investment philosophy. Klarman recommends focusing on business fundamentals, conducting independent research, and avoiding the temptation to chase hot trends or time the market. He suggests developing a checklist to distinguish between investments and speculations, such as asking whether the security is purchased at a discount to intrinsic value and whether the investment thesis is based on sound analysis rather than market momentum.

Historically, the distinction between investing and speculation has been at the heart of every major market cycle. From the dot-com bubble to the housing crisis, those who failed to heed these lessons suffered significant losses. In today’s environment of meme stocks and social media-driven trading, Klarman’s warning is more relevant than ever. Investors who anchor their decisions in intrinsic value and resist the pull of speculation are far better positioned to achieve lasting success.

Chapter 2: The Nature of Wall Street Works Against Investors

This chapter is crucial because it exposes the structural conflicts of interest that pervade Wall Street, often to the detriment of individual investors. Klarman argues that the incentives of brokers, analysts, and investment banks are typically misaligned with the interests of their clients, leading to biased advice and suboptimal outcomes. The chapter’s main concept is that investors must be skeptical of Wall Street’s motives and learn to think independently.

Klarman provides detailed examples of how up-front fees, commissions, and the pressure to “sell” financial products drive behavior on Wall Street. He highlights the bullish bias of analysts, who rarely issue sell recommendations for fear of alienating corporate clients or losing business. The book cites data showing that, over a multi-year period, more than 90% of analyst recommendations were “buy” or “hold,” regardless of market conditions. Klarman also discusses the proliferation of new financial products designed more to generate fees than to serve client needs.

To protect themselves, investors should develop a healthy skepticism toward Wall Street research and recommendations. Klarman advises conducting independent analysis, seeking out primary sources such as SEC filings, and being wary of products with high fees or complex structures. He also recommends asking advisors about their compensation and incentives to uncover potential conflicts of interest.

In the real world, the consequences of ignoring these lessons are evident in the repeated scandals and mis-selling episodes that have plagued the financial industry—from the dot-com era to the 2008 crisis. Modern investors face even greater challenges, given the rise of algorithmic trading, high-frequency strategies, and complex derivatives. Klarman’s call for independence and skepticism is a timeless antidote to the pervasive conflicts that still shape Wall Street behavior.

Chapter 3: The Institutional Performance Derby: The Client Is the Loser

This chapter is pivotal because it dissects the short-term, relative-performance orientation of institutional investors—a dynamic that Klarman argues often works against the interests of individual clients. The main concept is that institutional money managers are frequently incentivized to focus on beating benchmarks and peers over short periods, rather than generating absolute, long-term returns for their clients.

Klarman provides examples of how pension funds, mutual funds, and endowments are evaluated on quarterly or annual performance, leading to excessive trading, herding behavior, and a reluctance to take contrarian positions. He cites data showing that most institutional portfolios underperform market averages after fees, largely due to this short-term focus. Klarman also discusses the principal-agent problem, where managers’ incentives are not aligned with those of their clients, and the tendency to avoid career risk by sticking close to the consensus.

Investors can apply these lessons by choosing managers who are willing to invest their own money alongside clients, who emphasize absolute rather than relative performance, and who are transparent about their process and results. Klarman suggests asking prospective managers about their investment horizon, risk management approach, and willingness to hold unpopular positions. He also advocates for evaluating performance over multi-year periods, rather than reacting to short-term fluctuations.

Historically, the institutional performance derby has led to bubbles, panics, and widespread underperformance. The rise of passive investing and index funds is, in part, a response to these failures. However, the pressure to deliver short-term results remains pervasive in today’s markets, as seen in the rapid flows into and out of funds based on quarterly returns. Klarman’s critique is a reminder that true investment success requires patience, independence, and a focus on long-term, absolute results.

Chapter 5: Defining Your Investment Philosophy

This chapter is essential because it introduces the foundational principles of value investing and the necessity of having a clear, disciplined investment philosophy. Klarman argues that without a coherent set of beliefs and guidelines, investors are vulnerable to emotional decision-making and market noise. The main concept is that a well-defined philosophy is the bedrock of long-term investment success.

Klarman outlines the core tenets of value investing, including risk aversion, a focus on intrinsic value, and the importance of a long-term perspective. He provides examples of successful investors who have stuck to their philosophy through various market cycles, such as Warren Buffett and Benjamin Graham. Klarman also discusses the dangers of trying to chase trends or time the market, emphasizing that consistency and discipline are more important than short-term performance.

To implement these lessons, investors should take the time to articulate their own philosophy, write it down, and revisit it regularly. Klarman recommends developing a checklist of criteria for investment decisions, including margin of safety, conservative assumptions, and a clear understanding of the business. He also suggests setting rules for when to buy, hold, or sell, and for how to respond to market volatility.

In the real world, the absence of a clear investment philosophy is a common cause of poor performance, as investors are swayed by emotions, fads, and the opinions of others. The most successful investors—whether individuals or professionals—are those who remain true to their principles in both bull and bear markets. Klarman’s emphasis on philosophy over tactics is a timeless lesson for anyone seeking durable results in investing.

Chapter 6: The Margin of Safety

This chapter is the book’s centerpiece, introducing the concept of margin of safety—a principle that underpins all of Klarman’s investment decisions. The main concept is that by purchasing securities at a significant discount to their intrinsic value, investors create a buffer that protects against errors, bad luck, or unforeseen events. This focus on downside protection is what distinguishes value investing from other approaches.

Klarman provides practical examples of how to calculate margin of safety, such as buying stocks below their liquidation value or investing in bonds with strong asset coverage. He discusses the importance of conservative assumptions in valuation, using historical data to illustrate how even well-researched investments can go wrong. Klarman quotes Benjamin Graham, who described margin of safety as “the secret of sound investment.” He also provides case studies of investments that succeeded because of a sufficient margin of safety, even when the outcome was not as expected.

To apply this concept, investors should always demand a margin of safety in every investment, whether in equities, bonds, or special situations. Klarman recommends using conservative estimates of value, being wary of optimistic projections, and avoiding investments where the downside risk is not adequately protected. He also suggests diversifying across multiple securities to further reduce risk.

Historically, the margin of safety principle has proven its worth in every major market downturn. Investors who adhered to this discipline during the dot-com bust, the financial crisis, or the COVID-19 selloff were able to preserve capital and recover more quickly. In today’s environment of elevated valuations and increased uncertainty, Klarman’s insistence on margin of safety is more relevant than ever for investors seeking to avoid permanent losses.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 7: Value Investing: The Importance of a Bottom-Up Approach

This chapter is pivotal because it highlights the superiority of a bottom-up approach in value investing, as opposed to relying on macroeconomic forecasts or top-down strategies. Klarman argues that the most successful investors focus on analyzing individual securities, assessing their intrinsic value, and making decisions based on company-specific fundamentals rather than broad economic trends.

Klarman provides examples of how macroeconomic predictions are notoriously unreliable and often lead to poor investment decisions. He discusses the limitations of forecasting interest rates, GDP growth, or inflation, and contrasts this with the tangible benefits of understanding a company’s business model, assets, and competitive position. The chapter includes case studies of successful investments that were made despite negative macro headlines, simply because the underlying business was undervalued.

For investors, the actionable lesson is to focus research efforts on individual companies, reading annual reports, analyzing financial statements, and assessing management quality. Klarman recommends ignoring market noise and resisting the temptation to react to every economic data release. He suggests building a portfolio of undervalued securities based on bottom-up analysis, rather than trying to time the market or predict economic cycles.

Real-world examples abound of investors who have succeeded with a bottom-up approach, from Warren Buffett to Peter Lynch. The failures of macro-driven strategies—such as hedge funds that bet heavily on interest rates or currencies—underscore the wisdom of focusing on what can be known and analyzed. Klarman’s advocacy for bottom-up investing is a timeless lesson for anyone seeking to outperform over the long term.

Chapter 8: Valuation Techniques for Value Investors

This chapter is essential because it provides the practical tools and methods for valuing securities—a critical skill for any value investor. Klarman outlines the main valuation techniques used to assess intrinsic value, including asset-based approaches, earnings power valuation, and discounted cash flow analysis. He emphasizes the importance of conservative assumptions and the need to account for uncertainty in any valuation exercise.

Klarman offers detailed examples of how to value companies based on their net asset value, liquidation value, or normalized earnings. He discusses the pitfalls of relying on optimistic forecasts or using aggressive multiples, and provides guidelines for adjusting valuations in uncertain or volatile markets. The chapter includes real-world case studies of companies that appeared cheap based on superficial metrics but were actually value traps due to deteriorating fundamentals.

For investors, the application is straightforward: use multiple valuation methods, stress-test assumptions, and err on the side of caution. Klarman advises comparing current valuations to historical ranges, industry peers, and alternative investments. He also recommends focusing on tangible assets and recurring earnings, rather than speculative growth projections or non-recurring items.

In practice, mastering valuation techniques is what separates successful value investors from the crowd. The ability to identify mispriced securities, avoid value traps, and demand a sufficient margin of safety is essential in all market environments. Klarman’s guidance on valuation remains a cornerstone of disciplined investing, particularly in today’s market where accounting complexity and financial engineering can obscure true value.

Chapter 9: Research and Analysis in Value Investing

This chapter is critical because it details the research and analytical process that underpins every successful value investment. Klarman argues that thorough due diligence is the key to uncovering undervalued securities and avoiding costly mistakes. The main concept is that investors must go beyond surface-level analysis and dig deeply into company fundamentals.

Klarman describes his approach to research, which includes reading annual and quarterly reports, studying footnotes, and understanding the business’s competitive dynamics. He provides examples of how careful analysis can reveal hidden assets, underappreciated earnings power, or risks that are not immediately obvious. The chapter includes a checklist of items to review, such as management incentives, capital structure, and off-balance sheet liabilities.

To apply these lessons, investors should develop a systematic research process, including gathering data from primary sources, building financial models, and conducting scenario analysis. Klarman recommends maintaining a research journal, documenting investment theses, and revisiting assumptions as new information emerges. He also suggests seeking out contrarian opportunities where the market consensus is overly pessimistic or optimistic.

In the real world, the difference between winners and losers in value investing often comes down to the quality of research and analysis. The best investors are those who are willing to do the hard work, ask tough questions, and maintain intellectual honesty. Klarman’s process-oriented approach is a blueprint for building a durable edge in any market environment.

Chapter 13: Portfolio Management and Trading Strategies

This chapter is vital because it addresses the practical realities of managing a portfolio and executing trades—areas where many investors stumble despite having sound analysis. Klarman discusses the importance of diversification, position sizing, and the discipline required to execute trades without being swayed by emotion or market noise.

Klarman provides examples of how overconcentration in a single security can lead to catastrophic losses, even if the initial analysis was correct. He outlines strategies for balancing risk and return, including limiting exposure to any one position, rebalancing regularly, and maintaining flexibility to take advantage of new opportunities. The chapter also discusses the psychological challenges of trading, such as the temptation to sell winners too early or hold onto losers in the hope of a turnaround.

For investors, the actionable steps include setting clear rules for portfolio construction, such as maximum position sizes and minimum diversification requirements. Klarman recommends regular portfolio reviews, adherence to predetermined trading rules, and the use of stop-losses or other risk controls as appropriate. He also advises being willing to hold cash when no attractive opportunities are available.

In practice, disciplined portfolio management is what allows investors to survive market downturns and capitalize on dislocations. The failures of overleveraged funds and concentrated portfolios during crises underscore the importance of Klarman’s advice. His focus on risk management, flexibility, and discipline remains a hallmark of successful investing in any era.

Chapter 14: Selecting an Investment Professional

This closing chapter is crucial because it addresses the challenge faced by many investors: choosing a trustworthy and competent investment manager. Klarman provides a framework for evaluating professionals, emphasizing the importance of alignment of interests, transparency, and a proven track record.

Klarman offers specific criteria for selection, such as whether the manager invests their own money alongside clients, whether their compensation is tied to performance, and whether they are willing to be transparent about their process and results. He provides examples of questions to ask, such as how the manager defines risk, how they respond to market downturns, and how they handle conflicts of interest. The chapter also warns against being swayed by marketing hype or short-term performance statistics.

For investors, the application is to conduct thorough due diligence on any prospective manager, including reviewing regulatory filings, checking references, and understanding fee structures. Klarman recommends focusing on substance over style, looking for evidence of discipline, humility, and a commitment to client interests. He also suggests periodically reviewing the relationship to ensure continued alignment and satisfaction.

In the real world, the cost of choosing the wrong manager can be enormous, as seen in the many scandals and blowups that have plagued the industry. Klarman’s checklist is a valuable tool for avoiding common pitfalls and ensuring that your interests are protected. His insistence on alignment, transparency, and long-term orientation is as relevant today as it was when the book was written.

Practical Investment Strategies

- 1. Demand a Margin of Safety: Always purchase securities at a significant discount to their intrinsic value. Begin by estimating a company’s liquidation value, net asset value, or normalized earnings power. Set a target purchase price at least 20-40% below this value to provide a buffer against errors or unforeseen events. Use conservative assumptions in your calculations and avoid investments where the margin of safety is thin or nonexistent. This approach minimizes the risk of permanent capital loss and allows you to weather market volatility with greater confidence.

- 2. Focus on Absolute Performance: Measure your investment results in absolute terms, not relative to benchmarks or peers. Set clear, long-term goals for capital preservation and growth, and judge performance over multi-year periods. Avoid the temptation to chase short-term gains or match the latest market fad. Use tools like rolling 3- to 5-year return analysis to track progress and maintain discipline, regardless of what the broader market is doing.

- 3. Conduct Rigorous Fundamental Analysis: Build a research process that prioritizes deep, independent analysis of company financials, management, and competitive dynamics. Start with primary sources—annual and quarterly reports, conference calls, and regulatory filings. Develop financial models, stress-test assumptions, and focus on tangible assets and recurring earnings. Use checklists to ensure no critical factors are overlooked, and document your investment thesis for ongoing review.

- 4. Diversify Thoughtfully, Not Excessively: Construct a portfolio with enough diversification to reduce risk but not so much that you dilute your best ideas. Limit position sizes to no more than 10% of portfolio value for individual securities, and spread investments across sectors and asset classes. Rebalance periodically to avoid overconcentration and adjust exposures as new opportunities arise. Use scenario analysis to test how the portfolio would perform under different market conditions.

- 5. Avoid Leverage and Complex Products: Refrain from using borrowed money to enhance returns, as leverage magnifies both gains and losses. Steer clear of complex derivatives, structured products, or investments you do not fully understand. Focus on simplicity and transparency, choosing securities with clear cash flows, solid asset backing, and straightforward business models. This reduces the risk of catastrophic loss and ensures you remain in control of your investments.

- 6. Be Willing to Hold Cash: Maintain the discipline to hold cash when no attractive opportunities are available. Set a minimum expected return threshold for new investments, and do not compromise on quality or margin of safety just to “stay invested.” Use cash as dry powder to capitalize on market dislocations, corrections, or forced selling by others. This strategy provides flexibility and protects against the risk of overpaying in frothy markets.

- 7. Exploit Special Situations: Seek out niche opportunities such as liquidations, spin-offs, distressed securities, and other special situations where mispricings are more likely. Develop expertise in analyzing the legal, financial, and operational complexities of these events. Use event-driven strategies to identify catalysts that can unlock value, and be prepared to act quickly when opportunities arise. Special situations often offer higher returns with lower correlation to the broader market.

- 8. Monitor and Review Regularly: Establish a disciplined schedule for reviewing your portfolio, investment theses, and performance metrics. Conduct quarterly or semi-annual reviews to reassess assumptions, update valuations, and identify emerging risks or opportunities. Use stop-loss triggers or pre-set rules for exiting positions if the original thesis breaks down. Continuous monitoring ensures that you remain aligned with your investment philosophy and can adapt to changing market conditions.

Modern Applications and Relevance

The principles articulated in “Margin of Safety” have only grown more relevant in today’s rapidly changing investment landscape. While the tools and technologies available to investors have evolved dramatically since the book’s publication, the core tenets of value investing—risk aversion, margin of safety, and a focus on intrinsic value—remain as important as ever. In an environment characterized by low interest rates, high asset valuations, and increased market volatility, Klarman’s emphasis on downside protection and fundamental analysis provides a critical counterweight to the prevailing culture of speculation and short-termism.

Since the early 1990s, the rise of passive investing, algorithmic trading, and the proliferation of complex financial products have changed the way markets operate. However, these innovations have also introduced new forms of risk, including crowded trades, flash crashes, and the potential for systemic shocks. Klarman’s warnings about the dangers of leverage, complexity, and herd behavior are especially pertinent in a world where information travels instantly and market sentiment can shift in seconds. The book’s lessons about skepticism, independence, and the need for rigorous due diligence are more valuable than ever for navigating today’s markets.

Many of the book’s principles have been validated by subsequent market cycles. The dot-com bubble, the global financial crisis, and the COVID-19 pandemic all demonstrated the importance of margin of safety and the perils of speculative excess. Investors who adhered to Klarman’s discipline were able to preserve capital and take advantage of opportunities created by market dislocations. The enduring success of value-oriented investors like Warren Buffett, Howard Marks, and Klarman himself attests to the timelessness of these principles.

To adapt Klarman’s classic advice to current conditions, investors should leverage modern tools for research and analysis—such as AI-powered screeners, interactive charting, and real-time data—while maintaining the discipline and skepticism that define value investing. The temptation to chase momentum, follow social media trends, or rely on automated strategies is ever-present, but the fundamentals of sound investing have not changed. By combining Klarman’s timeless wisdom with the best of modern technology, investors can build resilient portfolios capable of weathering whatever the future may hold.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Articulate Your Investment Philosophy: Begin by writing down your core beliefs about investing—risk tolerance, time horizon, goals, and preferred strategies. Define what margin of safety means to you, and set clear criteria for what constitutes an acceptable investment. This foundational step ensures that all future decisions are grounded in a coherent framework, reducing the risk of emotional reactions or style drift.

- Build a Research and Valuation Process (1-3 Months): Develop a systematic approach to sourcing ideas, conducting due diligence, and valuing securities. Create templates for financial statement analysis, checklists for management assessment, and models for intrinsic value estimation. Allocate dedicated time each week for research, and commit to reading primary sources such as annual reports and regulatory filings. This process should be refined and improved as you gain experience.

- Construct Your Portfolio (Month 3-6): Based on your research, select a diversified set of securities that meet your margin of safety and risk criteria. Set maximum position sizes (e.g., no more than 10% in any single stock) and minimum diversification levels (e.g., at least 10-15 holdings across sectors). Allocate cash reserves for future opportunities, and avoid overconcentration in any one theme or asset class. Document your investment theses and entry/exit criteria for each position.

- Implement Ongoing Portfolio Management (Quarterly): Establish a regular review schedule—quarterly or semi-annually—to reassess your holdings, update valuations, and monitor for changes in fundamentals. Use pre-set rules for trimming, adding, or exiting positions based on performance, valuation, or changes in your investment thesis. Maintain discipline by adhering to your process, even during periods of market stress or euphoria.

- Pursue Continuous Improvement (Ongoing): Commit to lifelong learning and continuous refinement of your investment process. Read widely—books, shareholder letters, industry reports—and seek out new tools and resources, such as AI-powered screeners or advanced charting platforms. Attend conferences, network with other investors, and study both successes and failures. Regularly revisit your investment philosophy and process to ensure they remain aligned with your goals and the evolving market environment.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About Margin of Safety

1. Why is “Margin of Safety” by Seth Klarman considered such a rare and valuable book?

“Margin of Safety” is highly sought after because it was published in limited quantities in 1991 and has never been reprinted, making physical copies extremely rare and expensive. More importantly, the book’s content distills the wisdom of one of the most successful value investors of all time. Klarman’s practical, risk-averse approach and his critique of Wall Street’s conflicts have made the book a classic among professional and serious individual investors. Its reputation has only grown as the principles within have proven effective across multiple market cycles.

2. What is the central concept of “margin of safety” and how can investors apply it?

The central concept is purchasing securities at a significant discount to their intrinsic value, thus providing a buffer against errors, market volatility, or unforeseen events. Investors can apply this by conducting thorough analysis to estimate conservative values for assets or earnings, and only buying when the market price is well below this estimate. This approach reduces the risk of permanent capital loss and allows investors to capitalize on market inefficiencies.

3. How does Klarman’s approach differ from traditional Wall Street strategies?

Klarman’s approach is fundamentally risk-averse and skeptical of Wall Street’s incentives. He prioritizes capital preservation and absolute returns rather than chasing short-term performance or relative benchmarks. Unlike many Wall Street strategies that rely on macro forecasts, momentum, or leverage, Klarman focuses on deep fundamental analysis, independent thinking, and a long-term perspective. He also warns against the conflicts of interest and sales-driven culture that pervade much of the financial industry.

4. Is value investing still relevant in today’s technology-driven, fast-paced markets?

Yes, value investing remains highly relevant, even as markets have become more technology-driven and volatile. The principles of risk aversion, margin of safety, and intrinsic value are timeless and provide a durable framework for navigating uncertainty. While tools and data access have improved, the need for independent analysis, patience, and discipline is greater than ever in an era of information overload and rapid sentiment shifts.

5. What are the biggest mistakes investors make, according to Klarman?

Klarman identifies several common mistakes: confusing speculation with investing, relying on Wall Street advice without understanding the underlying incentives, chasing short-term performance, using leverage or complex products, and failing to demand a margin of safety. He also warns against emotional decision-making and the temptation to follow the crowd. The antidote, he argues, is to develop a clear investment philosophy, conduct rigorous analysis, and maintain discipline in both good times and bad.