Mario Gabelli - Gamco Investors, Inc. Et Al Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

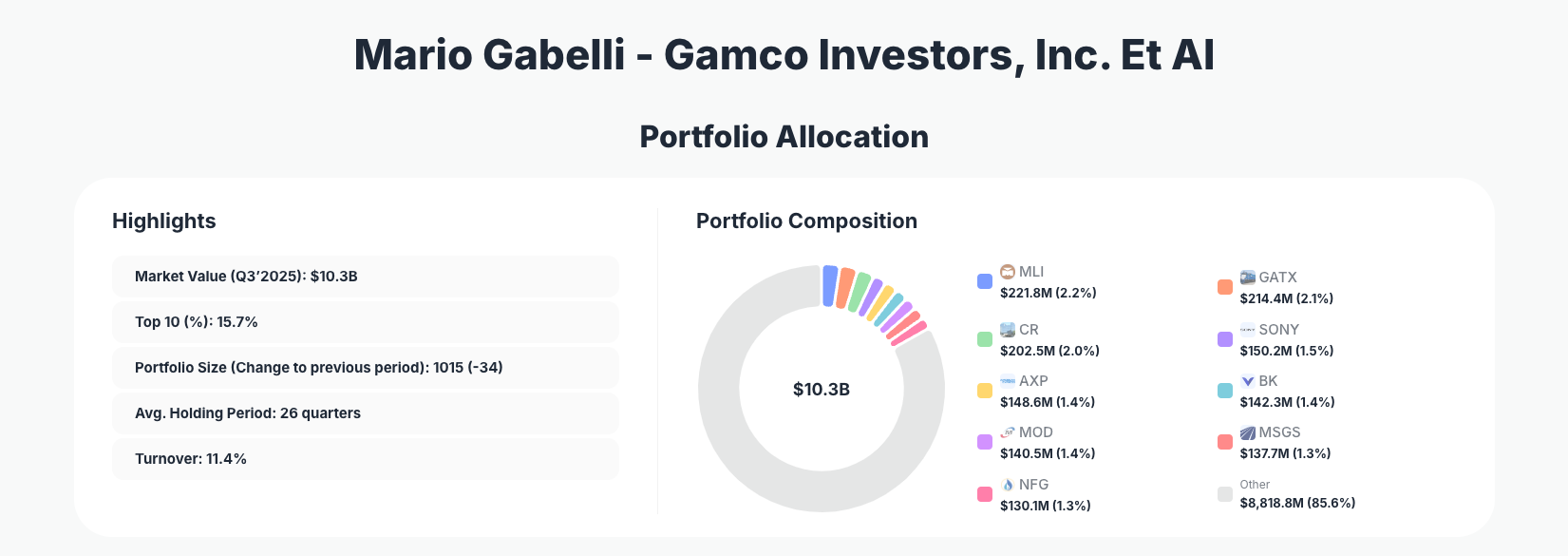

Mario Gabelli - Gamco Investors, Inc. Et Al remains one of the most disciplined value investors in the U.S. equity markets, and his latest 13F for Q3 2025 shows methodical trimming rather than wholesale repositioning. His $10.3B portfolio features over 1,000 positions, yet the top holdings list reveals targeted reductions in several long‑standing industrial, financial, and energy names such as Mueller Industries (MLI), GATX (GATX), and National Fuel Gas (NFG)—a classic Gabelli move to harvest gains while maintaining exposure.

Portfolio Overview: Broad Diversification, Surgical Adjustments

Portfolio Highlights (Q3 2025): - Market Value: $10.3B

- Top 10 Holdings: 15.7%

- Portfolio Size: 1015 -34

- Average Holding Period: 26 quarters

- Turnover: 11.4%

Gabelli’s Q3 2025 13F underscores how a “many small bets” philosophy can coexist with clear conviction at the top of the book. With 1,015 positions and the top 10 making up only 15.7% of the Gamco Investors portfolio, this is far from an ultra‑concentrated hedge fund approach—yet the largest names still matter for performance and signal where Gabelli sees the best risk‑reward.

The 26‑quarter average holding period highlights a long‑term, business‑owner mindset: Gabelli typically stays invested for more than six years, consistent with his reputation for deep fundamental work and patience. At the same time, an 11.4% turnover rate and the Q3 pattern of trims across multiple leaders show that he is not static—positions are actively sized up or down as valuations move, catalysts play out, or better opportunities emerge within the same industrial and financial value universe.

The reduction bias in Q3—across industrials like Mueller Industries (MLI), transport‑related GATX (GATX), equipment rental name Herc Holdings (HRI), and energy utility‑like National Fuel Gas (NFG)—suggests disciplined profit‑taking rather than a directional macro call. Investors studying the Gamco Investors portfolio can see a clear preference for incremental risk management over big, binary shifts.

Top Positions: Industrial Workhorses, Financial Franchises, and Energy Income

The Q3 2025 filing highlights 10 key positions with explicit changes, all of them trims. These holdings, combined with the broader top‑10 list, give a strong sense of Gabelli’s core themes: industrial cash generators, financial infrastructure, and steady energy names.

The second‑largest disclosed position is Mueller Industries (MLI), at 2.2% of the portfolio, where Gabelli chose to Reduce 15.56%, bringing the stake to 2,193,912 shares worth $221.8M. This sizable cut, while still leaving Mueller among the top holdings, points to valuation discipline in a name that has performed well over time.

Close behind is GATX (GATX) at 2.1% of the portfolio. Here, Gabelli Reduced 4.62%, ending the quarter with 1,226,539 shares valued at $214.4M. The modest trim suggests continued conviction in the railcar leasing model but with some risk being taken off after strength in the stock or sector.

Another industrial pillar is Crane Company (CR), representing 2.0% of the portfolio at $202.5M. Gabelli Reduced 4.19% to 1,099,528 shares, a small but notable adjustment that aligns with the broader pattern of fine‑tuning position sizes rather than exiting core ideas.

On the global consumer and entertainment side, Sony Group Corporation (SONY) stands at 1.5% of the portfolio, worth $150.2M, after a Reduce 10.35% move. This larger trim relative to others may reflect a reassessment of upside versus risk in media, hardware, and gaming at current prices, while keeping a meaningful stake in place.

Financials remain a central theme. American Express Company (AXP) accounts for 1.4% of the portfolio, with 447,299 shares valued at $148.6M after a Reduce 4.97% action. Similarly, The Bank of New York Mellon Corporation (BK) sits at 1.4%, 1,306,010 shares worth $142.3M, following a Reduce 9.48% adjustment. These trims suggest a careful rebalancing within financial services rather than an outright bearish stance.

In industrial and climate‑control manufacturing, Modine Manufacturing Company (MOD) is another 1.4% position at $140.5M. Gabelli made one of his larger proportional cuts here, Reduce 16.36% to 988,449 shares, hinting that the stock may have moved closer to his estimate of intrinsic value.

The portfolio also maintains exposure to live sports and media assets via Madison Square Garden Sports Corp. (MSGS), at 1.3% of the portfolio and $137.7M in value. The Reduce 1.35% action here is minimal—more of a tweak than a thesis change.

Energy and utilities‑like cash flow show up through National Fuel Gas Company (NFG), a 1.3% position worth $130.1M after Gabelli chose to Reduce 6.77% to 1,408,545 shares. This aligns with his long‑time interest in regulated and midstream‑style energy names, balanced by ongoing risk control.

Rounding out the key changes, Herc Holdings Inc. (HRI) holds 1.2% of the portfolio after a slight Reduce 1.13% to 1,101,214 shares, worth $128.5M. This small adjustment underscores the theme of incremental portfolio hygiene rather than dramatic repositioning.

Across these 10–11 names, the Q3 2025 13F paints a picture of a value investor who is trimming, not turning—reducing exposure where gains have accumulated, while still expressing conviction through meaningful position sizes.

What the Portfolio Reveals About Gabelli’s Current Strategy

Several strategic themes stand out from the Q3 2025 moves and the structure of the Gamco Investors portfolio:

- Quality at reasonable valuation, not hyper‑growth

The largest allocations center on established industrials, financial infrastructure, and energy names with durable cash flows rather than high‑beta growth stocks. The consistent pattern of “Reduce” rather than “Sell” reinforces a valuation‑sensitive approach: as prices move above Gabelli’s estimate of intrinsic value, position sizes come down, but quality businesses remain in the book. - Sector bias toward industrials and financials

Names like MLI, GATX, CR, MOD, and HRI point to a strong industrial tilt, while AXP and BK show continued interest in financials. This fits Gabelli’s long‑time focus on tangible businesses where he can model cash flows and capital cycles. - Global but U.S.‑centric orientation

The inclusion of SONY highlights selective international exposure, but the majority of highlighted holdings are U.S.‑listed companies serving domestic or globally diversified markets. Geographic risk is thus present but controlled. - Implicit income and capital‑return orientation

Stocks like AXP, BK, and NFG tend to have dividend streams and/or active buyback programs, consistent with Gabelli’s preference for shareholder‑friendly capital allocation—even if the 13F itself doesn’t disclose dividend yields. - Risk management via gradual trims

The absence of “Buy” or “Add” actions in the highlighted list and the prevalence of moderate “Reduce” percentages indicate a risk‑management posture: de‑risking winners, staying invested in core themes, and building dry powder for future bargains.

Portfolio Concentration Analysis

Using the top disclosed holdings with explicit changes:

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Mueller Industries, Inc. (MLI) | $221.8M | 2.2% | Reduce 15.56% |

| GATX Corporation (GATX) | $214.4M | 2.1% | Reduce 4.62% |

| Crane Company (CR) | $202.5M | 2.0% | Reduce 4.19% |

| Sony Group Corporation (SONY) | $150.2M | 1.5% | Reduce 10.35% |

| American Express Company (AXP) | $148.6M | 1.4% | Reduce 4.97% |

| The Bank of New York Mellon Corporation (BK) | $142.3M | 1.4% | Reduce 9.48% |

| Modine Manufacturing Company (MOD) | $140.5M | 1.4% | Reduce 16.36% |

| Madison Square Garden Sports Corp. (MSGS) | $137.7M | 1.3% | Reduce 1.35% |

| National Fuel Gas Company (NFG) | $130.1M | 1.3% | Reduce 6.77% |

Collectively, these positions underscore moderate concentration at the top: individual names mostly sit between 1.3% and 2.2% of the portfolio, leaving room for diversification while still impacting performance. The fact that every one of these top positions saw a “Reduce” action in Q3 2025 underlines Gabelli’s consistent willingness to resize risk as valuations evolve, without abandoning the core businesses he favors.

Investment Lessons from Mario Gabelli’s Gamco Strategy

Several practical takeaways emerge for investors studying the Mario Gabelli portfolio:

- Diversify broadly, but let your best ideas be larger

Holding over 1,000 stocks spreads idiosyncratic risk, yet Gabelli still allows top convictions like MLI, GATX, and CR to carry 2%‑level weights. - Use valuation‑driven trims instead of market timing

The consistent “Reduce X%” actions across leaders rather than wholesale exits illustrate a process built on incremental valuation discipline, not all‑in/all‑out calls. - Long holding periods amplify the value of good decisions

An average holding period of 26 quarters shows that once Gabelli finds a business he likes, he is willing to own it for many years, letting compounding and improving fundamentals do the heavy lifting. - Sector specialization can be a durable edge

Concentration in industrials, financials, and select energy names suggests that deep industry knowledge and networks in a few areas can be more valuable than shallow coverage across everything. - Position sizing is an ongoing decision, not a one‑time choice

The Q3 2025 trims—ranging from about 1% to more than 16%—demonstrate that managing a portfolio means continually re‑evaluating how much capital each idea deserves as prices and fundamentals change.

Looking Ahead: What Comes Next for Gamco Investors?

From the Q3 2025 13F, Gabelli appears to be locking in gains and moderating risk rather than aggressively redeploying into new high‑conviction ideas—at least within the top positions. With an 11.4% turnover and a net reduction in the number of holdings (down 34), investors can reasonably infer that capital is being freed for future opportunities, potentially in out‑of‑favor industrial or financial names that fit Gabelli’s value discipline.

Looking forward:

- The portfolio’s tilt toward cash‑generating industrial and financial assets should be relatively resilient if rates stay higher for longer, as many of these companies can pass on costs or benefit from financial spreads.

- Continued trimming in names like MOD, SONY, and NFG suggests Gabelli is sensitive to elevated valuations and ready to shift capital when better bargains emerge.

- Investors tracking future 13Fs should watch for new buys or “Add” actions that could signal where Gabelli believes the next multi‑year compounding opportunities lie within his favored sectors.

FAQ about Mario Gabelli – Gamco Investors Portfolio

Q: What were the most notable changes in Mario Gabelli’s Q3 2025 portfolio?

The most notable moves were reductions across many top holdings, including a 15.56% trim in Mueller Industries (MLI), 16.36% in Modine Manufacturing (MOD), and 10.35% in Sony (SONY), alongside smaller cuts in GATX, Crane, American Express, BNY Mellon, Madison Square Garden Sports, National Fuel Gas, and Herc Holdings.

Q: How concentrated is the Mario Gabelli – Gamco Investors portfolio?

The portfolio is broadly diversified with 1,015 positions, but the top 10 holdings still account for 15.7% of total value. Individual leading positions generally sit between 1.3% and 2.2% of the portfolio, balancing conviction with risk control.

Q: What does Gabelli’s strategy focus on?

Gabelli’s approach, as reflected in the Q3 2025 13F, centers on value investing in industrials, financials, and select energy and media names—businesses with tangible cash flows, understandable economics, and often shareholder‑friendly capital allocation. Long holding periods and incremental trims based on valuation are key features.

Q: Are there any signals about risk management in this quarter’s moves?

Yes. The across‑the‑board “Reduce” actions in top holdings indicate a risk‑management stance, with profits being taken in winners and exposure scaled back where valuations have risen, rather than abrupt liquidations or aggressive new bets.

Q: How can I track Mario Gabelli’s portfolio changes over time?

You can follow Mario Gabelli’s quarterly 13F filings via the SEC and use ValueSense’s superinvestor tracker at Gamco Investors’ portfolio page for up‑to‑date analysis, visualizations, and historical changes. Remember that 13F filings are reported with a 45‑day lag after quarter‑end, so positions may have changed since the reported date.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!