Mark Hillman - Hillman Value Fund Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

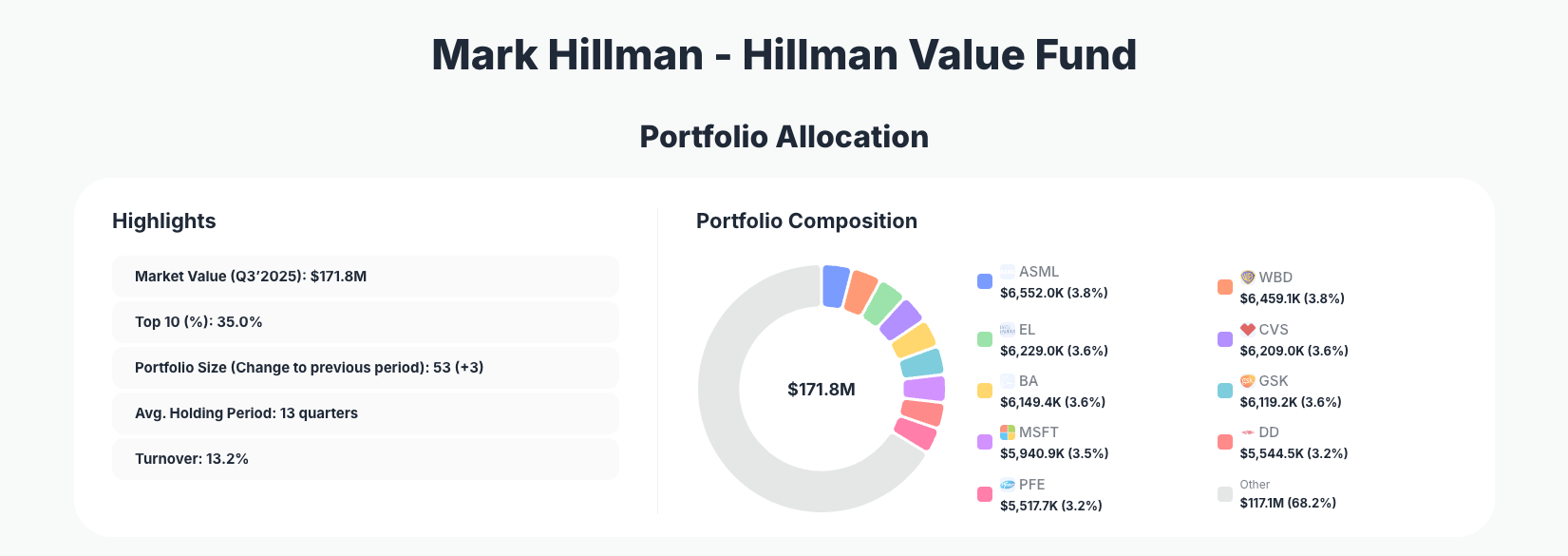

Mark Hillman of Hillman Value Fund demonstrates disciplined value investing through measured portfolio adjustments in his latest 13F filing. His $171.8M portfolio shows a broad approach across 53 positions, with notable reductions in key holdings signaling profit-taking amid market highs, while a small addition hints at selective opportunism.

Portfolio Snapshot: Diversified Discipline with Long-Term Focus

Portfolio Highlights (Q3’2025): - Market Value: $171.8M - Top 10 Holdings: 35.0% - Portfolio Size: 53 +3 - Average Holding Period: 13 quarters - Turnover: 13.2%

The Hillman Value Fund portfolio maintains a diversified structure, with the top 10 holdings representing just 35% of the total, underscoring a balanced risk approach rather than ultra-concentration. This setup, expanded to 53 positions (up by 3), reflects confidence in spreading bets across undervalued opportunities while keeping turnover low at 13.2%. The average holding period of 13 quarters—over three years—highlights a patient, long-term value strategy that prioritizes intrinsic business quality over short-term market noise.

This disciplined evolution in the Mark Hillman portfolio suggests active management without overtrading. Recent changes, primarily reductions, indicate trimming winners to lock in gains, potentially freeing capital for new ideas in a volatile environment. With such longevity in holdings, Hillman embodies classic value principles, waiting for market recognition of underlying worth.

Top Positions Breakdown: Reductions Dominate, Selective Adds Emerge

The portfolio's upper echelon features significant adjustments, starting with ASML Holding N.V. (ASML) at 3.8% after a Reduce 12.29% trim, followed closely by Warner Bros. Discovery, Inc. (WBD) also at 3.8% with a sharp Reduce 44.47% cut. The Estée Lauder Companies Inc. (EL) holds 3.6% post a Reduce 13.37%, while CVS Health Corporation (CVS) mirrors that weight after Reduce 11.44%.

Continuing the pattern, The Boeing Company (BA) sits at 3.6% following Reduce 9.77%, and GSK plc (GSK) matches with Reduce 7.09% at the same allocation. Microsoft Corporation (MSFT) weighs in at 3.5% after Reduce 12.41%, with DuPont de Nemours, Inc. (DD) at 3.2% via Reduce 13.44% and Pfizer Inc. (PFE) also 3.2% post Reduce 7.70%. Bucking the trend, The Kraft Heinz Company (KHC) at 3.2% saw a modest Add 0.68%, signaling fresh conviction in consumer staples.

These moves across tech leaders like ASML and MSFT, healthcare names such as CVS, GSK, and PFE, alongside industrials like BA and consumer plays like EL and KHC, paint a picture of tactical rebalancing in a value-oriented lineup.

What the Portfolio Reveals About Hillman’s Approach

Mark Hillman’s Q3 adjustments reveal a strategy emphasizing quality businesses at reasonable prices, with trims across sectors suggesting profit-taking on recoveries rather than outright exits. The heavy reductions—especially WBD’s 44.47% cut—indicate risk management in cyclical or challenged names, while the KHC add points to dividend-rich stability.

Sector exposure spans technology (ASML, MSFT), healthcare (CVS, GSK, PFE), media/entertainment (WBD), consumer (EL, KHC), and industrials/aerospace (BA), showing geographic diversity with international flavor via ASML and GSK. This mix prioritizes defensive growth with moats, balancing high-conviction tech against resilient healthcare and staples. Turnover at 13.2% underscores low churn, aligning with the 13-quarter hold average for patient capital deployment. Risk is mitigated through diversification (53 positions), avoiding over-reliance on any single bet despite top holdings' balanced sizing.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| ASML Holding N.V. (ASML) | $6,552.0K | 3.8% | Reduce 12.29% |

| Warner Bros. Discovery, Inc. (WBD) | $6,459.1K | 3.8% | Reduce 44.47% |

| The Estée Lauder Companies Inc. (EL) | $6,229.0K | 3.6% | Reduce 13.37% |

| CVS Health Corporation (CVS) | $6,209.0K | 3.6% | Reduce 11.44% |

| The Boeing Company (BA) | $6,149.4K | 3.6% | Reduce 9.77% |

| GSK plc (GSK) | $6,119.2K | 3.6% | Reduce 7.09% |

| Microsoft Corporation (MSFT) | $5,940.9K | 3.5% | Reduce 12.41% |

| DuPont de Nemours, Inc. (DD) | $5,544.5K | 3.2% | Reduce 13.44% |

| Pfizer Inc. (PFE) | $5,517.7K | 3.2% | Reduce 7.70% |

This table highlights the portfolio's even weighting among top positions, with no single holding exceeding 3.8% and the group totaling 35%. The uniform reductions—ranging from 7% to 44%—demonstrate systematic de-risking, particularly in WBD, possibly reflecting concerns over media sector volatility. Yet, values remain substantial ($5.5M-$6.5M each), preserving exposure to quality names while the +3 positions expansion suggests ongoing diversification.

Such balance tempers concentration risk, allowing Hillman to navigate uncertainty without forced selling, true to value investing's margin-of-safety ethos.

Investment Lessons from Mark Hillman’s Value Strategy

- Trim winners selectively: Reductions like ASML 12.29% and MSFT 12.41% show discipline in taking profits on outperformers, freeing capital without abandoning core convictions.

- Long holding periods pay off: 13 quarters average tenure emphasizes patience, letting compounders like healthcare staples (GSK, PFE) unfold.

- Diversify thoughtfully: 53 positions with 35% in top 10 balances conviction and prudence, avoiding overconcentration in any sector.

- Focus on resilient moats: Holdings in tech (ASML), healthcare (CVS, PFE), and consumer (KHC, EL) target durable businesses with pricing power and dividends.

- Low turnover builds wealth: 13.2% rate minimizes taxes and transaction costs, prioritizing intrinsic value over market timing.

Looking Ahead: What Comes Next?

With turnover at 13.2% and net reductions trimming exposure, Hillman likely holds dry powder from profit-taking for opportunistic buys, especially as the portfolio grew by 3 positions. Sectors like healthcare (PFE, GSK, CVS) and consumer staples (KHC add) position well for economic slowdowns, while trims in cyclicals (BA, WBD) hedge inflation or recession risks.

In a 2025 market facing rate uncertainty and AI hype, expect further value hunts in undervalued industrials or tech dips. Current setup—diversified, long-hold—sets up for steady compounding, with KHC's add hinting at defensive tilts amid volatility.

FAQ about Mark Hillman’s Hillman Value Fund Portfolio

Q: What drove the major reductions in Hillman’s Q3 2025 portfolio?

A: Reductions dominated, with standout cuts like WBD 44.47% and trims in ASML 12.29%, MSFT 12.41%, likely reflecting profit-taking on recoveries and risk management in volatile names.

Q: Why does Hillman maintain such a diversified portfolio with low top-10 concentration?

A: At 35% in top 10 across 53 positions, the strategy spreads risk while allowing focused bets, aligning with value investing's emphasis on margin of safety and avoiding single-stock blowups.

Q: What sectors dominate Hillman’s holdings, and why?

A: Healthcare (CVS, GSK, PFE), tech (ASML, MSFT), and consumer/industrials stand out for their moats, dividends, and undervaluation potential in uncertain markets.

Q: How can I track and follow Mark Hillman’s portfolio changes?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/hillman for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!