Mason Hawkins - Southeastern Asset Management Inc/tn/ Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Mason Hawkins - Southeastern Asset Management Inc/tn/ continues to lean into classic deep value and special situation opportunities. Their Q3’2025 portfolio shows nearly $2.0 billion allocated across 49 positions, with notable additions to energy, consumer, and real-asset names, as well as trims in select compounders after strong runs.

Portfolio Overview: Patient Value, Active Positioning

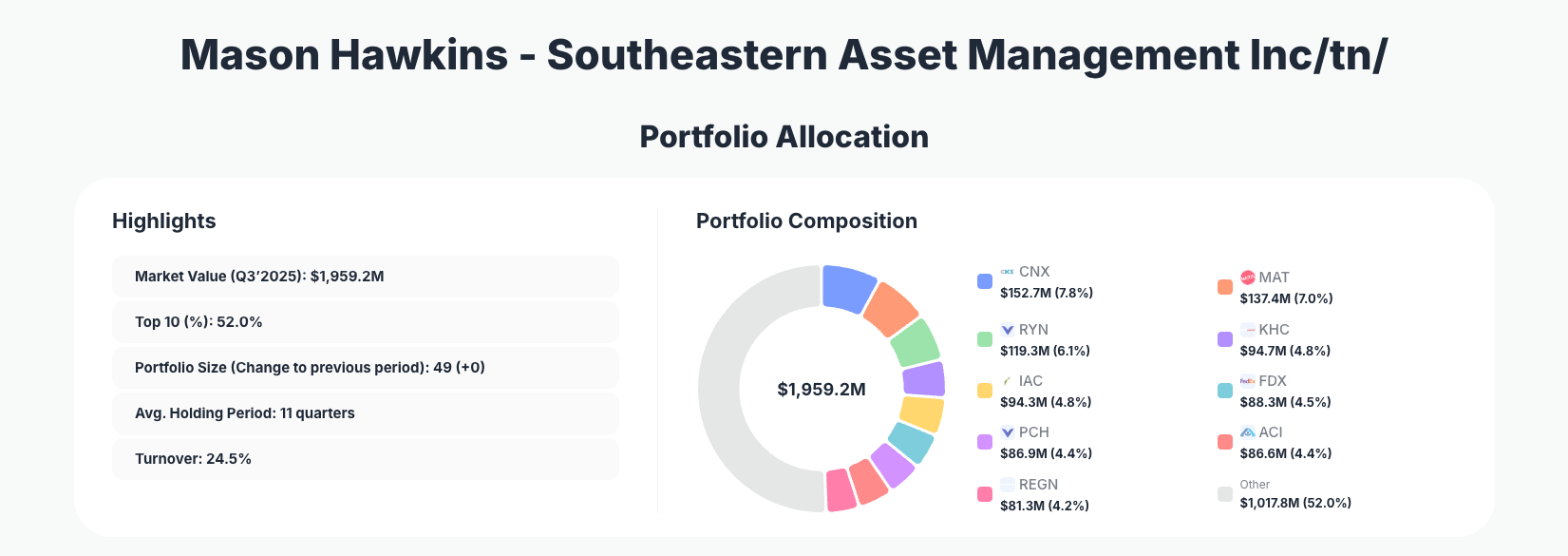

Portfolio Highlights (Q3 2025): - Market Value: $1,959.2M

- Top 10 Holdings: 52.0%

- Portfolio Size: 49 +0

- Average Holding Period: 11 quarters

- Turnover: 24.5%

The latest Southeastern portfolio blends long-term conviction with selective repositioning. A 52.0% allocation to the top 10 holdings indicates meaningful concentration in best ideas, yet 49 total positions provide diversification across industries and catalysts. An 11-quarter average holding period underscores Southeastern’s reputation for patience, allowing theses time to play out rather than trading around short-term noise.

At the same time, 24.5% turnover suggests the team is far from passive. The Q3’2025 portfolio shows active reallocation toward perceived mispricings—especially in energy, consumer, and real-asset plays—while trimming or recycling capital from winners and situations where risk/reward has shifted. This balance of long holding periods and moderate turnover reflects a value discipline that adapts as fundamentals and prices evolve.

The current positioning of Southeastern’s portfolio continues the firm’s historic preference for undervalued, often cyclical or asset-backed companies with identifiable catalysts. The concentration in a handful of core positions—backed by multi‑year holding periods—signals durable conviction, while the fresh activity this quarter points to a willingness to double down where the discount to intrinsic value has widened.

Top Holdings Overview: Energy, Consumer, Healthcare, and Real Assets

The most notable changes this quarter center on core cyclical and special-situation names. CNX Resources Corporation, a key energy holding, now represents 7.8% of the portfolio after an Add 6.50% move to 4,752,629 shares valued at $152.7M. This increased exposure highlights Southeastern’s conviction in CNX’s cash flow and asset value at current commodity expectations.

Consumer and entertainment exposure remains meaningful. Mattel, Inc. sits at 7.0% of the portfolio, with the firm choosing to Add 13.03% to 8,161,296 shares worth $137.4M. This suggests confidence in Mattel’s brand power and margin trajectory despite cyclical consumer headwinds.

Real-asset and land-backed plays are also front and center. RAYONIER INC, a timber and land REIT-type name, is a 6.1% position at $119.3M and 4,496,725 shares after a clear Buy action this quarter. POTLATCHDELTIC CORPORATION, another timber/land company, now accounts for 4.4% of the portfolio at $86.9M following a very aggressive Add 122.93% to 2,131,754 shares—indicating strong conviction in the underlying asset value and long-term demand for timber and real assets.

On the branded consumer side, The Kraft Heinz Company remains a sizable 4.8% holding at $94.7M with 3,637,374 shares, though Southeastern Reduce 1.00%, likely reflecting disciplined position sizing as the valuation adjusts. Similarly, in internet and media, IAC InterActive Corp. holds 4.8% of the portfolio at $94.3M, with 2,767,511 shares after a Reduce 5.58% move, locking in some gains while maintaining a meaningful stake.

Logistics and transportation exposure remains important but modestly trimmed. FedEx Corporation stands at 4.5% and $88.3M with 374,380 shares after a Reduce 1.36%, a fine‑tuning more than a thesis change. On the supermarket and merger-arbitrage front, Albertsons Companies, Inc. is now a 4.4% holding at $86.6M, with the firm choosing to Add 42.80% to 4,943,869 shares—underscoring Southeastern’s interest in the value and optionality embedded in this name.

In healthcare, Regeneron Pharmaceuticals, Inc. accounts for 4.2% of the portfolio at $81.3M and 144,607 shares, despite a meaningful Reduce 9.95%. This suggests continued belief in Regeneron’s pipeline and cash generation, balanced against risk management after strong performance. Rounding out the key moves, PVH Corp.—a global apparel name—sits at 4.0% and $78.4M with 935,398 shares, even after a substantial Reduce 31.72%, likely reflecting active capital rotation within consumer cyclicals.

Across these 10–11 highlighted positions, the Q3’2025 changes reveal an overarching pattern: adding into underappreciated or asset-backed value (CNX, MAT, POTLATCHDELTIC, ACI, RAYONIER), while trimming select winners or riskier growth/cyclical names (KHC, IAC, FDX, REGN, PVH) to keep the overall risk/reward profile aligned with Southeastern’s long-term value discipline.

What the Portfolio Reveals About Current Strategy

Several strategic themes stand out from this quarter’s moves:

- Deep value and asset backing remain central

Heavy conviction in companies like CNX, Mattel, timber/land owners, and supermarket operators suggests a focus on tangible assets, durable brands, and cash flows that can be modeled conservatively. - Cyclical opportunism with risk controls

Additions to energy and consumer cyclicals are paired with trims in names such as PVH, IAC, and FedEx, signaling a willingness to lean into volatility while capping downside through size management. - Balanced sector exposure

The portfolio blends energy, consumer discretionary, staples, healthcare, logistics, and real assets, avoiding overreliance on a single macro driver. This diversification within a value framework helps smooth outcomes while still targeting mispriced opportunities. - Selective growth through healthcare and digital assets

Positions in Regeneron and IAC show that Southeastern is not purely traditional value; they are willing to own growth franchises when the price embeds a margin of safety.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| CNX Resources Corporation | $152.7M | 7.8% | Add 6.50% |

| Mattel, Inc. | $137.4M | 7.0% | Add 13.03% |

| RAYONIER INC | $119.3M | 6.1% | Buy |

| The Kraft Heinz Company | $94.7M | 4.8% | Reduce 1.00% |

| IAC InterActive Corp. | $94.3M | 4.8% | Reduce 5.58% |

| FedEx Corporation | $88.3M | 4.5% | Reduce 1.36% |

| POTLATCHDELTIC CORPORATION | $86.9M | 4.4% | Add 122.93% |

| Albertsons Companies, Inc. | $86.6M | 4.4% | Add 42.80% |

| Regeneron Pharmaceuticals, Inc. | $81.3M | 4.2% | Reduce 9.95% |

With 52.0% of capital concentrated in the top 10, Southeastern is clearly conviction‑driven rather than index-like. The largest positions—CNX, Mattel, and RAYONIER—each represent 6–8% of the portfolio, large enough to move the needle, but diversified across unrelated industries (energy, toys/consumer, timberland). The mid‑single‑digit allocations to Kraft Heinz, IAC, FedEx, POTLATCHDELTIC, Albertsons, and Regeneron serve as core contributors while allowing room for incremental adds or trims as valuations move.

The spread of weights just below 5% across several names gives Southeastern flexibility: they can scale up into further dislocations or harvest gains without radically altering the overall risk profile. The pattern of “Add” and “Reduce” actions in this top tier underscores a dynamic approach to position sizing—not buy‑and‑forget, but compounder‑oriented with continuous valuation discipline.

Investment Lessons from Southeastern’s Value Investing Strategy

Southeastern’s Q3’2025 positioning offers several takeaways for investors studying the Mason Hawkins playbook:

- Concentrate where conviction is highest

A 52% top‑10 allocation shows that when the team understands a business and its intrinsic value, they are willing to size it meaningfully rather than spreading capital too thin. - Holding period is a core edge

An 11‑quarter average holding period reinforces the idea that value realization often requires time—through operational improvements, capital allocation, or shifting market sentiment. - Blend asset backing with catalysts

Names like CNX, POTLATCHDELTIC, RAYONIER, and Albertsons combine tangible assets with potential catalysts (capital returns, M&A, structural demand) to unlock value. - Actively manage position sizes

Trims in Regeneron, PVH, IAC, and FedEx show that even strong businesses can be partially sold when risk/reward skews, freeing capital for better opportunities. - Value investing need not ignore growth

Southeastern’s willingness to hold healthcare innovators and digital platforms at sensible prices illustrates that “value” is about price versus intrinsic worth, not low multiples alone.

Looking Ahead: What Comes Next?

Based on the current Southeastern portfolio, several forward‑looking themes emerge:

- Room to scale into dislocations

With many core positions sized in the 4–5% range, Southeastern retains the flexibility to add further if markets overreact, especially in energy, consumer cyclicals, and real assets. - Potential for continued activity in real assets and defensives

The major adds to POTLATCHDELTIC and RAYONIER hint that the team sees a multi‑year opportunity in timber and land-backed cash flows, particularly if inflation or supply constraints persist. - Selective profit‑taking if multiples expand

Recent reductions in winners like Regeneron and PVH suggest that further multiple expansion or sharp rallies in similar names could lead to additional trims and capital redeployment. - Scope for new ideas in out‑of‑favor sectors

With 24.5% turnover, the team is clearly willing to refresh the book. If broader market volatility returns, expect new positions in neglected industries that meet Southeastern’s intrinsic value thresholds.

For investors following along, monitoring future 13F updates will be key to understanding how Southeastern responds to shifts in interest rates, consumer demand, and commodity cycles.

FAQ about Southeastern Asset Management’s Portfolio

Q: What were the most significant changes in Southeastern’s Q3’2025 portfolio?

The largest positive adjustments were Add 122.93% in POTLATCHDELTIC CORPORATION, Add 42.80% in Albertsons, and meaningful adds to CNX Resources and Mattel, alongside notable reductions in Regeneron and PVH.

Q: How concentrated is the Southeastern Asset Management portfolio?

Southeastern runs a focused but diversified book: 49 positions in total, with the top 10 holdings at 52.0% of market value. This reflects high conviction in core ideas while still spreading risk across multiple sectors and catalysts.

Q: What does the current portfolio say about Southeastern’s value investing style?

The mix of energy, branded consumer, real assets, healthcare, and selective digital exposure shows a classic intrinsic value approach—favoring businesses with tangible assets or durable competitive advantages, purchased at discounts that allow for upside from both fundamentals and rerating.

Q: Which sectors or themes stand out most right now?

Key themes include energy value (CNX), consumer and brand plays (Mattel, Kraft Heinz, PVH), real assets/timber (RAYONIER, POTLATCHDELTIC), logistics (FedEx), and healthcare innovation (Regeneron), suggesting a blend of cyclical recovery bets and defensive cash‑flow franchises.

Q: How can I track Southeastern Asset Management’s portfolio going forward?

You can follow all of Southeastern’s 13F filings and ongoing changes using the ValueSense superinvestor tracker. 13F filings are reported with a 45‑day lag after quarter‑end[2][3], so platforms like ValueSense help you interpret these updates in context and monitor historical holdings, new positions, and sizing shifts over time.[2][3][4][5][6][8][9][10]

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!