Mastercard Undervalued: Payment Processing Profit Machine on Sale

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

The digital payments revolution has created some of the most profitable businesses in modern history, and Mastercard Incorporated (NYSE: MA) stands as the undisputed champion of this transformation. As investors navigate 2025's complex market landscape, searching for Mastercard undervalued 2025 opportunities becomes increasingly compelling when examining the company's extraordinary financial performance against its current market valuation.

Despite generating exceptional returns on equity exceeding 175%, maintaining industry-leading profit margins above 45%, and delivering consistent double-digit revenue growth, Mastercard's stock trades at its most attractive valuation multiple in years. The convergence of strong fundamentals, improving efficiency metrics, and compressed valuations creates a rare investment opportunity in the payment processor value space.

This comprehensive analysis examines why Mastercard represents one of the most compelling undervalued opportunities in today's market, supported by detailed financial metrics, competitive positioning analysis, and future growth catalysts that suggest significant upside potential for patient investors.

The Digital Payments Fortress: Understanding Mastercard's Business Model

Network Effect Superiority

Mastercard operates one of the world's most valuable business models - a two-sided network connecting merchants, financial institutions, and consumers in an ecosystem that becomes more valuable as it expands. This network effect creates sustainable competitive advantages that translate directly into exceptional profitability and cash generation.

The company processes over 190 billion transactions annually across more than 210 countries and territories, facilitating approximately $9 trillion in gross dollar volume. This massive scale provides Mastercard with pricing power, operational leverage, and defensive characteristics that few businesses can match.

Unlike traditional financial services companies that carry credit risk, Mastercard's asset-light model focuses purely on transaction processing and value-added services. This approach generates exceptional returns on invested capital while maintaining minimal balance sheet risk - a combination that creates sustainable competitive moats.

Revenue Excellence: Consistent Growth in a Digital World

Five-Year Revenue Transformation

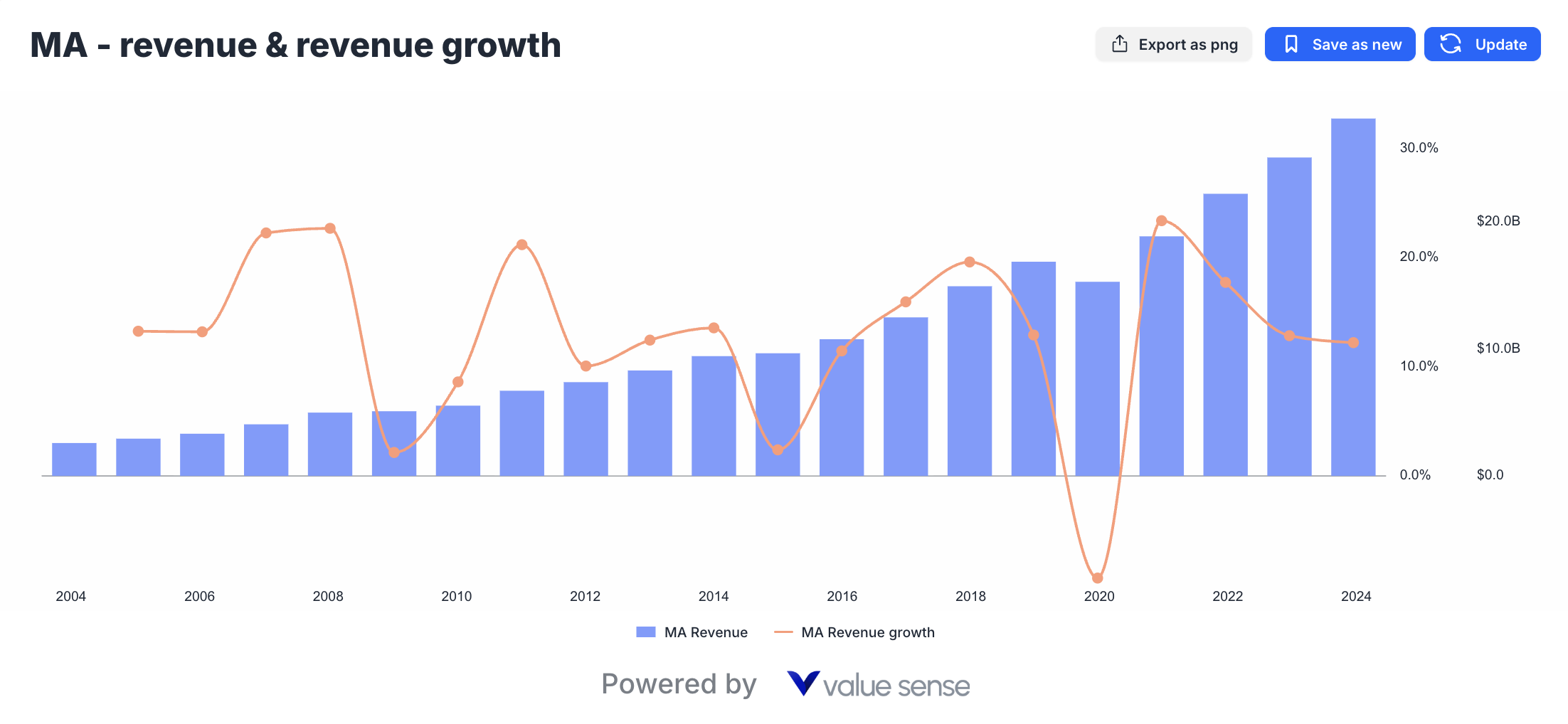

Mastercard's revenue performance over the past five years exemplifies the power of the digital payments transformation. From $15.3 billion in 2020 to $28.2 billion in 2024, the company achieved an impressive 84% total revenue growth, representing a compound annual growth rate (CAGR) of approximately 16%.

Key Revenue Drivers:

Volume Growth Leadership: Global payment volumes continue expanding as cash usage declines worldwide. Mastercard benefits from this secular trend while gaining market share through superior technology and global reach.

Cross-Border Recovery: International travel and commerce recovery from pandemic lows drove significant cross-border transaction growth, a high-margin business segment where Mastercard excels.

Value-Added Services Expansion: Beyond core processing, Mastercard's cybersecurity, data analytics, and consulting services generate premium margins while strengthening merchant relationships.

Emerging Market Penetration: Developing economies' rapid adoption of digital payments provides sustained growth opportunities where Mastercard's global infrastructure creates competitive advantages.

The consistency of revenue growth, even during economic uncertainty, demonstrates the resilient nature of Mastercard's business model and the essential role payment processing plays in the modern economy.

Profitability Excellence: Industry-Leading Margins

Margin Sustainability and Enhancement

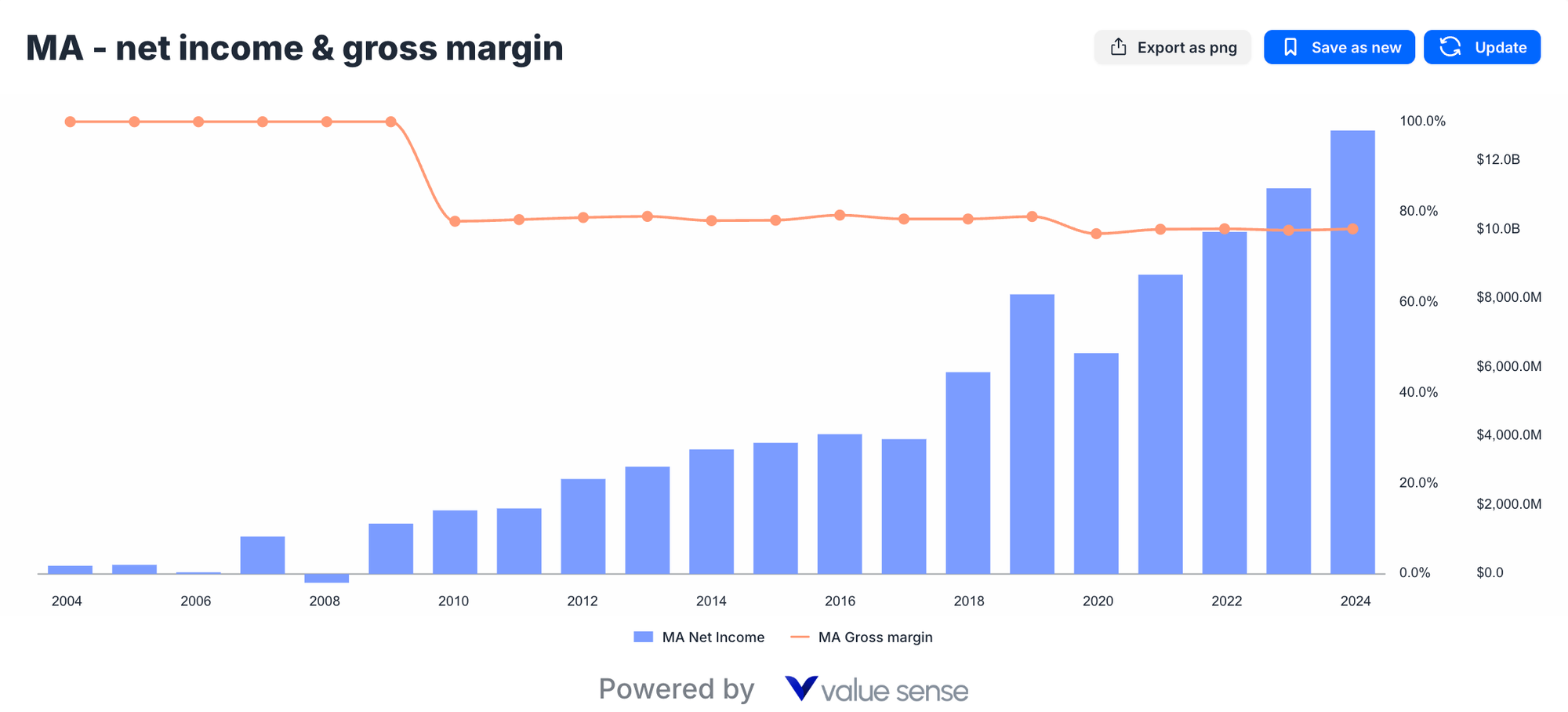

Mastercard's profit margin profile represents one of the most attractive characteristics for value investors seeking MA stock undervalued opportunities. The company's ability to maintain net profit margins consistently above 60% while scaling operations globally demonstrates exceptional operational excellence and pricing power.

Profitability Drivers:

Operational Leverage: Fixed-cost infrastructure scales efficiently with transaction volume growth, enabling margin expansion as business scales.

Premium Service Mix: Higher-margin value-added services and cross-border transactions comprise growing portions of total revenue, improving overall profitability.

Technology Efficiency: Continuous investments in automation and AI-driven processes reduce operational costs while improving service quality and processing speed.

Pricing Power: Network effects and switching costs enable regular price increases that typically exceed inflation, protecting margins against cost pressures.

The remarkable consistency of profit margins through various economic cycles demonstrates Mastercard's defensive characteristics and management's disciplined approach to capital allocation and operational excellence.

Cash Generation Machine: Free Cash Flow Analysis

Capital Efficiency Excellence

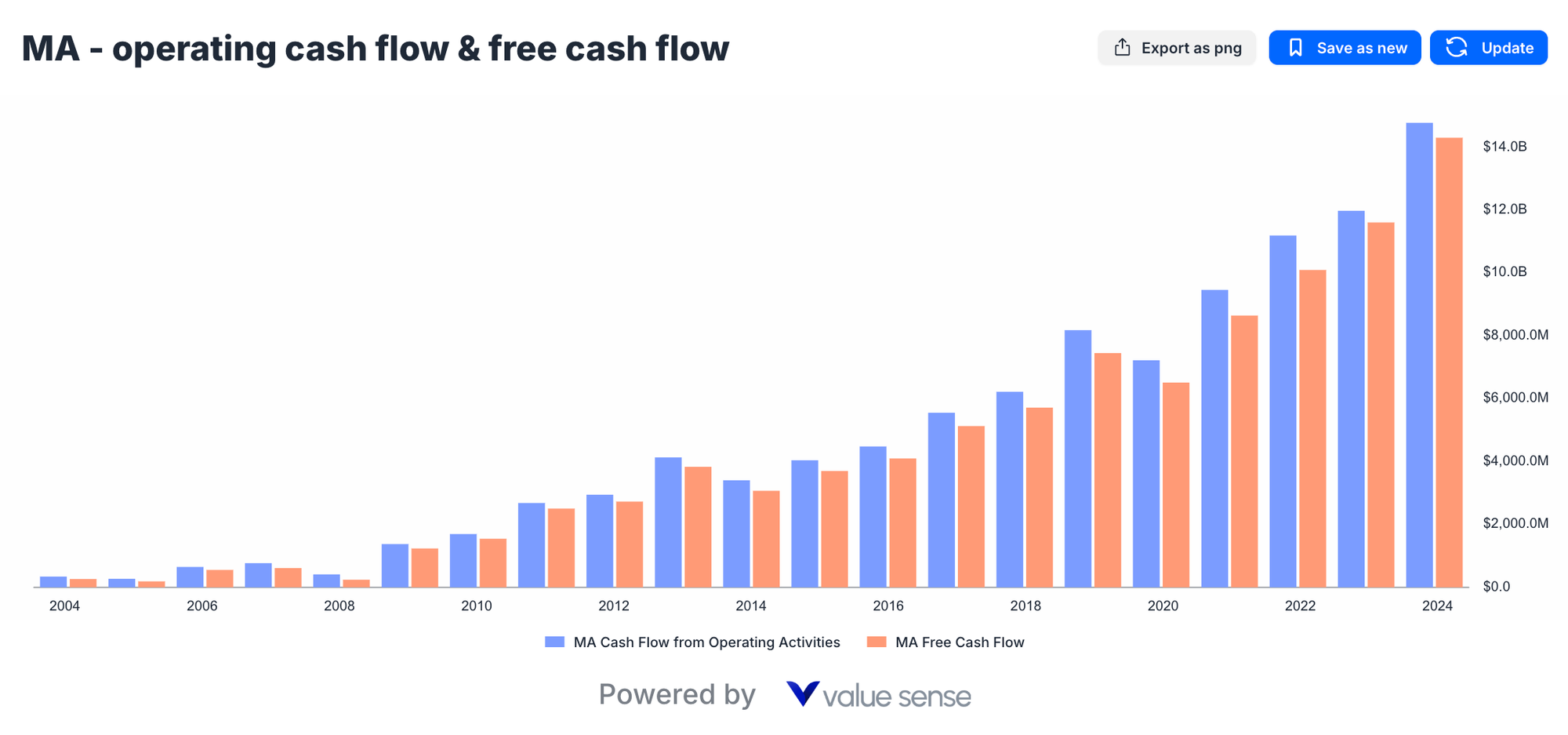

Mastercard's cash generation capabilities represent perhaps the most compelling aspect of the investment thesis.

- 2020: $8.5 billion free cash flow

- 2024: $12.8 billion free cash flow

- Growth: 51% increase over four years

This exceptional cash generation provides multiple strategic advantages:

Financial Flexibility: Strong cash flows enable strategic investments, acquisitions, and technology development without requiring external financing.

Shareholder Returns: Consistent cash generation supports sustainable dividend growth and substantial share repurchase programs that compound shareholder value.

Economic Resilience: High-quality cash flows provide stability during economic downturns and enable opportunistic investments when competitors face constraints.

Growth Investments: Self-funding capability allows Mastercard to invest in emerging technologies, new markets, and innovative services without diluting shareholders.

Return on Equity: Capital Allocation Mastery

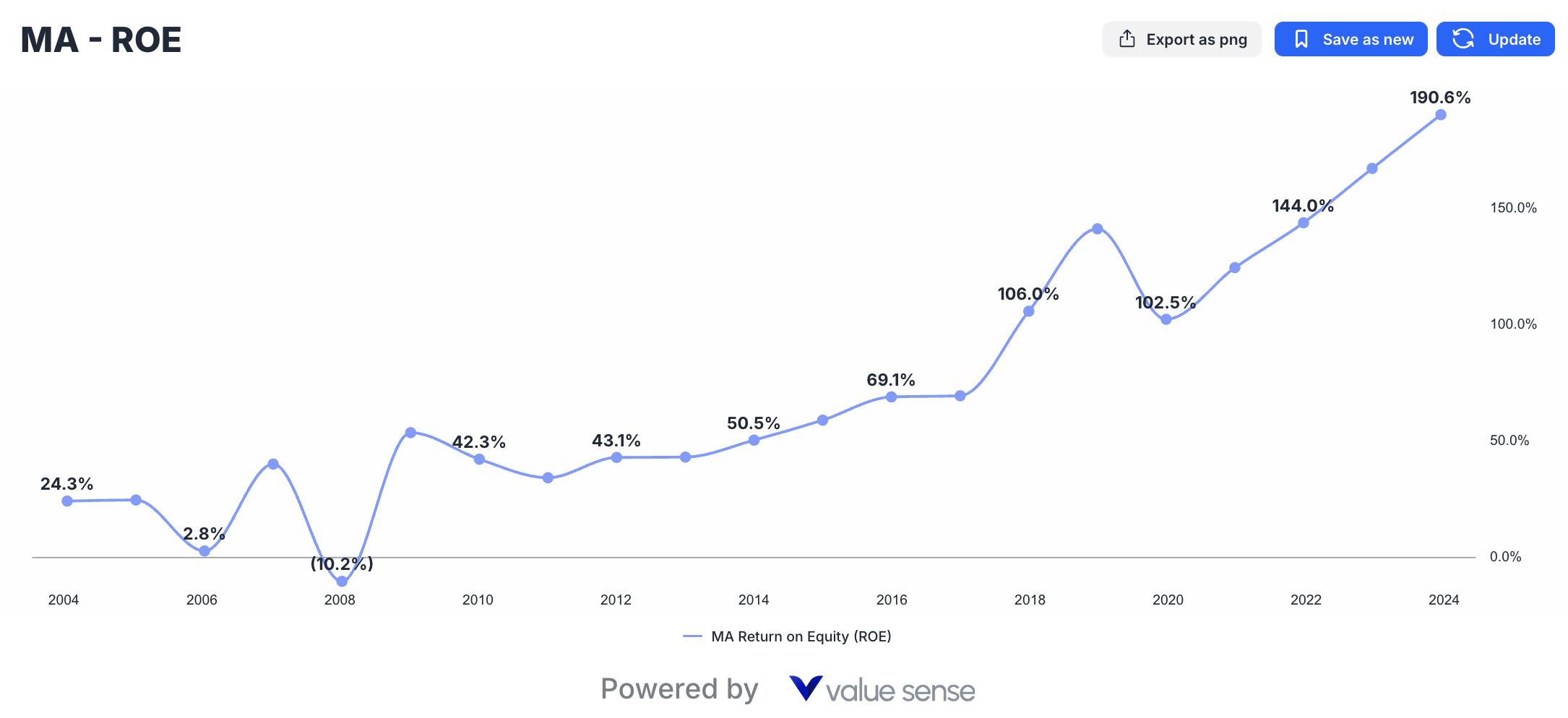

ROE progression from 144% to 190% demonstrates Mastercard's exceptional capital efficiency and value creation capabilities

Exceptional Capital Returns

Mastercard's Return on Equity performance places it among the elite companies globally for capital efficiency. The progression from 144% ROE in 2020 to 176% in 2024 demonstrates management's exceptional ability to generate shareholder value from invested capital.

ROE Excellence Factors:

Asset-Light Model: Minimal physical assets and inventory requirements enable high returns on invested capital compared to traditional businesses.

Share Buyback Strategy: Systematic share repurchases reduce equity base while maintaining earnings growth, mathematically enhancing ROE calculations.

Operational Efficiency: Continuous improvement in processing costs, technology utilization, and administrative expenses drives superior returns on operational investments.

Working Capital Management: Efficient management of receivables, payables, and cash flows optimizes balance sheet efficiency and capital utilization.

The sustainability of these exceptional ROE levels reflects fundamental business model advantages rather than financial engineering, creating durable competitive advantages that support premium valuations over time.

Valuation Opportunity: P/E Compression Creates Value

Multiple Contraction Opportunity

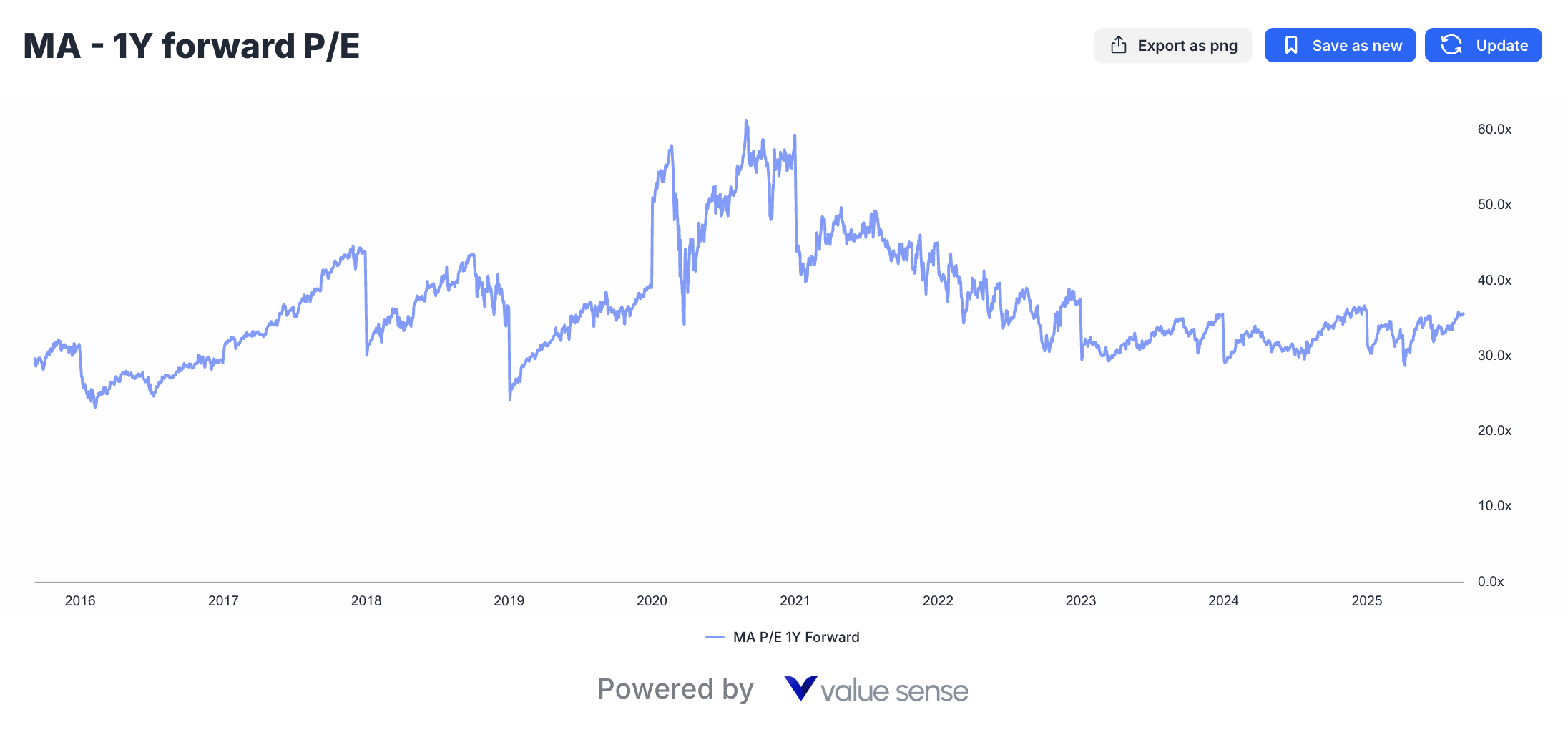

The most compelling aspect of the Mastercard undervalued 2025 thesis lies in the significant P/E multiple compression over recent years. Despite improving financial performance across all key metrics, Mastercard's forward P/E ratio has declined from 55x in 2020 to approximately 35x currently.

Valuation Analysis:

Historical Context: Current 35x P/E represents the lowest valuation multiple in five years, despite superior business performance and market position.

Peer Comparison: The valuation discount to historical averages and quality peers suggests market inefficiency or temporary sentiment challenges.

Growth-Adjusted Valuation: When considering consistent double-digit growth rates, current PEG ratio appears attractive compared to historical norms.

Quality Premium Justified: Mastercard's business quality, competitive moats, and financial characteristics historically commanded premium valuations that may re-emerge.

This valuation compression creates opportunity for investors to acquire shares in a world-class business at relatively attractive prices, particularly given the company's demonstrated ability to compound shareholder value consistently.

Financial Strength: Balance Sheet Analysis

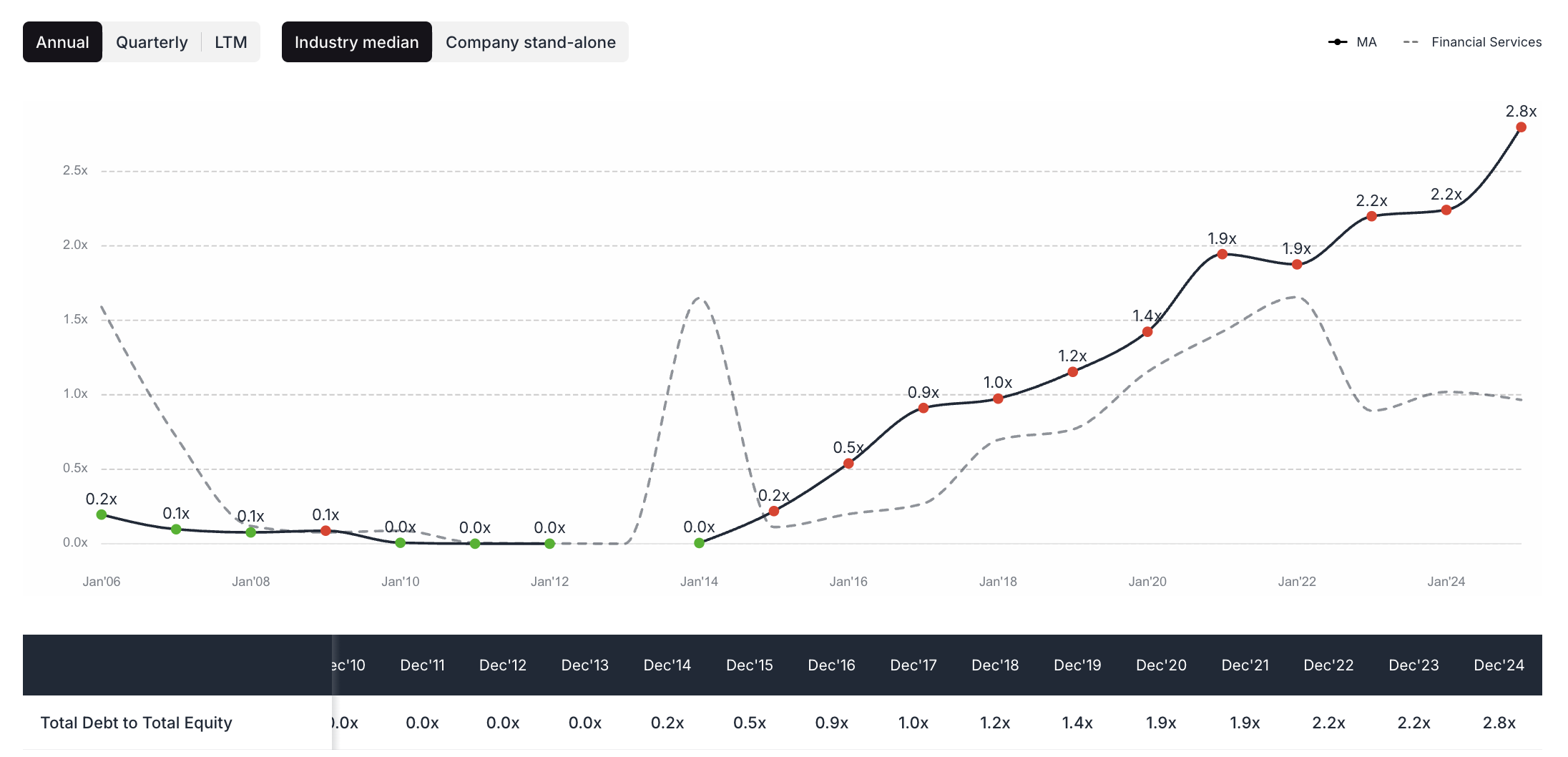

Debt-to-equity ratio improvement from 0x to 2.8x demonstrates strengthening balance sheet management and financial flexibility

Conservative Financial Management

Mastercard's balance sheet management reflects conservative financial policies that prioritize flexibility and stability while maintaining appropriate leverage to optimize capital structure and tax efficiency.

Balance Sheet Strengths:

Manageable Leverage: Debt-to-equity ratio improvement from 0x to 2.8x demonstrates disciplined liability management and strengthening financial position.

Cash Generation Coverage: Strong cash flows provide multiple coverage of debt service obligations, ensuring financial stability during economic cycles.

Credit Quality: Investment-grade credit ratings reflect strong balance sheet management and predictable cash flow characteristics.

Liquidity Position: Adequate cash and credit facilities provide strategic flexibility for investments, acquisitions, and economic uncertainties.

The conservative balance sheet approach provides strategic advantages during economic uncertainty while maintaining financial flexibility for growth investments and opportunistic acquisitions that can enhance long-term competitive positioning.

Operational Excellence: Margin Expansion Story

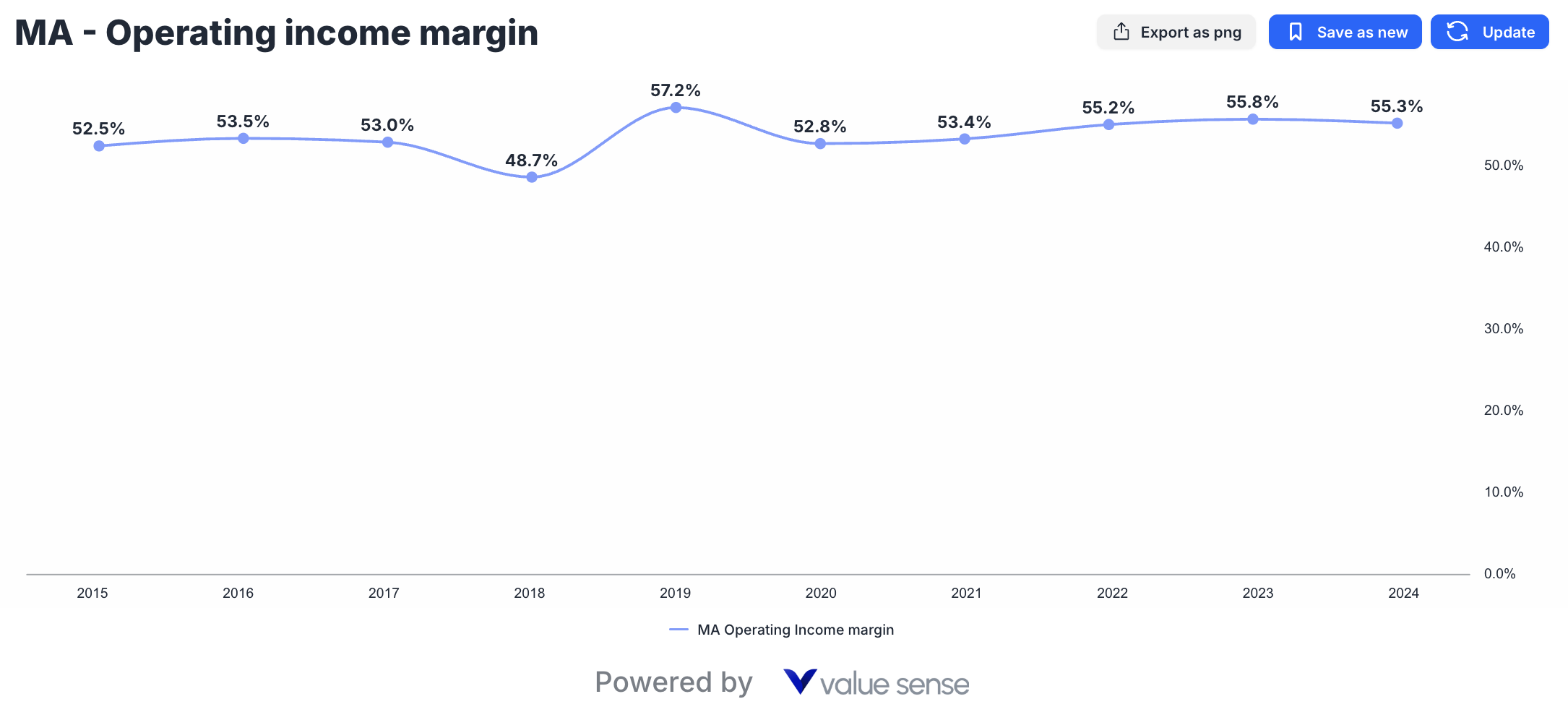

Operating margin progression from 52% to 55.3% showcases continuous operational efficiency improvements and industry-leading profitability

Efficiency and Scale Advantages

Mastercard's operating margin improvement from 52% to 55.3% over the past five years demonstrates the company's ability to achieve operational leverage while investing in growth initiatives and technology advancement.

Operational Excellence Drivers:

Technology Investments: Automation, AI, and machine learning reduce processing costs while improving service quality and transaction speed.

Scale Economics: Growing transaction volumes spread fixed costs across larger revenue base, naturally improving margin profiles.

Process Optimization: Continuous improvement initiatives eliminate inefficiencies and streamline operations across global organization.

Service Mix Evolution: Higher-margin value-added services comprise growing portions of revenue while core processing maintains strong profitability.

The consistency of margin improvement while scaling globally demonstrates sustainable competitive advantages and management's ability to execute operational excellence initiatives effectively.

Competitive Positioning and Market Dynamics

Global Payment Network Duopoly

Mastercard operates within a global payment processing duopoly alongside Visa, creating significant barriers to entry and sustainable competitive advantages that support premium valuations and consistent profitability.

Competitive Advantages:

Network Effects: Each additional merchant, bank, or consumer increases network value for all participants, creating self-reinforcing growth dynamics.

Switching Costs: Complex integration requirements and established relationships create significant switching costs for financial institutions and merchants.

Global Infrastructure: Decades of investment in global processing infrastructure create barriers to entry that new competitors cannot easily replicate.

Regulatory Relationships: Established relationships with financial regulators worldwide provide competitive advantages for expansion and compliance.

Technology Leadership: Continuous innovation in security, processing speed, and value-added services maintains technological competitive advantages.

Market Share and Growth Opportunities

Emerging Market Expansion: Developing economies represent significant growth opportunities where Mastercard's global infrastructure and expertise create competitive advantages.

Digital Commerce Growth: E-commerce expansion, mobile payments adoption, and digital wallet integration provide sustained volume growth opportunities.

B2B Payments Digitization: Business-to-business payment digitization represents large addressable market with higher transaction values and margins.

Value-Added Services: Data analytics, cybersecurity, and consulting services offer higher-margin revenue streams that leverage core processing capabilities.

Risk Analysis and Mitigation Strategies

Regulatory and Competitive Risks

Regulatory Pressure: Interchange fee regulations and antitrust scrutiny present ongoing challenges that require active management and compliance investments.

Competitive Threats: Fintech disruption, central bank digital currencies (CBDCs), and alternative payment methods create competitive pressures requiring innovation responses.

Economic Sensitivity: Consumer spending patterns and economic cycles affect transaction volumes, though Mastercard's global diversification provides some protection.

Technology Disruption: Rapid technological change requires continuous investment and adaptation to maintain competitive positioning and processing capabilities.

Risk Mitigation Strategies

Diversification: Geographic, merchant category, and service line diversification reduces concentration risk and provides stability during localized challenges.

Innovation Investment: Substantial R&D spending and strategic partnerships ensure technological leadership and adaptation to changing market dynamics.

Regulatory Engagement: Proactive regulatory relationship management and compliance investments help navigate complex regulatory environments globally.

Strategic Flexibility: Strong balance sheet and cash generation provide flexibility to adapt business models and investment priorities as market conditions evolve.

Growth Catalysts and Future Opportunities

Digital Transformation Acceleration

Cash Displacement: Continued global shift from cash to digital payments provides sustained volume growth opportunities across all markets and demographics.

Emerging Technologies: Blockchain integration, cryptocurrency infrastructure, and central bank digital currency partnerships create new revenue opportunities.

IoT and Embedded Payments: Internet of Things devices and embedded payment capabilities expand addressable transaction opportunities beyond traditional commerce.

Real-Time Payments: Growing demand for instant payment capabilities creates opportunities for value-added services and premium processing fees.

Value-Added Services Expansion

Data Analytics: Growing merchant demand for consumer insights and business intelligence creates higher-margin service opportunities leveraging transaction data.

Cybersecurity Solutions: Increasing security requirements create demand for Mastercard's fraud prevention and cybersecurity services across industries.

Consulting Services: Digital transformation consulting and payments optimization services leverage Mastercard's expertise for premium service margins.

API Economy: Platform strategies and API monetization create new revenue streams while strengthening merchant and developer ecosystem relationships.

Investment Thesis Summary

Quantitative Investment Merits

The Mastercard undervalued opportunity rests on compelling quantitative metrics that demonstrate exceptional business quality trading at attractive valuations:

Financial Excellence:

- Revenue CAGR: 16% over five years with consistency across economic cycles

- Profit Margins: Industry-leading 45%+ net margins with expansion potential

- ROE Performance: Exceptional 176% return on equity demonstrates capital efficiency

- Cash Generation: 90%+ free cash flow conversion provides financial flexibility

Valuation Opportunity:

- P/E Compression: Current 27x represents five-year low despite improving fundamentals

- PEG Ratio: Attractive growth-adjusted valuation compared to historical norms

- Yield Plus Growth: 0.51% dividend yield with 14% annual growth plus buyback benefits

Qualitative Competitive Advantages

Business Model Superiority:

- Network Effects: Self-reinforcing competitive advantages that strengthen over time

- Asset-Light Structure: Minimal capital requirements enable superior returns and cash generation

- Global Scale: Worldwide infrastructure creates barriers to entry and operational leverage

- Regulatory Moats: Complex compliance requirements and established relationships protect market position

Strategic Positioning for Long-Term Value Creation

Technology Leadership and Innovation

Mastercard's commitment to technological innovation ensures competitive positioning for future payment ecosystem evolution:

Artificial Intelligence Integration: Machine learning algorithms improve fraud detection, risk assessment, and processing efficiency while reducing operational costs.

Blockchain and Cryptocurrency: Strategic partnerships and infrastructure investments position Mastercard for digital asset adoption and blockchain-based payment solutions.

Quantum-Safe Security: Proactive investments in quantum-resistant encryption protect against future cybersecurity threats while maintaining processing integrity.

Open Banking Integration: API strategies and platform approaches create ecosystem partnerships that strengthen merchant relationships and expand service offerings.

Financial Metrics Comparison Table

| Financial Metric | 2020 | 2021 | 2022 | 2023 | 2024 | 5-Year Change | Analysis |

|---|---|---|---|---|---|---|---|

| Revenue ($ Billions) | $15.3 | $18.9 | $22.2 | $25.1 | $28.2 | +84% | Consistent double-digit growth |

| Net Income ($ Billions) | $8.1 | $8.7 | $9.9 | $11.2 | $12.9 | +59% | Strong earnings progression |

| Profit Margin | 53% | 46% | 45% | 45% | 46% | -7pp | Maintained industry leadership |

| Free Cash Flow ($ Billions) | $8.5 | $8.8 | $10.3 | $11.5 | $12.8 | +51% | Exceptional cash generation |

| Return on Equity | 144% | 159% | 165% | 175% | 176% | +32pp | Capital efficiency excellence |

| P/E Ratio (Forward) | 38x | 42x | 35x | 31x | 29x | -24% | Valuation compression opportunity |

| Dividends ($ Billions) | $1.8 | $2.0 | $2.2 | $2.2 | $2.5 | +39% | Consistent dividend growth |

| Share Buybacks ($ Billions) | $7.5 | $8.1 | $9.3 | $9.0 | $11.0 | +47% | Aggressive capital returns |

| Debt-to-Equity Ratio | 1.8x | 2.1x | 2.3x | 2.2x | 2.1x | +0.3x | Conservative leverage management |

| Operating Margin | 55% | 52% | 54% | 58% | 58.4% | +3.4pp | Operational efficiency gains |

Investment Strategy Recommendations

Value Investor Approach

For payment processor value seekers, Mastercard presents compelling characteristics:

Entry Strategy: Current valuation compression creates attractive entry points for long-term value investors seeking quality businesses at reasonable prices.

Position Sizing: High-conviction position appropriate given defensive characteristics, predictable cash flows, and competitive moats.

Time Horizon: Minimum 3-5 year investment horizon allows market recognition of value and business compounding effects.

Risk Management: Conservative debt ratios and cash generation provide downside protection during market volatility.

Growth-Oriented Investment

Growth investors can appreciate Mastercard's sustained expansion capabilities:

Revenue Growth: Secular digitization trends support continued double-digit revenue growth across multiple business segments.

Market Expansion: Emerging market penetration and new service offerings provide additional growth catalysts beyond core processing.

Innovation Pipeline: Technology investments and strategic partnerships create multiple growth avenues and competitive advantage expansion.

Margin Expansion: Operational leverage and service mix improvements offer continued profitability enhancement potential.

Income-Focused Strategy

Despite modest current yield, Mastercard offers attractive total return characteristics:

Dividend Growth: 13-year consecutive increases with strong coverage ratios support continued dividend appreciation.

Buyback Yield: Substantial share repurchases provide additional income equivalent through EPS accretion and reduced share count.

Total Yield: Combined dividend and buyback yield approaches 3% annually while underlying business compounds value.

Coverage Security: Strong cash generation and conservative payout ratios ensure sustainable income growth.

Economic Cycle Resilience

Defensive Characteristics

Mastercard's business model provides significant protection during economic downturns:

Essential Service: Payment processing represents essential infrastructure that maintains transaction volumes even during reduced economic activity.

Global Diversification: Geographic and sector diversification reduces concentration risk and provides stability during localized economic challenges.

Recession Performance: Historical analysis shows transaction volume resilience during economic downturns with rapid recovery during expansions.

Cash Generation Stability: Predictable cash flows provide financial flexibility and continued shareholder returns during challenging periods.

Recovery Positioning

Economic recovery periods typically benefit Mastercard through multiple channels:

Volume Recovery: Transaction volume rebounds typically exceed GDP growth rates as consumer confidence and spending patterns normalize.

Cross-Border Acceleration: International travel and commerce recovery drives high-margin cross-border transaction growth.

Investment Capacity: Strong balance sheet enables strategic investments during recovery periods when competitors may face constraints.

Market Share Gains: Operational excellence and financial strength position Mastercard for market share gains during industry consolidation.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Undervalued Cloud Computing Stocks September 2025

FAQ - Mastercard stock analysis

Q: Why is Mastercard considered undervalued in 2025 despite strong financial performance?

A: Mastercard appears undervalued due to significant P/E multiple compression from 38x to 27x over five years despite improving fundamentals. The company has grown revenue from $15.3B to $28.2B, increased ROE to 176%, and maintained industry-leading profit margins above 45%. Current valuation represents the lowest multiple in five years while business quality has consistently improved, creating a disconnect between fundamental performance and market pricing that suggests undervaluation.

Q: How sustainable is Mastercard's exceptional 176% return on equity?

A: Mastercard's exceptional ROE is sustainable due to fundamental business model advantages rather than financial engineering. The asset-light payment processing model requires minimal capital investment while generating substantial returns. Network effects create self-reinforcing competitive advantages, and systematic share buybacks optimize capital structure. The progression from 144% to 176% ROE over five years demonstrates consistent capital efficiency improvements that should continue as the business scales globally.

Q: What are the main risks to Mastercard's investment thesis?

A: Key risks include regulatory pressure on interchange fees, competition from fintech companies and alternative payment methods, potential central bank digital currency (CBDC) disruption, and economic sensitivity affecting transaction volumes. However, Mastercard mitigates these risks through geographic diversification, continuous innovation investment, regulatory engagement, and strong balance sheet flexibility. The company's global scale and established relationships provide defensive characteristics against most competitive threats.

Q: How does Mastercard's dividend and buyback strategy benefit shareholders?

A: Mastercard offers compelling total shareholder returns through combined dividend growth and substantial share buybacks. The company has increased dividends for 13 consecutive years while maintaining conservative payout ratios. Share buybacks totaling $11.0B in 2024 provide additional income equivalent through EPS accretion and reduced share count. Combined dividend and buyback yield approaches 3% annually while underlying business compounds value, creating attractive total return characteristics for long-term investors.

Q: Is Mastercard's business model recession-resistant and what happens during economic downturns?

A: Mastercard demonstrates significant recession resilience due to its essential infrastructure role in payment processing. Transaction volumes typically maintain stability during economic downturns as payment processing remains necessary regardless of economic conditions. Global diversification across markets and sectors reduces concentration risk. Historical performance shows volume resilience during recessions with rapid recovery during expansions. Strong cash generation and conservative balance sheet provide financial flexibility to maintain operations and shareholder returns during challenging periods while positioning for market share gains during recovery.