Michael Burry's Portfolio Analysis: The Big Short Legend's Latest Strategic Moves in 2025

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Michael Burry, the legendary investor immortalized in "The Big Short" for his prescient call on the 2008 housing crisis, continues to make waves with his latest portfolio moves at Scion Asset Management. The fund's Q2 2025 13F filing reveals a dramatic portfolio overhaul that showcases Burry's signature contrarian approach, with strategic bets on healthcare giants and consumer brands that have fallen out of favor with mainstream investors.

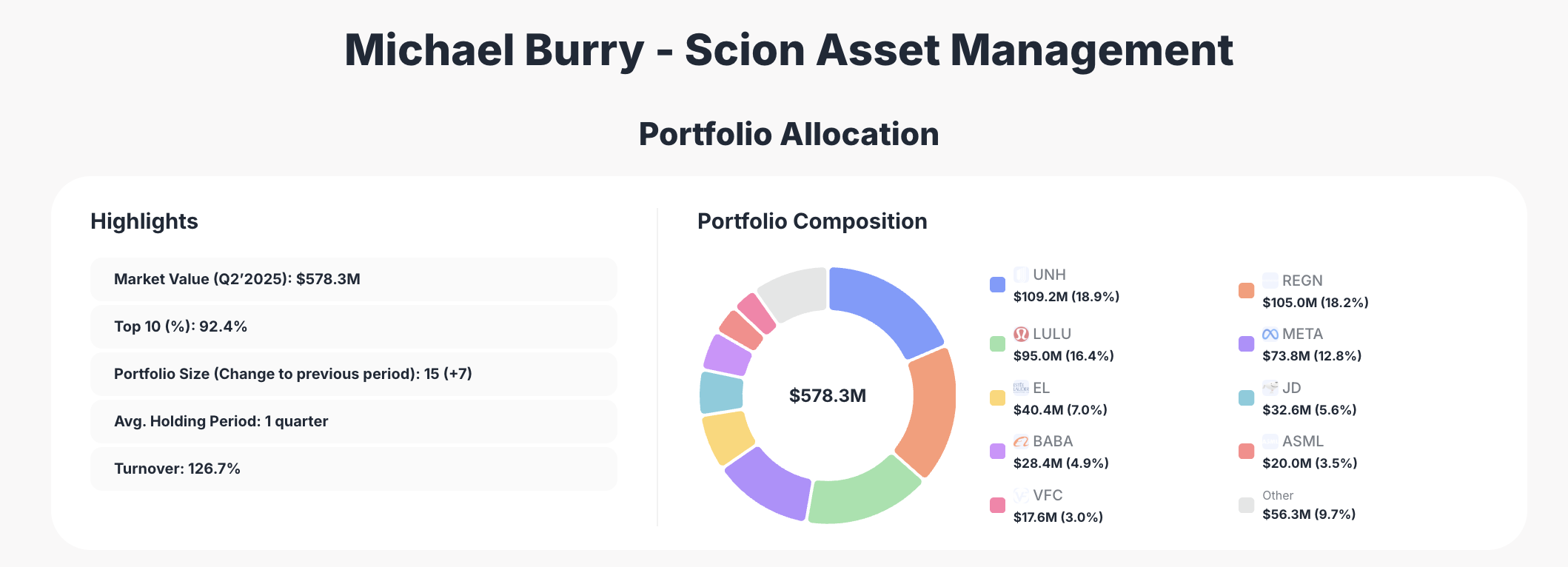

Portfolio Overview: Concentrated Conviction Plays

Scion Asset Management's portfolio (https://valuesense.io/superinvestors/scion) stands at $578.3 million as of Q2 2025, representing a significant shift from previous quarters. The fund's concentrated approach is evident with:

- Top 10 holdings: 92.4% of total portfolio

- Portfolio size: 15 positions (increase of 7 from previous period)

- Average holding period: 1 quarter

- Turnover rate: 126.7% (indicating high portfolio activity)

This level of concentration reflects Burry's high-conviction investment philosophy, where he places substantial bets on companies he believes are fundamentally undervalued by the market.

Top Holdings Breakdown: Healthcare Takes Center Stage

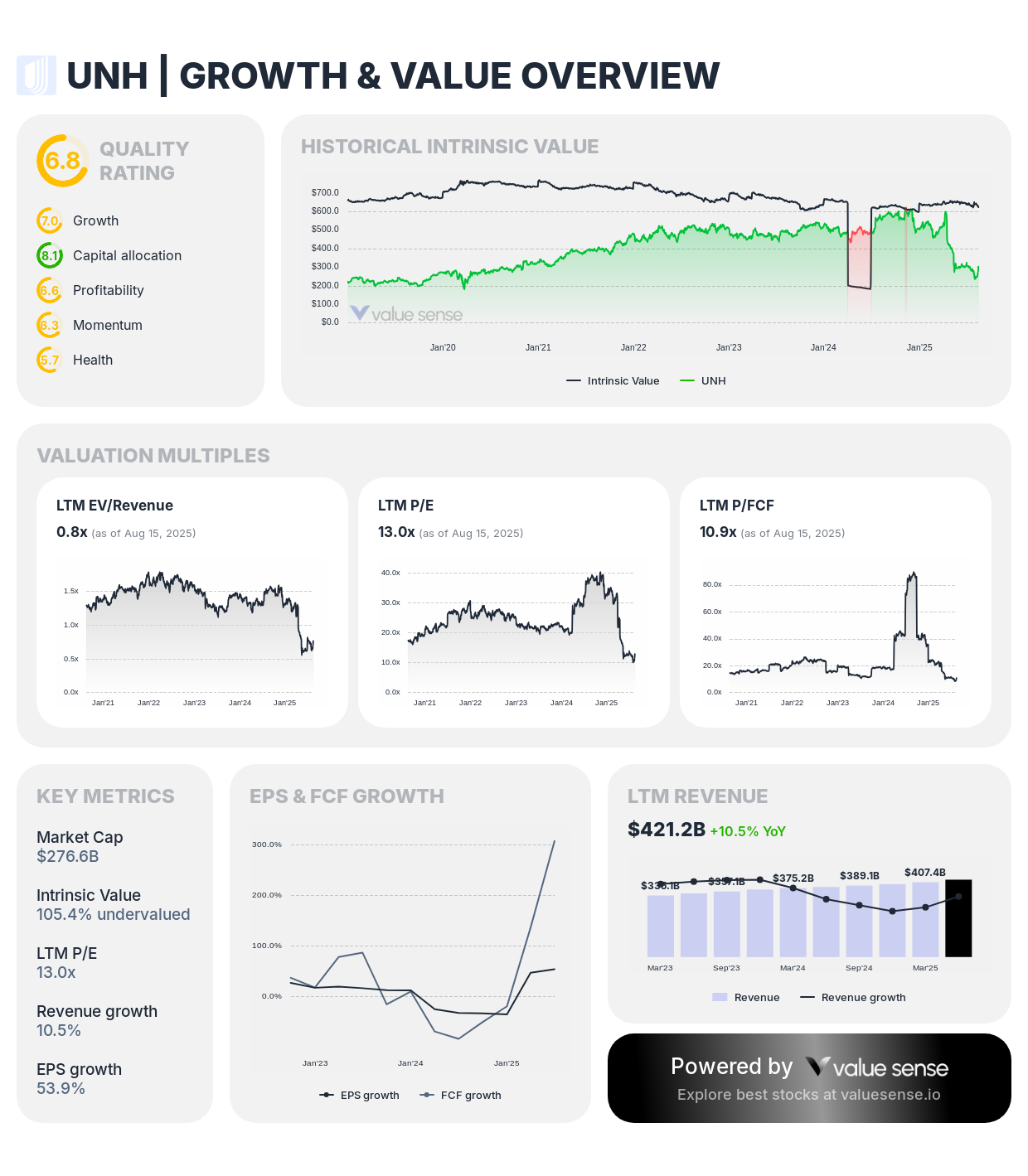

1. UnitedHealth Group (UNH) - 18.9% ($109.2M)

The crown jewel of Burry's portfolio, UnitedHealth represents his largest position with a massive 1,650% increase to 350,000 shares. This dramatic accumulation suggests Burry sees significant value in America's largest health insurer despite regulatory pressures and rising medical costs.

Why UNH Makes Sense:

- Trading at attractive valuation metrics despite strong fundamentals

- Diversified revenue streams across insurance and healthcare services

- Consistent dividend growth with current yield of 2.72%

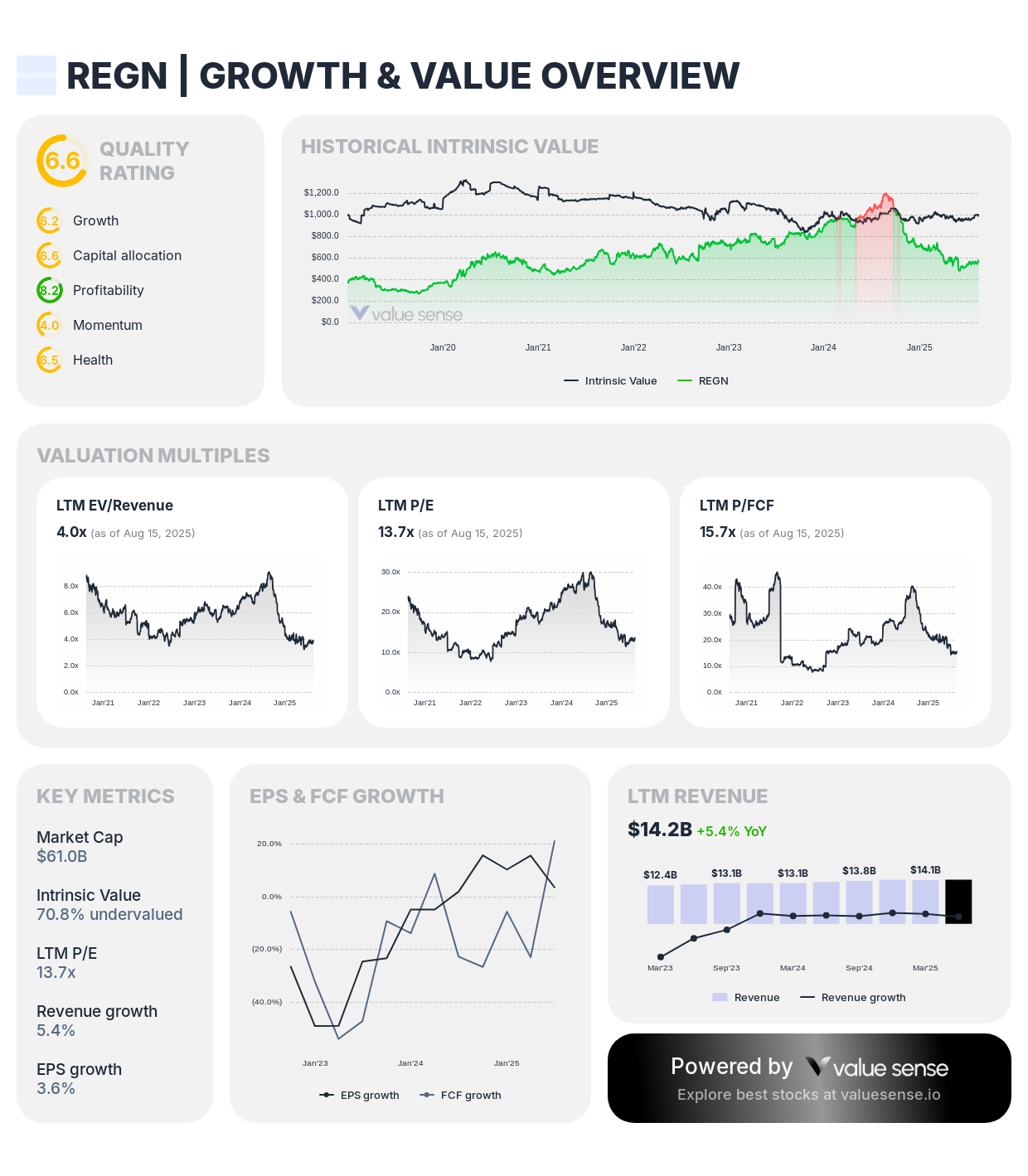

2. Regeneron Pharmaceuticals (REGN) - 18.2% ($105M)

Another healthcare heavyweight, Regeneron received a 1,233% position increase to 200,000 shares. The biotechnology company's focus on innovative treatments aligns with Burry's strategy of identifying undervalued growth opportunities.

Investment Thesis:

- Strong pipeline of innovative drugs including cancer and rare disease treatments

- Analyst price targets averaging $728.27 with potential upside of 39%

- Trading at discount to fair value estimates

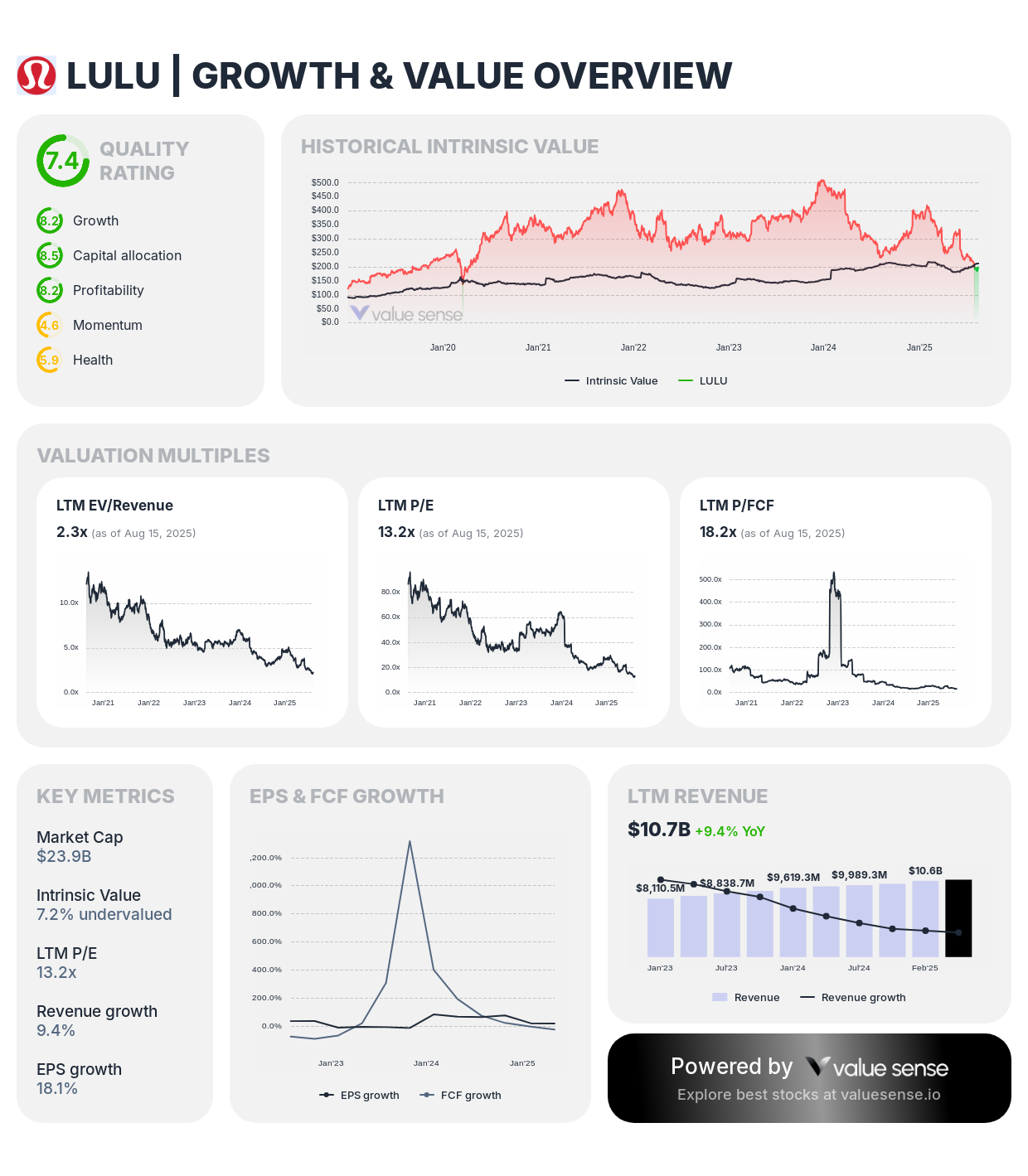

3. Lululemon Athletica (LULU) - 16.4% ($95M)

Perhaps the most surprising inclusion, Lululemon represents 400,000 shares with no change in position size. The athletic apparel retailer has faced significant headwinds in 2025, making it a classic Burry contrarian play.

The Contrarian Bet:

- Stock down approximately 47% in 2025, creating value opportunity

- Strong brand loyalty and premium positioning intact

- International expansion potential, particularly in Asia

- Trading at steep discount to historical multiples

Holdings & Activity - Scion Asset Management Q2 2025

| Company | Ticker | Recent Activity | Shares | Value | % of Portfolio |

|---|---|---|---|---|---|

| UnitedHealth Group Inc. | UNH | Add 1,650.00% | 350,000 | $109.2M | 18.9% |

| Regeneron Pharmaceuticals Inc. | REGN | Add 1,233.33% | 200,000 | $105.0M | 18.2% |

| Lululemon Athletica Inc. | LULU | No change | 400,000 | $95.0M | 16.4% |

| Meta Platforms Inc. | META | Add 25.00% | 100,000 | $73.8M | 12.8% |

| The Estée Lauder Companies Inc. | EL | Add 150.00% | 500,000 | $40.4M | 7.0% |

| JD.com Inc. | JD | Add 150.00% | 1,000,000 | $32.6M | 5.6% |

| Alibaba Group Holding Limited | BABA | Add 25.00% | 250,000 | $28.4M | 4.9% |

| ASML Holding N.V. | ASML | No change | 25,000 | $20.0M | 3.5% |

| V.F. Corporation | VFC | Add 650.00% | 1,500,000 | $17.6M | 3.0% |

| The Estée Lauder Companies Inc. | EL | Reduce 70.00% | 150,000 | $12.1M | 2.1% |

| Lululemon Athletica Inc. | LULU | Reduce 87.50% | 50,000 | $11.9M | 2.1% |

| Bruker Corporation | BRKR | Add 233.33% | 250,000 | $10.3M | 1.8% |

| Regeneron Pharmaceuticals Inc. | REGN | No change | 15,000 | $7,875.0K | 1.4% |

| MercadoLibre Inc. | MELI | No change | 3,000 | $7,849.9K | 1.4% |

| UnitedHealth Group Inc. | UNH | No change | 20,000 | $6,239.4K | 1.1% |

| Trip.com Group Limited | TCOM | Reduce 100.00% | 0 | $0.0 | 0.0% |

Notable Portfolio Changes: Strategic Repositioning

Major Additions:

- Meta Platforms (META): +25% increase to 100,000 shares ($73.8M)

- Estée Lauder (EL): +150% increase to 500,000 shares ($40.4M)

- JD.com (JD): +150% increase to 1,000,000 shares ($32.6M)

- Alibaba (BABA): +25% increase to 250,000 shares ($28.4M)

Complete Exit:

- Trip.com (TCOM): Reduced to 0 shares (100% reduction)

Significant Reductions:

- Estée Lauder (EL): Also reduced by 70% in another position

- Lululemon (LULU): Reduced by 87.5% in secondary position

Investment Philosophy: The Burry Methodology

Burry's approach remains rooted in deep value investing principles that have served him well throughout his career:

Core Tenets:

- Contrarian Positioning: Buying when others are selling

- Fundamental Analysis: Deep dive into financial statements and business models

- Market Inefficiency Exploitation: Capitalizing on temporary mispricings

- High Concentration: Placing large bets on highest conviction ideas

- Patient Capital: Willing to wait for thesis to play out

Current Market Context:

The Q2 2025 positioning suggests Burry sees value in sectors that have been beaten down by market sentiment, particularly healthcare facing regulatory scrutiny and consumer discretionary names hurt by economic uncertainty.

Sector Analysis: Healthcare Dominance

Healthcare represents the largest sector allocation in Burry's portfolio, comprising over 37% through UNH and REGN positions. This concentration reflects several potential catalysts:

Healthcare Investment Rationale:

- Defensive characteristics during economic uncertainty

- Aging demographics driving long-term demand

- Innovation in biotechnology creating value opportunities

- Regulatory clarity emerging after election cycle

- Attractive valuations after sector rotation

Risk Considerations: The Contrarian's Dilemma

While Burry's track record speaks for itself, his current portfolio carries notable risks:

Concentration Risk:

- Heavy weighting in few positions amplifies individual stock risk

- Sector concentration in healthcare increases regulatory exposure

Market Timing:

- High turnover suggests active timing attempts

- Contrarian bets may take time to materialize

- Current market conditions may not favor value plays

Fundamental Changes:

- Some holdings face structural challenges (retail, China exposure)

- Healthcare regulations could impact profitability

Lessons for Individual Investors

Burry's approach offers several insights for retail investors:

Key Takeaways:

- Do Your Homework: Deep fundamental analysis remains crucial

- Think Differently: Question market consensus and popular narratives

- Be Patient: Value investing requires time for thesis to play out

- Manage Risk: Even contrarian plays need proper position sizing

- Stay Disciplined: Stick to investment process despite short-term volatility

Adaptation for Retail:

- Most investors should maintain broader diversification

- Consider ETFs for sector exposure rather than individual stock concentration

- Use smaller position sizes when making contrarian bets

- Maintain emergency fund for market volatility

Looking Ahead: What's Next for Scion?

Based on current positioning and market dynamics, several trends may influence Burry's future moves:

Potential Catalysts:

- Healthcare policy clarity post-election

- China market recovery benefiting BABA and JD positions

- Consumer spending normalization helping LULU recovery

- Technology sector rotation favoring META

Watch Points:

- Quarterly earnings from major holdings

- Regulatory developments in healthcare

- Economic indicators affecting consumer discretionary

- Geopolitical factors impacting China exposure

Conclusion: The Art of Contrarian Investing

Michael Burry's Q2 2025 portfolio reveals a master strategist at work, applying time-tested contrarian principles to identify value opportunities in a complex market environment. His concentrated bets on healthcare leaders UnitedHealth and Regeneron, combined with contrarian plays in Lululemon and Chinese technology stocks, demonstrate the conviction-based approach that has defined his career.

For investors following Burry's moves, the key lesson remains consistent: successful investing often requires the courage to act differently from the crowd, backed by rigorous fundamental analysis and patient capital. While his concentrated approach may not be suitable for all investors, the underlying principles of value identification and contrarian thinking remain as relevant as ever in today's markets.

As we continue to track Scion Asset Management's evolving strategy, one thing remains certain: Michael Burry's investment decisions will continue to provide valuable insights into market dynamics and the eternal search for undervalued opportunities in an ever-changing financial landscape.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 Leopold Aschenbrenner's AI Revolution Portfolio

📖 How to Download Complete Stock Financial Data in Seconds

📖 Data-Driven Value Investing: Why Fundamentals Still Matter