The Hidden Potential of Micro-Cap Investments: 6 Stocks Flying Under Wall Street's Radar 2025

Welcome to Value Sense Blog

At Value Sense, we provide insights on the stock market, intrinsic value tools, and stock ideas with undervalued companies. You can explore our research products at valuesense.io and learn more about our approach on our site.

In today's market landscape dominated by mega-cap tech giants and household names, savvy investors are increasingly turning to micro-cap stocks for potentially outsized returns. These smaller companies, often overlooked by institutional investors and major financial media, can present compelling investment opportunities for those willing to accept higher risk in exchange for significant growth potential.

We've compiled a diverse collection of micro-cap investment theses from retail investors who have identified what they believe are asymmetric betting opportunities across various sectors. While these investments carry substantial risk, their potential upside has captured the attention of investors looking beyond traditional market darlings.

Biotech Innovations: Pioneering New Treatment Frontiers

Cabaletta Bio (CABA) - Revolutionizing Autoimmune Disease Treatment

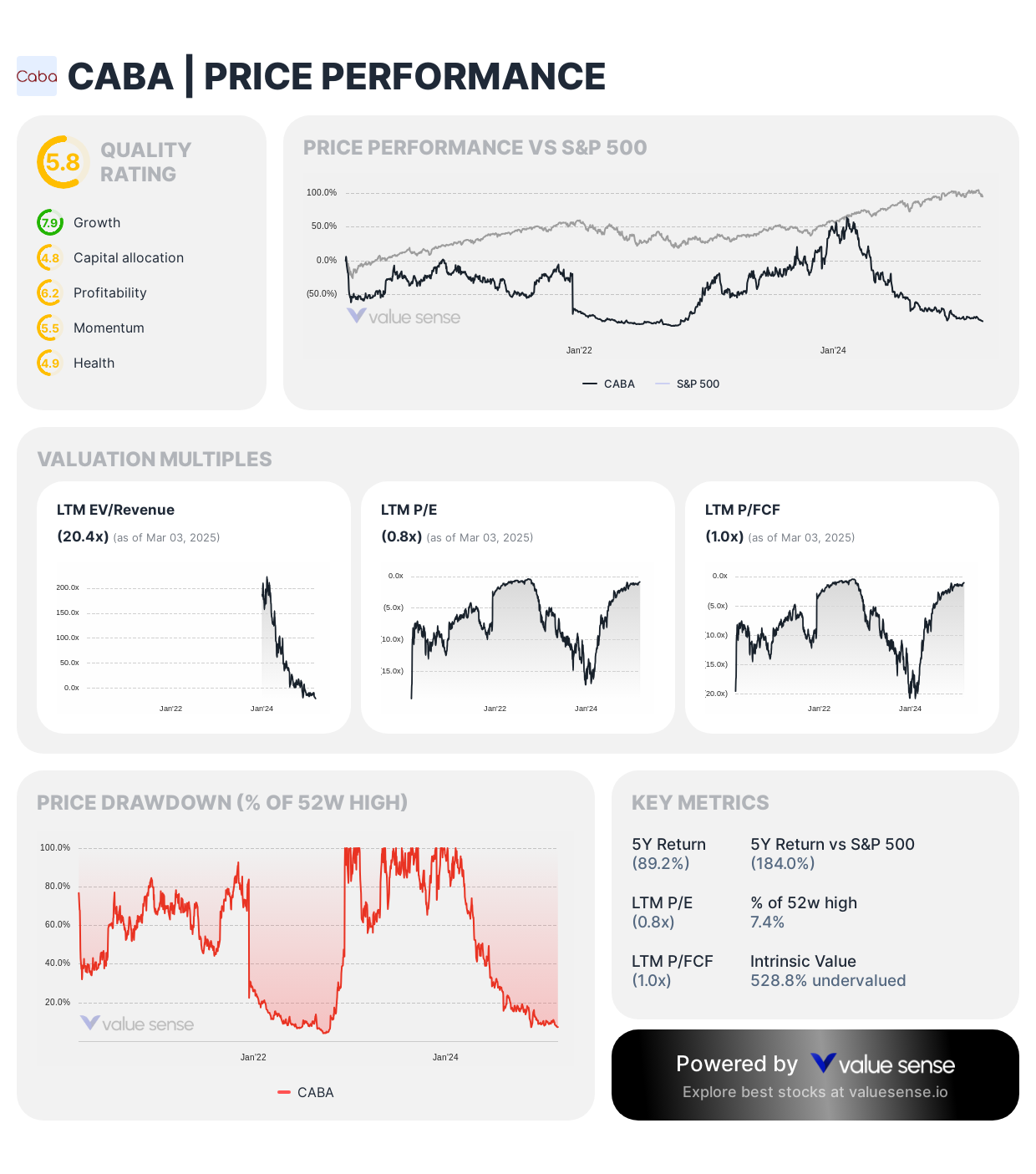

Cabaletta Bio represents one of the most intriguing asymmetric opportunities in the biotech space. The company is taking CAR-T therapy—a proven cancer treatment approach—and applying it to autoimmune diseases. Rather than merely suppressing immune responses like current treatments, CABA's approach aims to effectively reset the immune system.

The scientific foundation appears promising, with early CAR-T trials in lupus at Erlangen University demonstrating complete remission in all patients. Cabaletta secured $367 million in their IPO, providing substantial runway to advance their clinical trials for conditions like lupus, multiple sclerosis, and myasthenia gravis.

Trading at approximately $1.86 per share, supporters believe CABA could achieve a 5-10x return within three years contingent on FDA approval. While biotech investments inherently carry significant risks—from clinical trial failures to potential dilution—the transformative potential of Cabaletta's approach could position it as a leader in the next wave of autoimmune disease treatments.

For investors interested in deeper research, the r/CABAinvest community offers additional resources and discussion.

Compass Pathways (CMPS) - Breaking New Ground in Mental Health

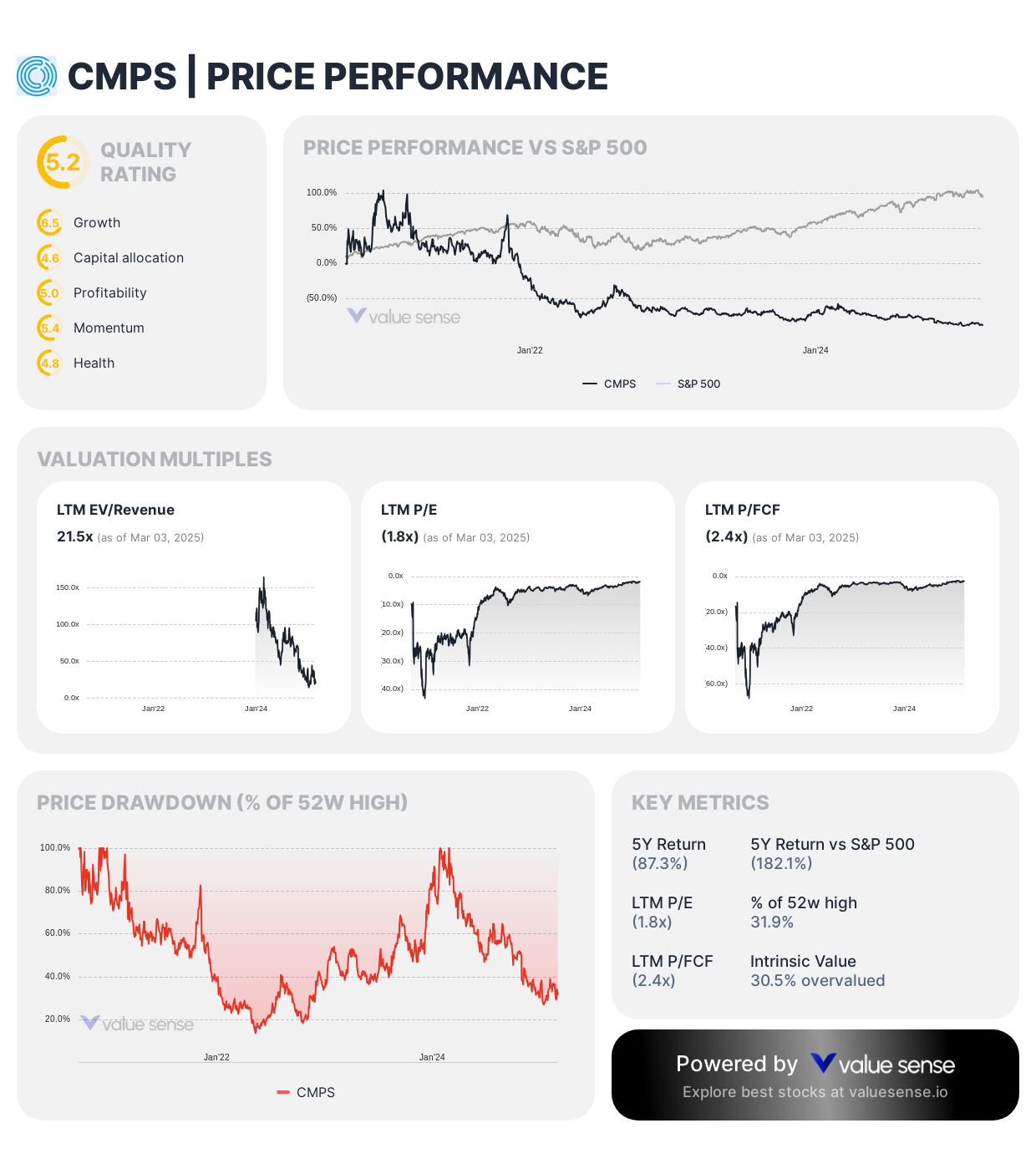

Compass Pathways stands at the forefront of psychedelic therapy, specifically utilizing psilocybin to treat treatment-resistant depression (TRD). In a mental health landscape that has seen little innovation beyond SSRIs and conventional therapy, CMPS is pioneering a potentially revolutionary approach—single-dose, therapist-guided psilocybin sessions that could provide lasting relief where traditional treatments have failed.

The company has advanced to Phase 3 clinical trials with results expected later this year. Success could make Compass the first to commercialize psychedelic-assisted therapy, securing a substantial first-mover advantage in an untapped market. Their synthetic psilocybin formulation (Comp360) is patent-protected, and they've established partnerships with leading researchers in the field.

Currently trading around $3.95 per share, proponents suggest CMPS could achieve 5x or greater returns within three years. While regulatory hurdles and scaling challenges present significant risks, FDA approval could position Compass as a transformative force in mental health treatment.

Predictive Oncology AI (POAI) - The Power of Tumor Data

Predictive Oncology AI represents an intriguing asset play in the oncology space. The company possesses approximately 150,000 live tumor samples and has developed AI technology capable of predicting tumor responses to drugs with 92% accuracy—a potentially valuable capability in precision oncology.

POAI has signed a letter of intent to merge with RENOVARO, with current shareholders potentially receiving $3 per share upon deal completion (compared to the current $1.40 trading price). RENOVARO recently secured $15 million in funding, satisfying one of the merger conditions, though this development was overshadowed by RENOVARO's announcement of another merger.

Even if the RENOVARO deal falls through, bulls argue that POAI's extensive tumor database represents significant untapped value that could attract alternative partnerships. While high volatility is expected, supporters believe the expected value exceeds the current stock price.

Energy & Natural Resources: Value Plays in Essential Industries

Brookside Energy (BRK.ASX/RDFEF) - Undervalued Oil Producer with Long-Term Vision

This Australian-listed oil and gas producer operates in Oklahoma, USA, and presents what some view as an asymmetric risk-reward opportunity for patient investors. With a market capitalization of just $27 million USD, Brookside's long-term projections suggest substantial future value.

The company maintains a solid foundation with $15 million cash on hand and a $25 million credit facility. While cash flows are expected to remain slightly negative until 2026 due to capital expenditures on new wells, projections indicate the company could accumulate approximately $200 million in cash by 2033.

Notably, the CEO has demonstrated confidence by purchasing shares above current market prices. Key risks include oil price sensitivity during the capital-intensive phase (2025-2026) and operational uncertainties regarding drilling success and production margins. For investors with a long-term horizon seeking oil exposure, Brookside presents an interesting value proposition.

Evolution Petroleum Corp (EPM) - Steady Income in a Volatile Sector

Evolution Petroleum offers several appealing characteristics for micro-cap investors. The company features a small float and thin trading volume, potentially supporting price stability. Unlike many small energy companies, EPM has maintained a conservative approach to shareholder dilution while establishing an impressive track record of paying dividends for 46 consecutive quarters.

The company has attracted two analyst buy ratings, and the founder remains actively involved in operations, suggesting continued alignment with the original vision. The primary downside is EPM's close correlation with oil prices, creating commodity price risk. Additionally, while executive share-based compensation is a consideration, the company has historically offset this through share buyback programs.

For income-focused investors seeking energy exposure, EPM's dividend history may provide an attractive combination of yield and growth potential.

Fortitude Gold Corp (FTCO) - Gold Exposure with Substantial Yield

Fortitude Gold represents an interesting play in the junior gold mining sector, combining precious metals exposure with an unusually high dividend yield for the industry (9-10%). The company operates with a low-cost structure specifically designed to return profits to shareholders.

FTCO maintains a debt-free balance sheet with a relatively strong cash position for its size. The company's business model centers around its active Isabella Pearl mine and 4-5 additional properties located within 30 miles. Their strategic approach involves using the established site for processing, which reduces costs and simplifies permitting requirements for satellite projects.

Recent permit delays at their County Line project and for deeper mining at Pearl have presented headwinds, though the Pearl permit was finally secured in Q4 2024. With approximately 40,000 ounces remaining on the leach pad and strong gold prices, operations appear sustainable in the near term. Supporters also anticipate accelerated permitting under the new presidential administration.

Environmental Services: Capitalizing on Critical Clean-Up Projects

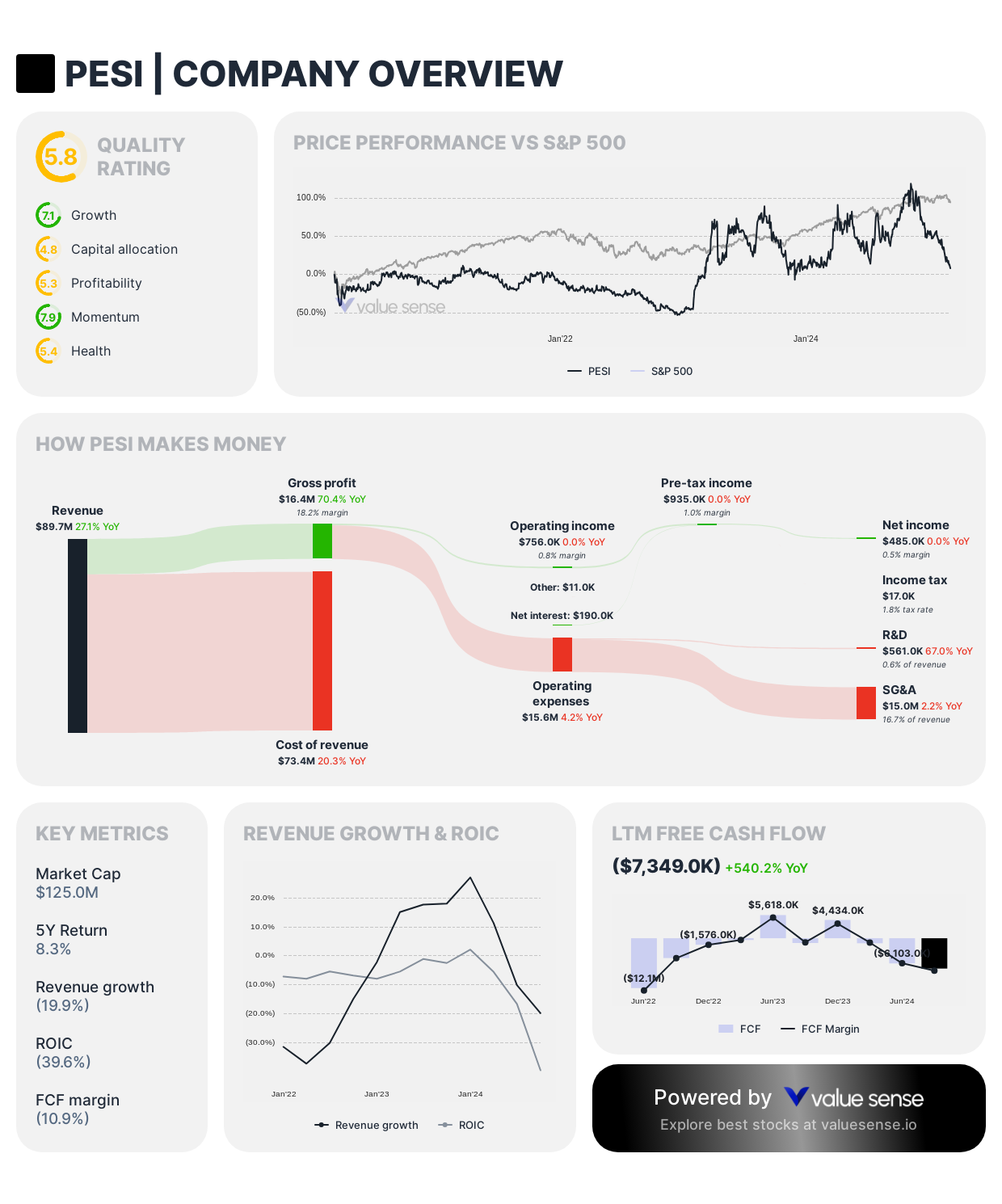

Perma-Fix Environmental Services (PESI) - Hazardous Waste Treatment Specialist

Perma-Fix provides hazardous waste treatment and services, with significant growth potential tied to major government contracts. The company secured a substantial role in the Hanford clean-up project, which begins ramping up in August and could generate over $1.50 in earnings per share—significant for a stock trading around $8 with no debt.

Additional contracts could further enhance earnings, including the West Valley Closure project. Looking ahead, PESI is positioned to capitalize on the emerging PFAS remediation market, expected to contribute meaningful revenue next year. Further upside potential exists for additional work from Hanford, specifically in grouting supplemental LAW (Low-Activity Waste).

Supporters believe PESI could become a "10-bagger" over time, though political risk exists regarding potential funding cuts under the Trump administration. While these concerns have weighed on the stock price, bulls consider these fears overblown given the essential nature of environmental remediation work.

Oil Exploration: High-Risk, High-Reward Plays

Sintana Energy (SEI) - Offshore Oil Licenses with Hidden Value

Sintana Energy owns multiple offshore oil licenses, primarily located off the Namibian coast. Proponents argue that the company's PEL-83 license alone likely exceeds the current market capitalization, effectively providing investors with their other prospects for free.

While details on development timelines and specific reserve estimates weren't provided, the thesis represents a classic natural resource "hidden asset" play. Investors interested in frontier oil exploration might find SEI's risk-reward profile compelling, though such investments typically require significant patience and risk tolerance.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Stocks With Great Health Ratings and 15%+ Returns Over 5 Years

📖 High ROIC Stocks with Exceptional Quality and Momentum

📖 11 Low-Debt Stocks With High FCF Conversion and Revenue Growth