11 Best Multibagger Stocks with Heavy Moats and 25%+ Growth Potential

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at valuesense.io.

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Multibagger Stocks: The Ultimate Wealth-Building Opportunity

Multibagger stocks represent the pinnacle of long-term wealth creation - companies that multiply initial investments several times over through sustained competitive advantages and exceptional execution. These rare opportunities combine explosive growth potential with durable business moats that protect against competition and market volatility.

Our analysis focuses on large-cap companies that have demonstrated the fundamental characteristics of multibagger potential: sustained high growth rates, heavy competitive moats, and the financial strength to compound shareholder wealth over extended periods. Each company in our selection maintains a quality rating of 6.0 or higher, indicating robust business fundamentals and competitive positioning.

Multibagger Selection Criteria:

- Quality rating of 6.0+ indicating strong competitive moats

- Large-cap market leaders with proven scale

- Exceptional revenue growth and free cash flow generation

- Sustainable competitive advantages across multiple business dimensions

Top 11 Multibagger Stocks - Comprehensive Value Analysis

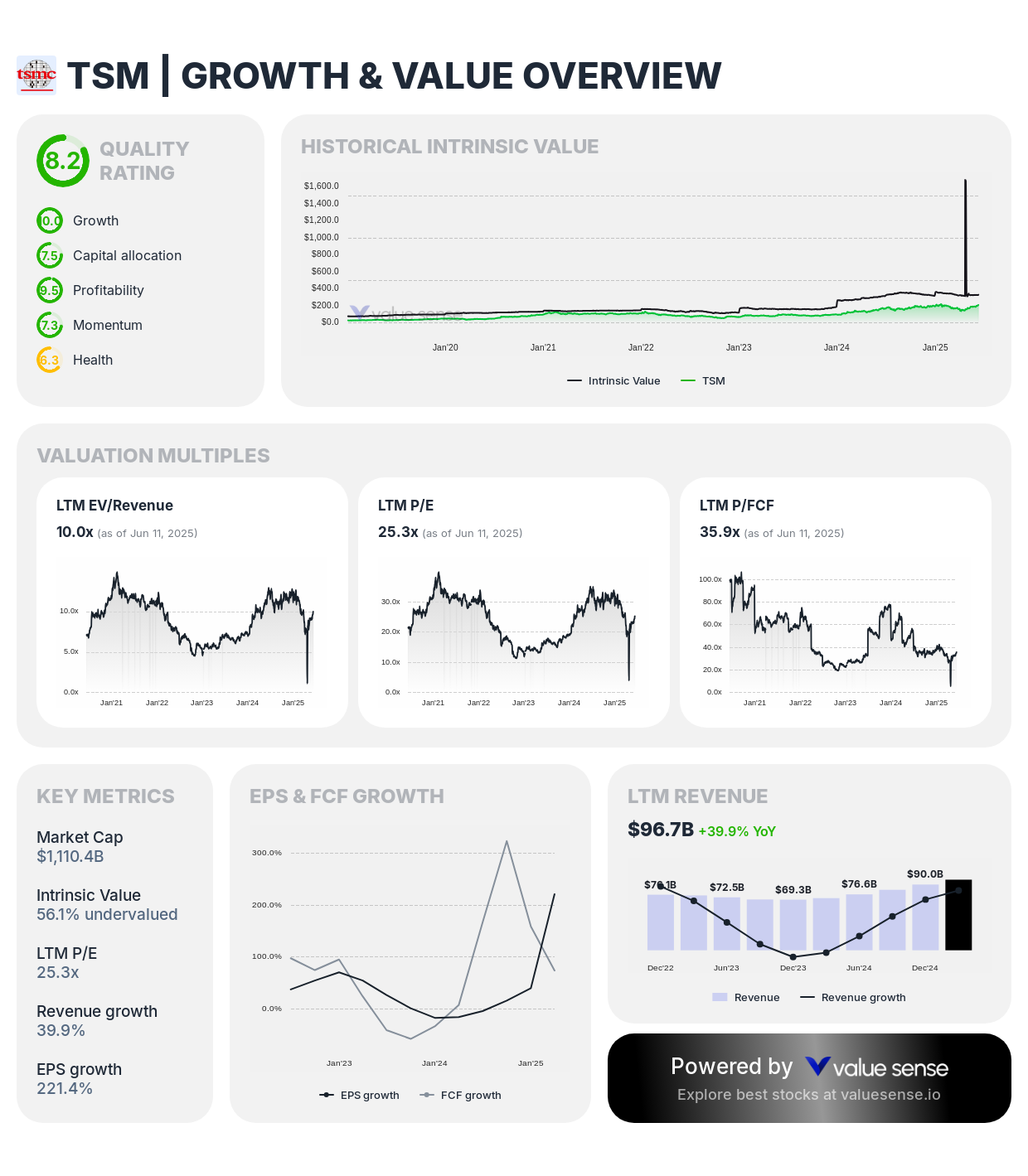

1. Taiwan Semiconductor Manufacturing Company (TSM) - 56.1% Undervalued ⭐

Sector: Semiconductors | Quality Rating: 8.2 | 1Y Return: 30.2%

Key Financials:

- Revenue: NT$3,140.9B

- Free Cash Flow: NT$922.4B

- Revenue Growth: 38.9%

- FCF Margin: 29.4%

Investment Thesis: TSMC stands as the crown jewel of our multibagger analysis - a company with the highest quality rating (8.2) trading at a significant 56.1% discount to intrinsic value. As the world's dominant semiconductor foundry, TSMC occupies an irreplaceable position in the global technology supply chain, manufacturing the most advanced chips for Apple, NVIDIA, AMD, and other technology leaders.

Competitive Moat: TSMC's heavy moat encompasses technological leadership in advanced process nodes, massive capital requirements creating barriers to entry, and mission-critical relationships with the world's leading chip designers. The company's continuous innovation in 3nm and 2nm processes maintains its technological edge while expanding capacity globally strengthens its competitive position.

Growth Catalysts:

- Accelerating AI and data center chip demand driving premium pricing

- Leadership in advanced manufacturing nodes with limited competition

- Global expansion reducing geopolitical risks while capturing growth

- Essential supplier relationships with technology giants

Why It's Our Top Pick: TSMC represents the rare combination of exceptional quality (8.2 rating) with attractive valuation (56.1% undervalued), offering both growth potential and downside protection for multibagger investors.

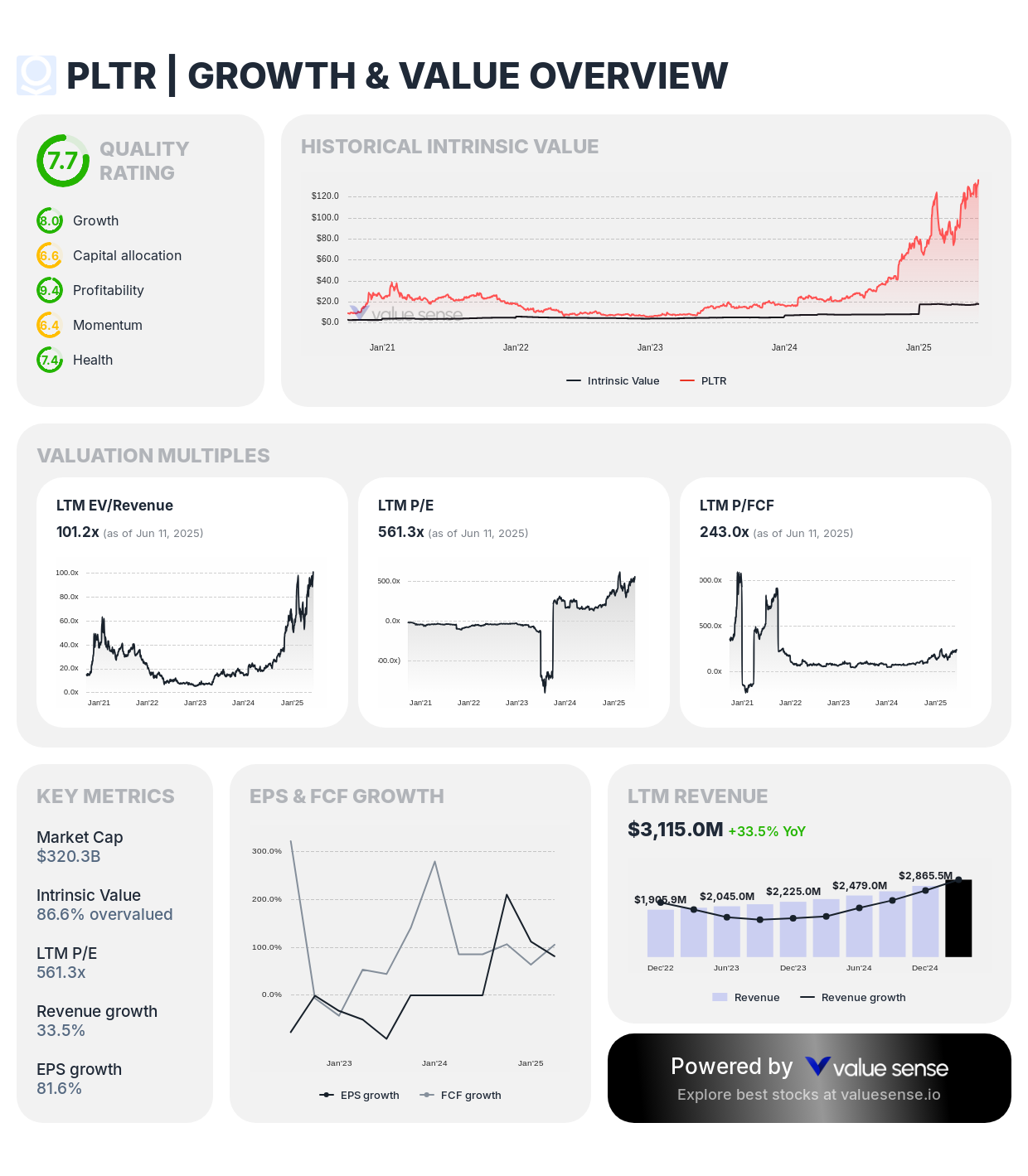

2. Palantir Technologies Inc. (PLTR) - 86.6% Overvalued

Sector: Software | Quality Rating: 7.7 | 1Y Return: 471.9%

Key Financials:

- Revenue: $3,115.0M

- Free Cash Flow: $1,318.4M

- Revenue Growth: 33.5%

- FCF Margin: 42.3%

Investment Thesis: Palantir has already delivered spectacular multibagger returns with a 471.9% one-year gain, demonstrating the explosive potential of companies with strong competitive moats in high-growth markets. The company's specialized data analytics platforms serve government and enterprise clients with mission-critical applications, creating substantial switching costs and customer stickiness.

Competitive Moat: Palantir's heavy moat stems from proprietary data integration technology, deep customer relationships requiring extensive customization, and specialized expertise in complex analytical problems. The company's platforms become increasingly valuable as customers integrate more data sources and business processes.

Valuation Consideration: Currently trading 86.6% above intrinsic value, Palantir's premium valuation reflects market enthusiasm for its AI capabilities and commercial expansion. Investors should exercise caution at current levels despite strong fundamentals.

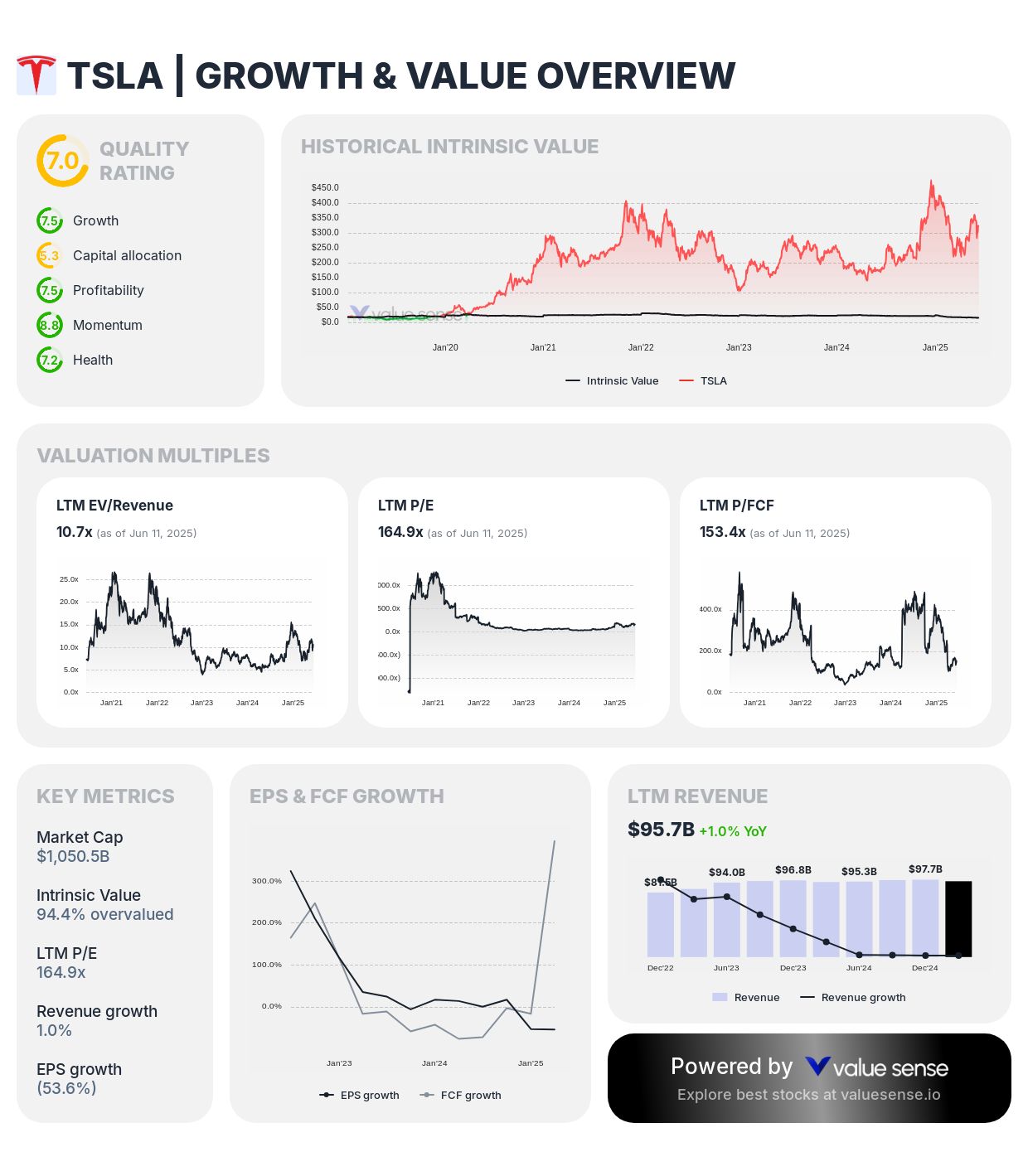

3. Tesla, Inc. (TSLA) - 94.4% Overvalued

Sector: Electric Vehicles | Quality Rating: 6.0 | 1Y Return: 91.3%

Key Financials:

- Revenue: $95.7B

- Free Cash Flow: $6,847.0M

- Revenue Growth: 1.0%

- FCF Margin: 7.2%

Investment Thesis: Tesla continues demonstrating multibagger potential with a 91.3% one-year return, driven by its leadership in electric vehicles, energy storage, and autonomous driving technology. The company's integrated approach to manufacturing, software, and energy creates multiple revenue streams and competitive advantages.

Competitive Moat: Tesla's moat includes vertically integrated manufacturing, Supercharger network infrastructure, over-the-air software capabilities, and strong brand recognition in premium electric vehicles. The company's energy business and potential autonomous driving services provide additional moat-widening opportunities.

Valuation Consideration: Trading 94.4% above intrinsic value, Tesla represents the most overvalued stock in our analysis despite strong competitive positioning and growth potential.

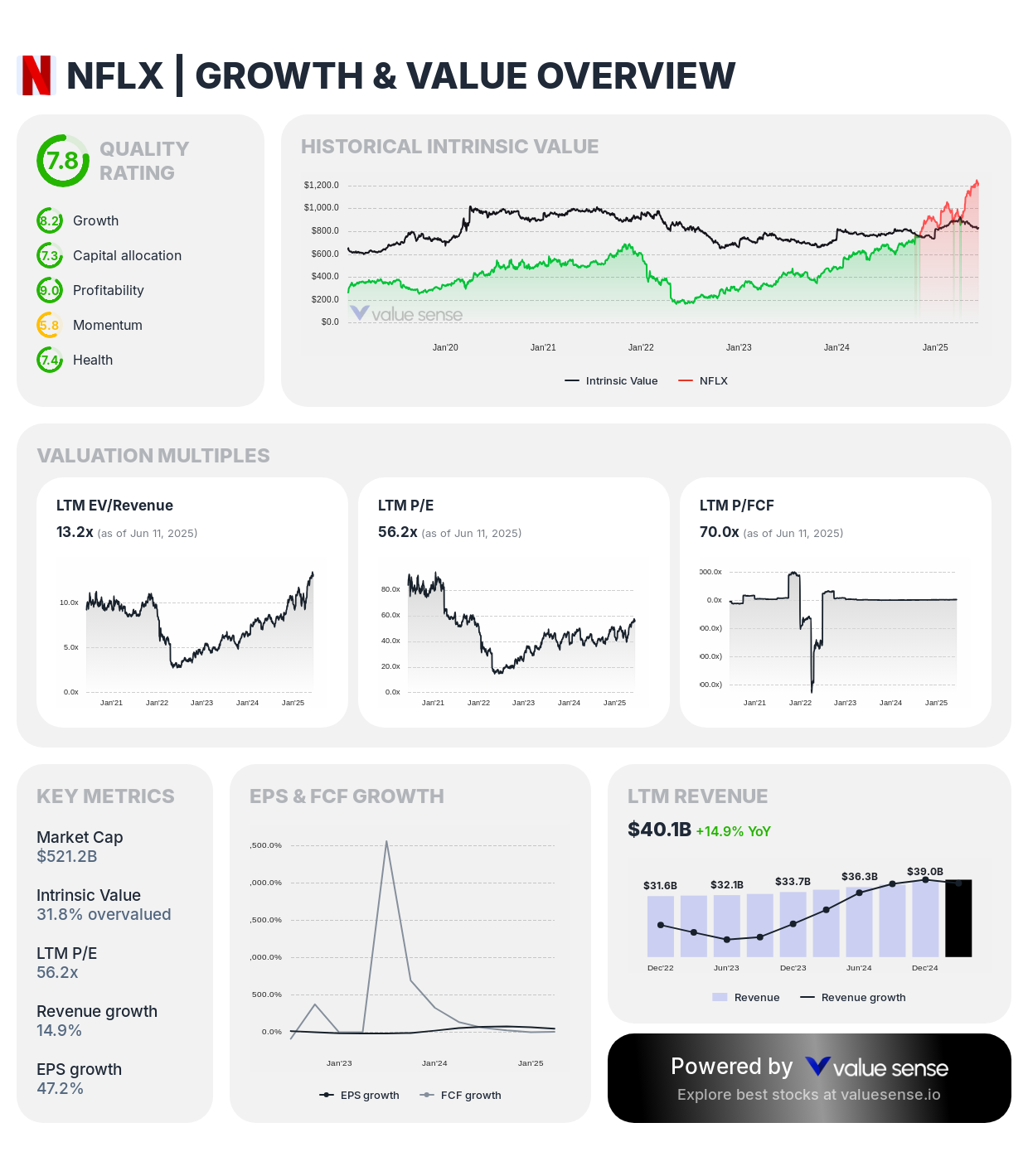

4. Netflix, Inc. (NFLX) - 31.8% Overvalued

Sector: Streaming Entertainment | Quality Rating: 7.8 | 1Y Return: 88.1%

Key Financials:

- Revenue: $40.1B

- Free Cash Flow: $7,445.9M

- Revenue Growth: 14.9%

- FCF Margin: 18.5%

Investment Thesis: Netflix delivered strong multibagger performance with 88.1% one-year returns, demonstrating the power of its global streaming platform and content strategy. The company's substantial investment in original content and international expansion creates significant competitive advantages in the entertainment industry.

Competitive Moat: Netflix's heavy moat includes its massive content library, global subscriber base, sophisticated recommendation algorithms, and first-mover advantage in streaming. The company's data-driven content creation and international localization strategies strengthen its competitive position.

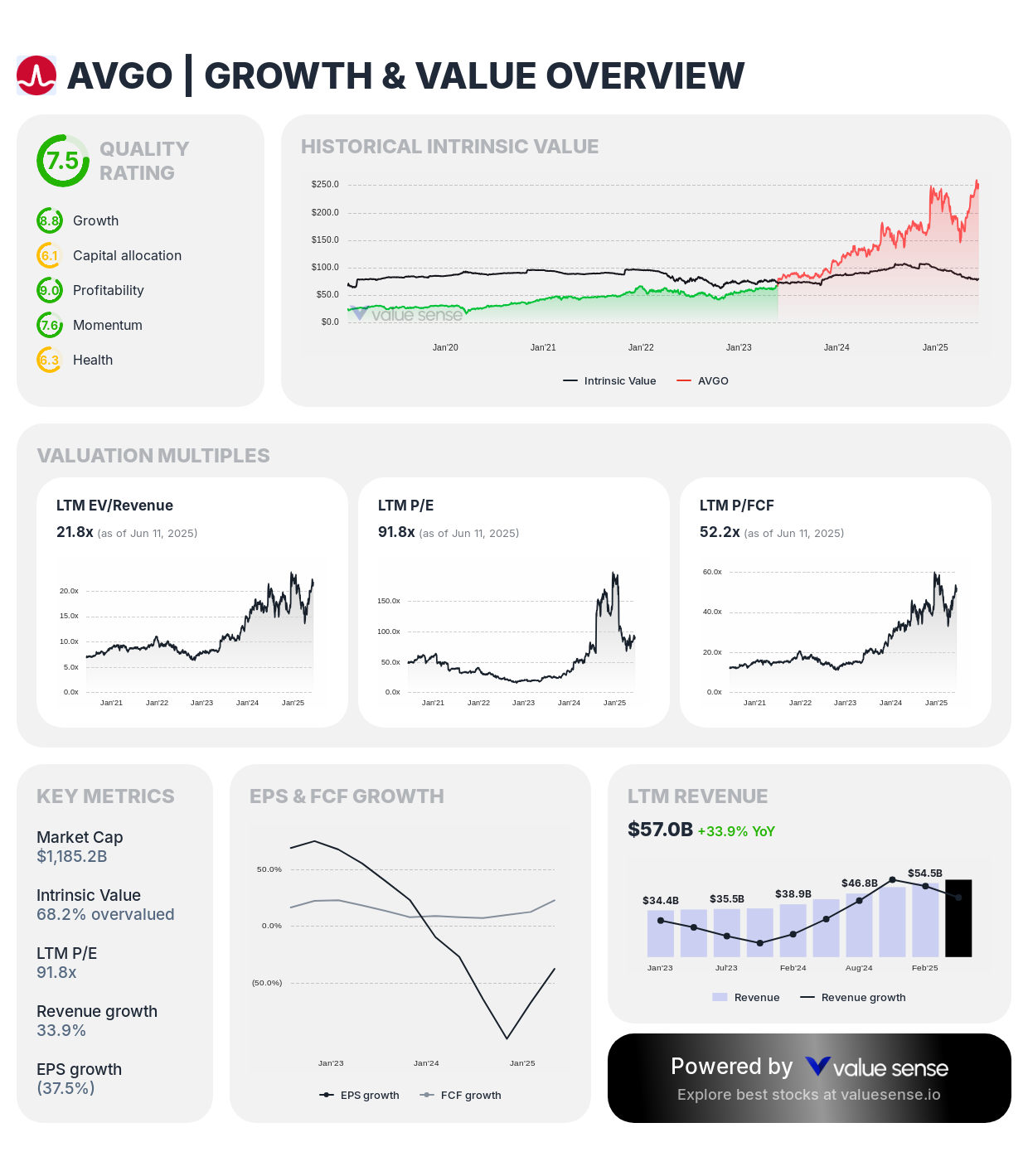

5. Broadcom Inc. (AVGO) - 68.2% Overvalued

Sector: Semiconductors | Quality Rating: 7.5 | 1Y Return: 73.1%

Key Financials:

- Revenue: $57.0B

- Free Cash Flow: $22.7B

- Revenue Growth: 33.9%

- FCF Margin: 39.8%

Investment Thesis: Broadcom achieved 73.1% one-year returns through its diversified semiconductor and infrastructure software portfolio. The company's strategic acquisitions and focus on mission-critical applications create substantial competitive advantages and pricing power.

Competitive Moat: Broadcom's moat encompasses essential semiconductor components for wireless communications, high switching costs in enterprise software, and strong customer relationships across multiple industries. The company's acquisition strategy successfully expands addressable markets and competitive advantages.

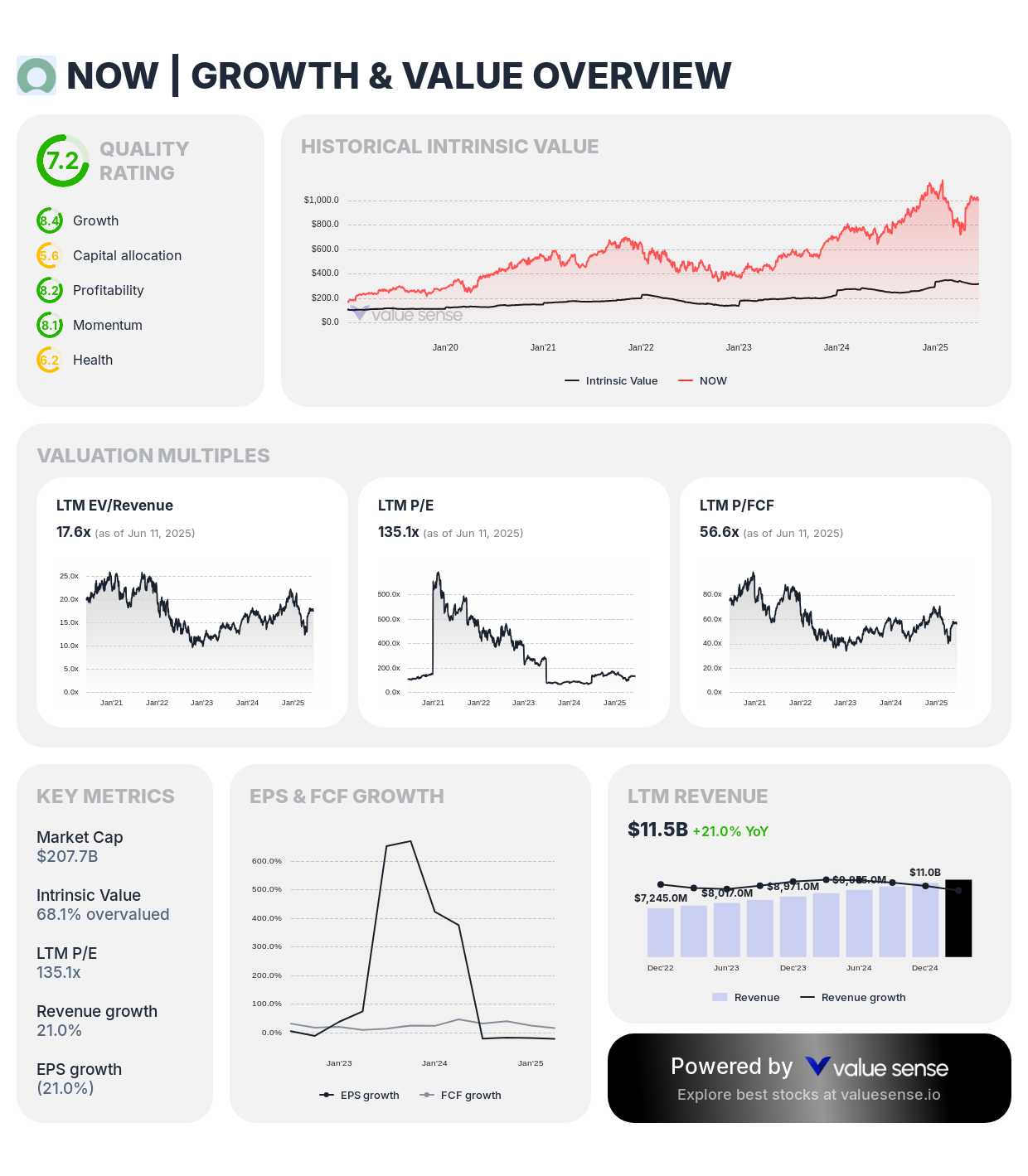

6. ServiceNow, Inc. (NOW) - 68.1% Overvalued

Sector: Enterprise Software | Quality Rating: 7.2 | 1Y Return: 41.0%

Key Financials:

- Revenue: $11.5B

- Free Cash Flow: $3,672.0M

- Revenue Growth: 21.0%

- FCF Margin: 32.0%

Investment Thesis: ServiceNow delivered solid 41.0% one-year returns through its leadership in enterprise workflow automation. The company's cloud-based platform helps organizations automate complex business processes, creating substantial value and customer stickiness.

Competitive Moat: ServiceNow's heavy moat includes high switching costs, deep integration with customer workflows, and network effects as more applications connect to its platform. The company's expansion into AI and automation strengthens its competitive advantages.

7. Eli Lilly and Company (LLY) - 72.4% Overvalued

Sector: Pharmaceuticals | Quality Rating: 7.2 | 1Y Return: (6.2%)

Key Financials:

- Revenue: $49.6B

- Free Cash Flow: $487.2M

- Revenue Growth: 36.4%

- FCF Margin: 1.0%

Investment Thesis: Despite a modest 6.2% decline over the past year, Eli Lilly maintains multibagger credentials through breakthrough treatments in diabetes and obesity. The company's innovative drug pipeline and market leadership in key therapeutic areas provide substantial growth potential.

Competitive Moat: Lilly's moat includes patent protection on key drugs, extensive R&D capabilities, and strong relationships with healthcare providers. The company's leadership in diabetes and obesity treatments creates significant competitive advantages in rapidly growing markets.

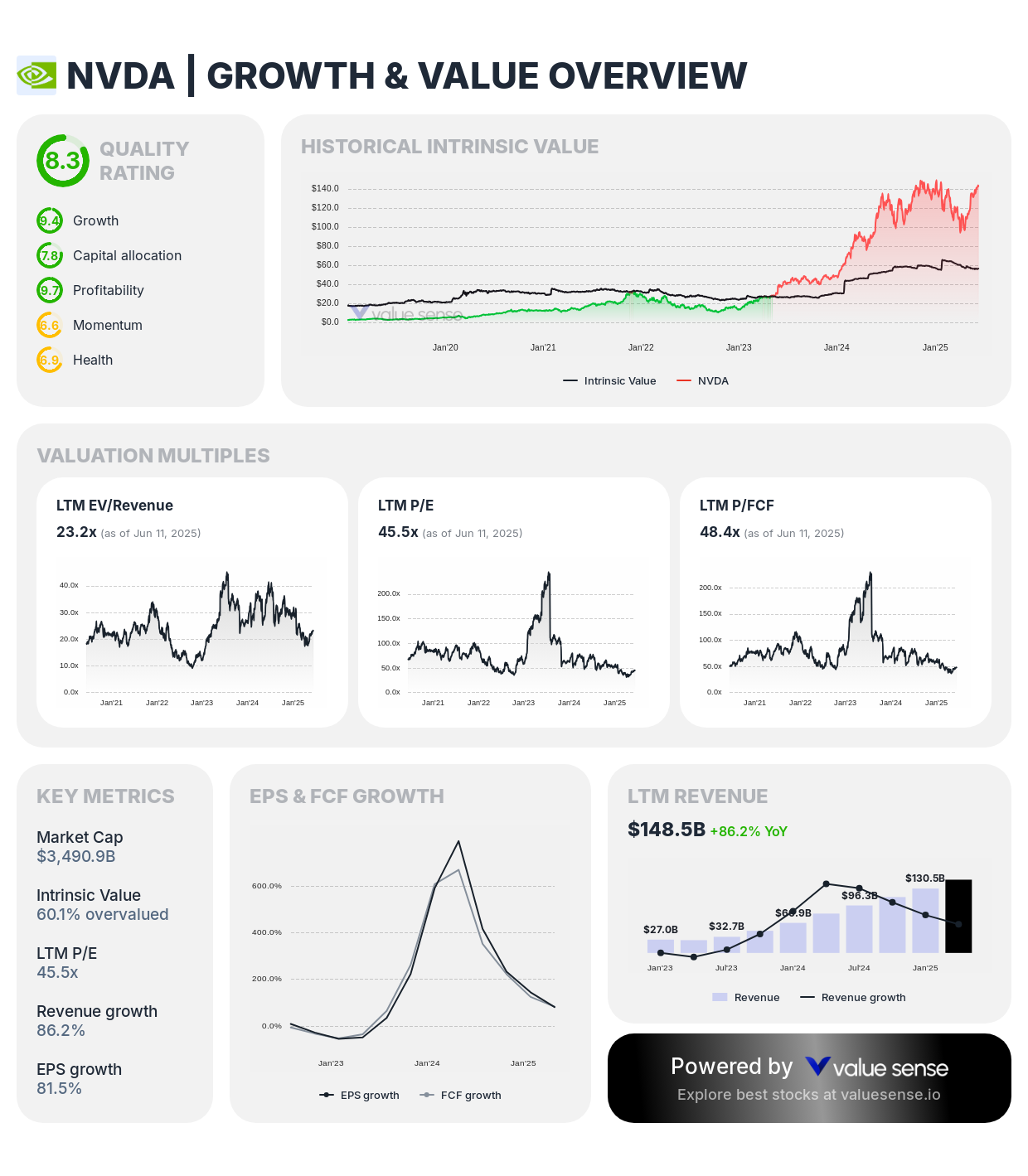

8. NVIDIA Corporation (NVDA) - 60.1% Overvalued

Sector: Semiconductors | Quality Rating: 8.3 | 1Y Return: 18.2%

Key Financials:

- Revenue: $148.5B

- Free Cash Flow: $72.1B

- Revenue Growth: 86.2%

- FCF Margin: 48.5%

Investment Thesis: NVIDIA achieved 18.2% one-year returns while maintaining the highest quality rating (8.3) alongside TSMC. The company's leadership in AI computing and graphics processing positions it at the center of multiple technology megatrends driving exceptional growth.

Competitive Moat: NVIDIA's heavy moat includes its CUDA software ecosystem, technological leadership in AI and high-performance computing, and strong brand recognition across gaming and professional markets. The company's platform approach creates significant switching costs and network effects.

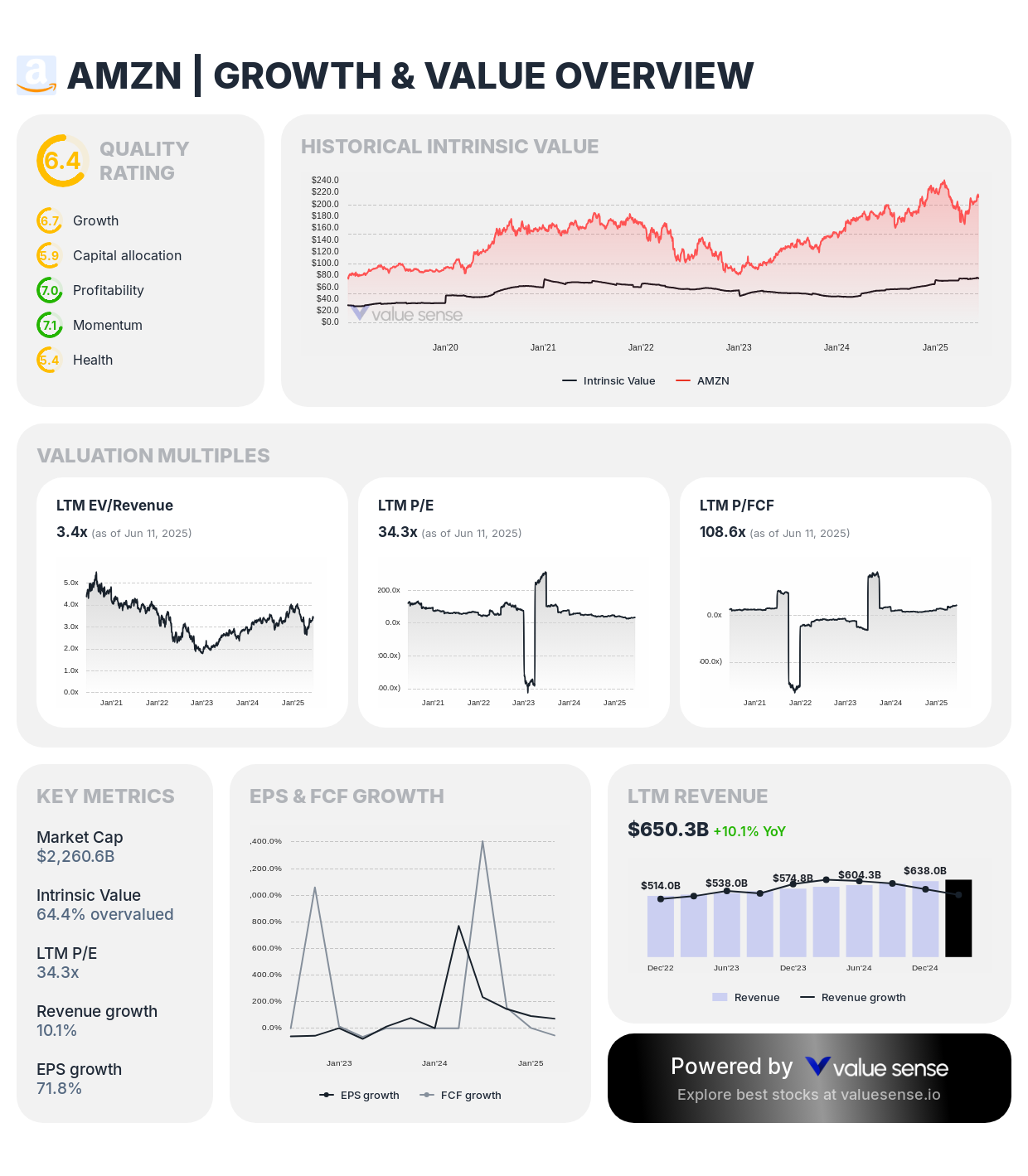

9. Amazon.com, Inc. (AMZN) - 64.4% Overvalued

Sector: E-commerce/Cloud | Quality Rating: 6.4 | 1Y Return: 13.9%

Key Financials:

- Revenue: $650.3B

- Free Cash Flow: $20.8B

- Revenue Growth: 10.1%

- FCF Margin: 3.2%

Investment Thesis: Amazon delivered 13.9% one-year returns through its diversified business model spanning e-commerce, cloud computing, advertising, and logistics. The company's scale advantages and customer-centric approach create substantial competitive advantages across multiple markets.

Competitive Moat: Amazon's moat includes its massive logistics network, Prime membership ecosystem, AWS cloud platform leadership, and scale advantages across multiple business segments. The company's flywheel effect continuously strengthens its competitive position.

10. Microsoft Corporation (MSFT) - 8.9% Overvalued

Sector: Software | Quality Rating: 7.2 | 1Y Return: 10.1%

Key Financials:

- Revenue: $270.0B

- Free Cash Flow: $69.4B

- Revenue Growth: 14.1%

- FCF Margin: 25.7%

Investment Thesis: Microsoft achieved 10.1% one-year returns while trading closest to fair value among our overvalued selections. The company's transformation to cloud computing and subscription services creates predictable revenue streams and strong competitive positioning.

Competitive Moat: Microsoft's heavy moat encompasses Office productivity suite dominance, Azure cloud platform growth, Windows operating system, and strong enterprise relationships. The company's integration across software and services creates significant switching costs.

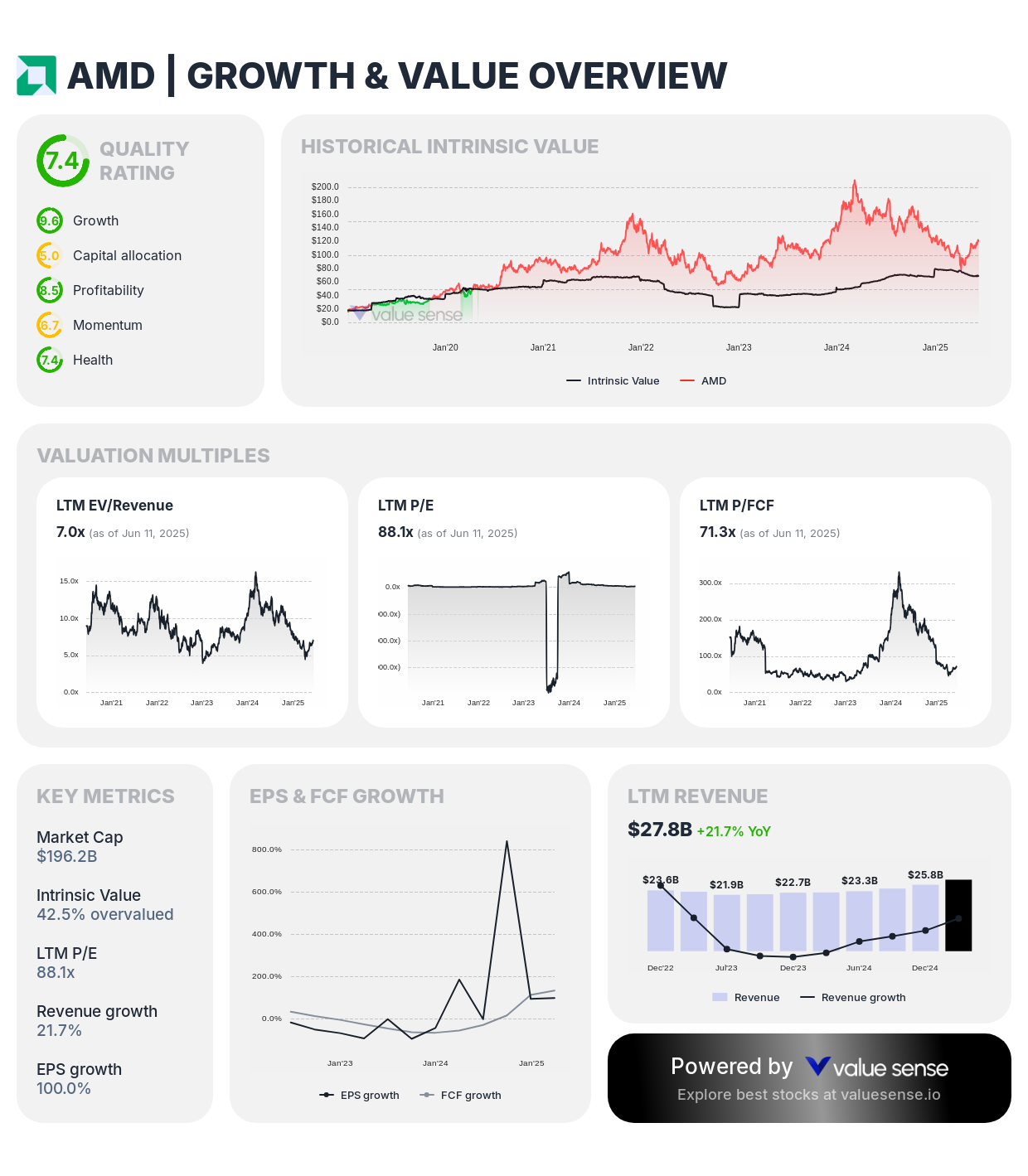

11. Advanced Micro Devices, Inc. (AMD) - 42.5% Overvalued

Sector: Semiconductors | Quality Rating: 7.4 | 1Y Return: (23.3%)

Key Financials:

- Revenue: $27.8B

- Free Cash Flow: $2,753.0M

- Revenue Growth: 21.7%

- FCF Margin: 9.9%

Investment Thesis: Despite a 23.3% decline over the past year, AMD maintains multibagger potential through competitive gains against Intel and expansion into AI computing markets. The company's technological innovations and market share growth support long-term value creation.

Competitive Moat: AMD's moat includes advanced processor architectures, competitive performance advantages in key segments, and strong relationships with major technology companies. The company's data center and AI opportunities provide significant growth potential.

Investment Strategy for Multibagger Success

Focus on Quality and Valuation: Our analysis reveals that only TSMC offers the combination of exceptional quality (8.2 rating) with attractive valuation (56.1% undervalued). This represents the most compelling multibagger opportunity in our selection.

Exercise Valuation Discipline: While many companies demonstrate strong competitive moats and growth potential, current premium valuations limit near-term upside potential. Consider waiting for more attractive entry points or focusing on the highest-quality businesses.

Diversification Across Themes: Successful multibagger investing requires exposure to multiple growth themes including artificial intelligence, cloud computing, biotechnology, and digital transformation while maintaining portfolio balance.

Long-Term Perspective: Multibagger returns require patience and conviction. These exceptional businesses compound shareholder wealth over years and decades, not quarters.

Our Multibagger Valuation Methodology

Quality Assessment (40% Weight):

- Competitive moat strength and sustainability

- Financial health and free cash flow generation

- Management execution and strategic positioning

- Market leadership and brand strength

Growth Analysis (35% Weight):

- Revenue growth consistency and sustainability

- Market opportunity size and capture potential

- Innovation pipeline and R&D effectiveness

- Operational leverage and margin expansion

Valuation Discipline (25% Weight):

- Intrinsic value calculation using multiple methodologies

- Comparison to historical valuation ranges

- Risk-adjusted return potential assessment

- Margin of safety considerations

Key Takeaways for Multibagger Investors

✅ Prime Opportunity: TSMC offers exceptional quality (8.2 rating) at attractive valuation (56.1% undervalued)

✅ Valuation Caution: Most multibagger candidates trade at significant premiums to intrinsic value

✅ Quality Focus: Companies with ratings above 7.0 demonstrate the strongest competitive moats

✅ Patience Required: Multibagger returns develop over years through sustained competitive advantages

✅ Diversification Essential: Spread investments across multiple themes and companies to manage risk

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

More Articles You Might Like

📖 10 Quality Low-Debt Stocks

📖 10 Undervalued Quality Stocks

📖 14 High ROIC Stocks with Legendary Rule of 40

Frequently Asked Questions About Multibagger Stocks

What makes a stock a potential multibagger?

A multibagger stock typically combines several key characteristics: sustainable competitive advantages (heavy moats), exceptional growth potential in large addressable markets, strong financial metrics including consistent free cash flow generation, and capable management teams with proven execution track records. Companies must demonstrate the ability to compound shareholder wealth over extended periods through reinvestment at high returns on invested capital while defending against competitive threats.

How important are competitive moats for multibagger success?

Competitive moats are absolutely critical for multibagger success because they enable companies to sustain high returns on invested capital over extended periods. Without strong moats, companies face margin compression and market share erosion as competitors enter attractive markets. Our analysis shows that companies with quality ratings above 7.0 (indicating heavy moats) have the best potential for sustained multibagger performance through technological leadership, network effects, switching costs, or brand strength.

Why do many quality multibagger stocks trade at premium valuations?

Quality multibagger stocks often trade at premium valuations because the market recognizes their exceptional growth potential and competitive advantages. Investors are willing to pay higher prices for companies with proven track records of wealth creation and sustainable competitive positioning. However, excessive premiums can limit future returns even for quality businesses. Our analysis shows 10 of 11 multibagger candidates currently trade above intrinsic value, highlighting the importance of valuation discipline.

How should investors approach overvalued multibagger stocks?

Investors should exercise patience and maintain watchlists for overvalued multibagger stocks while waiting for more attractive entry points. Consider dollar-cost averaging into the highest-quality names (rating 7.5+) over time, focus on companies with the strongest competitive moats and growth prospects, and maintain smaller position sizes to manage valuation risk. Market volatility often creates opportunities to purchase quality businesses at more reasonable prices.

What role does free cash flow play in identifying multibaggers?

Free cash flow is essential for multibagger identification because it represents the cash available for reinvestment, debt reduction, or shareholder returns after covering operational and capital expenditure needs. Companies with strong and growing free cash flow margins (like NVIDIA at 48.5% or Palantir at 42.3%) demonstrate the ability to generate substantial cash while funding growth initiatives. This financial flexibility enables sustained investment in competitive advantages and market expansion necessary for multibagger returns.