Nelson Peltz - Trian Fund Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

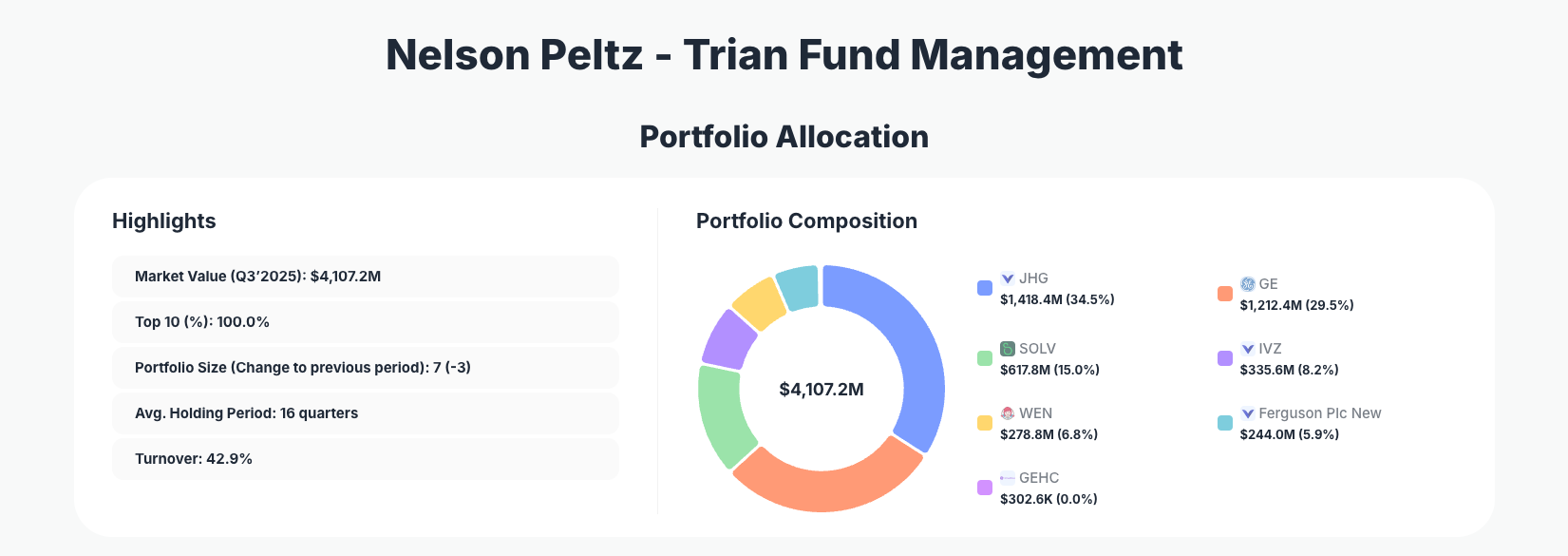

Nelson Peltz, the legendary activist investor behind Trian Fund Management, showcases his signature discipline in the latest 13F filing. His $4.1B Q3 2025 portfolio maintains extreme concentration across just seven positions, with minimal tweaks signaling confidence in core holdings amid market volatility.

Portfolio Overview: Activist Mastery Through Ultra-Concentration

Portfolio Highlights (Q3 2025): - Market Value: $4,107.2M - Top 10 Holdings: 100.0% - Portfolio Size: 7 -3 - Average Holding Period: 16 quarters - Turnover: 42.9%

Trian Fund's Q3 2025 portfolio exemplifies Nelson Peltz's activist philosophy: extreme focus on a handful of high-conviction ideas where operational improvements can unlock value. With 100% of the portfolio concentrated in the top 10 holdings—effectively the entire book—this structure minimizes distraction and maximizes influence over target companies. The reduction to seven positions from the prior quarter underscores a ruthless pruning process, eliminating underperformers to double down on winners.

The 16-quarter average holding period reveals patience beneath the activist label, contrasting with high-turnover traders. At 42.9% turnover, Peltz isn't chasing momentum but refining stakes for better positioning. This portfolio balances financial services heavyweights like asset managers with industrial spin-offs, reflecting bets on restructuring and efficiency gains. Investors tracking Trian via 13F filings can see how such concentration has historically amplified returns during turnarounds.

Top Holdings: Asset Managers and Industrial Spin-Offs Dominate

Trian's portfolio pivots around activist-friendly names with clear value-unlock potential. The standout change is a modest WEN (The Wendy's Company) addition of 0.01% to 6.8% $278.8M, signaling ongoing commitment to restaurant turnaround efforts, while The Allstate Corporation was fully sold (Sell 100%, now 0.0%), likely due to shifting priorities away from insurance.

Core stability anchors the rest: JHG (Janus Henderson Group plc) holds steady at 34.5% ($1,418.4M, No change), Trian's largest bet on asset management efficiency. GE (General Electric Company) remains at 29.5% ($1,212.4M, No change), benefiting from post-spin restructuring. SOLV (Solventum Corporation) commands 15.0% ($617.8M, No change), a healthcare spin-off play.

Rounding out the book, IVZ (Invesco Ltd.) stays at 8.2% ($335.6M, No change), another asset manager with activist upside. Ferguson Plc New holds 5.9% ($244.0M, No change), providing plumbing distribution exposure. Even tiny GEHC (GE HealthCare Technologies Inc.) persists at 0.0% ($302.6K, No change), hinting at legacy ties. This mix prioritizes sectors ripe for Peltz's operational activism.

What the Portfolio Reveals

Trian's Q3 moves highlight a strategy laser-focused on quality businesses with activist catalysts. Heavy weighting in asset managers like JHG and IVZ (over 42% combined) bets on fee pressure relief and cost discipline in a high-interest-rate world. Industrial spin-offs such as SOLV, GE, and GEHC reflect Peltz's expertise in unlocking conglomerate value.

Sector focus skews toward financials 43% and industrials/healthcare spin-offs 50%, with minimal tech or consumer exposure beyond WEN. Geographically, it's U.S.-centric with UK exposure via Ferguson Plc New. Risk management shines through portfolio shrinkage to seven holdings and high turnover, pruning fully like Allstate to fund conviction plays. No overt dividend chase, but steady cash-generators support long 16-quarter holds.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Janus Henderson Group plc | $1,418.4M | 34.5% | No change |

| General Electric Company | $1,212.4M | 29.5% | No change |

| Solventum Corporation | $617.8M | 15.0% | No change |

| Invesco Ltd. | $335.6M | 8.2% | No change |

| The Wendy's Company | $278.8M | 6.8% | Add 0.01% |

| Ferguson Plc New | $244.0M | 5.9% | No change |

| GE HealthCare Technologies Inc. | $302.6K | 0.0% | No change |

| The Allstate Corporation | $0.0 | 0.0% | Sell 100% |

This table underscores Trian's hallmark concentration: the top two holdings alone—JHG and GE—consume 64% of the $4.1B portfolio, enabling deep activist engagement. Stability dominates with six "No change" actions, while the WEN tweak and Allstate exit reflect surgical adjustments. Portfolio size shrinking to seven -3 amplifies per-position impact, a high-conviction tactic suited to Peltz's boardroom influence.

Investment Lessons from Nelson Peltz's Activist Approach

- Concentrate ruthlessly on fixable businesses: Trian's 100% top-10 allocation shows betting big only where activism can drive change, as in asset managers and GE spin-offs.

- Patience pairs with action: 16-quarter holds prove long-term vision, but 42.9% turnover enables exits like Allstate when theses falter.

- Target spin-offs for hidden value: Heavy SOLV, GE, and GEHC weight highlights unlocking conglomerate parts.

- Size positions by influence potential: Largest stakes in JHG 34.5% reflect where Peltz has or can gain board seats.

- Prune decisively: Dropping to seven holdings trims distractions, freeing capital for high-upside tweaks like WEN.

Looking Ahead: What Comes Next?

Trian's trimmed portfolio positions it nimbly for 2026 opportunities, with high turnover suggesting cash from sales like Allstate available for deployment. Expect activist pushes in core holdings—deeper JHG or IVZ involvement amid asset management consolidation. Spin-off momentum in healthcare/industrials could expand if SOLV or GEHC deliver. In volatile markets, Peltz may hunt undervalued consumer or financial turnarounds, leveraging his network for board influence.

FAQ about Nelson Peltz Trian Fund Portfolio

Q: What were the key changes in Trian's Q3 2025 13F filing?

A: Trian added 0.01% to WEN (6.8% weight), fully sold Allstate (Sell 100%), and shrank the portfolio to seven holdings -3, with most top positions unchanged.

Q: Why is Trian's portfolio so concentrated?

A: Nelson Peltz's activist strategy thrives on deep involvement in few names, with 100% in top 10 (really top 7), allowing board-level influence in targets like JHG and GE for operational fixes.

Q: What sectors does Trian favor, and why?

A: Financials (asset managers like JHG, IVZ) and industrial/healthcare spin-offs (GE, SOLV) dominate, as these offer clear paths to efficiency gains and value unlocks via activism.

Q: How can I track and follow Nelson Peltz's Trian Fund portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/trian for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!