Nelson Peltz - Trian Fund Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

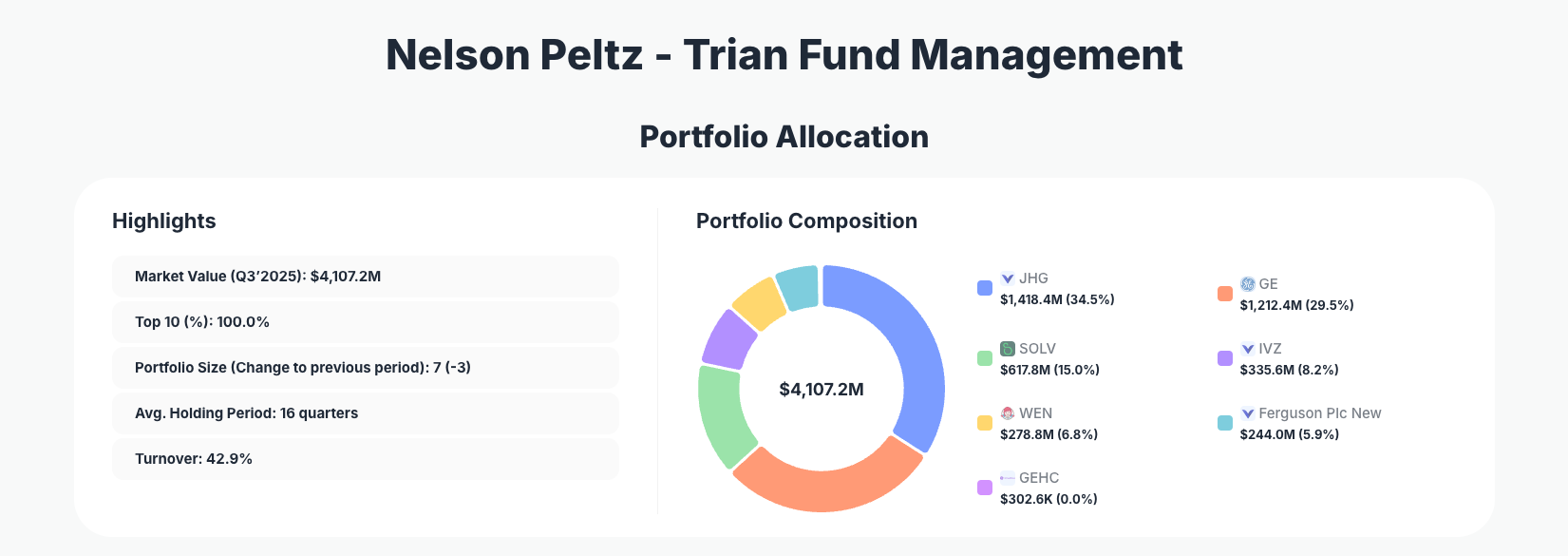

Nelson Peltz, the legendary activist investor behind Trian Fund Management, showcases his signature focus on operational turnarounds and value creation in the latest 13F filing. His $4.1B Q3 2025 portfolio maintains extreme concentration across just seven positions, with strategic tweaks like a complete exit from The Allstate Corporation and a minor addition to Wendy's, signaling disciplined portfolio pruning amid market volatility.

Portfolio Overview: Activist Concentration at 100%

Portfolio Highlights (Q3 2025): - Market Value: $4,107.2M - Top 10 Holdings: 100.0% - Portfolio Size: 7 -3 - Average Holding Period: 16 quarters - Turnover: 42.9%

Trian Fund Management's portfolio exemplifies Nelson Peltz's activist philosophy: ultra-concentrated bets on companies ripe for transformation, where top holdings command the entire allocation. With 100% of the $4.1 billion portfolio in just seven names—and the top three alone representing nearly 80%—Peltz demonstrates unwavering conviction in his picks, avoiding diversification for the sake of it. The reduction to seven positions from the prior quarter underscores a ruthless focus, eliminating underperformers to double down on high-conviction ideas.

This structure isn't accidental; it's a hallmark of Trian's strategy, honed over decades of pushing for board changes, cost cuts, and strategic shifts at portfolio companies. The 16-quarter average holding period reveals patience beneath the activist label, blending short-term catalysts with long-term ownership. High turnover at 42.9% reflects active management, yet the core remains stable, as seen in multiple "No change" actions among leaders. Investors tracking via Trian's portfolio page on ValueSense can monitor these dynamics quarter by quarter.

Top Holdings: Financial Services and Industrial Turnarounds Dominate

The portfolio's changes are limited but telling, starting with a modest Wendy's Company (WEN) addition of 0.01% to 6.8% $278.8M, suggesting fine-tuning in consumer-facing activism plays, alongside a full 100% sell of The Allstate Corporation, now at 0.0%. Anchoring the top is Janus Henderson Group plc at a massive 34.5% $1,418.4M with no change, reflecting sustained faith in asset management recovery. General Electric (GE) holds steady at 29.5% $1,212.4M, no change, as a core industrial bet post-restructuring.

Rounding out the leaders, Solventum Corporation (SOLV) remains at 15.0% $617.8M unchanged, a healthcare spin-off aligning with Peltz's value extraction expertise. Invesco Ltd. sits at 8.2% $335.6M, no change, doubling down on financial services. Ferguson Plc New commands 5.9% $244.0M unchanged, a distribution play with global reach. Even smaller positions like GE HealthCare Technologies Inc. (GEHC) at 0.0% $302.6K persist without alteration, showing commitment to GE ecosystem remnants. This mix—financials, industrials, healthcare—prioritizes businesses with activist potential, with changes limited to trimming fat rather than major overhauls.

What the Portfolio Reveals

Trian's Q3 moves paint a picture of refined activism: pruning three positions to sharpen focus on proven winners amid economic uncertainty. Key themes emerge:

- Quality Turnarounds Over Speculation: Heavy weighting in Janus Henderson and GE highlights bets on asset managers and conglomerates with operational leverage, where Peltz has historically driven change.

- Sector Focus on Cyclicals with Moats: Financial services (over 40%) and industrials dominate, favoring sectors sensitive to rates but buffered by scale—think asset management inflows and infrastructure spending.

- Risk Management via Concentration: 100% top-10 exposure minimizes distraction, with the portfolio shrink signaling exit from non-core bets like Allstate.

- Long-Term Horizon: 16-quarter average hold supports pushing for sustained improvements, not quick flips.

High turnover indicates vigilance, balancing patience with adaptability in a volatile market.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Janus Henderson Group plc | $1,418.4M | 34.5% | No change |

| General Electric Company | $1,212.4M | 29.5% | No change |

| Solventum Corporation | $617.8M | 15.0% | No change |

| Invesco Ltd. | $335.6M | 8.2% | No change |

| The Wendy's Company | $278.8M | 6.8% | Add 0.01% |

| Ferguson Plc New | $244.0M | 5.9% | No change |

| GE HealthCare Technologies Inc. | $302.6K | 0.0% | No change |

| The Allstate Corporation | $0.0 | 0.0% | Sell 100% |

This table underscores Trian's extreme concentration, with the top two holdings—Janus Henderson and GE—alone comprising 64% of the portfolio, unchanged and signaling rock-solid conviction. The full exit from Allstate and micro-add to Wendy's reflect precise reallocation, reducing positions from 10 to 7 while boosting turnover to 42.9%. Such focus amplifies returns from winners but heightens risk, a calculated trade-off in Peltz's activist arsenal.

The stability in core holdings like Solventum and Invesco suggests these are multi-year bets on sector tailwinds, with the portfolio's 100% top-10 capture leaving no room for dilution.

Investment Lessons from Nelson Peltz's Activist Approach

Nelson Peltz's Trian portfolio offers timeless principles for investors emulating activist discipline:

- Concentrate Ruthlessly on Change Catalysts: With 100% in top holdings, Peltz teaches betting big only where you can influence outcomes, as in GE's transformation.

- Long Holding Periods Unlock Value: 16 quarters average shows activism isn't flipping—it's installing lasting improvements.

- Trim Losers Decisively: The Allstate full sell and portfolio shrink to 7 positions highlight cutting non-performers to fuel winners.

- Position Sizing Reflects Conviction: 34.5% in Janus Henderson demands deep understanding, not diversification for safety.

- Balance Patience with Action: High 42.9% turnover pairs with stable cores, proving adaptability without abandoning thesis.

Looking Ahead: What Comes Next?

Trian's trimmed $4.1B portfolio positions Peltz for opportunistic strikes, with the three-position reduction freeing capital for high-impact activism in undervalued industrials or financials. No explicit cash is disclosed, but the Allstate exit implies dry powder amid Q3 2025's market highs. Expect new bets in consumer or healthcare turnarounds, given Wendy's nudge and Solventum stability—sectors ripe for Peltz's boardroom influence.

Current positioning sets up well for 2026 rate cuts boosting asset managers like Janus Henderson and Invesco, while GE's aerospace/industrial exposure hedges inflation. Volatility from elections or recessions could trigger buys, with ValueSense tracking via Trian's portfolio essential given 13F lags.

FAQ about Nelson Peltz Portfolio

Q: What were the key changes in Trian's Q3 2025 13F filing?

A: Trian added 0.01% to Wendy's (WEN) at 6.8%, fully sold Allstate (100% exit), and shrank the portfolio by three positions to seven, with cores like Janus Henderson unchanged.

Q: Why is Trian's portfolio so concentrated at 100% top 10?

A: Peltz's activist strategy prioritizes massive bets on transformable businesses, minimizing dilution—top two holdings alone are 64%, amplifying returns from operational wins like those at GE.

Q: What sectors does Peltz favor in this portfolio?

A: Financial services (Janus Henderson, Invesco ~43%), industrials/healthcare (GE, Solventum, Ferguson, GEHC), and consumer (Wendy's), targeting cyclical recoveries with activism upside.

Q: How can I track and follow Nelson Peltz's Trian Fund portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/trian for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!