Nicolai Tangen - Ako Capital Llp Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Nicolai Tangen, the Norwegian billionaire leading Ako Capital LLP, showcases his disciplined approach to high-conviction investing through the firm's latest 13F filing. His $7B portfolio for Q3 2025 reflects strategic rotations, with notable additions to gaming and healthcare names alongside significant reductions in legacy tech and industrial positions, signaling adaptability in a volatile market.

Portfolio Overview: High-Conviction Concentration with Active Rotation

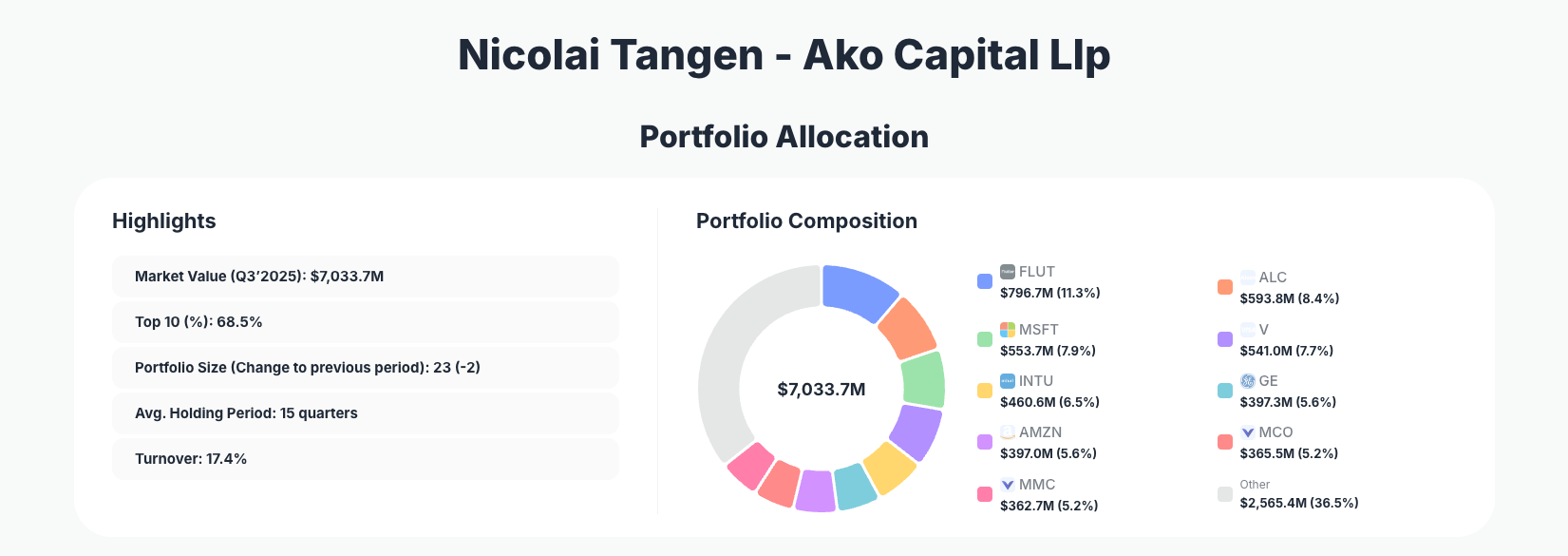

Portfolio Highlights (Q3 2025): - Market Value: $7,033.7M - Top 10 Holdings: 68.5% - Portfolio Size: 23 -2 - Average Holding Period: 15 quarters - Turnover: 17.4%

Nicolai Tangen's Ako Capital portfolio maintains its hallmark concentration, with the top 10 holdings commanding 68.5% of the $7 billion total. This structure underscores Tangen's philosophy of focusing capital on a select group of high-quality businesses where deep research provides an edge, rather than spreading bets thinly across dozens of names. The portfolio shrank by two positions to 23, suggesting deliberate pruning of underperformers amid the quarter's 17.4% turnover.

The average holding period of 15 quarters—over three years—highlights patience, aligning with Tangen's long-term orientation rooted in his background managing Norway's sovereign wealth fund assets. Yet the elevated turnover reveals proactive management, with bold moves like doubling down on select growth names while trimming overvalued megacaps. This balance of conviction and agility positions the portfolio to navigate tech sector volatility and capitalize on emerging opportunities in consumer-facing and healthcare sectors.

Overall, the Q3 2025 portfolio demonstrates Tangen's ability to rotate without abandoning core themes, maintaining heavy exposure to durable moats in technology, financials, and healthcare while adapting to market shifts.

Top Holdings Breakdown: Gaming Bets and Tech Pruning

The portfolio's changes paint a picture of strategic recalibration, starting with the second-ranked holding, Flutter Entertainment plc (FLUT) at 11.3% after an Add 4.94% boost to $796.7M, signaling growing conviction in the online gaming leader. Similarly, Alcon Inc. (ALC) rose to 8.4% with an Add 3.38% increase to $593.8M, reinforcing healthcare exposure through the eye care specialist.

Tech giants faced trims, including a sharp Reduce 16.00% in Microsoft (MSFT) now at 7.9% $553.7M, alongside Reduce 3.56% for Visa (V) (7.7%, $541.0M) and a minor Reduce 0.20% in Intuit (INTU) (6.5%, $460.6M). More dramatically, General Electric (GE) dropped 35.97% to 5.6% $397.3M, indicating de-risking from industrials.

Aggressive growth plays shone through with Amazon (AMZN) surging Add 23.78% to 5.6% $397.0M, while Moody's (MCO) saw Reduce 7.30% to 5.2% $365.5M and Marsh & McLennan (MMC) a slight Add 0.98% to 5.2% $362.7M. Beyond the top 10, Intercontinental Exchange (ICE) at 5.0% $351.1M endured Reduce 4.91%, rounding out the key changes in this dynamic mix of quality compounders.

What the Portfolio Reveals

Tangen's Q3 moves reveal a strategy emphasizing quality compounders with resilient moats, pivoting toward consumer discretionary and healthcare amid tech overcrowding: - Sector Focus: Heavy tilt to technology (MSFT, AMZN, INTU) and financials (V, MCO, MMC, ICE), but fresh bets on gaming (FLUT) and medtech (ALC) diversify beyond pure tech. - Risk Management: Major reductions in GE 35.97% and MSFT 16% suggest profit-taking on stretched valuations, balanced by adds in AMZN 23.78% for e-commerce growth. - Quality Over Speculation: Preference for wide-moat firms with recurring revenues, evident in insurance (MMC), payments (V), and data (MCO). - Geographic Concentration: Primarily U.S.-listed globals, with FLUT adding international gaming exposure.

This approach prioritizes businesses with pricing power and scalability, using turnover to refine exposure without chasing fads.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Flutter Entertainment plc | $796.7M | 11.3% | Add 4.94% |

| Alcon Inc. | $593.8M | 8.4% | Add 3.38% |

| Microsoft Corporation | $553.7M | 7.9% | Reduce 16.00% |

| Visa Inc. | $541.0M | 7.7% | Reduce 3.56% |

| Intuit Inc. | $460.6M | 6.5% | Reduce 0.20% |

| General Electric Company | $397.3M | 5.6% | Reduce 35.97% |

| Amazon.com, Inc. | $397.0M | 5.6% | Add 23.78% |

| Moody's Corporation | $365.5M | 5.2% | Reduce 7.30% |

| Marsh & McLennan Companies, Inc. | $362.7M | 5.2% | Add 0.98% |

The table highlights extreme concentration, with just nine positions (noting the missing #1) capturing over two-thirds of the portfolio at 68.5%. This setup amplifies returns from winners like FLUT and ALC but underscores risk if top bets falter. Tangen's adds in these names contrast with deep cuts in GE and MSFT, showing disciplined reallocation to higher-conviction ideas. At 17.4% turnover, the portfolio remains dynamic yet anchored by long-term holders, balancing offense and defense.

Investment Lessons from Nicolai Tangen's Approach

- Concentrate on Deeply Understood Moats: Tangen commits over 68% to top 10 holdings like FLUT and ALC, emphasizing businesses with durable competitive edges over diversification.

- Active Position Sizing Drives Performance: Bold moves—Add 23.78% in AMZN, Reduce 35.97% in GE—show constant vigilance on sizing to reflect evolving convictions.

- Long Holding Periods Reward Patience: 15-quarter average tenure proves holding quality compounders through volatility pays off, avoiding short-term noise.

- Trim Winners, Double Down Selectively: Reductions in MSFT and V fund adds in growth pockets, maintaining discipline amid market euphoria.

- Sector Rotation Without Abandoning Themes: Shifts toward gaming and healthcare refine tech/financial core, adapting to opportunities while staying true to quality.

Looking Ahead: What Comes Next?

With turnover at 17.4% and two positions exited, Ako Capital likely holds dry powder for opportunistic buys, especially if valuations cool in tech. Current positioning—bolstered by AMZN and FLUT—sets up well for e-commerce recovery and gaming tailwinds, while trims reduce exposure to high-flyers like MSFT. In a potentially range-bound 2026 market, Tangen's focus on moaty compounders positions the portfolio for steady compounding, with room to pounce on dips in healthcare or financials.

FAQ about Nicolai Tangen's Ako Capital Portfolio

Q: What are the most significant changes in Nicolai Tangen's Q3 2025 portfolio?

A: Key moves include Add 23.78% to Amazon (AMZN), Reduce 35.97% in GE, and Add 4.94% to Flutter (FLUT), reflecting rotation toward growth while trimming industrials and select tech.

Q: Why does Ako Capital maintain such high portfolio concentration?

A: Tangen favors 68.5% in top 10 holdings to maximize returns from high-conviction ideas like ALC and V, leveraging deep research for edge over broad indexing.

Q: What sectors dominate Tangen's strategy?

A: Technology, financials, and healthcare lead, with emerging bets in gaming (FLUT) and e-commerce (AMZN), prioritizing moats and recurring revenues.

Q: How can I track and follow Nicolai Tangen's Ako Capital portfolio?

A: Monitor quarterly 13F filings on the SEC site or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/ako-capital for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!