Norbert Lou - Punch Card Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

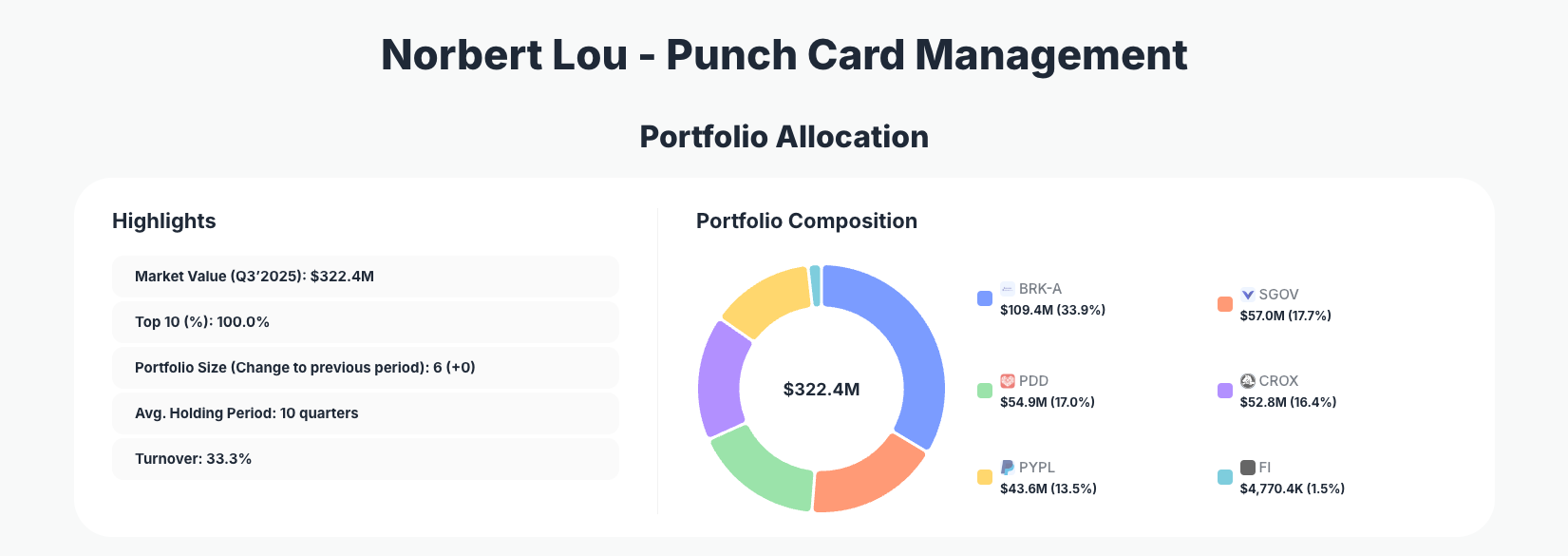

Norbert Lou of Punch Card Management exemplifies the punch card investing philosophy—committing to a handful of high-conviction ideas with patience and discipline. His Q3 2025 portfolio totaling $322.4M across just 6 positions showcases this approach, with notable moves like adding to CROX and introducing FI while completely exiting SWBI.

Portfolio Overview: The Punch Card Philosophy in Action

Portfolio Highlights (Q3 2025): - Market Value: $322.4M - Top 10 Holdings: 100.0% - Portfolio Size: 6 +0 - Average Holding Period: 10 quarters - Turnover: 33.3%

Norbert Lou's Punch Card Management portfolio remains a textbook example of extreme concentration, with the top 10 holdings—essentially the entire portfolio—accounting for 100% of assets under management. This setup reflects the firm's namesake strategy, inspired by Warren Buffett's idea of limiting lifetime investments to 20 "punches" on a card, ensuring only the highest-conviction bets make the cut. The unchanged portfolio size at 6 positions, combined with a 10-quarter average holding period, signals long-term commitment rather than reactive trading.

The 33.3% turnover rate indicates meaningful activity without abandoning core principles, as Lou trimmed underperformers and doubled down on select names. This disciplined approach in a volatile market underscores Punch Card's focus on quality businesses bought at reasonable valuations, allowing compounders like BRK-A to anchor the portfolio at 33.9%. Investors tracking this via ValueSense can appreciate how such concentration amplifies returns when theses play out, though it demands unwavering conviction.

Top Holdings: Core Anchors with Tactical Adjustments

The portfolio's changes highlight Norbert Lou's active management within a concentrated framework. A key move was adding 19.04% to Crocs, Inc. (CROX), now at 16.4% with $52.8M, signaling growing confidence in the footwear maker's recovery and growth trajectory. Punch Card also initiated a new position in Fiserv, Inc. (FI) at 1.5% $4,770.4K, a fresh buy that introduces exposure to financial technology services. Conversely, the firm sold 100% of Smith & Wesson Brands, Inc. (SWBI), removing it entirely from the portfolio at 0.0%.

Core holdings provide stability amid these shifts. Berkshire Hathaway Inc. (BRK-A) dominates at 33.9% $109.4M with no change, serving as the ultimate quality anchor. ISHARES TR (_) holds steady at 17.7% $57.0M, offering broad market exposure, while PDD Holdings Inc. (PDD) remains at 17.0% $54.9M unchanged, betting on e-commerce growth. PayPal Holdings, Inc. (PYPL) rounds out the major positions at 13.5% $43.6M, also unchanged, reflecting faith in fintech resilience.

This mix balances established giants with opportunistic plays, prioritizing businesses with durable moats over diversification.

What the Portfolio Reveals

Norbert Lou's Q3 moves reveal a strategy laser-focused on high-quality compounders with global reach and fintech undertones.

- Quality over speculation: Heavy weighting in BRK-A and steady holdings like PYPL emphasize proven management and economic moats, avoiding fleeting trends.

- Sector focus: Fintech and consumer discretionary stand out, with adds to CROX and FI alongside PDD, targeting resilient growth in payments and e-commerce.

- Geographic concentration: International exposure via PDD (China-based) diversifies beyond U.S. names, hedging domestic risks.

- Risk management: The complete exit from SWBI demonstrates cutting losses decisively, while modest new bets like FI limit downside.

Overall, the portfolio signals optimism in consumer recovery and digital payments amid economic uncertainty.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Berkshire Hathaway Inc. (BRK-A) | $109.4M | 33.9% | No change |

| ISHARES TR | $57.0M | 17.7% | No change |

| PDD Holdings Inc. | $54.9M | 17.0% | No change |

| Crocs, Inc. | $52.8M | 16.4% | Add 19.04% |

| PayPal Holdings, Inc. | $43.6M | 13.5% | No change |

| Fiserv, Inc. | $4,770.4K | 1.5% | Buy |

| Smith & Wesson Brands, Inc. | $0.0 | 0.0% | Sell 100% |

This table underscores Punch Card Management's ultra-concentrated structure, with the top four holdings alone comprising over 85% of the $322.4M portfolio. BRK-A's outsized 33.9% stake exemplifies Norbert Lou's conviction in Buffett's conglomerate as a perpetual compounder, while the complete exit from SWBI shows ruthless pruning of non-performers.

The 100% top-10 concentration (across just 6 names) amplifies upside from winners like the boosted CROX but heightens volatility risks. With 33.3% turnover, Lou maintains flexibility without diluting focus, a hallmark of punch card investing that prioritizes depth over breadth.

Investment Lessons from Norbert Lou's Punch Card Approach

Norbert Lou's portfolio demonstrates timeless principles of concentrated value investing:

- Extreme concentration requires supreme conviction: Betting 33.9% on BRK-A shows that true edges come from deeply understood businesses, not diversification.

- Long holding periods build wealth: A 10-quarter average tenure across positions emphasizes patience, allowing winners like PYPL to compound.

- Act decisively on thesis changes: Selling 100% of SWBI illustrates cutting losses without emotion, freeing capital for adds like CROX.

- Quality fintech and consumer plays at scale: Holdings in PDD and FI highlight scalable moats in digital economies.

- Turnover as a tool, not a habit: 33.3% activity refines the portfolio without chasing noise.

Looking Ahead: What Comes Next?

Punch Card's steady portfolio size at 6 positions suggests room for opportunistic deployment, especially with the small FI stake potentially scaling up. The CROX addition and SWBI exit position the fund for consumer rebound plays amid moderating inflation. Cash from the full sale could target undervalued fintech or e-commerce names similar to PDD.

In a market facing rate uncertainty, Lou's anchors like BRK-A provide ballast, while growth bets set up for economic recovery. Track updates on Punch Card's portfolio for signals on broader rotations.

FAQ about Norbert Lou Punch Card Management Portfolio

Q: What are the most significant changes in Norbert Lou's Q3 2025 portfolio?

A: Key moves include adding 19.04% to CROX (now 16.4%), buying a new stake in FI 1.5%, and selling 100% of SWBI, reflecting tactical refinements to core holdings.

Q: Why does Punch Card Management maintain such high portfolio concentration?

A: The 100% top-10 allocation across 6 positions embodies the "punch card" philosophy—limiting investments to high-conviction ideas, as seen in the 33.9% BRK-A stake, prioritizing depth for superior long-term returns.

Q: What sectors does Norbert Lou favor in this portfolio?

A: Fintech and consumer discretionary dominate, with positions in PYPL, FI, CROX, and PDD, alongside quality conglomerate exposure via BRK-A.

Q: How can I track and follow Norbert Lou's Punch Card Management portfolio?

A: Monitor quarterly 13F filings on the SEC website or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/punch-card for real-time analysis, historical changes, and visualizations—note the 45-day reporting lag means positions may evolve post-filing.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!