One Up on Wall Street by Peter Lynch with John Rothchild

Welcome to the Value Sense Blog, your resource for insights on the stock market! You're reading a book review written by the valuesense.io team.

On our platform, you'll find stock research and insights across all sectors. Dive into our research products and learn more about our unique approach at valuesense.io

We offer over 360+ automated stock ideas, a free AI-powered stock screener, interactive stock charting tools, and more than 10 intrinsic value models — all designed to help investors find undervalued growth opportunities.

Book Overview

“One Up on Wall Street” by Peter Lynch (with John Rothchild) is widely recognized as one of the most influential investment books of the twentieth century, and for good reason. Peter Lynch, the legendary manager of the Fidelity Magellan Fund from 1977 to 1990, delivered an astonishing annualized return of 29% during his tenure—more than doubling the S&P 500 and cementing his reputation as one of the most successful mutual fund managers in history. Lynch’s real-world experience managing billions of dollars, combined with his approachable writing style, makes this book a cornerstone for both aspiring and seasoned investors.

First published in 1989, “One Up on Wall Street” arrived at a time of profound change in the investment landscape. The 1980s saw a surge in individual investor participation, the rise of mutual funds, and a growing democratization of financial information. Lynch wrote the book to empower ordinary investors, sharing the lessons he learned from years of managing one of the world’s most closely scrutinized funds. He believed—and still believes—that individual investors have genuine advantages over professionals, particularly in spotting opportunities in everyday life before Wall Street catches on.

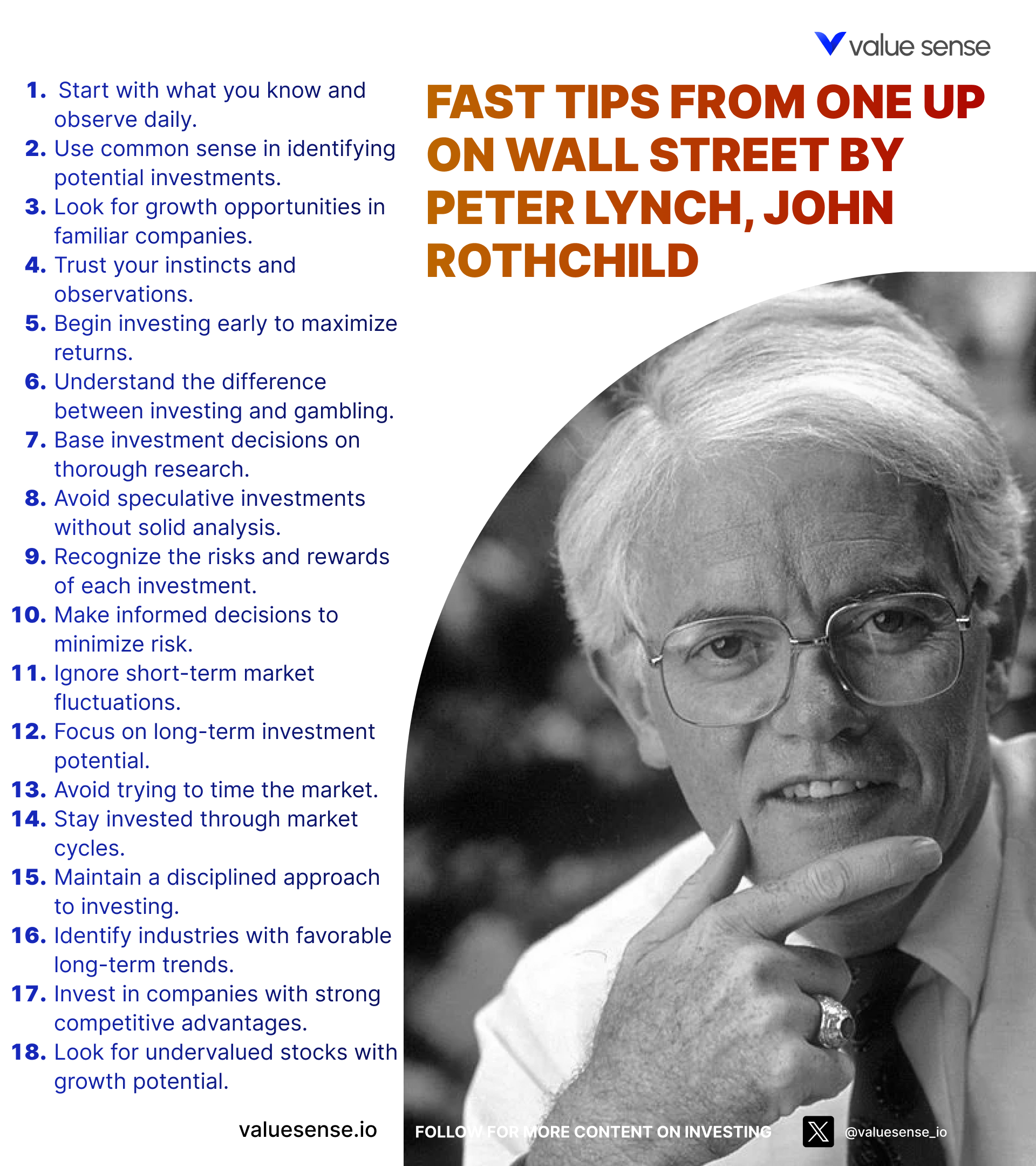

The book’s central theme is the practical, common-sense approach to stock picking. Lynch demystifies the process of finding “tenbaggers”—stocks that can increase tenfold in value—by emphasizing observation, curiosity, and diligent research. He encourages readers to leverage their own experiences and expertise, whether it’s noticing a new restaurant chain, a popular product, or a local business success story. Lynch’s philosophy is refreshingly optimistic: he contends that with patience and effort, anyone can outperform the market’s so-called experts.

What sets “One Up on Wall Street” apart from other investment books is its blend of timeless wisdom and actionable advice. Lynch’s writing is peppered with anecdotes, humor, and real-world case studies—from Dunkin’ Donuts to Fannie Mae. He breaks down complex concepts like earnings, valuation, and portfolio construction into accessible language, making the book suitable for beginners while still offering deep insights for experienced investors. The book’s structure—moving from philosophy to practical strategy—ensures that readers not only understand the “why” but also the “how” of successful investing.

This book is a must-read for anyone interested in investing—whether you’re a novice looking to buy your first stock, a DIY investor building a retirement portfolio, or a professional seeking to refine your approach. Lynch’s core message—that ordinary people can achieve extraordinary results by staying curious, doing their homework, and thinking independently—remains as relevant today as it was at publication. If you want to master the art of finding undervalued growth opportunities and develop the discipline to hold them for the long term, “One Up on Wall Street” is an indispensable guide.

Key Themes and Concepts

Throughout “One Up on Wall Street,” Peter Lynch weaves together several enduring themes that have shaped generations of investors. These themes are not just theoretical—they are grounded in Lynch’s daily practices and the real-world successes (and failures) he experienced managing the Magellan Fund. Lynch’s approach is holistic, combining behavioral insights, quantitative analysis, and a relentless focus on the fundamentals of business.

At the heart of the book is the idea that investing is both an art and a science. Lynch repeatedly stresses that successful investing is not reserved for Wall Street insiders; rather, it is accessible to anyone willing to observe, learn, and think independently. The book’s key themes offer a framework for navigating the complexities of the stock market, from identifying promising companies to avoiding the traps of herd mentality and market hype.

- Individual Investor Advantages: Lynch’s most empowering message is that individual investors possess real advantages over professionals. Unlike institutional managers, individuals are not constrained by bureaucracy, short-term performance pressures, or rigid investment mandates. Lynch encourages readers to use their firsthand knowledge as consumers, employees, and observers of daily life to spot trends before they become obvious to Wall Street. For example, he credits everyday experiences—like noticing full parking lots at a new store or observing product popularity among friends—for leading him to some of his most successful investments. By trusting their own insights and doing the necessary research, individuals can uncover “local” opportunities that institutional investors often overlook.

- Tenbaggers: The pursuit of “tenbaggers”—stocks that appreciate tenfold—is central to Lynch’s philosophy. He explains that finding just a few tenbaggers can dramatically boost a portfolio’s overall returns, even if other picks are mediocre or fail. Lynch details the characteristics of tenbaggers: strong growth potential, a simple and understandable business model, and often, a company that is still under the radar. He recounts real examples, such as Taco Bell and Dunkin’ Donuts, and emphasizes the importance of patience, since tenbaggers often take years to realize their full potential. For investors, the lesson is clear: focus on businesses with the capacity for sustained, exponential growth and be willing to hold them through market volatility.

- Earnings Focus: Lynch is unequivocal in his belief that earnings drive stock prices over the long term. He urges investors to pay close attention to a company’s earnings history, growth rate, and consistency. Chapters devoted to “Earnings, Earnings, Earnings” highlight how rising earnings are the clearest signal of a healthy, expanding business. Lynch provides practical tools for evaluating earnings, such as comparing price-to-earnings (P/E) ratios to growth rates (the PEG ratio) and looking for companies with a record of steady, predictable earnings growth. This focus on bottom-line performance helps investors cut through hype and identify companies with genuine staying power.

- Research and Analysis: Thorough research is the backbone of Lynch’s approach. He advocates for digging into annual reports, financial statements, and industry trends to truly understand a company’s strengths and weaknesses. Lynch demystifies the research process, outlining which numbers matter most (like debt levels, cash flow, and inventory turnover) and warning against common pitfalls, such as overreliance on Wall Street analysts. He shares stories of successful investments that began with simple questions and diligent fact-finding. For investors, the takeaway is that homework pays off—and that the best opportunities often require looking beyond headlines and hype.

- Long-term Investment: Patience is a recurring theme in Lynch’s writing. He cautions against the temptation to chase short-term gains or react emotionally to market swings. Instead, he urges investors to adopt a long-term perspective, holding onto well-chosen stocks through periods of volatility. Lynch’s own success at Magellan was largely due to his willingness to ride out downturns and let compounding work its magic. He illustrates this with case studies of companies that endured temporary setbacks but ultimately delivered exceptional returns to patient shareholders. The lesson: time in the market beats timing the market.

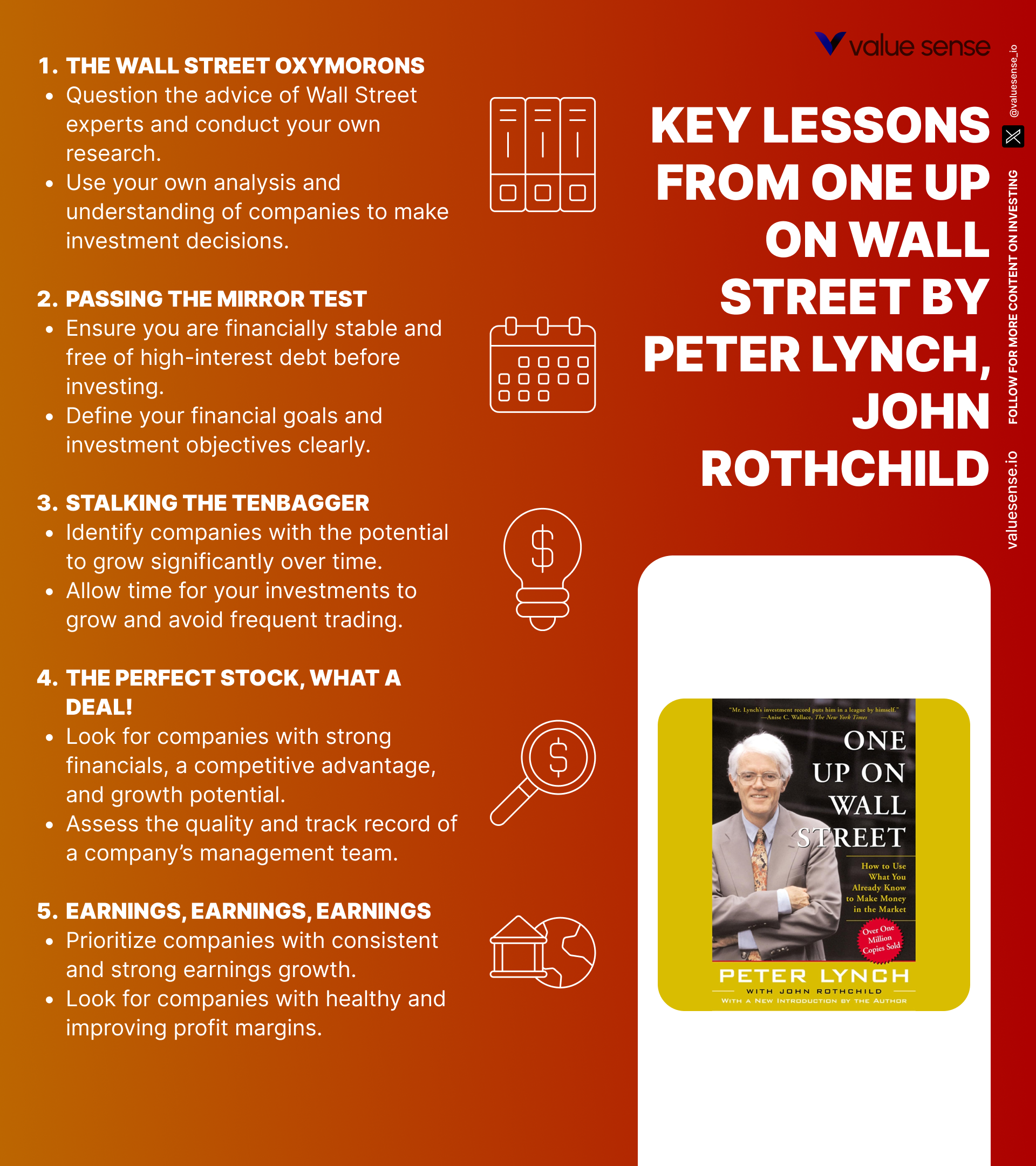

- Market Misconceptions: Lynch dedicates substantial attention to debunking common myths and misconceptions about the stock market. He lists the “twelve silliest things people say about stock prices,” such as “If it’s gone down this much already, it can’t go much lower,” and “It’s always darkest before the dawn.” By exposing these fallacies, Lynch encourages investors to think critically, question conventional wisdom, and avoid being swept up in crowd psychology. This independent mindset is vital for navigating bubbles, crashes, and the ever-present noise of financial media.

- Independent Thinking and Contrarianism: Finally, Lynch champions the value of independent thought. He warns against blindly following the herd, whether it’s professional analysts or the latest market fad. Lynch’s best investments often came from going against the prevailing sentiment—buying when others were fearful, or holding on when others were selling. He urges investors to develop their own criteria, stick to their convictions, and make decisions based on facts rather than emotion. In today’s information-saturated world, this lesson is more relevant than ever.

Book Structure: Major Sections

Part 1: Introduction and Investment Philosophy

This opening section, covering Chapters 1 to 3, lays the foundation for Lynch’s investment worldview. Here, Lynch introduces his background, the genesis of his investment philosophy, and the unique advantages that individual investors hold over professionals. He recounts personal anecdotes from his early days at Fidelity and highlights how everyday experiences can lead to profitable investments. The narrative is approachable, demystifying the stock market and encouraging readers to view investing as an extension of their daily lives.

Lynch emphasizes that individual investors are not burdened by the constraints of institutional mandates or short-term performance pressures. He illustrates how observing consumer trends, local businesses, and even casual conversations can yield valuable investment ideas. The concept of “tenbaggers” is introduced, planting the seed for the book’s focus on exponential growth opportunities. Lynch also stresses the importance of preparation—knowing your own risk tolerance, investment goals, and willingness to do the necessary homework.

For investors, this section is a call to action: pay attention to the world around you, trust your instincts, and be willing to dig deeper. Lynch’s stories about discovering investment ideas in mundane settings (like supermarkets or shopping malls) encourage readers to adopt a curious, opportunistic mindset. He reminds us that the stock market is ultimately a market of businesses, not just numbers on a screen.

Even decades after publication, this philosophy remains highly relevant. In an era of algorithmic trading and passive index funds, Lynch’s emphasis on individual initiative and grassroots research stands out. His belief in the “edge” of the individual investor is a powerful antidote to the cynicism and complexity that often deter newcomers from equity investing.

Part 2: Identifying Investment Opportunities

Chapters 4 through 7 comprise this section, focusing on the art of spotting promising stocks in everyday life. Lynch encourages readers to keep their eyes open for new products, services, and businesses that are gaining traction before Wall Street analysts take notice. He shares practical tips for translating personal observations into actionable investment ideas, stressing the importance of understanding the business behind the stock.

Lynch provides numerous examples of companies he discovered through firsthand experience—whether as a customer, employee, or casual observer. He explains that the best opportunities often arise from simple, overlooked businesses with strong fundamentals. The section also delves into the importance of earnings as a driver of stock prices, introducing the concept of “tenbaggers” in detail and outlining the traits that make a company a potential tenfold winner.

Investors can apply these lessons by cultivating a habit of curiosity and skepticism. Lynch suggests making lists of interesting companies encountered in daily life, then conducting basic research to assess their financial health and growth prospects. He advocates for starting with what you know—whether it’s a favorite restaurant chain or a successful local retailer—before venturing into more complex sectors.

In today’s world, where social media and online reviews can amplify consumer trends overnight, Lynch’s advice is even more actionable. The ability to spot early adopters, viral products, or rapidly expanding franchises remains a powerful edge for individual investors. This section serves as a practical guide to turning everyday observations into profitable stock picks.

Part 3: Analyzing Companies

Spanning Chapters 8 to 11, this section is devoted to the nuts and bolts of company analysis. Lynch walks readers through the process of reading financial statements, evaluating key metrics, and identifying red flags. He demystifies concepts like price-to-earnings ratios, debt levels, cash flow, and inventory turnover, explaining how each factor can signal strength or weakness in a business.

Lynch stresses that no single metric tells the whole story; rather, successful analysis requires looking at the interplay between growth, profitability, and financial health. He warns against common pitfalls, such as chasing hot stocks without understanding their underlying businesses or ignoring warning signs in the numbers. The section is rich with examples of both winners and losers, illustrating how careful analysis can make the difference between success and failure.

For investors, the takeaway is clear: do your homework. Lynch provides a checklist of questions to ask about any potential investment, from “Is the company profitable?” to “What is its competitive advantage?” He encourages readers to look beyond Wall Street consensus and develop their own informed opinions based on facts and logic.

This analytical framework remains essential in the age of big data and financial engineering. The principles Lynch outlines—scrutinizing earnings, assessing debt, and understanding a company’s business model—are timeless tools for separating value from hype in any market environment.

Part 4: Building and Managing a Portfolio

Chapters 12 through 15 explore the strategies and disciplines required to construct and maintain a successful stock portfolio. Lynch covers diversification, risk management, and the importance of long-term planning. He provides guidance on how many stocks to own, how to allocate capital, and when to buy or sell based on changing circumstances.

Lynch advocates for a balanced approach, emphasizing that over-diversification can dilute returns while under-diversification increases risk. He discusses the importance of periodically reevaluating each holding, ensuring that the original investment thesis still holds. The section also addresses the psychological challenges of investing, such as resisting the urge to sell during market downturns or chasing after the latest fad.

Investors can implement these lessons by setting clear portfolio goals, establishing rules for buying and selling, and maintaining a disciplined review process. Lynch suggests keeping an investment diary to track decisions and learn from both successes and mistakes. He underscores the value of patience and consistency in achieving long-term results.

With the proliferation of ETFs and robo-advisors, Lynch’s advice on portfolio construction is more relevant than ever. His emphasis on thoughtful diversification, ongoing evaluation, and emotional discipline provides a roadmap for investors seeking to build wealth steadily over time.

Part 5: Market Behavior and Long-term View

The final section, encompassing Chapters 16 to 20, addresses the psychology of markets, the importance of a long-term perspective, and the dangers of common misconceptions. Lynch explores how market sentiment, media narratives, and investor psychology can drive prices away from fundamental value. He debunks myths such as “this time it’s different” and “if it’s gone down this much, it can’t go lower,” urging investors to remain rational and independent-minded.

Lynch stresses that volatility and corrections are natural parts of the market cycle. He provides historical examples of companies and sectors that bounced back after periods of pessimism, highlighting the rewards of staying the course. The section concludes with a call for independent thinking, encouraging investors to trust their own research and avoid being swayed by the crowd.

For investors, this section serves as both a warning and an inspiration. Lynch’s insights into market behavior help readers develop the psychological resilience needed to weather downturns and capitalize on long-term opportunities. He emphasizes that the greatest returns often come to those who can ignore short-term noise and focus on the fundamentals.

In today’s fast-paced, media-saturated environment, Lynch’s counsel on market behavior and independent thinking is more vital than ever. His blend of optimism, realism, and skepticism equips investors to navigate uncertainty and build lasting wealth.

Deep Dive: Essential Chapters

Chapter 1: The Making of a Stockpicker

This opening chapter is critically important because it sets the tone for the entire book, introducing readers to Peter Lynch’s unique background and the foundational principles that guide his investment approach. Lynch recounts his early fascination with the stock market, his formative years at Fidelity, and the lessons he learned along the way. The chapter establishes the central thesis that ordinary investors, armed with curiosity and diligence, can outperform professionals by leveraging their everyday experiences and insights.

Lynch uses vivid anecdotes to illustrate how personal experiences often lead to the best investment ideas. For example, he describes how observing the success of Dunkin’ Donuts in his local area sparked his interest in the company long before it became a Wall Street favorite. He also shares stories from his time at Magellan, highlighting both triumphs and mistakes. Lynch’s writing is approachable and humorous, making complex concepts accessible to readers of all backgrounds. He emphasizes that investing is not about predicting the future but about recognizing value in the present.

Investors can apply these lessons by staying alert to trends in their own lives and communities. Lynch suggests keeping a journal of interesting businesses encountered in daily routines, then researching their financials and competitive positioning. He advocates for starting with what you know—whether it’s a favorite retailer, a local restaurant, or a product you use every day. By combining personal observation with fundamental research, investors can uncover opportunities that Wall Street analysts might overlook.

Historically, this approach has proven effective time and again. Many of Lynch’s most successful investments began with simple observations, such as the popularity of L’eggs pantyhose or the expansion of Taco Bell. In today’s world, where information travels even faster, the ability to spot emerging trends early remains a powerful edge. Lynch’s emphasis on grassroots research and independent thinking is as relevant now as it was in the 1980s.

Chapter 6: Stalking the Tenbagger

Chapter 6 is pivotal because it introduces the concept of the “tenbagger”—a stock that increases tenfold in value—which is the holy grail of Lynch’s investment strategy. Lynch explains that finding just a few tenbaggers can dramatically boost a portfolio’s overall returns, offsetting losses from other investments. The chapter delves into the characteristics of potential tenbaggers and the mindset required to identify and hold them for the long term.

Lynch provides concrete examples of tenbaggers from his own experience, such as Taco Bell and Dunkin’ Donuts, detailing how he discovered these companies through everyday observations and thorough research. He outlines key attributes to look for: a simple, understandable business model; strong growth potential; and a company that is still under the radar. Lynch warns that tenbaggers often require patience, as their full potential may not be realized for several years. He uses data from past investments to illustrate how holding onto winners can transform a portfolio.

To apply these lessons, investors should focus on businesses with scalable models, expanding markets, and strong management teams. Lynch recommends conducting in-depth research to assess a company’s growth prospects, competitive advantages, and financial health. He also stresses the importance of conviction—being willing to hold onto a stock through volatility if the underlying business remains strong. Investors should resist the urge to sell too soon, as the biggest gains often come after years of steady growth.

Historically, the concept of tenbaggers has inspired countless investors to seek out high-growth opportunities. Lynch’s own track record at Magellan is filled with examples of companies that delivered outsized returns to patient shareholders. In today’s market, the search for tenbaggers continues, with companies like Amazon and Tesla demonstrating the power of long-term compounding. Lynch’s framework remains a valuable guide for identifying and nurturing potential multibaggers.

Chapter 8: The Perfect Stock, What a Deal!

This chapter is essential because it defines the characteristics of an ideal stock investment, providing readers with a blueprint for what to look for in potential winners. Lynch describes the traits of a “perfect stock,” emphasizing factors such as strong financials, consistent earnings growth, a simple business model, and a sustainable competitive advantage. The chapter serves as a practical checklist for evaluating investment opportunities.

Lynch uses real-world examples to illustrate his points, such as companies with high returns on equity, low debt, and a history of steady dividend payments. He explains that the best stocks are often found in boring, overlooked industries—businesses that quietly compound wealth over time. Lynch cautions against chasing hot trends or flashy companies without substance, highlighting the importance of fundamentals over hype. He shares data on historical winners from his portfolio, showing how these criteria led to outsized returns.

Investors can use this framework by developing their own checklist of desirable traits, tailored to their investment goals and risk tolerance. Lynch suggests focusing on companies with predictable revenue streams, strong balance sheets, and a track record of prudent management. He advises against overcomplicating the process—sometimes the simplest businesses are the most rewarding. By sticking to these core principles, investors can avoid many common pitfalls and increase their odds of success.

Historically, many of Lynch’s best investments fit this mold—companies like Clorox, which dominated its niche and delivered steady growth for decades. In today’s market, the same principles apply: businesses with durable competitive advantages, strong financials, and disciplined management tend to outperform over the long run. Lynch’s checklist remains a valuable tool for investors seeking to separate signal from noise.

Chapter 10: Earnings, Earnings, Earnings

Chapter 10 is a cornerstone of Lynch’s investment philosophy, focusing on the critical role of earnings in stock valuation and performance. Lynch argues that earnings growth is the single most important driver of stock prices over the long term. He urges investors to scrutinize a company’s earnings history, growth rate, and consistency as the primary indicators of financial health and future potential.

Lynch provides detailed guidance on how to evaluate earnings, including the use of metrics like the price-to-earnings (P/E) ratio and the PEG ratio (P/E divided by earnings growth rate). He explains how to distinguish between sustainable earnings growth and temporary spikes driven by one-time events. Lynch shares examples of companies with strong, predictable earnings growth that delivered exceptional returns, as well as cautionary tales of businesses with erratic or declining profits.

Investors can apply these lessons by making earnings analysis a central part of their research process. Lynch recommends looking for companies with a track record of steady, above-average earnings growth, supported by strong fundamentals. He advises against investing in companies with opaque or unreliable earnings, as these are often signs of deeper problems. By focusing on earnings, investors can avoid being swayed by hype and identify businesses with real staying power.

Historically, the link between earnings and stock prices has been borne out across market cycles. Lynch’s emphasis on earnings helped him avoid many of the speculative bubbles and busts that plagued less disciplined investors. In today’s market, where accounting gimmicks and non-GAAP metrics abound, Lynch’s insistence on clear, consistent earnings remains a crucial safeguard for investors.

Chapter 12: Getting the Facts

This chapter is critically important because it underscores the necessity of thorough research and fact-finding in the investment process. Lynch explains that successful investing is not about having inside information or following hot tips—it’s about gathering reliable data and making informed decisions based on evidence. He demystifies the research process, showing readers how to access and interpret key financial documents.

Lynch provides a step-by-step guide to reading annual reports, SEC filings, and other publicly available information. He highlights the most important sections to focus on, such as the income statement, balance sheet, and management discussion. Lynch shares stories of investments that succeeded or failed based on his ability to uncover critical facts, emphasizing the value of skepticism and independent verification. He also warns against overreliance on Wall Street analysts, who may have conflicts of interest or incomplete information.

Investors can apply these lessons by developing a systematic approach to research. Lynch recommends starting with the basics—understanding what the company does, how it makes money, and what risks it faces—before diving into the numbers. He encourages readers to cross-check information from multiple sources and to look for inconsistencies or red flags. By building a solid foundation of knowledge, investors can make more confident and informed decisions.

Historically, Lynch’s commitment to thorough research helped him avoid costly mistakes and capitalize on overlooked opportunities. In today’s information-rich environment, the ability to separate fact from fiction is more important than ever. Lynch’s methods provide a roadmap for investors seeking to navigate the noise and make data-driven choices.

---

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best) overall value plays for 2025

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!

---

Chapter 14: Rechecking the Story

Chapter 14 is essential because it highlights the importance of ongoing evaluation and adaptability in investing. Lynch explains that even the best investment ideas require regular review to ensure they still meet the original criteria. He discusses the need for continuous monitoring of company performance, industry trends, and competitive dynamics, emphasizing that circumstances can change rapidly.

Lynch shares examples of investments that started strong but faltered due to shifts in management, market conditions, or competitive threats. He provides practical tips for tracking key performance indicators, such as revenue growth, profit margins, and debt levels. Lynch also discusses the importance of staying objective—being willing to sell or adjust a position if the facts no longer support the investment thesis.

Investors can implement these lessons by establishing a regular review process for their portfolios. Lynch suggests setting aside time each quarter to revisit the fundamentals of each holding, update assumptions, and assess whether the original rationale still holds. He cautions against falling in love with a stock or ignoring warning signs out of stubbornness. By staying flexible and open-minded, investors can avoid costly mistakes and capitalize on new opportunities.

Historically, the ability to adapt and reevaluate has been a hallmark of successful investors. Lynch’s willingness to change course when necessary helped him avoid major losses and redeploy capital to better opportunities. In today’s fast-moving markets, the discipline of regular review and adjustment is more critical than ever.

Chapter 16: Designing a Portfolio

This chapter is a cornerstone for readers seeking to build a balanced and diversified investment portfolio. Lynch provides a detailed framework for constructing a portfolio that aligns with an investor’s goals, risk tolerance, and time horizon. He discusses the importance of diversification—not just across sectors, but also across different types of companies (e.g., growth, stalwarts, turnarounds).

Lynch offers practical advice on how many stocks to own, how to allocate capital among different holdings, and how to balance risk and reward. He uses data from his own experience at Magellan to illustrate the benefits of diversification, showing how a few big winners can drive overall returns while limiting the impact of losers. Lynch also discusses the psychological aspects of portfolio management, such as resisting the urge to tinker excessively or chase after the latest fad.

Investors can apply these lessons by conducting a personal assessment of their investment objectives and risk appetite. Lynch recommends building a core portfolio of high-quality companies, supplemented by a smaller allocation to more speculative opportunities. He emphasizes the importance of regular rebalancing to maintain the desired risk profile and to avoid concentration in any one stock or sector.

Historically, diversified portfolios have outperformed more concentrated approaches, especially during periods of market volatility. Lynch’s balanced strategy helped him achieve exceptional returns while managing risk. In today’s environment, where new asset classes and investment vehicles abound, Lynch’s principles of diversification and discipline remain invaluable for investors at all levels.

Chapter 18: The Twelve Silliest (and Most Dangerous) Things People Say About Stock Prices

Chapter 18 stands out for its practical wisdom and myth-busting approach. Lynch systematically debunks a dozen common misconceptions and clichés that often lead investors astray. These include beliefs like “If it’s gone down this much already, it can’t go much lower,” or “It’s always darkest before the dawn.” By exposing the flaws in these sayings, Lynch teaches readers to think critically and avoid being swayed by crowd psychology or conventional wisdom.

Lynch provides real-world examples of how these misconceptions have led to poor investment decisions, drawing on both his own experiences and broader market history. He explains the psychological traps—such as loss aversion and recency bias—that underlie these beliefs. Lynch uses humor and storytelling to make his points memorable, helping readers internalize the importance of independent thought and skepticism.

Investors can apply these lessons by developing a habit of questioning assumptions and seeking evidence before making decisions. Lynch recommends keeping a list of common investment fallacies as a reminder to stay objective and rational. He also suggests using data and historical context to test prevailing narratives, rather than relying on gut feelings or media headlines.

Historically, the ability to resist herd mentality has been a key driver of investment success. Lynch’s myth-busting framework is especially relevant in today’s environment, where social media and 24/7 news cycles can amplify misinformation and panic. By cultivating critical thinking, investors can avoid costly mistakes and maintain a disciplined, long-term approach.

Chapter 20: 50,000 Frenchmen Can Be Wrong

The final chapter is a powerful call to independent thinking and contrarianism. Lynch argues that the crowd is often wrong, especially at market extremes. He urges investors to develop their own criteria, stick to their convictions, and make decisions based on facts rather than following popular opinion. The title itself—a play on the saying “50 million Frenchmen can’t be wrong”—underscores the dangers of herd mentality.

Lynch shares stories of investments that succeeded precisely because he went against the prevailing sentiment. He explains that the best opportunities often arise when others are fearful or dismissive. Lynch provides data on market cycles, showing how periods of pessimism have historically been the best times to buy. He also discusses the psychological challenges of independent thinking, acknowledging that it can be difficult to stand apart from the crowd.

Investors can apply these lessons by cultivating a contrarian mindset, seeking out opportunities where consensus is overly negative or positive. Lynch recommends building a personal checklist of criteria for evaluating stocks and sticking to it, regardless of market noise. He also suggests finding a community of like-minded investors to share ideas and provide support during periods of uncertainty.

Historically, some of the greatest investment returns have come from going against the crowd—buying during bear markets or holding onto undervalued stocks when others are selling. Lynch’s message of independent thinking is more relevant than ever in today’s interconnected, information-saturated markets. By trusting their own research and convictions, investors can achieve superior results over time.

Practical Investment Strategies

- Start with What You Know: Lynch advocates beginning your investment search within industries, products, or services you encounter in daily life. Make a list of companies you interact with as a consumer, employee, or observer. For each, research their financials, growth history, and competitive position. Use your unique “local knowledge” to spot trends and opportunities before they become mainstream. This approach helps you build conviction and reduces the risk of investing in businesses you don’t understand.

- Screen for Tenbaggers: Develop a systematic process for identifying potential tenbaggers. Look for companies with scalable business models, large addressable markets, and strong earnings growth. Use metrics like the PEG ratio (P/E divided by earnings growth rate) to find undervalued growth stocks. Focus on businesses that are still under the radar, with little analyst coverage or institutional ownership. Document your findings and track these stocks over time to see if they maintain their growth trajectory.

- Analyze Financial Statements Rigorously: Before investing, dive deep into a company’s income statement, balance sheet, and cash flow statement. Evaluate key metrics: revenue growth, profit margins, debt/equity ratio, and free cash flow. Compare these numbers to industry peers and historical averages. Be wary of high debt, inconsistent earnings, or aggressive accounting practices. Use annual reports and SEC filings as primary sources, and cross-check data with independent research tools.

- Continuous Monitoring and Reevaluation: Set a schedule to review your holdings quarterly or semi-annually. Revisit your original investment thesis, update your assumptions based on new data, and track key performance indicators. If a company’s fundamentals deteriorate or the story changes, be willing to sell or reduce your position. Document your decisions in an investment diary to learn from both successes and failures.

- Maintain a Diversified Portfolio: Spread your investments across different industries, company sizes, and business types (growth, stalwarts, turnarounds). Avoid over-concentration in a single stock or sector. Use a core-satellite approach: hold a core of high-quality companies, supplemented by smaller positions in higher-risk, higher-reward opportunities. Regularly rebalance your portfolio to maintain your desired risk profile.

- Ignore Market Noise and Myths: Develop a list of common investment fallacies (e.g., “If it’s gone down, it can’t go lower”) and use it as a checklist to guard against emotional decisions. Focus on company fundamentals and long-term prospects, rather than reacting to short-term market swings or media headlines. Practice patience and discipline, even during periods of volatility or pessimism.

- Think Independently and Contrarian: Before making any investment, ask yourself whether you’re following the crowd or making a decision based on your own research. Seek out opportunities where consensus is overly negative or positive. Be willing to buy when others are fearful and sell when others are greedy, provided the fundamentals support your view. Build a network of thoughtful investors for feedback and support.

- Document and Learn from Every Investment: Keep a detailed investment diary for each stock you buy. Record your rationale, expectations, and key data points at the time of purchase. After each quarter, review your notes, compare outcomes to your expectations, and adjust your process as needed. Over time, this habit will help you refine your strategy and avoid repeating mistakes.

Modern Applications and Relevance

The principles outlined in “One Up on Wall Street” remain highly applicable in today’s investment landscape, despite the dramatic evolution of markets and technology since the book’s publication. Lynch’s core ideas—grounded in observation, research, and independent thinking—offer a timeless framework for navigating both bull and bear markets. In an era dominated by algorithmic trading, ETFs, and passive investing, Lynch’s emphasis on grassroots research and fundamental analysis stands out as a powerful differentiator.

One area where the book’s relevance shines is in the explosion of information and access to data. Today, individual investors have unprecedented tools for company research, from free financial databases to advanced screening platforms. Lynch’s advice to “get the facts” is more actionable than ever, as investors can easily access SEC filings, earnings calls, and management presentations online. However, the abundance of data also increases the risk of information overload and analysis paralysis, making Lynch’s focus on simplicity and key metrics even more valuable.

What has changed since Lynch’s era is the speed at which trends develop and the scale of market participation. Social media and online communities can propel obscure stocks into the spotlight overnight, as seen in the GameStop and AMC surges. Lynch’s counsel to “start with what you know” and to be wary of hype is especially pertinent in this environment. Investors must be even more diligent in separating signal from noise, focusing on sustainable business models rather than fleeting popularity.

Yet, many of Lynch’s lessons remain timeless. The importance of earnings, the value of patience, and the dangers of herd mentality are as relevant today as they were in the 1980s. Modern examples abound: companies like Apple, Amazon, and Tesla were once overlooked or dismissed by the consensus, only to become tenbaggers for those who saw their potential early. Lynch’s emphasis on independent research and long-term thinking continues to yield results for disciplined investors.

To adapt Lynch’s classic advice to current conditions, investors should leverage new tools for research and portfolio management, while maintaining a focus on fundamentals and independent analysis. The democratization of financial information has leveled the playing field, but it has also increased competition. By combining Lynch’s timeless principles with modern technology, investors can continue to find undervalued growth opportunities and build lasting wealth.

Most investors waste time on the wrong metrics. We've spent 10,000+ hours perfecting our value investing engine to find what actually matters.

Want to see what we'll uncover next - before everyone else does?

Find Hidden Gems First!

Implementation Guide

- Begin with Self-Assessment: Start by clarifying your investment goals, risk tolerance, and time horizon. Write down your objectives (e.g., retirement, wealth accumulation, income generation) and determine how much volatility you’re comfortable with. This step ensures that your investment strategy aligns with your personal circumstances and long-term aspirations.

- Build Your Investment Watchlist (Month 1-2): Over the next 4-8 weeks, actively observe your daily life for potential investment ideas—products you use, stores you frequent, or services gaining popularity. Create a watchlist of companies that stand out. For each, conduct preliminary research: review their business model, financial health, and growth prospects. Use free tools like ValueSense’s stock screener to filter for strong candidates.

- Construct a Diversified Portfolio (Month 2-3): Select 8-15 stocks from your watchlist, ensuring diversification across sectors and company types (growth, stalwarts, turnarounds). Allocate capital based on conviction and risk—larger positions in high-quality, established companies, and smaller allocations to speculative or emerging opportunities. Document your rationale for each holding, including key metrics and expected catalysts.

- Establish an Ongoing Review Process (Quarterly): Set a recurring schedule (e.g., every quarter) to review each holding. Update your investment thesis based on new earnings reports, industry developments, or management changes. Track key performance indicators, such as revenue growth, profit margins, and debt levels. Be prepared to sell or reduce positions if the fundamentals deteriorate or if the original story no longer holds.

- Commit to Continuous Improvement: After each review cycle, reflect on your decisions and outcomes. Analyze both successes and mistakes, updating your checklist and criteria as needed. Read widely—books, annual reports, and industry publications—to deepen your knowledge. Engage with investment communities (online forums, local clubs) to share ideas and gain new perspectives. Leverage resources like ValueSense’s research tools and screener for ongoing idea generation and analysis.

--- ---

10+ Free intrinsic value tools

For investors looking to find a stock's fair value, our analytics team has you covered with intrinsic value tools:

📍 Free Intrinsic Value Calculator

📍 Reverse DCF & DCF value tools

📍 Peter Lynch Fair Value Calculator

📍 Ben Graham Fair Value Calculator

📍 Relative Value tool

...and plenty more.

🔍 Explore all these tools for free on the Value Sense platform and start discovering what your favorite stocks are really worth.

FAQ: Common Questions About One Up on Wall Street

1. What is the main message of “One Up on Wall Street”?

The book’s central message is that individual investors can achieve outstanding results by leveraging their unique insights, conducting thorough research, and thinking independently. Peter Lynch emphasizes that successful investing is accessible to anyone willing to observe, learn, and apply common sense. He encourages readers to focus on finding “tenbaggers” and to hold quality stocks for the long term.

2. How does Peter Lynch suggest finding investment ideas?

Lynch advocates for starting with everyday observations—products you use, stores you visit, or trends you notice in your community. He believes that many of the best investment opportunities are hiding in plain sight, often before they attract Wall Street’s attention. By combining personal experience with diligent research, investors can uncover promising stocks early.

3. What are “tenbaggers,” and why are they important?

“Tenbaggers” are stocks that increase tenfold in value. Lynch argues that finding just a few tenbaggers can dramatically boost a portfolio’s returns, even if other investments underperform. He provides a framework for identifying these opportunities, focusing on scalable business models, strong earnings growth, and companies that are still off the mainstream radar.

4. How does the book address risk management and portfolio construction?

Lynch provides detailed advice on diversification, recommending that investors spread their bets across different sectors and types of companies. He discusses how to determine the right number of stocks to own, how to allocate capital based on conviction and risk, and the importance of regularly reviewing and rebalancing the portfolio. Lynch’s approach balances risk and reward for long-term success.

5. Is “One Up on Wall Street” still relevant for today’s investors?

Absolutely. While the market has evolved with new technologies and investment vehicles, Lynch’s principles—such as focusing on fundamentals, thinking independently, and maintaining a long-term perspective—remain timeless. The book’s practical advice and actionable strategies are highly applicable in today’s fast-paced, information-rich environment, making it a valuable resource for both new and experienced investors.