ValueSense features - Overview templates

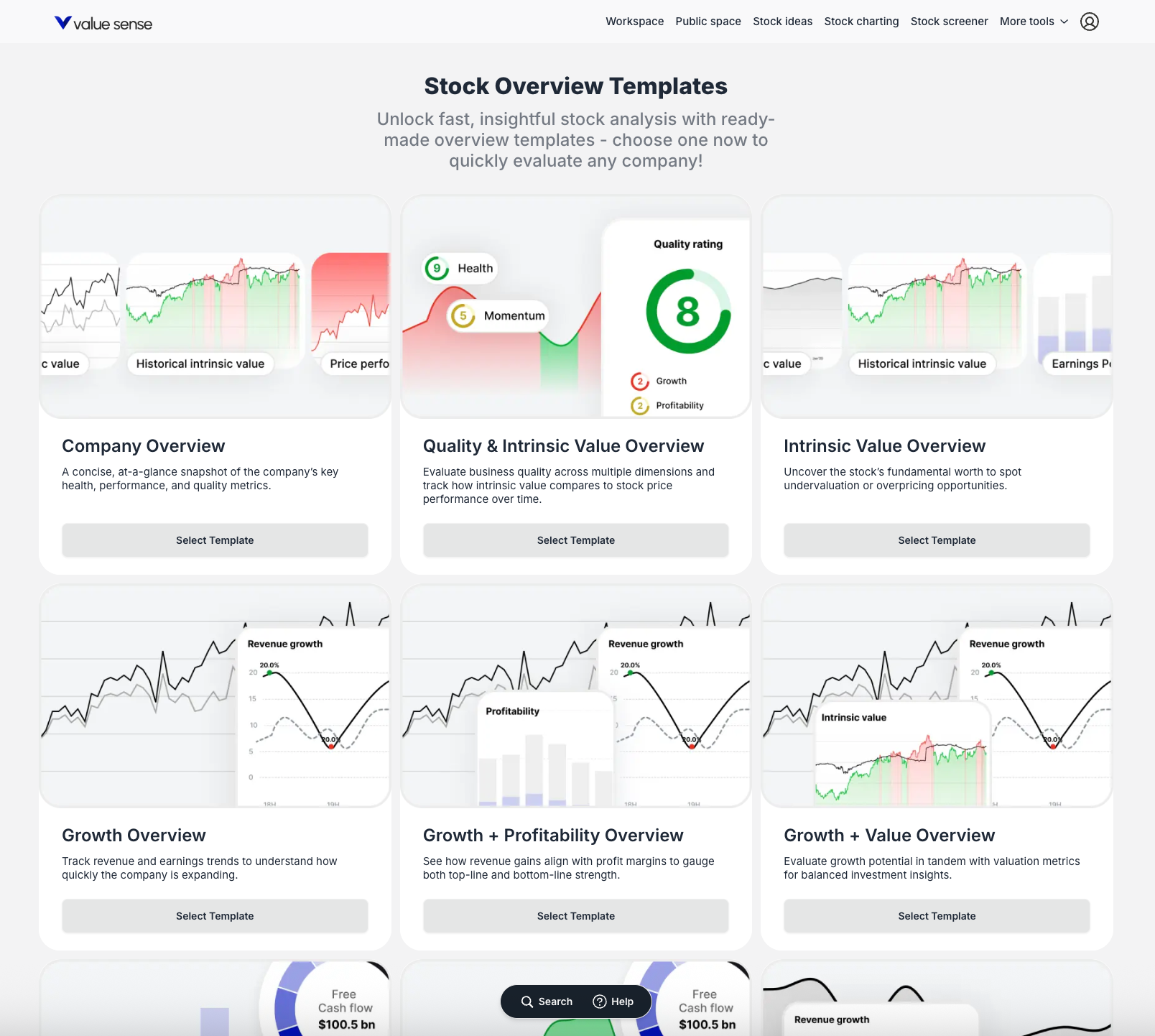

Overview Templates unlock fast, insightful stock analysis with ready-made analytical frameworks that help you quickly evaluate any company. Instead of building dashboards from scratch, you can select from a comprehensive library of curated templates, each focusing on different aspects of financial analysis to provide instant, professional-quality company reports.

Accessing Overview Templates

From the Main Navigation

- Hover over "More tools" in the main navigation bar

- Click "Overview templates" from the dropdown menu

- Access the template gallery with all available analytical frameworks

What Overview Templates Do

Core Purpose

Overview Templates automatically generate comprehensive, visually-rich, one-page summary reports on any publicly traded company using pre-defined analytical frameworks. This saves significant time in gathering and visualizing key data points while ensuring consistent, professional analysis.

Key Benefits

- Speed and Efficiency: Condenses hours of research into digestible, shareable pages

- Professional Quality: Institutional-grade analysis and visualization

- Comprehensive Coverage: Multiple analytical perspectives for complete company assessment

- Interactive Experience: Dynamic charts and data exploration capabilities

Available Template Library

Investment Analysis Templates

- Company Overview: Complete 360-degree company assessment

- Quality & Intrinsic Value Overview: Combined quality metrics and valuation analysis

- Intrinsic Value Overview: Focused valuation and fair value assessment

- Growth Overview: Growth trends and future potential analysis

- Growth + Profitability Overview: Combined growth and margin analysis

- Growth + Value Overview: Growth opportunities at attractive valuations

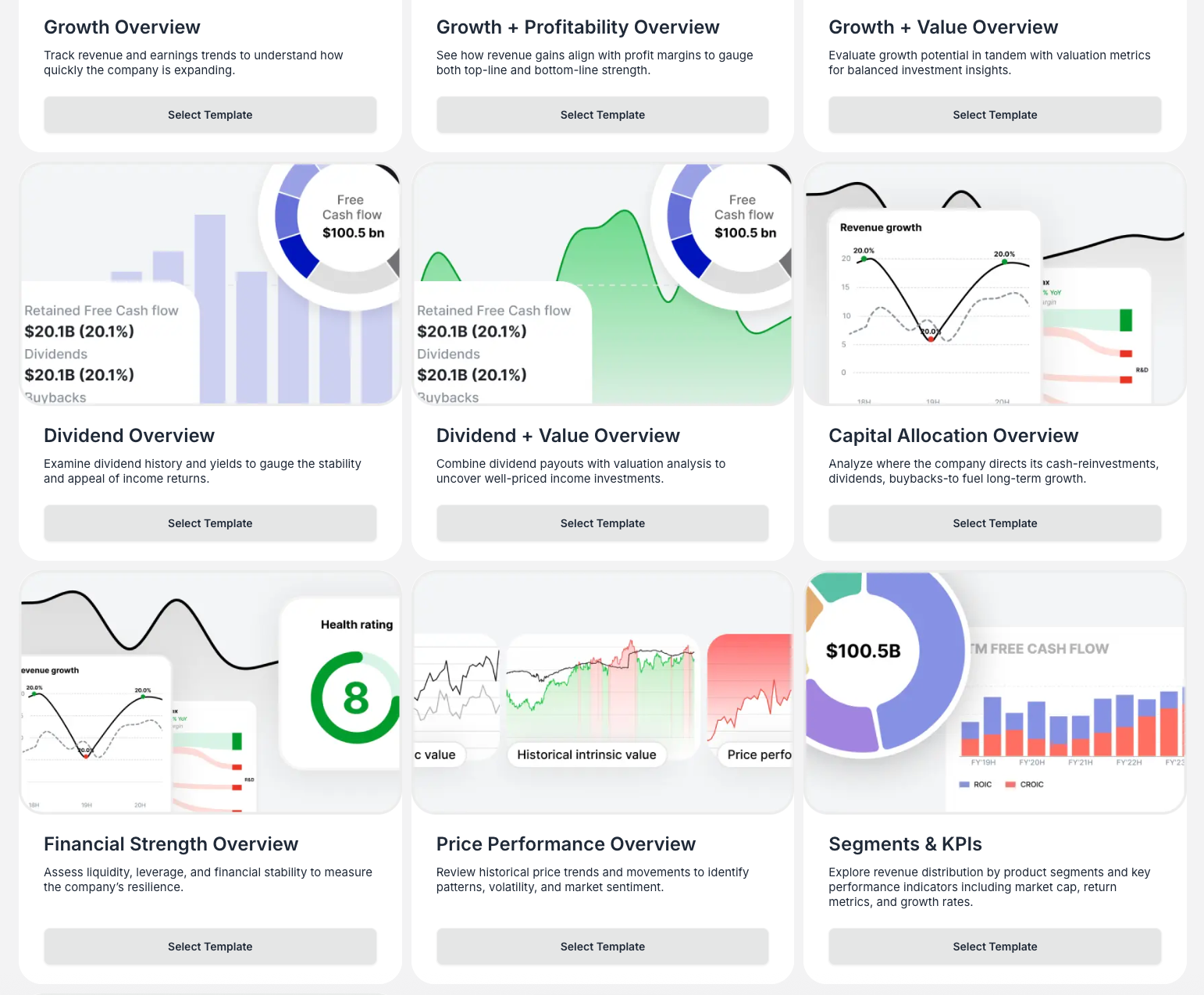

Income & Dividend Templates

- Dividend Overview: Dividend history, yield, and sustainability analysis

- Dividend + Value Overview: Income investing with valuation considerations

Operational & Financial Templates

- Capital Allocation Overview: Management efficiency and capital deployment

- Financial Strength Overview: Balance sheet health and stability analysis

- Segments & KPIs: Revenue breakdown and key performance indicators

- Revenue Breakdown: Detailed revenue composition and trends

Performance Templates

- Price Performance Overview: Stock performance vs. benchmarks

- Investing Visuals: Summary: Key investment metrics visualization

How to Use Templates

Method 1: Starting from Template Gallery

- Browse Templates: Navigate to the "Stock Overview Templates" page

- Preview Templates: Hover over template cards to see animated previews

- Select Template: Click "Select Template" on your desired framework

- Choose Company: Search for and select a company from the modal window

- Generate Report: Automatically creates comprehensive analysis

Method 2: Switching Templates on Existing Reports

- Use Template Dropdown: Click the "Template" dropdown at the top of any report

- Select New Framework: Choose different analytical perspective

- Dynamic Loading: Page content updates to match new template

- Maintain Context: Company selection remains consistent across template changes

Template Content and Analysis

Company Overview Template Features

- Quality Rating: Numerical score (e.g., 7.3) with sub-ratings for Growth, Capital Allocation, Profitability, Momentum, and Health

- Price Performance vs S&P 500: Line chart comparing stock performance against benchmark

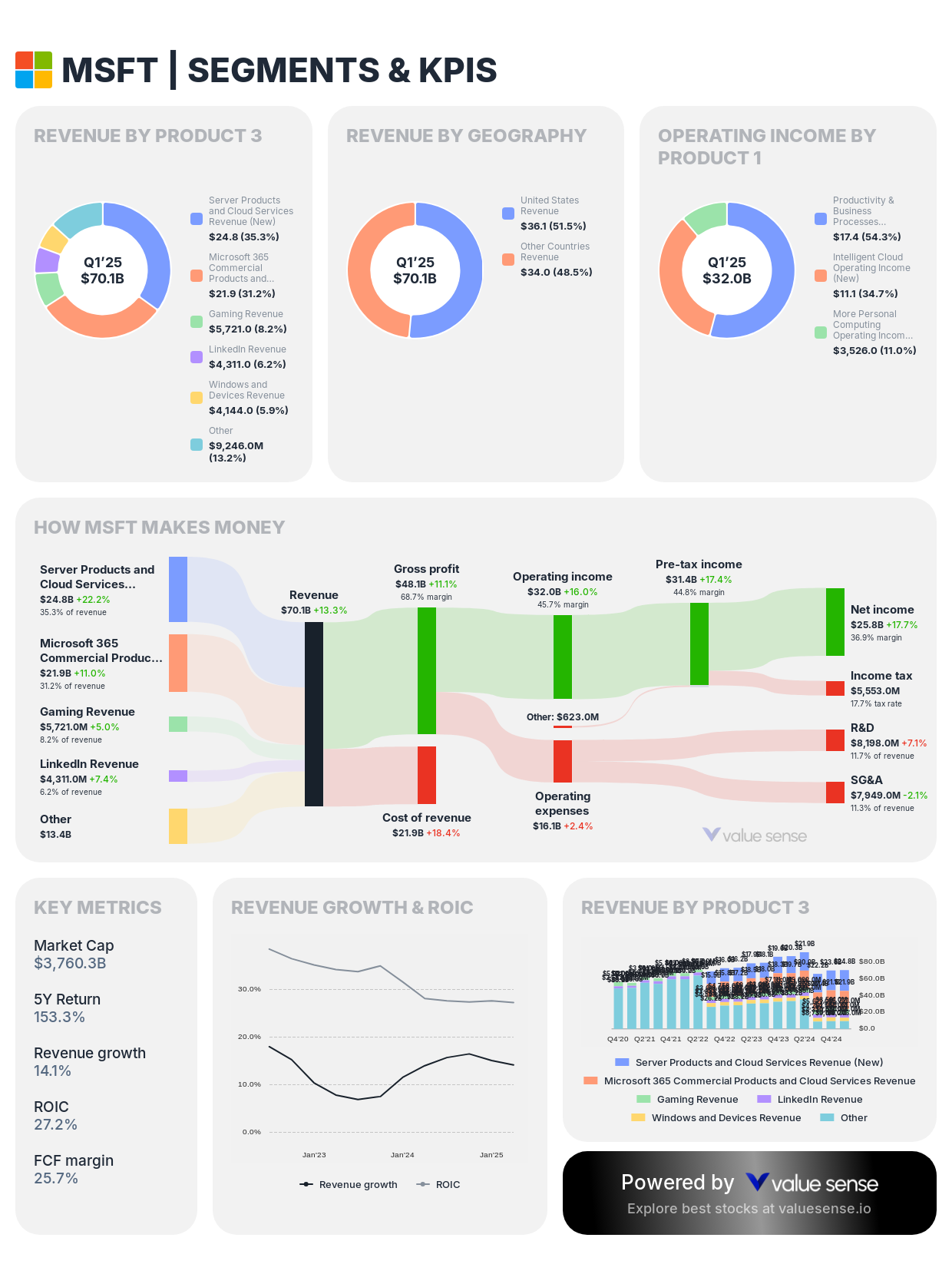

- How [Company] Makes Money: Sankey diagram showing revenue flow from segments to net income

- Key Metrics: Market Cap, 5Y Return, Revenue growth, ROIC, FCF margin

- Revenue Growth & ROIC: Historical performance trends

- LTM Free Cash Flow: Cash generation analysis

Segments & KPIs Template Features

- Revenue by Product: Donut chart showing revenue breakdown by business segment

- Revenue by Geography: Geographic revenue distribution analysis

- Operating Income by Product: Profit breakdown by business unit

- Key Performance Indicators: Segment-specific metrics and trends

Interactive Features

Template Gallery Experience

- Animated Previews: Hover over template cards to see content previews

- Visual Selection: Choose templates based on actual report appearance

- Clear Categorization: Templates organized by analytical focus

Company Search Functionality

- Dynamic Search: Results update as you type

- Popular Tickers: Quick access to commonly analyzed companies

- Clear Feedback: "Nothing found" messages and clear buttons

- Efficient Selection: Streamlined company selection process

Interactive Reports

- Hover for Details: Mouse over charts to see specific data points and dates

- Loading States: "Crunching data... Almost there!" progress indicators

- Download Capability: Export reports for presentations or archival

- Template Switching: Quick pivot between analytical perspectives

Key Workflow Steps

Step 1: Access and Browse

Navigate to Overview Templates and explore available analytical frameworks

Step 2: Select Template

Choose the template that matches your analysis needs and investment focus

Step 3: Choose Company

Search for and select the company you want to analyze

Step 4: Analyze Report

Review the generated comprehensive report with interactive charts and data

Step 5: Refine Analysis

Use template dropdown to switch analytical perspectives for the same company

Step 6: Export and Share

Download reports for presentations, investment meetings, or personal archives

Use Cases and Applications

Initial Due Diligence

- Company Overview: Get comprehensive understanding of new stock ideas

- Quality Assessment: Evaluate company fundamentals and investment quality

- Quick Screening: Rapidly assess multiple investment opportunities

Thesis-Driven Analysis

- Growth Focus: Use Growth Overview for companies with expansion potential

- Income Investing: Apply Dividend Overview for income-focused strategies

- Value Investing: Utilize Intrinsic Value templates for undervalued opportunities

- Segment Analysis: Employ Segments & KPIs for complex, diversified companies

Reporting and Communication

- Investment Presentations: Professional reports for meetings and presentations

- Team Collaboration: Share consistent analysis across investment teams

- Personal Archives: Maintain research records with standardized format

Best Practices

Template Selection

- Match Analysis Goals: Choose templates that align with your investment thesis

- Consider Company Type: Select frameworks appropriate for company characteristics

- Multiple Perspectives: Use different templates for comprehensive analysis

Report Analysis

- Interactive Exploration: Use hover functionality to examine specific data points

- Comparative Analysis: Switch templates to see different analytical angles

- Context Consideration: Understand industry and market context for metrics

Workflow Optimization

- Start with Overview: Begin with Company Overview for comprehensive assessment

- Drill Down: Use specialized templates for focused analysis

- Export Strategically: Download reports for important investment decisions

Key Features to Highlight

Animated Template Previews

- Visual Selection: See actual report content before committing

- Informed Choice: Understand template value before selection

- Efficient Browsing: Quickly evaluate multiple analytical frameworks

Sankey Diagram Visualization

- Unique Feature: "How [Company] Makes Money" flow visualization

- Revenue Transparency: Clear understanding of business model

- Competitive Differentiator: Standout visualization not commonly available

On-the-Fly Template Switching

- Convenient Analysis: Pivot analytical perspective without re-selecting company

- Efficient Workflow: Maintain context while changing focus

- Comprehensive Assessment: Easy access to multiple analytical angles

Download and Export

- Professional Reports: Export analysis for presentations and meetings

- Archive Capability: Maintain research records over time

- Sharing Functionality: Distribute analysis to team members or clients

Overview Templates transform complex financial analysis into accessible, professional-quality reports that can be generated in minutes rather than hours, making sophisticated investment research available to investors at all levels.