Pat Dorsey - Dorsey Asset Management Portfolio Q3'2025: Top Holdings & Recent Changes

Welcome to the Value Sense Blog, your resource for insights on the stock market! At Value Sense, we focus on intrinsic value tools and offer stock ideas with undervalued companies. Dive into our research products and learn more about our unique approach at [valuesense.io]

Explore diverse stock ideas covering technology, healthcare, and commodities sectors. Our insights are crafted to help investors spot opportunities in undervalued growth stocks, enhancing potential returns. Visit us to see evaluations and in-depth market research.

Pat Dorsey, founder of Dorsey Asset Management and renowned moat investor, showcases his disciplined approach to quality compounders in the latest 13F filing. His $1.11B portfolio reflects aggressive portfolio activity with multiple new buys, trims in big tech, and a complete exit from one position, all while maintaining ultra-high conviction through extreme concentration.

Portfolio Overview: The Art of Moat-Focused Concentration

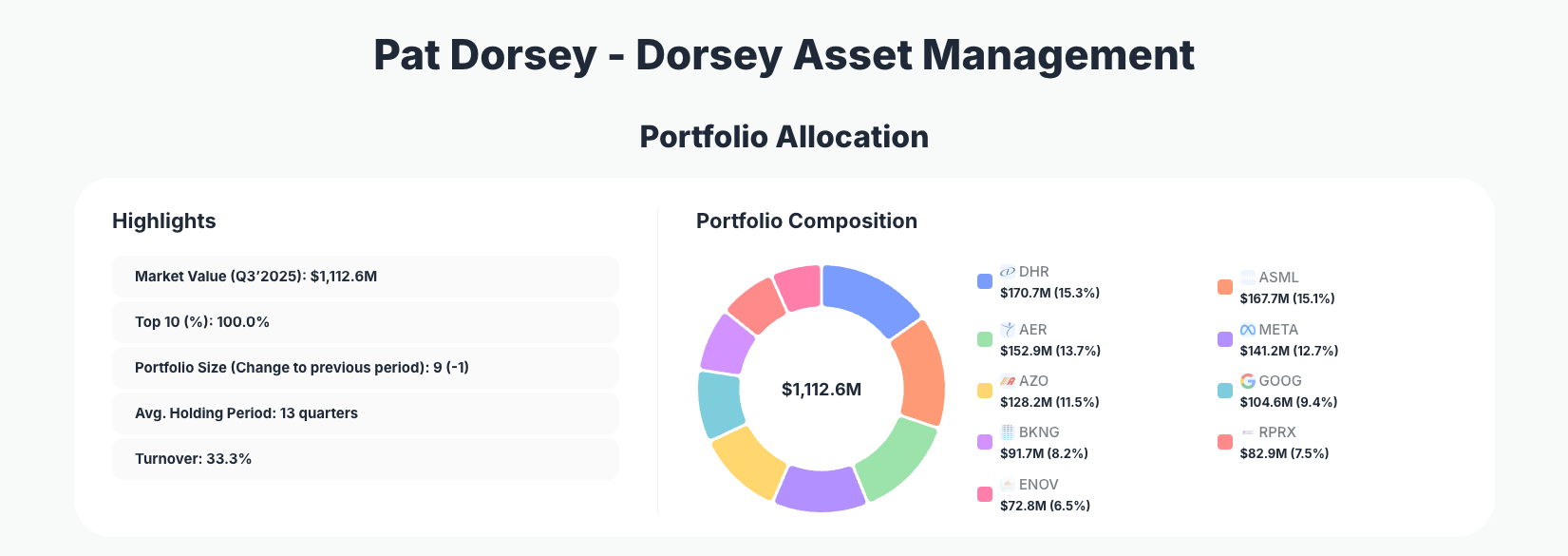

Portfolio Highlights (Q3’2025): - Market Value: $1,112.6M - Top 10 Holdings: 100.0% - Portfolio Size: 9 -1 - Average Holding Period: 13 quarters - Turnover: 33.3%

Pat Dorsey's Q3 2025 portfolio exemplifies the power of extreme concentration, with the top 10 holdings comprising 100% of the entire $1.11 billion portfolio across just 9 positions. This isn't diversification—it's a deliberate bet on businesses with wide economic moats, reflecting Dorsey's philosophy honed from years analyzing competitive advantages at Morningstar. The reduction to 9 holdings from 10 signals ruthless pruning, with turnover at 33.3% indicating active management without chasing momentum.

The 13-quarter average holding period underscores patience, yet recent moves show Dorsey isn't married to any position. New "Buy" initiations dominate, suggesting fresh opportunities in quality names amid market volatility. This portfolio structure prioritizes businesses with durable advantages over broad market exposure, a hallmark of Dorsey's strategy targeting high returns through deep conviction.

Top Holdings: New Bets on Industrial Leaders and Tech Giants

The portfolio's changes paint a picture of strategic evolution, starting with heavy new positions in industrial and semiconductor leaders. Danaher Corporation (DHR) leads at 15.3% following a "Buy," showcasing conviction in its life sciences and diagnostics moats worth $170.7M. Close behind, ASML Holding N.V. (ASML) at 15.1% $167.7M enters as a new "Buy," betting big on semiconductor lithography dominance. AerCap Holdings N.V. (AER) (13.7%, $152.9M) also joins via "Buy," highlighting aircraft leasing as a resilient asset play.

Big tech remains core but with adjustments: Meta Platforms, Inc. (META) holds 12.7% $141.2M after "Reduce 21.58%," trimming exposure to social media amid valuation concerns. AutoZone, Inc. (AZO) (11.5%, $128.2M) gets a "Buy" boost, affirming auto parts retailing strength. Alphabet Inc. (GOOG) (9.4%, $104.6M) enters as "Buy," doubling down on search and AI leadership.

Rounding out key moves, Booking Holdings Inc. (BKNG) (8.2%, $91.7M) and Royalty Pharma plc (RPRX) (7.5%, $82.9M) both receive "Buy" additions, emphasizing travel recovery and biotech royalties. Enovis Corporation (ENOV) (6.5%, $72.8M) sees "Reduce 6.03%," while Wix.com Ltd. (WIX) exits entirely via "Sell 100%." These shifts blend continuity in proven winners with opportunistic entries.

What the Portfolio Reveals About Dorsey's Strategy

Dorsey's moves reveal a clear focus on quality compounders with wide moats across technology, industrials, and healthcare—sectors where durable advantages drive outsized returns. The heavy "Buy" activity in DHR, ASML, and AER signals bets on mission-critical infrastructure, from lab equipment to chip manufacturing and aviation leasing.

- Sector tilt: Tech (ASML, META, GOOG, BKNG, WIX exit) and healthcare/industrials dominate, avoiding broad commodity exposure.

- Geographic mix: International flavor with Dutch ASML and Irish AER alongside U.S. giants, diversifying revenue streams.

- Risk management: Trims in META and ENOV show profit-taking discipline; full WIX sale prunes underperformers.

- Quality bias: Holdings feature high ROIC businesses with pricing power, aligning with Dorsey's moat investing roots.

This isn't growth-chasing—it's moat-hunting, prioritizing sustainability over hype.

Portfolio Concentration Analysis

| Position | Value | % of Portfolio | Recent Change |

|---|---|---|---|

| Danaher Corporation (DHR) | $170.7M | 15.3% | Buy |

| ASML Holding N.V. (ASML) | $167.7M | 15.1% | Buy |

| AerCap Holdings N.V. (AER) | $152.9M | 13.7% | Buy |

| Meta Platforms, Inc. (META) | $141.2M | 12.7% | Reduce 21.58% |

| AutoZone, Inc. (AZO) | $128.2M | 11.5% | Buy |

| Alphabet Inc. (GOOG) | $104.6M | 9.4% | Buy |

| Booking Holdings Inc. (BKNG) | $91.7M | 8.2% | Buy |

| Royalty Pharma plc (RPRX) | $82.9M | 7.5% | Buy |

| Enovis Corporation (ENOV) | $72.8M | 6.5% | Reduce 6.03% |

This table underscores Dorsey's ultra-concentrated philosophy: no position exceeds 15.3%, yet the top three alone command over 44% of the portfolio. The "Buy" frenzy in seven of nine top holdings reflects building stakes in perceived bargains, while targeted reductions in META (down 21.58%) and ENOV prevent overexposure. With 100% in top 10 across just 9 names, risk is amplified but mitigated by moat quality—classic high-conviction investing where diversification is the enemy of superior returns.

Investment Lessons from Pat Dorsey's Moat Strategy

Pat Dorsey's portfolio distills timeless principles from his moat-focused investing framework:

- Hunt wide moats relentlessly: Prioritize businesses like ASML with technological barriers no competitor can breach.

- Concentrate on what you understand: 100% in 9 positions demands deep conviction—avoid the crowd.

- Trim winners, cut losers: META reduction and WIX sale show discipline over sentiment.

- Patience pays: 13-quarter average hold rewards compounders like AZO.

- Act on change: 33.3% turnover proves monitoring moat erosion (ENOV trim) and seizing opportunities (multiple Buys).

Looking Ahead: What Comes Next?

With portfolio size shrinking to 9 and high turnover, Dorsey likely holds dry powder for further concentration or opportunistic strikes. The emphasis on semis (ASML), aviation (AER), and biotech royalties (RPRX) positions well for AI infrastructure buildout and travel rebound. Watch for more industrials/healthcare if valuations cool, or tech adds if AI hype tempers. In uncertain markets, Dorsey's moat bias sets up for resilient compounding.

FAQ about Pat Dorsey's Dorsey Asset Portfolio

Q: What are the biggest changes in Pat Dorsey's Q3 2025 13F filing?

A: Key moves include new "Buy" positions in DHR, ASML, AER, AZO, GOOG, BKNG, and RPRX; trims in META -21.58% and ENOV -6.03%; and full "Sell 100%" of WIX.

Q: Why does Dorsey's portfolio remain so concentrated?

A: Dorsey targets wide-moat businesses where conviction justifies outsized bets—100% in top 10 across 9 holdings maximizes returns from high-quality compounders while minimizing distractions.

Q: What sectors dominate Pat Dorsey's holdings?

A: Tech/semiconductors (ASML, META), industrials/healthcare (DHR, RPRX), and consumer/discretionary (AZO, BKNG) lead, emphasizing durable advantages.

Q: How can I track Pat Dorsey's Dorsey Asset Management portfolio?

A: Follow quarterly 13F filings on the SEC site (45-day lag post-quarter-end) or use ValueSense's superinvestor tracker at https://valuesense.io/superinvestors/dorsey-asset for real-time analysis, visualizations, and historical changes.

Explore More Investment Opportunities

For investors seeking undervalued companies with high fundamental quality, our analytics team provides curated stock lists:

📌 50 Undervalued Stocks (Best overall value plays for 2025)

📌 50 Undervalued Dividend Stocks (For income-focused investors)

📌 50 Undervalued Growth Stocks (High-growth potential with strong fundamentals)

🔍 Check out these stocks on the Value Sense platform for free!