ValueSense Intrinsic Value Tools - Peter Lynch Charts

Peter Lynch Charts provide a quick, visual assessment of a stock's current valuation relative to its own historical performance. This powerful tool compares a stock's market price to valuation bands calculated from its historical Price-to-Earnings (P/E) ratios, helping investors instantly identify if a stock appears overvalued, undervalued, or fairly valued based on its historical P/E range.

Accessing Peter Lynch Charts

From the Value Investing Tools Hub

- Navigate to the main "Intrinsic Value tools" dashboard

- Locate the "Peter Lynch charts" card

- Click on the card (described as "Peter Lynch Chart analysis that illustrates the valuation based on the historical P/E")

- Search for a stock by typing in the search bar or click on suggested tickers (MSFT, AAPL, GOOG)

What Peter Lynch Charts Do

Core Purpose

The charts provide instant visual assessment of stock valuation by comparing current market price to historical P/E-based valuation bands, answering the key question: "Is this stock expensive or cheap relative to its own history?"

Key Benefits

- Quick Visual Assessment: Immediate understanding of valuation status

- Historical Context: Shows how current valuation compares to past levels

- Relative Valuation: Compares company to its own historical performance

- Investment Screening: Identifies potentially undervalued or overvalued opportunities

Chart Components and Visualization

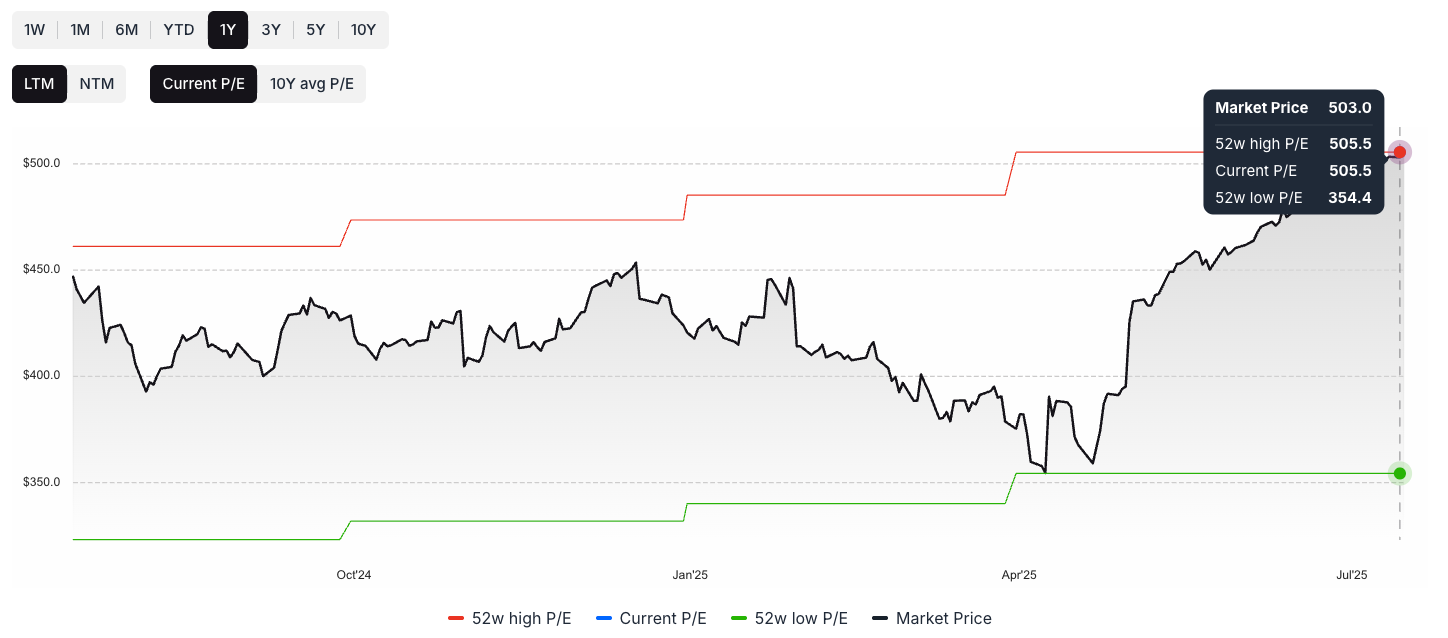

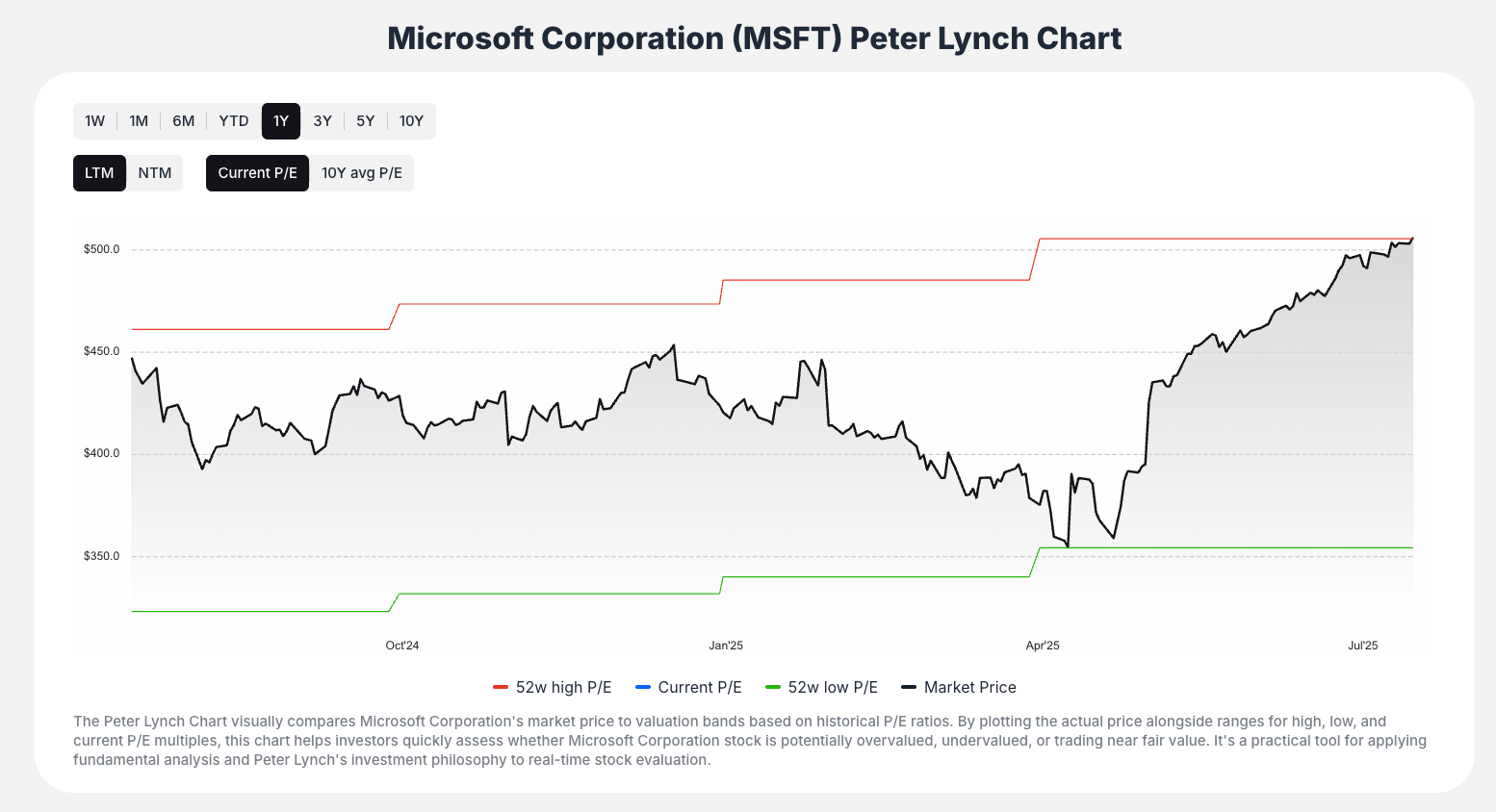

Three-Line Chart System

Market Price Line (Black)

- Shows actual stock price movement over selected timeframe

- Represents real market valuation

- Dynamic line that changes with market conditions

52-Week High P/E Band (Red)

- Upper valuation boundary

- Represents stock price if trading at 52-week high P/E ratio

- Indicates potential overvaluation zone

52-Week Low P/E Band (Green)

- Lower valuation boundary

- Represents stock price if trading at 52-week low P/E ratio

- Indicates potential undervaluation zone

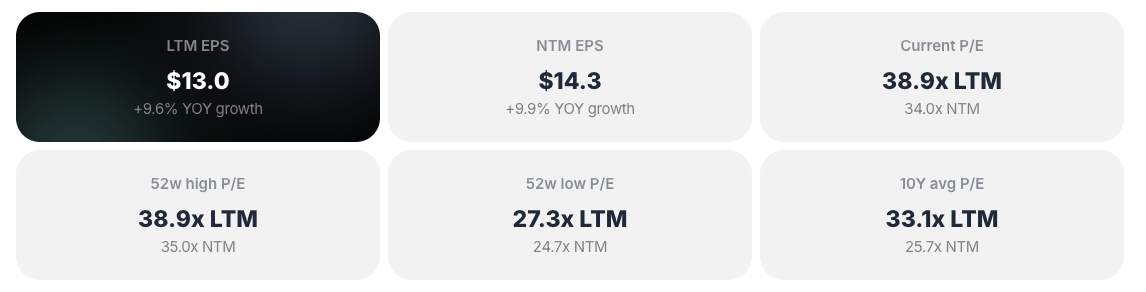

Supporting Data

- Summary Metrics: LTM EPS, NTM EPS, Current P/E ratio

- Interactive Tooltips: Point-in-time data on hover

- Clear Legend: Visual identification of each line's meaning

Interactive Features

Timeframe Selection

- Multiple Periods: 1Y, 3Y, 5Y, 10Y options

- Historical Context: Understand long-term valuation trends

- Flexible Analysis: Choose period most relevant to your investment horizon

Hover Functionality

- Detailed Tooltips: Hover over any chart point for specific data

- Precise Values: Market price, 52w High P/E, Current P/E, 52w Low P/E

- Historical Data: Access exact values for any date

User-Friendly Navigation

- Clean Interface: Logical flow from selection to analysis

- Search Functionality: Find stocks by name or ticker

- Suggested Stocks: Quick access to popular companies

Methodology and Concepts

Peter Lynch's P/E Bands

- Historical Foundation: Based on legendary investor Peter Lynch's approach

- P/E Ratio Analysis: Uses Price-to-Earnings multiples for valuation assessment

- Relative Valuation: Compares company to its own historical norms

- Practical Application: Simplifies complex valuation into visual format

Key Valuation Concepts

- Historical P/E Range: Uses company's own past performance as benchmark

- Earnings-Based Valuation: Focuses on relationship between price and earnings

- Market Sentiment: Reflects how market has historically valued the company

- Cyclical Patterns: Identifies recurring valuation cycles

How to Interpret the Charts

Valuation Assessment

Overvaluation Signal

- Above Red Band: Market price line significantly above high P/E band

- Historical Premium: Trading at higher multiples than historical highs

- Caution Indicator: May suggest expensive valuation

Undervaluation Signal

- Below Green Band: Market price line significantly below low P/E band

- Historical Discount: Trading at lower multiples than historical lows

- Opportunity Indicator: May suggest attractive valuation

Fair Valuation

- Between Bands: Market price line within historical P/E range

- Normal Levels: Trading at typical historical multiples

- Neutral Signal: Neither obviously cheap nor expensive

Advanced Interpretation

- Trend Analysis: Use timeframe selection to understand valuation trends

- Context Consideration: Consider broader market conditions and company changes

- Starting Point: Use as initial assessment, not final investment decision

Key Workflow Steps

Step 1: Access and Select

Navigate to Peter Lynch Charts and choose your target stock

Step 2: Visual Assessment

- Observe market price line (black) position relative to P/E bands

- Identify if stock appears over, under, or fairly valued

- Form initial valuation hypothesis

Step 3: Historical Context

- Use timeframe selectors (1Y, 3Y, 5Y, 10Y) to understand trends

- Assess if current valuation is recent development or long-term pattern

- Consider cyclical patterns and market cycles

Step 4: Detailed Investigation

- Hover over chart points for precise data values

- Examine specific dates and P/E ratios

- Understand valuation evolution over time

Step 5: Cross-Reference Analysis

- Use integrated tools hub to analyze same stock with other methods

- Compare Peter Lynch assessment with DCF, Graham Value, EPV

- Build comprehensive valuation picture

Step 6: Discovery and Expansion

- Explore linked stock screener lists

- Find other potential opportunities

- Apply insights to broader investment strategy

Best Practices

Effective Usage

- Quick Screening: Use for initial valuation assessment

- Historical Context: Always consider multiple timeframes

- Confirm with Other Methods: Cross-reference with other valuation approaches

- Market Conditions: Consider broader economic environment

Interpretation Guidelines

- Trend Over Point: Focus on overall patterns, not single data points

- Company Changes: Consider if business fundamentals have changed

- Earnings Quality: Assess sustainability of earnings driving P/E ratios

- Market Cycles: Understand cyclical vs. secular valuation changes

Limitations to Consider

- Relative Not Absolute: Compares to history, not intrinsic value

- P/E Dependency: Effectiveness depends on earnings quality and consistency

- Market Efficiency: Historical patterns may not predict future performance

- Supplementary Tool: Best used alongside other valuation methods

Key Questions the Tool Answers

- "Is this stock expensive relative to its history?"

- Visual comparison of price to historical P/E bands

- "What's the historical valuation range for this company?"

- Red and green bands show high and low P/E-based valuations

- "Is the current valuation a recent development?"

- Timeframe selection shows evolution of valuation

- "How has the market historically valued this company?"

- Complete historical P/E band analysis

- "Should I investigate this stock further?"

- Initial screening for deeper valuation analysis

Educational Value

Learning Peter Lynch Principles

- Historical Perspective: Understanding how valuations cycle over time

- P/E Ratio Application: Practical use of price-to-earnings analysis

- Visual Learning: Charts make complex concepts accessible

- Market Psychology: Insight into how markets value companies over time

Investment Skill Development

- Valuation Screening: Develop ability to quickly assess opportunities

- Historical Analysis: Learn to use past performance for context

- Multi-Method Approach: Understand importance of diverse valuation tools

- Market Timing: Recognize potential entry and exit points

Peter Lynch Charts transform complex historical valuation analysis into an intuitive, visual tool that helps investors quickly identify potential opportunities while maintaining the analytical rigor that made Peter Lynch one of history's most successful investors.