ValueSense Intrinsic Value Tools - Peter Lynch Fair Value Calculator

The Peter Lynch Fair Value calculator implements the renowned investor's approach to stock valuation, combining the Price-to-Earnings (P/E) ratio with a company's growth rate and dividend yield to determine if a stock is undervalued or overvalued. This time-tested method provides a straightforward way to assess whether a stock's current price reflects its growth potential.

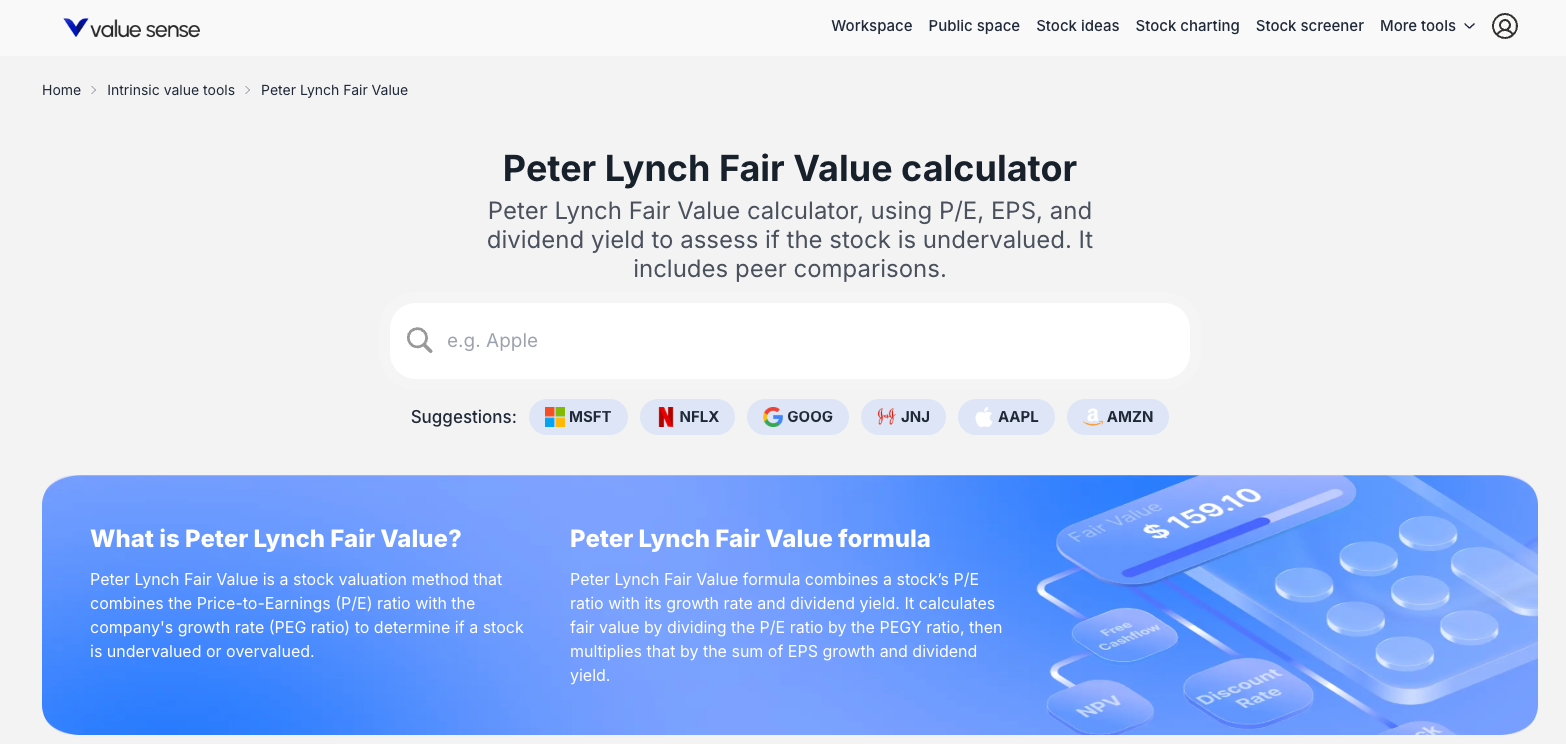

Accessing the Peter Lynch Fair Value Calculator

From the Intrinsic Value Tools Hub

- Navigate to the main

valuesense.io/intrinsic-value-toolspage - Scroll down to find the "Peter Lynch Fair Value" card

- Click on the card to access the calculator's landing page

- Search for a stock in the search bar (e.g., "Apple") or click on suggested tickers (MSFT, NFLX, GOOG)

- Access the comprehensive analysis page for your selected company

What the Peter Lynch Fair Value Method Does

Core Purpose

The tool determines whether a stock is undervalued or overvalued based on Peter Lynch's proven investment principles, specifically using the PEGY (Price/Earnings to Growth and Yield) ratio methodology.

Key Methodology

The calculation combines three fundamental factors:

- Price-to-Earnings (P/E) ratio: Current valuation multiple

- Earnings Per Share (EPS) growth: Company's growth rate

- Dividend Yield: Income component of total return

Investment Philosophy

Based on Lynch's principle that a fairly valued stock should have a P/E ratio roughly equal to its growth rate, with dividend yield providing additional value.

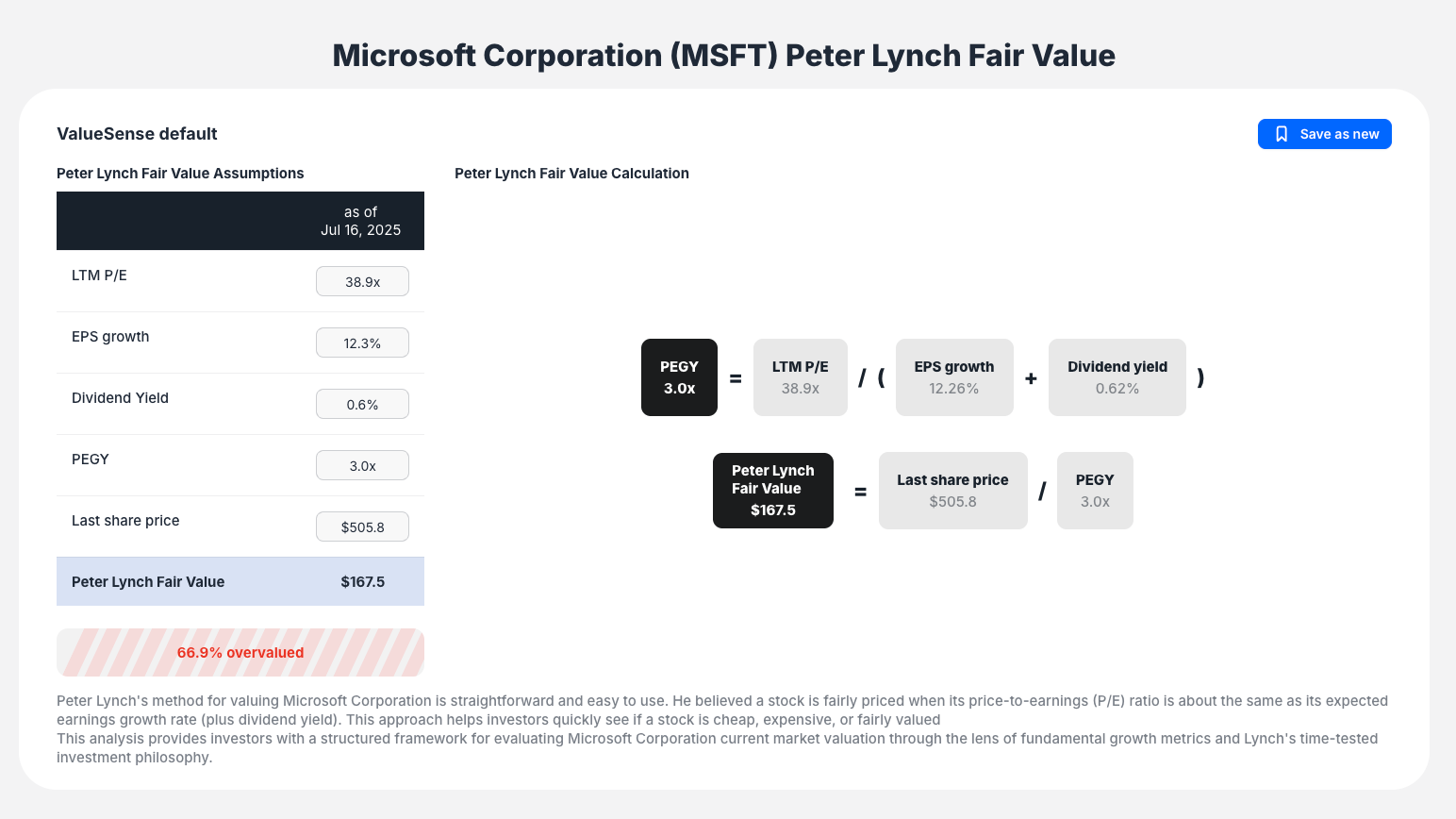

Core Calculation Method

Step 1: PEGY Ratio Calculation

PEGY = LTM P/E / (EPS growth % + Dividend Yield %)

Step 2: Peter Lynch Fair Value

Fair Value = Last Share Price / PEGY

Key Interpretation Rule

- PEGY < 1.0x: Stock may be attractively priced relative to its growth

- PEGY > 1.0x: Stock may be over-priced relative to its growth potential

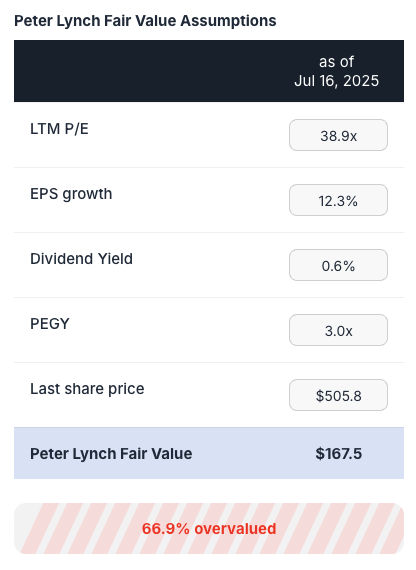

Input Data and Customization

Default Data Sources

- LTM P/E: Last twelve months price-to-earnings ratio

- EPS Growth: Earnings per share growth rate

- Dividend Yield: Current dividend yield percentage

- Last Share Price: Current market price

Customizable Assumptions

- Interactive Input Fields: Modify any assumption in the "Peter Lynch Fair Value Assumptions" section

- Scenario Testing: Input your own figures to test different growth or P/E scenarios

- Real-time Recalculation: Results update instantly as you modify inputs

- Save Scenarios: Use "Save as new" to preserve custom analysis

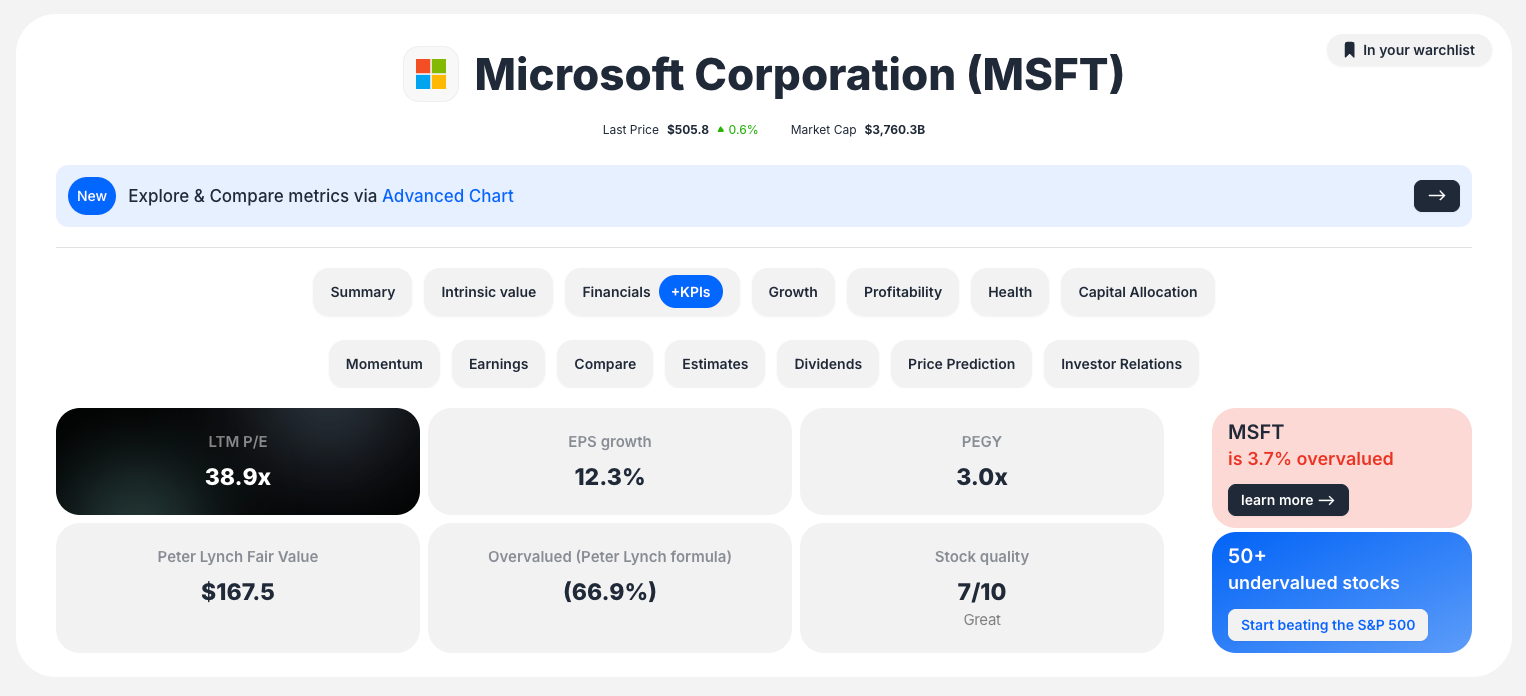

Comprehensive Results and Outputs

Summary Valuation

- Peter Lynch Fair Value: Calculated dollar value per share (e.g., $167.5)

- Over/Undervaluation: Clear percentage indication (e.g., "66.9% overvalued")

- PEGY Ratio: Key metric for quick assessment

Visual Formula Breakdown

- Step-by-step calculation: Shows how PEGY ratio and fair value are derived

- Transparent methodology: Visual representation of all inputs and calculations

- Clear result interpretation: Prominent display of final valuation status

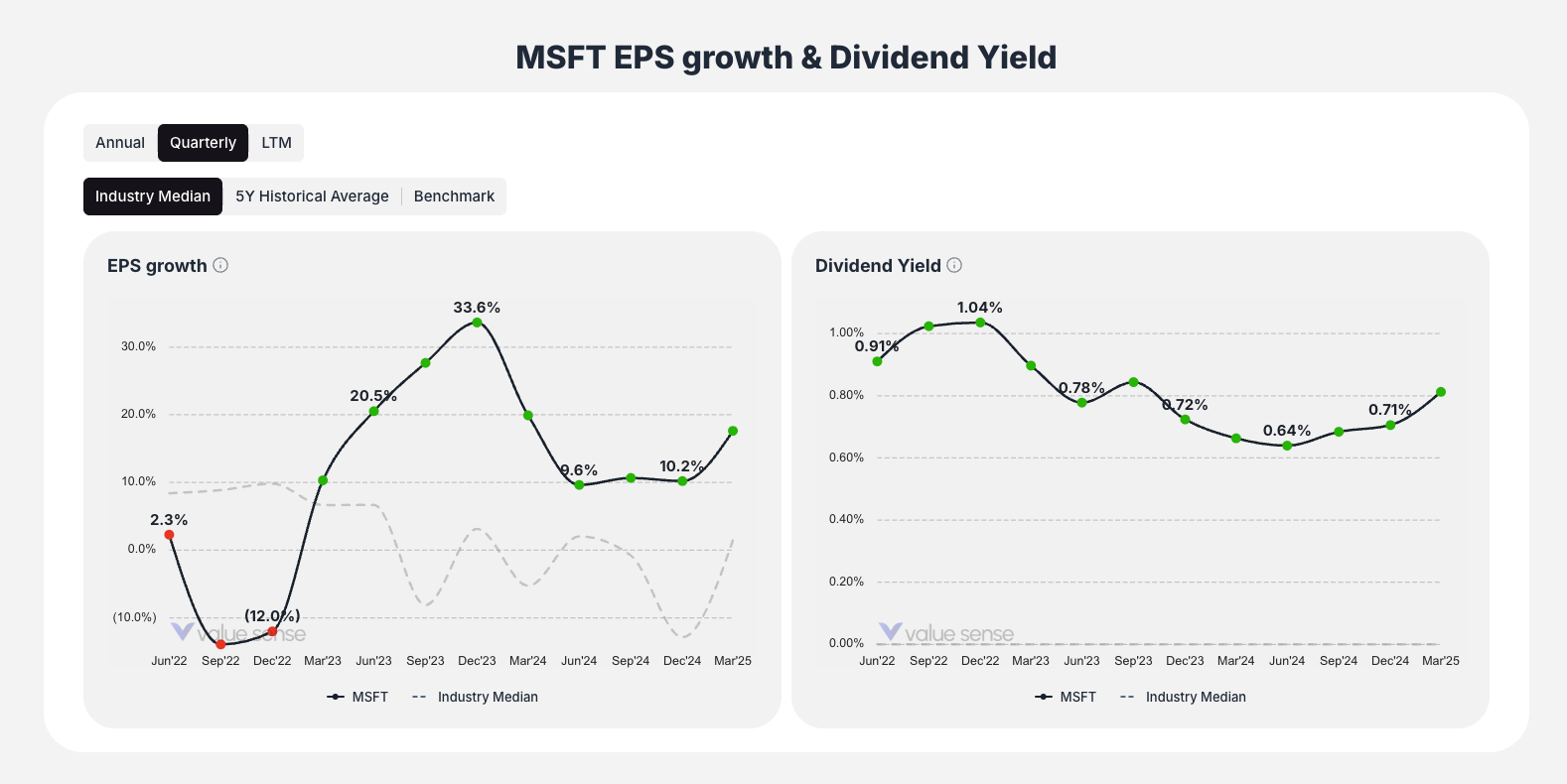

Historical Context Charts

- EPS Growth & Dividend Yield History: Historical trends for key input metrics

- Data validation: Helps assess if current assumptions are reasonable

- Trend analysis: Understanding sustainability of growth rates

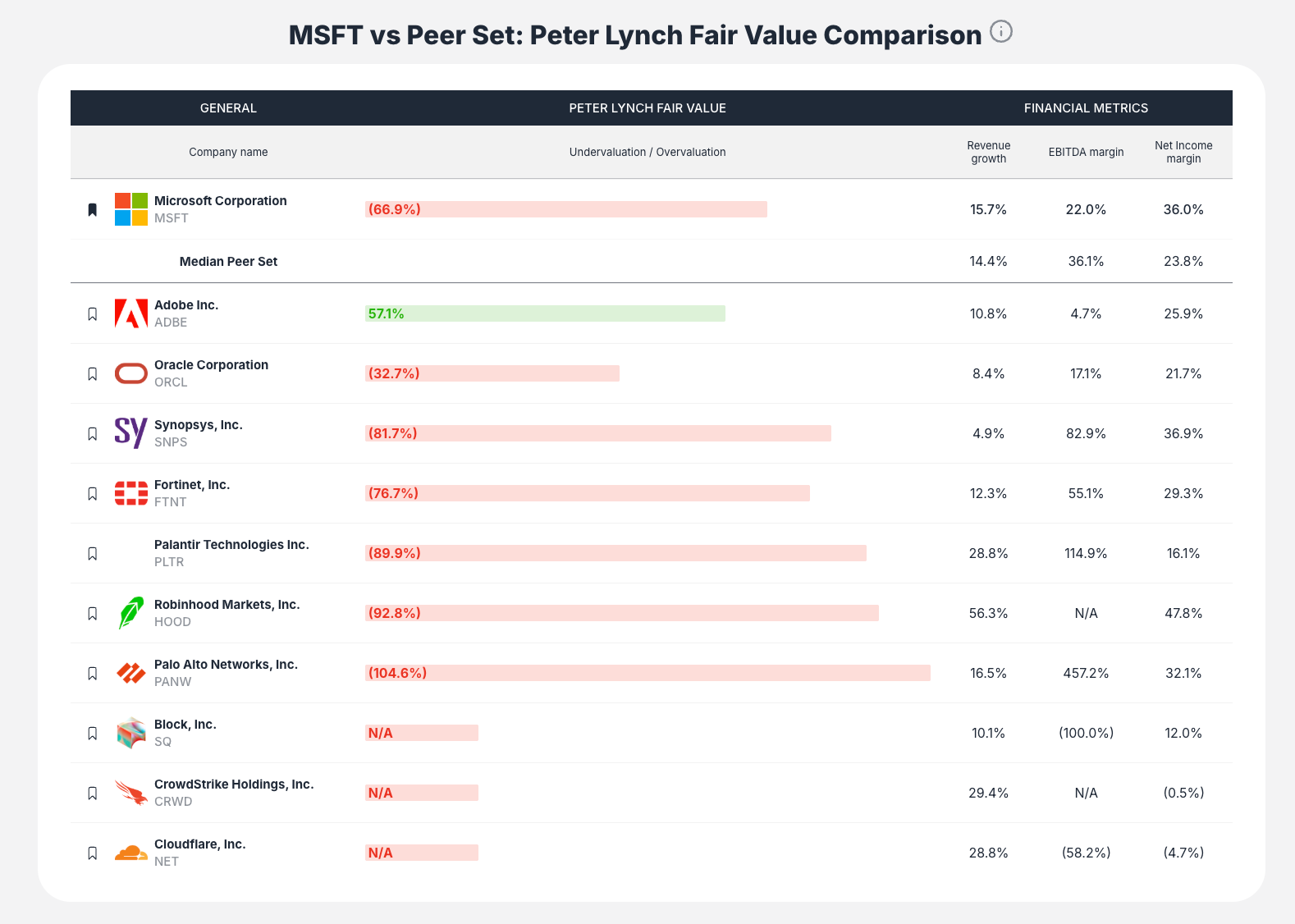

Peer Comparison Table

Benchmarks your selected stock against industry peers on:

- Peter Lynch Fair Value comparison

- Under/overvaluation percentages

- Revenue growth rates

- Profitability margins

How to Interpret Results

Primary Valuation Assessment

- Compare Fair Value to Current Price

- Higher fair value = potentially undervalued

- Lower fair value = potentially overvalued

- Analyze PEGY Ratio

- Below 1.0x = attractive valuation relative to growth

- Above 1.0x = expensive relative to growth potential

Contextual Analysis

- Peer Comparison: Understand if valuation is in line with, better, or worse than competitors

- Historical Trends: Assess sustainability of current growth rates using historical charts

- Growth Quality: Consider both EPS growth and dividend yield components

Key Workflow Steps

Step 1: Access and Select

Navigate to the Peter Lynch Fair Value calculator and choose your target stock

Step 2: Review Default Analysis

- Examine automatically generated fair value calculation

- Note default assumptions and formula breakdown

- Check initial over/undervaluation assessment

Step 3: Interpret Core Results

- Compare fair value to current share price

- Analyze PEGY ratio for quick assessment

- Review over/undervaluation percentage

Step 4: Customize Analysis (Optional)

- Modify assumptions in the "Assumptions" section

- Test different growth rate scenarios

- Experiment with P/E ratio variations

Step 5: Contextualize with Data

- Review historical EPS growth and dividend yield charts

- Analyze peer comparison table for industry context

- Assess sustainability of key assumptions

Step 6: Integration and Next Steps

- Use integrated links to explore related investment ideas

- Apply findings to broader investment strategy

- Consider analysis alongside other valuation methods

Best Practices

Assumption Validation

- Always review historical charts before accepting default assumptions

- Consider cyclical patterns in EPS growth

- Evaluate dividend sustainability

Peer Context

- Compare PEGY ratios across industry peers

- Understand industry-specific growth patterns

- Consider competitive positioning

Scenario Analysis

- Test conservative and optimistic growth scenarios

- Vary P/E assumptions based on market conditions

- Consider impact of dividend policy changes

Method Limitations

- Most effective for established companies with consistent earnings

- Less suitable for high-growth companies with no dividends

- Works best for companies with predictable business models

Key Questions the Tool Answers

- "Is this stock fairly valued according to Peter Lynch's method?"

- Direct answer through fair value calculation and PEGY ratio

- "How does the valuation compare to growth potential?"

- PEGY ratio provides growth-adjusted valuation assessment

- "What if my growth assumptions are different?"

- Customizable inputs allow personal assumption testing

- "How does this compare to similar companies?"

- Peer comparison table provides industry context

- "Are the current assumptions reasonable?"

- Historical charts validate input assumptions

The Peter Lynch Fair Value calculator brings one of investing's most successful methodologies to your analysis toolkit, providing clear, actionable insights based on the principle that great companies should trade at reasonable prices relative to their growth potential.